Good Times Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Good Times Bundle

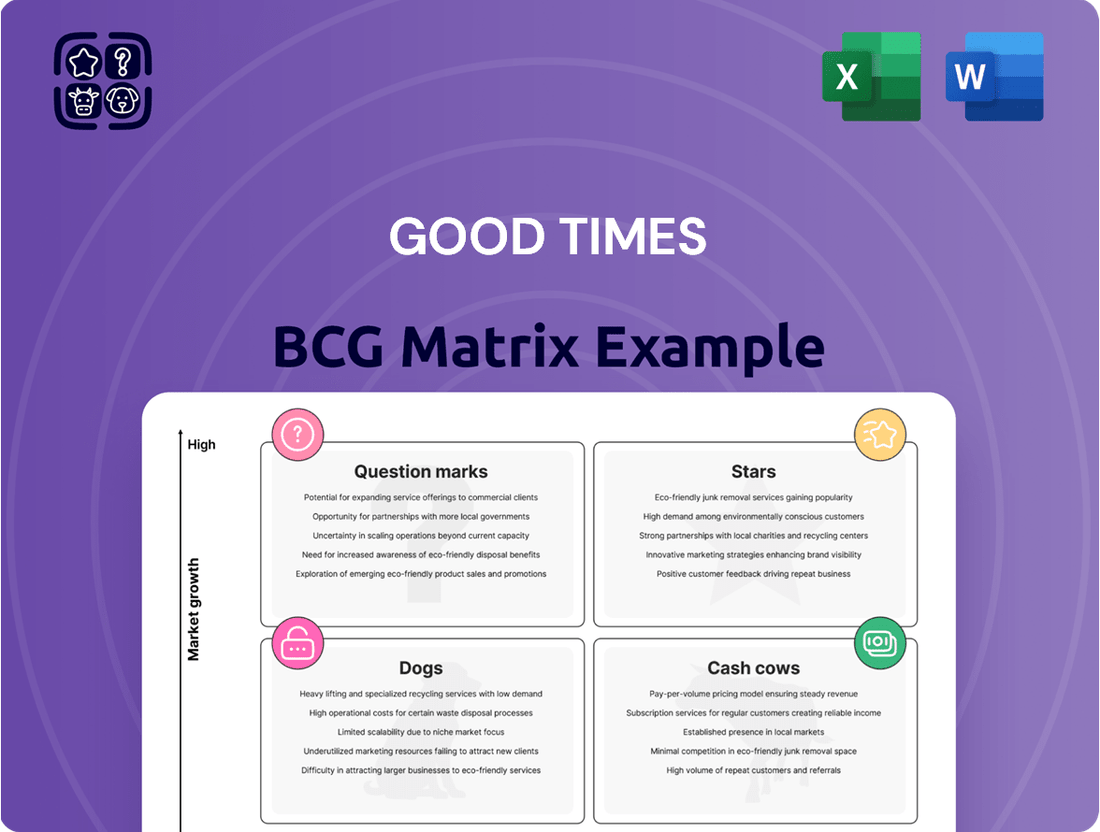

This glimpse into the Good Times BCG Matrix highlights products poised for growth and those generating consistent revenue. Understand the strategic advantage these "Stars" and "Cash Cows" offer. Purchase the full BCG Matrix for a comprehensive analysis of all product categories, enabling you to make informed decisions about resource allocation and future investments.

Stars

Bad Daddy's Burger Bar is positioned as a Star in the BCG matrix, reflecting its strong performance and growth trajectory. The company has been actively expanding its footprint, opening new locations and reacquiring franchised units to solidify its market presence. This strategic move aims to capitalize on the perceived growth within the upscale casual dining sector.

In 2024, Bad Daddy's continued its expansion, demonstrating a commitment to increasing its market share. For instance, the acquisition of previously franchised locations allows for greater control over brand consistency and operational efficiency, crucial for a growing brand. The introduction of innovative menu items also plays a key role in attracting and retaining customers, further bolstering its Star status.

