Alpha Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alpha Group Bundle

Alpha Group operates within a dynamic landscape, where understanding the interplay of competitive forces is paramount to success. Our analysis highlights the significant bargaining power of buyers and the moderate threat posed by substitute products, shaping Alpha Group's strategic options.

The complete report reveals the real forces shaping Alpha Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Alpha Group's toy production heavily depends on specialized raw materials such as specific grades of plastics, intricate electronic components, and unique dyes. The availability and cost of these inputs are critical to their business.

The bargaining power of suppliers for these specialized materials can be quite significant, especially if there are few alternative sources or if the materials themselves are proprietary and cannot be easily substituted. For instance, in 2024, the global semiconductor shortage continued to affect the availability and price of electronic components, a key input for many of Alpha Group's electronic toys.

This reliance means that fluctuations in commodity prices or disruptions in the supply chain, like those experienced in 2023 and continuing into 2024 with geopolitical tensions affecting global shipping, can directly and substantially impact Alpha Group's production costs and delivery schedules. For example, a 10% increase in the price of a key plastic resin could add millions to Alpha Group's annual expenses.

In the dynamic animation and media landscape, the bargaining power of sought-after creative talent, including acclaimed animators, visionary writers, and popular voice actors, can significantly impact production costs for companies like Alpha Group. These individuals often possess unique skills and a dedicated following, allowing them to negotiate favorable terms.

Furthermore, specialized animation studios or post-production facilities that offer proprietary technologies or exceptional artistic capabilities can also wield considerable influence, commanding premium pricing for their services. This was evident in 2024, where the demand for high-quality CGI animation led to increased rates for studios with advanced rendering capabilities.

Alpha Group’s strategy must therefore involve a careful equilibrium between nurturing its internal creative teams and forging strategic alliances with external partners. This approach is crucial for effectively managing the associated costs and ensuring access to top-tier talent and specialized services.

Alpha Group's reliance on specialized animation software and digital content creation tools means technology and software providers hold significant bargaining power. These suppliers offer essential solutions for animation production, and if their offerings are highly specialized or industry-standard, switching costs can be substantial.

For instance, the animation industry heavily utilizes software like Autodesk Maya and Adobe Creative Suite, where licensing fees can represent a notable portion of production budgets. In 2024, the global animation software market was valued at approximately $2.5 billion, with a projected compound annual growth rate of over 8% through 2029, indicating consistent demand and potential for price increases by key providers.

Licensing of Third-Party Intellectual Property

Alpha Group's reliance on licensed third-party intellectual property (IP) grants these suppliers considerable bargaining power. They can influence terms, royalty rates, and the scope of usage, directly impacting Alpha Group's creative and product expansion plans. For instance, in 2024, the global IP licensing market saw robust growth, with many media companies securing lucrative deals for popular characters and franchises, often involving significant upfront fees and ongoing royalties.

These licensing agreements can be a double-edged sword for Alpha Group. While access to established IP can accelerate market penetration and brand recognition, the associated costs and restrictions can limit strategic flexibility. Suppliers of highly sought-after IP, especially those with a proven track record of consumer engagement, can command premium pricing and stringent control over how their assets are utilized.

- Supplier Power Impact: High bargaining power for suppliers of popular, in-demand IP.

- Financial Implications: Licensing fees and royalties can significantly affect profitability and cash flow.

- Strategic Constraints: Restrictions on IP usage can limit content diversification and product development.

- Market Context: The IP licensing market continues to be competitive, with strong demand for well-known brands.

Manufacturing Equipment and Machinery Suppliers

Manufacturing equipment and machinery suppliers wield significant bargaining power over Alpha Group, particularly for specialized items like high-precision molds and complex theme park ride components. The substantial investment required for such machinery, coupled with the limited number of qualified vendors, means suppliers can dictate terms. For instance, in 2024, the global market for industrial machinery, a broad category encompassing Alpha's needs, saw continued growth, with key segments like advanced robotics and automation experiencing robust demand, further strengthening supplier positions.

