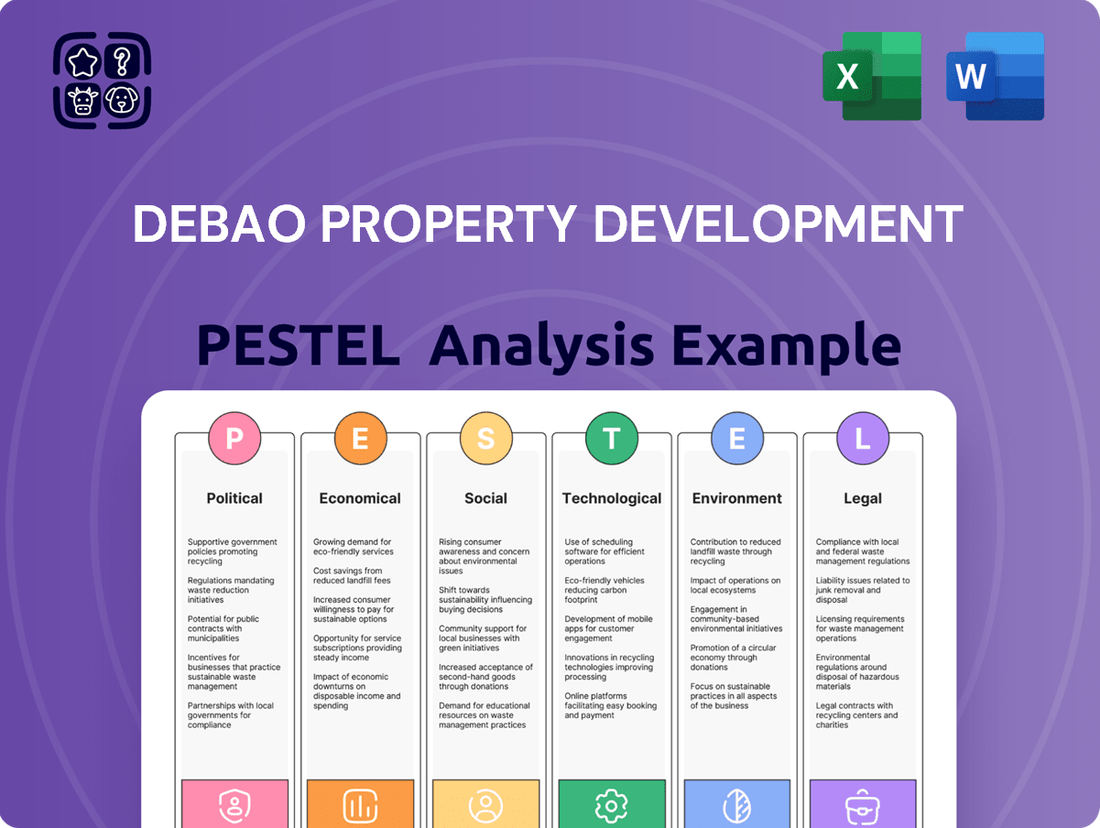

Debao Property Development PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Debao Property Development Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Debao Property Development's trajectory. Our comprehensive PESTLE analysis provides actionable intelligence, empowering you to anticipate market shifts and capitalize on emerging opportunities. Don't just react to change; lead it. Purchase the full PESTLE analysis now and gain the strategic clarity you need to thrive.

Political factors

The Chinese government is actively implementing measures to stabilize the real estate market, aiming to reverse its downturn. These efforts include providing financial support to eligible projects through mechanisms like the 'white list,' which by early 2024 had approved over 2,000 projects, and encouraging local governments to purchase unsold homes for affordable housing initiatives.

This strong political will to prevent further declines in the sector is crucial for developers like Debao Property. The government's intervention signals a commitment to market stability, potentially boosting investor confidence and improving liquidity for struggling projects.

Government policy in 2024-2025 strongly emphasizes boosting affordable housing supply and speeding up urban village renovations. This directly targets the housing needs of younger demographics and migrant populations, while also serving to reduce excess commercial property stock.

