Golden Agri-Resources Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Golden Agri-Resources Bundle

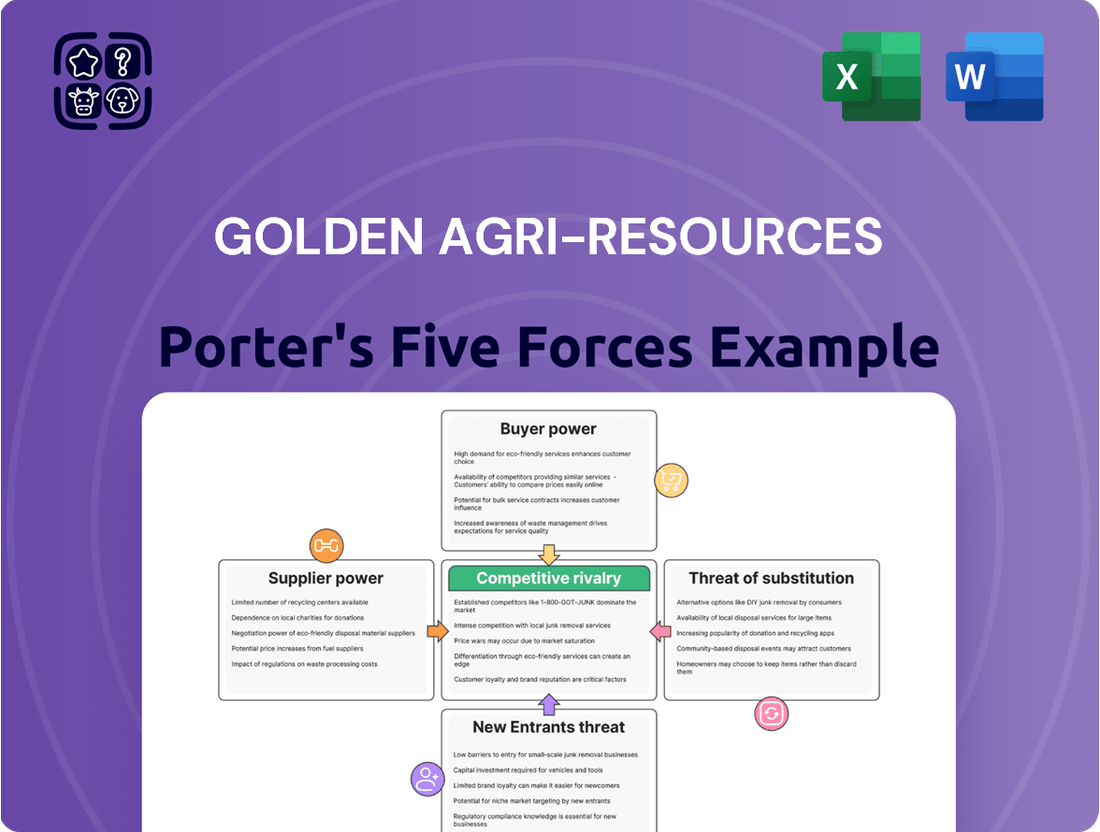

Golden Agri-Resources navigates a landscape shaped by intense rivalry and significant buyer power, while the threat of substitutes looms large. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Golden Agri-Resources’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration in the palm oil sector, especially in Indonesia where Golden Agri-Resources (GAR) operates, is a key factor. While there are many smallholder farmers, a smaller group of large plantation companies dominates. This concentration can shift bargaining power.

GAR sources some palm oil from plasma smallholders and third-party mills. The degree to which these external suppliers are concentrated directly impacts their ability to negotiate terms with GAR. For instance, if only a few large mills supply a significant portion of GAR's needs, those mills gain leverage.

In 2024, the Indonesian palm oil industry continued to see consolidation among larger players. This trend means that while GAR manages a substantial portion of its supply chain internally, its reliance on a more concentrated group of external suppliers for certain inputs or processed materials gives these suppliers a stronger position to influence pricing and supply availability.

