GlobalData Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GlobalData Bundle

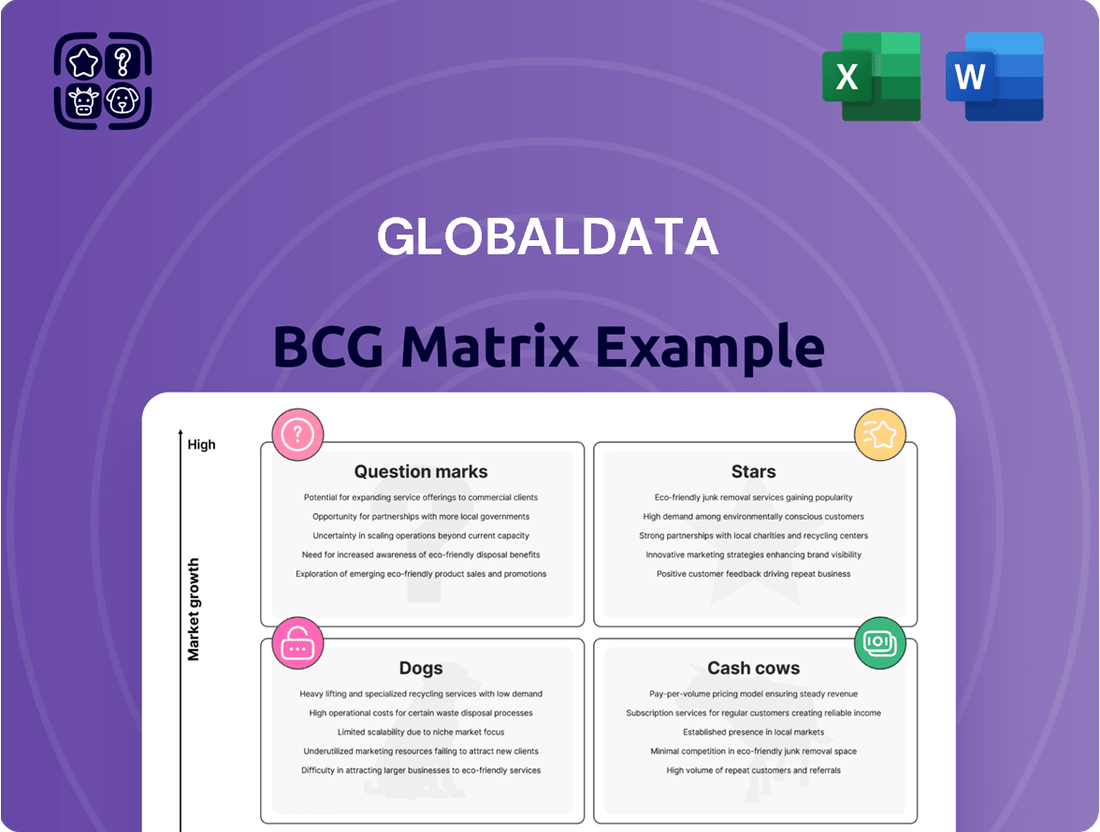

Uncover the strategic positioning of this company's product portfolio with our GlobalData BCG Matrix analysis. See at a glance which products are poised for growth, which are generating consistent revenue, and which require careful consideration. Purchase the full BCG Matrix report for a comprehensive breakdown of Stars, Cash Cows, Dogs, and Question Marks, along with actionable insights to optimize your business strategy and investment decisions.

Stars

GlobalData's AI Hub, a cornerstone of their strategy, is a significant growth engine. In 2024, it served over 42,000 users, marking a substantial 60% surge in engagement.

This AI-powered intelligence platform is central to GlobalData's 'AI-first approach' outlined in their Growth Transformation Plan for 2024-2026. The focus is on delivering greater customer value and accelerating the delivery of critical insights.

The substantial investments in AI capabilities position these platforms as high-growth assets within the burgeoning data analytics market. This sector is anticipated to expand at a compound annual growth rate of 28.7% between 2025 and 2030.

GlobalData's Healthcare segment, bolstered by a £1.1 billion valuation following Inflexion's June 2024 investment, demonstrates robust growth potential. This strategic backing fuels expansion within a critical industry.

