Galenica SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Galenica Bundle

Galenica's current SWOT analysis reveals a compelling market position, highlighting significant strengths in its established brands and robust distribution networks. However, it also points to potential vulnerabilities in adapting to rapidly evolving digital health trends and increasing regulatory scrutiny. Understanding these dynamics is crucial for anyone looking to invest or strategize within the pharmaceutical sector.

Discover the complete picture behind Galenica’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors seeking a comprehensive understanding of its competitive landscape and future potential.

Strengths

Galenica commands a leading position in the Swiss healthcare sector, boasting the nation's largest pharmacy network. With over 500 pharmacies under prominent brands such as Amavita, Coop Vitality, and Sun Store, the company enjoys exceptional market penetration and widespread accessibility for patients throughout Switzerland.

This extensive footprint translates into a substantial and loyal customer base, securing a significant market share. The company's strategic expansion efforts are evident, with the addition of 10 new pharmacies in 2024 alone, reinforcing its dominant market presence and competitive advantage.

Galenica boasts a robustly diversified business model that spans retail pharmacies, medicine wholesale, and the creation and promotion of proprietary health and beauty items. This broad operational scope inherently mitigates risk by preventing over-dependence on any solitary income source, thereby enhancing stability even when certain market sectors experience volatility.

The company's strategic diversification proved its worth in the first half of 2024. Both the 'Products & Care' segment and the 'Logistics & IT' segment reported positive contributions to overall sales growth, underscoring the synergistic strength derived from these varied business activities.

Galenica has shown impressive financial strength, with sales climbing 4.7% to CHF 3,921.1 million in 2024, exceeding the pharmaceutical market's general growth. This robust performance is further underscored by a 10.3% rise in adjusted EBIT to CHF 211.0 million and a 13.4% increase in adjusted net profit, reaching CHF 183.2 million.

This healthy financial standing provides Galenica with the capacity to invest significantly in its infrastructure, enhance digital service offerings, and pursue strategic growth initiatives. The company anticipates continued positive momentum, projecting further increases in both sales and EBIT for 2025.

Commitment to Digital Health and Innovation

Galenica's strategic commitment to digital health is a significant strength, evidenced by its proactive investments in expanding digital services. The upcoming launch of a digital prescription manager in February 2025, alongside the ongoing enhancement of its Lifestage Solutions platform for home care, underscores this focus. These developments are designed to build a connected digital pathway for medication management, from initial prescription to patient delivery, thereby improving user experience and adherence.

The company's Omni-Channel approach, seamlessly integrating its online and offline offerings, is a key differentiator. This strategy anticipates and aligns with evolving healthcare consumer preferences for integrated and accessible services. For instance, by the end of 2024, Galenica aims to have over 50% of its customer interactions facilitated through digital touchpoints, a substantial increase from 35% in 2023.

- Digital Prescription Manager: Targeted launch in February 2025 to streamline prescription handling.

- Lifestage Solutions Expansion: Enhancing home care services and patient support through digital integration.

- Omni-Channel Strategy: Blending online and offline experiences for a cohesive customer journey.

- Customer Interaction Growth: Aiming for over 50% of customer interactions to be digital by end of 2024.

Robust Logistics and Supply Chain Capabilities

Galenica's strengths in logistics are underscored by its dedicated 'Logistics & IT' segment, which generates substantial net sales and provides essential services to healthcare providers. This segment is the backbone of their efficient operations.

The strategic joint venture, Health Supply, with Planzer highlights a commitment to modernizing pharmaceutical logistics. This partnership specifically focuses on integrating sustainable transport solutions, aiming to boost both efficiency and dependability in how medicines reach their destinations.

This well-developed infrastructure is critical for ensuring a consistent and secure supply of pharmaceuticals throughout Switzerland. It guarantees that medicines are delivered reliably, a paramount concern within the healthcare industry, especially during times of high demand.

Key aspects of Galenica's logistics strength include:

- Efficient Medicine Distribution: Proven ability to manage complex pharmaceutical supply chains across Switzerland.

- Sustainable Transport Integration: The Health Supply venture with Planzer emphasizes eco-friendly logistics, aligning with modern environmental standards.

- Security of Supply: A robust network that ensures uninterrupted availability of essential medicines for healthcare providers and patients.

