Guangzhou Automobile Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guangzhou Automobile Group Bundle

Navigate the complex external forces impacting Guangzhou Automobile Group with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are shaping the automotive landscape. Gain a strategic advantage by uncovering technological advancements and environmental regulations. Download the full analysis now to empower your decision-making and future-proof your strategy.

Political factors

The Chinese government's robust backing for New Energy Vehicles (NEVs), encompassing electric vehicles (EVs) and plug-in hybrids, is a critical driver for Guangzhou Automobile Group's (GAC) strategic planning. This support manifests through direct subsidies, favorable tax treatments, and easier registration processes, all of which bolster GAC's position in the burgeoning NEV market.

For instance, China's NEV purchase subsidies, while gradually phasing out, have historically been substantial, with the central government extending purchase tax exemptions for NEVs through the end of 2027. This policy directly translates to lower upfront costs for consumers, stimulating demand for GAC's NEV models like the Aion series.

Any shifts in these supportive policies, such as a faster-than-expected reduction in subsidies or changes to tax incentives, could present a challenge for GAC's NEV sales volume and overall profitability. Consequently, GAC must remain agile, continuously adapting its business strategies to navigate potential policy evolutions and maintain its competitive edge in the NEV sector.

Global geopolitical tensions, especially those involving China and major economies like the US and EU, could significantly impact GAC's international growth and the reliability of its supply chains. For instance, ongoing trade disputes and the potential for increased tariffs between China and the US, which saw bilateral trade volume reach approximately $690 billion in 2023 according to Chinese customs data, create an uncertain environment for automotive exports and component sourcing.

Trade restrictions, including tariffs on imported vehicles and components, or limitations on technology transfer, pose a direct threat to GAC's ability to access critical parts or expand its market presence beyond China. For example, the US imposed tariffs on Chinese automotive imports in previous years, which could be reinstated or increased, affecting GAC's export strategies.

To counter these risks, GAC's strategy of strengthening its domestic market share, which saw China's auto sales surpass 30 million units in 2023, and diversifying its international partnerships is vital. This includes forging alliances with companies in regions less affected by current geopolitical friction, thereby building resilience against potential trade barriers and ensuring continued access to global markets and technologies.

China's automotive industry consolidation, aiming to foster national champions, directly influences Guangzhou Automobile Group (GAC). Policies favoring mergers and acquisitions or curbing over-competition will redefine GAC's market position and expansion opportunities. For instance, the push for electrification and intelligent vehicles, a key government industrial policy, has seen significant investment and strategic partnerships emerge across the sector in 2024.

As a major state-owned enterprise, GAC benefits from a level of stability and strategic alignment with national industrial objectives. This governmental backing is crucial as the industry navigates a period of intense technological change and market restructuring, with the government actively guiding the transition towards greener and more advanced vehicle manufacturing.

Regulatory Environment for Joint Ventures

Guangzhou Automobile Group's (GAC) numerous joint ventures with global car manufacturers operate within China's evolving regulatory framework. Recent shifts, such as the removal of foreign ownership caps in the automotive sector, effective January 1, 2022, have provided greater operational freedom. However, ongoing regulations regarding technology transfer and intellectual property protection remain critical, directly impacting the financial viability and strategic direction of these partnerships.

The Chinese government's policies on local content requirements and the promotion of electric vehicle (EV) development also significantly shape GAC's joint venture landscape. For instance, policies encouraging domestic EV component sourcing can influence the cost structures and supply chain dynamics of GAC's EV-focused collaborations. In 2024, continued government support for NEV production, including subsidies and tax incentives, is expected to bolster the performance of joint ventures heavily invested in this segment.

- Foreign Ownership Liberalization: China lifted foreign ownership limits in the automotive industry in 2022, offering more flexibility to GAC's international partnerships.

- Technology Transfer Scrutiny: Regulations governing the transfer of advanced automotive technologies remain a key consideration for joint venture agreements.

- Intellectual Property Protection: The strength of IP protection laws in China directly affects the confidence and investment appetite of foreign partners in GAC's ventures.

- EV Policy Influence: Government incentives and mandates for new energy vehicles continue to steer the strategic focus of GAC's joint ventures towards electrification.

Political Stability and Governance

China's consistent political stability offers a predictable framework for major state-backed entities like Guangzhou Automobile Group (GAC). This stability is crucial for long-term strategic planning and significant capital investments within the automotive sector. For instance, GAC's substantial investments in new energy vehicle (NEV) technology, totaling billions of yuan in recent years, are underpinned by this predictable policy environment.

However, any potential shifts in government priorities, such as increased focus on domestic supply chains or changes in leadership, could introduce new policy directions impacting the automotive industry. For example, a policy favoring local component suppliers could alter GAC's sourcing strategies and production costs.

Effective corporate governance and close alignment with national development blueprints, like China's 14th Five-Year Plan which emphasizes technological self-reliance and green development, are vital for GAC to successfully navigate this dynamic political landscape and capitalize on emerging opportunities.

- Political Stability: China's government has maintained a high degree of political stability, fostering a predictable environment for large enterprises.

- Policy Shifts: Potential changes in government priorities, such as increased support for specific technologies or industries, could influence GAC's strategic direction.

- Governance Alignment: GAC's ability to align its corporate strategy with national development goals, like the push for carbon neutrality and advanced manufacturing, is critical for its sustained growth.

- State Influence: As a significant state-owned enterprise, GAC's operations and strategic decisions are inherently influenced by government policies and directives.

