Guangzhou Automobile Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guangzhou Automobile Group Bundle

Guangzhou Automobile Group faces intense competition, with moderate buyer and supplier power shaping its market. The threat of new entrants is significant, while the bargaining power of substitutes presents a constant challenge.

The complete report reveals the real forces shaping Guangzhou Automobile Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Guangzhou Automobile Group (GAC) is significantly shaped by the concentration of those providing critical components. For instance, the market for advanced semiconductors and specialized EV battery chemistries is often dominated by a limited number of global players. This concentration allows these few suppliers to command higher prices and dictate terms, directly impacting GAC's production costs and supply chain stability.

The costs GAC incurs when switching suppliers are substantial. These include expenses for re-tooling manufacturing lines, redesigning components to fit new suppliers' specifications, and the lengthy re-qualification processes for new parts. For example, if GAC relies on a supplier's proprietary technology for a critical engine component, the cost and time to find and integrate an alternative could be prohibitive.

Suppliers providing highly specialized or technologically advanced components, like the next-generation batteries GAC aims for by 2026, wield significant bargaining power. If these critical inputs are essential for GAC's product differentiation and performance, these suppliers can indeed dictate higher prices, impacting GAC's cost structure.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into vehicle production could significantly enhance their bargaining power over Guangzhou Automobile Group (GAC). If key component suppliers, particularly in emerging areas like electric vehicle (EV) technology or advanced autonomous driving systems, possessed the capability and motivation to manufacture vehicles themselves, they could exert greater pressure on GAC regarding pricing and terms.

While historically less prevalent in the automotive industry, the evolving landscape of automotive technology presents potential scenarios where this threat might materialize. For instance, a leading supplier of specialized battery technology or sophisticated AI-driven software for autonomous driving might consider establishing its own vehicle assembly operations to capture more value.

- Potential for Forward Integration: Suppliers in high-growth, technology-intensive automotive segments may develop the capacity and strategic interest to produce vehicles.

- Impact on GAC: Increased supplier bargaining power could lead to higher component costs or unfavorable supply agreements for GAC.

- EV and Intelligent Vehicle Focus: The threat is more pronounced for suppliers of critical EV powertrains, battery management systems, and advanced driver-assistance systems (ADAS) components.

Importance of GAC to the Supplier

The significance of Guangzhou Automobile Group (GAC) to a supplier directly impacts the supplier's bargaining power. If GAC represents a substantial portion of a supplier's total revenue, that supplier becomes more reliant on GAC, thereby diminishing their leverage in negotiations. Conversely, for major, diversified component manufacturers, GAC may be just one of many clients, limiting GAC's ability to exert significant pressure.

Consider the automotive electronics sector in 2024. A general slowdown in demand for traditional automotive electronics could elevate GAC's importance for certain component suppliers. For instance, if a supplier experiences a 15% decrease in orders from other manufacturers, GAC's consistent business might represent a larger percentage of their remaining sales, increasing GAC's influence.

- Supplier Dependence: If GAC accounts for over 20% of a supplier's annual sales, the supplier's bargaining power is weakened.

- Market Conditions: A sector-wide downturn, such as the projected 5% contraction in global automotive chip sales for 2024, can make key clients like GAC more critical for suppliers.

- Supplier Diversification: Suppliers with a broad customer base, serving more than 50 automotive brands, have less dependence on any single buyer like GAC.

The bargaining power of suppliers for Guangzhou Automobile Group (GAC) is a critical factor, influenced by supplier concentration and the cost of switching. In 2024, the automotive industry continues to see a concentration of suppliers for advanced components like semiconductors and EV batteries, allowing these entities to negotiate favorable terms. GAC faces substantial costs, including retooling and re-qualification, when changing suppliers, particularly for proprietary technologies essential for their product differentiation.

| Factor | Impact on GAC | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration | Higher power for few dominant suppliers | Continued concentration in EV battery cells and advanced chips. |

| Switching Costs | High costs for GAC to change suppliers | Significant investment in retooling and component redesign. |

| Supplier Specialization | Stronger leverage for suppliers of unique tech | Critical for next-gen EV components, impacting GAC's innovation pace. |

| Threat of Forward Integration | Potential for suppliers to become competitors | Growing possibility for battery and software suppliers in the EV space. |

| GAC's Importance to Supplier | Weakened supplier power if GAC is a major client | GAC's reliance on specific suppliers can be a key negotiation point. |

