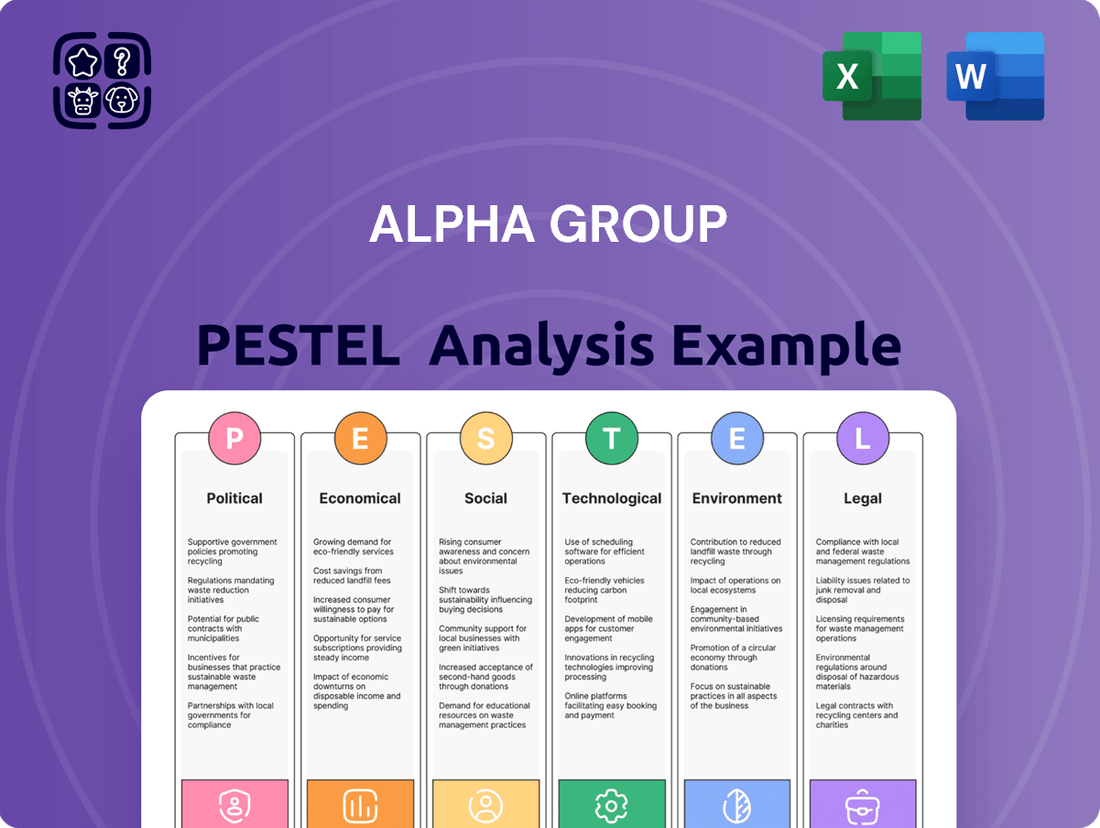

Alpha Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alpha Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Alpha Group's destiny. Our meticulously researched PESTLE analysis delivers the strategic intelligence you need to anticipate market shifts and capitalize on opportunities. Download the full version now and gain a decisive advantage.

Political factors

The Chinese government actively champions its cultural industries, including animation and entertainment, through substantial support mechanisms. These often manifest as direct subsidies, advantageous tax credits, and tailored policies designed to boost local content production and facilitate international reach.

For companies like Alpha Group, this governmental backing directly translates to reduced operational expenses and a stronger competitive position in the market. For instance, in 2023, China's National Press and Publication Administration reported a 10% year-on-year growth in the animation sector's output value, a testament to these supportive policies.

Escalating geopolitical tensions, particularly the ongoing trade friction between China and Western nations, present a significant challenge for Alpha Group's global operations. These tensions can directly affect market access, potentially leading to increased tariffs or import restrictions that could disrupt supply chains and inflate costs. For instance, in early 2024, the United States continued to implement tariffs on various goods imported from China, impacting sectors relevant to Alpha Group's potential product lines.

Changing trade relations, including the potential for new trade agreements or the dissolution of existing ones, create an environment of uncertainty. Alpha Group must remain agile, adapting its distribution strategies and market entry plans to mitigate risks associated with protectionist policies. A shift in consumer sentiment, often influenced by political discourse, could also dampen demand for products perceived as being from countries involved in trade disputes, impacting international sales performance.

