GoDaddy SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GoDaddy Bundle

GoDaddy, a leader in web hosting and domain registration, faces intense competition and evolving technological landscapes. Understanding its unique strengths, potential weaknesses, market opportunities, and threats is crucial for anyone looking to invest or strategize in the digital services sector.

Want the full story behind GoDaddy's market position, its innovative edge, and potential growth avenues? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to illuminate strategic planning and competitive analysis.

Strengths

GoDaddy's dominant market position is a significant strength, underscored by its management of over 84 million domain names globally. This vast portfolio, serving approximately 20 million customers, solidifies its leadership in the domain registration sector.

This substantial market share provides GoDaddy with considerable pricing power and a strong competitive moat, making it difficult for new entrants to challenge its established presence.

GoDaddy shines with its extensive range of services, truly aiming to be a single destination for all online needs. From securing domain names and building websites to providing robust hosting, email, and marketing tools, they cover the essential spectrum for small businesses and individuals.

This integrated approach significantly streamlines the often-complex process of establishing and managing an online presence. For instance, in 2023, GoDaddy reported over 20 million customers worldwide, highlighting the broad appeal of their all-in-one solution.

GoDaddy has shown impressive financial strength, with revenue climbing 8% year-over-year to $1.2 billion in the first quarter of 2025. This growth was particularly strong in its Applications and Commerce segment, which saw a 17% increase, indicating a successful shift towards higher-margin offerings.

The company is also committed to rewarding its investors. A significant $3 billion share buyback program has been authorized through 2027, demonstrating GoDaddy's confidence in its valuation and its dedication to enhancing shareholder value through strategic capital allocation.

Resilient Customer Base and Focus on Small Businesses

GoDaddy's core strength lies in its dedicated focus on small and micro-businesses, a segment that has historically demonstrated remarkable resilience even during periods of economic uncertainty. This customer base, often characterized by its entrepreneurial spirit, relies on GoDaddy for essential digital infrastructure, fostering a stable and recurring revenue stream.

The company's commitment to providing accessible and user-friendly digital tools empowers these entrepreneurs, contributing to GoDaddy's consistent performance and growth trajectory. For instance, in 2023, GoDaddy reported total revenue of $4.05 billion, reflecting the sustained demand from its target market.

- Resilient Customer Segment: Small and micro-businesses form a robust customer base less susceptible to broad macroeconomic downturns.

- Digital Empowerment: GoDaddy's suite of accessible tools aids entrepreneurs in establishing and growing their online presence.

- Recurring Revenue Model: The essential nature of domain registration and hosting services ensures a predictable revenue flow.

- Market Position: GoDaddy is a leading provider for small businesses seeking domain names, website building, and hosting solutions.

Strategic Investment in AI and Product Innovation

GoDaddy is making significant strides by strategically investing in and expanding its AI-powered product suite. A prime example is GoDaddy Airo, designed to streamline the process of creating an online presence and boost customer engagement through intelligent recommendations and the discovery of untapped potential.

This commitment to innovation is crucial for GoDaddy to stand out in a crowded marketplace. By leveraging AI, the company aims to offer more personalized and efficient solutions to its customers, fostering loyalty and attracting new users.

- AI-Powered Product Expansion: GoDaddy is actively developing and integrating AI into its offerings, exemplified by GoDaddy Airo.

- Enhanced Customer Experience: AI features like predictive recommendations and opportunity identification aim to simplify online presence management and improve customer engagement.

- Competitive Differentiation: This strategic focus on innovation helps GoDaddy carve out a distinct position in the competitive digital services landscape.

- Market Responsiveness: Investments in AI allow GoDaddy to adapt to evolving customer needs and technological advancements, ensuring continued relevance.

GoDaddy's market leadership is a cornerstone strength, managing over 84 million domain names for approximately 20 million customers globally as of 2023. This vast scale grants significant pricing power and a formidable barrier to entry for competitors.

The company's comprehensive service portfolio, ranging from domain registration and website building to hosting and marketing tools, offers a streamlined, all-in-one solution for small businesses. This integrated approach simplifies online presence management, as evidenced by their over 20 million customers in 2023.

GoDaddy demonstrates robust financial health, with Q1 2025 revenue reaching $1.2 billion, an 8% year-over-year increase. The Applications and Commerce segment, a key growth driver, saw a 17% surge, signaling a successful pivot to higher-margin services.