Bad Daddy's Burger Bar's commitment to menu innovation, exemplified by offerings like the Birria Burger and Smash n' Stack, positions it as a potential Star in the BCG Matrix. This strategy aims to capture and maintain high market interest, drawing in both new and returning customers. In 2024, restaurant industry reports highlighted that brands with dynamic menus saw an average of 5% higher customer engagement compared to those with static offerings.

Bad Daddy's Burger Bar is a significant revenue driver for Good Times Restaurants Inc., holding a leading position in its market segment. This strong performance indicates a substantial market share and widespread customer appeal.

In the fiscal year 2023, Good Times Restaurants Inc. reported that Bad Daddy's Burger Bar was its largest brand, contributing approximately 60% of the company's total revenue. This highlights its status as a Star in the BCG matrix.

Bad Daddy's Burger Bar - Same-Store Sales Growth (Historical)

Bad Daddy's Burger Bar has a history of robust same-store sales growth, achieving an impressive 18.2% increase in fiscal year 2021. This historical performance highlights the brand's ability to significantly expand its market presence during periods of favorable economic conditions. While recent quarters have presented challenges, this past success indicates a strong underlying potential for renewed growth.

The brand's ability to achieve such growth in the past suggests resilience and a capacity to adapt to market dynamics.

- Fiscal 2021 Same-Store Sales Growth: 18.2%

- Historical Performance Indicator: Strong market share capture potential

- Current Trend: Some recent quarterly declines

- Future Outlook: Potential for upward trajectory with strategic initiatives

Bad Daddy's Burger Bar - Strategic Remodels

Good Times Restaurants Inc. is strategically investing in remodels for its Bad Daddy's Burger Bar locations. Two-thirds of the Bad Daddy's system has already undergone these upgrades, with further plans for fiscal 2026.

These capital expenditures are crucial for enhancing the customer experience and boosting operational efficiency. This focus on modernization helps Bad Daddy's maintain its competitive edge in a dynamic market.

- Strategic Remodels: Good Times Restaurants is investing in remodels for its Bad Daddy's Burger Bar brand.

- Progress: Two-thirds of Bad Daddy's locations have been remodeled to date.

- Future Plans: Remodeling efforts are scheduled to continue in fiscal 2026.

- Objectives: The remodels aim to improve customer experience and operational efficiency.

Bad Daddy's Burger Bar is a prime example of a Star in the BCG matrix due to its significant market share and high growth potential. Its strong revenue contribution, making up about 60% of Good Times Restaurants Inc.'s total revenue in fiscal year 2023, underscores its Star status. The brand's historical 18.2% same-store sales growth in fiscal 2021 also points to its capacity for rapid expansion and market penetration.

The company's strategic investments in remodels, with two-thirds of its locations already upgraded and further plans for fiscal 2026, aim to enhance customer experience and operational efficiency. This focus on modernization is crucial for maintaining its competitive edge and continuing its growth trajectory in the current market environment.

| Metric | Value | Significance |

|---|---|---|

| FY2023 Revenue Contribution | ~60% of Good Times Restaurants Inc. total revenue | Indicates dominant market position and brand strength |

| FY2021 Same-Store Sales Growth | 18.2% | Demonstrates strong historical growth and market capture ability |

| Remodeled Locations | Two-thirds of system | Shows investment in brand modernization and customer experience |

| Future Remodel Plans | Scheduled for fiscal 2026 | Reinforces commitment to ongoing brand development and competitiveness |

What is included in the product

Strategic guidance on investing in Stars, maintaining Cash Cows, developing Question Marks, and divesting Dogs.

The Good Times BCG Matrix visually clarifies your portfolio, easing the pain of resource allocation by highlighting high-potential stars.

