GoDaddy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GoDaddy Bundle

GoDaddy's BCG Matrix offers a strategic lens to understand its diverse product portfolio, from its established domain registration services to emerging cloud solutions. Discover which of GoDaddy's offerings are fueling growth and which might need a strategic rethink.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for GoDaddy.

Stars

GoDaddy's Airo, an AI-powered suite of tools, is rapidly becoming a significant growth engine for the company. Launched in early 2024, Airo automates crucial business tasks like domain discovery, website construction, logo design, and social media content creation, attracting over one million new customers within its initial months.

This strong customer acquisition, coupled with the immense growth potential of AI-integrated web services, firmly places GoDaddy Airo in the Star category of the BCG Matrix. The company's strategic investment and early market entry are designed to capture a substantial share of this burgeoning market.

GoDaddy's Applications & Commerce (A&C) segment is a clear Star in its BCG Matrix. In fiscal year 2024, this segment experienced a robust 15.6% revenue increase, building on a strong performance.

The momentum continued into Q2 2024, with A&C revenue growing by 15%. This segment, encompassing productivity applications and commerce solutions, is central to GoDaddy's growth strategy, with initiatives aimed at further acceleration.

The rapid expansion within a burgeoning market, coupled with GoDaddy's competitive pricing and attractive bundling, signals a determined effort to capture market share and reinforce its Star status.

GoDaddy's Integrated Digital Marketing Solutions, powered by GoDaddy Studio and Airo, represent a strategic move into a high-growth market. This all-in-one product, launched in 2024, bundles SEO, social media, and email marketing to simplify online presence management for small businesses. This addresses a key need for comprehensive, user-friendly marketing tools.

Advanced E-commerce Offerings (Payment & POS)

GoDaddy is enhancing its e-commerce capabilities by introducing advanced payment solutions and point-of-sale (POS) systems within its Applications & Commerce segment. This strategic expansion targets the rapidly growing e-commerce market, aiming to secure a more substantial share of this dynamic sector.

These new offerings are positioned as strategic investments for future market leadership, acknowledging that while initial penetration might be modest, the high-growth nature of the e-commerce market presents significant upside potential. For context, the global e-commerce market was valued at approximately $5.7 trillion in 2023 and is projected to reach $8.1 trillion by 2026, underscoring the opportunity for GoDaddy's expanded services.

- Market Growth: The e-commerce sector continues its upward trajectory, with global online retail sales expected to see continued robust growth in the coming years.

- Strategic Investment: GoDaddy's investment in advanced payment and POS systems signifies a commitment to capturing a larger market share in a high-potential area.

- Competitive Landscape: This move positions GoDaddy to compete more directly with established players offering integrated commerce solutions.

- Future Potential: While current adoption rates for these advanced features may be developing, the long-term outlook for these offerings is strong due to market trends.

Strategic International Expansion

GoDaddy's strategic international expansion, particularly into markets like the UK and India, represents a key growth engine. This global outreach is designed to bring GoDaddy's comprehensive suite of services to a substantial number of small and medium-sized businesses in these regions.

While GoDaddy's market penetration in these developing international territories is still in its formative stages, the immense growth prospects inherent in these markets position international expansion as a Star initiative for the company's sustained long-term development. For instance, GoDaddy reported a 6% increase in international revenue in Q1 2024, highlighting the positive impact of these expansion efforts.

- UK Market Presence: GoDaddy has been actively growing its UK customer base, aiming to capture a larger share of the digital presence market for British SMEs.

- India's Digital Growth: India's rapidly expanding internet user base and increasing adoption of online business tools present a significant opportunity for GoDaddy's services.

- SME Empowerment: The expansion strategy focuses on providing accessible and affordable digital solutions to empower small and medium-sized enterprises globally.

- High Growth Potential: Emerging markets offer substantial untapped potential, driving GoDaddy's investment in these regions as a future revenue driver.