A $3 billion share buyback program authorized through 2027 underscores management's confidence in GoDaddy's valuation and commitment to shareholder returns.

| Metric | 2023 Data | Q1 2025 Data |

|---|---|---|

| Global Domain Names Managed | 84 million+ | N/A |

| Total Customers | 20 million+ | N/A |

| Total Revenue | $4.05 billion (2023) | $1.2 billion (Q1 2025) |

| Applications & Commerce Growth | N/A | 17% (Q1 2025) |

| Share Buyback Authorization | N/A | $3 billion through 2027 |

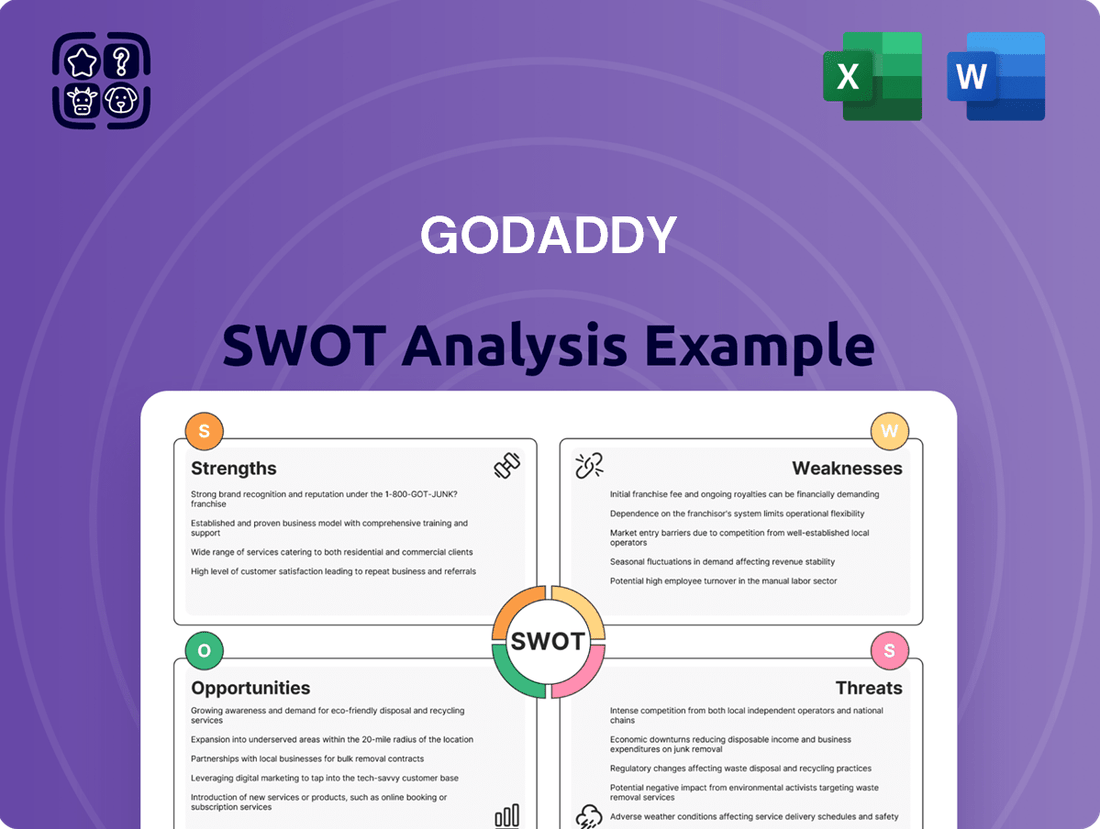

What is included in the product

Delivers a strategic overview of GoDaddy’s internal and external business factors, highlighting its strong brand recognition and vast customer base while also noting potential challenges in market saturation and evolving technology.

Identifies GoDaddy's core strengths and weaknesses, offering actionable insights to address competitive threats and leverage market opportunities.

Weaknesses

Despite GoDaddy's focus on customer support, a recurring theme in user feedback highlights significant concerns. Many customers have voiced frustration over extended wait times when trying to reach support, alongside difficulties in clear communication, particularly with overseas teams. These issues can erode customer trust and lead to increased churn.

