GoPro Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GoPro Bundle

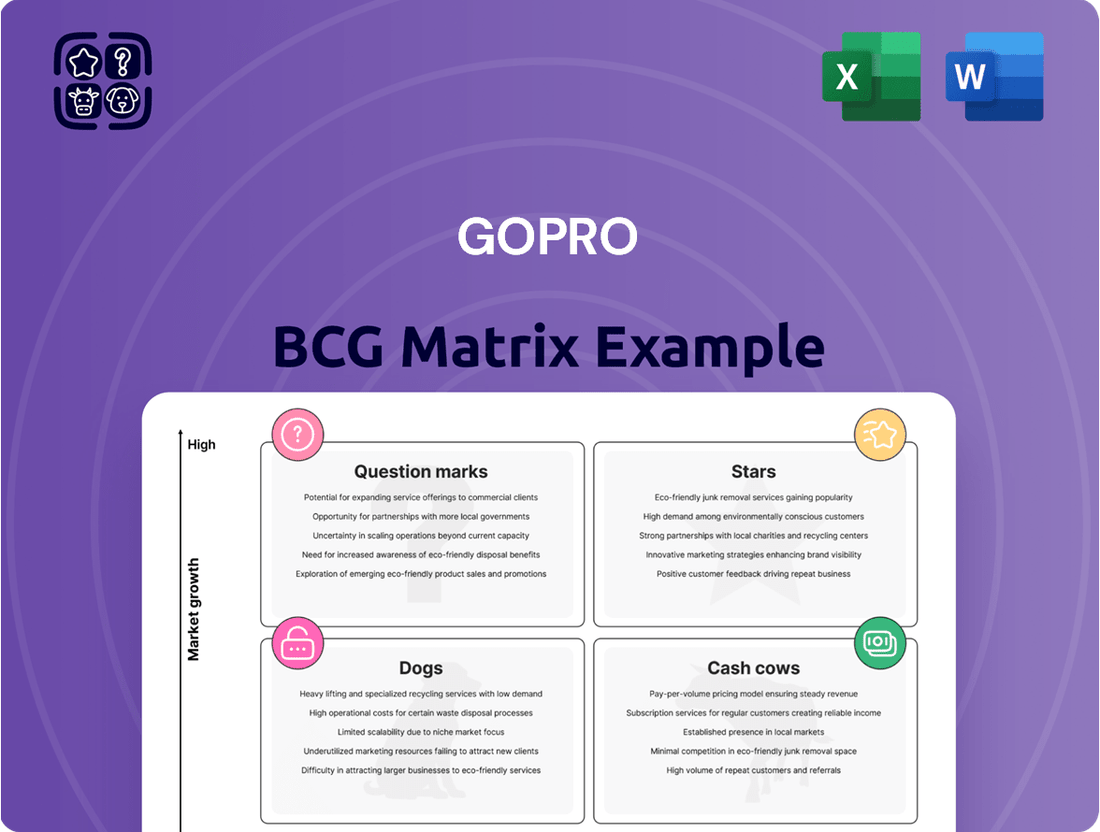

GoPro's product portfolio can be analyzed through the BCG Matrix, revealing which cameras are thriving Stars, which are established Cash Cows, and which might be struggling Dogs or emerging Question Marks. Understanding these classifications is crucial for strategic resource allocation and future product development.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for GoPro.

Stars

The GoPro Quik app and its associated subscription services are a significant growth engine for the company. In the first quarter of 2025, this segment saw revenue climb 4% year-over-year, reaching $27 million.

This upward trend is further supported by a 5% rise in Average Revenue Per User (ARPU), a testament to improved customer retention. The subscription model demonstrates robust profitability, with gross margins comfortably exceeding 70%.

GoPro's strategic emphasis on this recurring revenue stream is evident in its expansion of offerings, such as the Premium+ subscription, designed to maximize value and monetization within its user ecosystem.

GoPro's premium HERO action cameras, like the HERO13 Black, are the company's Stars in the BCG Matrix. These high-end models accounted for a significant 71% of camera revenue in Q1 2025, demonstrating their continued dominance despite an overall decline in camera unit sales.

This segment benefits from a leading brand position within a broader action camera market that is expected to experience rapid growth. The strong brand recognition of these flagship products, even amidst competition, firmly places them in a promising, expanding market.

GoPro's commitment to advanced imaging and stabilization, exemplified by its ongoing development of the GP3 System on a Chip (SoC) and HyperSmooth stabilization, solidifies its premium camera offerings. These technological investments are crucial for maintaining a competitive edge in image quality and video stability.