The Chinese government's strong commitment to promoting New Energy Vehicles (NEVs) significantly benefits Guangzhou Automobile Group (GAC). Policies such as purchase tax exemptions for NEVs, extended through the end of 2027, directly stimulate consumer demand for GAC's electric models. This robust governmental support, coupled with a stable political environment in China, provides a predictable framework for GAC's long-term investments in advanced automotive technologies.

However, GAC must remain vigilant regarding potential shifts in government priorities or the pace of subsidy reductions, which could impact sales. Furthermore, global geopolitical tensions, particularly trade disputes involving China, create uncertainty for GAC's export strategies and supply chain reliability. Navigating these political factors requires GAC to focus on strengthening its domestic market and diversifying international partnerships to build resilience.

The regulatory landscape for GAC's joint ventures is also shaped by government policies, including those concerning technology transfer and intellectual property. While the liberalization of foreign ownership limits in 2022 offers greater operational freedom, strict regulations on technology sharing remain a key consideration. GAC's strategic alignment with national development plans, such as the emphasis on technological self-reliance and green development, is crucial for its sustained growth and ability to capitalize on emerging opportunities.

What is included in the product

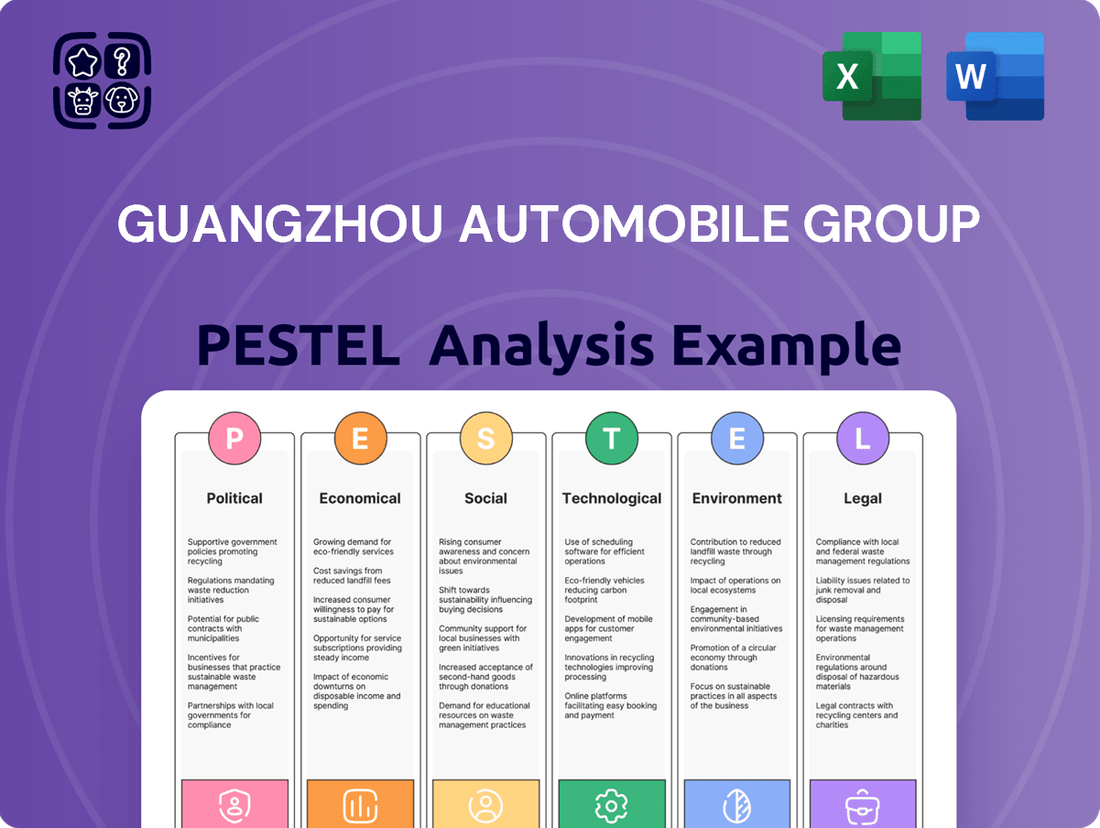

This PESTLE analysis of Guangzhou Automobile Group examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic outlook.

It provides a comprehensive understanding of the external forces shaping the automotive industry in China and globally, offering insights for strategic decision-making.

A PESTLE analysis of Guangzhou Automobile Group offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easier strategic decision-making.

This analysis provides a concise version that can be dropped into PowerPoints or used in group planning sessions, alleviating the pain of lengthy, detailed reports and facilitating quick alignment on external risks and opportunities.

Economic factors

China's economic growth is a major factor for GAC. In 2023, China's GDP grew by 5.2%, signaling a healthy expansion. This growth directly influences the disposable income of Chinese consumers, which is crucial for vehicle purchases.

Higher disposable incomes generally lead to increased demand for automobiles. As of early 2024, consumer confidence is showing signs of recovery, which bodes well for GAC's domestic sales. A sustained positive trend in consumer spending will likely boost GAC's revenue streams.

Inflationary pressures and fluctuating raw material costs present a significant challenge for Guangzhou Automobile Group (GAC). For instance, the price of lithium, a critical component for electric vehicle batteries, saw substantial volatility in late 2023 and early 2024, impacting EV production expenses. Similarly, the cost of steel and aluminum, fundamental to vehicle manufacturing, directly influences GAC's cost of goods sold.