What is included in the product

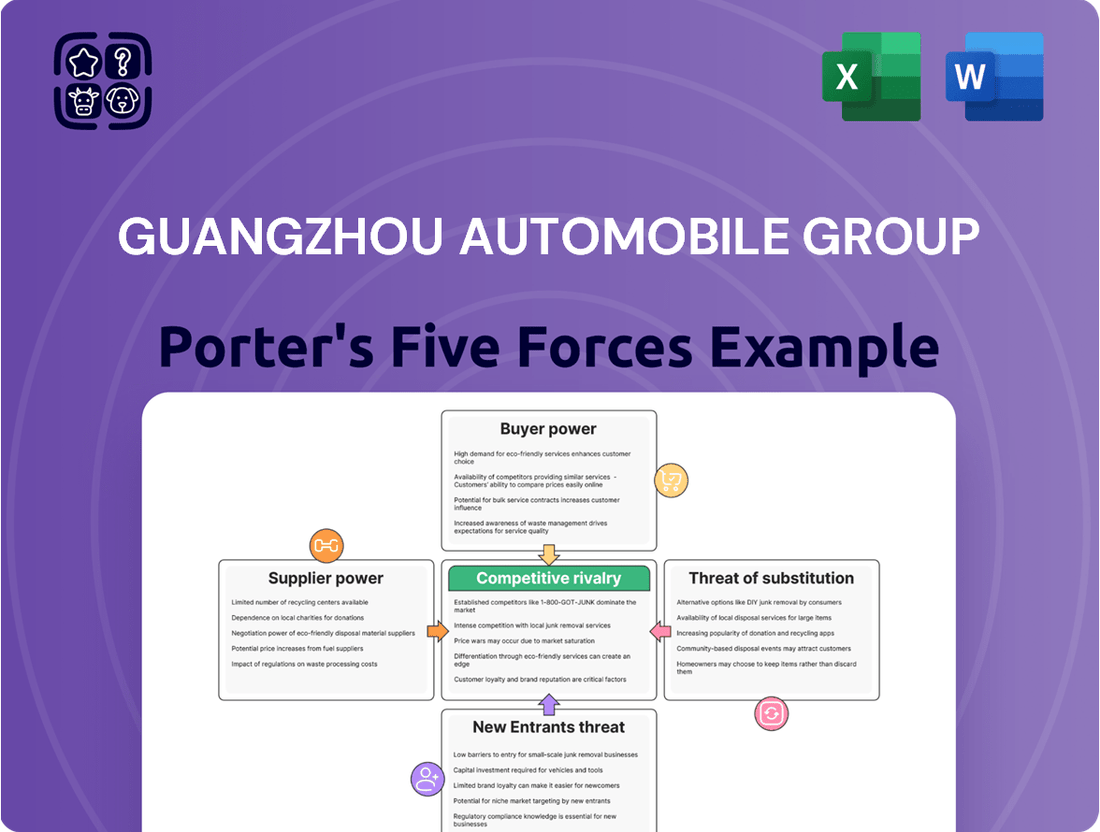

This analysis delves into the competitive landscape of Guangzhou Automobile Group, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

A visually intuitive dashboard that highlights the most impactful competitive pressures on Guangzhou Automobile Group, enabling targeted strategic responses.

Customers Bargaining Power

Customers in China's automotive market, especially for New Energy Vehicles (NEVs), exhibit strong price sensitivity. This is a critical factor for companies like Guangzhou Automobile Group (GAC).

The intense price competition within China's auto sector, which has seen significant price reductions on EVs and plug-in hybrids, directly empowers customers. They can effectively demand lower prices, which directly affects GAC's profit margins.

For instance, in early 2024, reports indicated aggressive price cuts across various EV manufacturers in China, with some models seeing reductions of over 10%. This trend highlights the substantial bargaining power customers wield, forcing automakers to compete aggressively on price.