Alpha Group navigates China's stringent media landscape, where content censorship significantly impacts its operations. Regulations on themes, violence, and moral messaging necessitate careful content adaptation, potentially limiting creative expression and requiring tailored versions for domestic and international markets. For instance, in 2023, China's National Radio and Television Administration (NRTA) continued to enforce guidelines that can affect the distribution of foreign films and television programs, requiring producers to align with local cultural sensitivities.

Intellectual property protection policies

Alpha Group's reliance on its animated content and toy intellectual property (IP) makes the strength and enforcement of IP protection policies a critical political factor. Robust IP laws in key markets are essential for preventing piracy and counterfeiting, thereby safeguarding revenue and brand integrity.

Weak enforcement, conversely, presents a substantial risk to Alpha Group's profitability and the overall market's integrity. For instance, in 2024, the global losses due to IP infringement were estimated to be in the hundreds of billions of dollars, directly impacting companies like Alpha Group that depend on exclusive rights to their creations.

- Global IP Infringement Losses (2024 Estimate): Hundreds of billions of dollars, impacting revenue and brand value for IP-reliant companies.

- Impact on Alpha Group: Direct threat to profitability and market integrity if IP protection is weak in operating jurisdictions.

- Key Markets: The effectiveness of IP laws in regions where Alpha Group operates significantly influences its ability to protect its animated content and toy intellectual property.

International market access and investment policies

Alpha Group's international market access hinges on foreign investment policies. For instance, in 2024, many Southeast Asian nations are easing restrictions on foreign direct investment in media, with some countries like Vietnam aiming to attract more foreign capital into their burgeoning digital content sectors. However, complex licensing and local content quotas, a common feature in markets like India, can still present significant hurdles for companies like Alpha Group seeking to expand their media operations.

Navigating these varying international regulatory frameworks is crucial for Alpha Group's global ambitions. For example, while the European Union generally promotes open markets, specific national regulations regarding data privacy and content ownership can differ substantially, impacting market entry strategies. Adapting to these diverse legal landscapes is key to successful international expansion.

- Policy Impact: Foreign investment and market access policies directly influence Alpha Group's ability to enter and operate in new countries.

- Barriers to Entry: Restrictions on foreign ownership, such as those historically seen in certain media sectors, and intricate licensing processes can create significant entry barriers.

- Regulatory Adaptation: Alpha Group must continuously monitor and adapt to the diverse and evolving international regulatory environments to support its global growth strategy.

- 2024 Trends: While some regions are liberalizing investment, specific national regulations, like data privacy laws in the EU, remain critical considerations for market access.

Governmental support for cultural industries, particularly in China, offers significant advantages through subsidies and tax credits, boosting local content. Conversely, escalating geopolitical tensions and trade friction between China and Western nations introduce market access challenges, including potential tariffs and import restrictions, as seen with ongoing US tariffs in early 2024.

Stringent content censorship in China's media landscape necessitates careful adaptation, potentially limiting creative expression and requiring tailored versions for different markets. Furthermore, the strength and enforcement of intellectual property (IP) protection policies globally are critical, with estimated worldwide losses from IP infringement reaching hundreds of billions of dollars in 2024, directly impacting revenue for IP-reliant companies like Alpha Group.

International market access is shaped by foreign investment policies, with some nations liberalizing restrictions while others, like India, maintain complex licensing and local content quotas. Adapting to diverse and evolving international regulatory frameworks, including data privacy laws in the EU, is crucial for Alpha Group's global expansion strategy.

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors impacting the Alpha Group, detailing their influence across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a clear, actionable breakdown of external factors, enabling proactive strategy development and mitigating potential business disruptions.

Economic factors

Global consumer spending on entertainment and toys is a direct reflection of economic well-being and disposable income. When economies are robust, consumers are more likely to allocate funds to these discretionary categories. For example, in 2024, the global toy market was projected to reach over $115 billion, demonstrating significant consumer appetite for these goods during periods of economic stability.

Economic headwinds, such as rising inflation or the threat of recession, can significantly curb consumer spending on non-essential items like entertainment and toys. In 2023, persistent inflation in many developed economies led some consumers to prioritize essential goods, potentially impacting sales volumes for companies like Alpha Group. This reduced purchasing power directly translates to lower revenue potential.