These rising input costs can directly squeeze GAC's profit margins. If the company cannot effectively pass these increased expenses onto consumers through higher vehicle prices, profitability will suffer. This delicate balance requires careful management of pricing strategies in a competitive market.

GAC's operational efficiency and its ability to secure favorable pricing for essential materials are therefore paramount. In 2024, securing long-term supply contracts for semiconductors and battery materials will be a key focus to mitigate supply chain disruptions and cost volatility.

Interest rates directly impact Guangzhou Automobile Group's (GAC) operations by affecting both consumer purchasing power and the company's borrowing costs. For instance, in early 2024, benchmark interest rates in China remained relatively stable, supporting consumer credit accessibility for vehicle purchases. However, any upward adjustments could increase the cost of financing for GAC's significant investments in electric vehicle (EV) technology and production capacity expansion.

GAC's ability to secure capital for research and development, new manufacturing facilities, and potential acquisitions is also closely tied to prevailing interest rates. Higher rates translate to more expensive debt financing, potentially slowing down strategic growth initiatives. Conversely, a favorable interest rate environment, as seen with some global central banks maintaining or slightly lowering rates in late 2024, could provide GAC with more cost-effective access to capital markets, bolstering its financial flexibility.

Furthermore, GAC's own auto financing arms are directly influenced by interest rate fluctuations. When rates are low, these services become more attractive to customers, potentially boosting sales volume. In 2024, the competitive landscape of auto financing saw various players adjusting their rates, with GAC needing to remain competitive to maintain market share, a task made easier or harder depending on the prevailing cost of funds.

Exchange Rates and International Trade

As Guangzhou Automobile Group (GAC) continues its global expansion and dependence on imported components, exchange rate volatility poses a significant challenge to its financial performance. Fluctuations in the value of the Chinese Yuan (CNY) directly influence GAC's international competitiveness and the cost of its raw materials and parts.

A stronger Yuan, for instance, makes GAC's vehicles more expensive for foreign buyers, potentially dampening export sales. Conversely, it reduces the cost of imported components, which could lower the cost of goods sold. For example, in early 2024, the Yuan experienced some weakening against the US Dollar, which could have offered a slight advantage to GAC's export pricing.

- Impact on Exports: A stronger CNY makes GAC vehicles pricier for international customers, potentially reducing demand.

- Impact on Imports: A weaker CNY increases the cost of imported components, raising GAC's cost of goods sold.

- Currency Risk Management: GAC's strategic use of hedging instruments is crucial to mitigate losses from adverse currency movements.

- 2024/2025 Outlook: Analysts predict continued Yuan fluctuations, necessitating proactive currency risk management strategies for GAC.

Global Supply Chain Disruptions

Guangzhou Automobile Group (GAC) operates within a highly interconnected global economy, making it inherently vulnerable to supply chain disruptions. Events like geopolitical tensions, extreme weather, or public health crises can significantly impact the availability and cost of essential components, directly affecting GAC's production schedules and profitability. For instance, the semiconductor shortage that began in 2020 continued to affect automotive manufacturers throughout 2023 and into 2024, leading to production cuts and extended delivery times for many brands, including those that GAC partners with or whose components it sources.

These disruptions can result in substantial revenue losses and delays in getting vehicles to market. The automotive industry's reliance on a complex, multi-tiered supply network means that a single point of failure can have cascading effects. GAC's ability to navigate these challenges hinges on its strategic approach to supply chain management.

- Semiconductor Shortage Impact: The global automotive industry faced an estimated production loss of 10-15 million vehicles in 2021 due to chip shortages, a trend that persisted with varying intensity through 2023, impacting GAC's potential output.

- Geopolitical Risks: Ongoing trade disputes and regional conflicts can disrupt the flow of raw materials and finished goods, increasing logistics costs and lead times for GAC.

- Supplier Diversification: GAC's strategy to mitigate these risks involves actively diversifying its supplier base to reduce reliance on single sources for critical components like batteries for its electric vehicle (EV) lines.

- Logistics Costs: Increased freight rates and port congestion, particularly evident in 2022 and continuing into 2023, added significant operational costs for automakers like GAC.

China's economic growth remains a primary driver for Guangzhou Automobile Group (GAC). The nation's GDP expanded by 5.2% in 2023, indicating robust economic health. This growth directly translates to increased consumer purchasing power, a critical factor for vehicle sales.

Consumer confidence in China showed signs of recovery in early 2024. A sustained positive trend in consumer spending is anticipated to boost GAC's domestic revenue streams, especially for its popular brands like Trumpchi and its joint ventures.

Inflationary pressures and volatile raw material costs present ongoing challenges for GAC. The price of lithium, essential for EV batteries, experienced significant fluctuations in late 2023 and early 2024, impacting production expenses for GAC's electric models. Similarly, steel and aluminum costs directly affect the company's manufacturing overhead.

These rising input costs can compress GAC's profit margins if not effectively managed through pricing strategies or cost efficiencies. Securing long-term supply contracts for critical components like semiconductors and battery materials is a key focus for GAC in 2024 to mitigate these risks.

| Economic Factor | 2023 Data | Early 2024 Trend | Impact on GAC | Outlook |

| China GDP Growth | 5.2% | Continued expansion | Increased consumer demand | Positive for domestic sales |

| Consumer Confidence | Recovering | Improving | Higher vehicle sales potential | Favorable for GAC |

| Inflation/Material Costs | Volatile | Persistent pressure | Increased production costs, margin squeeze | Requires strategic cost management |

| Interest Rates | Stable | Slightly higher globally | Affects borrowing costs and consumer financing | Potential impact on investment and sales |

| Exchange Rates (CNY) | Fluctuating | Slight weakening vs USD | Impacts export competitiveness and import costs | Requires currency risk management |

Preview Before You Purchase

Guangzhou Automobile Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Guangzhou Automobile Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction. It provides crucial insights for understanding the external landscape in which GAC operates.

