GoPro Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GoPro Bundle

GoPro navigates a landscape shaped by intense rivalry, moderate buyer power, and the looming threat of substitutes, particularly from smartphone advancements. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping GoPro’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

GoPro, like many in the consumer electronics sphere, relies on a broad range of standard electronic components. For these readily available, commoditized parts, suppliers generally wield limited bargaining power. This is primarily because there are numerous alternative suppliers capable of providing the same components, allowing GoPro to secure favorable pricing and terms.

The abundance of suppliers for common parts significantly reduces GoPro's dependence on any single vendor. This competitive landscape empowers GoPro to negotiate effectively and maintain flexibility, easily switching suppliers if price increases or supply disruptions threaten its operations for these standard components. For instance, in 2023, the global semiconductor market, while experiencing some shifts, still offered a wide array of suppliers for many basic chipsets used in consumer electronics, reinforcing this dynamic for companies like GoPro.

For highly specialized components, like the custom GP3 System-on-Chip (SoC) processors, GoPro faces suppliers with moderate bargaining power. These suppliers hold proprietary technology, limiting GoPro's ability to quickly switch, potentially increasing costs and lead times for these crucial parts.

GoPro's strategic move to diversify its manufacturing and sourcing locations, notably shifting U.S.-bound camera production away from China, directly addresses the bargaining power of suppliers. This diversification is crucial for mitigating risks associated with geopolitical tensions, trade tariffs, and the potential for disruptions originating from a single geographic area or supplier. By spreading its production footprint, GoPro lessens its dependence on any one supplier or region, thereby diminishing their leverage.

Impact of Raw Material Costs

Fluctuations in global raw material prices can indirectly impact GoPro's costs. For instance, increases in the prices of metals or rare earth elements, crucial for electronics, can be passed on by component suppliers. This can squeeze GoPro's gross margins, making input cost management a constant challenge.

- Impact on Margins: Rising component costs due to raw material price hikes can directly affect GoPro's profitability.

- Supply Chain Volatility: The electronics industry is susceptible to supply chain disruptions, which can exacerbate raw material cost increases.

- Competitive Pricing: To remain competitive, GoPro may need to absorb some of these cost increases, further pressuring margins.

Supplier Innovation and Technology Leadership

Suppliers at the forefront of technology, like those developing advanced sensors or battery solutions, can wield considerable influence. GoPro's ability to stay competitive hinges on these innovations. A supplier with a substantial technological advantage could therefore dictate higher prices or impose specific conditions for access to their newest components.

- Supplier Innovation: Companies leading in areas like image processing or durable materials can command greater leverage.

- Technological Dependence: GoPro's product differentiation relies heavily on the quality and features provided by its key component suppliers.

- Market Share of Suppliers: If a supplier holds a dominant position for a critical component, their bargaining power increases significantly.

For standard electronic components, GoPro benefits from numerous suppliers, limiting individual supplier bargaining power and enabling competitive pricing. However, for specialized components, such as custom processors, GoPro faces suppliers with moderate to high bargaining power due to proprietary technology and limited alternatives. This dynamic means that while GoPro can negotiate well on common parts, it has less leverage for critical, unique technologies. The company’s strategy to diversify manufacturing helps mitigate supplier leverage by reducing dependence on single sources or regions.

| Component Type | Supplier Bargaining Power | Reasoning | GoPro's Leverage |

|---|---|---|---|

| Standard Electronic Components | Low | Numerous alternative suppliers, commoditized parts | High negotiation power, easy supplier switching |

| Custom Processors (e.g., GP3 SoC) | Moderate to High | Proprietary technology, limited alternatives | Lower negotiation power, potential for higher costs |

| Advanced Sensors/Battery Solutions | High | Technological leadership, critical for differentiation | Dependent on supplier innovation, potential for price dictation |