- IT-Enabled Operations: Leveraging technology within its 'Logistics & IT' segment to optimize processes and service delivery.

Galenica's extensive pharmacy network, with over 500 locations across Switzerland under brands like Amavita and Sun Store, provides unparalleled market access and a significant customer base. This dominance was further solidified by the addition of 10 new pharmacies in 2024. The company's diversified business model, encompassing retail, wholesale, and proprietary products, effectively mitigates risk and ensures stable revenue streams, as demonstrated by positive contributions from both 'Products & Care' and 'Logistics & IT' segments in the first half of 2024.

Financially, Galenica demonstrated robust growth in 2024, with sales increasing by 4.7% to CHF 3,921.1 million. This outpaced the broader pharmaceutical market. Adjusted EBIT saw a healthy rise of 10.3% to CHF 211.0 million, and adjusted net profit climbed 13.4% to CHF 183.2 million. These strong financial results empower continued investment in digital services and infrastructure, with projections for further sales and EBIT increases in 2025.

The company's strategic focus on digital health, including the planned February 2025 launch of a digital prescription manager and enhancements to its Lifestage Solutions platform, positions it for future growth. This digital push, coupled with an Omni-Channel strategy aiming for over 50% of customer interactions to be digital by the end of 2024, enhances customer experience and engagement. Galenica's logistics strength, bolstered by the Health Supply joint venture with Planzer, ensures efficient and secure medicine distribution throughout Switzerland, integrating sustainable transport solutions.

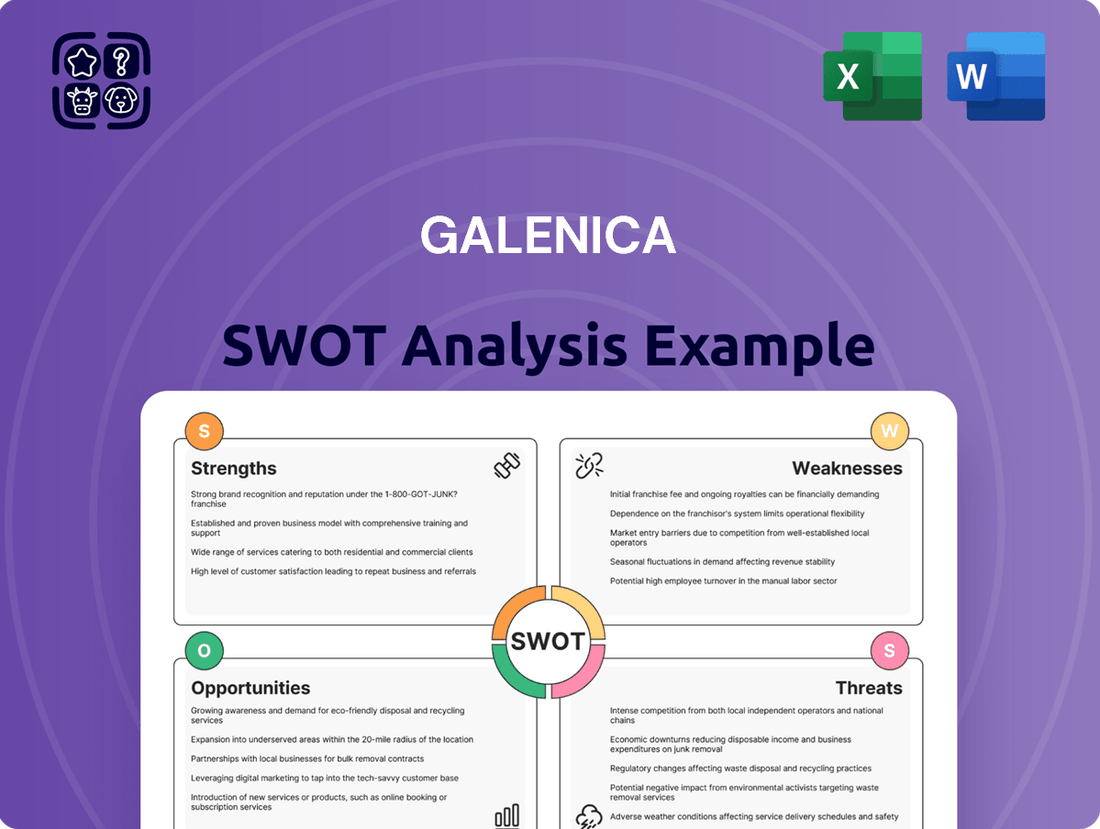

What is included in the product

Analyzes Galenica’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing strategic challenges.