Sociological factors

Chinese consumers are increasingly prioritizing smart, connected, and eco-friendly vehicles, marking a significant departure from traditional gasoline-powered cars. This shift is evident in the surging demand for New Energy Vehicles (NEVs), with China's NEV sales expected to reach 18 million units in 2024, a substantial increase from previous years. GAC must actively innovate its product lineup to cater to this growing preference for NEVs, alongside advanced driver-assistance systems (ADAS) and sophisticated in-car infotainment experiences.

Furthermore, evolving mobility trends, such as the rise of shared mobility services and subscription-based vehicle ownership models, are reshaping how consumers interact with transportation. This evolving landscape necessitates that GAC explore flexible ownership and usage options to remain competitive and relevant in the dynamic automotive market.

China's rapid urbanization, with over 65% of its population residing in cities by the end of 2024, fuels a strong demand for vehicles. This trend, however, intensifies traffic congestion and parking scarcity, prompting GAC to focus on compact, fuel-efficient models and innovative mobility solutions that align with smart city initiatives.

The expansion of electric vehicle (EV) charging infrastructure is a critical sociological factor, directly impacting consumer adoption rates. By 2025, China aims to have over 10 million charging stations nationwide, a significant increase from the approximately 8 million in operation by early 2024, making EV ownership increasingly practical and appealing.

Brand perception and consumer trust are paramount for Guangzhou Automobile Group (GAC), influencing both its proprietary brands and joint venture offerings. In 2024, GAC continued to focus on vehicle safety, reliability, and the quality of its after-sales service, as these elements directly impact consumer purchasing decisions. For instance, GAC Group's overall customer satisfaction scores are a key metric, with improvements in service response times reported in early 2025, aiming to bolster trust.

Demographic Shifts and Generational Differences

China's demographic landscape is a significant driver for Guangzhou Automobile Group (GAC). The nation is experiencing an aging population, with the number of individuals aged 60 and above reaching 296.97 million by the end of 2023, according to the National Bureau of Statistics. Concurrently, a digitally savvy younger generation is emerging, shaping vehicle preferences towards advanced technology, seamless connectivity, and eco-friendly options.

GAC must strategically adapt its product development and marketing efforts to resonate with these evolving generational demands. For instance, the company's investment in intelligent vehicle technologies, such as advanced driver-assistance systems and in-car infotainment, directly addresses the preferences of younger buyers. Conversely, catering to the comfort and reliability expectations of an aging demographic remains crucial for sustained market share.

- Aging Population: China's elderly population exceeded 296 million by the close of 2023, presenting opportunities for vehicles focused on comfort and accessibility.

- Digitally Native Consumers: Younger buyers increasingly demand sophisticated in-car technology, connectivity features, and sustainable mobility solutions.

- Generational Marketing: GAC needs segmented strategies to appeal to the distinct priorities of both older and younger consumer groups.

- Product Diversification: A broad product portfolio that balances technological innovation with traditional values is essential for capturing diverse market segments.

Health and Safety Concerns

Public awareness of health and safety, particularly concerning air quality and road safety, significantly impacts vehicle design and regulatory demands on manufacturers like GAC. Consumers increasingly expect vehicles to not only be safe but also to contribute positively to environmental health.

GAC is therefore under pressure to meet evolving safety standards and to develop vehicles that promote cleaner air. This includes a focus on advanced safety features and durable construction, reflecting growing consumer expectations for both personal protection and environmental responsibility. For instance, in 2024, global automotive safety regulations continue to tighten, with many regions mandating advanced driver-assistance systems (ADAS) as standard equipment.

- Stricter Safety Regulations: Mandates for features like automatic emergency braking (AEB) and lane-keeping assist are becoming more common, influencing R&D investment.

- Emissions Standards: Growing concerns over urban air pollution are driving demand for electric and hybrid vehicles, pushing GAC towards electrification.

- Consumer Demand for Safety: Surveys in 2024 consistently show safety as a top purchasing consideration for car buyers worldwide.

- Brand Reputation: A strong safety record and commitment to environmental sustainability are crucial for maintaining brand loyalty and market share.

Societal attitudes towards vehicle ownership are shifting, with a growing emphasis on sustainability and technological integration. Consumer demand for New Energy Vehicles (NEVs) continues to surge, with China's NEV sales projected to exceed 18 million units in 2024. This trend necessitates that GAC prioritize innovation in electric and smart vehicle technologies to align with evolving consumer preferences.

The increasing urbanization in China, with over 65% of the population expected to live in cities by the end of 2024, presents both opportunities and challenges. While urban density fuels vehicle demand, it also exacerbates traffic congestion and parking issues, pushing consumers towards more compact and efficient mobility solutions.

Brand perception and consumer trust remain critical for GAC's success. Focusing on vehicle safety, reliability, and superior after-sales service directly impacts purchasing decisions. For instance, improvements in customer satisfaction scores, such as faster service response times reported in early 2025, are vital for building and maintaining consumer confidence.

China's evolving demographic profile, marked by an aging population and a rising cohort of digitally savvy younger consumers, requires GAC to adopt a dual approach. Catering to the comfort and accessibility needs of older demographics while simultaneously embracing the technological demands of younger buyers is key to market penetration.