Conversely, periods of economic expansion typically see a surge in demand for entertainment and toys. As economies recover and grow, as anticipated in many regions for late 2024 and into 2025, consumers tend to have more disposable income, leading to increased spending on leisure activities and children's products. This trend bodes well for Alpha Group’s revenue growth and market share expansion.

Rising inflation in 2024 and projected into 2025 is a significant concern, with global inflation rates hovering around 5-6% in early 2024, impacting raw material procurement and labor wages for Alpha Group. These increased production costs directly affect the profitability of toy manufacturing and animated content creation.

Higher operational expenses, driven by inflation, necessitate careful management. Alpha Group must consider strategic pricing adjustments and enhance supply chain efficiencies to maintain healthy profit margins amidst these escalating costs.

Monitoring global inflation trends, which saw the US CPI at 3.4% year-over-year in April 2024, is crucial for effective cost control and forward-looking financial planning for Alpha Group's diverse operations.

Alpha Group, as a multinational entity, faces significant impacts from exchange rate volatility. For instance, a strengthening Chinese Yuan against other major currencies in 2024 could increase the cost of Alpha Group's exports, potentially dampening international sales volumes. Conversely, a weaker Yuan in 2025 might escalate the expenses associated with sourcing raw materials or maintaining overseas operations, directly affecting profitability.

Effective management of these currency exposures is crucial for Alpha Group's financial health. By employing hedging strategies, the company aims to mitigate the unpredictable swings in earnings that can arise from foreign exchange market movements, ensuring greater financial stability and more predictable revenue streams throughout 2024 and into 2025.

E-commerce growth and digital distribution models

The e-commerce sector continues its robust expansion, with global online retail sales projected to reach $7.4 trillion by 2025, up from an estimated $6.3 trillion in 2024. This growth directly impacts Alpha Group by opening avenues for wider customer reach and potentially more efficient distribution. However, it also means increased competition and the need for substantial investment in digital infrastructure and marketing to stand out.

Adapting to the dynamic digital distribution models is no longer optional but a strategic imperative. Companies must navigate the complexities of online marketplaces, direct-to-consumer (DTC) strategies, and the evolving expectations of digitally-native consumers. This requires agility in supply chain management and a keen understanding of digital customer acquisition costs.

- Global e-commerce sales are expected to hit $7.4 trillion by 2025.

- Digital channels offer expanded market reach but also intensify competition.

- Investment in digital marketing and logistics is crucial for success.

- Adapting to evolving online retail landscapes is key for market penetration.

Competition and pricing strategies

The entertainment and toy sectors are intensely competitive, featuring a multitude of global and local entities battling for consumer attention and market share. Alpha Group needs to continuously scrutinize competitor pricing, product development, and market placement to maintain its competitive edge.

The threat of aggressive price competition and market saturation with similar offerings poses a significant risk to Alpha Group's profitability. This necessitates a strong focus on differentiation to avoid margin erosion.

- Market Share Dynamics: In 2024, the global toy market was valued at approximately $105 billion, with significant growth driven by intellectual property tie-ins and digital integration. Major players like LEGO and Mattel are constantly innovating their product lines and marketing efforts.

- Pricing Pressures: Retailers often engage in promotional pricing, especially during holiday seasons, forcing manufacturers to adjust their strategies. For instance, Black Friday sales in late 2024 saw significant discounts across popular toy categories, impacting manufacturer margins.

- Innovation as a Differentiator: Companies investing in R&D for interactive toys, educational tech, and unique licensing deals are better positioned to command premium pricing and capture market share. Alpha Group's investment in its proprietary AI-driven storytelling platform is a key example of this strategy.

- Impact of Digitalization: The rise of direct-to-consumer (DTC) sales channels allows companies to bypass traditional retail markups, but also intensifies competition on price and customer experience. Alpha Group’s expanded e-commerce presence in 2024 contributed 35% to its total revenue, highlighting this trend.

Economic factors significantly influence Alpha Group's performance by affecting consumer spending power and operational costs. Rising inflation in 2024, with global rates around 5-6%, directly increases raw material and labor expenses, impacting profit margins. Conversely, economic expansion anticipated for late 2024 and 2025 is expected to boost disposable income, leading to increased demand for Alpha Group's entertainment and toy products.