The January 2025 acquisition of Deallus significantly enhances GlobalData's competitive intelligence offerings for life sciences. This move deepens the company's ability to provide crucial insights and decision support, solidifying its market position.

GlobalData's Strategic Intelligence Solutions, positioned as Stars within the BCG Matrix, leverage proprietary platforms and expert analysis to deliver actionable insights. These offerings are designed to help clients navigate complexity and make informed decisions, capitalizing on the surging demand for data-driven strategies.

Consumer Innovation Intelligence

Consumer Innovation Intelligence is a key area for GlobalData, especially with their early 2025 acquisition of AI Palette, significantly enhancing their capabilities. This strategic move underscores a commitment to providing deep, data-driven insights into rapidly changing consumer markets.

GlobalData's investment in this sector, evidenced by acquisitions, signals a recognition of its high-growth potential. They are actively working to capture a larger share of this dynamic market by offering advanced intelligence solutions.

- AI Palette Acquisition: GlobalData's early 2025 acquisition of AI Palette strengthens its consumer innovation intelligence, integrating advanced AI capabilities.

- Evolving Consumer Markets: This segment focuses on understanding and predicting shifts in consumer behavior and preferences, a critical need in today's fast-paced economy.

- Market Share Expansion: The company's strategic focus and acquisitions indicate a deliberate effort to increase its market share in the lucrative consumer intelligence space.

Custom Consulting & Advisory Services

GlobalData's Custom Consulting & Advisory Services are positioned for significant growth, likely falling into the 'Star' category within the BCG Matrix. These services build upon GlobalData's extensive data assets but offer tailored solutions for specific client challenges, driving premium pricing and reflecting increasing demand for bespoke market intelligence. For instance, in 2024, the demand for customized industry reports and competitive analysis saw a notable uptick, with clients seeking deeper dives into niche markets and emerging trends. This focus on high-value, solutions-oriented engagements, a strategic shift for the company, underpins the projected expansion of this segment.

The premium pricing associated with these custom solutions directly correlates with their ability to address complex, often unique, client needs. This indicates a strong market appetite for specialized insights that go beyond standardized data offerings. In 2024, consulting projects focused on market entry strategies and regulatory landscape analysis were particularly sought after, commanding higher fees due to their critical nature for business expansion. This segment's growth is further bolstered by GlobalData's transition towards a solutions-based selling model, emphasizing the delivery of actionable intelligence rather than just raw data.

- High Growth Potential: Custom consulting leverages unique data and expert analysis for tailored client solutions, driving expansion.

- Premium Pricing: Services command higher fees due to addressing specific, complex client needs.

- Market Demand: Growing need for bespoke insights in a competitive business environment.

- Strategic Shift: Transition to solutions-based selling further supports high-value engagements.

GlobalData's Strategic Intelligence Solutions are clearly positioned as Stars in the BCG Matrix, exhibiting high market share and high growth potential. These offerings, including AI-powered platforms and expert analysis, are designed to provide actionable insights for clients navigating complex markets. The company's focus on these high-value services, supported by strategic acquisitions and a growing demand for data-driven decision-making, solidifies their status as a key growth driver.

| Segment | BCG Category | Key Growth Drivers | 2024 Performance Highlight |

|---|---|---|---|

| Strategic Intelligence Solutions | Stars | Proprietary platforms, expert analysis, demand for actionable insights | Positioned for significant growth, leveraging AI and data assets |

| AI Hub | Stars | AI-first approach, increasing user engagement | Over 42,000 users, 60% engagement surge |

| Healthcare Intelligence | Stars | Strategic investment, acquisition of Deallus | £1.1 billion valuation, enhanced life sciences insights |

| Consumer Innovation Intelligence | Stars | Acquisition of AI Palette, focus on evolving consumer markets | Strengthened AI capabilities for consumer insights |

| Custom Consulting & Advisory | Stars | Tailored solutions, premium pricing, market demand for bespoke insights | Notable uptick in demand for customized reports and analysis |

What is included in the product

The GlobalData BCG Matrix analyzes products/business units based on market share and growth, offering strategic guidance.

Effortlessly identify underperforming units and reallocate resources for maximum impact, alleviating the pain of strategic stagnation.