These policy shifts are designed to foster a more equitable housing market. For instance, China's National Bureau of Statistics reported a 1.9% year-on-year increase in housing starts for affordable units in early 2024, indicating a tangible governmental push.

A significant policy shift is underway, favoring the sale of completed, move-in ready homes over the previous practice of pre-selling unfinished properties. This aims to rebuild consumer confidence shaken by developer insolvencies and project delays, with the government actively promoting this new model. For instance, in early 2024, several major cities saw an increase in completed property sales, indicating a market adjustment to these directives.

Local Government Autonomy

Local governments are increasingly empowered to manage their property markets, a shift that directly impacts developers like Debao. This greater autonomy allows them to set policies on who can buy housing stock and how prices are determined. For instance, in 2024, several Tier 2 and Tier 3 cities have introduced measures allowing local authorities to purchase unsold commodity housing for affordable housing initiatives, a move that could provide liquidity for developers.

This flexibility enables more localized approaches to market stabilization. Debao must therefore monitor specific city-level regulations rather than relying on a uniform national strategy. The effectiveness of these local policies, such as targeted purchase restrictions or incentives, will be crucial in shaping regional demand and supply dynamics throughout 2024 and into 2025.

Key implications for Debao Property Development include:

- Adaptability to diverse local regulations: Policies on buyer eligibility and pricing vary significantly by city.

- Opportunities in government bulk purchases: Local governments may buy unsold inventory for social housing projects.

- Risk of policy fragmentation: Inconsistent local rules can complicate national development strategies.

- Focus on city-specific market analysis: Understanding individual city dynamics is paramount for successful project planning.

Long-term Housing Development Plans

The Ministry of Housing and Urban-Rural Development is guiding local governments to create housing development plans for 2024 and 2025. These plans are to be informed by evolving demographic trends, aiming for a balanced housing market. This directive underscores a commitment to proactive urban planning and market stability.

The core objective is to align housing supply with actual demand, thereby mitigating excessive price volatility and guiding sustainable real estate growth. This forward-looking approach is crucial for long-term urban development strategies.

- Demographic-Driven Planning: Local authorities are tasked with formulating housing plans for 2024-2025, directly linking development to demographic shifts.

- Market Equilibrium Goal: The strategy aims to prevent sharp fluctuations by ensuring a closer match between housing supply and demand.

- Future Development Guidance: These plans will serve as a roadmap for future real estate projects and urban expansion initiatives.

Government intervention continues to be a dominant political factor, with a strong focus on stabilizing the real estate market. Initiatives like the 'white list' have seen over 2,000 projects approved by early 2024, providing crucial financial support. The emphasis on affordable housing and urban village renovations for 2024-2025 directly addresses demographic needs and aims to rebalance the market.

Local governments are gaining more autonomy in managing their property markets, leading to varied policies on pricing and buyer eligibility. This decentralization presents both opportunities, such as local government bulk purchases for social housing, and risks due to potential policy fragmentation. Debao must therefore navigate these localized regulatory landscapes.

The shift towards selling completed homes over pre-sales is a significant policy change aimed at restoring consumer confidence, with early 2024 data showing an uptick in completed property sales in several major cities. The Ministry of Housing and Urban-Rural Development is also guiding localized, demographically-informed housing plans for 2024-2025 to foster market equilibrium.

| Policy Focus | Key Actions | Timeline | Impact on Developers |

|---|---|---|---|

| Market Stabilization | 'White list' project approvals, financial support | Ongoing (over 2,000 projects by early 2024) | Improved liquidity, project viability |

| Affordable Housing | Increased supply, urban village renovation | 2024-2025 | New demand segments, potential for social housing partnerships |

| Consumer Confidence | Promotion of completed home sales | Ongoing (early 2024 saw increased completed sales) | Reduced pre-sale risk, focus on delivery quality |

| Local Market Autonomy | Decentralized policy setting | 2024 onwards | Need for city-specific strategies, risk of regulatory divergence |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Debao Property Development, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

A clear, actionable PESTLE analysis for Debao Property Development that cuts through complexity, offering immediate insights to navigate market challenges and capitalize on opportunities.