Cash Cows

Good Times Burgers & Frozen Custard, with its significant presence primarily in Colorado, operates within a mature market. The company boasts 28 of its 30 total locations within the state, highlighting a deeply established and concentrated operational footprint. This suggests a stable, loyal customer base and a strong, though geographically limited, market share within the quick-service restaurant sector.

Good Times Burgers & Frozen Custard has historically been a reliable generator of cash flow for its parent company. In fiscal year 2021, the brand saw a significant 10.5% increase in same-store sales, a clear indicator of its ability to drive revenue and, consequently, cash. This past performance highlights the brand's underlying potential to be a strong cash cow, particularly when external factors align favorably.

Good Times Burgers & Frozen Custard's drive-thru focus positions it as a strong Cash Cow within the Good Times BCG Matrix. This model thrives on efficiency and lower overhead, directly translating into consistent cash generation, particularly in a mature, low-growth market segment.

The drive-thru operational model has proven remarkably resilient, with consumer preference for this convenience continuing to grow, especially evident in recent years. For instance, drive-thru sales at quick-service restaurants (QSRs) saw significant increases, with many chains reporting over 70% of their sales coming through this channel in 2023, a trend expected to persist.

Good Times Burgers & Frozen Custard - Efficiency Focus

Good Times Burgers & Frozen Custard is positioned as a Cash Cow within the Good Times Restaurants Inc. portfolio. The company's strategic direction for this brand emphasizes enhancing operational efficiency and profitability, rather than pursuing rapid expansion. This approach is typical for Cash Cows, where the primary objective is to generate consistent returns from established, high-performing assets.

The focus on menu review for operational effectiveness and profitability highlights the brand's mature stage. For instance, Good Times Restaurants Inc. reported in their Q1 2024 earnings that same-store sales for the Good Times brand increased by 4.2%, indicating continued customer demand. This stability allows management to concentrate on optimizing existing operations.

- Menu Optimization: Reviewing the menu to ensure items are both profitable and efficient to prepare.

- Operational Efficiency: Implementing improvements in kitchen execution and product consistency to reduce waste and enhance customer experience.

- Profitability Enhancement: Initiatives aimed at maximizing the financial returns from the established Good Times customer base.

- Brand Stability: Leveraging the brand's existing market presence and customer loyalty for sustained revenue generation.

Good Times Burgers & Frozen Custard - Lower Investment Needs

Good Times Burgers & Frozen Custard, within the Good Times Restaurants portfolio, is characterized by its lower investment needs, a hallmark of a Cash Cow. The company has not outlined ambitious plans for extensive new restaurant development. This strategic approach means less capital is required for expansion, allowing the profits generated by this segment to be strategically redirected to other areas of the business.

This financial flexibility is crucial. The cash flow from Good Times Burgers & Frozen Custard can be used to nurture potential growth opportunities, such as investing in the company's Stars or Question Marks. The primary objective for this brand is to maintain its current level of operational efficiency and profitability, rather than pursuing aggressive growth initiatives that would demand significant capital outlay.

For instance, in 2023, Good Times Restaurants reported total revenue of $155.7 million. While specific segment breakdowns for Good Times Burgers & Frozen Custard aren't always explicitly detailed in public summaries, its established market presence and consistent performance typically contribute a stable revenue stream. This stability allows for the crucial reallocation of capital.

- Lower Capital Expenditure: Limited plans for new restaurant openings reduce the need for significant investment.

- Profit Reallocation: Cash generated can fund growth initiatives in other business segments.

- Focus on Efficiency: Emphasis is on maintaining existing productivity and profitability.

- Stable Revenue Contribution: Established brands like Good Times Burgers & Frozen Custard provide a reliable income stream.

The Good Times Burgers & Frozen Custard brand functions as a Cash Cow within its parent company's portfolio. Its established market presence, particularly in Colorado, and its efficient drive-thru model generate consistent cash flow with minimal need for reinvestment. This allows profits to be strategically allocated to support other, higher-growth segments of the business.