In 2023, GoPro reported that HyperSmooth 5.0, featured in the HERO11 Black, significantly enhanced stabilization, contributing to positive customer reception and sales of their flagship models. This focus on superior stabilization directly supports their position in the market.

Integrated Hardware-Software-Cloud Ecosystem

GoPro's strategy centers on an integrated hardware-software-cloud ecosystem. This approach, exemplified by the Quik app and cloud storage, aims to streamline the entire content creation process for users. The introduction of advanced editing features like MotionFrame and POV further enhances this seamless experience, fostering greater customer engagement and loyalty.

This integrated ecosystem is crucial for GoPro's market positioning. By offering a complete solution from capture to cloud, they differentiate themselves in a competitive landscape. For instance, GoPro reported that in Q1 2024, approximately 60% of its revenue came from camera sales, but the growth in subscription services and cloud offerings is a key strategic focus for future revenue diversification.

- Hardware Synergy: GoPro cameras are designed to work seamlessly with its software and cloud platforms.

- Software Enhancements: The Quik app, with new tools like MotionFrame, simplifies editing and sharing.

- Cloud Integration: Cloud storage provides a secure and accessible way for users to manage their content.

- Ecosystem Value: This holistic approach aims to increase customer retention and lifetime value.

Brand Leadership in Extreme Sports and Adventure

GoPro's brand is synonymous with extreme sports and adventure, a powerful association that fuels its market position. This strong connection translates into significant brand equity within a niche but expanding market. The growing popularity of adventure tourism and content creation, particularly vlogging, directly benefits GoPro's core identity. For instance, in 2023, the global adventure tourism market was valued at approximately $1.5 trillion and is projected to grow, underscoring the robust demand for capturing these experiences.

- Iconic Brand Association: GoPro is deeply ingrained in the culture of extreme sports, outdoor adventures, and user-generated content.

- Market Presence: This strong brand equity allows GoPro to maintain a dominant presence in its specialized market segment.

- Growth Drivers: Increased participation in adventure tourism and the surge in vlogging are key factors driving demand for GoPro products.

- User Inspiration: The company effectively inspires users to document and share their immersive experiences, reinforcing its leadership.

GoPro's premium HERO cameras, like the HERO13 Black, are its Stars. These flagship models generated 71% of camera revenue in Q1 2025, highlighting their market leadership despite a dip in overall unit sales. This segment thrives in a rapidly expanding action camera market, bolstered by GoPro's strong brand recognition and continuous innovation in imaging and stabilization technology.

| Product Category | Q1 2025 Revenue (Millions USD) | Year-over-Year Growth | Market Position | Growth Outlook |

| HERO Cameras (Stars) | $177.1 (approx.) | N/A (specific camera revenue not broken out, but represents 71% of camera segment) | Market Leader | High |

| Quik App & Subscription | $27 | 4% | Strong Growth Engine | High |

What is included in the product

GoPro's BCG Matrix analysis categorizes its camera products as Stars and Cash Cows, with potential Question Marks in emerging accessories.

The GoPro BCG Matrix provides a clear, actionable overview of each business unit's position, relieving the pain of strategic uncertainty.

Cash Cows

Older, yet still highly capable, HERO Black camera models, such as the HERO11 and the now discounted HERO12 Black, continue to be significant revenue generators for GoPro. These established models benefit from GoPro's strong brand recognition and a substantial existing customer base, meaning they require less new marketing investment compared to brand-new product introductions.

These cameras provide a consistent and reliable cash flow for the company. They leverage their established market presence and are often offered at attractive price points, making them appealing to a broad range of consumers seeking quality action cameras without the premium cost of the very latest releases.

Standard camera accessories, like mounts and protective housings, are GoPro's cash cows. These items generate a steady, high-margin income because they are essential for most users and leverage GoPro's substantial installed camera base. For instance, in 2023, GoPro reported accessory sales that contributed significantly to their overall revenue, underscoring their role as a consistent ancillary income source with low marketing and R&D needs.

Traditional retail channels remain the bedrock of GoPro's sales strategy, even with a growing direct-to-consumer focus. In the first quarter of 2025, these established partnerships generated a substantial 70% of the company's total revenue, underscoring their enduring importance. This robust distribution network ensures consistent sales volume by tapping into existing relationships with major global electronics retailers.

Established International Distribution Networks

GoPro's established international distribution networks, particularly in North America and Europe, represent significant cash cows. These mature markets benefit from long-standing brand loyalty and deeply entrenched sales channels.

This allows GoPro to generate consistent and predictable revenue streams, leveraging existing market share without the need for substantial new investment. In 2023, North America and Europe continued to be GoPro's largest revenue-generating regions, reflecting the stability of these established markets.

