Golden Agri-Resources Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Golden Agri-Resources Bundle

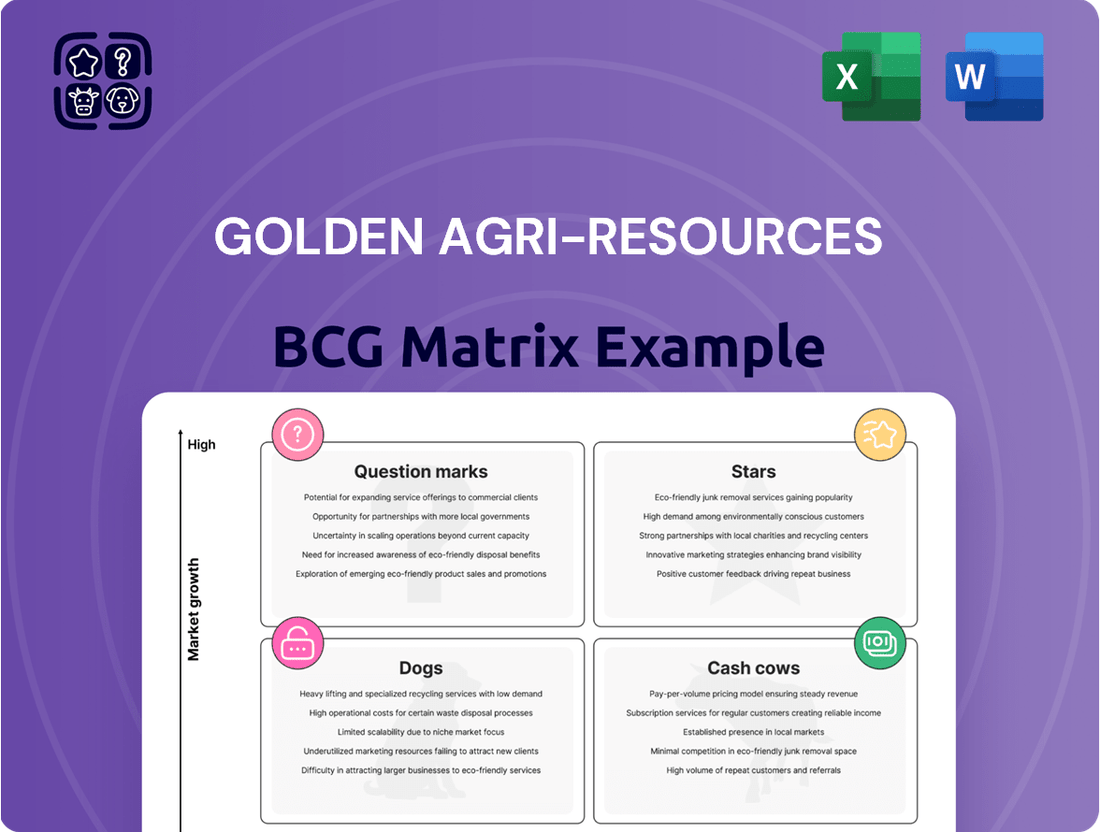

Explore the strategic positioning of Golden Agri-Resources within the dynamic agribusiness sector. Our BCG Matrix analysis reveals which of their ventures are poised for growth, which are generating stable income, and which may require a strategic re-evaluation.

This preview offers a glimpse into their market share and growth potential, but to truly unlock actionable insights and develop a robust strategy, you need the complete picture. Purchase the full BCG Matrix report to gain a detailed quadrant-by-quadrant breakdown and data-driven recommendations for optimizing your investment and product portfolio.

Stars

Golden Agri-Resources is strategically expanding its offerings in refined and value-added palm oil products such as cooking oil, margarine, and specialty fats. This segment is a crucial growth area for the company.

While the broader palm oil market sees steady growth, the demand for these downstream products, particularly in developing economies, presents a significant opportunity. GAR is leveraging its integrated supply chain and distribution capabilities to increase its market share in this high-value segment.

For instance, in 2024, Golden Agri-Resources reported that its downstream business, which includes these refined products, saw a revenue increase, demonstrating the success of its strategy to move beyond basic commodity palm oil.

Golden Agri-Resources' (GAR) high-yielding replanting programs are a key component of its strategy, focusing on renewing older oil palm estates. In 2024, GAR accelerated these efforts, targeting 21,500 hectares for rejuvenation with advanced planting materials. This initiative is a substantial investment aimed at boosting future productivity.

