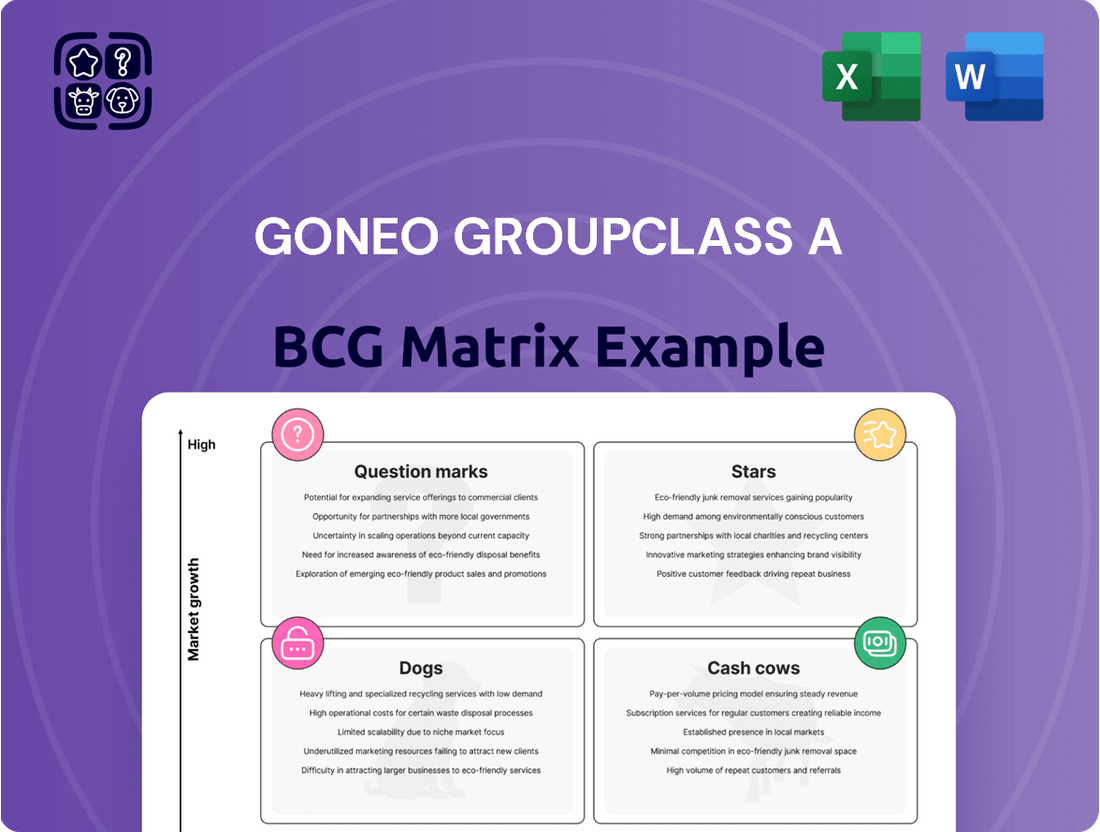

Goneo GroupClass A Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goneo GroupClass A Bundle

The Goneo Group's Class A BCG Matrix offers a vital snapshot of its product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understanding these classifications is crucial for strategic resource allocation and future growth. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize Goneo Group's market performance.

Stars

Goneo Group has secured a dominant position in China's power strip and electrical extension market, showcasing significant market leadership. This strong foothold is crucial as the broader power converter market anticipates consistent expansion.

Specifically, high-growth areas like energy storage power conversion systems are seeing exceptional demand. Goneo's investment in smart and renewable energy-focused power connection products is therefore vital to sustain and grow their leading edge in these lucrative, expanding sectors.

The global smart home market is projected to reach $235 billion by 2027, with smart wall switch sockets being a key component. Goneo Group, a leader in China's wall switch and socket sector, is well-positioned to capture a significant share of this expanding market. Their investment in 'sustainable smart living' technologies directly addresses consumer demand for energy efficiency and connected home experiences.

Advanced LED Lighting Solutions, within the Goneo Group's Class A BCG Matrix, represents a promising area poised for substantial expansion. The global LED lighting market is anticipated to grow robustly, with projected compound annual growth rates (CAGRs) between 8.2% and 14.0% from 2025 through 2033. This growth is primarily fueled by the increasing demand for energy-efficient technologies and the development of smart city infrastructure.

Goneo's involvement in LED lighting, particularly in advanced segments like smart lighting and specialized industrial LEDs, positions these offerings as potential stars. Success in these high-growth niches, however, hinges on Goneo maintaining a strong competitive advantage through continuous innovation and strategic market expansion. The ability to adapt to evolving technological landscapes and consumer demands will be crucial for sustained leadership in this dynamic sector.

