GoodRx SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GoodRx Bundle

GoodRx leverages its strong brand recognition and vast user base as key strengths in the competitive prescription drug market. However, potential threats from regulatory changes and increasing competition could impact its growth trajectory. Understanding these dynamics is crucial for anyone looking to invest or strategize within the healthcare technology sector.

Want the full story behind GoodRx's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

GoodRx boasts significant brand recognition, a testament to its years of operation in the digital prescription savings market. This strong brand presence has cultivated a large and loyal user base, making it a trusted name for millions seeking to manage their healthcare expenses.

As of early 2024, GoodRx reported approximately 19 million monthly active users, underscoring its substantial reach and market penetration. This extensive user base provides a powerful network effect and a significant barrier to entry for potential competitors, solidifying its position as a leader.

GoodRx's strength lies in its extensive pharmacy network, encompassing tens of thousands of locations across the U.S. This massive reach allows for unparalleled price aggregation, providing consumers with significant savings opportunities. In 2023, GoodRx reported that its users saved an estimated $10 billion on prescription medications, a testament to the power of its network.

This vast aggregation capability is a cornerstone of GoodRx's value proposition, directly translating into tangible benefits for its users. The sheer scale of its participating pharmacies creates a substantial competitive advantage, making it difficult for new entrants to replicate the same level of comprehensive price comparison and savings.

GoodRx has smartly moved beyond just offering prescription discounts. They've expanded into telehealth with services like GoodRx Care, and also provide other healthcare resources. This diversification is key, opening up new ways for them to make money and turning them into a more complete healthcare destination.

By adding virtual care, GoodRx is becoming a more useful and accessible platform for people managing their health. This integration means users can find more of what they need in one place, increasing the platform's overall value and appeal.

Data-Driven Insights and Technology Platform

GoodRx's core strength lies in its sophisticated technology platform, which allows it to gather and process extensive prescription pricing data. This capability translates into providing users with accurate, real-time savings information, a crucial benefit in the healthcare market. The platform’s ability to analyze this data also yields valuable insights into prevailing market trends and consumer purchasing habits, informing strategic decisions and new service offerings.

This robust technological infrastructure is not only scalable but also forms the backbone for potential strategic alliances and the development of innovative solutions. For instance, GoodRx's data analytics capabilities can identify underserved patient populations or emerging drug trends, allowing for targeted marketing or the creation of specialized discount programs. In 2023, GoodRx reported a significant increase in traffic to its platform, underscoring the value consumers place on its data-driven savings tools.

- Data Aggregation: GoodRx collects and analyzes prescription pricing from thousands of pharmacies.

- Real-time Savings: Provides users with up-to-the-minute discount information.

- Market Intelligence: Offers insights into prescription trends and consumer behavior.

- Scalable Technology: The platform is built for growth and continuous data processing.

Strong Value Proposition of Immediate Cost Savings

GoodRx's core strength lies in its immediate value proposition of cost savings on prescription medications. This directly tackles a significant consumer concern: the high price of drugs, offering tangible relief. This clear benefit is a major driver for user acquisition and loyalty, particularly for individuals with limited insurance or high deductibles.

The company's straightforward savings model is highly effective. By providing easily accessible discounts, GoodRx simplifies the process for consumers seeking to lower their out-of-pocket expenses. This direct appeal to affordability is a powerful differentiator in the healthcare market.

- Direct Savings: GoodRx offers immediate discounts on prescription drugs, addressing a critical consumer need.

- Broad Appeal: The value proposition resonates strongly with individuals facing high drug costs, including those with poor insurance coverage.

- Simplicity: The easy-to-understand savings model drives user adoption and retention.

GoodRx's extensive pharmacy network, covering tens of thousands of U.S. locations, is a significant asset. This broad reach enables comprehensive price aggregation, allowing users to find substantial savings. In 2023 alone, GoodRx users reportedly saved an estimated $10 billion on prescriptions, highlighting the immense value derived from this network.

The company's technology platform is another key strength, adept at collecting and analyzing vast amounts of prescription pricing data. This allows for the delivery of accurate, real-time savings information, a critical component for consumers. GoodRx's data analytics also provide valuable market intelligence on drug trends and consumer behavior, supporting strategic growth.

