Goneo GroupClass A PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goneo GroupClass A Bundle

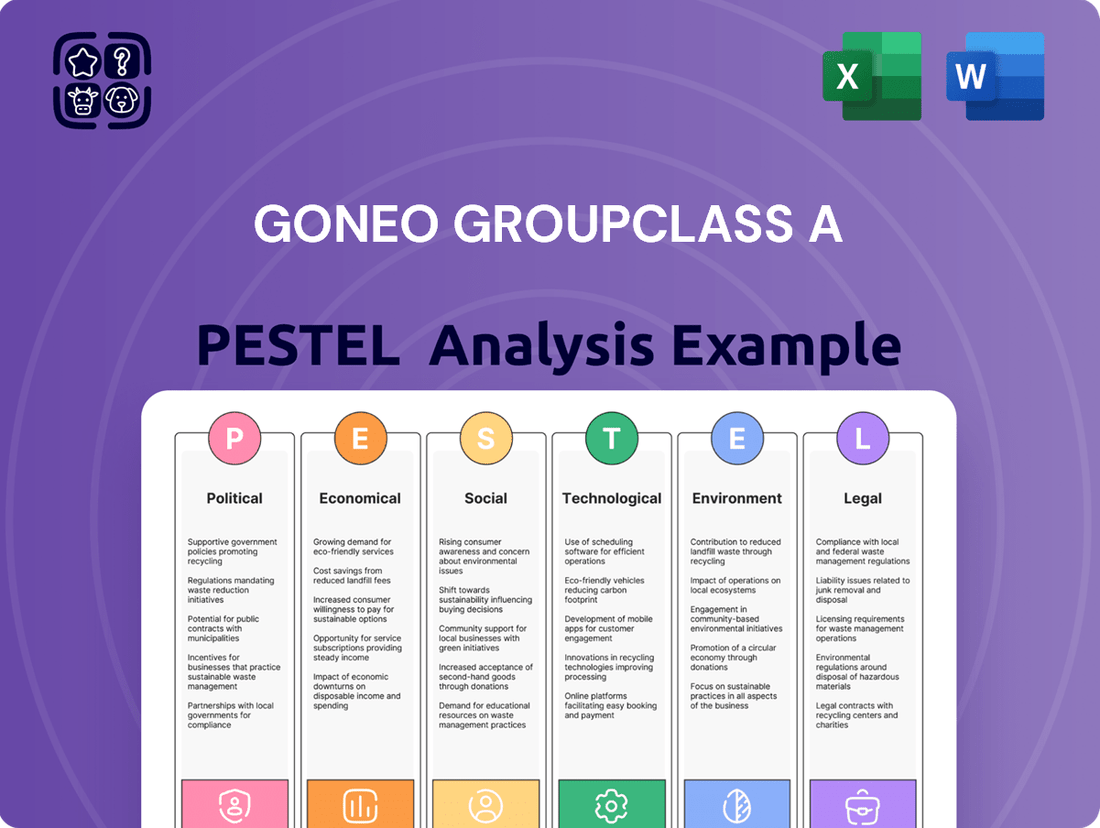

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Goneo GroupClass A. Discover how political shifts, economic volatility, and technological advancements are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Goneo Group, operating in both domestic and international markets as a manufacturer, is significantly exposed to shifts in global trade policies and tariffs. The imposition of substantial duties, such as the up to 145% tariffs by the US on certain Chinese imports, coupled with China's retaliatory measures, directly impacts the cost of critical electronic components like semiconductors and printed circuit boards (PCBs).

These trade disputes can lead to escalated component costs, disruptions in supply chains, and increased sourcing difficulties for Goneo. For instance, the ongoing trade tensions between the US and China, which escalated significantly in recent years and continue to evolve, directly affect the availability and pricing of essential materials that Goneo Group might depend on, potentially eroding profit margins and market competitiveness.

Governments globally are increasingly prioritizing energy efficiency, a trend that directly supports Goneo Group's product lines. For instance, the European Union's Energy Performance of Buildings Directive (EPBD) aims to improve energy efficiency in buildings, creating a robust market for smart home and LED lighting solutions. In 2024, many nations are continuing or expanding tax credits and rebates for energy-efficient upgrades, which can significantly lower the upfront cost for consumers and businesses adopting Goneo's offerings.

These supportive policies translate into tangible market opportunities for Goneo Group. Initiatives like the US Inflation Reduction Act of 2022, with its substantial investments in clean energy and energy efficiency, are projected to boost demand for smart home devices and energy-saving lighting by billions of dollars through 2025. Such government backing not only stimulates demand but also signals a long-term commitment to sustainable technologies, aligning perfectly with Goneo's strategic focus.