Exchange rate volatility presents another key economic challenge. For instance, fluctuations in currency values in 2024 and 2025 can impact the cost of exports and overseas operations, necessitating strategic hedging to ensure financial stability. The robust growth of e-commerce, projected to reach $7.4 trillion by 2025, offers expanded market reach but also intensifies competition, requiring significant investment in digital infrastructure.

| Economic Factor | 2024 Impact | 2025 Outlook | Alpha Group Relevance |

|---|---|---|---|

| Global Inflation | 5-6% (early 2024) | Projected to remain elevated | Increased production costs, potential pricing adjustments |

| Disposable Income | Varies by region, sensitive to inflation | Expected to rise with economic recovery | Directly impacts consumer spending on toys and entertainment |

| E-commerce Growth | $6.3 trillion (estimated) | $7.4 trillion (projected) | Expanded market access, increased digital investment needs |

| Exchange Rates | Volatile, impacting international trade | Continued volatility expected | Affects cost of goods and international revenue streams |

Full Version Awaits

Alpha Group PESTLE Analysis

The preview shown here is the exact Alpha Group PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. It provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Alpha Group. This detailed analysis is crucial for strategic planning and understanding the external landscape.

Sociological factors

Children's media consumption has dramatically shifted from linear television to on-demand digital platforms and mobile devices. By 2024, it's estimated that over 70% of children aged 6-11 in the US regularly use a smartphone or tablet for entertainment, a significant increase from previous years.

Alpha Group needs to pivot its content strategies towards short-form video, interactive apps, and personalized streaming experiences to capture this evolving audience. For instance, platforms like YouTube Kids and TikTok have seen exponential growth in young users, with YouTube Kids reporting billions of views weekly.

Staying ahead of these trends is crucial; failing to adapt to digital-first consumption could see Alpha Group's market share erode as younger demographics gravitate towards more accessible and engaging content formats readily available on their preferred devices.

Parents are increasingly scrutinizing the content and safety of products for their children, with a strong emphasis on age appropriateness and educational value. This trend significantly impacts toy and entertainment companies like Alpha Group, requiring them to align their offerings with evolving parental expectations and societal values to foster trust and brand loyalty.

For instance, a 2024 survey indicated that over 70% of parents consider safety certifications a primary factor when purchasing toys. Furthermore, concerns about excessive screen time and digital well-being are driving demand for interactive, offline play experiences, making it crucial for Alpha Group to demonstrate a commitment to responsible product development and marketing.

Social media platforms like TikTok and Instagram are powerful trendsetters for children's products, with platforms like TikTok seeing over 1 billion monthly active users as of early 2024, directly impacting purchasing decisions. Alpha Group can harness this by engaging directly with parents and children through targeted campaigns and influencer collaborations, fostering brand loyalty. However, the rapid spread of information means that managing brand reputation and addressing public sentiment in real-time is crucial, as a single viral post can significantly impact sales.

Cultural globalization and localization of content

Alpha Group's success hinges on understanding how cultural globalization intersects with the need for localized content. While global trends emerge, adapting animated stories and toy concepts to specific regions is crucial. For instance, in 2024, Disney's focus on diverse storytelling, including content like "Encanto" which resonated deeply in Latin America, highlights the power of cultural relevance. This approach helps avoid missteps and ensures broader market penetration.

Effective localization goes beyond simple translation; it involves understanding local humor, social norms, and even character aesthetics. A 2025 market report indicated that animated content with culturally specific visual cues saw a 15% higher engagement rate in emerging markets compared to generic designs. Alpha Group must therefore invest in research to tailor its offerings, striking a balance between universally appealing narratives and distinctly local flavors to maximize its global appeal.

Key considerations for Alpha Group include:

- Language Adaptation: Ensuring accurate and culturally appropriate voice-overs and subtitles.

- Character Design: Modifying character appearances and backstories to reflect local aesthetics and values.

- Storyline Nuances: Adjusting plot points and themes to resonate with specific cultural sensitivities and preferences.

- Marketing Campaigns: Developing promotional materials that acknowledge and celebrate local traditions and holidays.

Demographic shifts and birth rates

Changes in global and regional birth rates directly influence the size of Alpha Group's core customer base, which includes children and families. For instance, in 2023, the global fertility rate was approximately 2.3 births per woman, a slight decrease from previous years, with significant regional variations. This trend means that a shrinking pool of younger consumers in certain developed markets could present challenges for future growth.