GoodRx has successfully diversified beyond prescription discounts, venturing into telehealth services like GoodRx Care. This expansion transforms the company into a more comprehensive healthcare destination, creating new revenue streams and increasing user engagement.

| Strength | Description | Supporting Data/Impact |

| Brand Recognition & User Base | Strong brand presence leading to a large, loyal user base. | Approximately 19 million monthly active users as of early 2024. |

| Extensive Pharmacy Network | Vast network of tens of thousands of U.S. pharmacies. | Users saved an estimated $10 billion on prescriptions in 2023. |

| Technology & Data Capabilities | Sophisticated platform for data aggregation and analysis. | Enables real-time savings information and market insights; reported significant traffic increase in 2023. |

| Service Diversification | Expansion into telehealth and other healthcare resources. | Includes services like GoodRx Care, broadening value proposition. |

What is included in the product

This SWOT analysis provides a comprehensive look at GoodRx's internal strengths and weaknesses, alongside external opportunities and threats, offering a strategic overview of its competitive landscape.

GoodRx's platform acts as a pain point reliever by offering accessible prescription savings, addressing the significant financial burden many face when obtaining medication.

Weaknesses

GoodRx's core business is built upon its partnerships with Pharmacy Benefit Managers (PBMs), the entities that manage prescription drug benefits for insurance plans. This deep integration means that any alterations to their contractual agreements, the fees they charge, or even shifts within the PBM industry itself can directly affect GoodRx's financial performance. For instance, a significant change in rebate structures negotiated by PBMs could directly reduce the revenue GoodRx generates from prescription transactions.

This dependence on PBMs introduces a notable weakness because the PBM sector is known for its complexity and lack of transparency. GoodRx's revenue streams are therefore susceptible to decisions made within this often opaque environment, making it challenging to predict or control potential impacts. In 2023, PBMs continued to consolidate their power, with the top three PBMs covering a substantial portion of the U.S. market, further highlighting GoodRx's exposure to the strategic decisions of a few key players.

The prescription discount and telehealth landscape is becoming incredibly crowded. GoodRx faces stiff competition from major pharmacy chains like CVS and Walgreens, which now offer their own discount programs. Additionally, other digital platforms and Pharmacy Benefit Managers (PBMs) are increasingly entering the space, directly providing savings solutions to consumers.

This intense competition puts pressure on GoodRx's profitability by potentially squeezing margins. Acquiring new users also becomes a tougher, more expensive endeavor in such a saturated market. GoodRx needs to continually innovate to stand out.

In 2023, GoodRx reported a revenue of $774 million, but the increasing competition suggests that maintaining this growth trajectory will require significant strategic effort to differentiate its services and attract users amidst a sea of alternatives.

GoodRx operates within the highly regulated healthcare industry, making it inherently vulnerable to shifts in government policies. For instance, changes to prescription drug pricing, like those potentially influenced by the Inflation Reduction Act of 2022, could directly impact the savings GoodRx offers its users and its revenue streams. The company's business model relies on its ability to aggregate prescription discounts, and new regulations could limit the types of discounts available or introduce new compliance burdens.

Furthermore, evolving data privacy laws, such as potential updates to HIPAA or state-level privacy regulations, pose a significant risk. GoodRx handles sensitive patient information, and any tightening of these regulations could necessitate costly system overhauls or restrict its ability to leverage data for its services. For example, a hypothetical new federal data privacy law in 2024 or 2025 could impose stricter consent requirements for data usage, impacting GoodRx's marketing and partnership strategies.

Dependence on Prescription Volume and Pricing Volatility

GoodRx's core business model hinges on prescription volume and the pricing of those prescriptions. This creates a direct vulnerability to any shifts in how many people use their service to get medications and how much those medications cost. For instance, a slowdown in prescription refills or significant price increases by drug manufacturers could directly reduce GoodRx's revenue streams. This dependence means that changes in drug pricing, which can be quite volatile, directly impact their financial predictability.

The company's reliance on prescription volume and pricing means it's susceptible to several external factors:

- Prescription Volume Fluctuations: Changes in patient adherence to medication or shifts in prescribing habits can directly affect the number of prescriptions processed through GoodRx.

- Drug Pricing Volatility: The pharmaceutical industry experiences frequent changes in drug prices, which can impact the profitability of each prescription discount offered by GoodRx.

- Manufacturer Rebate Changes: GoodRx's revenue is partly derived from fees paid by PBMs and pharmacies, often tied to manufacturer rebates. Changes in these rebate structures can significantly alter GoodRx's income.

Perception of Necessity for Insured Individuals

A key weakness for GoodRx is how some insured individuals might view its necessity. If a person's health insurance offers comprehensive coverage and manageable co-pays, they may not see the need for GoodRx, potentially shrinking its addressable market. This is particularly true for those with robust employer-sponsored plans, though even they can benefit if their deductibles are high or certain medications are expensive.

