GoodRx Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GoodRx Bundle

GoodRx navigates a complex landscape shaped by intense rivalry and the significant bargaining power of both buyers and suppliers. Understanding these dynamics is crucial for any stakeholder in the healthcare and discount prescription market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore GoodRx’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The pharmaceutical industry's supply chain is notably concentrated, with a handful of large manufacturers and distributors dominating the market. This limited number of key players grants them substantial bargaining power, influencing pricing and the terms of their participation in discount programs. GoodRx's business model relies heavily on access to this data and the cooperation of these suppliers to provide competitive pricing to its consumers.

Pharmacy Benefit Managers (PBMs) wield considerable influence in the pharmaceutical landscape, acting as crucial intermediaries. Their power stems from their role in negotiating drug prices and managing prescription drug benefits for insurers and employers, impacting both manufacturers and pharmacies. In 2024, the top three PBMs, CVS Caremark, Express Scripts, and Optum Rx, collectively managed benefits for over 200 million Americans, giving them immense leverage in setting reimbursement rates.

GoodRx's historical reliance on partnerships with PBMs to access prescription pricing data highlights their bargaining power. These PBMs, by controlling a substantial portion of the prescription drug market, can dictate terms related to data access and reimbursement, directly affecting GoodRx's business model and ability to offer competitive pricing information to consumers.

Pharmaceutical companies wield considerable power in setting drug prices, a direct result of the immense investment in research and development and the lengthy, complex regulatory approval pathways. These factors create high barriers to entry, allowing manufacturers to dictate the initial pricing of their medications.

For instance, the average cost to develop a new drug that eventually reaches the market was estimated to be around $2.6 billion in 2023, a figure that underscores the significant financial risk and investment involved. This substantial upfront cost directly influences the pricing strategies of these companies, giving them substantial leverage over the base price of their products.

Regulatory Environment Impact

The complex web of regulations, overseen by agencies like the FDA, CMS, and FTC, significantly shapes supplier negotiations for platforms like GoodRx. These regulations directly influence the cost and availability of prescription drugs, impacting the leverage pharmaceutical companies, pharmacy benefit managers (PBMs), and GoodRx itself possess.

For instance, shifts in how drugs are approved or how Medicare drug pricing is managed can alter the bargaining power dynamics. In 2024, ongoing discussions and potential legislative changes around drug pricing transparency and rebate reforms continue to be a focal point, potentially empowering or weakening suppliers depending on the outcome.

- FDA Approval Processes: Lengthy and costly FDA approval pathways can give established drug manufacturers more power.

- CMS Reimbursement Rates: Changes in Medicare and Medicaid reimbursement rates directly affect the profitability of drug sales, influencing supplier pricing.

- FTC Scrutiny: Antitrust concerns and FTC investigations into PBM practices can impact the negotiating leverage of intermediaries, indirectly affecting suppliers.

- Drug Pricing Legislation: Evolving legislation aimed at controlling drug costs, such as the Inflation Reduction Act's provisions, directly impacts supplier pricing power.

Dependency on Pharmacy Participation

GoodRx's business model is heavily reliant on a wide array of pharmacies participating in its discount programs. While the company has been building direct relationships, its core function still necessitates pharmacies accepting its discount cards and offers. This participation can be swayed by the pharmacies' own financial considerations and their existing ties with Pharmacy Benefit Managers (PBMs).

The bargaining power of suppliers, in this case, pharmacies, is a significant factor for GoodRx. In 2023, GoodRx reported that approximately 70,000 pharmacies were part of its network. This broad reach is essential, but it also means that individual or groups of pharmacies can exert influence.

- Pharmacy Network Size: GoodRx's ability to negotiate terms with pharmacies is influenced by the sheer number of participating locations, which stood at around 70,000 in 2023.

- Direct Contracting Efforts: While GoodRx aims for direct contracts, the effectiveness of these depends on pharmacy willingness, which is tied to their profitability and strategic alliances.

- PBM Relationships: Pharmacies' existing relationships with PBMs can impact their openness to GoodRx's programs, potentially increasing supplier bargaining power if PBMs are unfavorable.