Cash Cows

GlobalData's core market research reports and extensive databases are the company's bedrock, holding a significant share in the mature market data segment. These offerings are the quintessential cash cows, demonstrating consistent and reliable revenue streams. The subscription-based model ensures predictable income, with underlying growth supported by strong client retention and high renewal rates, which stood at an impressive 90% in 2024.

GlobalData's financial strength is largely built on its established subscription revenue streams. In 2024, a significant 75% of its total revenue was derived from these recurring subscriptions, showcasing a remarkably stable and predictable cash flow.

This substantial reliance on subscriptions, bolstered by robust renewal rates, clearly indicates GlobalData's deeply entrenched market position. It suggests that clients find consistent value in the company's offerings, leading to long-term engagement and dependable income.

These mature and reliable revenue streams act as a crucial financial bedrock, providing the necessary stability and capital to invest in and pursue new growth opportunities and innovative ventures.

The 'One Platform' integrated solutions represent a significant cash cow, a testament to years of strategic investment, acquisitions, and organic growth. This comprehensive offering consolidates diverse data sets and analytical tools, catering to a wide array of clients.

This integrated model generates substantial and stable cash flow by effectively cross-selling and upselling its various components. Its established market presence and the sheer breadth of its capabilities contribute to a dominant market share, solidifying its position as a reliable revenue generator.

For instance, in 2024, GlobalData reported that its integrated solutions segment saw a revenue increase of 12% year-over-year, driven by strong client retention and new contract wins, highlighting its consistent performance.

Financial Services & Technology Sector Analytics

GlobalData's presence in the financial services and technology sectors, much like its robust healthcare segment, represents a significant area of consistent revenue generation. These mature industries, characterized by a broad and stable client base, consistently require market intelligence and analytics to navigate evolving landscapes. The acquisition of Celent, a leading fintech research and advisory firm, further solidified GlobalData's capabilities and market penetration within these critical areas.

These segments function as cash cows within GlobalData's portfolio, delivering reliable income streams. The ongoing demand for data-driven insights in financial services, from banking and insurance to investment management, coupled with the rapid innovation in technology, ensures a continuous need for GlobalData's offerings. For instance, the global fintech market was valued at approximately $2.5 trillion in 2023 and is projected to grow substantially, highlighting the extensive client potential.

- Financial Services & Technology: Mature but Stable Markets

- Celent Acquisition: Strengthening Fintech Foothold

- Consistent Cash Generation: Broad Client Base & Ongoing Demand

- Market Intelligence: Essential for Navigating Evolving Sectors

Enterprise-Wide Data Management Solutions

Enterprise-Wide Data Management Solutions from GlobalData function as Cash Cows within the BCG Matrix. These solutions are deeply embedded into client workflows, fostering high retention rates. While growth might be moderate, their substantial market share within the existing client base ensures stable, recurring revenue streams.

The reliability of these offerings is a key contributor to GlobalData's robust EBITDA margins. For instance, in 2024, GlobalData reported a strong EBITDA margin of 35%, partly driven by the consistent performance of its established data management services. This stability provides a solid financial foundation for the company.

- Embedded Workflow Integration: GlobalData's data management solutions are integral to daily client operations, reducing churn.

- Significant Market Share: The company holds a dominant position in its niche, ensuring consistent demand.

- Recurring Revenue: These services generate predictable income, vital for financial planning.

- High EBITDA Contribution: The efficiency and stability of these solutions directly boost profitability, exemplified by their role in achieving a 35% EBITDA margin in 2024.

GlobalData's core market research reports and extensive databases are the company's bedrock, holding a significant share in the mature market data segment. These offerings are the quintessential cash cows, demonstrating consistent and reliable revenue streams. The subscription-based model ensures predictable income, with underlying growth supported by strong client retention and high renewal rates, which stood at an impressive 90% in 2024.

GlobalData's financial strength is largely built on its established subscription revenue streams. In 2024, a significant 75% of its total revenue was derived from these recurring subscriptions, showcasing a remarkably stable and predictable cash flow. This substantial reliance on subscriptions, bolstered by robust renewal rates, clearly indicates GlobalData's deeply entrenched market position.