What is included in the product

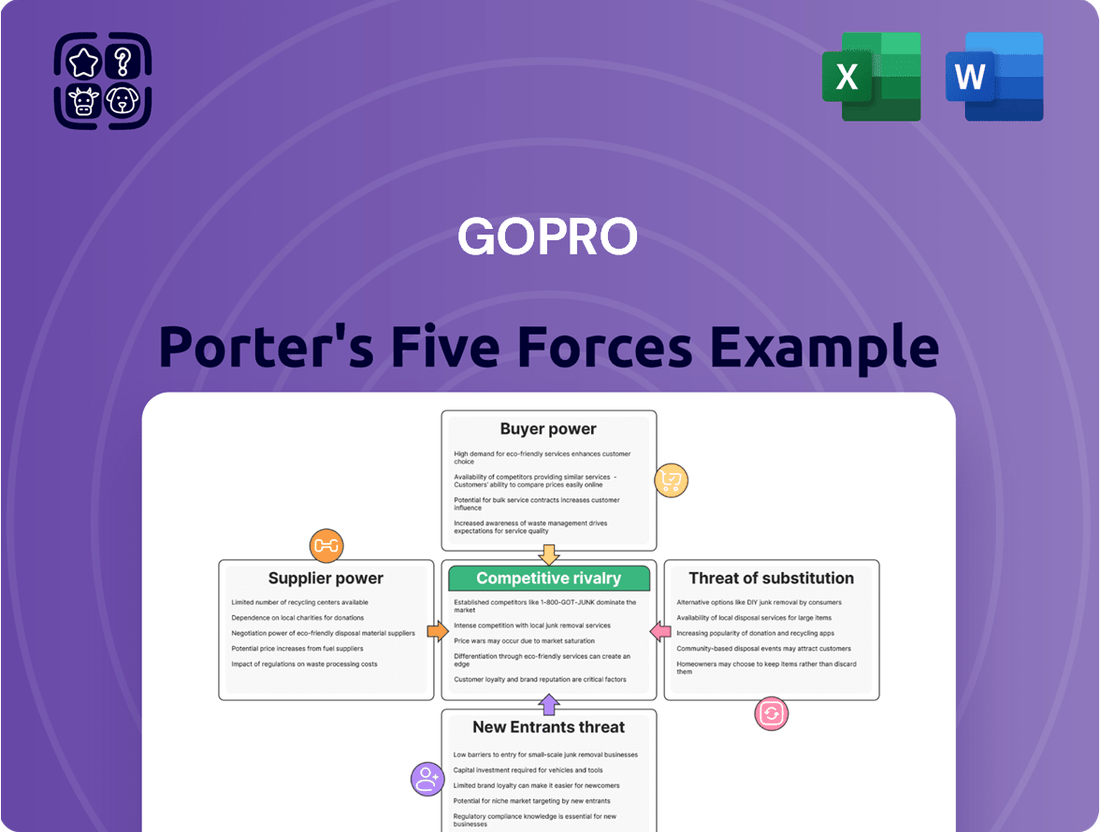

This analysis of GoPro's competitive landscape examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Instantly visualize competitive intensity with a dynamic Porter's Five Forces dashboard, alleviating the pain of complex market analysis.

Customers Bargaining Power

Individual consumers, the core of GoPro's customer base, wield significant bargaining power. This is largely due to the wide array of action camera alternatives and substitute products readily available in the market. Consumers can effortlessly compare pricing, features, and user reviews across different brands, putting pressure on GoPro to maintain competitive pricing and continuous product development.

In the action camera market, price sensitivity is a significant factor influencing customer bargaining power. While GoPro is a recognized leader, the availability of numerous budget-friendly alternatives from brands like AKASO, Xiaomi, and YI Technology means consumers can easily switch if GoPro's pricing is perceived as too high, particularly for their entry-level products.

Customer reviews and social media have become incredibly influential in the action camera market. For GoPro, this means that a customer's experience, whether good or bad, can be amplified rapidly. In 2024, platforms like YouTube and Instagram are crucial for potential buyers researching action cameras, with user-generated content often swaying purchase decisions more than traditional advertising.

Unsatisfied customers can quickly broadcast negative experiences, directly impacting GoPro's brand image and potentially deterring future sales. Imagine a viral video showcasing a product flaw; this can spread like wildfire. For instance, in early 2024, a widely shared social media post detailing battery issues with a competitor's product demonstrably affected consumer sentiment towards that brand.

Conversely, positive reviews and authentic user-generated content build strong brand loyalty for GoPro. When customers share thrilling adventures captured with their cameras, it serves as powerful, organic marketing. This highlights how critical customer satisfaction is, as happy users become brand advocates, fostering a sense of community that can be a significant competitive advantage.

Subscription Services and Customer Lock-in

GoPro's subscription services, such as GoPro Quik, are designed to foster customer loyalty and diminish their bargaining power. By bundling cloud storage and advanced editing features with their hardware, GoPro aims to create a sticky ecosystem that discourages customers from defecting to rivals.