The bargaining power of suppliers, particularly pharmaceutical manufacturers and Pharmacy Benefit Managers (PBMs), significantly impacts GoodRx's operations. Manufacturers can leverage high R&D costs and regulatory hurdles to set drug prices, while PBMs, managing benefits for millions, dictate reimbursement rates and data access terms. In 2024, the concentration of power among top PBMs like CVS Caremark, Express Scripts, and Optum Rx, who collectively served over 200 million Americans, underscores their substantial leverage.

GoodRx's reliance on these entities for pricing data and partnerships means supplier terms directly influence the company's ability to offer competitive discounts. The intricate regulatory environment, including FDA approval processes and evolving drug pricing legislation, further shapes these supplier dynamics, potentially shifting leverage. For example, legislative efforts in 2024 to increase drug pricing transparency could alter the power balance.

| Supplier Type | Key Influences | Impact on GoodRx |

|---|---|---|

| Pharmaceutical Manufacturers | R&D Costs, Regulatory Approval, Patent Protection | Dictate base drug prices, influencing the discounts GoodRx can offer. |

| Pharmacy Benefit Managers (PBMs) | Market Share, Negotiation Power with Insurers | Control data access and reimbursement rates, affecting GoodRx's partnerships and revenue streams. |

| Pharmacies | Network Size, PBM Relationships, Profitability | Participation in discount programs is crucial; their willingness to accept GoodRx discounts can be influenced by their own financial standing and existing PBM contracts. |

What is included in the product

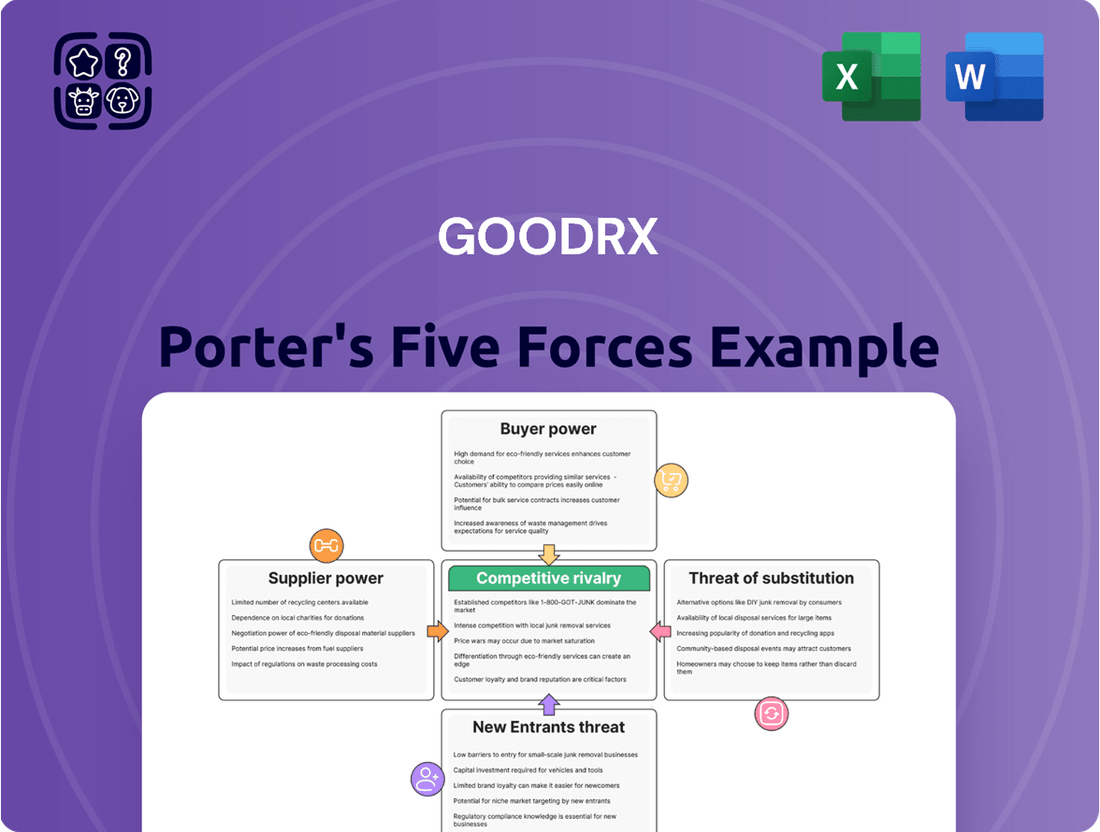

This Porter's Five Forces analysis for GoodRx dissects the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on its business model.