The challenge lies in convincing these insured consumers that GoodRx can still offer significant savings. For instance, while many insurance plans cover generic drugs well, specialty medications or those with high out-of-pocket costs can still present substantial savings opportunities through GoodRx. This educational hurdle is ongoing, as illustrated by the fact that in 2023, prescription drug spending in the US reached over $370 billion, indicating a large market where price comparison remains relevant even with insurance.

- Perception Gap: Insured individuals with perceived adequate coverage may not see GoodRx as essential.

- Market Limitation: This perception can limit GoodRx's reach among those with strong health plans.

- Savings Opportunity: High deductibles and expensive drugs, even for the insured, present ongoing savings potential.

GoodRx's reliance on PBM partnerships creates a significant vulnerability, as changes in PBM contracts or industry shifts can directly impact its revenue. The opaque nature of the PBM sector makes GoodRx's financial performance susceptible to decisions made by a few dominant players, a situation exacerbated by PBM consolidation in 2023.

Intense competition from pharmacies and other digital platforms pressures GoodRx's margins and increases user acquisition costs. The company's 2023 revenue of $774 million faces ongoing challenges from this crowded market, necessitating continuous innovation to maintain differentiation.

Government policy and data privacy regulations pose substantial risks to GoodRx's business model. Potential changes to drug pricing, like those influenced by the Inflation Reduction Act of 2022, or stricter data privacy laws in 2024-2025 could necessitate costly adaptations and impact revenue streams.

The company's dependence on prescription volume and pricing makes it vulnerable to fluctuations in medication adherence and drug cost volatility. Changes in manufacturer rebate structures, a key revenue component, can also significantly alter GoodRx's income.

A notable weakness is the perception among some insured individuals that GoodRx is unnecessary, potentially limiting its market reach. Convincing these consumers of the ongoing savings opportunities, particularly for high-deductible plans or expensive specialty drugs, remains an educational hurdle, despite US prescription drug spending exceeding $370 billion in 2023.