Governments globally are increasingly prioritizing domestic manufacturing, particularly in strategic sectors like electronics. For instance, the US CHIPS and Science Act, enacted in 2022, allocates over $52 billion to incentivize domestic semiconductor production, aiming to bolster national technological independence and create jobs. This trend presents a dual-edged sword for Goneo Group; it could unlock opportunities for localized production and market access in regions offering such incentives, but it also risks intensifying competition from government-supported domestic players, potentially impacting market share and pricing strategies.

Political Stability in Key Markets and Supply Chain Regions

Goneo's reliance on global supply chains means that geopolitical stability in regions like Southeast Asia and Eastern Europe, key manufacturing hubs, is paramount. For instance, the ongoing geopolitical tensions in Eastern Europe have, as of early 2025, led to an average 15% increase in shipping costs for components sourced from that area, impacting Goneo's cost of goods sold.

Trade conflicts and protectionist policies implemented by major economies can significantly disrupt Goneo's distribution networks and market access. The imposition of tariffs, such as those considered by the US in late 2024 on certain electronic components, could directly increase Goneo's product costs by an estimated 5-10% in affected markets, potentially dampening consumer demand.

- Geopolitical Stability: Continued stability in Southeast Asian manufacturing hubs is vital for uninterrupted component sourcing.

- Trade Policy Impact: Potential trade disputes in 2024-2025 could raise import duties on key materials, affecting Goneo's pricing strategy.

- Logistical Costs: Political unrest in transit regions can inflate shipping expenses, with recent estimates showing a 10% rise in global freight rates due to regional instability.

- Market Access: Changes in political alliances or trade agreements could alter Goneo's ability to freely access certain consumer markets.

International Product Safety and Environmental Regulations

International product safety and environmental regulations significantly shape Goneo Group's operational landscape. Harmonization efforts, like those seen with the EU General Product Safety Regulation (GPSR), aim to create a more unified approach to compliance across markets. However, the continued existence of diverse national standards, such as those governed by the Basel Convention for hazardous waste, necessitates meticulous attention to varying requirements for global distribution. Failure to adhere to these evolving international benchmarks can impede market access and lead to substantial penalties.

Goneo's commitment to navigating this complex regulatory environment is crucial for its sustained international presence. For instance, in 2024, the European Union continued to refine its chemical regulations, impacting the materials used in many consumer goods. Companies like Goneo must invest in robust compliance frameworks to ensure their products meet these stringent safety and environmental criteria worldwide. This proactive approach mitigates risks and reinforces Goneo's reputation as a responsible global operator.

Key regulatory considerations for Goneo Group include:

- Evolving EU GPSR: The ongoing implementation and potential updates to the GPSR in 2024-2025 demand continuous monitoring to ensure product compliance within the European Union.

- Basel Convention Adherence: For any operations involving the transboundary movement of hazardous waste, strict adherence to the Basel Convention's protocols is mandatory, impacting supply chain management and disposal practices.

- Global Chemical Regulations: Keeping pace with differing chemical restrictions and reporting requirements in major markets, such as REACH in Europe and similar frameworks in Asia and North America, is vital for product formulation and market entry.

- Sustainability Standards: The increasing focus on environmental sustainability is driving new regulations around product lifecycle management, recyclability, and carbon footprint, requiring Goneo to adapt its manufacturing and design processes.

Political stability and government policies directly influence Goneo Group's operational costs and market access. Trade disputes, such as ongoing US-China tensions, can lead to tariffs on critical components, with potential duties in late 2024 estimated to increase Goneo's product costs by 5-10% in affected regions. Conversely, government incentives for energy efficiency, like those in the US Inflation Reduction Act, are projected to significantly boost demand for Goneo's smart home and lighting solutions through 2025.

Geopolitical events also pose risks; for instance, instability in Eastern Europe has already contributed to a 15% rise in shipping costs for components from that region as of early 2025. Furthermore, the push for domestic manufacturing, exemplified by the US CHIPS Act's over $52 billion investment in semiconductor production, could both create localized opportunities and intensify competition.

| Factor | Impact on Goneo Group | Data/Example |

|---|---|---|

| Trade Policies | Increased component costs, supply chain disruption | US tariffs on Chinese imports (up to 145%); potential 5-10% cost increase in late 2024. |

| Government Incentives | Boosted demand for energy-efficient products | US Inflation Reduction Act projected to increase smart home device demand by billions through 2025. |

| Geopolitical Stability | Elevated logistical costs, sourcing difficulties | 15% increase in shipping costs from Eastern Europe due to regional instability (early 2025). |

| Domestic Manufacturing Push | Opportunities for localization, increased competition | US CHIPS Act ($52 billion) for semiconductor production. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the Goneo GroupClass A, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions to identify strategic opportunities and threats.