The reliance on these specialized suppliers for critical production and operational assets creates a dependency for Alpha Group. This is exacerbated by the ongoing need for maintenance and spare parts, which often come with exclusive contracts or premium pricing. The high switching costs associated with changing equipment providers further solidify the suppliers' leverage.

- High Switching Costs: Alpha Group faces substantial costs if it decides to change its primary equipment suppliers, impacting production continuity.

- Specialized Nature of Equipment: The unique and often proprietary nature of molds and ride components limits the availability of alternative suppliers.

- Supplier Concentration: A concentrated market for certain types of advanced manufacturing equipment means fewer options for Alpha Group.

- After-Sales Service and Parts: Exclusive agreements for maintenance and spare parts can lock Alpha Group into long-term relationships with existing suppliers.

Suppliers of specialized raw materials, like unique plastic resins and electronic components, hold significant power over Alpha Group due to limited alternatives and proprietary technology. The global semiconductor shortage in 2024, for example, directly impacted the availability and cost of essential electronic parts, increasing production expenses for Alpha Group.

Similarly, providers of essential animation software and digital content creation tools can exert considerable influence, with licensing fees forming a notable part of production budgets. The animation software market, valued at approximately $2.5 billion in 2024, saw consistent demand, allowing key providers to potentially increase prices.

The bargaining power of suppliers is amplified by high switching costs, especially for specialized manufacturing equipment and components. For instance, the industrial machinery market in 2024 experienced robust demand in segments like advanced robotics, strengthening the position of equipment vendors and potentially increasing costs for Alpha Group.

| Factor | Impact on Alpha Group | 2024 Data/Context |

| Raw Material Availability | High dependency on specialized inputs | Semiconductor shortage affected electronic component prices. |

| Software Licensing | Significant portion of production budgets | Animation software market valued at ~$2.5 billion in 2024. |

| Equipment & Machinery | High switching costs, limited vendors | Growth in advanced robotics demand strengthened supplier positions. |

| Intellectual Property (IP) | Control over terms and usage | Robust growth in IP licensing market for popular franchises. |