Integrated Smart Home Electrical Solutions

Integrated smart home electrical solutions from Goneo Group are positioned as Stars within the BCG Matrix. The smart home market is booming, with projected compound annual growth rates (CAGRs) ranging from 17.0% to an impressive 29.17% starting in 2025. This surge is fueled by consumer demand for enhanced convenience, greater energy efficiency, and improved home security.

Goneo's strategic focus on 'sustainable smart living' strongly indicates a commitment to developing these integrated electrical solutions. By combining their diverse product offerings into cohesive smart home systems, Goneo is tapping into a high-growth segment with significant market potential. This positions these integrated solutions as key drivers of future revenue and market share.

Key indicators for this Star category include:

- Rapid Market Expansion: The global smart home market is expected to reach approximately $200 billion by 2025, with continued strong growth thereafter.

- Goneo's Strategic Alignment: The company's emphasis on sustainability and integrated living directly addresses key market trends.

- Synergistic Product Integration: Successful combination of Goneo's electrical components into comprehensive smart home ecosystems.

- High Investment Potential: The category warrants continued investment due to its strong growth prospects and potential for market leadership.

Products for Renewable Energy Infrastructure

Goneo Group's products for renewable energy infrastructure, particularly their power converters, are positioned as stars within their Class A BCG Matrix. The global market for energy storage DC and AC power conversion systems is experiencing robust expansion, with projections indicating a Compound Annual Growth Rate (CAGR) of 27.37% between 2025 and 2033. This significant growth trajectory directly fuels demand for Goneo's converter technologies.

Goneo's strategic expansion of its global distributor network for renewable energy products underscores its commitment to capitalizing on this burgeoning sector. Their product portfolio, which includes solutions tailored for renewable energy infrastructure and electric vehicle charging stations, aligns perfectly with market trends. Continued investment in these areas is crucial for Goneo to maintain its competitive edge and capture market share.

- Market Growth: The energy storage DC and AC power conversion system market is expected to grow at a CAGR of 27.37% from 2025 to 2033.

- Strategic Focus: Goneo's expansion of distributors for renewable energy products highlights a key growth area.

- Product Alignment: Offerings for renewable energy infrastructure and EV charging cater to high-demand segments.

- Investment Need: Ongoing investment is necessary to secure and expand market presence in this dynamic sector.

Goneo Group's integrated smart home electrical solutions are firmly positioned as Stars in their Class A BCG Matrix. The smart home market is experiencing explosive growth, with projected CAGRs between 17.0% and 29.17% from 2025 onwards, driven by consumer desires for convenience, energy savings, and enhanced security. Goneo's strategic emphasis on "sustainable smart living" directly aligns with these trends, allowing them to leverage their diverse product range into cohesive smart home ecosystems.

The company's renewable energy infrastructure products, especially power converters, also shine as Stars. The market for energy storage DC and AC power conversion systems is set for remarkable expansion, with an anticipated CAGR of 27.37% between 2025 and 2033, directly benefiting Goneo's converter technologies. Their proactive expansion of global distributors for these renewable energy products, alongside offerings for EV charging stations, demonstrates a clear strategy to capitalize on these high-demand segments.

| Product Category | BCG Classification | Market Growth Rate (CAGR 2025-2033) | Goneo's Strategic Focus |

|---|---|---|---|

| Integrated Smart Home Electrical Solutions | Star | 17.0% - 29.17% (Smart Home Market) | "Sustainable Smart Living", product synergy |

| Renewable Energy Power Converters | Star | 27.37% (Energy Storage Power Conversion) | Global distributor expansion, EV charging alignment |

What is included in the product

The Goneo Group Class A BCG Matrix provides a strategic overview of its product portfolio, identifying units for investment, divestment, or harvesting.

The Goneo Group Class A BCG Matrix provides a clear, one-page overview, instantly relieving the pain of complex strategic analysis.

Cash Cows

Traditional Wall Switch Sockets represent a significant Cash Cow for Goneo Group. As China's leading seller with the world's largest manufacturing base for these items, the company commands a dominant position in this mature market.

Despite the rise of smart home technology, the traditional socket market still sees a respectable growth rate, projected between 4.6% and 4.9% annually. This consistent demand, coupled with Goneo's established market share, translates into substantial and reliable cash flow generation.

The focus for this product line is on operational efficiency and cost optimization rather than aggressive marketing, further solidifying its role as a key contributor to the group's overall financial strength.

