GlobalData PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GlobalData Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping GlobalData's trajectory. Our expert-crafted PESTLE analysis provides the deep-dive insights you need to anticipate market shifts and identify strategic opportunities. Download the full report now to gain a competitive advantage and make informed decisions.

Political factors

Government policies worldwide are intensifying their focus on data governance, privacy, and security. This directly influences how companies like GlobalData gather, process, and share information. For instance, the European Union's GDPR, which came into full effect in 2018, continues to shape data handling, with ongoing enforcement actions and potential updates impacting global operations.

Stricter regulations, such as evolving data protection acts in various nations, often require substantial changes to data management procedures and technological systems. These evolving frameworks can increase compliance costs and complexity. For a global data analytics firm, navigating these diverse and often changing legal landscapes is a significant operational challenge.

Furthermore, these policies critically affect cross-border data flows, which are absolutely essential for a company operating on a global scale. For example, the Schrems II ruling in 2020, impacting EU-US data transfers, highlights the complexities and potential disruptions to international data movement, requiring continuous adaptation of data transfer mechanisms.

Geopolitical stability and international trade relations are paramount for GlobalData's global operations and client base. Political tensions and trade disputes can directly impact market access, potentially leading to tariffs on digital services or creating significant uncertainty for international clients. For instance, ongoing trade friction between major economic blocs in 2024 highlights the need for adaptable market entry strategies.

The regulatory landscape for market research is a critical consideration for GlobalData. For instance, the General Data Protection Regulation (GDPR) in Europe, which came into full effect in 2018, significantly altered how companies collect, process, and store personal data. This has necessitated adjustments in data aggregation and analysis methodologies for market research firms.

Further evolving regulations, such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), enacted in 2023, impose stringent requirements on data privacy and consumer rights within the United States. These laws can impact the types of data GlobalData can legally access and utilize for its market insights, potentially affecting report scope and research design.

As of early 2024, discussions around AI regulation are intensifying globally, with potential implications for automated data analysis and report generation. Compliance with these diverse and often overlapping legal frameworks is paramount for GlobalData's operational integrity and the continued trust of its clients.

Government Spending on Analytics

Government spending on data analytics and consulting services directly impacts opportunities for companies like GlobalData. For instance, the US federal government's commitment to modernizing its IT infrastructure, including significant investments in data analytics capabilities, offers substantial growth potential. In 2024, agencies are expected to continue prioritizing digital transformation initiatives, potentially increasing demand for specialized analytics services.

Procurement policies also play a crucial role. Favorable government contracts and streamlined acquisition processes can accelerate market penetration, while restrictive policies or lengthy bidding cycles can pose challenges. Understanding the nuances of public sector purchasing, such as the focus on cybersecurity and data privacy in government contracts, is vital for strategic alignment.

Budgetary shifts can significantly influence public sector demand. For example, a projected increase in defense spending in several key markets for 2025 might translate to more opportunities in defense-related analytics, while a contraction in other areas could lead to reduced spending on broader government data initiatives.

- US Federal Government IT Modernization: Continued investment in data analytics for improved public services and operational efficiency.

- Defense Spending Trends: Potential for increased demand in defense analytics driven by geopolitical factors in 2025.

- Procurement Policy Focus: Emphasis on data security and privacy in government contracts shapes service provider requirements.

Political Stability and Business Confidence

Political stability significantly shapes business confidence, a crucial driver for GlobalData's clients investing in market intelligence and consulting. For instance, the World Bank's 2023 Worldwide Governance Indicators showed a slight improvement in political stability and absence of violence across many regions, yet persistent geopolitical tensions in Eastern Europe and the Middle East continue to dampen investor sentiment.

Periods of heightened political uncertainty, such as upcoming elections in major economies or significant policy shifts, often trigger a cautious approach from businesses. This can translate into delayed or reduced spending on external data and advisory services, directly impacting GlobalData's revenue projections. For example, a report by PwC in late 2024 noted that economic uncertainty, often linked to political factors, led 40% of CEOs to scale back their investment plans.

Conversely, a stable political environment provides the predictability that fosters robust demand for data analytics and market intelligence. When governments demonstrate consistent policy implementation and maintain a secure business landscape, companies are more likely to commit to long-term strategies that rely on accurate, up-to-date market insights. The International Monetary Fund's 2024 outlook highlighted that countries with strong institutional frameworks and stable political systems tend to attract higher foreign direct investment, which in turn fuels demand for market research.

- Global Business Confidence Index: Fluctuations in indices like the Global Business Confidence Index, heavily influenced by political events, directly correlate with corporate spending on market intelligence.

- Election Cycles: Major election cycles in key markets like the United States and the European Union in 2024 and 2025 have historically led to a temporary slowdown in consulting and data services as businesses await policy clarity.

- Geopolitical Risk Premiums: The perceived geopolitical risk premium in certain regions can deter investment, impacting the overall market size for data analytics services.