GoDaddy faces criticism for its pricing structure, with customers often experiencing rapid price hikes after initial promotional periods. Many users report feeling pressured into purchasing add-ons, such as SSL certificates, which are frequently presented as essential but can inflate the overall cost significantly. This approach can lead to a perception of a lack of transparency, potentially damaging customer loyalty.

GoDaddy faces challenges with website speed and performance, with some users reporting sluggishness, especially during high-traffic periods. This can detract from the customer experience, a crucial element for businesses depending on rapid website functionality.

Reliance on Core Platform for Revenue

GoDaddy's reliance on its core platform, encompassing domains and hosting, presents a notable weakness. In the second quarter of 2024, this segment still accounted for a substantial 64% of the company's total revenue. While this core business has been a stable revenue generator, its growth rate is noticeably slower than that of their Applications & Commerce segment.

This disparity in growth suggests a potential vulnerability. If the market for domain registration and web hosting becomes more saturated or faces intensified competition, GoDaddy's revenue streams could be significantly impacted due to this heavy concentration. This dependence means that any slowdown or disruption in these foundational services could disproportionately affect the company's overall financial performance.

- Core Platform Revenue Contribution: 64% of total revenue in Q2 2024.

- Growth Differential: Core Platform exhibits slower growth compared to Applications & Commerce.

- Vulnerability Factor: Increased market saturation or competition in core services poses a risk.

Net Income Decline in Q1 2025

GoDaddy's Q1 2025 results revealed a dip in net income, despite a revenue increase. This decline was largely attributed to the absence of significant tax benefits that boosted the prior year's earnings. While the core business showed strength, the net income figure underscores the impact of one-time items on reported profitability.

The company's net income for the first quarter of 2025 was $104.6 million, a decrease from $132.1 million in Q1 2024. This drop, while concerning, needs to be viewed in the context of the prior year's figures which included a $38 million tax benefit. Excluding such items, GoDaddy's operational performance remained robust.

- Net Income Impact: Q1 2025 net income stood at $104.6 million, down from $132.1 million in Q1 2024.

- Revenue Growth: Total revenue for Q1 2025 increased to $1.09 billion, up from $1.05 billion in the same period last year.

- Profitability Nuance: The net income decline was primarily driven by the prior year's non-recurring tax benefits, masking underlying operational improvements.

GoDaddy's customer service, while a stated focus, frequently draws criticism for long wait times and communication issues, particularly with international support teams. This can lead to customer frustration and potentially higher churn rates, impacting brand loyalty and recurring revenue. Additionally, the company's pricing model, characterized by aggressive initial promotions followed by significant price increases and pressure for add-on purchases, can create a perception of opacity and deter price-sensitive customers.

Website performance and speed are also identified as weaknesses, with reports of sluggishness impacting user experience, especially during peak traffic. This directly affects the value proposition for businesses relying on their online presence. Furthermore, GoDaddy's substantial reliance on its core domain and hosting services, which represented 64% of revenue in Q2 2024, poses a risk. This segment's slower growth compared to its Applications & Commerce offerings makes the company vulnerable to increased competition or market saturation in these foundational areas.

| Weakness Area | Specific Concern | Impact |

| Customer Support | Long wait times, communication issues | Customer frustration, potential churn |

| Pricing Structure | Aggressive promotions, price hikes, add-on pressure | Perceived opacity, reduced customer loyalty |

| Website Performance | Sluggishness, especially during peak times | Negative user experience, diminished value proposition |

| Revenue Concentration | Heavy reliance on domains/hosting (64% of Q2 2024 revenue) | Vulnerability to market saturation/competition |

Preview the Actual Deliverable

GoDaddy SWOT Analysis

You're previewing the actual analysis document. Buy now to access the full, detailed report, which includes a comprehensive breakdown of GoDaddy's Strengths, Weaknesses, Opportunities, and Threats.

This preview reflects the real document you'll receive—professional, structured, and ready to use for strategic planning. It provides a clear overview of GoDaddy's market position.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain deeper insights into GoDaddy's competitive landscape and future potential.

Opportunities

GoDaddy's investment in AI-driven products like GoDaddy Airo and Airo Plus is a prime opportunity. These tools simplify complex tasks for small businesses, offering predictive recommendations that can boost engagement and loyalty.