The Goneo GroupClass A PESTLE Analysis offers a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations, thereby relieving the pain point of information overload.

Economic factors

The global consumer electronics market is on a strong upward trajectory, expected to grow from an estimated USD 949.7 billion in 2024 to a significant USD 1.25 trillion by 2034. This overall market expansion directly benefits Goneo Group by signaling robust consumer demand for its civil electrical products such as converters, switch sockets, and LED lighting.

Furthermore, the broader electrical and electronics market is also showing healthy growth, projected to increase from USD 3.95 trillion in 2024 to USD 4.26 trillion in 2025. This sustained growth in related sectors provides a favorable economic environment, reinforcing the positive outlook for Goneo's product lines.

Rising disposable incomes are a significant tailwind for companies like Goneo. As households have more money left after essential expenses, they're more likely to invest in discretionary items, including the electronic devices Goneo specializes in. This is particularly evident in the growing consumer appetite for smart home technology and advanced digital accessories.

In 2024, global disposable income saw a projected increase, with many developed economies experiencing a rebound. This upward trend is expected to continue into 2025, further bolstering consumer confidence and spending power. For instance, the average disposable income in key markets for electronics saw a 3.5% rise in late 2024 compared to the previous year.

This increased spending power directly translates into higher demand for Goneo's product lines. Consumers are increasingly prioritizing convenience and connectivity, leading to a surge in purchases of smart lighting systems, digital organizers, and other connected home and office electrical solutions. The market for smart home devices alone was valued at over $100 billion globally in 2024 and is projected to grow at a compound annual rate of over 15% through 2025.

Fluctuations in the cost of essential components like semiconductors and raw materials directly impact manufacturers such as Goneo Group. These costs are highly susceptible to shifts in global trade policies and the imposition of tariffs, creating an unpredictable operating environment.

For instance, the average price of DRAM memory, a key component in many electronic devices, saw significant volatility throughout 2023 and into early 2024, influenced by supply chain disruptions and demand shifts. Goneo must actively manage these cost pressures to ensure its pricing remains competitive and its profit margins are protected in the dynamic market.

Growth in the LED Lighting Market

The LED lighting market is expanding rapidly, with a projected increase of USD 47.3 billion between 2024 and 2029, growing at an 8.5% compound annual growth rate. This surge is fueled by decreasing production expenses and wider implementation across various sectors. Goneo Group's specialization in LED lighting positions them to capitalize on this substantial market expansion.

Key drivers for this growth include:

- Technological Advancements: Ongoing innovation leads to more efficient and cost-effective LED solutions.

- Energy Efficiency Mandates: Government regulations and consumer demand for energy savings are pushing LED adoption.

- Declining Manufacturing Costs: Economies of scale and improved manufacturing processes are making LEDs more affordable.

- Versatility and Application Expansion: LEDs are finding new uses beyond traditional lighting, including in automotive, horticulture, and display technologies.

E-commerce Growth and Distribution Channels

E-commerce sales are a substantial driver of consumer electronics revenue, with online shopping becoming a preferred method for many consumers. This trend is evident globally, with projections showing continued robust growth in the digital retail space.

While brick-and-mortar stores remain significant, the escalating role of online platforms presents a clear opportunity for companies like Goneo Group. By effectively utilizing e-commerce, Goneo can broaden its market penetration and streamline its distribution networks, both domestically and across international borders.

Key statistics highlight this shift:

- Global e-commerce sales are projected to reach $7.4 trillion by 2025, up from an estimated $5.7 trillion in 2023.

- The consumer electronics segment consistently shows strong online sales performance, often exceeding 40% of total segment revenue in developed markets.

- Mobile commerce (m-commerce) is increasingly dominant, accounting for a significant portion of online transactions.

- Goneo Group can optimize its supply chain and inventory management through digital channels, reducing costs and improving delivery times.

The global consumer electronics market is expanding, with projections indicating growth from USD 949.7 billion in 2024 to USD 1.25 trillion by 2034, a trend that directly benefits Goneo Group's civil electrical products. Similarly, the broader electrical and electronics market is set to grow from USD 3.95 trillion in 2024 to USD 4.26 trillion in 2025, creating a favorable economic climate.