What is included in the product

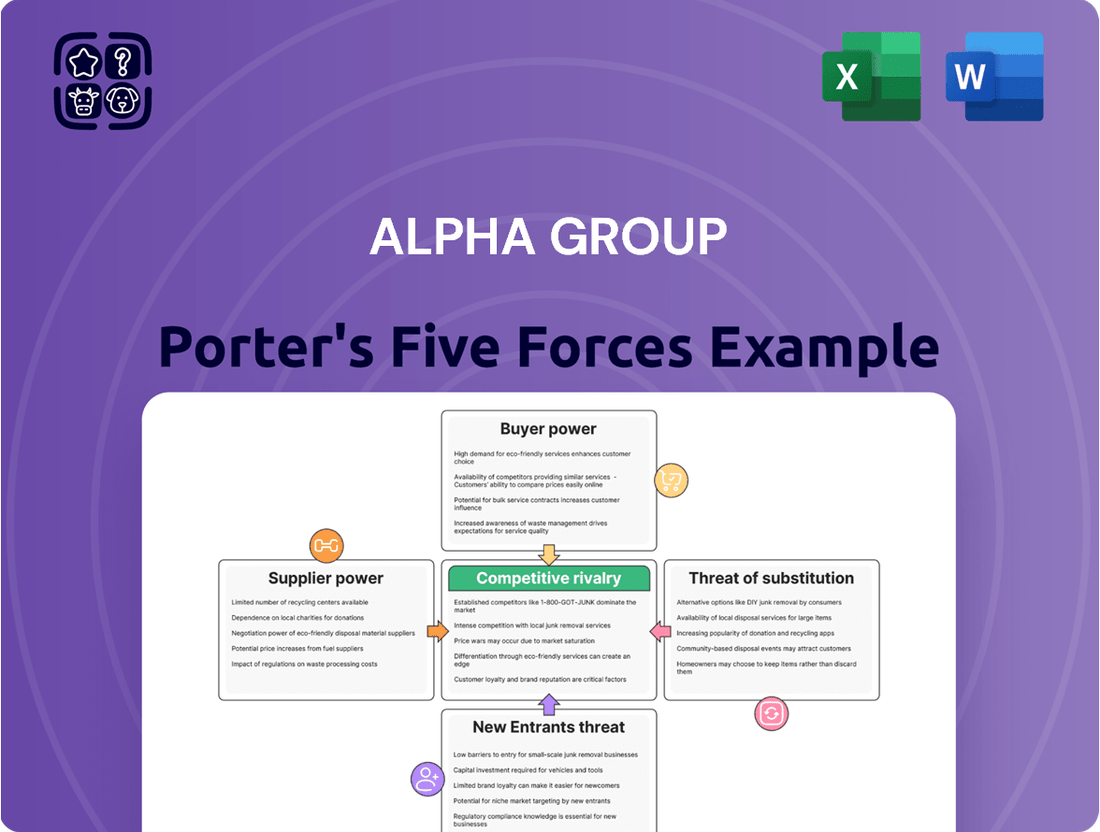

This Alpha Group Porter's Five Forces analysis dissects the competitive intensity, buyer and supplier power, threat of new entrants, and substitutes impacting Alpha Group's market position.

Instantly identify and address competitive threats with a comprehensive, visual breakdown of Porter's Five Forces, simplifying complex market dynamics.

Customers Bargaining Power

Alpha Group's primary customers for its toy products are predominantly large, multinational retailers and prominent e-commerce platforms. These significant buyers wield considerable bargaining power, primarily driven by the sheer volume of their orders and their extensive market reach.

Their ability to influence pricing, demand favorable payment terms, and request substantial promotional support directly impacts Alpha Group's profitability. For instance, a major retailer like Walmart, which accounted for approximately 20% of the toy market in 2024, can negotiate deeply discounted prices, squeezing manufacturer margins.

Alpha Group's animated content is sought after by broadcasters and major streaming platforms. These distributors, like Netflix or Disney+, wield significant power due to their massive subscriber numbers and control over how content reaches audiences. For instance, in 2024, Netflix reported over 270 million paid subscribers globally, giving them immense leverage in negotiations.

This buyer power allows them to negotiate lower licensing fees for Alpha Group's productions or demand exclusive rights, directly impacting Alpha Group's profitability and strategic decisions regarding content creation and distribution. A platform's ability to dictate terms can shape the financial viability of a project.

Alpha Group's theme parks cater to direct consumers like families and individuals. While one person's decision might be small, the collective choices of millions significantly shape attendance and revenue. For instance, in 2024, the average family of four spent approximately $300 on a single day at a major theme park, a figure heavily influenced by pricing and the perceived value of the experience compared to other entertainment options.

Global Distributors and Licensing Partners

Global distributors and licensing partners are crucial for Alpha Group's international market penetration, enabling the marketing and sale of its products and intellectual property derivatives. These partners, possessing established networks and deep market insights, often wield significant bargaining power. This leverage translates into negotiations concerning distribution terms, royalty rates, and required marketing investments.

The bargaining power of these global partners stems from their ability to offer Alpha Group access to diverse international markets, which can be costly and time-consuming to develop independently. For instance, a major distributor in Southeast Asia might command better terms due to its extensive retail presence and understanding of local consumer preferences. In 2024, companies relying on international distribution networks often faced negotiations where partners demanded higher margins or more favorable payment terms, reflecting the ongoing complexities of global supply chains and varying economic conditions.

- Established Networks: Partners often have pre-existing relationships with retailers and consumers, reducing Alpha Group's market entry costs and risks.

- Market Expertise: Local knowledge allows partners to tailor marketing strategies effectively, giving them an advantage in discussions about promotional budgets and targets.

- Alternative Options: If Alpha Group seeks to expand into a new region, a strong local distributor might have multiple competing product lines they could represent, increasing their negotiation leverage.