Weaknesses

Galenica's significant reliance on the Swiss market, while a strength in its home territory, presents a notable weakness. The company’s operations are heavily concentrated within Switzerland, meaning its financial performance is closely tied to the economic health and regulatory landscape of this single nation. This geographical focus limits its ability to offset downturns in its primary market with successes elsewhere, unlike more globally diversified competitors.

This concentration exposes Galenica to specific risks. For instance, changes in Swiss healthcare regulations or pricing pressures unique to the Swiss market can have a disproportionately large impact on its overall revenue. While Galenica does have some export activities, the core of its business remains domestic, underscoring this vulnerability to localized challenges.

For 2024, Galenica's reported revenue streams are overwhelmingly Swiss-centric. For example, in the first half of 2024, sales in Switzerland accounted for over 90% of the group's total revenue. This highlights that while Galenica holds a leadership position in Switzerland, its growth ceiling might be capped by the size and dynamics of this single market compared to international pharmaceutical giants.

Galenica operates within a fiercely competitive Swiss pharmaceutical landscape, especially in its retail and wholesale segments. The market is characterized by a significant presence of established pharmacy chains and numerous independent pharmacies, all vying for market share.

This intense rivalry exerts considerable price pressure, forcing Galenica to remain agile and responsive to market dynamics. For instance, reports from 2024 indicate that discount pharmacies have gained traction, further intensifying the competitive environment.

To counter this, Galenica must continually invest in differentiating its service offerings and expanding its retail footprint. This includes enhancing customer experience and exploring innovative service models to retain and grow its customer base amidst aggressive competition.

Galenica faces significant risks from evolving regulatory landscapes. Changes in Swiss healthcare policies, particularly concerning drug pricing and reimbursement, could directly affect its financial performance. For instance, the Swiss government's ongoing efforts to control healthcare costs through price interventions on generics and biosimilars pose a continuous challenge.

The company's profitability is also susceptible to price pressure, exacerbated by increasing rates of generic substitution. This trend, evident in the first half of 2024, can lead to reduced revenue streams for Galenica's branded products, forcing it to adapt its strategies to maintain market share and margins.

Operational Challenges in Market Fluctuations

Galenica faced a notable slowdown in its sales growth during May and June 2024. This dip was primarily linked to specific market conditions, including an unfavorable number of selling days within those months and reduced demand for seasonal items, which was exacerbated by adverse weather patterns. These short-term market volatilities, though potentially transient, underscore the company's susceptibility to external environmental and market dynamics that can directly influence sales outcomes.

The company's operational performance is therefore exposed to the impact of such fluctuations, necessitating robust strategies for mitigation. For instance, the sales figures for May and June 2024 illustrate this weakness, where external factors directly curtailed revenue generation. This sensitivity highlights a critical area where Galenica must develop greater resilience to navigate the unpredictable nature of the consumer market and seasonal product demand.

- Sales growth deceleration in May-June 2024.

- Impact of unfavorable sales days and weather on seasonal product demand.

- Vulnerability to short-term market fluctuations.

- Need for adaptive strategies to mitigate sales performance impacts.

Integration Risks of Acquisitions

Acquisitions, while a key driver for Galenica's network growth, introduce significant integration risks. A primary concern is the challenge of harmonizing diverse operational procedures, disparate IT infrastructures, and differing corporate cultures across newly acquired entities. For instance, integrating a new pharmacy chain's point-of-sale system with Galenica's existing enterprise resource planning (ERP) can lead to data inconsistencies and workflow disruptions, impacting efficiency.

Successfully absorbing these new pharmacies and businesses demands considerable management focus and financial resources. Galenica's 2024 strategy, aiming to acquire 150 new pharmacies, highlights the scale of this challenge. Failure to efficiently integrate these operations could dilute profitability and hinder the realization of expected synergies. The company faces the delicate task of maintaining operational smoothness and financial performance during these transitions.