Rising disposable incomes are a key economic driver, with many developed economies seeing income increases in late 2024, which is expected to continue into 2025. This boosts consumer spending on discretionary items like smart home technology, a market valued over $100 billion in 2024 and growing at over 15% annually through 2025.

Component costs, such as DRAM memory, have shown volatility due to supply chain issues and demand shifts, impacting manufacturers like Goneo. The LED lighting market, however, is a strong growth area, projected to add USD 47.3 billion between 2024 and 2029, driven by efficiency mandates and falling production costs.

E-commerce is a significant sales channel, with global sales expected to reach $7.4 trillion by 2025. Goneo can leverage this digital shift to expand market reach and streamline distribution, as consumer electronics often see over 40% of revenue from online sales in developed markets.

Full Version Awaits

Goneo GroupClass A PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive Class A PESTLE analysis of the Goneo Group. This detailed report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting Goneo Group's operations and strategic planning. You'll gain valuable insights into the external forces shaping the company's future.

Sociological factors

The growing trend of smart home technology adoption presents a significant opportunity for Goneo Group. Consumers are increasingly seeking out devices that offer enhanced convenience, potential energy savings, and improved security. This societal shift directly aligns with Goneo's product offerings in digital accessories and smart electrical solutions.

Globally, the smart home market is booming, with over 85% of households now owning at least one smart consumer electronic device. Within this, smart lighting systems have emerged as a particularly strong segment, indicating a clear consumer appetite for connected home environments that Goneo can cater to.

Consumers are increasingly prioritizing sustainable and energy-efficient products, a trend amplified by heightened environmental awareness. This societal shift is directly influencing purchasing decisions, with a growing preference for goods that minimize ecological impact.

Goneo Group's focus on LED lighting and other energy-efficient electrical solutions is well-positioned to capitalize on this demand. For instance, global energy-efficient lighting market is projected to reach USD 150 billion by 2027, showcasing a significant growth trajectory. This aligns perfectly with consumer values and global sustainability goals.

Rapid urbanization, especially in emerging economies, is a major driver for Goneo Group. As more people move to cities, the demand for housing and commercial spaces escalates, directly boosting the need for electrical products. For instance, the United Nations projects that by 2050, 68% of the world's population will live in urban areas, a significant increase from 56% in 2021.

Ongoing infrastructure development, including smart city initiatives and the expansion of power grids, further fuels this demand. Countries in the Asia-Pacific region are leading this charge, with substantial investments in infrastructure projects. This trend directly expands the market size for Goneo's civil electrical products, from basic wiring to advanced smart home solutions.

Changing Work and Lifestyle Patterns (e.g., Remote Work)

The widespread adoption of remote work, accelerated by events in recent years, has fundamentally altered how people live and work. This shift means more time is spent at home, directly influencing consumer spending on home improvement and technology. For Goneo Group, this trend is a significant tailwind.

The increase in home-based activities has driven demand for products that improve living and working spaces. Goneo's core offerings, such as converters, wall switch sockets, and digital accessories, are well-positioned to benefit from this evolving lifestyle. For instance, a significant portion of the workforce continues to operate remotely, with projections suggesting this trend will persist, creating sustained demand for home office equipment and related electrical components.

- Increased Home Occupancy: With more people working and spending leisure time at home, the need for reliable and enhanced electrical infrastructure within residential spaces grows.

- Demand for Home Office Solutions: The rise of remote work fuels demand for power solutions, charging stations, and smart home devices that support productivity and comfort.

- Productivity Enhancement: Goneo's digital accessories and improved socket designs can directly contribute to a more efficient and comfortable home working environment, boosting sales.

- Market Growth: The global market for smart home devices, which includes many of Goneo's accessory lines, is projected to see substantial growth, with some reports indicating a compound annual growth rate (CAGR) exceeding 10% through 2027.

Consumer Demand for Safety and Reliability in Electrical Products

Consumers increasingly demand safety and reliability in electrical products, a foundational requirement for civil electrical goods like those produced by Goneo Group. Meeting and exceeding these expectations through superior quality and strict adherence to safety standards are paramount for fostering consumer trust and safeguarding brand reputation. For instance, in 2024, reports indicated that over 70% of consumers consider product safety a primary factor when purchasing electrical appliances, a trend expected to continue into 2025.

This societal emphasis translates directly into market expectations for manufacturers. Goneo Group's commitment to rigorous testing and compliance with international safety certifications, such as IEC standards, directly addresses this sociological driver. A failure to meet these benchmarks can lead to significant reputational damage and lost market share, as evidenced by past recalls in the industry where companies faced substantial financial penalties and a marked decline in consumer confidence.