The sheer volume of vehicle choices in China significantly boosts customer bargaining power. With numerous domestic and international manufacturers offering a wide spectrum of internal combustion engine (ICE), hybrid (HEV), plug-in hybrid (PHEV), and battery electric vehicle (BEV) models, consumers have plenty of alternatives to consider.

This abundance of substitutes is amplified by the swift expansion of Chinese brands in the new energy vehicle (NEV) sector. For instance, in 2023, China's NEV sales reached 9.495 million units, representing a 37.9% year-on-year increase, with domestic brands like BYD and Geely playing a dominant role. This competitive landscape directly translates to greater leverage for buyers when negotiating prices and features.

Buyer information and transparency have significantly increased, making it easier for consumers to compare Guangzhou Automobile Group's (GAC) offerings with competitors. Online platforms and review sites provide detailed information on pricing, features, and reliability, directly impacting GAC's pricing power. For instance, in 2023, the average transaction price for new vehicles in China saw fluctuations, and readily available comparison tools mean buyers can quickly identify better value, thus strengthening their bargaining position.

Customer Concentration

Customer concentration can significantly influence bargaining power. While individual car buyers are generally fragmented, large fleet operators or government entities represent concentrated customer bases. If Guangzhou Automobile Group (GAC) has substantial sales to these concentrated groups, they would wield greater negotiation leverage, potentially impacting GAC's pricing and margins.

For instance, if a significant portion of GAC's sales in 2024 were directed towards large ride-sharing companies or government vehicle procurement programs, these buyers could demand volume discounts or specific customization at lower costs. This would directly increase their bargaining power against GAC.

- Fragmented Individual Buyers: The vast majority of GAC's customers are individual consumers, making them largely price-takers.

- Concentrated Fleet Buyers: Large corporate fleets, rental car companies, or government agencies represent concentrated customer segments.

- Negotiation Leverage: These concentrated buyers can exert considerable bargaining power due to the volume of their purchases.

Switching Costs for Customers

For most consumers, the financial and logistical hurdles of switching between vehicle brands are generally low. The primary effort involves the process of selling an existing car and acquiring a new one.

While brand loyalty does exist, it's often not a significant barrier in the automotive market. The competitive landscape, particularly with the rapid advancements and appealing new models emerging in the electric vehicle (EV) segment, frequently outweighs established brand preferences. For instance, in 2024, the sheer volume of new EV models introduced by various manufacturers, offering competitive pricing and advanced features, provides consumers with ample alternatives, thereby diminishing the impact of brand loyalty on switching decisions.

- Low Switching Costs: The primary costs are transactional, related to selling and buying.

- Brand Loyalty Erosion: Intense competition and innovation, especially in EVs, reduce the power of brand loyalty.

- 2024 EV Market Dynamics: A surge in new EV models offers consumers more choices, making brand switching easier.

Customers in China's automotive market, particularly for New Energy Vehicles (NEVs), possess significant bargaining power. This stems from intense price competition, a wide array of substitutes, and increased buyer information, all of which compel manufacturers like Guangzhou Automobile Group (GAC) to offer competitive pricing and value.

The prevalence of price reductions, with some EV models seeing cuts exceeding 10% in early 2024, directly empowers buyers. Furthermore, the sheer volume of choices, bolstered by the 37.9% year-on-year growth in China's NEV sales to 9.495 million units in 2023, means consumers can easily switch to alternatives, diminishing brand loyalty.

While individual buyers are fragmented, concentrated customers like fleet operators can exert substantial leverage. The low switching costs for consumers, primarily transactional, further amplify their ability to negotiate favorable terms, directly impacting GAC's pricing power and profit margins.

| Factor | Impact on GAC | Supporting Data/Trend |

|---|---|---|

| Price Sensitivity | High | Aggressive EV price cuts in early 2024, some exceeding 10%. |

| Availability of Substitutes | High | China NEV sales reached 9.495 million units in 2023 (37.9% YoY growth). |

| Buyer Information | High | Increased transparency via online platforms for price and feature comparisons. |

| Switching Costs | Low | Primarily transactional costs for selling/buying; brand loyalty is weakening. |

| Customer Concentration | Variable (High for fleets) | Large fleet operators can demand volume discounts. |

What You See Is What You Get

Guangzhou Automobile Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Guangzhou Automobile Group, detailing the competitive landscape of the automotive industry. The document you see here is the exact, fully formatted report you will receive immediately after purchase, offering an in-depth examination of supplier power, buyer bargaining power, threat of new entrants, threat of substitutes, and industry rivalry. You can trust that what you are previewing is the complete, ready-to-use analysis for your strategic decision-making.