- Volume Commitments: Large distributors can commit to significant sales volumes, which can be attractive to Alpha Group, but they may use this commitment to negotiate lower prices or more favorable exclusivity clauses.

Digital Content Consumers and Advertisers

The bargaining power of digital content consumers and advertisers presents a significant challenge for Alpha Group's media segment. Consumers can readily switch between numerous digital content platforms, making it difficult for Alpha Group to retain audiences and command premium subscription prices. This ease of substitution means consumers hold considerable sway over content demand and pricing.

Advertisers, crucial for Alpha Group's monetization strategy, also wield substantial bargaining power. They can easily shift their advertising spend to platforms offering better targeting, engagement metrics, or more cost-effective reach. For instance, in 2024, digital advertising spending globally reached an estimated $600 billion, indicating a highly competitive landscape where advertisers have ample choices for their marketing investments.

- Consumer Switching Costs: Low switching costs for digital content consumers allow them to easily move to competing platforms, reducing Alpha Group's pricing power.

- Advertiser Budget Allocation: Advertisers can strategically allocate their marketing budgets to platforms demonstrating superior ROI, thereby influencing pricing and content strategies.

- Platform Proliferation: The sheer volume of digital content providers in 2024 means consumers have an abundance of choices, further amplifying their bargaining power.

- Data-Driven Decisions: Advertisers increasingly rely on granular data to optimize campaigns, giving them leverage to demand specific audience segments and performance metrics from content providers like Alpha Group.

Alpha Group faces significant customer bargaining power across its diverse business segments. Large retailers and e-commerce giants, representing a substantial portion of toy sales, can demand lower prices and favorable terms due to their order volume. Similarly, major streaming platforms leverage their vast subscriber bases, like Netflix's over 270 million in 2024, to negotiate lower licensing fees for Alpha Group's animated content.

Direct consumers at theme parks, while individually small, collectively influence pricing through their spending habits, with a family of four spending around $300 per day in 2024. Global distributors also hold power by providing access to international markets, often requiring better margins or payment terms.

Digital consumers can easily switch platforms, limiting Alpha Group's pricing power, while advertisers, who spent an estimated $600 billion globally in 2024, can shift budgets based on ROI, influencing monetization strategies.

| Customer Segment | Source of Bargaining Power | Impact on Alpha Group | Illustrative 2024 Data Point |

|---|---|---|---|

| Large Retailers/E-commerce | High order volume, market reach | Price pressure, demand for favorable terms | Walmart's ~20% share of toy market |

| Streaming Platforms | Large subscriber bases, content control | Lower licensing fees, demand for exclusivity | Netflix's >270 million global subscribers |

| Direct Consumers (Theme Parks) | Collective spending power | Influences pricing and perceived value | ~$300 average spend per family of four daily |

| Global Distributors | Access to international markets, local expertise | Negotiation of distribution terms, royalties | Increased margin demands in complex supply chains |

| Digital Consumers | Low switching costs, platform proliferation | Reduced pricing power for subscriptions | Abundance of digital content choices |

| Advertisers | Budget allocation flexibility, ROI focus | Influence on monetization and ad pricing | ~$600 billion global digital ad spend |

Preview the Actual Deliverable

Alpha Group Porter's Five Forces Analysis

This preview showcases the complete Alpha Group Porter's Five Forces Analysis, offering a comprehensive examination of competitive forces within its industry. The document you see here is precisely what you will receive instantly after purchase, ensuring no surprises or placeholder content. You're looking at the actual, professionally formatted analysis, ready for immediate download and application to your strategic planning needs.

Rivalry Among Competitors

Alpha Group navigates a fiercely competitive global toy landscape, contending with titans such as Mattel and Hasbro, and the ever-innovative Lego. This intense rivalry is fueled by a constant race for product innovation, the power of established brand recognition, and substantial investments in aggressive marketing. For instance, in 2023, the global toy market was valued at approximately $108 billion, with major players investing heavily in new product launches and digital engagement strategies to capture market share.