Golden Agri-Resources (GAR) relies heavily on fresh fruit bunches (FFB) as its core raw material for producing crude palm oil (CPO) and palm kernel (PK). The quality and consistent supply of FFB directly impact GAR's production efficiency and output. Suppliers who can consistently deliver high-quality FFB therefore possess a degree of bargaining power.

Fertilizers represent another crucial input for GAR's palm oil plantations, with a significant portion of these being imported. The global fertilizer market can be volatile, and suppliers of essential fertilizer components can exert influence through pricing and availability. In 2023, global fertilizer prices saw fluctuations, impacting plantation operational costs for companies like GAR.

Golden Agri-Resources (GAR) benefits from a highly integrated supply chain, encompassing everything from palm oil cultivation to final processing. This integration creates substantial switching costs for its core raw material, fresh fruit bunches (FFB). Developing new supplier relationships and integrating them into GAR's sophisticated traceability systems would demand considerable investment in time and resources, thereby solidifying GAR's position.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers is relatively low for Golden Agri-Resources (GAR). While some larger third-party mill suppliers might possess the capital to move into refining or creating finished palm oil products, this is not a widespread concern. GAR's substantial downstream infrastructure and established market presence effectively neutralize this potential threat for the majority of its suppliers.

- Limited Integration Capability: Most individual smallholder farmers, who form a significant portion of GAR's supply base, lack the financial and operational capacity to integrate forward into palm oil processing or downstream product manufacturing.

- GAR's Downstream Dominance: GAR's extensive downstream operations, including refining and the production of various palm oil derivatives, create a strong barrier to entry for suppliers considering forward integration.

- Mitigation through Scale: The sheer scale of GAR's operations and its broad market reach make it difficult for individual suppliers to compete effectively in the downstream segments, thus mitigating the perceived threat.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences supplier bargaining power. For Golden Agri-Resources (GAR), the core input, fresh fruit bunches (FFB), faces virtually no direct substitutes in palm oil production. This lack of alternatives for FFB strengthens the bargaining power of palm oil plantation owners or internal GAR plantations.

However, for other operational necessities like specific chemicals, fertilizers, or specialized machinery, GAR can often find a broader selection of suppliers. This wider choice for non-FFB inputs dilutes the bargaining power of any single supplier in these categories, allowing GAR to negotiate more favorable terms.

For example, in 2024, GAR's diversified sourcing strategy for agricultural inputs, beyond its own plantations, likely meant it could leverage competition among chemical suppliers. If one supplier raised prices significantly for a particular fertilizer, GAR could shift procurement to another provider, limiting the impact of individual supplier price hikes.

- No direct substitutes for fresh fruit bunches (FFB) in palm oil production.

- Broader supplier options for chemicals and equipment reduce supplier bargaining power in these areas.

- GAR's ability to switch suppliers for non-FFB inputs provides leverage in negotiations.

The bargaining power of suppliers for Golden Agri-Resources (GAR) is influenced by the concentration of suppliers and the availability of substitutes. While GAR's integrated model reduces reliance on external FFB, its need for inputs like fertilizers, where global supply can be concentrated, presents a challenge. For instance, in 2023, global fertilizer prices were volatile, impacting plantation costs. GAR's ability to diversify sourcing for non-FFB inputs helps mitigate individual supplier leverage.

| Factor | Impact on GAR | 2024 Context/Data |

| Supplier Concentration (FFB) | Moderate to High for external sources | Continued consolidation among large Indonesian palm oil players |

| Availability of Substitutes (FFB) | Virtually None | Strengthens FFB supplier leverage |

| Availability of Substitutes (Other Inputs) | High | Dilutes supplier leverage for fertilizers, chemicals, etc. |

| Supplier Forward Integration Threat | Low | GAR's downstream dominance acts as a barrier |

What is included in the product

This analysis delves into the competitive forces impacting Golden Agri-Resources, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the palm oil industry.

Easily identify and mitigate the intense competitive rivalry and supplier power impacting Golden Agri-Resources' profitability.