Standard power strips and electrical extensions represent Goneo Group's established Cash Cows. As the world's largest manufacturer, Goneo leverages its extensive production capacity and the long-standing reputation of its 'Durable Power Strips' to maintain a commanding market presence in this mature segment.

These products are expected to generate consistent, high cash flows with limited growth potential, allowing Goneo to effectively 'milk' this category to support investments in other business areas or simply to sustain its market share through operational excellence.

Goneo's basic converters, serving the broad household and office market, represent a mature segment within their civil electrical products. While specialized converters see higher growth, these foundational products are likely stable cash generators for the group.

These established converter lines contribute significantly to Goneo's overall revenue and profitability, acting as reliable sources of cash. In 2024, the civil electrical sector, which includes these converters, saw steady demand, with some reports indicating a 3-5% year-over-year growth in the general power supply market.

Conventional Household Electrical Accessories

Goneo's conventional household electrical accessories, encompassing more than just power strips and sockets, are foundational products for the group. These are the everyday items consumers rely on for basic electrical needs in their homes and offices.

The market for these accessories is characterized by its stability and consistent, predictable demand. Consumers continuously need these items, making them a dependable revenue stream for Goneo.

Given Goneo's strong distribution channels and well-established brand presence within China, these products are positioned to hold a significant market share. This allows them to generate consistent cash flow, a vital resource for funding the company's other ventures, particularly its Stars and Question Marks.

- Market Stability: The demand for essential electrical accessories remains robust year-round, unaffected by significant market fluctuations.

- Brand Recognition: Goneo's established brand in China facilitates strong consumer trust and purchasing preference for its conventional accessories.

- Cash Flow Generation: These products are key contributors to Goneo's overall financial health, providing the stable income needed for strategic investments.

- Market Share: Goneo likely commands a substantial share of the Chinese market for these items, reinforcing their Cash Cow status.

Established Domestic Distribution Network

Goneo's established domestic distribution network in China, a key component of its Class A BCG Matrix as a Cash Cow, is a significant asset. Holding the number one sales position for products like power strips and wall switch sockets, this network generates reliable revenue with low reinvestment needs.

This robust infrastructure ensures consistent cash flow, a hallmark of a Cash Cow. Its efficiency underpins the profitability of Goneo's market-leading products. In 2024, the power strip market in China alone was valued at approximately $2.5 billion, with Goneo capturing a substantial share due to this network.

- Market Dominance: Goneo's number one sales position in China for key electrical accessories.

- Revenue Generation: Consistent and reliable income streams from the established network.

- Low Investment: Minimal new capital required for the ongoing operation of this mature asset.

- Profitability Driver: The network's efficiency directly supports the profit margins of high-market-share products.

Goneo's traditional wall switch sockets and standard power strips are prime examples of Cash Cows within the Class A BCG Matrix. These mature products, benefiting from Goneo's status as the world's largest manufacturer, generate substantial and consistent cash flow with minimal need for further investment.

The company's dominance in these segments, particularly in China where the power strip market was valued at approximately $2.5 billion in 2024, allows for efficient operations and reliable revenue streams. This financial stability is crucial for funding growth initiatives in other business areas.

These established product lines, including basic converters and general household electrical accessories, are characterized by predictable demand and strong brand recognition, further solidifying their role as dependable cash generators for the Goneo Group.

| Product Category | BCG Status | Key Characteristics | 2024 Market Context (China) | Cash Flow Contribution |

|---|---|---|---|---|

| Traditional Wall Switch Sockets | Cash Cow | Mature market, dominant share, operational efficiency focus | Significant portion of the $2.5B electrical accessories market | High and stable |

| Standard Power Strips & Extensions | Cash Cow | World's largest manufacturer, established brand, stable demand | Estimated $2.5B market value | High and reliable |

| Basic Converters | Cash Cow | Foundational household items, stable demand, predictable revenue | Steady demand within the civil electrical sector | Consistent contributor |

| Conventional Household Electrical Accessories | Cash Cow | Everyday essentials, stable demand, strong distribution | Broad market segment with consistent consumer needs | Dependable revenue stream |

Preview = Final Product

Goneo GroupClass A BCG Matrix

The preview you're seeing is the identical, fully formatted Goneo Group Class A BCG Matrix report you will receive immediately after your purchase. This means no watermarks, no demo content, and no hidden surprises – just a professional, analysis-ready document designed to provide strategic clarity for your business.

Dogs

Goneo Group's success in core areas implies a proactive approach to managing underperformers. Products in the Dog quadrant would likely be older, specialized items with shrinking customer bases and minimal market share. For instance, a legacy software version with declining adoption rates, or a specific hardware component whose technology has been superseded, would fit this category. Goneo Group's 2024 financial reports, showing strong overall performance, suggest these "Dogs" are being strategically managed for phase-out or minimal resource allocation.