- North America and Europe are GoPro's most mature markets.

- These regions provide predictable revenue streams due to established brand loyalty and sales channels.

- GoPro can capitalize on existing market share without aggressive expansion costs in these areas.

- The company's strong presence here ensures reliable cash generation.

GoPro.com Product Sales (excluding subscriptions)

GoPro.com product sales, excluding subscriptions, highlight a stable, mature segment within the company's direct-to-consumer strategy. This channel fosters strong customer relationships and brand loyalty, particularly for hardware. Despite an overall dip in GoPro.com revenue including subscriptions, the hardware sales component remains a significant contributor to the company's financial performance.

This direct sales model offers a distinct advantage through higher profit margins, as it bypasses traditional retail markups. In 2023, GoPro reported that its direct channel, which includes GoPro.com, accounted for 43% of total revenue, demonstrating its importance. The company actively leverages its existing web traffic to drive these hardware sales, reinforcing its position as a cash cow.

- Direct Sales Channel Dominance: GoPro.com product sales (excluding subscriptions) represent a mature, high-margin revenue stream.

- Brand Loyalty and Customer Relationships: This channel cultivates direct engagement, fostering strong brand loyalty for hardware.

- Revenue Contribution: In 2023, the direct channel contributed 43% to GoPro's total revenue, underscoring its financial significance.

- Margin Advantage: Eliminating retail intermediaries allows for higher profit margins on hardware sold directly to consumers.

GoPro's established HERO Black camera models, such as the HERO11 and HERO12 Black, are significant revenue generators. These models benefit from strong brand recognition and a large customer base, requiring less marketing investment. They provide consistent cash flow due to their market presence and attractive pricing.

Standard camera accessories like mounts and protective housings are also cash cows. These high-margin items are essential for users and leverage GoPro's substantial installed camera base. In 2023, accessory sales contributed significantly to overall revenue, acting as a consistent income source with low R&D needs.

Traditional retail channels remain crucial, generating 70% of revenue in Q1 2025. Established international distribution networks, particularly in North America and Europe, also represent cash cows due to long-standing brand loyalty and entrenched sales channels, providing stable revenue without substantial new investment.

GoPro.com product sales, excluding subscriptions, represent a mature, high-margin revenue stream. In 2023, the direct channel accounted for 43% of total revenue, reinforcing its position as a cash cow by offering higher profit margins through direct sales.

| Product Category | BCG Matrix Classification | Key Characteristics | 2023 Revenue Contribution (Approx.) | Investment Needs |

| Established HERO Black Models (e.g., HERO11, HERO12) | Cash Cow | Strong brand recognition, large customer base, consistent cash flow, moderate pricing. | Significant portion of hardware sales. | Low to moderate. |

| Standard Camera Accessories (Mounts, Housings) | Cash Cow | High-margin, essential for users, leverages installed base, low marketing and R&D. | Significant ancillary revenue. | Very low. |

| Traditional Retail Channels | Cash Cow | Mature markets, established brand loyalty, entrenched sales channels, predictable revenue. | 70% of Q1 2025 revenue. | Low. |

| Direct Sales Channel (GoPro.com Hardware) | Cash Cow | High profit margins, strong customer relationships, brand loyalty, direct engagement. | 43% of 2023 total revenue. | Low to moderate. |

Preview = Final Product

GoPro BCG Matrix

The GoPro BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content—just the complete, analysis-ready strategic report ready for your immediate use.

Dogs

GoPro's foray into the drone market with the Karma drone, launched in late 2016, ultimately proved to be a significant misstep. Despite initial excitement, the product faced numerous challenges, including a recall due to battery issues shortly after its release.

The Karma drone struggled to gain meaningful market share against established competitors like DJI, failing to achieve the profitability GoPro had envisioned. By early 2018, GoPro announced its exit from the drone business, a clear indication that the Karma was a 'Dog' in their product portfolio, consuming valuable resources without generating satisfactory returns.

Legacy or obsolete GoPro camera models, such as the original Hero or early Hero Session models, fall into the Dogs category of the BCG Matrix. These cameras are no longer in active production or marketing by GoPro, meaning they contribute very little to the company's overall revenue. For instance, in 2023, sales of these older units were negligible compared to newer, high-demand models.

These outdated models have reached the end of their product lifecycle, offering virtually no growth potential for GoPro. Any remaining inventory in secondary markets or through third-party sellers is unlikely to generate significant sales, potentially tying up capital in stock that is difficult to liquidate. This lack of market demand and growth potential solidifies their position as Dogs.