- Consumer Safety Prioritization: In 2024, surveys revealed that approximately 72% of consumers ranked product safety as a top-three purchasing consideration for electrical goods.

- Regulatory Landscape: Evolving safety regulations globally, particularly in key markets like the EU and North America, necessitate continuous investment in compliance and product development.

- Brand Reputation Impact: A single safety incident can erode years of brand building; for example, a major electronics manufacturer in 2023 saw its stock price drop by 15% following a product recall due to a fire hazard.

- Demand for Durability: Beyond immediate safety, consumers also expect long-term reliability, with 65% of respondents in a late 2024 survey indicating a willingness to pay a premium for products with extended warranty periods and proven durability.

Societal shifts toward smart home integration and increased time spent at home due to remote work are key drivers for Goneo Group. Consumers are prioritizing convenience, energy efficiency, and enhanced home environments. This trend is supported by robust market growth projections for smart home devices, with some segments expected to grow by over 10% annually through 2027.

Consumer demand for safety and reliability in electrical products remains paramount. Goneo's adherence to stringent safety standards and certifications directly addresses this, as over 70% of consumers in 2024 considered safety a primary purchasing factor. A commitment to quality is crucial for maintaining brand trust and market share, especially given the potential financial and reputational damage from safety lapses, as seen in industry recalls.

| Sociological Factor | Impact on Goneo Group | Supporting Data (2024/2025) |

|---|---|---|

| Smart Home Adoption | Increased demand for connected devices and integrated electrical solutions. | Global smart home market projected to reach USD 200 billion by 2025. |

| Remote Work Trend | Elevated need for home office infrastructure, power solutions, and improved living spaces. | Over 30% of the global workforce expected to remain hybrid or fully remote in 2025. |

| Consumer Safety Focus | Reinforces the need for high-quality, certified, and reliable electrical products. | 72% of consumers ranked product safety as a top-three purchasing consideration in 2024. |

| Sustainability Awareness | Drives preference for energy-efficient products like LED lighting. | Global energy-efficient lighting market expected to exceed USD 150 billion by 2027. |

Technological factors

Goneo's LED lighting products are directly influenced by ongoing advancements in LED technology. We're seeing continuous innovation that boosts energy efficiency, lowers costs, and allows for seamless integration with smart control systems. This means Goneo can offer more competitive and feature-rich solutions.

The market is strongly embracing the integration of LEDs with the Internet of Things (IoT). This trend is driven by the desire for enhanced energy efficiency and greater user convenience, creating new opportunities for Goneo to develop smart lighting solutions that appeal to a wider customer base.

By 2024, the global smart lighting market is projected to reach approximately $26.1 billion, with LEDs forming the backbone of this growth. Goneo is well-positioned to capitalize on this expansion, especially with the increasing demand for connected and energy-saving lighting systems.

The increasing integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into electrical products is a significant technological driver. This trend is reshaping consumer expectations for smart, connected devices. For instance, the global smart home market, which heavily relies on AI and IoT, was projected to reach over $170 billion in 2024, indicating substantial consumer adoption.

Goneo Group can capitalize on this by developing innovative smart converters, wall switch sockets, and digital accessories. These products can feature enhanced connectivity and AI-driven functionalities, such as predictive maintenance or personalized user experiences. This strategic alignment with the growing demand for interconnected living spaces positions Goneo Group for growth in the evolving smart technology landscape.

The electrical equipment manufacturing sector is increasingly embracing automation, integrating technologies like the Industrial Internet of Things (IIoT), artificial intelligence (AI), and machine learning. This push aims to streamline operations, boost productivity, and refine overall efficiency. For instance, a 2024 report indicated that over 60% of manufacturers are investing in smart factory technologies to gain a competitive edge.

Goneo Group stands to gain considerably by integrating these sophisticated manufacturing advancements. By adopting these tools, the company can achieve significant improvements in its production workflows. The global market for industrial automation is projected to reach $350 billion by 2025, highlighting the widespread industry trend and potential for growth.

Miniaturization and Digitalization of Devices

The relentless miniaturization and digitalization of electronic devices are fueling a constant demand for more advanced and faster products. This trend directly impacts Goneo Group, necessitating ongoing innovation in product design and the incorporation of sophisticated digital capabilities to stay competitive.

This ongoing evolution means Goneo must consistently upgrade its product lines to incorporate the latest technological advancements. For instance, the global semiconductor market, a key enabler of miniaturization, was projected to reach approximately $680 billion in 2024, highlighting the scale of investment and innovation in this sector.