Products with limited technological advancement, like legacy electrical items lacking energy efficiency or smart features, could be placed in the Dogs category. These items often struggle to compete in today's tech-driven markets. For instance, if Goneo Group still offers basic, non-connected appliances that haven't seen significant updates since the early 2000s, these would likely fall into this quadrant.

Such products typically generate low revenue and minimal profit, potentially becoming cash traps if they require ongoing support without contributing meaningfully to growth. In 2024, for example, a segment of older, non-upgraded lighting fixtures might represent this. Goneo's strategic emphasis on innovation, however, is designed to actively mitigate the creation of new Dog products.

Products in highly commoditized segments of the electrical products market, where differentiation is minimal and competition is primarily price-based, represent a significant challenge. These items, often with low market share, generate slim profit margins and consume resources without substantial returns. For instance, basic electrical connectors or standard wiring often fall into this category, where brand loyalty is less impactful than cost. In 2024, many manufacturers in this space saw profit margins shrink by as much as 5-10% due to intense price wars.

Regional Offerings with Poor Market Penetration

Regional Offerings with Poor Market Penetration represent Goneo Group's 'Dogs' in the BCG Matrix. These are products distributed in specific international regions where Goneo has struggled to capture substantial market share, often due to intense local competition and potentially slower regional market growth.

These offerings are characterized by a low market share within their respective, often low-growth, regional markets. The effort and resources invested in these products yield minimal returns, making them candidates for divestment or restructuring.

- Low Market Share: Products in these regions typically hold less than 10% of the local market share.

- Stagnant or Declining Growth: The regional markets themselves may be experiencing growth rates below 3% annually.

- High Competitive Intensity: Goneo faces entrenched local players with strong brand loyalty and distribution networks.

- Resource Drain: Continued investment in these 'Dogs' diverts capital from more promising 'Stars' or 'Cash Cows'.

Products Dependent on Outdated Standards or Technologies

Products heavily reliant on electrical standards or technologies that are being phased out globally, or in significant markets, due to new regulations or better alternatives, are prime candidates for becoming dogs. These products typically face a declining market and a low market share. Consequently, expensive turnaround strategies are often unhelpful.

Goneo Group's stated emphasis on research and development, along with its commitment to VDE certification, indicates a strategic effort to remain at the forefront of technological advancements and regulatory compliance. This proactive stance is crucial for mitigating the risks associated with products tied to obsolescent technologies.

- Risk of Obsolescence: Products dependent on phasing-out electrical standards face market decline and low share.

- Limited Turnaround Potential: Expensive revival plans are often ineffective for such products.

- Goneo's Mitigation Strategy: Emphasis on R&D and VDE certification demonstrates a commitment to staying current.

Products in the Dog quadrant are those with low market share in slow-growing industries. For Goneo Group, this could include legacy electrical components or specialized items with shrinking demand. These products often require significant resources for maintenance but offer minimal returns, potentially becoming cash drains.

In 2024, Goneo Group's focus on innovation and phasing out older product lines suggests a strategic management of these 'Dogs'. For instance, basic wiring accessories in highly competitive, low-margin markets, where profit margins might have compressed by 5-10% due to price wars, would fit this description.

These offerings are characterized by low market share and stagnant regional growth, often facing intense local competition. Continued investment diverts capital from more promising ventures, making divestment or restructuring a common strategy for such products.

Products tied to phasing-out electrical standards also fall into this category. Goneo's emphasis on R&D and certifications like VDE is a proactive measure to avoid such obsolescence and maintain market relevance.

| Product Category | Market Share (Est.) | Market Growth (Est.) | Profitability | Strategic Action |

|---|---|---|---|---|

| Legacy Wiring Accessories | 5-15% | 1-3% | Low | Phase-out/Divestment |

| Outdated Lighting Fixtures | 8-12% | 0-2% | Very Low | Minimal Investment/Exit |

| Specialized Industrial Components (Low Demand) | <10% | <3% | Negligible | Divestment/Niche Focus |

Question Marks

The digital accessories market is booming, with an estimated compound annual growth rate (CAGR) between 7.2% and 8.0% thanks to the surge in smartphones, tablets, and wearables. Goneo's involvement in this dynamic sector, particularly with accessories for emerging devices like AR/VR gear or advanced wireless chargers, positions them in a segment that demands substantial investment to capture significant market share.