While the immediate impact of land preparation might temporarily affect current yields, these programs are strategically designed for long-term production growth. By ensuring the continuous renewal of its core asset base, GAR positions its mature, replanted plantations to become high-growth, high-share assets, solidifying its market leadership.

Golden Agri-Resources' (GAR) focus on sustainable palm oil production, evidenced by its RSPO certification and the SmartTrace blockchain system, positions it favorably against increasing global demand for ethical sourcing. This commitment is crucial for navigating regulations like the EU Deforestation Regulation (EUDR), which came into effect in late 2024, impacting market access for non-compliant producers.

By investing in certified sustainable palm oil and advanced traceability, GAR is building a competitive edge. This allows them to tap into premium markets and meet the stringent requirements of regulated economies, transforming sustainability from a cost center into a significant growth driver. In 2024, GAR reported that over 99% of its fresh fruit bunches were sourced from certified sustainable plantations.

Biodiesel Production Capacity

Indonesia's commitment to increasing biodiesel mandates, including the B40 blend rate planned for 2025 and further ambitions for B50, signals a robust growth environment for palm oil-derived biodiesel.

Golden Agri-Resources (GAR), a prominent integrated producer in Indonesia, is strategically positioned to capitalize on this expanding domestic energy market. Leveraging its robust upstream supply chain and downstream processing infrastructure, GAR is poised to capture a significant portion of this burgeoning demand.

This policy-driven growth offers a clear and substantial demand channel for a considerable volume of GAR's crude palm oil (CPO) output, solidifying its position in this expanding sector.

- Indonesia's Biodiesel Mandates: The nation's push for higher biodiesel blending, such as the B40 mandate for 2025, creates a substantial growth opportunity.

- GAR's Strategic Advantage: As a leading integrated producer, GAR's control over its supply chain and processing capabilities allows it to efficiently meet this increasing demand.

- Market Share Potential: This policy-driven market expansion is expected to secure a significant share for GAR in the domestic biodiesel sector.

- CPO Utilization: The growing biodiesel demand provides a strong, policy-supported outlet for a substantial portion of GAR's CPO production.

Integrated Supply Chain Efficiency and Innovation

Golden Agri-Resources (GAR) leverages its vertically integrated supply chain, spanning from palm cultivation to global distribution, to drive efficiency. This model, supported by continuous investment in innovation and advanced technology, boosts productivity and allows GAR to adapt to market shifts. For instance, in 2023, GAR reported a significant improvement in its operational efficiency, contributing to a stronger financial performance.

- Vertical Integration: GAR's control over the entire value chain, from upstream plantations to downstream refining and distribution, ensures greater operational synergy and cost control.

- Innovation Investment: The company actively invests in R&D and technology, such as precision agriculture and digital supply chain management, to enhance yields and reduce waste.

- Market Position: This integrated and innovative approach solidifies GAR's leading position in the global palm oil market, enabling them to capture higher margins and maintain competitiveness.

- 2024 Outlook: GAR's strategy positions them well to capitalize on the projected growth in global demand for sustainable palm oil in 2024 and beyond.

Golden Agri-Resources' (GAR) downstream refining and value-added products, like cooking oil and margarine, represent a significant growth avenue. This segment benefits from increasing demand, particularly in emerging markets, and GAR's integrated supply chain is key to capturing this opportunity. In 2024, GAR noted a revenue increase in its downstream operations, underscoring the success of its strategy to move into higher-margin products.

GAR's strategic replanting programs, targeting 21,500 hectares in 2024 with advanced planting materials, are designed for long-term production gains. This investment in renewing older estates ensures that future yields will be higher, solidifying GAR's position as a market leader with robust, high-growth assets. These efforts are crucial for maintaining a competitive edge in the evolving palm oil landscape.

The company's commitment to sustainable palm oil, with over 99% of its fresh fruit bunches sourced from certified sustainable plantations in 2024, is vital for market access, especially with regulations like the EUDR implemented in late 2024. This focus on ethical sourcing and traceability, using systems like SmartTrace, transforms sustainability into a competitive advantage, allowing GAR to tap into premium markets and meet stringent global demands.