- Regulatory Predictability: A stable and predictable regulatory environment, a direct outcome of political stability, encourages businesses to invest in growth strategies that require comprehensive market data.

Government policies are increasingly shaping the data landscape, with regulations like GDPR and the CPRA impacting how companies like GlobalData handle information. These evolving legal frameworks necessitate continuous adaptation of data management and cross-border data transfer mechanisms, as highlighted by rulings like Schrems II.

Geopolitical stability and trade relations are critical for GlobalData's operations, as tensions can affect market access and create uncertainty for international clients, a dynamic evident in ongoing trade friction in 2024.

Government spending and procurement policies directly influence opportunities, with significant US federal investments in data analytics and a growing emphasis on data security in government contracts in 2024.

Political stability fosters business confidence and predictability, crucial for clients investing in market intelligence, though election cycles and policy shifts can lead to cautious spending, as noted by a late 2024 PwC report.

| Policy Area | Impact on GlobalData | Example/Data Point (2024/2025) |

|---|---|---|

| Data Privacy Regulations | Increased compliance costs, altered data access | GDPR (EU), CPRA (California) continue to shape data handling; ongoing enforcement actions. |

| Geopolitical Stability | Market access challenges, client uncertainty | Trade friction between major economic blocs in 2024 necessitates adaptable market strategies. |

| Government IT Spending | Growth opportunities in public sector analytics | US federal government prioritizing digital transformation and data analytics in 2024. |

| Political Uncertainty | Potential slowdown in client spending on market intelligence | 40% of CEOs scaled back investment plans due to economic uncertainty (PwC, late 2024). |

What is included in the product

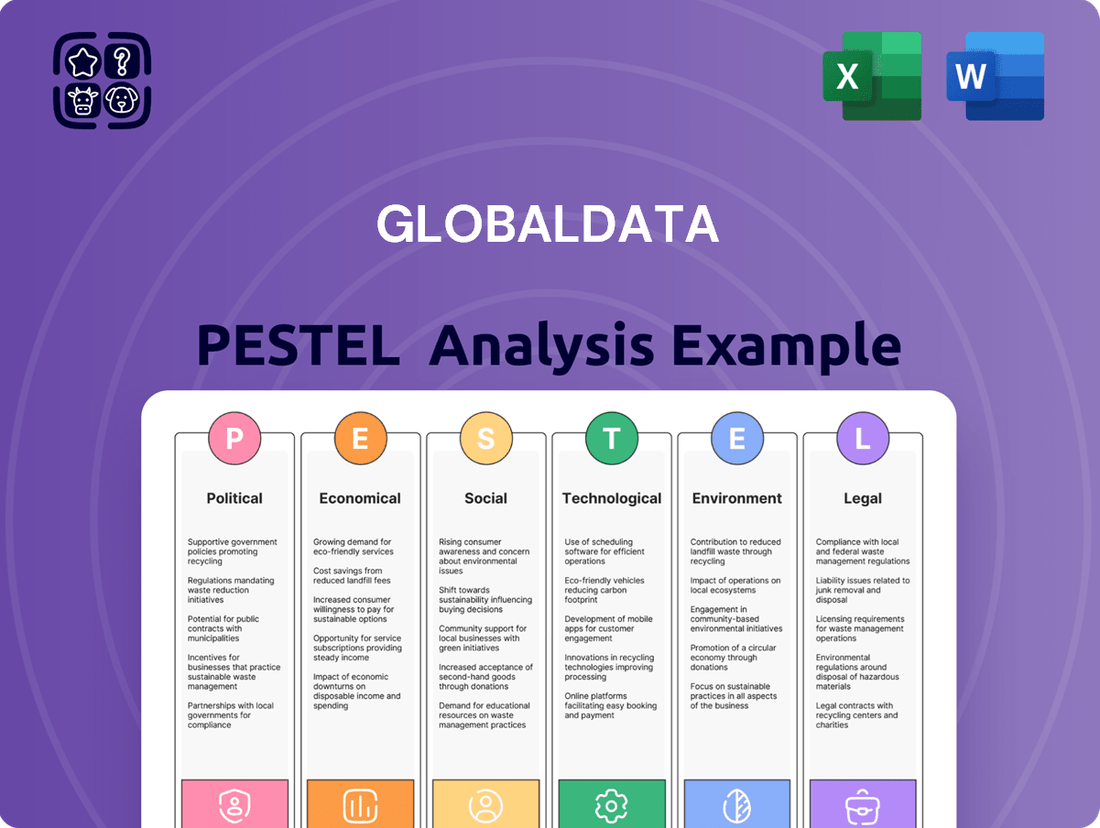

The GlobalData PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors influencing the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and data-backed evaluations to identify strategic opportunities and mitigate potential risks for informed decision-making.

Provides a clear, actionable summary of complex global trends, eliminating the guesswork and saving valuable time in strategic decision-making.