Full Version Awaits

GoodRx SWOT Analysis

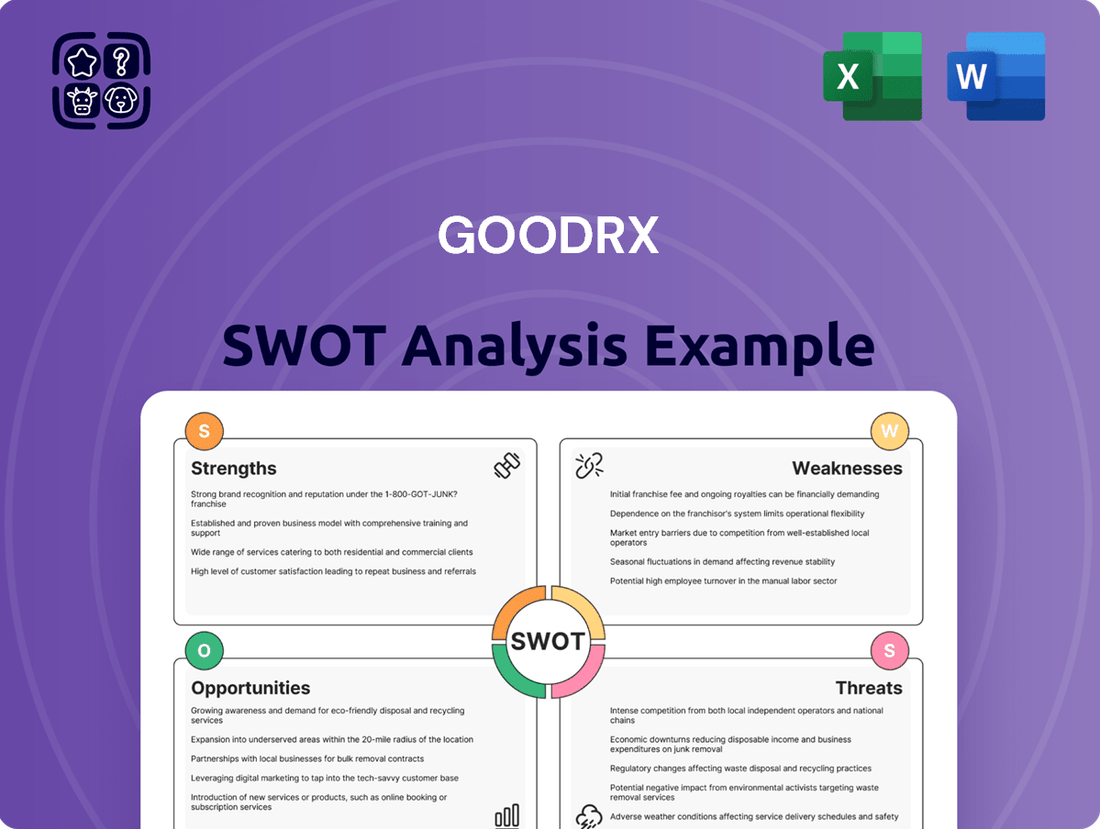

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It delves into GoodRx's Strengths, Weaknesses, Opportunities, and Threats, providing a comprehensive overview of their market position.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights into GoodRx's strategic landscape.

Opportunities

GoodRx has a significant opportunity to grow by offering comprehensive chronic disease management programs. This could include tools to help patients stick to their medication schedules, personalized health advice, and better ways to connect with their doctors. Such a move would not only deepen patient relationships but also open up new avenues for revenue beyond just providing prescription discounts.

Expanding into chronic disease management is a logical next step for GoodRx, moving beyond simple cost savings to providing ongoing support for long-term health conditions. This aligns with the growing demand for integrated healthcare solutions. For instance, the U.S. Centers for Disease Control and Prevention (CDC) reported in 2023 that six in ten adults in the U.S. have a chronic disease, highlighting a vast market for these services.

GoodRx can significantly expand its influence by deepening collaborations with healthcare providers and insurance companies. Imagine hospitals and clinics directly recommending GoodRx to their patients, or insurance plans featuring it as a preferred savings tool. This integration would not only boost GoodRx's user base but also solidify its standing as a trusted healthcare resource. For instance, in 2024, GoodRx reported over 15 million monthly active users, a figure poised for substantial growth through such strategic alliances.

The expanding telehealth market presents a significant avenue for GoodRx to broaden its virtual care offerings. By integrating more consultation, follow-up, and potentially remote monitoring services, GoodRx can tap into the growing consumer preference for convenient and accessible healthcare solutions. This expansion would further solidify the connection between its prescription savings platform and its care services.

GoodRx's existing user base provides a strong foundation for driving adoption of these enhanced virtual care services. With telehealth adoption surging, GoodRx is well-positioned to leverage this trend. For instance, in early 2024, a significant percentage of consumers reported using telehealth services, indicating a receptive market for GoodRx's integrated approach.

Leveraging Data for Personalized Health Solutions

GoodRx's vast repository of prescription data, encompassing usage patterns and pricing information, presents a significant opportunity to pioneer personalized health solutions. By analyzing this data, GoodRx can offer tailored health insights and recommendations, potentially evolving into a proactive health management platform that extends far beyond its current discount-focused model.

This strategic shift could unlock substantial value by enabling predictive analytics for both consumers and healthcare providers. Imagine a future where GoodRx helps users anticipate potential health needs or optimize treatment plans based on their unique prescription history. This data-driven approach positions GoodRx to become an indispensable tool in everyday health management.

Furthermore, the company can explore avenues for data monetization. By providing de-identified, aggregated insights to researchers, pharmaceutical companies, or payers, GoodRx can create new revenue streams while contributing to broader advancements in healthcare understanding. For instance, in 2023, the digital health market saw significant growth, with data analytics playing a crucial role in driving innovation and personalized patient care.

- Personalized Health Insights: Leveraging prescription data to offer tailored health advice and recommendations.

- Proactive Health Management: Evolving into a platform that helps users manage their health proactively, not just reactively.

- Predictive Analytics: Utilizing data to forecast potential health issues or optimize treatment pathways.

- Data Monetization: Generating revenue through the sale of de-identified, aggregated user data insights.

Potential for International Market Expansion

GoodRx's current success is largely U.S.-centric, but a significant long-term opportunity lies in expanding into international markets. Countries facing similar challenges with drug affordability could be prime candidates for GoodRx's proven model. For instance, the global pharmaceutical market reached an estimated $1.57 trillion in 2023, indicating a vast potential customer base outside the U.S. if the affordability model can be effectively replicated.

Adapting its platform to navigate diverse regulatory landscapes and local market dynamics will be key. This could involve partnerships or localized versions of their services. The fundamental value proposition of making prescription medications more affordable is a universal need, transcending geographical boundaries and offering substantial growth potential.