Indonesia's increasing biodiesel mandates, including the B40 blend rate for 2025, create a substantial and policy-driven demand for palm oil. GAR, as a leading integrated producer, is well-positioned to supply this growing domestic energy market, leveraging its robust upstream and downstream capabilities to capture a significant share of this expanding sector and secure a strong outlet for its crude palm oil.

| Business Segment | Market Share | Growth Rate | Profitability | Strategic Importance |

|---|---|---|---|---|

| Refined & Value-Added Products | High | High | High | Star (Growth & Profitability) |

| Sustainable Palm Oil Production | High | Medium | Medium | Question Mark (Compliance & Market Access) |

| Biodiesel Feedstock | High | High | Medium | Star (Policy-Driven Growth) |

| Upstream Plantation Operations | High | Low | Medium | Cash Cow (Foundation for Growth) |

What is included in the product

This BCG Matrix overview for Golden Agri-Resources highlights its palm oil business as a Cash Cow, while its downstream products may be Stars or Question Marks.

This BCG Matrix provides a clear, one-page overview of Golden Agri-Resources' business units, relieving the pain of strategic uncertainty.

Cash Cows

Golden Agri-Resources' (GAR) extensive mature oil palm plantation, spanning roughly 499,000 hectares as of March 2025, primarily located in Indonesia, serves as its primary engine for generating consistent cash. This vast landbank underpins the company's ability to produce significant volumes of Crude Palm Oil (CPO).

While plantation yields can experience minor variations year-over-year due to environmental factors like El Niño or ongoing replanting efforts, the sheer scale of GAR's mature estates ensures a steady output of CPO. This essential commodity caters to a large, established global market, solidifying its role as a reliable cash generator.

The upstream palm oil production segment demonstrably contributed significantly to GAR's overall financial results throughout 2024 and into the first quarter of 2025, highlighting its status as a core "cash cow" for the company.

Palm Kernel (PK) production is a significant co-product of Golden Agri-Resources' (GAR) fresh fruit bunch milling, representing a high-volume, consistent output. In 2024, GAR's upstream operations continued to leverage this integrated model, ensuring efficient PK extraction.

Despite operating in a mature market, PK and its derivative, Palm Kernel Oil (PKO), generate a steady and reliable cash flow for GAR. This stability is a direct result of their highly efficient, integrated milling processes, requiring minimal additional capital investment, thus bolstering overall milling profitability.

Golden Agri-Resources' bulk cooking oil and basic margarine sales represent a classic Cash Cow in their BCG Matrix. Their massive production scale and strong merchandising capabilities tap into a consistent, high-volume consumer demand.

While profit margins on these staples are tighter than specialty fats, GAR's vast refining infrastructure and established global sales channels ensure steady revenue streams. These sales are crucial for generating reliable cash flow, even in a mature market. In 2024, this segment demonstrated notable resilience, performing well despite challenging market conditions.

Established International Marketing and Distribution Network

Golden Agri-Resources (GAR) boasts a formidable international marketing and distribution network, a key component of its Cash Cow status. This extensive infrastructure, encompassing destination refining, ex-tank operations, and sales offices in critical markets, ensures efficient global reach for its palm-based products. In 2024, GAR's strategic placement of these assets allowed for seamless product flow, contributing significantly to its robust profit base.

This mature network is instrumental in driving high sales volumes for GAR's core palm oil derivatives. The established channels provide a stable and predictable revenue stream, requiring minimal incremental investment for continued operation. The efficiency of this distribution system underpins GAR's ability to generate consistent cash flow, a hallmark of a Cash Cow business.

- Global Reach: GAR's network spans major consuming countries, facilitating worldwide distribution.

- Operational Efficiency: Destination refining and ex-tank operations streamline product delivery.

- Stable Revenue: The mature network ensures consistent sales volumes and cash generation.

- Low Growth Investment: Existing infrastructure requires minimal additional capital for continued cash flow.

Oil Palm Mills Operations

Golden Agri-Resources' oil palm mills are classic Cash Cows. These operations are the backbone of the company, processing fresh fruit bunches into crude palm oil and palm kernel. It's a high-volume, well-established business that consistently turns raw materials into marketable commodities.

The efficiency of these mills is key. They represent mature infrastructure and processes, ensuring a steady output of products with a significant market share. This consistent production, coupled with stable demand for palm oil, translates into substantial operational cash flow for Golden Agri-Resources.

- High-Volume Processing: The mills handle vast quantities of fresh fruit bunches, a testament to their established scale.