Economic factors

Global economic growth is projected to moderate in 2024 and 2025, with the IMF forecasting 3.1% in 2024 and 3.2% in 2025. This slowdown, coupled with persistent inflation and geopolitical tensions, elevates recession risks in key markets, directly impacting client budgets for market intelligence and consulting services.

During economic downturns, businesses often reduce discretionary spending, potentially affecting GlobalData's revenue from market intelligence and consulting. For instance, a significant contraction in GDP in major economies could lead to a sharper decline in demand for such services.

Conversely, periods of robust economic expansion typically see increased demand for strategic insights. Businesses are more likely to invest in understanding market opportunities and competitive landscapes when growth prospects are strong, benefiting service providers like GlobalData.

Rising inflation is a significant concern for GlobalData, as it directly impacts operational costs. For instance, the US Consumer Price Index (CPI) saw an annual increase of 3.4% in April 2024, indicating sustained cost pressures across various sectors. This means GlobalData's expenses for salaries, essential technology infrastructure upgrades, and acquiring new, high-quality data are likely to climb.

These increased expenses can squeeze GlobalData's profit margins if the company cannot effectively pass these costs onto its clients through price adjustments. Maintaining competitiveness in the data analytics market necessitates a delicate balance between absorbing some of these rising costs and ensuring revenue growth keeps pace.

Effectively managing these inflationary pressures will require robust financial planning and a proactive approach to optimizing operational efficiencies. This could involve renegotiating vendor contracts, leveraging automation to reduce labor costs, or finding more cost-effective data sources without compromising quality, all to safeguard profitability.

GlobalData, as a worldwide entity, faces significant impacts from currency exchange rate shifts on both its earnings and expenses. For instance, if the US dollar strengthens, GlobalData's services might become pricier for customers in countries with weaker currencies, potentially dampening international sales.

Conversely, a weaker domestic currency can escalate the expenses incurred in foreign operations, affecting the cost of goods and services sourced internationally.

Managing these currency risks is crucial. For example, in early 2024, the US Dollar Index (DXY) saw fluctuations, impacting companies with substantial international revenue streams. Effective hedging strategies, like forward contracts, are essential for GlobalData to maintain stable profits and predictable revenue across its diverse global markets, safeguarding against adverse currency movements.

Investment Trends in Digital Transformation

Investment in digital transformation is accelerating, with global spending projected to reach $3.4 trillion in 2024, a 9.4% increase from 2023, according to IDC. This surge is fueled by businesses across sectors recognizing the economic imperative of data analytics for strategic decision-making and competitive advantage. Companies are increasingly allocating budgets towards advanced analytics platforms and AI-driven insights, directly impacting the demand for specialized market intelligence providers like GlobalData.

The increasing reliance on data analytics is reshaping investment priorities. For instance, the financial services sector saw a 15% year-over-year growth in AI and analytics investments in 2023, as reported by Deloitte. This trend necessitates that GlobalData continuously refines its data and analytical tools to meet the evolving needs of clients seeking to optimize operations, understand customer behavior, and identify new market opportunities. Aligning service offerings with these investment trends is crucial for market share expansion.

- Digital Transformation Spending: Global spending on digital transformation is expected to hit $3.4 trillion in 2024, marking a significant economic driver.

- Data Analytics Adoption: Industries are prioritizing data-driven strategies, leading to increased demand for comprehensive market analysis and forecasts.

- AI and Analytics Investment: Sectors like financial services are demonstrating substantial year-over-year growth in AI and analytics investments, highlighting a key area for market intelligence providers.

- Market Intelligence Demand: The growing emphasis on data analytics directly increases the need for actionable insights and predictive capabilities from market research firms.

Competitive Landscape and Pricing Dynamics

The competitive landscape in data analytics and consulting is fiercely contested, directly influencing pricing strategies. Companies offering unique data sets, sophisticated analytical tools, and specialized expertise can often charge higher rates. For instance, the global data analytics market was valued at approximately $27.18 billion in 2023 and is projected to reach $105.84 billion by 2030, growing at a CAGR of 21.5% during this period, according to some market analyses. This rapid growth fuels intense competition.

GlobalData needs to constantly evaluate its standing against rivals. Differentiation is key; this can be achieved through proprietary data sources, innovative analytical methodologies, and the depth of its industry-specific insights. Companies that successfully differentiate can often command premium pricing, securing a stronger market share even in a crowded market. For example, firms focusing on AI-driven predictive analytics are seeing increased demand and can justify higher service fees.

Pricing dynamics are also shaped by the perceived value delivered. Clients are willing to pay more for solutions that offer clear ROI, such as improved operational efficiency or enhanced customer acquisition. The ability to translate complex data into actionable business intelligence is a significant value driver.

- Market Growth: The data analytics market is experiencing robust growth, with projections indicating substantial expansion through 2030.

- Competitive Intensity: High market growth attracts numerous players, leading to intense competition and pressure on pricing.