Instantly identify and address competitive threats, from supplier power to new entrants, with GoodRx's Porter's Five Forces analysis, streamlining strategic planning.

Customers Bargaining Power

Consumers of prescription medications frequently grapple with substantial costs, rendering them acutely sensitive to price fluctuations. This financial pressure drives a strong demand for solutions that can alleviate their out-of-pocket expenses.

GoodRx directly capitalizes on this high consumer price sensitivity by offering a platform that facilitates the discovery of lower prices and discounts on prescription drugs. For instance, in 2023, GoodRx reported that its users saved an average of $15 per prescription, underscoring the tangible value customers derive from such cost-saving tools.

The proliferation of digital health platforms has significantly boosted the availability of price comparison tools for prescription medications. Consumers can now effortlessly check prices at various pharmacies and discount programs, directly enhancing their ability to negotiate by making well-informed decisions.

The increasing prevalence of high-deductible health plans (HDHPs) significantly boosts customer bargaining power. As of 2024, a substantial segment of the insured population faces higher upfront costs for healthcare services and prescription drugs, making them more sensitive to price variations. This financial pressure directly incentivizes consumers to actively search for cost-saving solutions, thereby strengthening their leverage when choosing where and how to purchase medications.

Potential for Medication Abandonment or Alternatives

When prescription drug prices become too high, consumers have significant leverage. They can choose to delay refilling their prescriptions, ration their current supply, or simply stop taking their medication altogether. This directly impacts pharmaceutical companies by reducing sales volume and revenue.

Furthermore, the availability of alternatives amplifies customer bargaining power. Patients might opt for over-the-counter medications for less severe conditions or explore purchasing prescriptions from international pharmacies where prices can be substantially lower. This willingness to seek out cheaper options gives consumers a strong position to refuse premium pricing.

In 2024, the pressure on drug pricing intensified, with many consumers actively seeking cost-saving measures. Data from GoodRx indicated that a significant percentage of Americans reported difficulty affording their prescription medications, leading to increased use of discount cards and a greater exploration of alternative sourcing. For instance, a notable portion of users reported delaying or skipping doses due to cost, directly impacting adherence and manufacturer sales.

- Medication Rationing: Consumers may reduce their dosage or skip doses to make prescriptions last longer.

- Treatment Discontinuation: High costs can lead patients to stop taking essential medications, impacting health outcomes and company revenue.

- Seeking Alternatives: Patients may switch to over-the-counter drugs or import medications from other countries to avoid high prices.

- Increased Price Sensitivity: The documented struggle to afford medications in 2024 highlights a heightened consumer sensitivity to price increases.

User Engagement with Discount Programs

GoodRx's substantial user base, reaching millions of monthly active consumers actively searching for more affordable prescription medications, highlights the significant collective bargaining power of its customers. This engagement with discount programs and coupons directly fuels the demand for cost-effective pharmaceutical solutions.

The sheer volume of users actively seeking savings gives customers considerable leverage. In 2023, GoodRx reported an average of 19 million monthly active users, a testament to the widespread reliance on their platform for prescription price comparisons and discounts.

- Millions of monthly active users: GoodRx's platform consistently attracts a large consumer base actively seeking prescription savings.

- High engagement with discount programs: Users actively utilize coupons and comparison tools, demonstrating their preference for lower prices.

- Price sensitivity: The core value proposition for GoodRx users is the ability to reduce out-of-pocket medication costs.

- Collective bargaining power: The aggregated demand from millions of users gives them a strong position to influence pricing and service offerings.

Customers possess significant bargaining power due to their high price sensitivity and the increasing availability of cost-saving alternatives. As of 2024, a notable portion of Americans reported difficulty affording prescriptions, driving them to seek discounts and compare prices across platforms like GoodRx. This widespread need for affordability empowers consumers to demand lower prices.