- Mature Operations: Infrastructure and processes are optimized, leading to efficient conversion of raw materials.

- Market Share Dominance: Consistent production supports a high market share in the palm oil commodity sector.

- Stable Cash Flow Generation: Mature operations and stable demand create a reliable source of significant operational cash flow.

Golden Agri-Resources' (GAR) extensive upstream operations, particularly its mature oil palm plantations, function as its primary cash cows. The sheer scale of its landbank, approximately 499,000 hectares as of March 2025, predominantly in Indonesia, ensures a consistent and high-volume production of Crude Palm Oil (CPO).

This steady output, despite minor yield fluctuations, caters to a robust global demand for CPO, solidifying its role as a reliable revenue generator. In 2024, the upstream segment demonstrably contributed substantially to GAR's financial performance, underscoring its cash cow status.

The company's bulk cooking oil and basic margarine sales also represent classic cash cows. Leveraging massive production scale and efficient refining infrastructure, GAR taps into consistent, high-volume consumer demand, generating stable revenue streams even in a mature market. This segment showed resilience in 2024.

GAR's integrated milling processes, efficiently extracting Palm Kernel (PK) and Palm Kernel Oil (PKO), further bolster its cash cow profile. These operations, requiring minimal new capital investment, provide a steady and reliable cash flow, enhancing overall milling profitability.

| Segment | Role in BCG Matrix | Key Characteristics | 2024/Early 2025 Data Point |

|---|---|---|---|

| Upstream Oil Palm Plantations | Cash Cow | Vast landbank, high-volume CPO production, mature operations | ~499,000 hectares mature plantations (March 2025) |

| Bulk Cooking Oil & Margarine | Cash Cow | Massive production scale, established sales channels, consistent demand | Demonstrated resilience in 2024 market conditions |

| Palm Kernel & Palm Kernel Oil | Cash Cow | Efficient integrated milling, high-volume co-product, stable revenue | Continued steady cash flow generation from milling operations |

What You’re Viewing Is Included

Golden Agri-Resources BCG Matrix

The Golden Agri-Resources BCG Matrix you are currently previewing is the identical, fully formatted report you will receive immediately after your purchase. This comprehensive analysis of their palm oil business units, categorized into Stars, Cash Cows, Question Marks, and Dogs, is presented with actionable insights and strategic recommendations. Rest assured, there are no watermarks or demo content; you are viewing the final, polished document ready for your strategic planning and decision-making.

Dogs

Golden Agri-Resources' older, low-yielding oil palm plantations, awaiting replanting, represent a segment of their portfolio that, while still maintained, contributes less to current output. These areas typically show reduced fresh fruit bunch yields compared to more mature or recently replanted sections. The company’s strategic focus in 2024 included accelerating replanting initiatives for these specific estates, aiming to revitalize their productivity and profitability.

Golden Agri-Resources (GAR) might categorize certain very small, undifferentiated non-palm commodity businesses, such as niche soybean or sunflower products in limited regions, as Dogs within its BCG Matrix. These segments typically exhibit low market share and operate in stagnant or declining local markets, offering minimal growth potential and potentially draining valuable resources. For instance, if GAR had a small, regional operation producing sunflower oil with less than a 5% market share in a market experiencing a 2% annual decline, it would fit this classification.

Golden Agri-Resources (GAR), despite its focus on innovation, can have aspects that resemble 'Dogs' in the BCG Matrix. These are typically inefficient legacy operational processes or older technologies that haven't kept pace with industry advancements. Such systems often require significant maintenance resources while offering little in terms of competitive advantage or substantial productivity gains. For instance, if GAR still relies on outdated manual data entry systems for plantation management, these would drain resources without contributing to growth.

Segments with Persistent Low Refining Margins

Golden Agri-Resources' downstream segment, while generally robust, faced persistent low refining margins in 2024. This situation, if it continues without being counterbalanced by increased sales volumes or the introduction of more valuable products, could position parts of this segment as question marks within the BCG matrix. These operations, focused on bulk refining, might be yielding less profit compared to the investment made, especially given the intense competition and market fluctuations common in this sector.

GAR is actively working to mitigate these lower margins by shifting its focus towards developing and marketing higher value-added products. This strategic pivot aims to improve the profitability of its downstream operations.

- Persistent Low Refining Margins: In 2024, GAR's downstream segment experienced reduced refining margins.