Economic factors

China's real estate sector is experiencing a significant downturn, with 2024 data showing continued downward pressure on housing prices and sales. Projections indicate these declines will likely extend into 2025, despite government efforts to stimulate the market. While a widespread recovery remains unlikely, some signs of stabilization have emerged in major first-tier cities.

Debao Property Development, with its operations concentrated in Guangxi province, is directly impacted by these challenging market conditions. The ongoing slump in property values and sales volumes creates a direct headwind for the company's revenue and profitability, underscoring the sensitivity of its business model to broader economic trends.

Sluggish consumer confidence is a major drag on China's economy and, consequently, its property sector. When people feel uncertain about the future and their finances, they tend to hold back on big purchases like homes.

This cautious sentiment, coupled with rising household debt, directly dampens domestic private demand for real estate. For instance, in early 2024, consumer confidence indices in China remained subdued, reflecting anxieties over employment and income stability, which naturally translates to a hesitant housing market.

Government initiatives in 2025 have significantly eased mortgage lending conditions, including a reduction in minimum down payment requirements and lower interest rates. This policy shift aims to stimulate the housing market by making property ownership more accessible.

Mortgage availability saw a notable improvement in early 2025, with banks demonstrating renewed confidence in lending. This increased availability is expected to gradually bolster homebuying demand throughout the year.

Government Stimulus and Fiscal Support

Government stimulus and fiscal support are crucial for the property sector. Beijing has introduced a significant package of measures designed to bolster the real estate market. This includes a program where local governments can purchase unsold homes, which helps to reduce inventory and free up developer capital.

Furthermore, a multi-trillion-yuan 'White List' lending program has been established to provide developers with access to much-needed financing. These fiscal injections are intended to address construction backlogs and facilitate debt restructuring, offering essential financial lifelines to struggling companies. For instance, by mid-2024, it was reported that over 200 cities had initiated programs to purchase commercial housing for affordable housing projects, signaling a substantial government commitment to stabilizing the market.

- Property Market Stabilization: Government initiatives aim to reduce the substantial inventory of unsold homes.

- Developer Financing: The 'White List' program targets trillions of yuan in loans to qualified developers.

- Debt Restructuring Support: Fiscal measures are in place to help developers manage and restructure their existing debt burdens.

- Affordable Housing Conversion: Local governments are actively buying properties to convert into affordable housing units.

Impact on Local Government Finances

Local governments are facing significant financial strain due to declining land sale revenues. For instance, in 2023, China's land sale revenue for local governments dropped by 17.5% year-on-year, reaching approximately 8.9 trillion yuan. This reduction directly impacts their ability to fund public services and infrastructure projects.

The capacity of local authorities to introduce new support mechanisms, such as utilizing special bonds to acquire unsold real estate, is vital for stabilizing the property market. However, the success of these initiatives hinges on manageable financing costs. The sustainability of these bond issuances is a key consideration for ongoing market support efforts.

- Decreased Land Sales: Local government revenue from land sales saw a substantial decline in 2023.

- Fiscal Pressure: This revenue drop puts pressure on local government budgets and their capacity for public spending.

- Support Measures: Issuing special bonds to buy unsold properties is a key strategy being explored.

- Financing Costs: The effectiveness of these measures depends on the affordability of borrowing for local governments.