The collective strength of millions of active users on platforms like GoodRx amplifies customer leverage. In 2023, GoodRx reported approximately 19 million monthly active users, all actively seeking to reduce their prescription expenses. This large, engaged user base demonstrates a clear preference for cost-effective solutions, giving them considerable power to influence pricing.

| Factor | Description | Impact on Bargaining Power |

|---|---|---|

| Price Sensitivity | Consumers are highly sensitive to prescription costs, especially with the rise of high-deductible health plans in 2024. | Increases bargaining power as consumers actively seek lower prices. |

| Availability of Alternatives | Patients can delay, ration, or switch to lower-cost alternatives, including over-the-counter options or international pharmacies. | Strengthens customer leverage by providing options to avoid high prices. |

| Platform Usage (GoodRx) | Millions of monthly active users (e.g., 19 million in 2023) actively use discount programs. | Creates collective bargaining power through aggregated demand for savings. |

Preview the Actual Deliverable

GoodRx Porter's Five Forces Analysis

This preview showcases the exact GoodRx Porter's Five Forces Analysis you will receive immediately after purchase, offering a comprehensive examination of competitive forces within the prescription drug pricing landscape. You'll gain insights into the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products, all presented in a professionally formatted document. This is the complete, ready-to-use analysis file; what you're previewing is precisely what you'll be able to download after payment, ensuring no surprises and immediate utility for your strategic planning.

Rivalry Among Competitors

GoodRx faces significant competitive rivalry from direct competitors offering similar prescription price comparison and discount services. Companies like Blink Health, SingleCare, RxSaver, and WellRx actively compete for the same consumer base, leading to intense price and feature-based competition.

In 2023, the prescription discount market continued to be highly fragmented. While GoodRx remained a dominant player, its market share was challenged by the growing user bases of these direct rivals, each employing various strategies to attract and retain customers, from app-based convenience to broader pharmacy network access.

The competitive landscape for prescription savings is intensifying with the entry of major retail and tech players. Large pharmacy chains, such as CVS Health and Walgreens Boots Alliance, are leveraging their extensive physical footprints and established customer loyalty programs to compete directly. These companies are increasingly integrating digital offerings, including prescription management apps and home delivery services, to capture a larger share of the market.

Tech giants like Amazon Pharmacy are also making significant inroads, utilizing their robust logistics networks and vast online customer bases to disrupt traditional pharmacy models. Amazon's acquisition of PillPack and its ongoing expansion of pharmacy services, often coupled with Prime membership benefits, present a formidable challenge. For instance, Amazon Pharmacy reported significant growth in prescription volume in 2023, indicating its increasing market penetration.

Pharmacies are increasingly rolling out their own loyalty programs and in-house discounts, directly challenging third-party savings platforms. These initiatives, like CVS ExtraCare or Walgreens Balance Rewards, aim to lock in customers by offering personalized savings and rewards, effectively creating a competitive alternative to services like GoodRx.

These direct pharmacy discounts can erode the value proposition of external coupon aggregators. For instance, many major pharmacy chains in the US reported significant growth in their loyalty program membership in 2024, with millions of active users benefiting from these exclusive offers, directly impacting the need for customers to seek savings elsewhere.

PBM-Affiliated Discount Programs

Pharmacy Benefit Managers (PBMs) directly challenge GoodRx by offering their own discount programs, often partnering with major pharmacy chains. This creates a significant competitive pressure as PBMs leverage their existing infrastructure and relationships within the healthcare ecosystem. For instance, Optum Rx, a major PBM, operates its own discount programs that can directly compete with GoodRx for consumer savings on prescription drugs.

The inherent market concentration of PBMs, such as CVS Caremark, Express Scripts, and Optum Rx, amplifies this rivalry. These large entities possess established networks and strong negotiating power with both pharmacies and insurance providers. This allows them to create bundled offerings or preferential discount arrangements that can be difficult for a standalone platform like GoodRx to fully replicate.

- PBM Market Share: In 2023, the top three PBMs (CVS Caremark, Express Scripts, and Optum Rx) managed approximately 75-80% of all PBM-covered lives in the US, highlighting their significant market power.

- Pharmacy Partnerships: PBMs often have exclusive or preferred agreements with large pharmacy chains, which can limit the visibility or accessibility of GoodRx discounts at those locations.

- Direct Consumer Programs: PBMs are increasingly developing direct-to-consumer discount cards and mobile applications, mirroring GoodRx's core offering and directly vying for user engagement.