- Question Mark Potential: If these low margins persist and aren't offset by volume or value-added products, parts of the downstream business could be classified as question marks.

- Competitive Market: The refining industry is characterized by high competition and volatility, impacting profitability.

- Strategic Response: GAR is addressing this by focusing on higher value-added downstream products.

Underperforming Market Segments with High Competition

Golden Agri-Resources (GAR) may identify underperforming market segments characterized by high competition as 'Dogs' in its BCG Matrix. These are areas where GAR struggles to gain significant market share despite moderate market growth. Such segments demand substantial investment in marketing and sales for meager returns.

While specific underperforming segments aren't detailed in publicly available reports, GAR operates in diverse geographical markets and product categories within the palm oil industry. Intense competition is a constant factor across many of these, potentially leading to some sub-segments fitting the 'Dog' profile. For instance, in highly saturated consumer markets for refined palm oil products, achieving differentiation and profitability can be challenging.

- Intense Competition: Certain refined palm oil product categories in mature markets face numerous established players, limiting GAR's ability to capture substantial market share.

- Low Profitability: In these competitive landscapes, price wars and high promotional costs can erode profit margins, making these segments less attractive.

- Moderate Market Growth: While the overall palm oil market might see growth, specific product niches within it could be experiencing slower expansion, further exacerbating the 'Dog' characteristics.

- Strategic Review: Segments identified as 'Dogs' would necessitate a careful evaluation of whether to divest, restructure, or invest further to improve their standing.

Within Golden Agri-Resources' portfolio, certain older, less productive oil palm plantations, awaiting replanting, can be considered 'Dogs'. These areas, characterized by lower fresh fruit bunch yields, require ongoing maintenance but contribute minimally to overall output. GAR's 2024 strategy included accelerating replanting efforts for these specific estates to boost their productivity and profitability.

Additionally, niche, undifferentiated non-palm commodity businesses, such as small regional soybean or sunflower operations with low market share in stagnant markets, also fit the 'Dog' classification. These segments offer limited growth and can consume resources without significant returns.

Inefficient legacy operational processes or outdated technologies within GAR can also represent 'Dogs'. These systems demand considerable maintenance and offer little competitive advantage or productivity gains, draining resources without contributing to growth.

In 2024, persistent low refining margins in GAR's downstream segment, if not offset by increased volumes or higher-value products, could position parts of this business as 'Dogs'. Intense competition and market volatility in bulk refining further impact profitability.

| Category | Characteristics | GAR Example | 2024 Context |

| Low Yield Plantations | Low market share, low growth potential | Older oil palm estates awaiting replanting | Accelerated replanting initiatives |

| Niche Commodities | Low market share, stagnant/declining markets | Small, regional soybean or sunflower products | Limited growth potential |

| Inefficient Processes | Low market share, low growth potential | Outdated manual data entry systems | Resource drain without competitive advantage |

| Low Margin Refining | Low market share, low growth potential | Bulk refining operations with persistent low margins | Intense competition, strategic shift to value-added products |

Question Marks

Golden Agri-Resources (GAR) is actively developing new, highly specialized oleochemicals and bio-based products. This strategic move aims to capture value in emerging industrial and consumer markets with significant growth prospects. These specialized products represent a push towards higher value-added offerings, aligning with GAR's objective to bolster its competitive advantage.

In these nascent segments, GAR's market share is expected to be initially low. Significant investment in research and development (R&D) and market development will be crucial for these specialized oleochemicals to gain traction. For instance, GAR's investment in sustainable palm oil derivatives, including those for advanced materials and bio-lubricants, underscores this focus on innovation and market penetration.

Expanding into new, high-growth geographical markets for Golden Agri-Resources (GAR)'s refined and branded palm oil products, particularly in regions with rising disposable incomes and evolving dietary preferences, could represent a significant 'star' opportunity within the BCG matrix. For instance, by 2024, countries in Southeast Asia and Africa are showing robust economic growth, with increasing consumer spending on packaged food items. GAR's entry into these markets, leveraging its established refining capabilities, could capture substantial market share.

These emerging markets offer significant expansion opportunities, but GAR would need to invest heavily in brand building, distribution networks, and localized marketing strategies to establish a strong foothold. For example, in 2024, the packaged food market in Vietnam alone was projected to grow by over 8%, presenting a prime target. Overcoming established local brands and navigating diverse regulatory landscapes will be key challenges requiring substantial capital and strategic planning.