- Differentiation Strategy: Proprietary data, advanced analytics, and expert insights are crucial for commanding premium pricing and market share.

- Value Proposition: Demonstrating clear ROI and actionable insights is vital for clients willing to pay higher service fees.

Global economic growth is expected to be moderate in 2024 and 2025, with the IMF forecasting 3.1% for 2024 and 3.2% for 2025. This slowdown, combined with ongoing inflation and geopolitical instability, raises the risk of recessions in major economies, directly impacting client spending on market intelligence and consulting services.

Rising inflation is a significant concern, increasing operational costs. For instance, the US CPI rose 3.4% year-over-year in April 2024, indicating sustained cost pressures. This means GlobalData's expenses for salaries, technology, and data acquisition are likely to increase, potentially squeezing profit margins if costs cannot be passed on to clients.

Currency exchange rate fluctuations also significantly impact GlobalData's earnings and expenses. A stronger US dollar, for example, could make services more expensive for international clients, potentially reducing sales. Effective hedging strategies are crucial to maintain stable profits across diverse global markets.

Digital transformation spending is projected to reach $3.4 trillion in 2024, a 9.4% increase from 2023, according to IDC. This surge drives demand for advanced analytics and AI-driven insights, benefiting market intelligence providers like GlobalData.

The data analytics market is growing rapidly, valued at approximately $27.18 billion in 2023 and projected to reach $105.84 billion by 2030, with a CAGR of 21.5%. This intense competition necessitates differentiation through proprietary data, advanced analytics, and expert insights to command premium pricing.

Preview Before You Purchase

GlobalData PESTLE Analysis

The GlobalData PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report provides an in-depth examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting a specific industry or market. Gain immediate access to actionable insights and strategic frameworks to inform your business decisions.

Sociological factors

There's a significant societal and business trend towards making decisions based on data, and this is happening everywhere. As more and more information becomes available, companies are realizing they need to understand it to get ahead.

This widespread adoption of analytics means GlobalData's services are in high demand. Businesses are actively looking for ways to use insights from data to gain a competitive edge. For example, a 2024 report indicated that 85% of executives believe data analytics is crucial for their company's success.

The real value lies in being able to take complex data and turn it into clear, actionable advice. This ability to provide understandable intelligence from vast datasets is what makes services like GlobalData's so sought after in today's market.

GlobalData faces a dynamic workforce landscape, with a growing demand for data-literate professionals. The intense global competition for data science talent, a critical skill for our industry, directly impacts our ability to attract and keep top employees. This talent scarcity can slow down our innovation and affect how well we deliver services.

A significant skills gap in advanced analytics is a key challenge. For instance, a 2024 report indicated that over 60% of companies struggle to find candidates with the necessary data science and AI expertise. This gap can impede GlobalData's capacity for cutting-edge research and the development of sophisticated analytical tools.

To address these issues, GlobalData is prioritizing investment in continuous talent development programs. We are also focusing on creating attractive work environments that foster growth and collaboration. Exploring flexible and remote work models is crucial for accessing a broader talent pool, ensuring we can secure the specialized skills needed to maintain our competitive edge.

Public trust in how data is handled is a major sociological factor. Recent surveys in 2024 indicate that a significant majority of consumers are concerned about how their personal data is collected and utilized by businesses. For instance, a Pew Research Center study from late 2023 found that over 70% of adults feel they have very little or no control over the data companies collect about them.

When data breaches occur, like the widely reported incidents affecting major tech firms in late 2023 and early 2024, public confidence plummets. This erosion of trust directly impacts a company's ability to gather valuable insights and can lead to reduced engagement from both individuals and other businesses. For example, after a major breach, participation in loyalty programs or willingness to share information for personalized services often sees a noticeable decline.

To counter this, GlobalData needs to prioritize transparency and ethical data governance. Demonstrating a commitment to data privacy through clear policies and secure practices is crucial. Companies that proactively communicate their data usage and security measures, such as implementing advanced encryption and anonymization techniques, are better positioned to build and maintain the trust necessary for continued data-driven operations and growth in the evolving digital landscape.

Ethical Considerations of AI and Automation

The societal conversation around the ethical dimensions of AI and automation, particularly within data analysis, is intensifying. Concerns are frequently raised regarding inherent algorithmic bias, the potential for widespread job displacement, and the critical issue of data privacy. For instance, a 2024 report highlighted that 65% of consumers are concerned about how their personal data is used by AI systems.

GlobalData, as a prominent player in data analytics, has a responsibility to proactively address these ethical considerations. This involves a commitment to developing and deploying AI-powered solutions in a manner that is both responsible and equitable. By 2025, it's projected that the global AI market will reach $200 billion, underscoring the urgency of establishing ethical frameworks.

- Algorithmic Bias: Ensuring AI models do not perpetuate or amplify existing societal prejudices.

- Job Displacement: Addressing the impact of automation on the workforce and exploring reskilling initiatives.