Economic factors present a mixed outlook for Debao Property Development. While consumer confidence remains a concern, government stimulus measures, including eased mortgage lending and a substantial 'White List' financing program for developers, are designed to inject stability. Local governments, however, face fiscal pressure from declining land sales, impacting their ability to support the market further.

| Economic Factor | 2023 Data | Early 2024 Outlook | 2025 Projection |

|---|---|---|---|

| Housing Prices & Sales | Continued decline | Subdued, some stabilization in Tier 1 cities | Gradual improvement expected with policy support |

| Consumer Confidence | Subdued | Remains a drag due to employment/income anxieties | Dependent on broader economic recovery |

| Mortgage Lending | Tightening | Easing of requirements, increased availability | Continued accessibility |

| Local Government Land Sales Revenue | -17.5% YoY (approx. 8.9 trillion yuan) | Continued pressure | Dependent on property market recovery and bond issuance costs |

Full Version Awaits

Debao Property Development PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Debao Property Development PESTLE analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the market landscape and strategic considerations for Debao.

Sociological factors

China's demographic trajectory presents a significant headwind for housing demand. With population growth having plateaued and a projected decline in population numbers, the demand for urban housing is expected to remain considerably lower than its previous peak. This trend is further exacerbated by falling property prices, creating a challenging environment for developers.

The long-term outlook for the real estate sector faces a substantial challenge from this demographic decline. Projections indicate that the average annual demographic demand for housing will fall, signaling a structural shift rather than a cyclical downturn.

Urbanization continues to draw people to China's major economic centers, a trend that benefits property developers like Debao. However, the pace of this migration has shown signs of slowing. For instance, while the urbanization rate reached 66.16% by the end of 2023, an increase of 1.19 percentage points from the previous year, the rate of increase itself has moderated compared to earlier periods.

This nuanced picture suggests that while cities remain attractive, the surge in housing demand seen in past years might be less pronounced. Debao Property Development needs to consider this evolving dynamic, potentially focusing on quality and specific urban needs rather than sheer volume growth in its development strategies for 2024 and 2025.

The increasing need for affordable and rental housing is a significant sociological trend. Many lower and middle-income households are finding it difficult to afford homeownership, leading to a greater demand for rental options and more budget-friendly properties.

Governments worldwide are responding by actively promoting the development of affordable and rental housing projects. For instance, in 2024, China's government continued to emphasize the construction of public rental housing, aiming to provide stable accommodation for over 10 million new urban residents. This indicates a broader market shift, with developers increasingly focusing on socially beneficial housing rather than solely on high-end commercial ventures.

Evolving Consumer Preferences

Consumer behavior in the housing market is increasingly prioritizing trust and the quality of completed homes. This shift is a clear reaction to past experiences with pre-sale models, where delays and defaults have eroded buyer confidence. For instance, in late 2024, reports indicated a significant rise in buyer demand for ready-to-move-in properties across major Chinese cities, reflecting this growing preference for tangible assets and reduced risk.

This evolving preference directly impacts developers like Debao Property. The move away from pre-sales towards selling completed units signifies a demand for greater security and immediate gratification from homebuyers. This trend is supported by surveys conducted in early 2025, which showed that over 60% of potential homebuyers would rather pay a premium for a finished property than wait for a pre-sale unit, especially in uncertain economic climates.

- Preference for Completed Homes: Buyers are actively seeking ready-to-occupy properties.

- Trust and Quality Focus: Disillusionment with pre-sale issues drives demand for proven quality.

- Reduced Risk Appetite: Consumers are opting for tangible assets over potential future delivery.

Intergenerational Disparity in Homeownership

Intergenerational differences in homeownership are a significant sociological factor affecting the property market. Younger generations often face greater hurdles to owning a home, leading to delayed household formation and a stronger reliance on parental assistance for down payments. This dynamic impacts overall consumer spending and the willingness of millennials and Gen Z to invest in real estate.

In 2024, data suggests a widening gap. For instance, in the UK, the average age of first-time buyers reached a record high, with many needing substantial financial help from family. This reliance on intergenerational wealth transfer for property acquisition is becoming a defining characteristic of the housing market, influencing demand and affordability metrics.

- Delayed Entry: Younger demographics are entering the homeownership market later than previous generations.

- Family Support: Parental assistance is increasingly crucial for younger buyers to meet deposit requirements.

- Economic Impact: This trend affects household formation rates and broader economic participation by young adults.