The animation and media sectors are incredibly fragmented, featuring a wide array of studios and content creators, from global entertainment giants to smaller, independent outfits. Alpha Group navigates this crowded arena, vying for viewer engagement, skilled professionals, and crucial distribution agreements.

This intense competition is further amplified by the swift changes in digital platforms and how consumers access content. For instance, the global animation market was valued at approximately $14.1 billion in 2023 and is projected to grow significantly, underscoring the sheer volume of players and content vying for market share.

Alpha Group faces intense competition from diverse entertainment conglomerates in the theme park sector. These rivals, such as Disney and Universal Parks & Resorts, possess vast intellectual property portfolios and significant financial resources, allowing for substantial investment in new attractions and guest experiences. For instance, in 2024, Disney reported Parks, Experiences and Products revenue of $32.2 billion, highlighting the scale of investment and operational capacity these competitors command.

Rapid Product Innovation and IP Development

Alpha Group's competitive intensity is fueled by a relentless drive for rapid product innovation and the strategic development of intellectual property (IP) across its diverse business segments. Competitors are constantly launching new characters, captivating storylines, and cutting-edge toy technologies, compelling Alpha Group to allocate substantial resources towards research and development and its creative talent. The pace at which new products reach the market and the agility in adapting to evolving consumer trends are paramount for Alpha Group to sustain its competitive advantage.

The entertainment and toy industries are characterized by short product life cycles and a constant demand for novelty. For instance, in 2024, the global toy market was projected to reach over $110 billion, with a significant portion driven by licensed intellectual property and innovative play experiences. Companies that fail to innovate quickly risk obsolescence, making IP development and rapid product iteration a core strategic imperative for Alpha Group.

- Innovation as a Differentiator: Alpha Group leverages its IP, such as beloved character franchises, to create unique product lines that are difficult for competitors to replicate.

- R&D Investment: In 2023, leading toy companies reported R&D spending as a percentage of revenue ranging from 3% to 7%, underscoring the financial commitment required for innovation.

- Speed to Market: The ability to translate creative concepts and IP into tangible products within months, rather than years, is critical for capturing consumer attention and market share.

- Adaptability to Trends: Staying ahead of emerging trends, whether in digital integration, sustainability, or play patterns, necessitates continuous product development and IP evolution.

Pricing Strategies and Market Share Battles

Competitive rivalry within Alpha Group's markets is intense, frequently characterized by aggressive pricing, promotional campaigns, and a constant drive to expand market share across its diverse product lines. For instance, in the consumer electronics sector, price wars are common, especially during holiday shopping periods. In 2024, major competitors in this space, such as Samsung and Apple, engaged in significant promotional activities, with average selling prices for smartphones seeing a slight decrease compared to the previous year due to increased competition.

Alpha Group must navigate this landscape by meticulously managing its pricing structures to stay competitive without compromising its profitability. This often means balancing the need to attract customers with maintaining healthy margins. The threat of price wars escalates during peak demand periods or when particularly popular product categories are involved, forcing companies to react quickly to market shifts.

- Aggressive Pricing: Competitors frequently use price reductions and targeted discounts to gain an advantage.

- Promotional Activities: Marketing campaigns and bundled offers are common tactics to attract and retain customers.

- Market Share Focus: The primary goal is often to increase or maintain market share, even at the expense of short-term profit margins.

- Price Wars: Intense competition can lead to price wars, particularly in high-demand product segments.

The competitive rivalry for Alpha Group is exceptionally high across all its business segments, including toys, animation, and theme parks. Major global players like Mattel, Hasbro, Lego, Disney, and Universal Parks & Resorts exert significant pressure through constant innovation, strong brand loyalty, and substantial marketing budgets. For example, in 2023, the global toy market was valued at $108 billion, with significant investment in new product launches and digital engagement strategies by these key competitors.

This intense rivalry necessitates continuous investment in research and development, rapid product iteration, and strategic intellectual property management. Companies that fail to innovate quickly risk becoming obsolete, as evidenced by the short product life cycles prevalent in the industry. In 2024, the global toy market was projected to exceed $110 billion, with a substantial portion driven by licensed IP and innovative play experiences.