- Data Privacy: Implementing robust measures to protect sensitive information and maintain user trust.

- Transparency: Making AI decision-making processes understandable and accountable.

Shifting Client Expectations for Insights

Clients are increasingly demanding insights that go beyond simply reporting past events. They now expect predictive analytics to forecast future trends and prescriptive recommendations to guide strategic decisions. For instance, a recent survey indicated that 72% of business leaders consider predictive capabilities crucial for competitive advantage in 2024.

This shift means that descriptive data alone is no longer sufficient. Businesses are actively seeking to understand not just what happened, but why it happened, what is likely to happen next, and what specific actions they should take to optimize outcomes. This is driving demand for more sophisticated analytical tools and services.

To remain competitive, GlobalData must evolve its service portfolio to incorporate these advanced analytical needs. This involves leveraging technologies like AI and machine learning to provide real-time, actionable intelligence. Companies that successfully integrate these capabilities are seeing significant improvements; for example, early adopters of AI-driven insights reported a 15% increase in operational efficiency in Q1 2025.

- Predictive Analytics Demand: 72% of business leaders prioritize predictive capabilities for competitive advantage in 2024.

- Actionable Insights: Businesses seek to understand not just past events but also future outcomes and recommended actions.

- Technology Integration: AI and machine learning are key to delivering the real-time, actionable intelligence clients expect.

- Efficiency Gains: Early adopters of AI-driven insights have observed up to a 15% increase in operational efficiency by Q1 2025.

Societal trends highlight a growing demand for data-driven decision-making, with 85% of executives in 2024 deeming data analytics crucial for success. This necessitates clear, actionable intelligence derived from complex datasets, increasing the value of services like GlobalData's. Furthermore, public trust in data handling is paramount, as over 70% of adults in late 2023 felt they lacked control over their data, making transparency and ethical governance essential for maintaining client engagement.

Technological factors

GlobalData's competitive edge is significantly bolstered by rapid advancements in Artificial Intelligence (AI), Machine Learning (ML), and Big Data analytics. These technologies empower the company to process vast datasets, uncovering intricate patterns and automating the generation of valuable insights. This leads directly to more sophisticated and data-driven products and services for clients.

For instance, in 2024, the AI market size was estimated to reach over $200 billion, with significant growth projected. GlobalData's investment in these areas allows them to leverage these powerful tools, enhancing their ability to deliver precise market intelligence and predictive analytics. This continuous investment is vital for staying ahead in a rapidly evolving data landscape.

The escalating complexity of cyber threats demands that GlobalData invests heavily in advanced cybersecurity and data protection technologies. This is crucial for safeguarding sensitive company data, client information, and valuable intellectual property, which directly impacts trust and operational stability.

In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, highlighting the significant financial risks associated with inadequate security measures. Consequently, GlobalData must prioritize adopting and maintaining cutting-edge security protocols and adhering to evolving compliance frameworks, such as GDPR and CCPA, to ensure data integrity and business continuity.

GlobalData's reliance on cloud computing infrastructure, like Amazon Web Services (AWS) and Microsoft Azure, offers significant scalability and flexibility. This allows the company to efficiently manage vast datasets and rapidly deploy new analytical tools and client solutions. In 2024, the global cloud computing market was projected to reach over $600 billion, highlighting the industry's robust growth and the critical role cloud services play in data-intensive businesses.

The ability to scale cloud resources up or down based on demand is crucial for GlobalData's operational efficiency, particularly in handling fluctuating data workloads from its diverse client base. This adaptability ensures cost-effectiveness by avoiding over-provisioning of hardware. Optimizing cloud utilization directly impacts GlobalData's ability to deliver timely and accurate market intelligence, a core component of its service offering.

Development of Data Visualization and Reporting Tools

The ongoing advancement of data visualization and reporting tools is fundamentally reshaping how GlobalData delivers its market intelligence. These tools are crucial for translating complex datasets into easily digestible formats.

Interactive dashboards and visually engaging reports significantly boost the clarity and impact of GlobalData's findings, making sophisticated market trends more accessible to a broader audience. For instance, the market for business intelligence and analytics software, which underpins these visualization tools, was projected to reach $34.8 billion in 2024, indicating substantial investment in this area.

- Enhanced Client Understanding: Interactive dashboards allow clients to explore data dynamically, leading to deeper insights.

- Improved Engagement: Visually compelling narratives capture attention and facilitate better comprehension of market dynamics.

- Competitive Edge: Companies leveraging advanced visualization tools in 2024 are better positioned to identify emerging opportunities and risks.

- Data Accessibility: User-friendly interfaces democratize access to complex data, empowering more informed decision-making.

Disruptive Technologies in Market Research

Emerging disruptive technologies are poised to significantly alter traditional market research. Advanced natural language processing (NLP) is increasingly capable of extracting nuanced insights from vast amounts of unstructured data, like customer reviews and social media conversations. For instance, in 2024, the global NLP market was valued at approximately $25.4 billion and is projected to grow substantially, indicating a strong trend towards AI-driven text analysis.