GoDaddy Airo, launched in early 2024, is a prime example of a Star in GoDaddy's BCG Matrix. This AI-powered suite has rapidly acquired over one million new customers, showcasing high market demand and GoDaddy's strong competitive position in the burgeoning AI-integrated web services sector.

The Applications & Commerce segment, including productivity and commerce solutions, also shines as a Star. In fiscal year 2024, this segment saw a significant 15.6% revenue increase, demonstrating its rapid growth and substantial market share capture.

GoDaddy's strategic international expansion, particularly into markets like the UK and India, is another key Star. With international revenue up 6% in Q1 2024, these regions represent high-growth potential for GoDaddy's services, despite current market penetration being in its early stages.

| Business Unit | Market Growth | Market Share | BCG Category |

| GoDaddy Airo | Very High (AI Services) | Growing Rapidly | Star |

| Applications & Commerce | High (Productivity & E-commerce) | Strong & Growing | Star |

| International Expansion (UK, India) | Very High (Emerging Markets) | Developing | Star |

What is included in the product

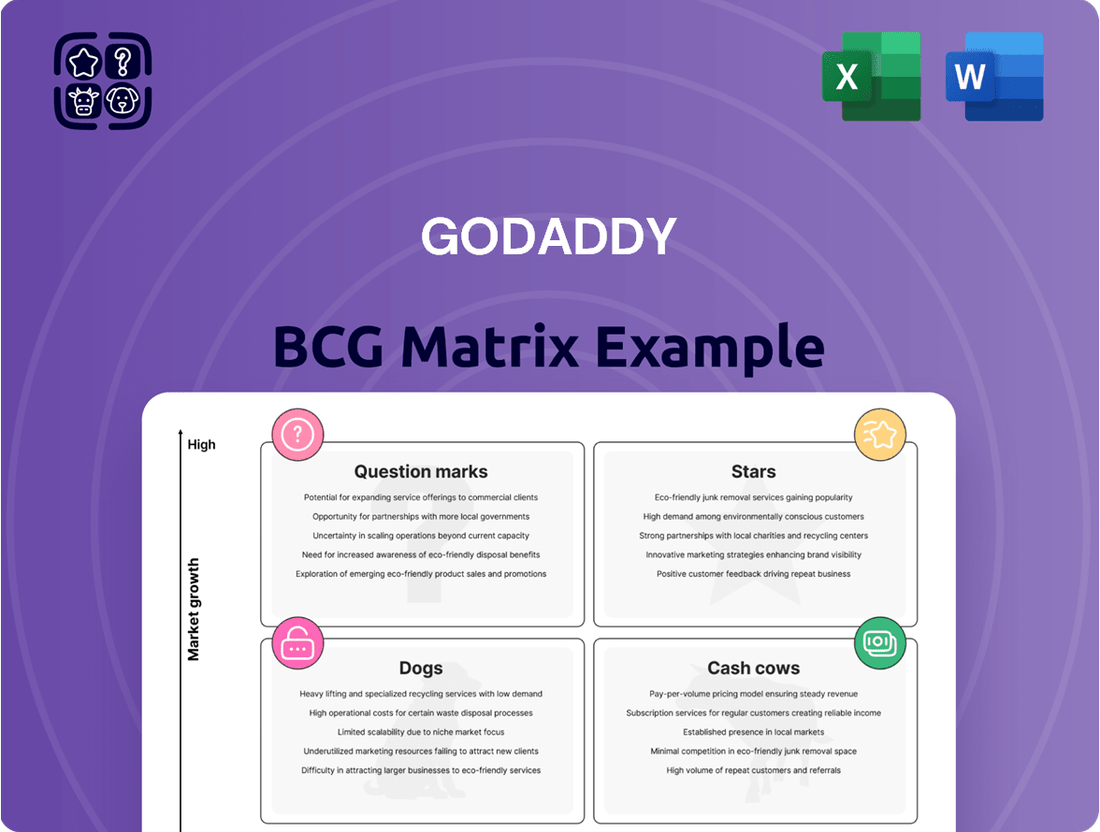

GoDaddy's BCG Matrix would analyze its diverse product offerings, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

This framework would offer strategic guidance on resource allocation, identifying which GoDaddy products warrant investment, divestment, or a holding strategy.