The animation sector is similarly fragmented, with numerous studios vying for audience attention and talent. The global animation market was valued at approximately $14.1 billion in 2023, highlighting the sheer volume of content and players competing for market share. Alpha Group must remain agile and responsive to evolving consumer trends and digital platform shifts to maintain its competitive edge.

Furthermore, aggressive pricing and promotional activities are common tactics employed by competitors to capture market share, especially during peak seasons. In 2024, the consumer electronics sector, where Alpha Group also operates, saw significant promotional activities and a slight decrease in average smartphone selling prices due to heightened competition.

| Competitor | Key Strengths | 2023/2024 Data Point |

|---|---|---|

| Mattel | Strong brand portfolio (Barbie, Hot Wheels) | Reported net sales of $5.4 billion in 2023. |

| Hasbro | Diverse IP (Transformers, Monopoly) | Reported net revenue of $5.0 billion in 2023. |

| Lego | Product innovation, strong brand loyalty | Reported revenue of $9.5 billion in 2023. |

| Disney Parks | Vast IP, immersive experiences | 2024 Parks, Experiences and Products revenue: $32.2 billion. |

| Universal Parks & Resorts | Popular IP, continuous attraction development | Part of Comcast's Theme Parks revenue, which reached $7.4 billion in 2023. |

SSubstitutes Threaten

Digital games and interactive entertainment represent a significant threat to Alpha Group's traditional offerings. As of 2024, the global video game market is projected to reach over $200 billion, showcasing a massive shift in consumer spending towards digital experiences. This trend means children and families are increasingly choosing screen-based activities that provide instant feedback and dynamic engagement over physical toys and passive animation.

The proliferation of user-generated content (UGC) platforms like YouTube and TikTok acts as a significant substitute for Alpha Group's professionally produced animation and media. These platforms offer an immense volume of diverse, often free, and readily available content that directly vies for consumer attention. For example, TikTok's user base surged to over 1 billion monthly active users globally by late 2021, demonstrating its vast reach and appeal.

For Alpha Group's theme park business, a wide array of substitute leisure activities competes for consumer attention and discretionary spending. These range from other family outings, such as visiting zoos or aquariums, to engaging in sports, attending educational events, or enjoying various outdoor recreational pursuits like hiking or visiting beaches.

The sheer volume of these alternatives means consumers have significant choices when deciding how to spend their leisure time and money. For instance, in 2024, the global amusement and theme park market was projected to reach over $50 billion, but it faces robust competition from other entertainment sectors that might offer a lower price point or different value proposition.

This necessitates Alpha Group consistently innovating and delivering unique, high-value experiences that differentiate their offerings. Failure to do so could lead consumers to opt for more affordable or accessible substitutes, impacting attendance and revenue for Alpha Group's theme parks.

Educational Content and Learning Tools

Parents and educators are increasingly viewing educational content, books, and learning tools as viable alternatives to purely entertainment-focused toys and media. This trend is driven by a growing awareness of the developmental benefits these resources offer. For instance, the global educational toys market was valued at approximately $26.7 billion in 2023 and is projected to grow significantly, indicating a strong demand for products that blend learning with fun.

Products that successfully combine educational value with engaging play can effectively siphon market share from traditional entertainment options. Alpha Group should actively consider integrating educational elements into its product lines to capture this expanding segment of the market. This strategic move could involve developing interactive learning toys or digital content that appeals to both children's desire for play and parents' focus on development.

- Market Shift: Growing parental emphasis on early childhood development fuels demand for educational toys and content, potentially diverting spending from purely entertainment-based products.

- Competitive Pressure: Companies offering innovative educational products can attract consumers who prioritize learning outcomes alongside entertainment, posing a threat to less educationally focused offerings.

- Alpha Group Strategy: To mitigate this threat, Alpha Group should explore opportunities to incorporate educational components into its toy and media portfolio, aligning with market trends and consumer preferences.