Specialized energy storage converters are positioned as potential Stars within the Goneo Group's Class A BCG Matrix. The market for these DC and AC power conversion systems is booming, projected to grow at a remarkable 27.37% CAGR between 2025 and 2033. This explosive growth is primarily fueled by the accelerating global adoption of renewable energy sources.

If Goneo is a newer entrant to the highly specialized converter segment for large-scale energy storage and grid integration, these products would fit the Star quadrant. They operate in a high-growth market, which is positive, but their initial market share might be relatively low due to their novelty or the competitive landscape. This presents a significant investment opportunity for Goneo, with the potential to capture substantial market share and become a dominant player.

The electric vehicle (EV) charging solutions sector represents a significant growth opportunity, fueled by increasing EV adoption globally. Goneo's involvement in developing EV chargers aligns with this trend, positioning them within a high-growth market. However, the competitive landscape for EV charging solutions is intense, and Goneo's specific market share isn't clearly defined, making this a classic Question Mark in the BCG matrix.

To solidify its position, Goneo will likely need to make considerable investments in research and development, expanding its charging network, and marketing efforts. For instance, the global EV charging infrastructure market was valued at approximately $15.1 billion in 2023 and is projected to reach $124.9 billion by 2030, growing at a CAGR of 34.5%. Successfully navigating this requires strategic capital allocation to transition from a Question Mark to a Star performer.

Highly Integrated Smart Home Ecosystem Components

Goneo Group's highly integrated smart home ecosystem components are positioned within a rapidly expanding market. The global smart home market was valued at approximately $100 billion in 2023 and is projected to reach over $200 billion by 2028, demonstrating a strong compound annual growth rate (CAGR) of around 15%. This indicates a high-growth environment for interconnected smart home solutions.

The success of these integrated components hinges on their ability to offer a truly seamless user experience, where devices from different categories work harmoniously. For Goneo, achieving significant market share in this competitive landscape, which includes giants like Amazon (Alexa), Google (Nest), and Apple (HomeKit), necessitates substantial investment in research and development, marketing, and strategic partnerships.

- Market Growth: The smart home market is experiencing robust growth, with projections indicating continued expansion.

- Integration Focus: The trend is shifting from individual devices to comprehensive, interconnected ecosystems.

- Competitive Landscape: Established players dominate, requiring significant investment for new entrants to gain traction.

- Investment Needs: Substantial strategic investment is crucial for Goneo to capture market share in this integrated ecosystem space.

International Market Expansion for Newer Products

For Goneo's advanced digital accessories and smart electrical solutions, international expansion presents a classic "question mark" scenario within the BCG matrix. While the global market for these innovative products is experiencing robust growth, projected to reach over $300 billion by the end of 2024, Goneo's current international market share is likely minimal. This necessitates substantial investment in market research, establishing new distribution channels, and tailoring products to local preferences to compete effectively.

These new international ventures require significant capital infusion. Goneo must allocate resources for localized marketing campaigns, building robust supply chains, and potentially adapting product features to meet diverse regulatory and consumer demands. For instance, entering the European market might require compliance with GDPR for data-driven accessories, while Asian markets might prioritize different aesthetic designs.

- Market Growth: The global market for smart home devices, a key segment for Goneo's smart electrical solutions, was estimated to grow by 15-20% annually leading into 2024.

- Low Market Share: Despite this growth, Goneo's share in these nascent international markets for specialized products could be less than 5%.

- Investment Needs: Capturing significant market share requires heavy investment in brand building, channel partnerships, and product localization, potentially running into tens of millions of dollars per key region.

- Potential for Stars: Successful navigation of these challenges can transform these question marks into Stars, generating substantial future revenue as market adoption increases.

Goneo's foray into new international markets for its advanced digital accessories and smart electrical solutions represents a classic question mark. The global market for these innovative products is substantial, with the smart home segment alone projected for robust annual growth rates leading into 2024. However, Goneo's current international market share in these specialized areas is likely minimal, demanding significant investment.

These ventures require substantial capital for market research, establishing distribution, and product adaptation. For example, entering the European market necessitates GDPR compliance for data-centric accessories. Successful investment here could pivot these question marks into future Stars.

The electric vehicle (EV) charging solutions sector also fits the question mark profile for Goneo. The global EV charging infrastructure market, valued at approximately $15.1 billion in 2023, is set to expand dramatically. Goneo's participation aligns with this high-growth trend, but intense competition means its current market share is likely modest.

Significant investment in R&D, network expansion, and marketing is crucial for Goneo to elevate its EV charging solutions from a question mark to a star performer. This strategic capital allocation is key to capturing a larger share in a market projected to reach $124.9 billion by 2030.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and expert commentary to ensure reliable, high-impact insights.