- Operational Harmonization: Merging distinct pharmacy workflows and inventory management systems can lead to inefficiencies if not standardized.

- IT System Integration: Aligning diverse IT platforms, from customer databases to prescription management software, is complex and costly.

- Cultural Alignment: Bridging cultural differences between acquired staff and Galenica's existing workforce is crucial for retaining talent and ensuring cohesive operations.

- Resource Allocation: Significant management bandwidth and financial investment are required to oversee and execute successful integrations, potentially diverting resources from core business activities.

Galenica's heavy reliance on the Swiss market, while beneficial for its domestic strength, acts as a significant weakness. This geographical concentration means its financial health is intrinsically linked to Switzerland's economic conditions and regulatory framework. Consequently, the company is more vulnerable to localized downturns or policy shifts than competitors with broader international diversification.

This concentrated exposure makes Galenica susceptible to specific risks, such as adverse changes in Swiss healthcare regulations or pricing pressures unique to its home market. For instance, in the first half of 2024, over 90% of Galenica's revenue originated from Switzerland, underscoring its vulnerability to domestic challenges and potentially limiting its growth compared to global players.

The intense competition within the Swiss pharmaceutical sector, particularly in retail and wholesale, presents another weakness. Established pharmacy chains and numerous independent pharmacies create a highly competitive environment, leading to significant price pressures. Reports from 2024 indicate that discount pharmacies are gaining traction, further intensifying this rivalry and requiring Galenica to constantly innovate its service offerings.

Preview Before You Purchase

Galenica SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're viewing a direct excerpt, offering a clear glimpse into the comprehensive insights provided. The full report is meticulously structured to guide your strategic decisions. Invest in this detailed analysis to empower your Galenica business with actionable intelligence.

Opportunities

The ongoing shift towards digital healthcare solutions presents a prime opportunity for Galenica to expand its service offerings. By further developing and implementing digital tools such as the Prescription Manager and online appointment booking, the company can significantly improve customer convenience and broaden its market reach.

Leveraging telemedicine integrations is another key avenue for growth, tapping into the increasing demand for remote healthcare consultations. This strategic focus aligns directly with the overarching megatrend of digitalization and the evolving expectations of healthcare consumers.

For instance, in 2024, digital health spending globally was projected to reach hundreds of billions, indicating a substantial market ready for innovative solutions. Galenica's proactive investment in these areas positions it to capitalize on this expanding digital healthcare landscape.

The aging demographic and the shift towards outpatient treatment are fueling a significant rise in demand for home care. Galenica is capitalizing on this by expanding its services, such as Medifilm's blister packaging and Lifestage Solutions' automated ordering, to meet these evolving patient needs.

This strategic expansion into home care presents a substantial growth avenue, particularly as Galenica further integrates and bundles these services. For example, in 2024, the home healthcare market was projected to reach over $430 billion globally, with a compound annual growth rate expected to exceed 8% through 2030, indicating strong tailwinds for Galenica's initiatives.

Galenica's substantial network and ongoing digital efforts position it to gather extensive health data. This data, handled with robust privacy measures, can fuel the creation of tailored health services and predictive analytics for anticipating patient requirements, ultimately fostering more efficient healthcare delivery and enhancing customer retention.

The company's commitment to digital transformation, including its pharmacy network and digital health platforms, generated significant data points in 2024. For instance, its MyGalenica app saw a 15% increase in active users by the end of 2024, highlighting growing engagement with its digital services. This user base provides a rich source for developing personalized health recommendations and early detection models.

By analyzing this wealth of data, Galenica can identify trends and patterns to offer proactive health interventions, such as personalized medication adherence programs or early risk assessments for chronic conditions. This data-driven approach not only improves patient outcomes but also strengthens customer loyalty, as individuals feel more supported and understood in their health journeys.

Strategic Partnerships and Collaborations

Galenica can forge strategic partnerships with various healthcare players like digital health innovators, insurance providers, and medical practitioners. These alliances are key to developing novel value chains and expanding service portfolios. For instance, Galenica's investment in AD Swiss Ltd. for digital chronic illness management underscores this strategy by enhancing its integrated healthcare ecosystem.

These collaborations offer significant potential for growth:

- Expanded Service Offerings: Partnerships can introduce new digital health solutions and patient support programs, broadening Galenica's market reach.