Rivalry Among Competitors

Guangzhou Automobile Group (GAC) operates within a fiercely competitive Chinese automotive market. This sector is crowded with a multitude of players, ranging from established international joint ventures like GAC Toyota and GAC Honda, to domestic giants such as BYD and SAIC Motor, and a surge of innovative new energy vehicle (NEV) startups like NIO and XPeng.

The sheer volume and diversity of these competitors mean that GAC faces constant pressure to innovate and differentiate. In 2023, China's auto sales surpassed 30 million units, highlighting the vastness of the market but also the intensity of the battle for consumer attention and loyalty. This dynamic landscape necessitates continuous investment in research and development and aggressive marketing strategies.

While the New Energy Vehicle (NEV) segment in China is experiencing robust growth, the broader domestic auto market has shown more subdued performance, with some periods of decline. For instance, in 2023, China's overall automobile sales reached 30.09 million units, a 12% increase year-on-year, but this growth was largely driven by NEVs, which saw a 37.9% surge to 9.495 million units.

This divergence creates intense competition for established market share among traditional automakers as the overall pie grows at a slower pace than the rapidly expanding NEV sector. The industry is also grappling with significant overcapacity, particularly in traditional internal combustion engine (ICE) vehicles, which intensifies price pressures and competitive dynamics.

Competitive rivalry within the automotive sector, particularly for Guangzhou Automobile Group (GAC), is intensely fueled by a relentless pursuit of innovation in intelligent driving, advanced connectivity, and new energy vehicle (NEV) technologies. This constant push for technological advancement means companies are in a perpetual race to offer superior features and performance, directly impacting market share and brand perception.

GAC's strategic investments in research and development, coupled with collaborations like its partnership with Huawei, are key to differentiating its product portfolio. However, this differentiation is a moving target as competitors are also making significant strides in these same cutting-edge areas. For instance, in 2024, the global NEV market continued its rapid expansion, with many established and emerging players introducing advanced autonomous driving features and enhanced in-car digital experiences, intensifying the pressure on GAC to maintain its competitive edge through unique technological offerings.

Exit Barriers

Guangzhou Automobile Group (GAC) faces substantial exit barriers within the automotive industry. The immense capital required for manufacturing plants, ongoing research and development, and the establishment of widespread distribution channels means that leaving the market is an incredibly costly proposition. These high fixed costs, often running into billions of dollars for major automakers, effectively tie companies like GAC to the industry, even when market conditions are unfavorable.

This situation naturally intensifies competition. When companies cannot easily exit, they are compelled to remain operational and fight for market share, even if profitability is low. This persistence can lead to prolonged periods of aggressive pricing and innovation as firms strive to survive and eventually thrive, impacting overall industry rivalry.

For instance, the automotive sector is characterized by massive investments. In 2024, global automotive R&D spending was projected to exceed $200 billion, with significant portions allocated to electric vehicle (EV) technology and autonomous driving. GAC, like its peers, must continue investing heavily in these areas to remain competitive, further solidifying the high exit barriers.

- High Capital Intensity: Automakers require enormous upfront investment in factories, machinery, and technology, making divestment difficult.

- R&D Commitments: Continuous investment in new vehicle development, particularly in areas like electrification and connectivity, creates ongoing financial obligations.

- Distribution Networks: Establishing and maintaining a broad dealership and service network represents a significant, often sunk, cost.

- Brand Reputation: A company's brand is built over years and is intrinsically linked to its manufacturing and sales operations, making a clean exit challenging.

Price Competition and Profit Margins

The Chinese automotive market, particularly the burgeoning New Energy Vehicle (NEV) segment, has been a hotbed of intense price competition throughout 2024. This aggressive pricing strategy by numerous manufacturers has inevitably squeezed profit margins across the industry.