Differentiation through Telehealth and Other Services

GoodRx's competitive rivalry is shaped by its differentiation strategy, which extends beyond simple prescription price comparison. The company actively competes by offering ancillary services, notably telehealth consultations through its GoodRx Care platform. This move allows GoodRx to capture a broader share of the healthcare consumer's wallet and build deeper customer loyalty.

Competitors are responding by also broadening their service portfolios. For instance, other pharmacy benefit managers or direct-to-consumer healthcare platforms may differentiate through unique features, such as integrated chronic condition management, personalized wellness programs, or specialized niche offerings targeting specific patient populations. This dynamic means the competitive landscape is influenced by more than just the lowest prescription prices.

In 2024, the telehealth market continued its robust growth, with platforms like GoodRx Care playing a significant role. While specific, granular data for GoodRx's telehealth segment in 2024 isn't publicly detailed, the broader telehealth market saw substantial engagement. For example, reports indicated that by the end of 2023, a significant percentage of consumers had used telehealth services, a trend that has likely continued and expanded in 2024, demonstrating the growing importance of these value-added services in attracting and retaining customers.

- Beyond Price Comparison: GoodRx differentiates by offering telehealth consultations via GoodRx Care, adding value beyond prescription discounts.

- Competitive Response: Rivals are enhancing their offerings with unique features, broader service portfolios, or niche specializations.

- Market Trend: The telehealth sector's continued growth in 2024 underscores the strategic importance of integrated healthcare services.

GoodRx faces intense rivalry from direct competitors like Blink Health and SingleCare, all vying for the same customer base through price and feature competition. The market remained fragmented in 2023, with rivals actively seeking to expand their user numbers and pharmacy networks.

Major retail pharmacies, including CVS and Walgreens, are increasingly leveraging their loyalty programs and integrated digital offerings to compete directly, often providing in-house discounts that can reduce the need for third-party savings platforms. By the end of 2023, millions of consumers were actively engaged with these pharmacy loyalty programs, demonstrating their impact.

Pharmacy Benefit Managers (PBMs), such as CVS Caremark, Express Scripts, and Optum Rx, represent another significant competitive force. These entities manage a substantial portion of covered lives, often holding exclusive pharmacy agreements and developing their own direct-to-consumer discount programs that mirror GoodRx's core offerings.

GoodRx is also differentiating itself by offering ancillary services like telehealth through GoodRx Care, a strategy that competitors are also adopting by broadening their own service portfolios to include features like chronic condition management.

SSubstitutes Threaten

Traditional health insurance plans, encompassing commercial offerings and government programs like Medicare and Medicaid, represent significant substitutes for GoodRx. These plans are often the initial recourse for individuals seeking to manage prescription drug expenses, thereby diminishing the perceived necessity of discount aggregation services for many.

In 2023, approximately 91.4% of the U.S. population had health insurance coverage, according to the U.S. Census Bureau. This high penetration rate means a substantial portion of consumers already have a mechanism in place to address healthcare costs, including prescription medications, making them less likely to actively seek out or rely on GoodRx for savings.

Pharmaceutical manufacturers' co-pay and patient assistance programs present a significant threat of substitution for platforms like GoodRx. These manufacturer-sponsored programs directly lower the out-of-pocket cost for patients, particularly for expensive brand-name medications, offering a compelling alternative to general discount cards. For instance, in 2024, many pharmaceutical companies continued to heavily invest in these programs as a strategy to maintain market share for their patented drugs, effectively bypassing third-party discount providers.

The rise of generic and biosimilar medications poses a substantial threat of substitution for brand-name drugs. These alternatives offer significant cost savings, directly impacting the need for discount platforms. For instance, in 2023, the U.S. Food and Drug Administration (FDA) approved 1,300 generic drug applications, highlighting the growing availability of cheaper options.

Consumers increasingly opt for these lower-cost generics and biosimilars, bypassing the need for brand-name drugs and the services that facilitate their purchase. This trend directly erodes the value proposition of companies like GoodRx, as it provides an alternative pathway to affordability for many prescription medications.