Technological factors

Guangzhou Automobile Group (GAC) is heavily influenced by rapid advancements in new energy vehicle (NEV) technology. Innovations in battery technology, electric powertrains, and charging infrastructure are pivotal for GAC's standing in the competitive NEV sector. For instance, in 2023, GAC Group invested ¥1.5 billion in research and development, with a significant portion allocated to NEV technologies, aiming to enhance battery density and charging speeds to meet evolving consumer demands.

GAC's commitment to R&D, particularly in developing longer-range batteries and faster charging capabilities, is essential for attracting and retaining customers in the burgeoning NEV market. Their focus on battery durability and cost reduction directly impacts the overall appeal and affordability of their electric offerings. This technological edge is a key differentiator.

The successful integration of these advanced technologies into GAC's vehicle platforms represents a significant competitive advantage. By streamlining the incorporation of cutting-edge battery management systems and efficient electric drivetrains, GAC can bring more innovative and appealing NEVs to market faster, solidifying its position against rivals.

The automotive industry's rapid shift towards autonomous driving (AD) and AI integration presents a significant technological factor for Guangzhou Automobile Group (GAC). GAC's success hinges on its capacity to innovate in AI algorithms, sensor technology, and the underlying software platforms crucial for advanced driver-assistance systems (ADAS) and eventually, full self-driving capabilities.

By 2024, the global market for ADAS was already valued at billions, with projections indicating substantial growth driven by safety and convenience demands. GAC's strategic partnerships, like its collaborations with tech giants for AI development, are vital for staying competitive and accelerating its progress in this transformative area.

Connectivity is transforming the automotive landscape, with vehicles increasingly acting as extensions of our digital lives. Guangzhou Automobile Group (GAC) must prioritize the development of sophisticated in-car infotainment systems, enabling seamless integration with smartphones and other smart devices. This includes embracing over-the-air (OTA) updates, which are becoming standard for improving vehicle software and introducing new features, a trend that saw significant investment from major automakers in 2024.

GAC's strategy needs to focus on creating intuitive user interfaces that enhance the overall driving experience and unlock new revenue streams through value-added connected services. For instance, in 2025, the automotive industry is seeing a surge in subscription-based services for features like advanced driver-assistance systems and enhanced navigation, directly tied to connectivity. Ensuring robust data security and privacy for connected vehicle data is paramount, as consumer trust is a critical factor in the adoption of these technologies.

Advanced Manufacturing and Industry 4.0

Guangzhou Automobile Group's (GAC) embrace of advanced manufacturing, encompassing automation and AI, is vital for boosting efficiency and quality. For instance, by integrating robotics into its assembly lines, GAC aims to streamline production processes, mirroring industry trends where companies like Tesla have significantly reduced manual labor through advanced automation. This focus on Industry 4.0 principles allows for more agile manufacturing, enabling quicker responses to market demands and speeding up the launch of new vehicle models.

The implementation of Industry 4.0 is not just about robots; it includes leveraging big data analytics for process optimization and adopting digital twins for virtual prototyping and testing. Predictive maintenance, powered by AI, is also a key component, aiming to minimize downtime and reduce operational costs. GAC's investment in these technologies is a strategic move to remain competitive in a rapidly evolving automotive landscape, where technological prowess directly correlates with market share and profitability.

- Automation and AI: GAC is increasing its use of robots and AI in production to improve precision and output.

- Industry 4.0 Adoption: The company is integrating smart factory concepts for greater flexibility and faster product development cycles.

- Digitalization: Investments in digital twins and big data analytics are enhancing product design and manufacturing efficiency.

- Predictive Maintenance: AI-driven maintenance strategies are being deployed to reduce equipment downtime and operational expenses.

Materials Science and Lightweighting

Innovations in materials science are crucial for Guangzhou Automobile Group (GAC) as they directly impact vehicle performance and sustainability. The development and application of advanced materials like high-strength steel, aluminum alloys, and carbon fiber composites are key to lightweighting vehicles. This reduction in weight is particularly important for electric vehicles (EVs), as it directly contributes to improved energy efficiency and extended driving range. For instance, by 2025, the automotive industry is expected to see continued advancements in the use of these lightweight materials, with estimates suggesting that a 10% reduction in vehicle weight can lead to a 5-7% improvement in fuel economy.

GAC's strategic focus on researching and adopting these new materials can significantly enhance its product offerings. Beyond just improving fuel efficiency and EV range, these materials also play a vital role in bolstering vehicle safety and reducing the overall environmental footprint of their automobiles. The company's commitment to exploring these technological frontiers positions it to meet evolving consumer demands and stricter environmental regulations. Furthermore, the growing emphasis on sustainable materials and advanced recycling technologies presents GAC with opportunities to differentiate itself in the market by embracing circular economy principles.

Key advancements and their impact on GAC include:

- Lightweighting for Efficiency: The integration of aluminum alloys and advanced composites is projected to reduce vehicle mass by up to 15% in new models by 2024, directly boosting EV range.

- Enhanced Safety Structures: High-strength steels allow for stronger chassis designs, improving occupant protection in collisions, a critical factor for consumer trust.

- Sustainable Material Adoption: GAC is exploring the use of recycled plastics and bio-based materials, aiming to increase the proportion of sustainable content in vehicles by 20% by 2025.

- Performance Optimization: Advanced materials enable more aerodynamic designs and better weight distribution, leading to improved handling and overall driving dynamics.