Blockchain technology also presents opportunities for secure and transparent data sharing in market research, addressing concerns about data integrity and privacy. Companies like GlobalData need to actively monitor and assess these innovations. Strategic integration of technologies such as AI-powered analytics and blockchain could lead to more efficient data collection, enhanced data security, and the development of novel research services.

Early adoption of these relevant innovations can unlock new market opportunities and significantly improve existing offerings. For example, by leveraging advanced NLP, market research firms can offer deeper sentiment analysis and predictive trend identification, differentiating themselves in a competitive landscape. The global AI in market research market is expected to reach over $8 billion by 2025, highlighting the significant investment and adoption in this area.

- AI-powered NLP: Enables deeper analysis of unstructured data, improving sentiment tracking and trend prediction.

- Blockchain for Data Security: Offers enhanced data integrity and privacy in data sharing and collection processes.

- Market Opportunity: Early adoption of these technologies can lead to competitive advantages and new service development.

- Market Growth: The AI in market research sector is experiencing rapid expansion, with significant growth projected in the coming years.

Technological factors are pivotal for GlobalData, with AI, ML, and Big Data analytics driving its competitive edge by enabling sophisticated insights from vast datasets. The company's investment in these areas, as evidenced by the over $200 billion AI market size in 2024, ensures the delivery of precise market intelligence. Furthermore, robust cybersecurity investments, crucial given the projected $10.5 trillion annual cost of cybercrime in 2024, safeguard sensitive data and maintain client trust.

GlobalData's utilization of cloud computing, with the global cloud market exceeding $600 billion in 2024, provides essential scalability for managing data and deploying analytical tools efficiently. Advanced data visualization tools, supported by a market projected at $34.8 billion in 2024, enhance client understanding and engagement by making complex data accessible. Emerging technologies like NLP, valued at approximately $25.4 billion in 2024, and blockchain are also being integrated to extract deeper insights from unstructured data and ensure data integrity, positioning GlobalData for future growth in the AI in market research sector, expected to surpass $8 billion by 2025.

Legal factors

The increasing global adoption of data privacy laws like GDPR and CCPA significantly shapes how GlobalData operates. These regulations mandate strict protocols for data handling, impacting everything from collection to storage.

Failure to comply with these evolving legal landscapes can result in substantial penalties, with GDPR fines potentially reaching €20 million or 4% of annual global turnover. This necessitates ongoing legal vigilance and process adjustments to ensure adherence and safeguard client confidence.

Legal frameworks governing intellectual property (IP) and data ownership are paramount for GlobalData's operations. The company's proprietary datasets, sophisticated analytical models, and comprehensive market research reports are its core assets. Protecting these from infringement through patents, copyrights, and trade secrets is vital for sustaining its competitive edge and revenue generation.

In 2024, the global IP market continued to see significant activity, with companies investing heavily in patent filings and copyright protections. For instance, the World Intellectual Property Organization (WIPO) reported a steady increase in international patent filings, reflecting a growing emphasis on innovation and asset safeguarding across various industries that GlobalData serves.

GlobalData operates in environments where anti-trust and competition laws are paramount. These regulations are designed to foster a competitive marketplace by preventing monopolistic practices and ensuring fair play among businesses. For instance, in 2024, the European Union continued its robust enforcement of competition law, with significant investigations into digital markets that could impact data providers like GlobalData.

Any strategic moves by GlobalData, such as mergers, acquisitions, or even how it structures its market offerings, must strictly adhere to these legal frameworks. Non-compliance can lead to substantial fines and severe reputational damage, as seen in past cases where tech companies faced billions in penalties for violating competition rules. Ensuring adherence guarantees GlobalData can operate without undue legal hurdles.

Contractual Obligations and Service Level Agreements

The legal enforceability of contractual obligations and Service Level Agreements (SLAs) is crucial for GlobalData. These agreements define the scope of services, data usage rights, and liability, ensuring clarity and protection for both GlobalData and its clients. A robust legal framework minimizes disputes and builds trust, which is essential for sustained business relationships.

In 2024, GlobalData's ability to enforce its SLAs with data providers and clients directly impacts revenue streams. For instance, failure to meet agreed-upon data delivery timelines could result in penalties or contract termination, affecting the company's financial performance. Conversely, strong contractual terms safeguard GlobalData's intellectual property and data access rights.

- Contractual Enforceability: GlobalData relies on legally binding contracts to govern its relationships with clients and data suppliers, ensuring that agreed-upon terms are upheld.

- Service Level Agreements (SLAs): Clearly defined SLAs are vital for maintaining service quality and client satisfaction, directly impacting customer retention and revenue.

- Risk Mitigation: Thorough legal review of all agreements helps to identify and mitigate potential legal risks, preventing costly disputes and safeguarding the company's reputation.