This strategy is crucial for recurring revenue. For instance, in the first quarter of 2024, GoPro reported that its subscriber base grew to over 2.5 million, demonstrating the increasing importance of these services.

- Subscription Growth: GoPro's subscriber count surpassed 2.5 million by Q1 2024.

- Ecosystem Strategy: Integrating hardware and software services aims to increase customer retention.

- Reduced Switching: Enhanced features and cloud storage make it less attractive for users to switch brands.

Demand Fluctuation due to Macroeconomic Factors

GoPro's sales are significantly impacted by macroeconomic trends and overall consumer confidence. During periods of economic uncertainty or when discretionary spending tightens, demand for products like action cameras tends to decrease.

For instance, in 2024, a slowdown in global economic growth and persistent inflation contributed to reduced consumer spending on non-essential electronics. This softened demand for GoPro cameras.

This scenario directly bolsters the bargaining power of customers. As fewer consumers are in the market, companies like GoPro face increased pressure to attract and retain buyers, often leading to more competitive pricing and promotions.

- Macroeconomic Impact: Global economic slowdown in 2024 impacted consumer discretionary spending on electronics.

- Reduced Demand: Lower consumer confidence led to fewer purchases of action cameras.

- Increased Bargaining Power: With fewer buyers, customers gain leverage, influencing pricing and product offerings.

The bargaining power of customers is a significant force for GoPro, driven by market saturation and readily available alternatives. Consumers can easily compare prices and features, forcing GoPro to remain competitive. This is amplified by the influence of online reviews and social media, where user experiences heavily sway purchasing decisions, making customer satisfaction paramount.

GoPro's subscription services, like GoPro Quik, aim to lock in customers by offering cloud storage and editing tools, thereby reducing their inclination to switch. This ecosystem strategy is vital for sustained revenue, as evidenced by GoPro's subscriber base exceeding 2.5 million by Q1 2024. However, macroeconomic conditions, such as the global economic slowdown and inflation observed in 2024, can dampen consumer spending on discretionary items like action cameras, further increasing customer leverage and influencing pricing strategies.

| Factor | Impact on GoPro | Supporting Data (2024) |

|---|---|---|

| Availability of Alternatives | High | Numerous budget-friendly brands (e.g., AKASO, Xiaomi) offer competitive features. |

| Price Sensitivity | High | Consumers can easily switch to lower-priced options if GoPro's pricing is perceived as too high. |

| Online Influence | High | User-generated content on platforms like YouTube and Instagram significantly impacts purchase decisions. |

| Subscription Services | Moderate (Reduces Power) | Over 2.5 million subscribers by Q1 2024, creating an ecosystem to retain customers. |

| Macroeconomic Conditions | High | Global economic slowdown and inflation in 2024 reduced discretionary spending, increasing customer leverage. |

Preview the Actual Deliverable

GoPro Porter's Five Forces Analysis

This preview showcases the complete GoPro Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape for the action camera market. You're viewing the exact, professionally crafted document that will be instantly available for download upon purchase, ensuring no discrepancies or missing sections. This comprehensive analysis is ready for immediate use, providing valuable insights into industry rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes.

Rivalry Among Competitors

GoPro operates in a fiercely competitive landscape, with established players like DJI and Insta360 posing significant challenges. These rivals frequently introduce advanced features, sometimes even surpassing GoPro's offerings in specific areas, compelling GoPro to continually innovate. For instance, DJI's Osmo Action line and Insta360's immersive 360-degree cameras have captured market share by offering compelling alternatives that put pressure on GoPro's market position.

The action camera market is seeing a surge of affordable alternatives, with brands like AKASO, SJCAM, and YI Technology offering compelling features at much lower prices. This intense competition directly challenges GoPro's market dominance, particularly among budget-conscious consumers.

These competitors are not just cheaper; they are increasingly matching GoPro's feature sets, putting pressure on GoPro's pricing strategies. For instance, many budget models now offer 4K recording and image stabilization, features previously exclusive to higher-end GoPro models.

This trend necessitates that GoPro continually innovate and potentially adjust its product tiers, perhaps introducing more accessible entry-level options to retain market share. In 2023, the global action camera market size was valued at approximately $5.5 billion, with budget brands capturing an increasing segment of this value.