International Online Pharmacies and Cross-Border Purchases

Consumers facing significantly high prescription drug costs in the U.S. are increasingly exploring international online pharmacies as a viable alternative. This trend directly substitutes for traditional domestic prescription fulfillment, with cost savings being the primary motivator.

The allure of lower prices from overseas can be substantial, especially for individuals managing chronic conditions or requiring expensive specialty medications. For instance, a report in late 2023 highlighted that certain common medications could be purchased from international sources at savings of 50% or more compared to U.S. retail prices.

- Cost Savings: A significant driver, with potential savings exceeding 50% on select medications.

- Accessibility: Provides an avenue for obtaining medications not readily available or prohibitively expensive domestically.

- Regulatory Landscape: While offering savings, consumers must navigate varying international regulations and potential quality control concerns.

Lifestyle Changes and Over-the-Counter Alternatives

Consumers might bypass prescription drugs for conditions by adopting lifestyle changes, dietary adjustments, or using over-the-counter (OTC) alternatives. This trend is amplified when prescription costs become a significant barrier, impacting medication adherence and the overall demand for prescription savings platforms like GoodRx. For instance, a 2024 survey indicated that 35% of individuals facing high prescription costs considered alternative treatments or lifestyle modifications instead of filling their prescriptions.

The availability of effective OTC options presents a direct threat. Many common ailments, from minor pain to certain vitamin deficiencies, have readily accessible and often cheaper alternatives. This segment of the market is substantial; the global OTC pharmaceutical market was valued at over $150 billion in 2023 and is projected to continue growing, offering consumers a tangible substitute for prescription medications.

- Impact of High Prescription Costs: Elevated drug prices directly push consumers towards cheaper, non-prescription alternatives.

- Growth of OTC Market: The expanding global OTC market provides a growing array of viable substitutes for prescription drugs.

- Consumer Behavior Shift: Increased awareness and accessibility of lifestyle changes and OTC products empower consumers to seek alternatives.

Traditional health insurance plans represent a primary substitute, as a vast majority of the U.S. population, approximately 91.4% in 2023, already has coverage for healthcare expenses. Pharmaceutical manufacturers' own co-pay and patient assistance programs also directly reduce out-of-pocket costs, especially for brand-name drugs, with continued investment in these programs by companies in 2024. Furthermore, the increasing availability of lower-cost generic and biosimilar medications, with 1,300 generic drug applications approved by the FDA in 2023, directly addresses the need for discount platforms by offering inherent affordability.

| Substitute Category | Description | 2023/2024 Relevance/Data |

|---|---|---|

| Health Insurance | Existing coverage for prescription costs. | 91.4% of U.S. population covered in 2023. |

| Manufacturer Programs | Direct patient assistance from drug makers. | Continued heavy investment by pharma companies in 2024. |

| Generics & Biosimilars | Lower-cost alternative medications. | 1,300 generic drug applications approved by FDA in 2023. |

Entrants Threaten

The digital nature of GoodRx's core price comparison service presents a low barrier to entry for potential new competitors. Developing a platform to aggregate prices and offer discounts is achievable with readily available technology, which naturally encourages new entrants to the market.

For instance, in 2024, the digital health market continued to expand, with numerous startups emerging focused on various aspects of healthcare access and affordability. This ecosystem readily supports new players who can leverage existing cloud infrastructure and open-source development tools to launch similar price comparison functionalities.

While it might seem easy for new digital players to enter the prescription drug discount market, building a robust network of pharmacies and forging crucial relationships with Pharmacy Benefit Managers (PBMs) or directly with drug manufacturers presents a substantial hurdle. These established connections are not easily replicated.

GoodRx, for instance, has invested years in cultivating these vital partnerships, which are essential for accessing and negotiating drug prices. As of early 2024, GoodRx reported having agreements with over 70,000 pharmacies across the United States, a testament to the significant effort required to build such an extensive network.

The threat of new entrants to GoodRx's market is significantly mitigated by the sheer complexity and cost of replicating its core competitive advantage: data aggregation and algorithm sophistication. Building an equally comprehensive database of prescription prices across numerous pharmacies and payers, coupled with the advanced algorithms needed to identify the absolute lowest prices in real-time, demands immense capital investment and specialized technical expertise. For instance, in 2023, GoodRx reported access to pricing information for over 70,000 pharmacies, a scale that would be prohibitively expensive for a newcomer to match.