- Data Usage Rights: Contracts clearly delineate data usage rights, protecting GlobalData's proprietary information and ensuring compliance with data privacy regulations.

International Business Law and Compliance

Operating internationally means GlobalData must understand a maze of international business laws. These cover everything from how money crosses borders to tax rules and hiring people in different countries. For instance, the European Union's General Data Protection Regulation (GDPR) significantly impacts how companies handle personal data globally, with fines potentially reaching 4% of annual global turnover or €20 million, whichever is higher.

Staying compliant with the legal frameworks of every nation where GlobalData does business or has customers is essential. Failing to do so can lead to hefty fines and disrupt operations. In 2024, companies worldwide faced increased scrutiny on data privacy and cybersecurity regulations, with many facing penalties for non-compliance.

To manage this complexity, engaging local legal experts is often a necessity. They provide crucial insights into country-specific regulations, helping GlobalData avoid pitfalls. For example, navigating intellectual property laws in China requires specialized knowledge to protect its assets effectively.

- Cross-Border Transaction Laws: Understanding regulations like the Uniform Customs and Practice for Documentary Credits (UCP 600) is vital for secure international payments.

- International Taxation: Compliance with double taxation treaties and transfer pricing rules is critical, with the OECD's Base Erosion and Profit Shifting (BEPS) project continuing to shape global tax landscapes in 2024-2025.

- Employment Law Variations: Adhering to diverse labor laws, such as those concerning employee benefits and termination in Germany versus the United States, is paramount.

- Data Privacy and Security: Meeting stringent data protection standards, like Brazil's Lei Geral de Proteção de Dados (LGPD), is increasingly important for global data handling.

GlobalData's operations are heavily influenced by evolving data privacy regulations like GDPR and CCPA, requiring strict adherence to data handling protocols. Non-compliance carries significant financial risks, with GDPR fines potentially reaching €20 million or 4% of annual global turnover, underscoring the need for continuous legal adaptation.

Intellectual property and data ownership laws are critical for protecting GlobalData's core assets, including proprietary datasets and analytical models. The World Intellectual Property Organization (WIPO) reported a steady increase in international patent filings in 2024, highlighting the growing importance of safeguarding intellectual assets.

Anti-trust and competition laws are paramount, ensuring fair market practices and preventing monopolistic behavior. The European Union's continued robust enforcement of competition law in digital markets in 2024 directly impacts data providers, necessitating careful strategic planning to avoid penalties.

International business laws, including cross-border transaction regulations, international taxation (influenced by the OECD's BEPS project), and varying employment laws, demand diligent attention. Compliance with data privacy standards like Brazil's LGPD is also increasingly crucial for global data handling.

| Legal Factor | Impact on GlobalData | 2024/2025 Relevance |

| Data Privacy Laws (e.g., GDPR, CCPA) | Mandates strict data handling protocols; non-compliance incurs substantial fines. | Ongoing enforcement and potential for increased scrutiny on cross-border data transfers. |

| Intellectual Property Rights | Protects core assets like datasets and models; vital for competitive edge. | Continued growth in IP filings globally (WIPO data) emphasizes asset protection. |

| Competition/Anti-trust Laws | Governs market practices; strategic moves must comply to avoid penalties. | Increased regulatory focus on digital markets and data monopolies in regions like the EU. |

| International Business & Tax Laws | Governs cross-border transactions, taxation, and employment; requires localized expertise. | OECD's BEPS initiative continues to shape global tax landscapes, impacting multinational operations. |

Environmental factors

The demand for Environmental, Social, and Governance (ESG) data and analytics is surging as investors, regulators, and consumers increasingly prioritize sustainability. This trend is creating a substantial market opportunity for firms like GlobalData to expand their ESG reporting and risk assessment services.

For instance, the global ESG investing market reached an estimated $35.3 trillion in assets under management by the end of 2023, according to the Global Sustainable Investment Alliance. This highlights the significant financial impetus behind the need for robust ESG data and insights.

The substantial energy demands of data centers, crucial for GlobalData's operations, contribute significantly to its carbon footprint. In 2024, the global data center industry's electricity consumption was estimated to be around 1.5% of total global electricity usage, a figure projected to rise. This reliance on energy makes managing and mitigating emissions a key environmental consideration for the company.

GlobalData's commitment to sustainability necessitates exploring energy-efficient technologies and adopting renewable energy sources to reduce its operational carbon footprint. By 2025, many leading tech companies are setting ambitious targets to power their data centers with 100% renewable energy, a trend that reflects growing corporate social responsibility and client demand for environmentally conscious operations.

Businesses face increasing demands from regulators worldwide to report on their environmental impact. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD), which fully applies from 2024 for large companies, mandates extensive disclosure on environmental, social, and governance (ESG) matters. This regulatory push necessitates more granular and reliable environmental data.

GlobalData assists clients in navigating these complex reporting landscapes by offering comprehensive environmental datasets and sophisticated analytical tools. These resources help organizations accurately measure and communicate their sustainability performance, ensuring compliance with evolving regulations.