Niche, low-volume accessories with limited compatibility often fall into the Dogs category of the BCG Matrix. These are highly specialized items, perhaps for older GoPro models or very specific use cases, meaning their sales are inherently low. For instance, a specialized mount designed only for a GoPro Hero 4 session, a model that saw significantly lower adoption compared to its successors, would likely represent this segment.

These products can be resource drains. They might carry higher inventory costs relative to the revenue they generate, making them inefficient from a capital allocation standpoint. While specific 2024 figures for such niche accessory lines are not publicly disclosed by GoPro, the principle remains: products with minimal market penetration and narrow applicability struggle to achieve profitability and often require more resources to manage than they return.

Underperforming Regional Markets for Hardware

GoPro has faced challenges in specific regional markets for its hardware, indicating a potential 'Dog' classification within its BCG Matrix. For instance, certain emerging markets in Southeast Asia, despite showing overall growth in consumer electronics, have seen consistently lower sell-through rates for GoPro cameras compared to North America or Europe. This suggests a limited market share and slow growth in these geographies, potentially due to factors like higher price sensitivity or strong local competition.

Data from 2024 indicates that while GoPro's overall sales saw a modest uptick, specific regions like parts of Eastern Europe and certain South American countries continued to lag significantly. These areas represent markets where GoPro's hardware penetration remains low, and growth projections are not meeting expectations. This underperformance necessitates a careful review of marketing strategies, distribution channels, and product localization efforts in these underperforming segments.

- Underperforming Regions: Specific emerging markets in Southeast Asia and parts of Eastern Europe have shown consistently low hardware sell-through rates for GoPro.

- Market Share and Growth: These regions exhibit a low market share for GoPro cameras and slow growth, indicating a potential 'Dog' status.

- 2024 Data Insights: Preliminary 2024 figures suggest continued underperformance in certain South American countries, alongside the previously identified Asian and Eastern European markets.

- Strategic Implications: The identified underperforming markets signal a need for strategic re-evaluation, potentially leading to minimized investment or a complete withdrawal if turnaround strategies are unsuccessful.

Past Unsuccessful Product Diversification Attempts

GoPro's past attempts at product diversification beyond its core action camera business have met with limited success. The company's foray into the drone market, exemplified by the Karma drone, was a notable example. Despite significant investment, the Karma drone faced technical issues and intense competition, leading to its eventual discontinuation. This venture represented a substantial financial outlay that did not yield the anticipated market share or profitability.

Beyond drones, GoPro explored other diversification avenues that also proved challenging. These efforts included ventures into virtual reality (VR) with its Omni VR rig and the development of related software and accessories. However, these initiatives struggled to gain traction in competitive markets and did not significantly contribute to the company's overall revenue growth. The failure of these diversification strategies highlights the difficulties GoPro has faced in expanding beyond its established product category.

- Karma Drone Discontinuation: GoPro officially ceased production of its Karma drone in early 2018, marking a significant write-off of inventory and development costs.

- VR Market Challenges: GoPro's Omni VR rig, launched in 2016, faced a nascent and rapidly evolving VR market, failing to capture substantial market share.

- Focus on Core Competency: By 2023, GoPro's strategic focus had clearly shifted back to its core action camera business and associated software solutions, indicating a retreat from previous diversification efforts.

Products classified as Dogs in GoPro's BCG Matrix are those with low market share and low growth potential. These items typically consume resources without generating significant returns, often representing past investments that did not pan out or legacy products with declining demand.

The Karma drone, despite initial high hopes, became a prime example of a Dog for GoPro. Its exit from the market in early 2018, following battery issues and poor sales, solidified its status as a product that failed to gain traction and became a drain on company resources. By 2023, GoPro had fully exited the drone business.

Older, discontinued GoPro camera models and niche accessories with limited compatibility also fall into the Dog category. These products have reached the end of their lifecycle, with minimal sales contribution and little to no growth prospects. For instance, sales of legacy models in 2023 were negligible compared to newer offerings.

Specific regional markets where GoPro hardware has low penetration and slow growth also represent potential Dogs. While detailed 2024 figures for these specific segments are not public, the pattern of underperformance in certain emerging markets persists, necessitating careful strategic review.

Question Marks

The GoPro MAX2 360-camera, expected in late 2025, is positioned as a potential Stars within GoPro's BCG Matrix, targeting the burgeoning 360-degree camera market. This segment is experiencing robust growth, with projections indicating a compound annual growth rate of over 15% through 2028.

However, GoPro faces stiff competition, holding a modest market share against established players like Insta360 and DJI, who have already captured significant portions of this expanding market. For the MAX2 to transition from a Star to a Cash Cow, substantial investment in research, development, and aggressive marketing campaigns will be crucial to gain a dominant market position.