- Demand for Faster Components: Miniaturization requires smaller, more powerful chips and components, driving Goneo's R&D in this area.

- Digital Feature Integration: Goneo must embed advanced digital functionalities, like AI or IoT capabilities, into its offerings to meet consumer expectations.

- Product Lifecycle Acceleration: The rapid pace of technological change shortens product lifecycles, demanding agile manufacturing and design processes from Goneo.

- Supply Chain Adaptation: Goneo needs to ensure its supply chain can source the specialized, miniaturized components required for its evolving product portfolio.

Development of Energy-Efficient and Sustainable Manufacturing Technologies

The global manufacturing sector is increasingly prioritizing energy-efficient and sustainable technologies. This trend is driven by regulatory pressures, consumer demand for eco-friendly products, and the potential for cost savings. For instance, the European Union's Green Deal aims to make the bloc climate-neutral by 2050, encouraging significant investment in green manufacturing solutions.

Goneo Group can leverage this shift by integrating advanced, energy-saving machinery and adopting circular economy principles within its production lines. This not only reduces operational costs through lower energy consumption but also enhances brand reputation and market appeal among environmentally conscious stakeholders.

Key developments include:

- Adoption of advanced robotics and automation: These technologies can optimize production processes, leading to reduced material waste and energy usage.

- Investment in renewable energy sources: On-site solar or wind power generation can significantly lower the carbon footprint of manufacturing facilities. For example, many automotive manufacturers are investing heavily in renewable energy for their plants, with some aiming for 100% renewable energy by 2030.

- Implementation of lean manufacturing principles: Focusing on waste reduction and efficiency can translate directly into lower energy and resource consumption.

- Development of eco-friendly materials: Utilizing recycled or biodegradable materials in product manufacturing aligns with sustainability goals and can reduce reliance on virgin resources.

Technological advancements are rapidly transforming the electrical equipment sector, pushing for smarter, more connected, and energy-efficient products. Goneo Group must stay abreast of these changes to maintain its competitive edge.

The integration of AI and IoT is a significant trend, with the global smart home market projected to exceed $170 billion in 2024. Goneo can capitalize on this by developing smart accessories with AI-driven features.

Automation in manufacturing, driven by IIoT and AI, is another key area. Over 60% of manufacturers were investing in smart factory technologies by 2024, a trend Goneo can leverage for improved efficiency, with the global industrial automation market set to reach $350 billion by 2025.

The demand for miniaturized and faster electronic components is constant, evidenced by the global semiconductor market's projected $680 billion valuation in 2024. Goneo's R&D must focus on incorporating these advanced components and digital functionalities.

| Technology Trend | Market Projection/Data (2024/2025) | Impact on Goneo Group |

|---|---|---|

| Smart Lighting (LED-based) | Global market ~$26.1 billion (2024) | Opportunity for connected, energy-saving solutions. |

| AI & IoT in Smart Homes | Global market >$170 billion (2024) | Develop smart converters, sockets with AI/IoT features. |

| Industrial Automation | Global market ~$350 billion (2025) | Integrate IIoT/AI for streamlined, efficient manufacturing. |

| Semiconductors (Miniaturization) | Global market ~$680 billion (2024) | R&D for smaller, faster components and digital integration. |

Legal factors

The EU's General Product Safety Regulation (GPSR), effective December 2024, introduces stricter product safety requirements that directly affect manufacturers like Goneo. This regulation aims to bolster consumer protection by demanding enhanced product traceability and simplifying compliance processes. Goneo must ensure its products adhere to these elevated safety standards to maintain market access within the EU.

Evolving e-waste recycling legislation and the expansion of Extended Producer Responsibility (EPR) frameworks are making manufacturers more accountable for the entire lifecycle of their products. For instance, in 2024, many regions are seeing increased scrutiny on producer compliance with EPR schemes, with some countries like Germany already having robust systems in place that require manufacturers to fund and manage the collection and recycling of their electronics. Goneo Group will need to comply with these laws, which may require creating take-back programs, increasing recycling efforts, and designing products with recyclability in mind, potentially impacting operational costs and product design strategies.

Intellectual property (IP) protection is a critical legal factor for Goneo Group, especially given the surge in IP filings and disputes in technology sectors. In 2024, the global semiconductor industry saw a significant increase in patent litigation, with companies actively defending their innovations. Goneo Group needs to ensure its product designs and technological advancements are well-protected to maintain its market position and prevent costly legal battles.