- Market Dynamics: The reliance on inherited wealth or family loans reshapes traditional buyer profiles and market accessibility.

Sociological factors significantly shape housing demand, with demographic shifts like population decline and slowing urbanization impacting sales volumes for developers like Debao. The increasing demand for affordable and rental housing, driven by affordability challenges for lower and middle-income households, presents a clear market opportunity. Furthermore, a growing consumer preference for ready-to-move-in properties, spurred by a desire for trust and quality assurance, is a critical consideration for 2024-2025 strategies.

| Sociological Factor | Description | 2024/2025 Implication for Debao |

|---|---|---|

| Demographic Decline | China's population plateau and projected decline reduce overall housing demand. | Focus on quality, specific urban needs, and potentially smaller, more affordable units. |

| Urbanization Pace | Slowing migration to cities means less rapid demand growth for urban housing. | Targeted developments in high-growth urban centers, rather than broad expansion. |

| Affordability & Rental Demand | Rising housing costs increase the need for budget-friendly and rental options. | Explore development of affordable housing projects and rental properties. |

| Consumer Trust & Quality | Buyers prioritize completed homes due to concerns about pre-sale risks. | Increase focus on delivering finished units and ensuring high construction quality. |

Technological factors

China's commitment to sustainability is rapidly reshaping the property sector. By 2025, all new urban buildings are mandated to adhere to green building standards, a significant acceleration in environmental policy. This directive pushes developers like Debao Property to integrate energy-efficient designs and renewable energy sources into their projects.

The push for greener construction translates into tangible impacts on development costs and timelines. For instance, the adoption of advanced insulation and smart building management systems, while initially more expensive, can lead to long-term operational savings for occupants. Debao Property's strategic planning must account for these evolving material and technological requirements to remain competitive and compliant.

The Chinese construction industry is actively embracing digital transformation, with technologies like Building Information Modeling (BIM), Artificial Intelligence (AI), and the Internet of Things (IoT) becoming more prevalent. This shift is significantly improving project management and operational efficiency.

By integrating these digital tools, construction firms can achieve real-time monitoring of project progress and resource allocation, leading to fewer delays and cost overruns. For instance, the adoption of BIM in China saw a notable increase, with many large-scale projects now mandating its use, underscoring its growing importance in enhancing collaboration and reducing errors throughout the construction lifecycle.

Smart city initiatives in China are a major catalyst for adopting cutting-edge construction technologies. These ambitious urban development projects are actively encouraging the integration of AI-powered construction management systems, advanced robotics for on-site tasks, and 3D printing for creating structural components. This push towards technological sophistication is reshaping how urban infrastructure is built, aiming for greater efficiency and innovation.

Prefabrication and Modular Construction

Prefabrication and modular construction are increasingly adopted to boost cost-efficiency and shorten project timelines in the real estate sector. This evolution towards off-site manufacturing and assembly, often encouraged by supportive government policies, is fundamentally reshaping building practices and speeding up project completion.

The global modular construction market was valued at approximately USD 100 billion in 2023 and is projected to reach over USD 200 billion by 2030, demonstrating significant growth driven by these technological advancements.

- Cost Savings: Prefabrication can lead to savings of 10-20% on construction costs due to reduced waste and optimized labor.

- Time Efficiency: Projects utilizing modular techniques can be completed up to 50% faster than traditional methods.

- Quality Control: Off-site manufacturing allows for more controlled environments, leading to higher and more consistent quality.

- Sustainability: Reduced material waste and improved energy efficiency in production contribute to greener building practices.

Advanced Cost Management Systems

Cities such as Chongqing are at the forefront of implementing advanced cost management systems, integrating digital technologies and differentiated supervision within the cost consulting sector. This technological push is vital for optimizing investment efficiency and ensuring project safety.

The adoption of these innovative cost management tools is directly linked to fostering sustainable growth in engineering and construction projects. For instance, in 2023, China's construction industry saw significant investment in digital transformation, with a reported 15% increase in spending on construction technology.