Customers Bargaining Power

Golden Agri-Resources (GAR) mitigates customer concentration risk by serving a geographically diverse customer base across major global markets, including Indonesia, China, India, the USA, Latin America, Europe, and the Middle East. This broad reach means no single customer represents an overwhelming portion of GAR's sales, thereby limiting the bargaining power of any individual buyer.

The company's ownership of over 30 consumer brands further strengthens its position. This brand portfolio allows GAR to engage directly with end consumers and build brand loyalty, reducing reliance on large wholesale buyers and giving it more control over pricing and distribution channels.

For industrial clients relying on Golden Agri-Resources (GAR) for Crude Palm Oil (CPO) and refined palm products, the cost of switching suppliers, while present, is often manageable. These costs might include minor adjustments in product formulation or slight re-tooling of processing equipment, typically not a significant barrier.

However, in consumer-facing markets, switching costs are more influenced by factors like brand recognition and consistent product availability. GAR's strategic focus on building a robust brand identity and ensuring widespread product distribution is designed to foster customer loyalty and reduce the likelihood of customers seeking alternatives. This approach aims to create a sticky customer base, making it less appealing for consumers to switch to competitors, even if minor price differences exist.

Customers, particularly large industrial buyers of palm oil, are often highly informed about prevailing market prices and are therefore quite sensitive to price fluctuations. This knowledge allows them to negotiate more effectively with suppliers like Golden Agri-Resources.

The growing availability of alternative oils and increased consumer demand for sustainably sourced products further strengthen customer bargaining power. In 2024, for instance, the global vegetable oil market saw continued interest in alternatives like sunflower and rapeseed oil, putting pressure on palm oil pricing and supply chain practices.

Threat of Backward Integration by Customers

The threat of backward integration by customers for Golden Agri-Resources (GAR) is relatively low. Large food manufacturers or consumer goods companies that are major buyers of palm oil might consider acquiring plantations or processing facilities to secure their supply chain. However, the substantial capital investment and the specialized knowledge needed for palm oil cultivation and processing create significant barriers to entry for most potential customers looking to integrate backward.

While the potential for backward integration exists, it's not a dominant concern for GAR. The industry's high capital requirements and the need for specific agricultural and processing expertise mean that only a few well-resourced and strategically aligned customers could realistically pursue this path. For instance, a major food conglomerate might possess the financial muscle, but the operational complexities of managing vast oil palm plantations, including dealing with agronomic challenges and sustainability certifications, are considerable deterrents.

- High Capital Outlay: Establishing palm oil plantations and processing facilities requires billions of dollars in upfront investment, making it prohibitive for most customers.

- Specialized Expertise: Success in palm oil cultivation and processing demands deep knowledge of agronomy, crop management, and complex refining processes, which is not readily available to typical downstream buyers.

- Operational Complexity: Managing plantations involves navigating land acquisition, labor, environmental regulations, and fluctuating commodity prices, adding layers of operational difficulty.

Importance of GAR's Products to Customers

Palm oil and its derivatives are fundamental building blocks for a multitude of global products, spanning food, cosmetics, and biofuels. This broad applicability underscores the essential nature of Golden Agri-Resources' (GAR) offerings to its diverse customer base.

While GAR's products are critical, the market presents alternatives. The availability of other vegetable oils as substitutes can temper GAR's ability to dictate pricing, as customers can potentially switch suppliers if prices become uncompetitive.

- Global Palm Oil Demand: The worldwide demand for palm oil and its derivatives remains robust, driven by its versatility and cost-effectiveness in various industries.

- Substitute Availability: Consumers and manufacturers have access to other vegetable oils such as soybean oil, rapeseed oil, and sunflower oil, which can serve as functional alternatives.

- Price Sensitivity: Customer purchasing decisions are often influenced by price, especially in industries where palm oil is a significant cost component.