The expansion of these AI solutions allows GoDaddy to differentiate itself in a competitive market, potentially increasing average revenue per user (ARPU). For instance, by making website creation and digital marketing more accessible, GoDaddy can attract and retain a larger customer base, particularly among entrepreneurs.

GoDaddy's Applications and Commerce (A&C) segment is a significant growth engine, demonstrating a robust 17% year-over-year increase in its performance during the first quarter of 2025.

By broadening its omnicommerce offerings, which encompass integrated online payment gateways and sophisticated marketing tools, GoDaddy can unlock even faster revenue expansion. This strategic move also supports a beneficial shift in its business composition towards services that typically yield higher profit margins.

GoDaddy has a substantial opportunity to grow by entering and expanding in international markets, especially in emerging economies. These regions are seeing a surge in internet adoption and a greater number of small businesses embracing digital tools, creating a fertile ground for GoDaddy's services.

By tailoring its offerings and support to specific local needs, GoDaddy can effectively attract and retain new customer bases. For instance, in 2024, emerging markets are projected to contribute significantly to global internet user growth, with a notable increase in small business digitalization efforts.

Increasing Small Business Digital Transformation Needs

Small businesses are significantly boosting their spending on digital tools. This includes everything from setting up online stores and improving digital advertising to adopting AI for better customer engagement. This growing demand presents a substantial opportunity for GoDaddy to expand its customer base.

GoDaddy is well-positioned to benefit from this trend. They can offer specialized packages that help small businesses navigate their digital journey, from website creation to online marketing strategies. For instance, in 2024, it's estimated that over 50% of small businesses planned to increase their digital marketing budgets.

- E-commerce Growth: The global e-commerce market is projected to reach $8.1 trillion by 2024, highlighting the need for robust online platforms.

- AI Adoption: Small businesses are increasingly exploring AI for tasks like customer service and personalized marketing, areas where GoDaddy can provide integrated solutions.

- Digital Marketing Investment: A significant portion of small businesses are allocating more resources to online advertising and SEO to reach a wider audience.

Strategic Acquisitions and Partnerships

GoDaddy has a proven track record of growth through strategic acquisitions. For instance, its acquisition of PlusServer in April 2024 demonstrates a continued commitment to expanding its market presence and revenue streams. This approach can significantly bolster its competitive edge.

These strategic moves are crucial for enhancing GoDaddy's service portfolio. By integrating new technologies and customer bases, the company can offer a more comprehensive suite of solutions, thereby strengthening its position in the dynamic digital services market.

- Acquisition of PlusServer (April 2024): This move is expected to contribute to future revenue growth and market share expansion.

- Service Portfolio Enhancement: Strategic partnerships and acquisitions allow GoDaddy to broaden its offerings, catering to a wider range of customer needs.

- Competitive Positioning: By acquiring complementary businesses or forging strategic alliances, GoDaddy can solidify its standing against competitors in the web hosting and domain registration industry.

GoDaddy's strategic expansion into international markets, particularly in emerging economies, presents a significant growth avenue as internet adoption and small business digitalization accelerate globally. The company's focus on AI-driven products like GoDaddy Airo is another key opportunity, simplifying complex digital tasks and enhancing customer engagement, which is crucial in a competitive landscape. Furthermore, GoDaddy's Applications and Commerce segment is a strong revenue driver, showing robust year-over-year growth, indicating potential for further expansion through enhanced omnicommerce offerings.

| Opportunity Area | 2024/2025 Data/Projection | Impact |

|---|---|---|

| International Market Expansion | Emerging markets projected to drive global internet user growth in 2024. | Access to new customer bases and revenue streams. |

| AI-Driven Products (GoDaddy Airo) | Increased small business investment in AI for customer engagement. | Product differentiation, higher ARPU, and customer retention. |

| E-commerce & Omnicommerce | Global e-commerce market projected to reach $8.1 trillion by 2024. | Increased demand for integrated online platforms and marketing tools. |

| Strategic Acquisitions (e.g., PlusServer) | Acquisition of PlusServer in April 2024. | Portfolio enhancement, market share expansion, and revenue growth. |

Threats

The web hosting and domain registration sector is fiercely competitive, featuring a wide array of providers. GoDaddy faces rivals like Wix, Squarespace, and Shopify, alongside major cloud entities such as Google Cloud and Amazon Web Services, not to mention a multitude of budget-friendly hosting services.