In fiscal year 2023, Good Times Restaurants reported total revenue of $155.7 million, with the Good Times brand contributing a stable portion. The brand's focus remains on optimizing operations and profitability rather than aggressive expansion, a classic Cash Cow strategy. This stability is crucial for funding other ventures.

| Brand Segment | Market Growth | Relative Market Share | Cash Flow Generation | Strategic Focus |

| Good Times Burgers & Frozen Custard | Low | High | High | Cash Generation & Profitability |

Preview = Final Product

Good Times BCG Matrix

The preview you are currently viewing is the precise, unedited Good Times BCG Matrix document you will receive immediately after purchase. This means the strategic insights, graphical representations, and analytical frameworks are identical to the final deliverable, ensuring no surprises and immediate usability for your business planning.

Dogs

Good Times Burgers & Frozen Custard's recent performance suggests a potential shift for some of its locations into the 'Dog' category of the BCG Matrix. In the second quarter of 2025, company-owned restaurants saw same-store sales drop by 3.6%. This follows a year-to-date decline of 1.9% in the same metric.

This negative sales trend in what is generally considered a mature market segment, characterized by low growth, points towards a potential erosion of market share. Such a scenario, where a business unit has low growth and low market share, is the hallmark of a 'Dog' in the BCG framework.

If these downward sales trends persist, Good Times may need to consider strategic actions. These could range from significant operational overhauls and marketing re-strategizing to potentially divesting underperforming locations to reallocate resources more effectively.

Good Times Burgers & Frozen Custard's restaurant-level operating profit saw a decline of $0.3 million, reaching $0.9 million in the first quarter of 2025. This drop, representing a 490 basis point decrease to 8.6% of sales, is attributed to rising operational expenses.

The squeeze on profitability, fueled by increased food, labor, and occupancy costs, indicates that Good Times is facing challenges in preserving its margins within a competitive market. This situation positions the brand as a potential cash trap, where profits are consumed by ongoing costs rather than generating surplus for growth or investment.

Minimum wage hikes in Colorado, Good Times Burgers & Frozen Custard's primary market, have significantly increased labor expenses. This rise in operational costs directly impacts the company's profitability, especially since menu prices haven't kept pace proportionally.

The inability to fully pass on these increased labor costs to consumers, as evidenced by labor costs representing a higher percentage of sales, has squeezed profit margins. This financial pressure, coupled with the brand's slower growth compared to market leaders, solidifies its position as a Dog in the BCG Matrix.

Good Times Burgers & Frozen Custard - Ineffective Marketing Mix

Good Times Burgers & Frozen Custard is facing challenges with its current marketing approach, particularly with radio advertising. Recent evaluations indicate radio's diminishing effectiveness, prompting a shift towards digital platforms like streaming video and connected TV. This strategic pivot aims to better reach consumers in a crowded quick-service restaurant market.

An underperforming marketing mix can directly impact brand visibility and foot traffic, ultimately hindering market share growth. For Good Times, this translates to a potential struggle in attracting and keeping customers engaged, a critical factor for success in the competitive fast-casual dining sector.

- Marketing Mix Re-evaluation: Good Times is actively reassessing its media channels, recognizing the declining impact of traditional radio.

- Digital Expansion: The company plans to test streaming video and connected TV advertising to connect with a more digitally-oriented audience.

- Impact of Ineffective Marketing: A weak marketing strategy can result in low brand recall and reduced customer visits, directly affecting market share.

- Competitive Landscape: In the quick-service industry, failing to attract and retain customers through effective marketing can be detrimental to overall performance.

Good Times Burgers & Frozen Custard - Strategic Review of Menu and Operations

Good Times Burgers & Frozen Custard's strategic menu review, while a positive move towards modernization and efficiency, signals potential underperformance. This internal assessment suggests that certain menu items or operational processes might be lagging, requiring significant adjustments to prevent them from becoming strategic Dogs within the company's portfolio. For instance, in 2023, fast-casual burger chains saw varied performance, with some reporting flat or declining same-store sales due to evolving consumer preferences for healthier or more unique options.