Golden Agri-Resources (GAR) faces moderate customer bargaining power, primarily due to the price sensitivity of its industrial buyers and the availability of substitute oils. While GAR's diverse customer base and brand loyalty initiatives mitigate some of this power, informed industrial clients can leverage market knowledge and potential switching to alternative suppliers, especially when palm oil prices fluctuate. The threat of backward integration by customers is low due to high capital and expertise requirements.

| Factor | Impact on GAR | Example/Data (2024) |

|---|---|---|

| Customer Concentration | Lowers Bargaining Power | GAR serves markets across Indonesia, China, India, USA, Europe, and the Middle East, preventing over-reliance on single buyers. |

| Switching Costs (Industrial) | Moderate | Minor formulation adjustments or equipment recalibration are typically manageable for buyers, allowing some negotiation leverage. |

| Substitute Availability | Increases Bargaining Power | In 2024, the global vegetable oil market saw continued interest in alternatives like sunflower and rapeseed oil, impacting palm oil pricing. |

| Price Sensitivity | Increases Bargaining Power | Industrial clients, well-informed on market prices, can negotiate more effectively, especially when palm oil is a significant cost input. |

Full Version Awaits

Golden Agri-Resources Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Golden Agri-Resources, detailing the competitive landscape and strategic positioning within the palm oil industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing players. The document you see here is the exact, professionally formatted analysis you will receive instantly upon purchase, ready for immediate use.

Rivalry Among Competitors

The palm oil market is projected to experience a steady expansion, with an estimated compound annual growth rate (CAGR) of 3.7% between 2024 and 2025. This growth is further anticipated to reach 4.8% by 2029.

Key drivers fueling this industry expansion include a rising global population, increasing demand from industrial food processing sectors, and a growing need for biofuels. Such market growth can help to moderate the intensity of competitive rivalry.

The palm oil sector is characterized by a concentrated market structure, with Indonesia and Malaysia together producing over 80% of the world's palm oil. This means Golden Agri-Resources (GAR) competes directly with other substantial integrated players.

Key competitors for GAR include global giants like Wilmar International, which also has extensive operations across the entire palm oil value chain. This creates a highly competitive environment where market share is fiercely contested.

Golden Agri-Resources (GAR) actively differentiates its offerings beyond basic crude palm oil. By investing in downstream processing, GAR transforms palm oil into higher-value products such as cooking oil, margarine, and various specialty fats. This strategic move allows them to capture more value and appeal to a broader customer base.

Furthermore, GAR's commitment to sustainable palm oil production and robust traceability systems serves as a significant differentiator. In 2024, the company continued to emphasize its sustainability certifications, aiming to meet the growing demand from consumers and businesses prioritizing environmentally responsible sourcing. This focus can lessen the intensity of direct price-based competition.

Exit Barriers

The palm oil industry, including players like Golden Agri-Resources, faces substantial exit barriers due to the immense capital required for establishing and maintaining plantations, processing mills, and refining facilities. These high upfront and ongoing investments create a significant financial commitment that makes it difficult for companies to simply walk away, even when market conditions are unfavorable.

This sticky situation can force companies to remain operational despite periods of low profitability, thereby intensifying competition among existing players. For instance, in 2023, while commodity prices fluctuated, the long-term nature of plantation development means that sunk costs in land and infrastructure continue to exert pressure on companies to maintain production.

- High Capital Intensity: Establishing palm oil plantations and associated processing infrastructure requires billions in upfront investment.

- Long-Term Asset Life: Palm oil trees have a productive lifespan of over 20 years, locking in capital for extended periods.

- Specialized Assets: Mills and refineries are highly specialized, with limited alternative uses if a company exits the palm oil sector.

- Geographic Commitment: Land leases and development often involve long-term commitments in specific regions, making relocation or divestment complex.

Industry Cost Structure

The palm oil sector is inherently capital-intensive, demanding substantial upfront investment in land acquisition, advanced machinery, and sophisticated processing facilities. These high fixed costs create a significant barrier to entry and mean that operational efficiency is paramount for profitability.

Companies like Golden Agri-Resources (GAR), which boast integrated supply chains and streamlined operations, can leverage economies of scale to secure cost advantages. However, the industry's competitive nature means that even with efficiency gains, intense rivalry can still exert considerable pressure on profit margins, particularly during periods of fluctuating commodity prices.

- Capital Intensity: High fixed costs in land, machinery, and processing plants characterize the palm oil industry.