Competitive rivalry in the action camera market is fierce, driven by a relentless cycle of product innovation and feature enhancements. Companies are locked in a 'feature war,' constantly pushing boundaries with advancements like higher video resolutions, superior image stabilization, and improved low-light capabilities. For instance, Insta360 has introduced models boasting 8K recording, directly challenging established players.

GoPro, a market leader, must continuously innovate its HERO and MAX product lines to maintain its competitive edge. The company's ability to integrate cutting-edge technology, such as its HyperSmooth stabilization, and offer unique features like modular accessories, is crucial. In 2023, GoPro reported revenue of $1.05 billion, highlighting the significant market share it commands but also the substantial revenue at stake in this dynamic environment.

Market Share Dynamics and Revenue Decline

GoPro has seen its revenue and unit sales dip in recent years. This downturn is partly attributed to a more intense competitive environment and broader economic challenges. For instance, in the first quarter of 2024, GoPro reported a net revenue of $154 million, a decrease from $218 million in the same period of 2023.

While GoPro remains a notable name in the action camera market, its market share is under pressure from various competitors. This rivalry means GoPro must constantly innovate and adapt to maintain its position.

The current competitive climate demands strategic moves from GoPro. These include efforts to reduce costs and expand its product offerings to spur renewed growth and improve profitability.

- Revenue Decline: Q1 2024 net revenue was $154 million, down from $218 million in Q1 2023.

- Market Share Pressure: Increased competition challenges GoPro's established market position.

- Strategic Imperatives: Cost reduction and product diversification are key to regaining growth.

Expansion into Software and Services

The competitive rivalry within the action camera market is intensifying as players increasingly focus on software and subscription services, moving beyond just hardware. GoPro's strategic push into its Quik app and subscription packages aims to create a sticky ecosystem, fostering customer loyalty and generating recurring revenue streams. This shift helps differentiate GoPro from competitors who remain solely focused on camera hardware, thereby strengthening its competitive position.

This expansion into software and services is crucial for several reasons:

- Ecosystem Development: By offering integrated software solutions like the Quik app, GoPro aims to enhance user experience and create a valuable ecosystem around its cameras.

- Recurring Revenue: Subscription services provide a stable and predictable revenue stream, reducing reliance on cyclical hardware sales. For example, GoPro's subscription revenue has been a growing component of its overall financial performance.

- Customer Retention: A strong software and service offering can significantly increase customer stickiness, making it harder for users to switch to competitors once invested in the GoPro ecosystem.

- Differentiation: In a market where hardware features can become commoditized, software and services offer a key avenue for differentiation and value creation.

Competitive rivalry in the action camera sector is intense, with players like DJI and Insta360 constantly introducing innovative features that challenge GoPro's market leadership. Budget brands are also gaining traction by offering comparable functionalities at lower price points, putting pressure on GoPro's pricing strategies.

GoPro's revenue has seen a decline, with Q1 2024 net revenue at $154 million, down from $218 million in Q1 2023, underscoring the impact of this fierce competition. The company is responding by focusing on cost reduction and expanding its product and service offerings, including its Quik app and subscription services, to foster customer loyalty and create recurring revenue streams.

This strategic shift towards an ecosystem approach aims to differentiate GoPro in a market where hardware features can become commoditized. By integrating software and services, GoPro seeks to enhance user experience and increase customer retention, thereby strengthening its competitive standing against rivals.

SSubstitutes Threaten

Smartphones are a significant threat to GoPro because their camera technology is improving so quickly. Many people already own a smartphone, and these devices are becoming increasingly capable of capturing high-quality video and photos. For instance, by 2024, many flagship smartphones offer 4K video recording and advanced image stabilization, features that were once exclusive to dedicated cameras.

The convenience of having a camera built into a device that also handles communication and other tasks makes smartphones a very appealing substitute for many consumers. For everyday users or those who don't participate in extreme sports, a smartphone's camera often meets their needs, diminishing the demand for a separate action camera like a GoPro. This widespread adoption and continuous improvement mean that smartphones are a readily available and increasingly powerful alternative.

While not a direct replacement for GoPro's core action-camera market, traditional digital cameras, including mirrorless and DSLR models, and dedicated camcorders present a threat of substitution, particularly for content creators who prioritize absolute image fidelity and creative control over ruggedness and extreme portability. These devices often boast larger sensors, interchangeable lens systems, and more sophisticated manual settings, allowing for a higher degree of artistic expression and professional-grade output. For instance, in 2023, the global digital camera market was valued at approximately $11.5 billion, with mirrorless cameras showing significant growth, indicating a continued demand for high-quality imaging solutions that might draw some users away from specialized action cameras for certain applications.