The brand's focus on operational effectiveness and profitability during this review highlights a need to address any inefficiencies that could be hindering growth. If not managed proactively, these underperforming elements could drain resources and detract from the success of stronger offerings. In the competitive QSR landscape of 2024, brands that fail to adapt their menus and operations risk losing market share to more agile competitors.

The potential for menu items to become Dogs underscores the importance of continuous market analysis and adaptation. A deep dive into product profitability and customer demand is crucial.

- Menu Item Profitability Analysis: Identifying specific products with low margins or high costs.

- Operational Efficiency Audit: Streamlining preparation and service for existing and new items.

- Consumer Trend Alignment: Ensuring offerings meet current demand for quality, health, and convenience.

- Sales Data Review: Pinpointing items with consistently low sales volume.

Good Times Burgers & Frozen Custard's declining same-store sales and squeezed profit margins, exacerbated by rising labor costs and an evolving marketing landscape, indicate a potential shift into the 'Dog' quadrant of the BCG Matrix. This classification signifies units with low market share in a low-growth market, often requiring careful management or divestment.

The brand's strategic review of its menu and marketing mix, including a pivot from radio to digital advertising, suggests an acknowledgment of these challenges. In the competitive QSR market of 2024, failing to adapt to consumer preferences and operational efficiencies can lead to underperformance and resource drain.

The company's restaurant-level operating profit decline of $0.3 million in Q1 2025, dropping to 8.6% of sales, highlights the impact of increased operational expenses. This financial pressure, coupled with a less effective marketing approach, reinforces the 'Dog' classification for certain locations or offerings.

The following table illustrates key performance indicators that might place certain Good Times locations in the 'Dog' category:

| Metric | Q2 2025 Performance | Implication for BCG Matrix |

|---|---|---|

| Same-Store Sales (Company-Owned) | -3.6% | Indicates declining customer traffic or spending, suggesting low market share in a mature segment. |

| Restaurant-Level Operating Profit Margin | 8.6% (down 490 basis points) | Reflects pressure from rising costs (labor, food) and inability to pass them on, indicating low profitability. |

| Marketing Effectiveness | Shift from radio to digital | Suggests previous marketing channels were not driving sufficient growth or market share. |

| Operational Costs (Labor) | Increased due to minimum wage hikes | Directly impacts profitability, especially if not offset by price increases or efficiency gains. |

Question Marks

Bad Daddy's Burger Bar's company-owned restaurants experienced a 3.7% drop in same-store sales during Q2 2025, and are down 1.1% year-to-date. This marks a significant shift for a segment typically associated with growth.

Such a decline in comparable sales, especially in a generally expanding market, positions Bad Daddy's as a Question Mark within the BCG Matrix. This suggests a potential erosion of market share if the negative trend persists.

The brand's recent performance demands careful observation and the implementation of strategic initiatives to reverse this downward sales trajectory and regain market momentum.

Bad Daddy's Burger Bar faces a significant challenge with rising ground beef costs, a key ingredient for its gourmet burgers. These costs are projected to climb further through fiscal year 2025, directly impacting the company's food and beverage expenses.

As a premium burger chain, absorbing these escalating input costs without passing them to customers could severely squeeze profit margins. This situation places Bad Daddy's in a precarious position within the BCG matrix, potentially classifying it as a Question Mark. It requires substantial investment to maintain its competitive pricing and quality, yet the return on this investment is uncertain given the ongoing commodity price volatility.

Bad Daddy's Burger Bar competes in the upscale casual dining sector, a market characterized by robust growth potential but also significant competitive pressures. This dynamic positions it as a potential Question Mark within the BCG matrix. The brand’s distinctive menu and experience require substantial investment to capture and maintain market share amidst numerous established and emerging players.