- Efficiency as a Differentiator: Companies with integrated supply chains, such as GAR, can achieve cost leadership.

- Margin Pressure: Despite efficiency, fierce competition frequently compresses profit margins.

- 2024 Outlook: Anticipated stable to slightly increasing production costs for key inputs like fertilizer and labor in 2024 could further challenge margins for less efficient producers.

Golden Agri-Resources (GAR) operates in a highly competitive palm oil market, facing rivals with similar integrated operations and significant market share, particularly from Indonesian and Malaysian producers. While industry growth and GAR's focus on downstream products and sustainability offer some differentiation, the sector's high capital intensity and long-term asset commitments create substantial exit barriers. This forces existing players to remain competitive, often leading to price pressures and a constant drive for operational efficiency to maintain profitability amidst fluctuating commodity prices.

| Competitor | Market Position (Estimated) | Key Strengths |

|---|---|---|

| Wilmar International | Leading global agribusiness, significant integrated palm oil operations | Extensive global reach, diversified product portfolio, strong downstream presence |

| Musim Mas Group | Major integrated palm oil producer | Strong focus on sustainability, significant refining capacity, wide product range |

| KLK (Kuala Lumpur Kepong Berhad) | One of Malaysia's largest plantation companies | Diversified agribusiness, strong plantation base, significant downstream integration |

SSubstitutes Threaten

The availability of substitutes like soybean, sunflower, and rapeseed oil presents a significant threat to Golden Agri-Resources. These alternatives are readily available and increasingly chosen by consumers and industries concerned about the environmental impact of palm oil production. For instance, in 2024, global soybean oil production is projected to reach over 65 million metric tons, offering a substantial alternative supply.

Palm oil's cost-effectiveness is a key advantage, often positioning it as a more budget-friendly option compared to other vegetable oils. For instance, in early 2024, while palm oil prices fluctuated, they generally remained competitive against alternatives like soybean oil and sunflower oil, which saw their own price pressures.

However, significant price increases in palm oil, such as those experienced during periods of supply chain disruption or heightened demand, can indeed trigger a shift towards substitutes. Buyers, particularly in price-sensitive sectors like food manufacturing or animal feed, might opt for soybean oil or other oils if the price differential becomes substantial enough to impact their margins.

Buyer propensity to substitute for Golden Agri-Resources (GAR) is rising due to increasing awareness of palm oil's environmental and social impacts. Regulations like the EU Deforestation Regulation (EUDR) are a significant driver, pushing buyers to seek alternatives. For instance, the EUDR requires companies to prove their commodities, including palm oil, are deforestation-free, adding complexity and cost for producers like GAR and incentivizing buyers to explore other oils.

Innovation in Substitute Products

Research and development are actively creating new palm oil substitutes. Companies are exploring yeast-based oils, algae-based oils, and even alternative shortenings derived from byproducts like linseed and rapeseed oil. These advancements represent a growing long-term threat as they offer potential alternatives for various applications.

The threat of substitutes is amplified by ongoing innovation in the food and oleochemical industries. For instance, by 2024, several startups were making strides in producing microbial oils, which can be cultivated in controlled environments, potentially offering a more sustainable and consistent alternative to traditional palm oil. This continuous development means that the competitive landscape for palm oil producers like Golden Agri-Resources is constantly evolving.

- Innovative Alternatives: Development of yeast-based oils, algae-based oils, and shortenings from linseed and rapeseed oil.

- Long-Term Threat: These innovations could significantly impact palm oil demand over time.

- Industry Trends: Startups are focusing on microbial oils as a sustainable alternative.

Regulatory and Sustainability Pressures

Increasing regulatory and sustainability pressures, such as the European Union Deforestation Regulation (EUDR), are significantly influencing consumer and industry choices, directly impacting the demand for conventionally produced palm oil. This trend pushes both producers and buyers towards certified sustainable palm oil or even alternative oils, thereby intensifying the threat of substitutes. For Golden Agri-Resources (GAR), their proactive commitment to sustainability and robust traceability systems are crucial in mitigating this particular threat.