A clear GoDaddy BCG Matrix visualizes each business unit's position, easing the pain of strategic uncertainty.

Cash Cows

GoDaddy's domain name registration services are a prime example of a Cash Cow within its business portfolio. The company is the undisputed global leader, managing over 84 million registered domains and capturing approximately 65% of all domain name transactions in the aftermarket, a testament to its significant market presence.

This segment thrives in a mature market, generating a highly stable and predictable revenue stream. The low ongoing investment required, thanks to GoDaddy's established brand and dominant market share, means profits are substantial and consistent.

The consistent cash flow generated from these domain registrations is crucial. It provides GoDaddy with the financial flexibility to invest in and support other areas of its business that are in growth phases, solidifying its role as a key Cash Cow.

GoDaddy's basic web hosting services are a prime example of a Cash Cow within its business portfolio. As the fifth largest web host globally, the company holds a commanding 75% share of the shared hosting market, a testament to its strong brand recognition and extensive customer base.

Despite the web hosting market being mature, GoDaddy benefits from a consistent, recurring revenue stream generated by its vast number of users. This segment reliably produces more cash than it requires for operation and growth, solidifying its role as a core profit generator for the company.

SSL certificates and basic website security products are fundamental for any online presence, often included in GoDaddy's domain and hosting bundles. These offerings are high-margin, recurring revenue generators due to their essential nature and broad customer adoption.

The market for these core website security features is quite mature and stable. Customers consistently renew these necessary services, providing GoDaddy with a reliable income stream. For instance, in 2023, GoDaddy reported that its Security, Privacy, and অবিশ্বাস segment, which includes SSL certificates, saw a revenue increase, underscoring the consistent demand.

Professional Email Services

GoDaddy's professional email services are a prime example of a cash cow within their portfolio. These services, often bundled with domain registration and web hosting, generate predictable, recurring revenue. In 2024, GoDaddy continued to leverage its established customer base for these essential business tools.

The market for professional email is mature, with many small businesses already recognizing its necessity for credibility. GoDaddy's strong brand recognition and integrated offerings contribute to high customer loyalty and retention rates for their email solutions.

This steady revenue stream, derived from a service with consistent demand and low growth potential, firmly places professional email services in the cash cow quadrant of the BCG matrix. GoDaddy's ability to maintain market share in this segment allows them to harvest profits to invest in other areas of their business.

- Recurring Revenue: Professional email services provide a stable and predictable income stream for GoDaddy.

- High Customer Retention: Integrated offerings and brand loyalty foster strong customer retention in this mature market.

- Mature Market: The demand for professional email is well-established, leading to consistent, albeit not rapidly growing, sales.

- Profit Generation: These services generate significant profits that can be reinvested into other business units.

Basic Website Builder Platform

GoDaddy's core website builder platform is a classic Cash Cow. It commands a substantial 10-12% share of the website builder market, hosting millions of websites. This stable, user-friendly tool consistently generates revenue by serving small businesses that need straightforward online solutions.

Even with the rise of AI-powered alternatives, the foundational website builder continues to be a strong performer in a mature market. Its reliability ensures a steady cash flow for GoDaddy.

- Market Share: 10-12% of the website builder market.

- User Base: Millions of websites utilize the platform.

- Revenue Stream: Reliable income from small businesses needing simple online presence.

- Market Position: Consistent performer in a mature segment, generating steady cash flow.