This growing need for transparency and accountability in environmental reporting presents significant opportunities for data service providers like GlobalData. The market for ESG data and analytics is projected to expand substantially, driven by regulatory mandates and investor demand for sustainable investment opportunities.

Climate Change Impact on Industries

Climate change presents a complex web of risks and opportunities for businesses worldwide. Understanding these impacts is crucial for strategic planning and risk management. For instance, in 2024, the agricultural sector faced significant disruptions due to extreme weather events, with crop yields in some regions declining by as much as 15% compared to the previous year, highlighting supply chain vulnerabilities.

GlobalData offers critical data and insights to help organizations navigate these challenges. Our analysis focuses on climate resilience, identifying sectors most at risk from rising sea levels or increased frequency of natural disasters. We also track the growth of green technologies, a rapidly expanding market driven by the global push for decarbonization. For example, the renewable energy sector saw investments surge by over 20% in 2024, reaching a global total exceeding $1.7 trillion, according to our data.

- Supply Chain Resilience: Assessing the impact of climate-related disruptions on raw material availability and logistics.

- Green Technology Adoption: Tracking investments and market growth in areas like carbon capture and sustainable materials.

- Regulatory Shifts: Analyzing how evolving environmental regulations influence industry operations and investment decisions.

- Consumer Demand: Gauging the increasing preference for sustainable products and services across various markets.

By providing granular analysis on how climate change affects specific industries, GlobalData empowers clients to develop robust adaptation strategies. This includes identifying potential financial impacts, such as increased insurance costs or the need for capital expenditure on climate-proofing infrastructure, and capitalizing on emerging opportunities in the transition to a low-carbon economy.

Sustainability in Supply Chains and Data Sourcing

The emphasis on sustainability now firmly includes the entire supply chain, meaning companies like GlobalData are increasingly evaluated on the ethical and environmental standards of their data sourcing partners. This scrutiny means GlobalData could face questions about the environmental footprint or the ethical underpinnings of how it acquires its vast datasets.

Demonstrating a commitment to sustainable and ethical practices throughout its data and technology supply chain is not just about compliance; it's a strategic move that can significantly boost GlobalData's reputation and solidify client trust in an era where corporate responsibility is paramount. For instance, by 2024, over 70% of major corporations are expected to have integrated ESG (Environmental, Social, and Governance) criteria into their procurement processes, a trend that directly impacts data providers.

- ESG Integration: Over 70% of large companies are expected to embed ESG into procurement by 2024.

- Data Ethics Scrutiny: Partners are being vetted for ethical data acquisition, impacting companies like GlobalData.

- Reputational Boost: Sustainable supply chains enhance brand image and client confidence.

- Risk Mitigation: Proactive ethical sourcing reduces regulatory and reputational risks.

Environmental factors are increasingly shaping business strategy, with a growing demand for ESG data and analytics. For example, the global ESG investing market was valued at an estimated $35.3 trillion by the end of 2023, underscoring the financial significance of sustainability. Companies like GlobalData are pivotal in helping clients navigate these evolving environmental landscapes and regulatory demands.

Climate change presents both risks and opportunities, impacting supply chains and driving investment in green technologies. In 2024, renewable energy sector investments surged by over 20%, exceeding $1.7 trillion globally. GlobalData's analysis helps clients understand climate resilience and capitalize on these shifts.

Businesses are facing stricter environmental reporting mandates, such as the EU's CSRD, which fully applies from 2024 for large companies. This necessitates accurate environmental data and robust reporting capabilities, areas where GlobalData provides essential support to ensure client compliance and transparency.

The environmental footprint of operations, particularly data centers, is a key concern, with global data center electricity consumption estimated at 1.5% of total global usage in 2024. Companies are increasingly adopting renewable energy sources, with many aiming for 100% renewable power for their data centers by 2025, reflecting a broader trend towards sustainability.

| Key Environmental Trend | Impact on Businesses | Data & Analytics Relevance | Example Data Point (2023-2025) |

| Rising ESG Investment | Increased pressure for sustainable practices and reporting | Demand for ESG data and analytics services | Global ESG investing market reached $35.3 trillion (end of 2023) |

| Climate Change Impacts | Supply chain disruptions, increased operational risks | Need for climate resilience analysis and green tech tracking | Renewable energy investments grew >20% in 2024, exceeding $1.7 trillion |

| Regulatory Mandates | Stricter environmental disclosure requirements | Requirement for granular environmental data and compliance tools | EU CSRD fully applicable from 2024 for large companies |

| Operational Footprint | Focus on energy efficiency and renewable energy adoption | Data on energy consumption and carbon emissions | Data centers consumed ~1.5% of global electricity in 2024 |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from leading international organizations like the World Bank and IMF, coupled with comprehensive industry-specific reports and official government publications. This ensures a holistic view of the political, economic, social, technological, legal, and environmental landscapes.