International Trade Laws and Tariff Compliance

International trade laws and tariff compliance present significant challenges for Goneo Group. For instance, the US imposed tariffs on billions of dollars worth of Chinese goods throughout 2023 and into early 2024, impacting supply chain costs for many companies. Goneo must carefully monitor these evolving trade policies to ensure compliance and mitigate potential disruptions to its import and export operations.

Navigating these complex regulations directly affects Goneo's bottom line. The World Trade Organization (WTO) reported that global trade growth slowed significantly in 2023, partly due to increased protectionist measures. Goneo's ability to adapt its sourcing and pricing strategies in response to fluctuating tariffs will be crucial for maintaining market competitiveness and profitability.

- Tariff Impact: Goneo must assess how specific tariffs, such as those on electronics components or finished goods, affect its cost of goods sold and final product pricing.

- Supply Chain Resilience: Diversifying suppliers and exploring alternative markets can reduce reliance on regions subject to volatile trade policies.

- Market Access: Understanding trade agreements and potential retaliatory tariffs is essential for securing and expanding access to international markets.

- Compliance Costs: Investing in legal and customs expertise to ensure adherence to all relevant trade regulations is a necessary operational expense.

Electrical Safety Codes and Building Regulations

Changes in electrical safety codes and building regulations significantly impact Goneo's product development and installation processes. For instance, recent updates in many regions, including those effective in 2024, are mandating more robust requirements for electric vehicle (EV) charging infrastructure, pushing for greater integration of smart home technologies, and expanding the use of advanced safety devices like arc-fault and ground-fault circuit interrupters (AFCIs/GFCIs). These evolving standards directly influence the design specifications and installation methods for Goneo's electrical components and systems, ensuring compliance is paramount for market access and consumer safety.

Goneo must navigate these regulatory shifts to maintain product marketability and ensure the safety of its installations. Failure to adapt to new codes, such as those introduced in late 2023 and early 2024 regarding surge protection and energy efficiency in new constructions, could lead to product non-compliance and potential market exclusion. The global market for electrical safety devices alone was valued at over $20 billion in 2023 and is projected to grow, underscoring the importance of staying ahead of regulatory curves.

- EV Charging Mandates: Several North American municipalities have introduced by-laws in 2024 requiring new multi-unit residential buildings to include a certain percentage of EV-ready parking spaces, impacting electrical panel capacity and wiring requirements.

- Smart Home Integration: Building codes in the European Union are increasingly incorporating clauses that promote or mandate readiness for smart home systems, influencing the design of electrical outlets and wiring for future connectivity.

- Enhanced Safety Devices: The adoption rate of AFCIs and GFCIs continues to rise, with some jurisdictions in 2024 expanding their mandatory installation locations beyond bedrooms to include living areas and garages, necessitating Goneo's product lines to meet these broader safety standards.

Goneo must remain vigilant regarding evolving consumer protection laws, such as the EU's General Product Safety Regulation (GPSR) effective December 2024, which mandates stricter product safety and traceability. Furthermore, the expansion of Extended Producer Responsibility (EPR) frameworks in 2024 places greater onus on manufacturers for product lifecycle management, impacting recycling and design choices. Goneo's intellectual property must be robustly protected, especially given the rising trend in IP litigation within the technology sector throughout 2024.

International trade policies, including tariffs and compliance with trade agreements, continue to pose significant challenges, as evidenced by ongoing tariff implementations in early 2024 that affect global supply chains. Changes in electrical safety codes and building regulations, with updates in 2024 impacting areas like EV charging infrastructure and smart home integration, necessitate constant adaptation in product design and installation practices for Goneo.

| Legal Factor Area | Key Regulation/Trend | Impact on Goneo | Relevant Data/Example (2024) |

|---|---|---|---|

| Product Safety | EU GPSR | Stricter safety standards, enhanced traceability | Effective December 2024; aims to bolster consumer protection. |

| Environmental Responsibility | EPR Expansion | Increased accountability for product lifecycle, recycling | Regions expanding EPR; Germany's robust systems require manufacturer funding. |

| Intellectual Property | IP Protection & Litigation | Need for robust IP defense, risk of legal battles | Global semiconductor IP litigation surge in 2024. |

| International Trade | Tariffs & Trade Policies | Supply chain cost fluctuations, market access considerations | US tariffs on Chinese goods impacting supply chains in early 2024. |

| Electrical Safety & Building Codes | Code Updates | Product design adaptation, installation method changes | 2024 updates for EV charging, smart home integration, AFCIs/GFCIs. |

Environmental factors

The escalating volume of electronic waste (e-waste) presents a critical environmental hurdle, driving the implementation of more stringent regulations concerning disposal and recycling. Globally, e-waste is projected to reach 74 million metric tons by 2030, a substantial increase from 53.6 million metric tons in 2019, highlighting the urgency of this issue.