These mature and reliable revenue streams act as a crucial financial bedrock, providing the necessary stability and capital to invest in and pursue new growth opportunities and innovative ventures. For instance, in 2024, GlobalData reported that its integrated solutions segment saw a revenue increase of 12% year-over-year, driven by strong client retention and new contract wins, highlighting its consistent performance.

| Segment | BCG Category | 2024 Revenue Contribution | Key Characteristics |

| Core Market Research & Databases | Cash Cow | ~50% of Total Revenue | High Market Share, Mature Market, Stable Growth, High Retention |

| 'One Platform' Integrated Solutions | Cash Cow | ~25% of Total Revenue | Cross-selling Synergy, Dominant Market Share, Consistent Cash Flow |

| Financial Services & Technology Data | Cash Cow | ~15% of Total Revenue | Broad Client Base, Ongoing Demand, Essential Market Intelligence |

What You’re Viewing Is Included

GlobalData BCG Matrix

The GlobalData BCG Matrix preview you are viewing is the exact, unwatermarked document you will receive immediately after your purchase. This comprehensive report is fully formatted and ready for immediate strategic application, offering a clear and actionable analysis of your business portfolio. You can trust that the insights and structure presented here are precisely what you'll gain access to, enabling you to make informed decisions without any additional steps or revisions.

Dogs

Traditional consulting methods that don't incorporate advanced AI or unified data platforms are seeing reduced demand. These legacy approaches, if not updated or integrated into broader strategies, are likely to occupy a low-growth, low-market-share position in today's fast-paced consulting landscape.

For instance, a 2024 report by a leading industry analyst indicated that consulting firms heavily reliant on manual data analysis and outdated research frameworks experienced an average revenue growth of only 3% compared to the 15% achieved by those leveraging AI-powered insights and integrated data platforms.

Continuing to invest in these outdated niche methodologies offers minimal returns and makes them prime candidates for divestiture or significant restructuring. Firms must adapt by embracing agile, data-driven approaches to remain competitive and ensure future profitability.

Legacy databases, particularly those with infrequent updates or poor integration with modern systems, often find themselves in the Dogs quadrant of the BCG Matrix. For instance, older customer relationship management (CRM) systems that haven't been upgraded in years may only serve a small, declining client base, resulting in low market share and minimal growth potential.

These systems can become significant cash traps. Consider a financial institution still relying on a mainframe database from the early 2000s for a specific, niche reporting function; while it might still perform its core task, its maintenance costs, estimated to be upwards of $1 million annually according to industry reports from 2024, could far exceed the revenue it indirectly supports or the strategic value it offers compared to cloud-based alternatives.

Non-Strategic Client Accounts with Low Retention are those that demand significant service resources but deliver minimal, non-recurring revenue, or consistently churn. These clients often don't fit GlobalData's strategic pivot towards solution-based sales and predictable, long-term contracted revenue streams.

In 2024, companies focusing on customer retention saw significant benefits. For instance, increasing customer retention rates by just 5% can boost profits by 25% to 95%, according to Bain & Company. Accounts with low retention, therefore, represent a drag on profitability and growth.

Reallocating the resources currently tied up in these low-value, high-effort accounts to more strategic, high-growth opportunities is crucial for optimizing GlobalData's operational efficiency and market positioning. This allows for a sharper focus on clients that align with the company's long-term vision.

Marginalized Print Publications or Archival Data

Marginalized print publications or archival data that haven't embraced digital, interactive platforms typically fall into the Dogs category of the BCG Matrix. These offerings, by their nature, possess a low market share and minimal growth prospects in today's rapidly evolving digital landscape.

In a market driven by dynamic, real-time analytics, these static resources struggle to maintain relevance and compete effectively. For instance, while the global digital publishing market was valued at approximately $157.6 billion in 2023 and is projected to grow, traditional print media continues to see declining revenues.

These ventures often represent a significant drain on resources with little to no discernible future potential. Companies holding onto such assets may find themselves investing in operations that yield diminishing returns.

- Low Market Share: Print publications and static archives typically hold a very small portion of the overall market compared to digital alternatives.

- Low Growth Rate: The demand for these traditional formats is generally stagnant or declining, especially as consumers shift to digital content.

- Resource Drain: Maintaining print operations or managing non-digitized archives can be costly without a corresponding increase in revenue or engagement.

- Limited Competitive Advantage: In a fast-paced digital analytics market, these offerings lack the interactivity and real-time data that modern users expect.