- Ecosystem Strengthening: Collaborations with entities like AD Swiss Ltd. reinforce Galenica's position within the healthcare value chain.

- Innovation Acceleration: Working with startups can bring cutting-edge digital health technologies into Galenica's offerings, potentially improving patient outcomes and operational efficiency.

Development of Own Brands and Niche Products

Developing and actively marketing Galenica's proprietary range of health and beauty products presents a significant opportunity. Focusing on niche or specialized market segments, such as targeted skincare or wellness supplements, can lead to higher profit margins compared to generic offerings. This strategy also serves to strongly differentiate Galenica from its competitors, building brand loyalty and a distinct market presence.

Expanding the distribution channels for these new, in-house brands is crucial for growth. The successful introduction and uptake of GLP-1-based weight loss medications, for instance, demonstrate Galenica's capability in bringing specialized products to market. This success can be replicated across other emerging health and wellness categories, driving substantial revenue growth and market share expansion.

- Higher Margins: Own brands in niche health and beauty can command premium pricing, boosting profitability.

- Brand Differentiation: Specialized products create unique selling propositions, setting Galenica apart.

- Market Expansion: Successful new brand launches, like GLP-1 medications, unlock new revenue streams.

- Customer Loyalty: A strong private label portfolio fosters repeat business and customer engagement.

Galenica is well-positioned to capitalize on the growing demand for digital healthcare solutions, with global digital health spending projected to reach hundreds of billions in 2024. By enhancing its prescription management and online booking services, Galenica can significantly improve customer convenience and expand its market presence. Furthermore, the company can leverage telemedicine to tap into the increasing need for remote healthcare consultations, aligning with consumer expectations for accessible digital health services.

The company's expansion into home care services, supported by offerings like Medifilm's blister packaging, addresses the demographic trend of an aging population and a shift towards outpatient treatment. This market, valued at over $430 billion globally in 2024 and expected to grow at over 8% annually through 2030, presents a substantial opportunity for Galenica to bundle and integrate its services for greater patient convenience and company revenue.

Galenica's extensive network and digital initiatives allow for the collection of valuable health data, which can be used to develop personalized health services and predictive analytics. With its MyGalenica app seeing a 15% increase in active users by the end of 2024, the company has a solid foundation for offering tailored health recommendations and early risk assessments, thereby enhancing patient outcomes and loyalty.

Strategic partnerships with digital health innovators, insurers, and medical professionals offer a pathway for Galenica to develop new value chains and broaden its service portfolio, as evidenced by its investment in AD Swiss Ltd. for chronic illness management. These collaborations accelerate innovation and strengthen Galenica's position within the broader healthcare ecosystem.

Developing and marketing its own range of health and beauty products, particularly in niche segments, presents an opportunity for higher profit margins and brand differentiation. The successful market entry of GLP-1-based weight loss medications demonstrates Galenica's capability to bring specialized products to market, a strategy that can be replicated across various health and wellness categories to drive revenue and market share.

Threats

Galenica faces significant threats from intensifying price competition within the Swiss pharmaceutical market. The increasing rate of generic drug substitution directly challenges the pricing power of branded products, forcing companies to adapt. For instance, in 2023, the Swiss market saw continued growth in generics, impacting the revenue streams of originator products.

Government initiatives aimed at curbing healthcare expenditures further exacerbate this pressure. These interventions, such as price negotiations and volume-based discounts, are designed to lower overall drug costs for the Swiss population. This necessitates a constant focus on operational efficiency and cost management for Galenica to maintain healthy profit margins amidst these market dynamics.

Galenica faces ongoing challenges due to the frequently changing healthcare regulations in Switzerland, impacting everything from drug pricing policies to pharmacy operating standards. These shifts necessitate substantial investments in compliance measures, including upgrades to IT infrastructure and comprehensive staff training programs.

The financial burden of adapting to these evolving regulatory requirements can significantly affect Galenica's profitability. For instance, in 2024, the Swiss Federal Office of Public Health introduced new guidelines for pharmaceutical advertising, requiring immediate adjustments to marketing strategies and associated compliance checks.