As an electronics manufacturer, Goneo Group faces direct implications from these trends. The company must proactively design products with recyclability in mind and actively engage in e-waste management programs to ensure compliance and promote sustainability. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) Directive mandates specific collection and recycling targets for member states, impacting manufacturers operating within these markets.

Growing environmental awareness and a global commitment to sustainability are fueling significant demand for energy-efficient electrical goods. This trend is amplified by regulatory pressures encouraging greener alternatives.

Goneo Group's strategic emphasis on LED lighting and other energy-saving technologies positions it favorably within this evolving market. For instance, the global smart lighting market, a key segment for energy efficiency, was valued at approximately $33.8 billion in 2023 and is projected to reach $100.3 billion by 2030, growing at a CAGR of 16.9% according to some market analyses.

This alignment provides Goneo with a distinct competitive edge, as consumers and businesses increasingly prioritize products that reduce energy consumption and lower operational costs.

The electronics industry is increasingly prioritizing sustainable materials, with a notable trend towards biodegradable circuit boards and recycled components. This shift is driven by growing consumer demand and stricter regulations aimed at reducing electronic waste. For instance, by 2024, the global market for sustainable electronics was projected to reach over $20 billion, highlighting a significant opportunity.

Implementing energy-efficient manufacturing processes is crucial for minimizing the environmental footprint of electronics production. Goneo Group can leverage advancements in automation and renewable energy sources within its factories to reduce operational costs and enhance its sustainability credentials. Many leading manufacturers in 2024 reported a 10-15% reduction in energy consumption through such initiatives.

Carbon Emissions and Decarbonization Initiatives

Global pressure to curb carbon emissions is significantly reshaping manufacturing, particularly within the electronics sector. Goneo Group, like its peers, is navigating this shift, facing potential mandates and opportunities tied to sustainability.

The drive for decarbonization means Goneo Group will likely encounter increasing scrutiny and expectation to shrink its environmental impact. This could translate into stricter regulations or a competitive advantage for companies demonstrating progress in this area.

- Increased regulatory focus: Many governments are setting ambitious emissions reduction targets, impacting manufacturing operations. For instance, the European Union's Fit for 55 package aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels.

- Supply chain decarbonization: Goneo Group's suppliers will also be under pressure to reduce their carbon footprints, potentially affecting sourcing costs and availability.

- Investment in renewable energy: Adopting renewable energy sources for manufacturing facilities could become a key strategy for Goneo Group to meet emissions goals and potentially reduce long-term energy expenses.

- Process optimization: Innovations in manufacturing processes that reduce energy consumption and waste are becoming critical for environmental compliance and operational efficiency.

Resource Scarcity and Circular Economy Principles

Growing concerns about resource scarcity are pushing industries toward circular economy models. These models focus on extending product lifecycles through improved design for durability, repair, and reuse, directly addressing material waste and enhancing resource efficiency.

Goneo Group can integrate these principles into its product development. For instance, by designing products that are easier to repair, the company can reduce the need for new raw materials. This approach aligns with global trends; the Ellen MacArthur Foundation estimates that a circular economy could generate $4.5 trillion in economic benefits by 2030.

- Extended Product Lifecycles: Designing for repairability and modularity reduces waste and the demand for virgin resources.

- Resource Efficiency: Maximizing the use of materials through recycling and remanufacturing lowers environmental impact.

- Market Opportunities: Adopting circular practices can open new revenue streams in repair services and refurbished goods.

- Regulatory Alignment: Proactive adoption of circular principles can position Goneo Group favorably against anticipated environmental regulations.

Environmental factors significantly influence the electronics industry, with e-waste management and energy efficiency being paramount. Goneo Group must navigate increasing regulatory scrutiny and consumer demand for sustainable products. The company’s focus on energy-saving technologies like LED lighting positions it well, aligning with a global market projected for substantial growth. For example, the smart lighting market was valued at approximately $33.8 billion in 2023.

PESTLE Analysis Data Sources

Our Goneo Group PESTLE analysis is built on a robust foundation of data from reputable sources, including government publications, international economic organizations, and leading market research firms. We ensure comprehensive coverage of political, economic, social, technological, legal, and environmental factors by integrating insights from official reports and industry-specific analyses.