Guangzhou Automobile Group's (GAC) financial performance has directly mirrored this industry trend. The company's own results demonstrate the significant pressure on profitability, underscoring that price remains a critical factor in the competitive landscape.

- Intensified Price Wars: Leading automakers in China have engaged in significant price cuts on NEVs in 2024, impacting overall industry profitability.

- Margin Compression: GAC's reported net profit margin for the first half of 2024 saw a decline compared to the same period in 2023, directly attributable to these pricing pressures.

- Price as a Key Differentiator: For many consumers, especially in the rapidly growing NEV market, price is a primary consideration, forcing companies like GAC to compete aggressively on this front.

Competitive rivalry within Guangzhou Automobile Group's (GAC) operating environment is exceptionally high, driven by a crowded market featuring both established international players and rapidly growing domestic brands, especially in the New Energy Vehicle (NEV) sector.

In 2024, China's automotive market continued to be characterized by aggressive pricing strategies and intense competition, with NEVs seeing significant sales growth but also facing price wars that compressed margins for all manufacturers.

GAC's ability to differentiate through innovation in areas like intelligent driving and connectivity is crucial, but competitors are also heavily investing in these technologies, making it a constant challenge to maintain a unique market position.

The sheer volume of competitors, including giants like BYD and SAIC, alongside numerous NEV startups, means GAC must continuously invest in R&D and marketing to capture and retain market share, a dynamic amplified by the industry's high capital intensity and exit barriers.

| Competitor Type | Key Players | 2023 China NEV Sales (Units) | 2024 Competitive Pressure |

| Domestic Giants | BYD, SAIC Motor | BYD: ~3.02 million | High, aggressive pricing and product launches |

| International JVs | GAC Toyota, GAC Honda | N/A (Segmented by brand) | Moderate, focus on established ICE and hybrid tech |

| NEV Startups | NIO, XPeng, Li Auto | NIO: ~160,000; XPeng: ~141,000 | Very High, rapid innovation and market share capture |

SSubstitutes Threaten

The growing availability and affordability of public transportation, coupled with the widespread adoption of ride-sharing platforms like DiDi, pose a substantial threat to Guangzhou Automobile Group's (GAC Group) traditional car sales. In 2023, China's public transport ridership saw a significant rebound, with urban rail transit alone carrying over 24 billion passengers, indicating a strong preference for alternatives to private car ownership in densely populated areas.

This trend is further amplified by the increasing efficiency and coverage of these services, making them a convenient and often more economical choice for daily commutes. For instance, ride-sharing services in major Chinese cities often offer competitive pricing, especially during off-peak hours, directly challenging the value proposition of owning a personal vehicle.

The threat of substitutes for Guangzhou Automobile Group (GAC) is significant, particularly from emerging alternative mobility solutions. Beyond traditional public transport, the rise of micro-mobility options like electric scooters and shared bicycles offers convenient, short-distance travel, potentially diverting demand from personal vehicles, especially in urban areas. For instance, by mid-2024, many cities have seen a substantial increase in shared scooter usage, with some reporting millions of rides annually, impacting short urban commutes.

Furthermore, GAC itself is actively involved in exploring future mobility innovations, such as mass-produced flying cars. While still in nascent stages, the successful development and adoption of such technologies could fundamentally alter transportation needs, offering entirely new ways for consumers to travel and potentially reducing reliance on conventional automobiles. This forward-looking investment by GAC underscores the acknowledgment of these evolving substitute threats.

A growing generational preference for sustainable and shared mobility options, fueled by environmental awareness and economic considerations, presents a significant threat to traditional private car sales. This evolving consumer mindset could reduce the demand for vehicles manufactured by companies like Guangzhou Automobile Group (GAC).

For instance, in 2024, ride-sharing services continued to gain traction, with global usage projected to increase significantly. Furthermore, the increasing availability and adoption of electric vehicles (EVs) and micro-mobility solutions like e-scooters and e-bikes offer viable alternatives to private car ownership, particularly in urban centers.