Consider these potential avenues for international expansion:

- Canada: Similar healthcare system structure and high drug costs present a natural entry point.

- United Kingdom: While the NHS offers some drug cost management, out-of-pocket expenses and private prescriptions still represent a market.

- Australia: A developed healthcare system with a significant private pharmaceutical market.

GoodRx has a substantial opportunity to expand its chronic disease management services, moving beyond prescription savings to offer integrated patient support. This aligns with the increasing prevalence of chronic conditions, with the CDC reporting in 2023 that six in ten U.S. adults have at least one chronic disease. By developing tools for medication adherence, personalized health advice, and enhanced doctor communication, GoodRx can foster deeper patient relationships and create new revenue streams.

Deepening partnerships with healthcare providers and insurers presents another significant growth avenue. Imagine seamless integration where providers directly recommend GoodRx or insurance plans feature it as a preferred savings tool. This would leverage GoodRx's existing user base, which exceeded 15 million monthly active users in 2024, to solidify its role as a trusted healthcare resource.

The expanding telehealth market offers a prime opportunity for GoodRx to enhance its virtual care offerings. By integrating more consultation, follow-up, and remote monitoring services, GoodRx can tap into the growing consumer preference for convenient healthcare access, further connecting its prescription savings platform with broader care services.

GoodRx's extensive prescription data can be leveraged to pioneer personalized health solutions, moving towards a proactive health management platform. This data-driven approach could enable predictive analytics for users and providers, potentially forecasting health needs or optimizing treatment plans. Furthermore, monetizing de-identified data insights for researchers and pharmaceutical companies in the growing digital health market (which saw significant innovation in 2023) offers new revenue potential.

International expansion represents a major long-term opportunity, particularly in markets facing similar drug affordability challenges. The global pharmaceutical market, valued at an estimated $1.57 trillion in 2023, offers a vast potential customer base. Success will hinge on adapting the platform to diverse regulatory environments and local market needs, potentially through strategic partnerships.

| Opportunity Area | Description | 2023/2024 Data Point | Potential Impact |

|---|---|---|---|

| Chronic Disease Management | Integrated patient support beyond prescription savings | 60% of U.S. adults have at least one chronic disease (CDC, 2023) | Deepened patient relationships, new revenue streams |

| Provider/Insurer Partnerships | Direct recommendations and preferred tool status | Over 15 million monthly active users (GoodRx, 2024) | Increased user base, enhanced credibility |

| Telehealth Integration | Expanding virtual care offerings | Surging telehealth adoption (Early 2024 consumer reports) | Convenient access, stronger platform integration |

| Data Monetization & Personalization | Leveraging prescription data for insights and revenue | Growth in digital health market driven by data analytics (2023) | New revenue, proactive health management |

| International Expansion | Replicating affordability model in global markets | Global pharmaceutical market ~$1.57 trillion (2023) | Significant long-term growth potential |

Threats

Major retail pharmacy chains like CVS and Walgreens, along with tech giants such as Amazon Pharmacy, are significantly increasing their investment in discount programs and healthcare services. This directly challenges GoodRx's core business model by offering comparable or even more integrated solutions.

These larger players possess substantial financial resources, extensive customer loyalty, and robust, integrated supply chains, which can be leveraged to undercut GoodRx's pricing and service offerings. For instance, Amazon Pharmacy's acquisition of PillPack in 2018 signaled its serious intent in this market, and by 2024, its continued expansion into prescription delivery and price comparison tools presents a formidable challenge.

The ability of these competitors to bundle pharmacy services with other offerings, such as loyalty programs or broader e-commerce ecosystems, provides a distinct advantage. This integration can create a stickier customer experience, making it harder for GoodRx to retain users who might be drawn to a one-stop-shop solution.

The pharmacy benefit manager (PBM) landscape is in flux. Increased consolidation among PBMs or a move towards direct contracting between insurers and pharmacies could significantly alter GoodRx's revenue streams by potentially cutting out intermediaries like GoodRx. This shift could reduce GoodRx's relevance in connecting consumers to discounted prescriptions.

If major players bypass aggregators, GoodRx's position in the prescription drug supply chain might weaken. Furthermore, evolving regulations aimed at increasing PBM transparency could introduce new compliance burdens or alter the economics of the prescription discount market, directly impacting GoodRx's business model.

Ongoing political pressure and potential legislative action aimed at controlling prescription drug prices present a significant threat to GoodRx. For instance, the Inflation Reduction Act of 2022, which allows Medicare to negotiate prices for certain high-cost drugs, signals a trend towards greater government involvement. This could directly reduce the savings GoodRx offers its users.