Golden Agri-Resources' (GAR) venture into palm kernel shell (PKS) exports through its subsidiary, Golden Biomass Energy (GBE), positions it within a rapidly expanding renewable energy market, particularly with significant demand from Japan. This aligns with the characteristics of a Star in the BCG Matrix, indicating high market growth potential.

While the PKS export business is experiencing strong growth, it's a newer segment for GAR compared to its established palm oil operations. This suggests a potentially lower current market share within the overall global biomass energy sector, even as the market itself is expanding quickly.

The global biomass market is projected to reach over $100 billion by 2027, with significant contributions from PKS. In 2024, Japan continued to be a leading importer of biomass fuels, including PKS, driven by ambitious renewable energy targets.

Advanced Digital Traceability and Supply Chain Technologies

Golden Agri-Resources (GAR) is making significant strides in advanced digital traceability, notably with its blockchain-powered SmartTrace system launched in late 2024. This initiative, alongside other digital supply chain investments, positions GAR in a rapidly expanding sector focused on transparency and regulatory compliance. These technologies are crucial for future market access, particularly for regulations like the EU Deforestation Regulation (EUDR).

While these digital capabilities represent a forward-looking strategy for GAR, aiming to build market leadership in supply chain transparency, their immediate impact on revenue generation and market share is still in development. The company is investing in this high-growth area, recognizing its importance for long-term sustainability and market competitiveness.

- SmartTrace System: Launched late 2024, utilizing blockchain for enhanced supply chain transparency.

- Market Access: Critical for meeting future regulatory requirements, such as the EUDR.

- Strategic Investment: GAR is building market leadership in a high-growth area of supply chain technology.

- Developing Impact: Immediate revenue generation and dominant market share are still evolving.

Strategic Partnerships in Agricultural Innovation (e.g., CIRAD collaboration)

Golden Agri-Resources' (GAR) strategic partnership with CIRAD, a French agricultural research organization, exemplifies a Stars quadrant investment. This renewed agreement focuses on accelerating innovation in sustainable palm oil, specifically targeting climate resilience and novel agroforestry systems. These initiatives are positioned for high growth, aiming to develop future-proof agricultural practices.

The collaboration with CIRAD is designed to foster cutting-edge research, a key characteristic of Stars. While the direct impact on GAR's current market share and profitability is still emerging, the long-term potential for market leadership in sustainable palm oil is significant. For instance, GAR reported a 16% increase in its sustainability-linked financing in 2023, underscoring its commitment to these forward-looking strategies.

- Focus on Climate Resilience: Research into drought-resistant palm oil varieties and improved water management techniques.

- Agroforestry Development: Exploring integrated farming systems that enhance biodiversity and soil health.

- Innovation Acceleration: Leveraging CIRAD's expertise to fast-track the development and adoption of sustainable practices.

- Future Market Leadership: Positioning GAR as a leader in environmentally responsible palm oil production.

Golden Agri-Resources' (GAR) investment in specialized oleochemicals and bio-based products places it in a high-growth, emerging market. While current market share in these niche areas is low, the potential for future dominance is significant, characteristic of a Star in the BCG matrix. GAR's commitment to R&D in areas like advanced materials and bio-lubricants highlights this forward-looking strategy.

GAR's expansion into new geographical markets for refined and branded palm oil products, particularly in Southeast Asia and Africa, represents a Star opportunity. These regions show robust economic growth and increasing consumer spending on packaged foods. For example, Vietnam's packaged food market was projected to grow by over 8% in 2024.

The export of palm kernel shell (PKS) through Golden Biomass Energy (GBE) positions GAR in the booming renewable energy sector, especially with demand from Japan. This is a high-growth market, with Japan actively importing biomass fuels to meet its renewable energy targets in 2024.

GAR's development of digital traceability, such as the blockchain-powered SmartTrace system launched in late 2024, targets a rapidly expanding sector focused on transparency. This investment aims to build market leadership in supply chain technology, crucial for meeting future regulations like the EU Deforestation Regulation (EUDR).

The strategic partnership with CIRAD to accelerate innovation in sustainable palm oil, focusing on climate resilience and agroforestry, is another Star initiative. This collaboration aims to position GAR as a leader in environmentally responsible palm oil production, building on its commitment to sustainability-linked financing, which saw a 16% increase in 2023.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.