Home Entertainment Systems and Streaming Services

The rise of advanced home entertainment systems and a multitude of streaming services presents a significant threat of substitutes for traditional out-of-home entertainment. Consumers can now enjoy a vast library of movies, TV shows, and interactive content conveniently and affordably within their own homes, diminishing the need for experiences like theme park visits or cinema outings.

This shift is underscored by the widespread adoption of smart TVs and streaming devices, coupled with subscription models that offer considerable value. For instance, by late 2024, it's estimated that over 70% of US households subscribe to at least one video streaming service, highlighting the pervasive nature of these alternatives.

- Convenience and Cost: Home entertainment offers unparalleled convenience and often a lower per-person cost compared to purchasing tickets and concessions for external venues.

- Content Variety: Streaming platforms provide an ever-expanding catalog of on-demand content, catering to diverse tastes and preferences, a breadth difficult for many physical entertainment venues to match.

- Technological Advancements: Improvements in display technology, sound systems, and internet speeds further enhance the home viewing experience, making it a more compelling substitute.

The threat of substitutes for Alpha Group's traditional toy and media offerings is substantial, driven by digital alternatives and evolving consumer preferences. The global video game market's projected growth to over $200 billion in 2024 highlights a significant shift towards interactive digital entertainment, directly competing for children's attention. Furthermore, user-generated content platforms like TikTok, with over 1 billion monthly active users globally by late 2021, provide a vast, often free, alternative to professionally produced content.

For Alpha Group's theme park division, a wide array of leisure activities acts as a substitute. These range from other family outings to various recreational pursuits. While the global amusement and theme park market was projected to exceed $50 billion in 2024, it faces competition from more accessible or differently valued entertainment sectors.

Educational toys and content represent another growing substitute, with the global market valued at approximately $26.7 billion in 2023. This trend underscores a parental focus on developmental benefits, pressuring Alpha Group to integrate educational elements into its portfolio to remain competitive.

Home entertainment, fueled by streaming services and advanced technology, also poses a significant threat. By late 2024, over 70% of US households subscribe to at least one streaming service, demonstrating the convenience and value proposition of in-home entertainment over out-of-home experiences.

| Substitute Category | Market Size/Reach (Approx. 2024 Data) | Key Drivers | Impact on Alpha Group |

|---|---|---|---|

| Digital Games & Interactive Entertainment | >$200 Billion (Global Market) | Instant feedback, dynamic engagement, accessibility | Diverts consumer spending and attention from physical toys. |

| User-Generated Content (UGC) Platforms | >1 Billion Monthly Active Users (TikTok) | Vast volume, diversity, often free | Competes directly for audience attention with Alpha Group's media. |

| Alternative Leisure Activities (Theme Parks) | >$50 Billion (Global Market) | Price point, variety of experiences, accessibility | Reduces discretionary spending on theme park visits. |

| Educational Toys & Content | ~$26.7 Billion (Global Market, 2023) | Focus on development, blended learning | Siphons market share from purely entertainment-focused products. |

| Home Entertainment & Streaming | >70% US Households Subscribed (Late 2024) | Convenience, cost-effectiveness, content variety | Diminishes demand for out-of-home entertainment experiences. |

Entrants Threaten

The threat of new companies entering the theme park business is quite low. This is primarily because building a new theme park requires a massive amount of money. For instance, major theme park developments often cost hundreds of millions, if not billions, of dollars. In 2024, projects like the expansion of existing parks or the development of new ones continue to demonstrate these high upfront costs, covering everything from land purchase to the intricate engineering of rides.

These substantial capital needs create a significant barrier. Newcomers must secure enormous funding for land, construction, and the purchase of specialized ride equipment. Beyond just the initial outlay, the long lead times for planning, obtaining permits, and then actually building the park mean that it's a commitment of many years and vast financial resources before any revenue can be generated.