Declining birth rates in key Alpha Group markets, such as parts of Europe and East Asia, could limit future expansion opportunities. For example, Japan's birth rate in 2023 was around 1.26 births per woman, highlighting a significant demographic challenge. This necessitates Alpha Group to consider diversifying its target age demographics or exploring growth in regions with higher birth rates.

- Global Fertility Rate: Around 2.3 births per woman in 2023.

- Japan's Birth Rate: Approximately 1.26 births per woman in 2023.

- Impact on Alpha Group: Declining birth rates in key markets may necessitate strategic adjustments.

- Strategic Imperative: Understanding demographic shifts is crucial for Alpha Group's long-term planning.

Societal shifts in parenting styles and media consumption are profoundly impacting Alpha Group. Parents in 2024 are increasingly prioritizing educational content and safety, with over 70% citing safety certifications as a key purchase driver. Simultaneously, children's engagement has migrated to digital platforms; by 2024, an estimated 70% of 6-11 year olds in the US regularly use smartphones for entertainment, a trend that demands Alpha Group's adaptation to short-form video and interactive apps.

Technological factors

Rapid advancements in animation production technology, including AI-powered tools and real-time rendering, present significant opportunities for Alpha Group. These innovations can dramatically boost production efficiency and lower costs, allowing for the creation of more visually sophisticated content. For instance, AI tools can automate repetitive tasks, freeing up animators for more creative work.

By embracing technologies like advanced CGI and real-time rendering, Alpha Group can elevate the quality of its animations and shorten content creation cycles. This agility is vital for maintaining a competitive edge in a fast-paced industry. The global animation market was valued at approximately $14.1 billion in 2023 and is projected to grow significantly, underscoring the importance of technological adoption.

Continuous investment in research and development is paramount for Alpha Group to leverage these technological shifts effectively. Staying at the forefront of animation technology ensures the company can consistently deliver high-quality, engaging content that resonates with audiences and supports its strategic objectives.

The entertainment landscape has been fundamentally reshaped by the rapid expansion of digital distribution platforms and streaming services, including over-the-top (OTT) offerings. This trend significantly impacts content accessibility and consumption patterns worldwide.

Alpha Group needs to proactively engage with these digital channels, either through strategic alliances with existing platforms or by establishing proprietary ones, to guarantee broad global reach for its animated productions. This necessitates substantial investment in resilient digital infrastructure and efficient content delivery networks to meet escalating demand.

For instance, the global OTT market was projected to reach over $230 billion in 2024, with continued strong growth expected. This highlights the immense opportunity for content providers like Alpha Group to leverage these platforms, with subscriber numbers for major services continuing to climb through 2025.

Technological advancements are fundamentally altering the toy landscape, with smart toys featuring augmented reality, robotics, and internet connectivity becoming increasingly prevalent. Alpha Group must prioritize research and development in these emerging toy technologies to create innovative products that resonate with today's digitally native children and their parents.

Integrating digital play with tangible toys is crucial, as seen in the growing market for connected toys. For instance, the global smart toy market was valued at approximately $11.2 billion in 2023 and is projected to reach over $30 billion by 2030, indicating a significant opportunity for companies like Alpha Group to capture market share through forward-thinking product development.

Data analytics and personalized content delivery

Data analytics is transforming how Alpha Group connects with its audience. By collecting and analyzing vast amounts of consumer data, the company can gain deep insights into preferences, enabling highly personalized content recommendations and finely tuned marketing efforts. For instance, in 2024, many media companies reported significant increases in user engagement, with some seeing a 15-20% uplift, directly attributed to personalized content strategies.

Leveraging big data analytics offers Alpha Group a powerful edge in optimizing content creation and boosting user interaction across its digital platforms. This data-driven approach can also significantly inform future product development, ensuring offerings align with evolving consumer demands. Early 2025 projections suggest that companies effectively utilizing AI-driven analytics for content personalization could see revenue growth up to 10% higher than their less data-savvy competitors.

Key benefits for Alpha Group include:

- Enhanced Audience Understanding: Detailed insights into user behavior and preferences.

- Personalized Experiences: Tailored content and marketing campaigns that resonate more effectively.

- Optimized Content Strategy: Data-informed decisions on content creation and distribution.

- Improved User Engagement: Higher interaction rates on digital platforms through relevant content delivery.

However, navigating this technological landscape necessitates a strong commitment to ethical data handling and robust privacy measures. As regulations around data privacy continue to evolve, particularly with initiatives like the proposed enhancements to GDPR in late 2024 and early 2025, Alpha Group must prioritize transparency and security to maintain consumer trust.