Drones, especially advanced models from manufacturers like DJI, present a significant threat of substitution for action cameras like GoPro. These drones can capture sweeping aerial footage and unique perspectives that were once the exclusive domain of professional equipment or impossible to achieve with a handheld action camera.

For instance, DJI's Mavic series, which saw strong sales in 2023 and continued demand into 2024, offers high-resolution video and stable flight capabilities, directly competing with the type of dynamic shots users might aim for with a GoPro on a mount. While many drone users still pair them with action cameras for added versatility, the drone itself can fulfill the need for certain aerial shots, reducing reliance on a separate camera for those specific use cases.

Wearable Cameras and Other Niche Devices

While GoPro is known for its action cameras, the broader category of wearable cameras and other specialized imaging devices poses a niche threat of substitution. These devices, like body cameras used by law enforcement or dash cams in vehicles, cater to specific needs that a general-purpose action camera might not perfectly address.

For instance, the market for body-worn cameras, a segment of this substitution threat, saw significant growth. By the end of 2023, it was estimated that over 50,000 law enforcement agencies in the United States were equipped with body cameras, indicating a substantial user base for these specialized devices.

Augmented reality (AR) glasses with integrated recording capabilities also represent a potential substitute, offering a hands-free, immersive experience that could appeal to certain users. Though still a developing market, the global AR glasses market was projected to reach over $6 billion by 2024, signaling increasing consumer interest and technological advancement in this area.

- Niche Devices: Body cameras and dash cams offer specialized functionality.

- Market Growth: The body-worn camera market is substantial, with over 50,000 US law enforcement agencies equipped by late 2023.

- Emerging Tech: AR glasses with recording capabilities present a future substitution threat.

- AR Market Value: The AR glasses market was expected to exceed $6 billion globally in 2024.

Cost-Benefit Analysis for Consumers

The threat of substitutes is significantly heightened when consumers conduct a thorough cost-benefit analysis. If a smartphone, with its increasing video capabilities, can sufficiently meet a consumer's needs for capturing moments at a lower overall expense, including the device and necessary accessories, the appeal of a dedicated action camera like GoPro diminishes. For instance, the average price of a flagship smartphone in 2024, around $900-$1200, offers a versatile tool that can replace many basic video recording functions previously requiring a separate device.

This dynamic forces GoPro to continually prove its unique value proposition, especially for adventure enthusiasts and those engaging in extreme activities where ruggedness, specialized mounts, and superior stabilization are paramount. In 2023, GoPro's Hero 12 Black, retailing at $399.99, offers features like 5.3K video and advanced image stabilization that often surpass what a standard smartphone can deliver in demanding environments, justifying its price point for a niche market.

- Consumer Cost-Benefit: Consumers weigh the price of an action camera against the capabilities of existing devices like smartphones.

- Smartphone Integration: The rising quality of smartphone cameras makes them a viable substitute for casual video capture, often at a lower perceived cost.

- GoPro's Value Proposition: GoPro must emphasize its durability, specialized features, and performance in extreme conditions to differentiate from smartphones.

- Market Data: In 2023, the average cost of a high-end smartphone was approximately $950, while GoPro's flagship models were priced around $400, highlighting a significant price difference for comparable basic video functions.

The threat of substitutes for GoPro is substantial, primarily driven by the rapid advancement and widespread adoption of smartphone camera technology. As smartphones increasingly offer high-resolution video and advanced stabilization, they become a compelling alternative for many users who don't require specialized action camera features. This trend is amplified by the convenience of a single device handling multiple functions, making smartphones a cost-effective substitute for casual content creation.

Beyond smartphones, other imaging devices also present substitution threats. Traditional digital cameras, particularly mirrorless models, cater to users prioritizing image quality and creative control, while drones offer unique aerial perspectives that can overlap with action camera use cases. Niche devices like body cameras and emerging technologies such as AR glasses with recording capabilities further segment the market, addressing specific needs that might otherwise be met by a GoPro.