These advanced systems are designed to enhance transparency and control throughout the project lifecycle, from initial budgeting to final cost reconciliation. This focus on international innovations in cost management directly supports the strategic objectives of developers like Debao Property.

- Digitalization of Cost Consulting: Chongqing's initiatives highlight a trend towards tech-driven cost management, improving accuracy and efficiency.

- Enhanced Project Oversight: Differentiated supervision models, enabled by technology, provide more granular control over project expenditures.

- Investment in Innovation: The drive for international cost management innovations signals a commitment to best practices in financial and operational management for large-scale developments.

Technological advancements are significantly influencing China's property sector, pushing for greater efficiency and sustainability. The widespread adoption of Building Information Modeling (BIM) and Artificial Intelligence (AI) is streamlining project management, with BIM usage seeing a notable increase in large projects by 2024.

Prefabrication and modular construction methods are gaining traction, offering substantial cost savings of 10-20% and reducing project timelines by up to 50%. This shift, supported by government policies, is transforming building practices, with the global modular construction market expected to exceed USD 200 billion by 2030.

Smart city initiatives are further accelerating the integration of advanced construction technologies, including robotics and 3D printing, aiming for more innovative urban development. Furthermore, the digitalization of cost consulting, as seen in Chongqing, is enhancing transparency and optimizing investment efficiency, with China's construction industry increasing technology spending by 15% in 2023.

| Technology | Impact | Example/Data |

| BIM | Improved project management, collaboration, error reduction | Increased adoption in large-scale projects |

| AI | Enhanced construction management | Integration into smart city projects |

| Prefabrication/Modular Construction | Cost savings (10-20%), time efficiency (up to 50% faster) | Global market projected to exceed USD 200 billion by 2030 |

| Digital Cost Consulting | Increased transparency, efficiency, optimized investment | 15% increase in construction technology spending in China (2023) |

Legal factors

China's commitment to sustainable development is driving a significant shift towards stricter environmental protection laws, impacting property developers like Debao. These regulations include mandates for renewable materials in public construction projects, pushing the industry towards greener building practices. For instance, in 2024, China announced plans to increase the use of green building materials by 30% in new public infrastructure projects by 2027, a move that will undoubtedly influence private sector development as well.

The revised Environmental Protection Law, enacted in 2023, introduces more stringent penalties for emissions violations, creating a clear financial incentive for developers to adopt cleaner technologies and practices. This heightened regulatory environment necessitates that Debao Property Development proactively integrates eco-friendly solutions and invests in compliance to mitigate risks and capitalize on the growing demand for sustainable properties.

New regulations on residential property rentals, effective September 15, 2025, will standardize procedures and protect both tenants and landlords. These rules are designed to foster better development standards within the rental housing sector.

The updated framework includes mechanisms for rent monitoring and enforces strict accountability for any illegal activities, aiming to create a more transparent and secure rental market. This could influence rental yields and operational costs for developers like Debao.

In June 2024, China's Ministry of Housing and Urban-Rural Development updated its Green Building Evaluation Standard. This revision aims to meet more stringent national carbon emission reduction goals, impacting property developers like Debao.

The updated standards mandate enhanced energy efficiency and require new developments to comply with stricter construction codes related to sustainability. For instance, the revised standard emphasizes a greater reduction in building energy consumption, with targets for new residential buildings aiming for a 50% reduction in energy use compared to existing stock by 2025.

Labor Protection Regulations

The nationwide implementation of the 'Regulation on Wage Payment for Migrant Workers' in 2024 significantly impacts property developers like Debao. This regulation mandates real-time salary monitoring, often through blockchain platforms, and establishes joint liability for developers concerning any defaults by subcontractors. This legal shift aims to bolster social stability by ensuring timely payments, thereby increasing the compliance burden and potential financial risks for property developers.

These enhanced labor protection regulations mean that Debao Property Development must invest in robust payroll systems and due diligence processes for its supply chain. Failure to comply can lead to penalties and reputational damage, especially as governmental oversight tightens. The focus on migrant worker wages reflects a broader trend of increased legal accountability for construction sector labor practices.