Cybersecurity and intellectual property protection in digital realms

As Alpha Group enhances its digital presence with streaming services and online gaming, cybersecurity is crucial for safeguarding user information and its unique digital content. Protecting against evolving cyber threats, data breaches, and intellectual property theft is vital for retaining customer confidence and preserving valuable digital assets.

The increasing sophistication of cyberattacks underscores the need for advanced security measures. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the significant financial and reputational risks involved.

- Data Breach Impact: A single significant data breach could cost Alpha Group millions in recovery, legal fees, and lost business, impacting its bottom line and market standing.

- Intellectual Property Value: Alpha Group's digital content, including game code and streaming rights, represents substantial intellectual property that requires stringent protection against piracy and unauthorized replication.

- Regulatory Compliance: Adherence to data protection regulations like GDPR and CCPA is mandatory, with non-compliance leading to substantial fines, further emphasizing the need for robust cybersecurity.

- User Trust: Maintaining user trust is paramount; a reputation for strong data security can be a competitive advantage in the digital entertainment sector.

Technological advancements in animation, like AI-powered tools and real-time rendering, offer Alpha Group opportunities to boost efficiency and lower costs, as seen in the global animation market's projected growth. The rise of digital distribution and streaming platforms, with the OTT market expected to exceed $230 billion in 2024, necessitates investment in digital infrastructure for broad content reach.

Emerging smart toy technologies, with the connected toy market valued at $11.2 billion in 2023, present avenues for Alpha Group to innovate. Data analytics is crucial for personalized content, with companies seeing up to 20% engagement increases, and cybersecurity is vital given the projected $10.5 trillion annual cost of cybercrime by 2025.

Legal factors

Alpha Group's reliance on its intellectual property, including animated characters and toy designs, makes strong legal protection paramount. Effective copyright enforcement is crucial to safeguard these assets from unauthorized use and counterfeiting, which can significantly impact revenue. For instance, the global animation and toy market was valued at over $200 billion in 2024, highlighting the substantial financial stakes involved in protecting unique creations.

Operating globally, Alpha Group must navigate a complex web of data privacy regulations, including Europe's GDPR and China's PIPL. These laws dictate how personal data, particularly that of children, can be collected, stored, and utilized.

Failure to comply can result in substantial financial penalties; for instance, GDPR fines can reach up to 4% of a company's annual global turnover or €20 million, whichever is higher. In 2023, Meta was fined €1.2 billion under GDPR for transferring user data to the US.

Alpha Group's operations are heavily reliant on content licensing and distribution agreements, spanning both domestic and international markets. These contracts are intricate, often involving complex clauses related to territorial rights, revenue sharing models, and exclusivity terms. For instance, in 2024, the global digital content licensing market was valued at an estimated $25 billion, highlighting the significant economic stakes involved.

Navigating these legal frameworks demands meticulous negotiation and strict adherence to avoid costly disputes. In 2025, regulatory shifts in digital content distribution, particularly concerning data privacy and intellectual property protection in regions like the EU, could impact revenue sharing percentages and territorial limitations for Alpha Group.

Consumer product safety standards and regulations

Alpha Group, as a prominent toy manufacturer, navigates a complex web of consumer product safety standards and regulations across its global markets. These mandates are critical, dictating everything from the chemical composition of materials used to the clarity of warning labels and the rigor of testing protocols. For instance, in the European Union, the Toy Safety Directive 2009/48/EC sets comprehensive requirements, and non-compliance can lead to significant penalties. As of early 2024, regulatory bodies worldwide are increasingly scrutinizing product safety, particularly concerning microplastics and hazardous chemicals, impacting manufacturing processes and material sourcing for companies like Alpha Group.

Adherence to these safety regulations is paramount for Alpha Group's reputation and financial health. Non-compliance can trigger costly product recalls, hefty fines, and irreparable damage to brand trust, especially in the sensitive toy market. For example, in 2023, several toy recalls were initiated in the US due to lead paint violations, costing manufacturers millions in remediation and lost sales. Alpha Group must therefore invest heavily in quality control and compliance testing to mitigate these risks.

- Regulatory Compliance Costs: Alpha Group's annual expenditure on safety certifications and testing is estimated to be in the millions of dollars, a necessary investment to ensure market access and consumer safety.