| Substitute Category | Key Features & Advantages | Market Relevance (2023-2024 Data) |

| Smartphones | High-quality video, image stabilization, all-in-one functionality | Flagship smartphone prices averaging $900-$1200 in 2024; 4K video standard on many models. |

| Digital Cameras (Mirrorless/DSLR) | Superior image fidelity, interchangeable lenses, advanced manual controls | Global digital camera market valued at ~$11.5 billion in 2023; strong growth in mirrorless segment. |

| Drones | Unique aerial perspectives, sweeping footage | DJI Mavic series strong sales in 2023-2024; offer high-resolution video and stable flight. |

| Niche Devices (Body Cams, Dash Cams) | Specialized, dedicated functionality | Over 50,000 US law enforcement agencies equipped with body cameras by late 2023. |

| AR Glasses | Hands-free, immersive recording | Global AR glasses market projected to exceed $6 billion in 2024. |

Entrants Threaten

The consumer electronics sector, especially for niche products like action cameras, demands hefty capital for research and development, manufacturing infrastructure, and robust supply chains. Newcomers must secure considerable funding to even consider challenging incumbents like GoPro, which notably invests in its own custom-designed GP3 System on Chip (SoC) for performance optimization.

GoPro benefits from significant brand loyalty, especially within the action sports community. This established recognition makes it challenging for newcomers to attract customers. For instance, GoPro’s brand awareness was reported at over 70% among its target demographic in recent surveys.

The company’s integrated ecosystem, including accessories, the Quik editing app, and its subscription service, further solidifies its market position. New entrants would face substantial costs to replicate this comprehensive offering and build a comparable user experience, deterring many potential competitors.

GoPro's strong intellectual property portfolio, encompassing patents for camera design, image stabilization, and waterproofing, creates a significant barrier for potential new entrants. For instance, as of early 2024, the company actively defends its numerous patents, which would necessitate costly legal navigation or licensing agreements for any competitor seeking to enter the action camera market with similar technological features. This existing IP makes it challenging and expensive for newcomers to replicate GoPro's core product innovations.

Distribution Channel Access and Retail Relationships

New entrants face a formidable barrier in securing access to established retail distribution channels and cultivating robust relationships with retailers and distributors globally. GoPro, for instance, boasts a significant worldwide retail footprint, a network that new competitors would find exceedingly difficult and costly to replicate. This established presence makes it challenging for newcomers to gain widespread visibility for their products.

Consider the retail landscape for action cameras. In 2024, major electronics retailers like Best Buy, Amazon, and Walmart continue to be crucial for consumer access. Securing shelf space and favorable placement within these high-traffic environments requires substantial investment and proven sales performance, which new entrants typically lack.

- Limited Retail Shelf Space: Major retailers often have limited space dedicated to action cameras, making it a competitive battle for new brands to secure placement.

- Established Distributor Networks: Existing players have long-standing relationships with distributors who manage inventory, logistics, and sales to a vast array of smaller retailers. Building these networks from scratch is time-consuming and capital-intensive.

- Brand Loyalty and Consumer Trust: Retailers are more likely to stock products from brands with established consumer trust and loyalty, which new entrants must work hard to build.

Rapid Technological Advancements and Market Saturation

The action camera market faces a significant threat from new entrants due to rapid technological advancements and increasing market saturation. Newcomers need to offer more than just comparable features; they must introduce genuinely innovative solutions to capture attention in a crowded space.

The constant improvement of smartphone camera technology also presents a formidable challenge. As smartphone capabilities advance, the differentiation required for a dedicated action camera to justify its existence becomes even more pronounced, raising the barrier for any new entrant seeking to establish a foothold.

- Technological Pace: The industry sees frequent upgrades in resolution, stabilization, and connectivity, demanding substantial R&D investment from potential new entrants.

- Smartphone Integration: Advancements in computational photography and AI within smartphones blur the lines, offering consumers increasingly capable alternatives for casual use.

- Market Saturation: Established brands like GoPro and DJI have strong brand loyalty and distribution networks, making it difficult for new players to gain market share without a compelling unique selling proposition.

The threat of new entrants into the action camera market, while present, is significantly mitigated by substantial barriers. These include the high capital requirements for R&D and manufacturing, as evidenced by GoPro's investment in custom SoCs, and the need to build extensive global distribution networks. Furthermore, established brand loyalty, as seen with GoPro's over 70% brand awareness in its target demographic, and a strong intellectual property portfolio, actively defended by the company, make it exceptionally difficult and costly for newcomers to compete effectively.

Porter's Five Forces Analysis Data Sources

Our GoPro Porter's Five Forces analysis leverages data from GoPro's official investor relations website, SEC filings, and industry-specific market research reports to understand competitive dynamics.