This crowded marketplace directly impacts GoDaddy's ability to maintain market share and exert pricing power. For instance, in 2023, the global web hosting market was valued at approximately $23.4 billion, with projections indicating continued growth, underscoring the intense battle for customers.

As a leading web hosting and domain registrar, GoDaddy faces significant threats from cybersecurity attacks. Phishing, ransomware, and increasingly sophisticated AI-powered malware pose constant risks, aiming to disrupt services or steal sensitive customer information. A successful breach could be devastating.

The potential fallout from a data breach is immense. Customer trust, a critical asset for any online service provider, can be irrevocably damaged. In 2023, the average cost of a data breach reached a staggering $4.45 million globally, a figure that could severely impact GoDaddy's financial stability and reputation.

The digital realm is constantly shifting with new rules on data privacy and consumer protection. For GoDaddy, keeping up with these changes, like the potential impact of the EU's Digital Services Act on content moderation and platform liability, can mean higher operational expenses and more intricate processes.

Customer Churn Due to Service Issues and Pricing

Negative customer experiences, particularly concerning support quality and perceived hidden fees, are significant drivers of customer churn for GoDaddy. These issues can erode trust and lead clients to seek more transparent and reliable alternatives. The company's reliance on automatic renewals, while convenient for some, can also backfire if customers feel blindsided by charges, increasing dissatisfaction.

In the highly competitive domain of web hosting and domain registration, customer loyalty is fragile. GoDaddy faces the constant threat of losing customers to competitors offering more competitive pricing or superior service. For instance, in early 2024, reports indicated that a portion of GoDaddy's customer base expressed frustration over unexpected price increases following introductory periods, a common trigger for switching providers.

- Customer Retention Challenges: Service issues and pricing concerns directly impact GoDaddy's ability to retain its existing customer base.

- Competitive Landscape: Competitors actively target dissatisfied GoDaddy customers by offering better value propositions.

- Pricing Transparency: Perceived hidden fees and automatic renewal policies can alienate customers, prompting them to explore other options.

Economic Downturns Affecting Small Businesses

Economic downturns pose a significant threat to GoDaddy, given its core customer base of small and micro-businesses. When these smaller entities face financial strain, they often cut discretionary spending, which can include website hosting, domain registration, and marketing services. This directly impacts GoDaddy's revenue streams.

For instance, during periods of economic contraction, small businesses may delay upgrading their online presence or even downgrade existing services to save costs. This trend was observable in earlier economic slowdowns, where spending on digital services saw a noticeable dip as businesses prioritized essential operational expenses.

According to a 2024 report by the Small Business Administration, approximately 60% of small businesses consider economic conditions a top concern. This sentiment suggests a heightened vulnerability to reduced consumer spending and tighter credit conditions, which could translate into lower demand for GoDaddy's offerings.

- Reduced Customer Spending: Economic slowdowns directly impact the disposable income of small business owners, leading to decreased investment in online tools and services.

- Increased Churn Rate: Financially stressed businesses are more likely to cancel or downgrade their GoDaddy subscriptions to cut costs, increasing customer churn.

- Slower Growth: A weaker economic environment can stifle the creation of new businesses, a key driver of GoDaddy's new customer acquisition.

The intense competition in the web hosting market, with players like Wix and Shopify, puts pressure on GoDaddy's pricing power and market share. Additionally, the constant threat of sophisticated cybersecurity attacks, which cost an average of $4.45 million per breach in 2023, could severely damage customer trust and GoDaddy's reputation.

Evolving data privacy regulations, such as the EU's Digital Services Act, can increase operational costs and complexity for GoDaddy. Negative customer experiences, often stemming from perceived hidden fees and automatic renewals, contribute to customer churn, as seen in early 2024 reports of customer frustration over price hikes.

Economic downturns significantly impact GoDaddy, as small businesses, its core clientele, often reduce discretionary spending on digital services during financial strain. With around 60% of small businesses citing economic conditions as a top concern in 2024, this vulnerability translates to reduced demand and potentially slower growth for GoDaddy.

SWOT Analysis Data Sources

This GoDaddy SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded perspective.