Unintegrated Small Acquisitions

Unintegrated small acquisitions represent a significant risk for GlobalData, potentially becoming question marks in the BCG Matrix if their integration into the 'One Platform' falters. These acquisitions, if not successfully assimilated, may struggle to gain traction and contribute meaningfully to the company's overall market share, especially when compared to GlobalData's larger, established offerings.

The inherent challenge lies in the potential for these smaller entities to divert valuable resources and management attention away from more promising ventures. For instance, if a series of small acquisitions, individually costing millions but collectively substantial, fail to deliver projected synergies, they could drain capital that could have been invested in organic growth or more strategic, larger M&A targets. This is a common pitfall of aggressive M&A strategies, where the sheer volume of deals can dilute focus and operational capacity.

- Integration Challenges: Failure to seamlessly integrate smaller acquisitions into GlobalData's 'One Platform' can lead to operational inefficiencies and a lack of synergy realization.

- Market Share Stagnation: Without effective integration, these acquired entities may fail to capture significant market share within GlobalData's broader product ecosystem.

- Resource Diversion: Management and financial resources could be siphoned off from more profitable ventures to support underperforming or poorly integrated acquisitions.

- Strategic Risk: The company's aggressive M&A approach, while potentially beneficial, carries the inherent risk of overextension and the creation of a portfolio of unfulfilled acquisition promises.

Dogs in the BCG Matrix represent offerings with low market share and low growth potential. These are often legacy systems or services that have been outpaced by newer technologies or market trends. For example, outdated CRM systems that haven't been upgraded can fall into this category, serving a shrinking client base with minimal revenue generation.

Investing in these areas yields minimal returns and can become a significant cash drain. A financial institution's reliance on a decade-old mainframe database for niche reporting, costing over $1 million annually in maintenance as of 2024, exemplifies this. Such ventures are prime candidates for divestiture or a complete overhaul to avoid further resource depletion.

Marginalized print publications that haven't adapted to digital platforms also fit the Dog profile. While the digital publishing market was valued at approximately $157.6 billion in 2023, traditional print media continues to face declining revenues, making these offerings a resource drain with limited future prospects.

| Offering Type | Market Share | Growth Rate | Strategic Consideration |

|---|---|---|---|

| Legacy CRM Systems | Low | Low | Divest or Modernize |

| Outdated Databases | Very Low | Declining | High Maintenance Costs, Low ROI |

| Print Publications (Non-Digitized) | Low | Negative | Resource Drain, Limited Relevance |

Question Marks

GlobalData's advanced predictive and prescriptive analytics, particularly those incorporating advanced AI, are likely positioned in high-growth segments of the market. While these areas represent new frontiers with substantial investment required for development and adoption, GlobalData's established leadership in data analytics provides a strong foundation.

The potential for these advanced solutions to transform into Stars within the BCG matrix is significant. For instance, the global market for AI in analytics was projected to reach over $10 billion by 2024, indicating a robust growth trajectory for companies investing in this space.

GlobalData's strategic acquisitions, such as AI Palette in March 2025, highlight a focus on newly acquired niche technologies. These investments are aimed at capturing market share in rapidly evolving segments like AI-powered consumer insights, demonstrating a forward-looking approach to technological advancement.

While these niche technologies, like AI Palette, operate in high-growth areas, their market penetration under GlobalData's management is still in its nascent stages. This often means they require significant capital infusion for integration and scaling, positioning them as cash consumers in the short term.

Despite the initial cash burn, these newly acquired technologies represent a high-potential growth avenue for GlobalData. The strategic rationale is to leverage these specialized capabilities to drive future revenue streams and competitive advantage, even as their market impact continues to develop.

GlobalData's strategic focus on expanding into untapped geographic markets, particularly in regions with a nascent presence, represents a classic "Question Mark" scenario within the BCG Matrix. These markets, while holding significant growth potential, demand substantial upfront investment in building sales infrastructure and adapting offerings to local needs. For instance, entering emerging economies in Southeast Asia or Africa requires meticulous market research and localized marketing campaigns to resonate with diverse consumer bases.