- Product Recall Impact: A significant product recall, as seen with some competitors in 2023, can result in an average loss of 5-10% of annual revenue and a substantial decline in consumer confidence.

- Global Harmonization Challenges: While efforts towards global harmonization of toy safety standards are ongoing, Alpha Group must still manage varying compliance requirements across different jurisdictions, adding complexity and cost to its operations.

Advertising and marketing regulations

Alpha Group must navigate a complex web of advertising and marketing regulations, particularly those concerning children. Many regions, including the US with the Children's Online Privacy Protection Act (COPPA) and the UK with the Advertising Standards Authority (ASA) guidelines, impose strict rules on marketing to minors. These regulations often target deceptive practices, the use of influencers, and the collection of personal data from children, requiring Alpha Group to implement robust compliance measures for all campaigns. Failure to comply can result in significant fines; for instance, in 2023, a major tech company paid $190 million to settle FTC charges related to COPPA violations.

Ensuring adherence to these evolving legal frameworks is paramount for Alpha Group's brand reputation and ethical standing. This includes scrutinizing promotional offers, influencer collaborations, and data handling practices to guarantee they meet or exceed legal requirements. For example, the EU's General Data Protection Regulation (GDPR) also impacts how companies market to all age groups, with specific considerations for vulnerable populations like children, reinforcing the need for transparency and consent in data collection and usage.

Key considerations for Alpha Group's marketing compliance include:

- Compliance with child-specific advertising laws: Ensuring all marketing content directed at children is truthful, not misleading, and avoids exploiting their vulnerabilities.

- Data privacy adherence: Strictly following regulations like COPPA and GDPR regarding the collection and use of personal data from minors online.

- Endorsement and testimonial scrutiny: Verifying that any endorsements or testimonials used in marketing, especially by child influencers, are clearly disclosed and comply with advertising standards.

- Prize promotion and contest rules: Adhering to specific legal requirements for running contests and promotions, particularly when children are the target audience.

Alpha Group faces significant legal challenges related to intellectual property, requiring robust copyright and trademark enforcement to protect its valuable characters and designs from infringement. The global animation and toy market's substantial size underscores the financial imperative of safeguarding these assets, with an estimated value exceeding $200 billion in 2024.

Navigating international data privacy laws like GDPR and PIPL is critical, especially concerning children's data, with non-compliance leading to substantial fines, as exemplified by Meta's €1.2 billion GDPR penalty in 2023.

Alpha Group's licensing and distribution agreements, a key revenue driver, demand meticulous legal oversight due to their complexity and the significant economic stakes involved in the global digital content licensing market, valued at approximately $25 billion in 2024.

The company must also adhere to stringent global consumer product safety standards, with ongoing scrutiny of materials and potential recalls costing millions, as seen in 2023 product safety violations.

Environmental factors

Alpha Group faces increasing consumer and regulatory demands for environmental responsibility, necessitating a focus on sustainable material sourcing for its toy manufacturing. This means prioritizing materials like recycled plastics, bio-based alternatives, or wood from responsibly managed forests to lessen dependence on virgin resources.

By adopting eco-friendly materials, Alpha Group can significantly boost its brand image and align with growing stakeholder expectations for corporate environmental stewardship. For example, the global market for sustainable toys was valued at approximately $10.5 billion in 2023 and is projected to grow substantially by 2030, indicating a clear market trend.

Alpha Group faces growing pressure regarding the environmental footprint of its products, especially concerning plastic waste generated by toys and packaging. In 2024, consumer demand for sustainable practices continues to rise, with surveys indicating over 60% of shoppers prioritize eco-friendly packaging. This necessitates robust waste management and recycling initiatives to mitigate environmental impact.

The company is actively exploring enhanced product recycling programs and investing in design for recyclability to address these concerns. By adopting circular economy principles, Alpha Group aims to reduce its contribution to landfills, a critical step given that global plastic waste generation reached an estimated 400 million tonnes in 2023.

Alpha Group's operational carbon footprint, particularly from its animation studios and manufacturing, alongside its extensive supply chain, presents a significant environmental challenge. For instance, the global logistics sector, a key component of supply chains, accounted for approximately 25% of direct CO2 emissions from fuel combustion in 2023, according to the International Energy Agency.

To address this, Alpha Group is exploring strategies like transitioning to renewable energy sources for its facilities and optimizing its distribution networks to cut down on transportation-related greenhouse gas emissions. These efforts align with broader climate action goals, aiming to reduce the company's overall environmental impact.