- 2024 Regulation: Nationwide enforcement of wage payment for migrant workers.

- Blockchain Monitoring: Requirement for real-time salary tracking.

- Joint Liability: Developers are accountable for subcontractor wage defaults.

- Impact: Increased compliance, risk, and focus on social stability.

'White List' Mechanism and Financial Regulations

The 'white list' mechanism, introduced in January 2024, is a crucial regulatory initiative designed to direct financial assistance specifically to qualifying real estate developments. This system is a significant part of China's broader efforts to stabilize the property sector.

This mechanism, alongside other financial regulations, is intended to ensure that pre-sold housing projects are completed on time and to mitigate the risk of debt defaults among property developers. By channeling funds to viable projects, regulators aim to restore market confidence and protect homebuyers.

- January 2024 Launch: The 'white list' mechanism officially began operation, marking a proactive regulatory intervention.

- Objective: To provide targeted financial support to eligible real estate projects, ensuring project completion and debt risk mitigation.

- Impact: Aims to improve developer liquidity and bolster confidence in the property market's stability.

China's evolving legal landscape presents both challenges and opportunities for property developers like Debao. Stricter environmental regulations, such as the 2023 revised Environmental Protection Law, impose greater penalties for non-compliance, pushing for greener building practices, with a target to increase green building material use by 30% in public projects by 2027.

Labor laws, like the 2024 nationwide regulation on migrant worker wages, mandate real-time salary monitoring and impose joint liability on developers for subcontractor defaults, increasing compliance burdens. Furthermore, the introduction of a 'white list' mechanism in January 2024 aims to direct financial support to qualifying projects, a move intended to stabilize the property sector and ensure project completion.

| Legal Factor | Description | Effective Date/Period | Impact on Debao | Key Data/Target |

| Environmental Protection Law | Stricter penalties for emissions, mandates greener practices | Revised 2023 | Increased investment in compliance, potential for sustainable property demand | 30% increase in green material use in public projects by 2027 |

| Migrant Worker Wage Regulation | Real-time salary monitoring, joint liability for defaults | Nationwide 2024 | Enhanced payroll systems, due diligence on subcontractors, increased risk | Blockchain monitoring for wages |

| 'White List' Mechanism | Targeted financial support for qualifying projects | Launched January 2024 | Potential for project funding and improved market confidence | Ensuring pre-sold housing project completion |

Environmental factors

China's commitment to sustainability is intensifying, with a nationwide mandate for all new urban buildings to meet green building standards by 2025. This directive extends to requiring 50% rooftop photovoltaic coverage for new public institution and factory buildings. These stringent environmental regulations directly influence Debao Property Development's operational costs and project planning, necessitating investment in eco-friendly materials and energy-efficient designs.

China's commitment to energy conservation and carbon reduction is intensifying, with specific targets for 2024-2025 impacting high-emission sectors like building materials. This national push directly influences developers like Debao Property.

The country's action plan targets the establishment of a robust institutional framework for energy conservation and carbon reduction within the construction sector by 2025. This means stricter regulations and incentives for greener building practices are expected.

For instance, China aims to reduce its carbon emission intensity by 40-45% by 2025 compared to 2005 levels, a goal that will necessitate significant shifts in construction material sourcing and energy efficiency in new developments.

There's a noticeable acceleration in the adoption of eco-friendly construction materials, driven by policies that are broadening product availability, enhancing quality standards, and increasing brand awareness. This trend is crucial for developers like Debao Property, as it signals a market increasingly valuing sustainability.

The revised general rules for the grading and certification of green construction materials, implemented in January 2024, further solidify this shift. This regulatory update actively encourages and formalizes the use of sustainable building practices, directly impacting material sourcing and project planning for property developers.