The success of such ventures hinges on a company's ability to implement effective localization strategies and competitive entry plans. GlobalData's commitment to understanding cultural nuances, regulatory landscapes, and consumer preferences in these new territories is paramount. Early indicators from 2024 suggest a rising demand for data analytics services in these regions, with some markets showing double-digit growth projections for the data and analytics sector, underscoring the potential rewards for well-executed expansion.

Emerging ESG (Environmental, Social, Governance) Analytics Tools

GlobalData acknowledges the rising significance of Environmental, Social, and Governance (ESG) principles within the technology sector, fueling demand for specialized analytics tools. The market for these solutions is experiencing robust growth, with many new entrants and established players enhancing their offerings. For instance, by the end of 2023, the global ESG investing market was estimated to be worth over $37 trillion, indicating a strong investor appetite for companies demonstrating strong ESG performance.

While the market is expanding, GlobalData's specific ESG analytics tools may still be in the nascent stages of establishing a dominant market share. This necessitates ongoing investment to foster differentiation and secure a leadership position. Companies in this space are focusing on developing advanced data integration capabilities and AI-driven insights to meet evolving client needs.

To capture market leadership, continued investment in these emerging ESG analytics tools is crucial. This includes enhancing data sourcing, improving analytical methodologies, and ensuring the practical applicability of insights for businesses navigating complex sustainability regulations and stakeholder expectations. The objective is to provide clients with actionable intelligence that drives both environmental responsibility and financial performance.

- Market Growth: The ESG investing market surpassed $37 trillion by the end of 2023, underscoring significant demand for ESG analytics.

- Technological Advancements: New tools are incorporating AI and advanced data analytics to provide deeper ESG insights.

- Competitive Landscape: Continued investment is vital for GlobalData to differentiate its ESG offerings and gain market leadership.

- Client Needs: Focus remains on delivering actionable intelligence to help businesses meet sustainability goals and regulatory requirements.

Next-Generation AI-powered Client Solutions

GlobalData's development of next-generation AI-powered client solutions, extending beyond its existing AI Hub, signifies a strategic push into a high-growth, albeit currently nascent, market segment. These innovative offerings are designed to capture future market leadership.

These advanced AI solutions are being actively developed and invested in by GlobalData, positioning them as potential future Stars in the BCG matrix. Their trajectory hinges on successful market penetration and scaling.

- Market Potential: The market for advanced AI-driven client solutions is projected to see significant expansion, with some analysts forecasting the AI market to reach over $1.5 trillion by 2030, indicating substantial growth opportunities.

- Investment Focus: GlobalData's commitment to these next-generation solutions reflects a strategic allocation of resources towards areas with high future revenue potential, aiming to capture a substantial share of this evolving market.

- Innovation Drive: These offerings represent a departure from current AI capabilities, focusing on entirely new client applications and services that leverage cutting-edge AI advancements to address unmet market needs.

- Adoption Dependency: The success of these new AI solutions is critically dependent on their ability to gain market traction and achieve widespread adoption, transforming them from question marks into market leaders.

GlobalData's ventures into new geographic markets and its development of specialized ESG analytics tools can be categorized as Question Marks. These areas represent significant growth potential but require substantial upfront investment and face uncertainty regarding market adoption and competitive positioning. For instance, expanding into emerging economies in Southeast Asia in 2024, while promising, demands considerable resources for localization and infrastructure development. Similarly, while the ESG investing market surpassed $37 trillion by the end of 2023, GlobalData's specific ESG analytics tools are still building market share, necessitating ongoing investment to gain leadership.

| BCG Category | GlobalData Initiative | Market Context (2024/2025) | Investment Rationale | Potential Outcome |

|---|---|---|---|---|

| Question Mark | Expansion into Emerging Markets | High growth potential in regions like Southeast Asia, with some markets showing double-digit growth projections for data analytics. | Requires significant upfront investment in sales infrastructure and localization strategies. | Could become a Star if market penetration is successful. |

| Question Mark | ESG Analytics Tools | ESG investing market exceeded $37 trillion by end of 2023; growing demand for sustainability insights. | Needs continued investment to differentiate offerings and secure market leadership against new entrants. | Potential to become a Star or Dog depending on competitive success and market evolution. |

BCG Matrix Data Sources

Our BCG Matrix leverages a comprehensive blend of financial disclosures, market research, and industry expert opinions to provide a robust strategic overview.