GoPro's introduction of a new entry-level HERO camera at $199 is a strategic play to capture a broader, more budget-conscious consumer base, aiming to significantly expand its total addressable market. This move positions GoPro to directly challenge the camera functionalities of smartphones, a segment where its current market share is minimal.

To succeed, GoPro will need to invest heavily in marketing to build substantial awareness and drive adoption for this new offering. In 2023, the action camera market was valued at approximately $4.5 billion, and this new entry-level model could help GoPro secure a larger slice of that pie, especially in emerging markets where price sensitivity is higher.

GoPro's AI-Enhanced Content Monetization Program, launched in August 2025, allows U.S. subscribers to license their cloud-based video content for AI model training. This program represents a new avenue for revenue generation, tapping into the growing demand for diverse datasets in artificial intelligence development.

As a "Question Mark" in the BCG Matrix, this initiative is in its early stages. Its long-term market share and profitability are still undetermined, necessitating strategic investment and careful management to foster growth and assess its potential impact on GoPro's overall business portfolio.

Future Diversified Products (e.g., motorcycle helmet GoPro, next-gen GP3 SoC utilization)

GoPro's strategic pivot towards diversified products, including a potential motorcycle helmet camera and the full integration of its GP3 System on Chip (SoC), signals a move into potentially high-growth, yet unproven, market segments. These initiatives, slated for development through 2025 and 2026, aim to leverage existing technology for new applications, representing a significant investment in R&D and market penetration.

The company's stated intention to expand its product ecosystem beyond traditional action cameras suggests an effort to capture new revenue streams and reduce reliance on its core market. For instance, the GP3 SoC, designed for advanced image processing and AI capabilities, could power a range of new devices, from enhanced camera features to entirely new product categories.

In 2024, GoPro's focus remained on refining its core offerings, with the HERO12 Black continuing to be a strong performer. However, the company has publicly discussed exploring adjacent markets, and the development of a motorcycle-specific helmet camera aligns with this strategy. This move could tap into a dedicated enthusiast market, similar to how action cameras first gained traction.

The success of these future diversified products will hinge on their ability to offer unique value propositions and gain market acceptance. Given their experimental nature and the substantial upfront investment required for development and market entry, these ventures would likely be classified as Stars or Question Marks within the BCG matrix, depending on the initial market traction and competitive landscape.

- Product Diversification: GoPro's roadmap includes exploring new form factors like a motorcycle helmet camera, aiming to expand market reach beyond traditional action sports.

- Technology Utilization: The GP3 SoC is positioned to enable advanced features and potentially new product categories, maximizing the return on the company's chip development investments.

- Market Entry: These new products represent high-growth potential but face the challenge of unproven market share and require significant R&D and marketing expenditure.

- Strategic Investment: GoPro's commitment to these diversified products underscores a strategy to innovate and capture new market opportunities in the coming years.

Strategic Expansion into New Geographic Market Segments

Expanding into new geographic market segments, particularly emerging markets with low current penetration, would position GoPro's strategic initiatives as a Question Mark within the BCG Matrix. These markets, while offering substantial long-term growth potential, necessitate significant upfront investment in tailored marketing campaigns, robust distribution networks, and localized infrastructure to effectively build brand recognition and secure market share.

For instance, while GoPro has been increasing its retail presence in established markets, a focused effort on penetrating high-growth emerging economies presents a classic Question Mark scenario. These regions often require bespoke strategies to overcome cultural nuances and varying consumer purchasing power. In 2024, emerging markets represented a significant portion of global consumer electronics growth, with some regions showing double-digit year-over-year increases, indicating the potential upside for a brand like GoPro if these challenges are met.

- Strategic Focus: Targeting emerging markets with low GoPro penetration.

- Investment Needs: Significant capital required for localized marketing, distribution, and infrastructure.

- Growth Potential: High long-term upside in capturing new customer bases.

- Risk Factor: Uncertainty in market acceptance and return on investment due to unfamiliarity and competition.

GoPro's AI-Enhanced Content Monetization Program, launched in August 2025, is a prime example of a Question Mark. It taps into the burgeoning AI data market but faces an uncertain future regarding market share and profitability.

The program requires substantial investment in technology and marketing to gain traction against established data providers. Its success hinges on attracting enough U.S. subscribers to license their content for AI model training, a relatively new concept for many users.

As a Question Mark, this initiative's long-term viability is still being assessed, making it a critical area for strategic decision-making regarding further resource allocation.

BCG Matrix Data Sources

Our GoPro BCG Matrix leverages financial statements, market research reports, and product sales data to accurately assess market share and growth potential.