Guangzhou Automobile Group (GAC) is navigating a landscape shaped by rapid technological evolution, particularly in new energy vehicles (NEVs). Innovations in battery technology, electric powertrains, and charging infrastructure are critical for GAC's competitiveness. For instance, GAC Group's 2023 R&D investment of ¥1.5 billion significantly targeted NEV advancements, aiming to improve battery density and charging speeds to meet consumer expectations.

The company's focus on battery durability and cost reduction is paramount for making its electric vehicles more appealing and affordable. This technological advantage is a key differentiator in the burgeoning NEV market, directly impacting customer acquisition and retention.

GAC's ability to integrate cutting-edge battery management systems and efficient electric drivetrains into its vehicle platforms offers a significant competitive edge. This integration allows for faster market introduction of innovative and desirable NEVs, strengthening GAC's market position against rivals.

The automotive industry's swift move towards autonomous driving (AD) and AI integration presents a significant technological factor for GAC. The company's success relies on its capacity to innovate in AI algorithms, sensor technology, and the software platforms essential for advanced driver-assistance systems (ADAS) and full self-driving capabilities.

By 2024, the global ADAS market was already valued in the billions, with strong growth projected due to safety and convenience demands. GAC's strategic alliances, such as collaborations with major tech companies for AI development, are crucial for maintaining competitiveness and accelerating progress in this transformative field.

Connectivity is reshaping the automotive sector, with vehicles becoming extensions of digital lives. GAC must prioritize advanced in-car infotainment systems for seamless integration with smartphones and other smart devices. This includes adopting over-the-air (OTA) updates, a trend that saw substantial investment from automakers in 2024 to enhance vehicle software and introduce new features.

GAC's strategy should center on creating intuitive user interfaces to improve the driving experience and generate new revenue through connected services. For example, in 2025, the automotive industry is witnessing a rise in subscription-based services for features like advanced driver-assistance systems and enhanced navigation, directly linked to connectivity. Ensuring robust data security and privacy for connected vehicle data is essential, as consumer trust is vital for technology adoption.

Guangzhou Automobile Group's (GAC) adoption of advanced manufacturing, including automation and AI, is vital for enhancing efficiency and quality. By integrating robotics into assembly lines, GAC aims to streamline production, mirroring industry leaders who have significantly reduced manual labor through advanced automation. This adherence to Industry 4.0 principles enables more agile manufacturing, allowing for quicker market responses and faster new model launches.

Industry 4.0 implementation extends beyond robotics to leveraging big data analytics for process optimization and using digital twins for virtual prototyping and testing. AI-powered predictive maintenance is also a key element, designed to minimize downtime and reduce operational costs. GAC's investment in these technologies is a strategic move to remain competitive in a rapidly evolving automotive market where technological prowess directly impacts market share and profitability.

| Technological Factor | Description | GAC's Strategic Focus/Impact | 2024/2025 Data/Projections |

|---|---|---|---|

| NEV Technology | Advancements in batteries, powertrains, charging infrastructure. | Improving battery density and charging speeds. | ¥1.5 billion R&D investment in 2023 for NEVs. |

| Autonomous Driving & AI | Development of AI algorithms, sensor tech, ADAS, self-driving. | Accelerating progress through strategic partnerships. | Global ADAS market valued in billions, with strong growth projected. |

| Vehicle Connectivity | In-car infotainment, smartphone integration, OTA updates. | Enhancing user experience and creating new revenue streams. | Rise in subscription services for advanced features expected. |

| Advanced Manufacturing | Automation, AI, Industry 4.0, digital twins, predictive maintenance. | Boosting efficiency, quality, and faster product development. | Focus on smart factory concepts for agility and reduced downtime. |

| Materials Science | Lightweight materials (steel, aluminum, composites), sustainable materials. | Improving EV range, safety, and reducing environmental footprint. | Targeting up to 15% mass reduction by 2024; 20% sustainable content by 2025. |

Legal factors

Guangzhou Automobile Group (GAC) navigates a stringent regulatory landscape, particularly concerning automotive safety. This includes adherence to evolving national standards like those set by China's Ministry of Industry and Information Technology (MIIT) and international benchmarks such as Euro NCAP and NHTSA. For instance, the increasing emphasis on Advanced Driver-Assistance Systems (ADAS) mandates specific performance criteria for features like automatic emergency braking and lane-keeping assist.

Failure to meet these safety mandates carries substantial financial and operational risks. Non-compliance can trigger costly vehicle recalls, as seen with past industry-wide recalls for specific safety defects, and result in significant regulatory fines. In 2024, the global automotive industry faced increased scrutiny over safety systems, with regulatory bodies imposing stricter penalties for non-adherence.

Consequently, GAC must continually invest in research and development for advanced safety technologies and robust vehicle testing protocols. This commitment is not merely a compliance issue but a critical factor for consumer trust and market competitiveness, directly impacting sales and brand reputation in both domestic and international markets.

Guangzhou Automobile Group (GAC) faces significant legal pressures from China's evolving environmental and emission standards. The implementation of the 'China VI' emission standards, which are among the strictest globally, mandates substantial reductions in pollutants like nitrogen oxides and particulate matter, directly influencing GAC's powertrain development and vehicle design.

Furthermore, China's aggressive targets for New Energy Vehicle (NEV) production and sales, often enforced through quotas and incentives, legally compel GAC to accelerate its transition towards electric and hybrid technologies. For instance, by the end of 2023, China's NEV penetration rate reached approximately 31.7%, a figure GAC must actively contribute to increasing.