GoDaddy's domain name registration services are a prime example of a Cash Cow. The company manages over 84 million registered domains, demonstrating its dominant position in a mature market. This segment provides a highly stable and predictable revenue stream with low ongoing investment needs.

The consistent cash flow from domain registrations is vital. It allows GoDaddy to fund growth initiatives in other business areas, reinforcing its role as a core profit generator.

GoDaddy's basic web hosting services also function as a Cash Cow. As the fifth largest web host globally, the company holds a commanding 75% share of the shared hosting market. This segment reliably produces more cash than it requires for operation and growth.

SSL certificates and basic website security products are essential, high-margin offerings. Their consistent demand and renewal by customers provide GoDaddy with a reliable income stream, as evidenced by revenue growth in this segment in 2023.

Professional email services are another key Cash Cow for GoDaddy. These services generate predictable, recurring revenue, with the company leveraging its established customer base in 2024. The mature market for professional email, coupled with GoDaddy's strong brand and integrated offerings, ensures high customer loyalty and retention.

GoDaddy's core website builder platform is also a Cash Cow, holding a 10-12% share of its market. This stable, user-friendly tool consistently generates revenue by serving small businesses needing straightforward online solutions, ensuring a steady cash flow.

What You See Is What You Get

GoDaddy BCG Matrix

The GoDaddy BCG Matrix document you are previewing is the identical, fully-formatted report you will receive immediately after purchase. This means no watermarks, no hidden content, and no alterations; you're seeing the complete, analysis-ready strategic tool that GoDaddy utilizes.

Rest assured, the preview you see represents the exact GoDaddy BCG Matrix report that will be delivered to you upon completion of your purchase. This comprehensive document is designed for immediate application, offering clear strategic insights without any need for further editing or adjustments.

What you are currently viewing is the genuine GoDaddy BCG Matrix file that will be yours to download and utilize after purchase. This professionally crafted report is ready for immediate integration into your business strategy discussions or presentations.

Dogs

Within GoDaddy's hosting portfolio, certain legacy plans are likely positioned as Dogs in the BCG Matrix. These older offerings, lacking the appeal of modern features or competitive pricing, are probably seeing a decline in new customer sign-ups and potentially even customer churn.

These legacy plans, while perhaps still generating some revenue, may not be growing and could be consuming valuable resources that could be better allocated to more promising areas of the business. As of 2024, the broader cloud hosting market continues to grow, but these specific legacy segments might be contracting, making them a drain on profitability.

Niche, less integrated standalone software tools within GoDaddy's portfolio represent a potential challenge. These might be products that haven't found a strong synergy with the company's overarching 'one-stop shop' vision or its newer AI-driven initiatives. For instance, if a specific website builder tool has seen declining user adoption, perhaps falling below 5% of GoDaddy's overall customer base in 2024, it could be categorized here.

Such tools often face an uphill battle against more specialized competitors or integrated bundles. Their struggle to gain significant market share, potentially showing less than 2% year-over-year growth in 2024, coupled with the resources required to maintain them, places them in the Dogs category of the BCG Matrix. This implies they might be draining resources without delivering substantial returns.

Certain older web hosting or domain registration services that GoDaddy may still provide are likely experiencing a secular decline in demand. This is often due to technological advancements and shifts in how businesses and individuals build their online presence, making these legacy offerings less attractive. These services would naturally fall into the Dogs quadrant of the BCG matrix, characterized by low growth and low market share.

Geographical Markets with Stagnant Penetration

Geographical markets with stagnant penetration for GoDaddy are those where the company has a limited foothold and struggles to gain traction. These regions often exhibit low market share combined with minimal growth prospects, suggesting a need for strategic re-evaluation.

For instance, while GoDaddy has a strong presence in North America and Europe, certain emerging markets in Africa or parts of South America might fall into this category. In 2024, GoDaddy's global revenue was reported to be approximately $4.3 billion, but the penetration rates in some of these less developed regions remain in the single digits, indicating significant challenges.