The EUDR, which came into effect in late 2024, requires companies importing commodities like palm oil into the EU to prove they are deforestation-free. This regulation directly affects the marketability of palm oil not meeting these stringent criteria. Consequently, alternatives or sustainably sourced palm oil are becoming more attractive, even if at a premium. GAR's investments in traceable supply chains and sustainable practices are designed to ensure compliance and maintain market access.

GAR reported that in 2023, over 50% of its palm oil supply chain was covered by its traceability system, a figure they aim to increase. This focus on transparency is vital as it addresses the core concerns driving the demand for substitutes. By demonstrating adherence to sustainability standards, GAR aims to retain its customer base and differentiate itself in a market increasingly sensitive to environmental impact.

- Regulatory Shift: The EUDR, active from late 2024, mandates deforestation-free supply chains for palm oil imports, increasing the appeal of certified sustainable options and alternatives.

- Consumer Demand: Growing consumer awareness of environmental issues drives demand for sustainably sourced products, making non-certified palm oil less desirable.

- GAR's Mitigation Strategy: Golden Agri-Resources' commitment to traceability and sustainability certifications helps to counter the threat of substitutes by ensuring market access and customer loyalty.

- Market Impact: The pressure from regulations and consumer preferences is likely to increase the cost competitiveness of sustainably produced palm oil and its alternatives over time.

The threat of substitutes for Golden Agri-Resources (GAR) is substantial, driven by the availability of alternatives like soybean, sunflower, and rapeseed oil, which consumers and industries increasingly favor due to environmental concerns. For instance, in 2024, global soybean oil production was projected to exceed 65 million metric tons, offering a significant alternative supply. While palm oil often holds a cost advantage, price spikes can easily shift buyers towards these substitutes.

Buyer propensity to switch is also heightened by growing awareness of palm oil's environmental and social impacts, further amplified by regulations like the EU Deforestation Regulation (EUDR) which came into effect in late 2024. This regulation necessitates deforestation-free sourcing, making alternatives or certified sustainable palm oil more attractive. GAR's investment in traceability, with over 50% of its supply chain covered by its system in 2023, is crucial for mitigating this threat.

| Substitute | 2024 Production Projection (Million Metric Tons) | Key Driver for Substitution |

| Soybean Oil | > 65 | Environmental Concerns, Price Sensitivity |

| Sunflower Oil | ~20 (Global estimate) | Environmental Concerns, Price Sensitivity |

| Rapeseed Oil | ~35 (Global estimate) | Environmental Concerns, Price Sensitivity |

Entrants Threaten

Entering the integrated palm oil industry, which spans from cultivation to downstream processing, demands immense capital. Companies need significant funds for acquiring land, developing plantations, building mills and refineries, and establishing robust logistics networks. For instance, establishing a new palm oil plantation can cost upwards of $5,000 to $10,000 per hectare, and this is before factoring in processing facilities.

These substantial upfront costs act as a formidable barrier, effectively deterring many potential new players from entering the market. The sheer scale of investment required means only well-capitalized firms can realistically consider competing, thus limiting the threat of new entrants.

Golden Agri-Resources (GAR) benefits immensely from economies of scale in its vast palm oil operations. This scale allows GAR to achieve lower per-unit costs in cultivation, harvesting, milling, and refining compared to potential new entrants. For instance, in 2024, GAR's extensive plantation size and integrated supply chain significantly reduce its operational expenses, a hurdle that newcomers would find challenging to overcome, particularly in matching competitive pricing.

Golden Agri-Resources (GAR) benefits from its established international marketing network and global distribution channels, which include destination refining and ex-tank operations. This expansive reach, serving customers in over 110 countries, presents a substantial barrier for any new player attempting to enter the palm oil market.

Proprietary Product Differences and Brand Identity

While crude palm oil (CPO) is largely a commodity, Golden Agri-Resources (GAR) has strategically invested in building strong consumer brands and developing value-added products. This differentiation, coupled with a brand identity emphasizing sustainable practices, creates a significant barrier for potential new entrants. For instance, GAR's commitment to traceable supply chains and certifications like RSPO (Roundtable on Sustainable Palm Oil) resonates with increasingly conscious consumers.