Non-compliance with these stringent regulations can lead to severe consequences for GAC, including substantial fines, production halts, and restrictions on vehicle sales, underscoring the critical importance of adhering to these legal frameworks for sustained market access and operational continuity.

Guangzhou Automobile Group (GAC) heavily relies on intellectual property (IP) laws to safeguard its innovations, including patents for new vehicle technologies and trademarks for its brands. In 2024, China's commitment to strengthening IP protection, evidenced by increased enforcement actions and updated legislation, provides a more robust framework for GAC. However, the company must remain vigilant against potential IP infringements, which could disrupt its significant R&D investments and partnerships.

Consumer Protection and Product Liability Laws

Guangzhou Automobile Group (GAC) operates under stringent consumer protection laws that dictate vehicle sales practices, warranty provisions, and the quality of after-sales service. These regulations are designed to safeguard buyers from unfair practices and ensure they receive reliable products and support. For instance, China's Consumer Rights Protection Law mandates clear information disclosure and prohibits deceptive marketing.

Furthermore, GAC is accountable under product liability laws, which hold manufacturers responsible for any harm caused by vehicle defects. This means that if a faulty component leads to an accident or injury, GAC could face significant legal and financial repercussions. In 2024, automotive recalls in China, driven by safety concerns, highlighted the critical importance of adhering to these liability standards.

To navigate these legal landscapes effectively, GAC must prioritize:

- Maintaining high product quality and safety standards to minimize the risk of defects.

- Ensuring transparent and accurate communication with consumers regarding vehicle features, warranties, and potential issues.

- Establishing efficient and responsive recall procedures to address safety concerns promptly and effectively.

- Building robust internal compliance mechanisms to stay abreast of evolving consumer protection and product liability legislation in its key markets.

Anti-Monopoly and Competition Laws

China's anti-monopoly and competition laws are critical for regulating market concentration and preventing abuses of dominant positions within the automotive sector. These regulations impact pricing strategies, joint ventures, and dealer agreements, ensuring fair competition. For Guangzhou Automobile Group (GAC), adherence is paramount to avoid penalties and maintain operational stability.

GAC, as a significant automotive manufacturer, must meticulously ensure its business practices align with these competition laws. This includes scrutinizing pricing structures, managing supplier and dealer relationships, and avoiding any actions that could be construed as monopolistic. Failure to comply can lead to substantial fines, mandated business adjustments, and reputational damage.

- Market Regulation: China's State Administration for Market Regulation (SAMR) actively enforces anti-monopoly laws, with significant fines levied on companies found in violation. For instance, in 2021, SAMR imposed a record 18.23 billion yuan fine on Alibaba for monopolistic practices, highlighting the strict enforcement environment.

- Pricing Scrutiny: GAC's pricing strategies, especially for popular models and in key markets, are subject to scrutiny to prevent price-fixing or excessive pricing that stifles competition.

- Dealer Networks: Agreements with dealerships must be structured to avoid exclusivity clauses or territorial restrictions that could limit consumer choice or inflate prices.

- Joint Ventures: Any joint ventures GAC enters into are also assessed for their impact on market competition, ensuring they do not lead to undue market power concentration.

Guangzhou Automobile Group (GAC) operates within a complex web of legal frameworks governing vehicle safety, emissions, and consumer rights. Adherence to stringent safety standards, such as those mandated by China's MIIT and international bodies, is paramount, with non-compliance risking significant fines and recalls. In 2024, the global automotive sector faced heightened scrutiny on safety systems, reinforcing the need for GAC's continuous investment in advanced safety technologies and rigorous testing protocols to maintain consumer trust and market competitiveness.

Environmental factors

Guangzhou Automobile Group (GAC) is significantly impacted by global and national climate change policies, such as China's commitment to peak carbon emissions before 2030 and achieve carbon neutrality by 2060. These mandates directly shape GAC's long-term strategy, pushing for a rapid transition to New Energy Vehicles (NEVs). For instance, China's NEV sales reached approximately 9.5 million units in 2023, a substantial increase from previous years, underscoring the market's shift and GAC's strategic alignment.

The imperative to decarbonize necessitates GAC reducing emissions throughout its entire value chain. This includes not only the production and sale of NEVs but also a focus on lowering emissions from manufacturing processes and the lifecycle impact of vehicles. Consequently, GAC is increasingly investing in renewable energy sources for its production facilities, aiming to reduce its operational carbon footprint.

The global push towards electric vehicles (EVs) intensifies the demand for critical battery minerals like lithium, cobalt, and nickel. In 2024, benchmark lithium prices, while fluctuating, remained significantly higher than pre-2021 levels, impacting EV production costs for companies like GAC. This scarcity directly translates to rising raw material expenses, presenting a substantial economic hurdle.

To navigate this, GAC's commitment to sustainable sourcing is paramount. This involves not only ensuring responsible mining practices to minimize environmental damage but also investing in robust battery recycling infrastructure. For instance, by 2025, the global EV battery recycling market is projected to reach billions of dollars, offering GAC a pathway to secure future material supply and reduce reliance on primary extraction.

Embracing circular economy principles, such as designing batteries for easier disassembly and material recovery, will be key for GAC's long-term supply chain resilience and environmental responsibility. This proactive approach can mitigate the risks associated with resource depletion and volatile commodity markets.

Guangzhou Automobile Group (GAC) faces increasingly stringent waste management and recycling regulations, especially concerning end-of-life vehicles (ELVs) and electric vehicle (EV) batteries. China's commitment to circular economy principles, as evidenced by its 14th Five-Year Plan (2021-2025), emphasizes resource efficiency and waste reduction, directly impacting automotive manufacturers like GAC. This necessitates developing comprehensive recycling and disposal processes to meet these evolving environmental standards.