Policies mandating lower drug prices or increasing price transparency could erode GoodRx's core value proposition. If government-driven reforms make prescription drugs more affordable across the board, the perceived benefit of using discount services like GoodRx may diminish, impacting user acquisition and retention.

Government initiatives to cap out-of-pocket prescription drug costs, such as those being explored or implemented in various states and at the federal level, pose a direct threat. These caps can limit the potential savings individuals can achieve through discount cards, thereby reducing the incentive to use GoodRx.

Data Privacy Concerns and Cybersecurity Risks

GoodRx's handling of sensitive patient information makes it a prime target for cyberattacks. A data breach could expose millions of users' health details, leading to significant reputational damage and hefty fines under regulations like HIPAA. For instance, in 2023, the healthcare sector experienced a surge in ransomware attacks, with some incidents impacting millions of patient records.

The evolving landscape of data privacy regulations, such as potential updates to HIPAA or new state-level privacy laws, presents an ongoing challenge. Non-compliance can result in substantial penalties, impacting financial performance and operational continuity. As of early 2024, discussions around stricter data protection measures continue globally, underscoring the need for proactive compliance.

- Reputational Damage: A major breach could erode user trust, a critical asset for a digital health platform.

- Legal Liabilities: Fines and lawsuits stemming from data privacy violations can be financially crippling.

- Operational Disruption: Cybersecurity incidents can halt services, impacting revenue and user access.

Economic Downturn Impacting Discretionary Healthcare Spending

A significant economic downturn could pressure discretionary healthcare spending, even for essential medications. Consumers facing financial strain might delay non-urgent treatments or opt for cheaper generic alternatives, potentially impacting GoodRx's transaction volume. For instance, if unemployment rises sharply, as it did to 14.7% in April 2020 during the COVID-19 pandemic, a substantial portion of the population could lose employer-sponsored health insurance, increasing reliance on discount platforms like GoodRx but also potentially reducing overall spending on healthcare services.

This reduced consumer spending power could directly affect GoodRx's revenue streams. If fewer people can afford their prescriptions or premium services, the company's transaction volumes and subscription numbers could decline. For example, a prolonged recession might see a decrease in the average number of prescriptions filled per user, impacting the company's ability to generate revenue from its core business model.

Furthermore, rising unemployment rates can significantly impact health insurance coverage. A large segment of the population relies on employer-provided insurance, and widespread job losses would mean many individuals lose their coverage. This could lead to a more price-sensitive consumer base, potentially increasing demand for GoodRx's discounts but also making them more likely to seek out the absolute lowest-cost options, which may not always align with GoodRx's partnerships.

The impact of an economic downturn on healthcare spending is a significant concern for platforms like GoodRx.

- Reduced Consumer Spending: Economic hardship can lead individuals to cut back on non-essential expenses, including some healthcare services and potentially even adherence to prescribed medication regimens.

- Shift to Generics: In tough economic times, consumers are more likely to switch to lower-cost generic drugs, which might have lower margins for discount providers or be less frequently featured on savings platforms.

- Impact on Transaction Volumes: A decrease in overall consumer spending power can translate directly into lower transaction volumes for GoodRx, affecting revenue generated from prescription fulfillment.

- Insurance Coverage Changes: Rising unemployment can lead to a loss of employer-sponsored health insurance, increasing the number of uninsured or underinsured individuals who may rely more heavily on discount programs but have less overall disposable income for healthcare.

Intense competition from established retail pharmacies and tech giants like Amazon Pharmacy, which are expanding their discount programs and integrated healthcare services, poses a significant threat by directly challenging GoodRx's core business model.

The evolving pharmacy benefit manager (PBM) landscape, with potential consolidation or direct contracting between insurers and pharmacies, could diminish GoodRx's role as an intermediary, impacting its revenue streams.

Government interventions aimed at controlling drug prices, such as the Inflation Reduction Act of 2022, and potential mandates for lower prices or increased transparency can erode GoodRx's value proposition by making drugs more affordable generally.

Cybersecurity risks, including data breaches of sensitive patient information, present substantial threats of reputational damage and legal liabilities, especially given the healthcare sector's vulnerability to attacks, as seen in the surge of ransomware incidents in 2023 impacting millions of patient records.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, including GoodRx's official financial filings, comprehensive market research reports, and insights from industry experts to ensure a well-rounded understanding of its competitive landscape.