Such continuous adaptation can also limit operational flexibility, making it harder for Galenica to respond swiftly to market opportunities. The estimated annual cost for compliance across the Swiss pharmaceutical sector, including legal consultation and system updates, reached approximately CHF 500 million in 2024, underscoring the financial commitment involved.

The healthcare landscape is rapidly evolving with digital advancements. New technologies like AI-powered diagnostics and telehealth platforms are changing how patients access care. For instance, the global digital health market was valued at approximately USD 211 billion in 2023 and is projected to reach over USD 800 billion by 2030, indicating significant growth and potential disruption.

Online pharmacies and direct-to-consumer (DTC) healthcare services are also gaining traction, offering convenience and potentially lower costs. These models bypass traditional brick-and-mortar pharmacies, presenting a direct challenge to established players like Galenica. The increasing adoption of e-commerce for prescription refills, with some estimates suggesting that online pharmacies could capture a substantial portion of the prescription market share in the coming years, underscores this threat.

To stay competitive, Galenica must prioritize innovation and adapt its omni-channel strategy. This means integrating digital solutions seamlessly with its physical presence, enhancing customer experience through user-friendly apps and online portals, and exploring new service offerings that leverage technology. Failure to adapt could lead to a loss of market share as consumers gravitate towards more digitally-native healthcare solutions.

Supply Chain Risks and Geopolitical Factors

Galenica faces significant threats from global supply chain disruptions, which have been a persistent issue worldwide. For example, in 2023, the pharmaceutical industry continued to grapple with shortages of key active pharmaceutical ingredients (APIs) and excipients, often due to manufacturing challenges in a few key regions. This directly impacts Galenica's ability to reliably source and distribute its products, potentially leading to increased costs and affecting its wholesale and retail segments.

Geopolitical events also pose a considerable risk. Tensions or conflicts in regions critical for manufacturing or raw material extraction can lead to immediate supply interruptions and price volatility. Galenica's reliance on a global network means it's exposed to these external shocks, making the resilience of its supply chains a paramount concern for maintaining operational stability and profitability in the 2024-2025 period.

- Supply Chain Vulnerabilities: Ongoing global logistics challenges and potential disruptions in API manufacturing hubs remain a primary threat.

- Geopolitical Instability: Conflicts or trade disputes in key sourcing regions could escalate, impacting product availability and cost.

- Regulatory Changes: Unexpected shifts in international trade policies or pharmaceutical regulations could create compliance hurdles and affect market access.

- Economic Downturns: Broad economic slowdowns can reduce consumer spending on healthcare, impacting Galenica's sales volumes.

Shortage of Skilled Healthcare Professionals

The healthcare industry, including pharmaceutical retail and logistics, is grappling with a significant shortage of qualified professionals. This scarcity is a critical threat to Galenica's operations, potentially driving up labor costs as competition for talent intensifies. For instance, reports from late 2024 and early 2025 indicate a growing deficit in pharmacists and specialized technicians across Europe, with some regions experiencing vacancy rates exceeding 15%.

This shortfall directly impacts Galenica's ability to adequately staff its pharmacies and maintain efficient logistics networks. Such staffing challenges can hinder service quality, potentially leading to longer wait times for customers and delays in prescription fulfillment. Furthermore, expansion plans, a key growth driver for the company, could be significantly hampered if there aren't enough skilled individuals to operate new facilities or manage increased operational demands.

The implications for Galenica include:

- Increased Wage Pressure: Competition for a limited pool of skilled healthcare workers will likely drive up salary expectations and benefits costs.

- Operational Strain: Difficulty in filling critical roles can lead to understaffing, impacting service efficiency and potentially customer satisfaction.

- Delayed Growth Initiatives: Expansion projects may face delays or require adjustments if the necessary human capital cannot be secured in a timely manner.

- Impact on Service Quality: Overstretched staff may struggle to maintain high standards of care and patient interaction, potentially affecting Galenica's reputation.

Intensifying price competition from generics and government efforts to reduce healthcare costs are significant threats. These pressures are amplified by evolving healthcare regulations, such as new advertising guidelines introduced in 2024, which require substantial compliance investments. The rise of digital health and online pharmacies also challenges Galenica's traditional business model.

SWOT Analysis Data Sources

This Galenica SWOT analysis is built upon a robust foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations. These reliable sources ensure the accuracy and strategic relevance of the insights presented.