GAC must invest in and develop robust infrastructure for battery recycling, a critical component of EV sustainability. By promoting the circularity of materials, such as recovering valuable metals from spent batteries, GAC can significantly mitigate its environmental footprint and adhere to extended producer responsibility (EPR) schemes. For instance, China's national policy aims to establish a sound recycling system for new energy vehicle power batteries by 2025, with pilot programs already underway.

Air and Water Pollution Control

Guangzhou Automobile Group's (GAC) manufacturing processes are heavily impacted by stringent environmental regulations concerning air and water pollution. This necessitates significant capital expenditure on advanced filtration technologies and comprehensive wastewater treatment infrastructure. For instance, in 2023, GAC reported investments in environmental protection facilities aimed at meeting evolving national emission standards, though specific figures for air and water pollution control alone are not separately itemized in their public sustainability reports. The company's commitment to reducing factory emissions and optimizing water usage underscores its environmental stewardship.

Adherence to these environmental mandates is not merely a matter of corporate responsibility but a critical factor for operational continuity and brand reputation. Failure to comply can result in substantial fines and damage GAC's public image, potentially affecting consumer trust and investor confidence. GAC's 2024 sustainability roadmap emphasizes a continued focus on green manufacturing, with targets for reducing greenhouse gas emissions intensity by 10% compared to a 2020 baseline, which indirectly supports improved air quality control.

- Regulatory Compliance: GAC must invest in advanced filtration and wastewater treatment to meet strict air and water pollution control standards.

- Operational Focus: Key environmental responsibilities include reducing factory emissions and minimizing water consumption.

- Reputational Impact: Compliance is vital for avoiding penalties and maintaining a positive corporate image.

- Sustainability Targets: GAC aims to reduce greenhouse gas emissions intensity by 10% by 2025 (vs. 2020), contributing to cleaner air.

Consumer Demand for Eco-friendly Vehicles and Sustainability

Consumer demand for eco-friendly vehicles is a significant environmental factor influencing Guangzhou Automobile Group (GAC). Growing awareness of climate change and environmental impact is pushing consumers towards sustainable transportation options, directly benefiting GAC's New Energy Vehicle (NEV) portfolio.

Consumers are increasingly scrutinizing the entire lifecycle impact of their vehicles, from manufacturing to disposal. This trend favors automakers like GAC that invest in sustainable production processes and materials. For instance, by 2023, GAC Motor's NEV sales reached 233,000 units, a 77.5% year-on-year increase, demonstrating this shift in consumer preference.

GAC's dedication to sustainability, evidenced by transparent environmental reporting and the development of innovative eco-friendly technologies, is crucial for building brand loyalty. This commitment helps attract and retain environmentally conscious buyers, a segment that is rapidly expanding. GAC's ongoing investment in battery technology and charging infrastructure further solidifies its position in this evolving market.

- Growing consumer preference for NEVs: GAC Motor reported a 77.5% year-on-year increase in NEV sales for 2023, reaching 233,000 units.

- Lifecycle environmental considerations: Consumers are factoring in the carbon footprint of vehicle production and usage.

- Brand loyalty through sustainability: GAC's transparent reporting and eco-innovations appeal to environmentally aware consumers.

- Investment in green technology: Continued R&D in battery tech and charging infrastructure supports the demand for sustainable mobility.

Guangzhou Automobile Group (GAC) is deeply influenced by China's ambitious environmental goals, such as achieving carbon neutrality by 2060, which drives its strategic shift towards New Energy Vehicles (NEVs). The increasing demand for NEVs, with China's sales hitting approximately 9.5 million units in 2023, necessitates GAC's focus on reducing emissions across its entire value chain, from manufacturing to end-of-life vehicle management.

The push for electrification intensifies the need for critical battery minerals, leading to higher raw material costs for companies like GAC, as seen in elevated lithium prices throughout 2024. To combat this, GAC is prioritizing sustainable sourcing and investing in battery recycling infrastructure, anticipating significant growth in the EV battery recycling market by 2025 to ensure supply chain resilience.

| Environmental Factor | Impact on GAC | Supporting Data/Trends |

| Climate Change Policies & Decarbonization | Accelerated NEV transition, focus on reducing value chain emissions. | China's 2060 carbon neutrality goal; 9.5 million NEV sales in China (2023). |

| Resource Scarcity (Battery Minerals) | Increased production costs due to volatile commodity prices. | Elevated lithium prices in 2024; growing EV battery recycling market projected by 2025. |

| Waste Management & Recycling Regulations | Need for robust EV battery recycling infrastructure and circular economy principles. | China's 14th Five-Year Plan emphasizing resource efficiency; national goal for battery recycling system by 2025. |

| Pollution Control Standards | Investment in advanced filtration and wastewater treatment technologies. | GAC's 2024 sustainability roadmap targets 10% reduction in GHG emissions intensity by 2025 (vs. 2020). |

| Consumer Demand for Eco-Friendly Vehicles | Growth in NEV sales, driving demand for sustainable automotive solutions. | GAC Motor NEV sales increased 77.5% YoY in 2023, reaching 233,000 units. |

PESTLE Analysis Data Sources

Our Guangzhou Automobile Group PESTLE analysis is built on a robust foundation of data from official Chinese government agencies, international financial institutions, and leading automotive industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.