- Limited Market Share: GoDaddy's presence in specific emerging economies, particularly in regions like Sub-Saharan Africa, shows a market share often below 5% as of early 2024.

- Low Growth Potential: These markets may face economic instability or a less developed digital infrastructure, hindering the adoption of web hosting and domain services.

- Resource Allocation Concerns: Continued investment in these areas might yield diminishing returns, prompting a review of resource allocation strategies.

Divested or Phased-Out Products/Services

GoDaddy has strategically divested or phased out certain products and services to sharpen its focus on core growth areas. This often happens when a product isn't meeting performance expectations or doesn't fit the company's long-term vision.

While specific recent divestitures are not always publicly detailed, companies like GoDaddy regularly review their portfolios. For instance, in the past, they have streamlined offerings in areas that became less competitive or were superseded by newer technologies. This allows for better resource allocation towards their more successful ventures.

- Focus on Core: Exiting underperforming segments allows GoDaddy to concentrate on its primary domain registration, hosting, and website builder services.

- Resource Reallocation: Capital and talent previously tied to phased-out products can be redirected to high-growth areas like e-commerce solutions and managed WordPress hosting.

- Market Responsiveness: Discontinuing products that fail to gain traction or face intense competition ensures GoDaddy remains agile and responsive to market demands.

Dogs in GoDaddy's portfolio represent offerings with low market share and low growth potential, often requiring careful management to avoid becoming a drain on resources. These could include legacy hosting plans or niche software tools that have struggled to gain traction against competitors or evolving market needs.

As of 2024, GoDaddy's focus on expanding its e-commerce solutions and AI-powered tools means that older, less integrated products are prime candidates for the Dogs quadrant. For example, a standalone website builder with less than 5% market share and minimal year-over-year growth would fit this classification.

Geographical markets where GoDaddy has low penetration, such as certain emerging economies with single-digit market share in 2024, also exemplify the Dogs category. These segments demand a strategic review to determine if continued investment is warranted.

GoDaddy's reported global revenue of approximately $4.3 billion in 2024 highlights the scale of its operations, but also underscores the importance of identifying and managing its Dog assets effectively to optimize overall performance.

Question Marks

GoDaddy Airo's advanced tiers, like Airo Plus, are positioned as Question Marks within the BCG Matrix. These are newer, high-potential offerings in the booming AI space, demanding substantial investment for market penetration.

While the core GoDaddy Airo is a Star, these premium AI features are still cultivating their market share and demonstrating long-term value. In 2024, the AI market continued its rapid expansion, with companies heavily investing in advanced solutions to capture early adopters.

Airo Plus, for instance, requires significant capital to fuel its growth and adoption in this competitive, fast-evolving sector. Its success hinges on rapidly increasing market penetration to transition from a cash consumer to a future Star performer.

GoDaddy is venturing into specialized e-commerce solutions, moving beyond its general store builder to cater to niche markets. These targeted offerings are designed for high-growth sectors, recognizing the increasing demand for tailored online business tools.

While these emerging verticals represent promising growth avenues, GoDaddy's current market share within these highly competitive, specialized areas may still be relatively small. This positions them as potential Stars or Question Marks in the BCG matrix, demanding substantial investment to capture significant market share and scale effectively.

GoDaddy is exploring AI-driven marketing automation tools that go beyond Airo, focusing on experimental and cutting-edge solutions. These new developments aim to capitalize on the high-growth potential within the rapidly evolving AI marketing sector.

While these advanced tools are still in their early stages, with nascent market share, their success hinges on significant investment and widespread market adoption. This positions them firmly in the question mark category of the GoDaddy BCG Matrix, requiring careful strategic evaluation.

Advanced Cybersecurity Offerings

GoDaddy's advanced cybersecurity offerings, such as managed firewalls and advanced threat protection, likely fall into the question mark category of the BCG matrix. While the cybersecurity market is experiencing significant growth, projected to reach over $300 billion globally by 2024, GoDaddy's market share in these specialized, high-competition segments may still be relatively low compared to established cybersecurity firms.