In 2024, the U.S. casual dining segment faced an estimated compound annual growth rate of 4.5%, according to industry reports, highlighting both opportunity and the intensity of competition. Bad Daddy's, with its focus on gourmet burgers and craft beer, must continually innovate and market effectively to stand out. Failure to do so could lead to a decline in market share, a common challenge for Question Marks needing strategic focus.

Bad Daddy's Burger Bar - Capital Investment for New Units

Bad Daddy's Burger Bar is positioned as a Question Mark within the Good Times Restaurants Inc. portfolio, primarily due to its significant capital investment requirements for new unit expansion. This strategy, while aiming for market share growth, demands substantial upfront capital, which is characteristic of Question Marks that consume cash without immediate, guaranteed returns or market dominance. For instance, in fiscal year 2024, Good Times Restaurants Inc. reported capital expenditures of $10.3 million, a notable portion of which was allocated to new restaurant development, reflecting the investment needed to scale the Bad Daddy's brand.

The success of these new Bad Daddy's locations is crucial for their progression. If these units achieve strong sales and profitability, they have the potential to transition into Stars, generating significant cash flow and solidifying market leadership. However, failure to gain traction or achieve projected performance could lead to them becoming Dogs, requiring divestment or restructuring. The company's strategic focus on Bad Daddy's for unit growth highlights the inherent risk and reward associated with this segment.

- Capital Intensive Growth: Bad Daddy's Burger Bar represents a significant capital investment for Good Times Restaurants Inc., with the majority of projected unit growth stemming from this brand.

- Question Mark Characteristics: The brand exhibits Question Mark traits by requiring substantial capital for expansion, which may not immediately translate into market leadership or positive cash flow.

- Fiscal Year 2024 Investment: Good Times Restaurants Inc. allocated $10.3 million in capital expenditures during fiscal year 2024, with new unit development being a key driver of this spending, underscoring the financial commitment to Bad Daddy's expansion.

- Path to Star Status: The ultimate success of these new Bad Daddy's units hinges on their ability to capture market share and generate strong returns, thereby potentially evolving them from Question Marks into Stars within the company's portfolio.

Bad Daddy's Burger Bar - Remodeling Program Investment

Bad Daddy's Burger Bar's ongoing remodeling program is a significant investment, aiming to enhance customer experience and operational efficiency. This strategic move is crucial for staying competitive and expanding its market presence within the burgeoning casual dining sector.

While these upgrades are vital for future growth, the financial returns from these substantial investments are still in the process of materializing. This phase, where significant capital is deployed with uncertain but potentially high future payoffs, aligns with the characteristics of a Question Mark in the BCG matrix.

- Investment Focus: Remodeling efforts across Bad Daddy's locations.

- Strategic Goal: Improve customer experience and operational efficiency.

- Market Position: Targeting growth in the casual dining segment.

- Financial Status: High investment, with returns yet to be fully realized.

Question Marks represent business units with low market share in high-growth industries. Bad Daddy's Burger Bar, despite operating in a growing casual dining sector, faces this classification due to its need for substantial investment to gain market traction. The brand requires significant capital for expansion and remodeling, with uncertain future returns.

The company's strategy of investing heavily in Bad Daddy's for unit growth, as seen in the $10.3 million capital expenditures in fiscal year 2024, highlights its Question Mark status. This investment is critical for potentially transforming it into a Star, but the outcome remains contingent on market reception and competitive performance.

Bad Daddy's faces the challenge of increasing ground beef costs, projected to rise through fiscal year 2025, which could squeeze profit margins if not passed on to consumers. This financial pressure, coupled with the need for ongoing investment in remodeling and expansion, solidifies its position as a Question Mark needing strategic focus and capital allocation.

| Business Unit | Industry Growth Rate | Market Share | BCG Category | Key Considerations |

|---|---|---|---|---|

| Bad Daddy's Burger Bar | High (Casual Dining) | Low to Moderate | Question Mark | Requires significant investment for expansion; vulnerable to rising costs; remodeling program underway. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.