Cost-Effectiveness of Substitutes

The increasing affordability and convenience of public transportation and ride-sharing services present a significant threat to Guangzhou Automobile Group (GAC). If the total cost of owning a vehicle, encompassing purchase price, ongoing maintenance, fuel or electricity, insurance, and parking, becomes substantially higher than utilizing these alternatives, consumer preference will shift away from private car ownership. For instance, in 2024, many urban centers saw continued increases in public transit subsidies and expansions of ride-sharing networks, making these options more economically viable for daily commutes.

This trend is further amplified by evolving urban planning and environmental regulations that may disincentivize private vehicle use in city centers.

- Rising Fuel/Electricity Costs: Fluctuations in energy prices directly impact the operational cost of personal vehicles, making public transit a more predictable expense.

- Growth of Ride-Sharing Platforms: The convenience and competitive pricing of services like Didi Chuxing in China, especially for shorter trips, offer a compelling alternative to car ownership.

- Public Transportation Investment: Government investments in expanding and modernizing public transport infrastructure, including high-speed rail and efficient bus networks, enhance their attractiveness.

- Urban Congestion and Parking Challenges: Increasing traffic congestion and the high cost or limited availability of parking in major cities make driving less appealing.

Technological Advancements in Substitutes

Technological advancements are continuously making substitutes for traditional car ownership more attractive. Improvements in public transport, like integrated multi-modal apps, enhance convenience and accessibility, potentially drawing consumers away from private vehicles.

Ride-sharing platforms are also becoming more efficient and widespread, offering a flexible alternative. For example, by mid-2024, many cities reported significant increases in ride-sharing usage, driven by app improvements and wider driver availability, directly impacting demand for new car sales.

- Enhanced Public Transport: Investments in high-speed rail and smart city transit solutions are making commuting without a personal car faster and more convenient.

- Ride-Sharing Evolution: Advanced algorithms in ride-sharing apps optimize routes and wait times, making them a more competitive option, especially in urban areas.

- Micromobility Growth: Electric scooters and bikes, often integrated into city-wide sharing programs, offer last-mile solutions that can reduce reliance on cars for shorter trips.

The threat of substitutes for Guangzhou Automobile Group (GAC) is substantial, primarily driven by the increasing viability and adoption of alternative transportation methods. Public transportation, enhanced by government investment and technological integration, offers a cost-effective and convenient option for many consumers, particularly in urban centers. Ride-sharing platforms further erode the necessity of private car ownership by providing on-demand mobility solutions that are often more economical and less hassle than maintaining a personal vehicle.

The growing preference for shared and sustainable mobility, coupled with the rising costs associated with car ownership, presents a significant challenge. For instance, in 2024, many major Chinese cities continued to expand their public transit networks, with urban rail transit ridership showing robust growth. This trend, alongside the increasing efficiency and affordability of ride-sharing services, directly competes with GAC's traditional car sales by offering compelling alternatives for daily commuting and travel needs.

| Substitute Type | Key Drivers | Impact on GAC |

|---|---|---|

| Public Transportation | Government investment, network expansion, integrated apps | Reduced demand for personal vehicles, especially for urban commutes |

| Ride-Sharing Platforms | Convenience, competitive pricing, app efficiency | Direct competition for short to medium-distance travel needs |

| Micromobility (E-scooters, E-bikes) | Urban planning integration, last-mile solutions | Potential reduction in demand for entry-level vehicles |

Entrants Threaten

The automotive manufacturing sector, a core area for Guangzhou Automobile Group (GAC), demands colossal upfront capital. Newcomers must contend with significant expenditures for research and development, establishing state-of-the-art production facilities, and building extensive distribution and after-sales service networks. For instance, the development of a single new vehicle platform can cost billions of dollars, a daunting figure for any aspiring competitor.

Established players like Guangzhou Automobile Group (GAC) leverage significant economies of scale in production and procurement. For instance, GAC's substantial vehicle output allows for lower per-unit costs, a barrier that new entrants find difficult to overcome. Their accumulated experience in manufacturing processes and supply chain optimization also translates into greater efficiency and cost control.

Establishing robust sales, service, and parts distribution networks, alongside securing dependable, high-quality supply chains, represents a significant hurdle for any new player aiming to enter the automotive market. This is a process that demands substantial investment and considerable time to mature.