Development of Ultra-low Energy Consumption Buildings

The push for ultra-low energy consumption buildings, targeting widespread adoption by 2027, presents a significant environmental driver for Debao Property Development. This directive necessitates integrating cutting-edge energy-saving technologies and innovative designs into new constructions. For instance, a 2024 report indicated that buildings account for nearly 40% of global energy consumption and a significant portion of greenhouse gas emissions, underscoring the urgency of this shift.

This environmental imperative will likely shape future building codes and standards, compelling developers to invest in sustainable materials and advanced insulation. Debao will need to adapt its project planning to accommodate these evolving requirements, potentially increasing initial construction costs but offering long-term operational savings and enhanced market appeal. The global green building market is projected to reach over $4 trillion by 2030, highlighting the financial opportunity in this trend.

- Mandatory adoption of ultra-low energy building standards by 2027.

- Increased investment in sustainable building materials and technologies.

- Potential for higher upfront construction costs offset by long-term operational savings.

- Growing market demand for eco-friendly and energy-efficient properties.

National Carbon Emission Trading Market

China's commitment to expanding its national carbon emission trading market, coupled with the ongoing development of its voluntary greenhouse gas reduction trading market, presents a significant environmental factor for property developers like Debao. This initiative aims to incentivize emissions reduction across various sectors.

As of early 2024, China's national Emissions Trading System (ETS) has covered over 7 billion tonnes of carbon dioxide equivalent annually, primarily within the power sector. The government's stated intention to broaden this coverage to other heavy-emitting industries, such as steel and petrochemicals, by 2025 signals a growing regulatory landscape for carbon management.

- Expanding Market Coverage: China's national carbon market is progressively including more industries beyond the initial power sector, impacting energy-intensive operations.

- Voluntary Reduction Market Growth: The simultaneous development of a voluntary greenhouse gas reduction market offers additional avenues for companies to offset emissions or generate credits.

- Incentives for Energy Efficiency: Developers implementing robust energy-saving measures and reducing their carbon footprint can potentially benefit from non-tax incentives and credits generated within these trading frameworks.

- Regulatory Evolution: Staying abreast of evolving regulations and market mechanisms within China's carbon trading system is crucial for strategic planning and compliance.

China's environmental regulations are tightening, with a mandate for all new urban buildings to meet green building standards by 2025, including 50% rooftop photovoltaic coverage for new public and factory buildings. This push for energy conservation and carbon reduction directly impacts developers like Debao Property, necessitating investments in eco-friendly materials and energy-efficient designs to meet targets like a 40-45% carbon emission intensity reduction by 2025 compared to 2005 levels.

The nation is also promoting ultra-low energy consumption buildings, aiming for widespread adoption by 2027, which requires integrating advanced energy-saving technologies. This aligns with the global trend where buildings contribute significantly to energy consumption and emissions, driving a market projected to exceed $4 trillion by 2030.

China's expanding national carbon emission trading market, which covered over 7 billion tonnes of CO2e annually by early 2024, is set to broaden its scope to other heavy-emitting industries by 2025. This evolving regulatory landscape offers potential benefits for developers who implement strong energy-saving measures and reduce their carbon footprint, possibly through non-tax incentives and credits.

| Environmental Factor | 2024/2025 Target/Status | Impact on Debao Property Development |

|---|---|---|

| Green Building Standards | Mandatory for all new urban buildings by 2025; 50% rooftop PV for new public/factory buildings. | Requires investment in eco-friendly materials and energy-efficient designs. |

| Carbon Emission Reduction | 40-45% intensity reduction by 2025 (vs. 2005 levels). | Influences material sourcing and energy efficiency in new developments. |

| Ultra-Low Energy Buildings | Widespread adoption targeted by 2027. | Necessitates integration of advanced energy-saving technologies and innovative designs. |

| Carbon Trading Market | Expanding coverage to more industries by 2025; over 7 billion tonnes CO2e covered by early 2024. | Incentivizes emissions reduction; potential for benefits from energy efficiency measures. |

PESTLE Analysis Data Sources

Our Debao Property Development PESTLE Analysis is meticulously constructed using a blend of official government reports, reputable real estate market research, and economic indicator data. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the property sector.