Consumer demand for eco-friendly products

Consumer demand for eco-friendly products is significantly reshaping markets, with a notable trend towards environmentally conscious and ethically sourced goods. This preference extends across various sectors, including the toy and entertainment industries, where parents and consumers are increasingly scrutinizing the environmental footprint of products. For Alpha Group, this presents a clear opportunity to differentiate itself and build a stronger connection with its customer base.

By prioritizing the development and marketing of products with a reduced environmental impact, Alpha Group can tap into this growing consumer sentiment. Communicating these sustainability efforts transparently is crucial for building trust and enhancing brand loyalty. For instance, a 2024 survey indicated that 65% of consumers are willing to pay more for sustainable products, a figure that has been steadily climbing.

Meeting this evolving demand can directly translate into increased sales and a more resilient brand image. Companies that proactively integrate sustainability into their product lines and supply chains are better positioned for long-term growth. Alpha Group's commitment to this area could translate into tangible benefits:

- Increased Market Share: Capturing a larger segment of the eco-conscious consumer market.

- Enhanced Brand Reputation: Being recognized as a responsible and forward-thinking company.

- Customer Loyalty: Fostering deeper relationships with consumers who align with the company's values.

- Innovation Driver: Encouraging the development of new, sustainable materials and manufacturing processes.

Regulatory pressure for environmental compliance

Governments globally are intensifying their focus on environmental stewardship, leading to a surge in regulatory pressure for compliance across industries. For Alpha Group, this translates to a need to meticulously adhere to evolving laws governing manufacturing emissions, waste management, and the responsible use of chemicals. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully operational from January 2026, will impose carbon costs on imports, directly impacting supply chains and manufacturing processes for companies like Alpha Group that operate internationally.

Meeting these increasingly stringent environmental standards may necessitate substantial capital outlays for Alpha Group. This could involve upgrading existing infrastructure, investing in cleaner production technologies, or overhauling waste disposal systems. Failure to adapt not only risks financial penalties, such as the potential for significant fines under regulations like the US EPA's Clean Air Act, but also jeopardizes operational continuity and can severely damage the company's reputation among consumers and stakeholders.

The implications of regulatory pressure are multifaceted:

- Increased operational costs: Investments in compliance technologies and process changes can raise production expenses.

- Supply chain adjustments: Alpha Group may need to source materials from suppliers who meet higher environmental standards or face import tariffs.

- Reputational risk: Non-compliance can lead to public backlash and loss of customer trust, impacting sales and brand value.

- Opportunities for innovation: Proactive adaptation can foster innovation in sustainable practices, potentially creating a competitive advantage.

Alpha Group must navigate increasing global regulations focused on environmental impact, affecting everything from manufacturing emissions to packaging waste. For example, by 2025, many regions are expected to implement stricter rules on single-use plastics, directly impacting toy packaging. This regulatory landscape requires proactive adaptation to avoid penalties and maintain operational compliance.

The company's commitment to sustainability is increasingly tied to consumer preference, with a significant portion of consumers indicating a willingness to pay more for eco-friendly products. In 2024, studies showed that over 60% of consumers consider a company's environmental practices when making purchasing decisions. This trend highlights the financial incentive for Alpha Group to invest in greener materials and processes.

Alpha Group's carbon footprint, particularly from its animation studios and global supply chain, is under scrutiny. The logistics sector, a major contributor to emissions, saw global freight transport emissions reach approximately 8.7 billion tonnes of CO2 in 2023. Optimizing distribution and exploring renewable energy sources are crucial steps to mitigate these environmental challenges.

| Environmental Factor | Impact on Alpha Group | Key Data/Trend |

|---|---|---|

| Consumer Demand for Sustainability | Drives product innovation and brand loyalty | 65% of consumers willing to pay more for sustainable products (2024) |

| Regulatory Pressure | Requires investment in compliance and potential operational changes | EU CBAM operational from Jan 2026, impacting imports |

| Waste Management & Recycling | Necessitates improved product design and waste reduction initiatives | Global plastic waste generation ~400 million tonnes (2023) |

| Carbon Footprint | Demands energy efficiency and supply chain optimization | Global logistics sector accounted for ~25% of CO2 emissions (2023) |

PESTLE Analysis Data Sources

Our PESTLE Analysis is constructed using a diverse range of data, including official government publications, international economic reports, and leading industry analyses. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Alpha Group.