New entrants would find it exceptionally difficult to match Guangzhou Automobile Group's (GAC) existing extensive reach and its deeply entrenched relationships with established suppliers. For instance, GAC's expansive dealer network across China, a key competitive advantage, took years to build and solidify, making it a formidable barrier.

Brand Loyalty and Customer Switching Costs

Existing brands, including Guangzhou Automobile Group's (GAC) own marques and its joint ventures like GAC Toyota and GAC Honda, have cultivated significant brand recognition and deep customer loyalty over many years. This established trust means new entrants face a considerable hurdle in attracting buyers away from familiar and reliable options.

To overcome this ingrained loyalty, new competitors must present highly compelling value propositions. This often necessitates substantial investments in marketing campaigns to build awareness and establish credibility, alongside aggressive pricing strategies to incentivize initial purchases and encourage switching.

- Brand Recognition: GAC benefits from strong brand equity built through its joint ventures, which often rank high in customer satisfaction surveys in China. For instance, in 2024, GAC Toyota continued to be a leader in reliability perceptions.

- Customer Loyalty: Repeat purchase rates for GAC's joint venture brands remain robust, indicating a high degree of customer stickiness.

- Switching Costs: Beyond price, switching costs for consumers include the effort of researching new brands, potential differences in service networks, and the perceived risk associated with unfamiliar products in a market as critical as personal transportation.

- Marketing Investment: New entrants in 2024 and 2025 are expected to allocate significant portions of their budgets, potentially 15-20% of projected sales, towards brand building and promotional activities to gain market share.

Government Policy and Regulations

Government policies significantly shape the threat of new entrants in the automotive sector, particularly concerning new energy vehicles (NEVs). While policies often aim to accelerate NEV adoption, they can simultaneously erect barriers through rigorous safety, emissions, and manufacturing standards. For instance, China's stringent NEV credit system, implemented to boost production, requires manufacturers to meet specific targets, which can be challenging for newcomers to achieve without substantial investment and established production capabilities.

Licensing requirements and the allocation of subsidies also play a crucial role. Governments may offer preferential treatment or financial incentives that favor existing, well-capitalized companies or specific types of entrants, such as joint ventures with domestic partners. In 2024, the landscape continues to evolve with ongoing adjustments to these policies, impacting the cost and feasibility of market entry for aspiring automotive manufacturers.

- Regulatory Hurdles: New entrants must navigate complex and evolving safety, emissions, and manufacturing standards, increasing compliance costs.

- Licensing and Subsidies: Government-issued licenses and targeted subsidies can provide significant advantages to established players or favored new entrants.

- Policy Uncertainty: Fluctuations in government support and regulatory frameworks create an unpredictable environment for potential new competitors.

The threat of new entrants for Guangzhou Automobile Group (GAC) remains moderate due to substantial capital requirements, strong brand loyalty, and established distribution networks. While the burgeoning electric vehicle market presents opportunities, the high cost of R&D and manufacturing facilities, coupled with stringent regulatory standards, acts as a significant deterrent. For example, developing a new EV platform can easily exceed billions of dollars, a prohibitive cost for most aspiring competitors in 2024.

| Factor | Impact on New Entrants | Relevance to GAC |

|---|---|---|

| Capital Intensity | Very High (R&D, manufacturing, distribution) | GAC benefits from established infrastructure and scale. |

| Brand Loyalty & Switching Costs | High (Consumer trust, service networks) | GAC's joint ventures foster strong customer allegiance. |

| Government Regulations & Standards | High (Safety, emissions, NEV mandates) | GAC has experience navigating these, while newcomers face learning curves. |

| Economies of Scale | High (Procurement, production efficiency) | GAC's volume provides cost advantages over potential entrants. |

Porter's Five Forces Analysis Data Sources

Our Guangzhou Automobile Group Porter's Five Forces analysis is built upon a foundation of comprehensive data, including the company's annual reports, investor presentations, and official regulatory filings. We also incorporate insights from reputable automotive industry research reports and market intelligence platforms to provide a thorough assessment of the competitive landscape.