New players entering the CPO market would need substantial capital not only for production but also for extensive marketing and brand-building initiatives to establish a comparable market presence. Without a strong brand identity and distinct product offerings, newcomers would likely compete solely on price, which is challenging in a commodity market where large-scale producers often have cost advantages.

- Brand Differentiation: GAR's focus on consumer brands like "Sania" and "Filma" in key markets creates customer loyalty, requiring new entrants to invest heavily in marketing to build similar recognition.

- Value-Added Products: Moving beyond basic CPO, GAR's production of oleochemicals and specialty fats offers higher margins and requires specialized technology, posing a barrier to entry for those focused solely on raw CPO.

- Sustainability as a Differentiator: In 2024, consumer demand for sustainably sourced products is a significant driver. GAR's investments in sustainable palm oil production, evidenced by its numerous certifications, present a hurdle for new entrants lacking similar commitments and track records.

Government Policy and Regulation

Government policy and regulation significantly influence the threat of new entrants in the palm oil sector, especially in Indonesia. New players must contend with intricate land use regulations, which can be costly and time-consuming to comply with. For instance, Indonesia's moratorium on new palm oil plantation permits, initially implemented in 2011 and extended, directly limits expansion and new entry.

Furthermore, export duties and varying international trade policies create an uncertain environment. New entrants might face higher initial costs or market access barriers compared to established companies with existing trade relationships. The Indonesian government's focus on domestic processing and downstream industries, through policies like export levies on crude palm oil while incentivizing refined products, also presents a hurdle for those looking to establish new export-oriented operations.

Biofuel mandates, such as Indonesia's B30 program (requiring 30% palm oil blend in diesel fuel), create demand but also tie market access to compliance with specific national objectives. This regulatory complexity, coupled with the potential for policy shifts, raises the barrier to entry by increasing uncertainty and the need for specialized legal and governmental affairs expertise.

- Land Use Regulations: Indonesia's ongoing efforts to manage forest cover and peatlands through policies like the moratorium on new permits create significant hurdles for new plantation development.

- Export Policies: Changes in export duties and trade agreements can impact the profitability and market access for new entrants, requiring constant adaptation.

- Biofuel Mandates: While creating demand, adherence to domestic biofuel blending targets, like the B30 program, necessitates alignment with national energy policies.

- Environmental Certifications: Increasingly stringent requirements for sustainability certifications, such as the Roundtable on Sustainable Palm Oil (RSPO), add another layer of compliance for new market participants.

The threat of new entrants in the integrated palm oil industry is significantly mitigated by the substantial capital requirements for land acquisition, plantation development, and processing facilities. For example, establishing a new palm oil plantation can cost upwards of $5,000 to $10,000 per hectare, a considerable hurdle for potential competitors.

Economies of scale enjoyed by established players like Golden Agri-Resources (GAR) further deter new entrants, as GAR's vast operations in 2024 allow for lower per-unit costs in cultivation and processing. Additionally, GAR's established international marketing network and strong consumer brands, such as Sania and Filma, necessitate significant investment in marketing and brand-building for newcomers to gain traction.

Government policies and regulations, including land use restrictions and sustainability certification requirements, also act as barriers. For instance, Indonesia's moratorium on new palm oil plantation permits and the growing demand for RSPO-certified products in 2024 add complexity and cost for new market participants.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for land, development, and processing. | Deters new entrants due to substantial financial needs. |

| Economies of Scale | Lower per-unit costs for established, large-scale producers. | Makes it difficult for new entrants to compete on price. |

| Brand & Distribution | Established networks and consumer recognition. | Requires significant marketing investment for new entrants. |

| Regulatory & Policy | Land use, sustainability, and trade regulations. | Increases complexity, cost, and uncertainty for new entrants. |

Porter's Five Forces Analysis Data Sources

Our Golden Agri-Resources Porter's Five Forces analysis is built upon a foundation of comprehensive data, including the company's annual reports, investor presentations, and regulatory filings. We supplement this with industry-specific market research reports and data from reputable financial information providers to capture the competitive landscape.