Brand Recognition and User Trust

GoodRx has cultivated significant brand recognition and user trust, making it a go-to resource for millions of Americans looking to save on prescriptions. This established reputation presents a substantial barrier for any new competitor aiming to enter the prescription savings market.

New entrants would need to invest heavily in marketing and build a track record of reliability to gain consumer confidence, a process that can take years and considerable capital. In 2023, GoodRx reported over 19 million monthly active users, underscoring the depth of its established user base and the challenge new platforms face in reaching comparable scale.

- Brand Loyalty: GoodRx's consistent delivery of savings has fostered strong brand loyalty.

- Trust Factor: Consumers often rely on trusted platforms for healthcare-related services.

- Market Saturation: While the market for prescription savings exists, established players like GoodRx make it difficult for newcomers to gain traction.

- Acquisition Costs: The cost of acquiring new users in this space is high due to the need for extensive marketing to build trust.

Regulatory Scrutiny and Compliance Costs

The threat of new entrants for GoodRx is significantly impacted by the intense regulatory environment within the healthcare sector. New companies must contend with stringent compliance mandates, particularly concerning patient data privacy under regulations like HIPAA, and the complexities of drug pricing transparency and consumer protection laws. For instance, the U.S. healthcare industry is projected to reach $6.8 trillion by 2027, underscoring the vast market but also the significant regulatory overhead associated with operating within it.

Recent increased regulatory attention on how patient data is shared and utilized presents an additional barrier. Companies looking to enter the prescription savings market, like GoodRx, would face considerable challenges in building compliant data infrastructure and strategies from the ground up. This scrutiny, exemplified by ongoing discussions and potential legislation around data brokerage practices, could deter potential new entrants who lack established compliance frameworks.

- High Compliance Burden: Navigating HIPAA, drug pricing regulations, and consumer protection laws requires substantial investment in legal, technical, and operational resources.

- Data Privacy Scrutiny: Increased focus on data sharing practices, particularly in light of potential privacy violations, creates a higher bar for new market entrants.

- Capital Intensive Entry: The need for robust, compliant technology platforms and legal expertise makes entering the market a capital-intensive endeavor, limiting the pool of potential new competitors.

While the digital nature of GoodRx's platform might suggest low barriers to entry, significant challenges exist for new competitors. Building a comprehensive pharmacy network and securing crucial relationships with Pharmacy Benefit Managers (PBMs) or directly with drug manufacturers requires substantial time and investment, acting as a considerable deterrent. GoodRx's established network, encompassing over 70,000 pharmacies as of early 2024, highlights the difficulty in replicating this core advantage.

Furthermore, the complexity and cost associated with replicating GoodRx's sophisticated data aggregation and pricing algorithms present a major hurdle. Matching GoodRx's access to pricing information for tens of thousands of pharmacies, a feat requiring immense capital and technical expertise, is prohibitively expensive for most newcomers. The company's reported access to pricing information for over 70,000 pharmacies in 2023 underscores this scale.

GoodRx's strong brand recognition and user trust, cultivated over years of consistent savings delivery, create another significant barrier. With over 19 million monthly active users reported in 2023, new entrants face the daunting task of building similar consumer confidence and scale, which necessitates substantial marketing investment and a proven track record of reliability.

| Barrier to Entry | Description | GoodRx's Advantage (as of early 2024) |

| Pharmacy Network & PBM Relationships | Establishing agreements with pharmacies and PBMs is complex and time-consuming. | Agreements with over 70,000 pharmacies. |

| Data Aggregation & Algorithm Sophistication | Replicating GoodRx's extensive pricing database and advanced algorithms requires significant capital and technical expertise. | Access to pricing for over 70,000 pharmacies; sophisticated real-time price comparison. |

| Brand Recognition & User Trust | Building consumer confidence and a large user base takes years and substantial marketing investment. | Over 19 million monthly active users (2023); established reputation as a go-to resource. |

Porter's Five Forces Analysis Data Sources

Our GoodRx Porter's Five Forces analysis is built upon a robust foundation of data, incorporating insights from company investor relations pages, competitor announcements, and market share data. This blend of primary and secondary sources allows for a comprehensive understanding of the competitive landscape.