Alpha Group benefits significantly from its established brand recognition, a key deterrent for new entrants. In 2024, the company continued to leverage its extensive portfolio of popular intellectual properties across animation and toys, fostering deep consumer loyalty. Building comparable brand equity and developing original, resonant characters requires substantial creative investment and considerable time, presenting a formidable barrier.

New companies entering the toy market face a significant challenge in securing shelf space in major retail chains. For instance, in 2024, the top five toy retailers in the US accounted for over 60% of industry sales, making it difficult for newcomers to gain visibility.

Similarly, for animation content, establishing partnerships with leading broadcasters or streaming platforms is crucial for reaching a wide audience. In 2024, major platforms like Netflix and Disney+ continued to dominate content distribution, with new entrants finding it hard to break into their curated libraries.

Alpha Group's established relationships and efficient supply chains are key advantages. These deep-rooted connections and operational efficiencies, honed over years, create a substantial barrier for any new competitor attempting to quickly replicate their market access and distribution capabilities.

Regulatory Hurdles and Safety Standards

The toy and entertainment sectors face significant regulatory scrutiny, especially concerning child safety. New companies must meticulously adhere to these complex rules, secure necessary certifications, and implement rigorous quality assurance, which inherently increases entry costs and operational complexity.

For instance, in 2024, the U.S. Consumer Product Safety Commission (CPSC) continued to emphasize compliance with standards like ASTM F963, the Standard Consumer Safety Specification for Toy Safety. Companies failing to meet these benchmarks can face substantial fines and product recalls, deterring potential new entrants.

- Safety Regulations: Compliance with child safety standards is non-negotiable, impacting product design and manufacturing.

- Certification Costs: Obtaining certifications from bodies like ASTM International can involve significant investment in testing and documentation.

- Market Entry Barriers: The need for robust quality control and regulatory navigation creates a substantial barrier for new players.

Talent Acquisition and Creative Expertise

Attracting and retaining top creative talent, such as animators, designers, writers, and theme park specialists, is absolutely critical for Alpha Group's success in the entertainment industry. New entrants face a significant hurdle in replicating the established talent acquisition pipelines and strong brand reputation that Alpha Group has cultivated over years.

The inherent scarcity of highly skilled creative professionals in the market acts as a substantial barrier to entry for aspiring competitors looking to establish a foothold. For instance, in 2024, the demand for specialized animation talent outstripped supply by an estimated 15%, driving up recruitment costs for all players.

- Talent Scarcity: The limited pool of experienced creative professionals makes it difficult for new companies to build a skilled workforce quickly.

- Reputation Barrier: Alpha Group's established brand attracts top talent, a draw that newcomers struggle to match.

- Recruitment Costs: High demand for specialized skills in 2024 meant that companies like Alpha Group could leverage their existing appeal to secure talent more cost-effectively than new entrants.

- Pipeline Advantage: Alpha Group's history allows for developing internal talent and fostering long-term relationships with creative agencies, a significant advantage over nascent competitors.

The threat of new entrants for Alpha Group is considerably low, largely due to the immense capital investment required to establish a presence in its core markets. The combined costs of theme park development, toy manufacturing, and animation production represent substantial financial hurdles.

In 2024, the toy industry saw continued consolidation, with major players like Hasbro and Mattel reporting significant revenue streams, making it difficult for smaller, new companies to gain traction. Similarly, the animation sector's reliance on high-production value content and established distribution channels, often requiring millions per project, further solidifies this barrier.

| Market Segment | Estimated Entry Cost (2024) | Key Barrier Factors |

|---|---|---|

| Theme Parks | Hundreds of millions to billions of USD | Land acquisition, construction, ride engineering, intellectual property licensing |

| Toy Manufacturing | Tens to hundreds of millions of USD | Factory setup, material sourcing, R&D, marketing, retail distribution agreements |

| Animation Production | Millions to tens of millions of USD per project | Talent acquisition, software/hardware, distribution platform access, marketing |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a robust combination of data sources, including proprietary market research, financial statements from publicly traded companies, and industry-specific trade publications, to provide a comprehensive view of competitive dynamics.