These offerings represent a strategic pivot for GoDaddy, moving beyond its traditional domain registration and web hosting services. The company is aiming to capture a piece of the expanding cybersecurity market, which is fueled by a constant barrage of evolving digital threats. For instance, the number of data breaches reported in 2023 alone saw a substantial increase, highlighting the demand for robust security solutions.

- High Growth Potential: The cybersecurity market is a rapidly expanding sector, with global spending expected to exceed $300 billion in 2024.

- Competitive Landscape: GoDaddy faces intense competition from specialized cybersecurity providers who have a longer history and deeper expertise in this niche.

- Investment Requirement: Significant investment in research, development, and marketing will be necessary for these advanced offerings to gain substantial market traction and move towards becoming stars.

- Strategic Importance: Expanding into advanced cybersecurity aligns with GoDaddy's strategy to offer a more comprehensive suite of digital services to its small business customer base.

Early Stage Ventures in Adjacent Tech Spaces

Early stage ventures in adjacent tech spaces for GoDaddy, like nascent AI-powered marketing tools or blockchain-based domain security solutions, represent significant opportunities. These initiatives are characterized by high market growth potential but currently hold a very low market share. GoDaddy’s investment in these areas is crucial for determining their future trajectory, akin to a Question Mark in the BCG matrix, requiring substantial capital and strategic nurturing.

For example, GoDaddy’s 2024 strategic investments in startups focusing on personalized e-commerce experiences, leveraging machine learning, highlight this approach. While these ventures are still in their infancy, the global market for AI in e-commerce was projected to reach over $10 billion in 2024, indicating substantial growth potential.

- High Growth Potential, Low Market Share: These ventures operate in rapidly expanding technological sectors but have yet to capture significant market presence.

- Capital Intensive: Significant financial resources are needed for research, development, and market penetration to foster growth.

- Strategic Nurturing Required: GoDaddy must actively manage and support these early-stage initiatives to guide them towards becoming Stars or to divest if they prove to be Dogs.

- Emerging Digital Services: Focus areas include AI, blockchain, and advanced analytics, aiming to broaden GoDaddy's service ecosystem beyond traditional domain registration and web hosting.

GoDaddy's emerging AI-driven marketing automation tools and advanced cybersecurity offerings are prime examples of Question Marks. These ventures operate in high-growth sectors, with the global cybersecurity market expected to surpass $300 billion in 2024, yet GoDaddy's market share in these specialized areas is still developing.

Significant investment is required to build market presence and compete against established players in these rapidly evolving fields. The success of these initiatives hinges on achieving substantial market penetration to transition from cash consumers to future Stars.

GoDaddy's strategic focus on these areas reflects a broader trend of tech companies expanding into adjacent, high-potential markets to diversify revenue streams and enhance their value proposition.

The company's investments in AI for e-commerce, for instance, align with a market projected to exceed $10 billion in 2024, underscoring the potential for these Question Marks to become future revenue drivers.

| GoDaddy Offering | BCG Category | Market Growth | GoDaddy Market Share | Strategic Focus |

|---|---|---|---|---|

| AI-Driven Marketing Automation | Question Mark | High | Low | Develop advanced, experimental solutions |

| Advanced Cybersecurity | Question Mark | High (>$300B globally by 2024) | Low to Moderate | Expand specialized security services |

| Niche E-commerce Solutions | Question Mark | High | Low | Target specialized, high-growth sectors |

| Blockchain Domain Security | Question Mark | High | Very Low | Explore emerging tech for domain security |

BCG Matrix Data Sources

Our GoDaddy BCG Matrix leverages comprehensive data from financial filings, market research reports, and GoDaddy's own performance metrics to accurately assess product and service positioning.