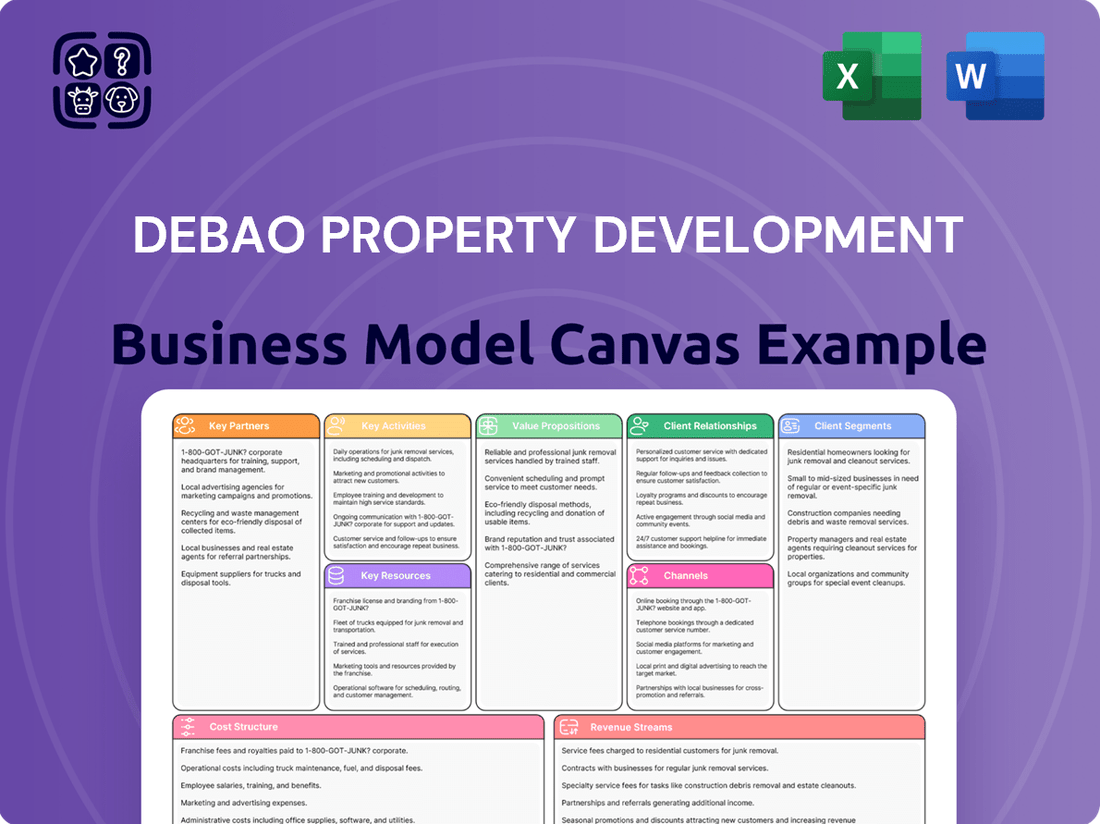

Debao Property Development Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Debao Property Development Bundle

Unlock the strategic core of Debao Property Development's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their approach to customer relationships, revenue streams, and key resources, offering invaluable insights for anyone looking to understand their competitive edge. Dive into the specifics and discover how they build value.

Partnerships

Debao Property Development's key partnerships include government and regulatory bodies, particularly within Guangxi province. Close collaboration with these entities is essential for navigating the complex real estate policies, securing permits, and maintaining compliance with evolving regulations. This is especially important given the Chinese property market's dynamic regulatory landscape, which in 2024 continues to focus on controlling speculation and managing developer debt levels.

Debao Property Development relies heavily on its key partnerships with financial institutions and investors. Establishing strong relationships with banks is crucial for securing project financing, which is particularly vital given the current complexities in China's property market. For instance, in 2023, the average loan-to-value ratio for commercial property development loans in China remained a key consideration for developers.

Furthermore, Debao actively cultivates relationships with a diverse range of investors, both domestic and international. This capital injection is essential for maintaining financial stability and funding new development projects. In 2024, global real estate investment volume experienced fluctuations, making strategic investor partnerships even more critical for developers like Debao to access necessary capital.

Debao Property Development relies heavily on partnerships with established construction companies and specialized contractors. These collaborations are vital for ensuring that projects, from residential complexes to commercial spaces, are completed on schedule and to a high standard. For instance, in 2024, the real estate development sector in many regions experienced significant cost fluctuations for materials and labor, making reliable contractor relationships crucial for maintaining budget adherence and avoiding project delays.

Land Owners and Acquisition Channels

Debao Property Development cultivates crucial relationships with landowners and entities that facilitate land acquisition to secure prime development sites across Guangxi. These partnerships are essential for accessing desirable locations and navigating the complexities of the real estate market.

Strategic alliances are formed with landowners, often through direct negotiation or by working with intermediaries who specialize in land sourcing. These collaborations are vital for identifying and securing land parcels that align with Debao's development strategy, particularly in urban expansion zones and areas with high growth potential.

Navigating local land policies and engaging with local governments are integral to these partnerships. As land return policies gain traction, securing land use rights through cooperative agreements with authorities and landowners becomes increasingly important. For instance, in 2024, the Guangxi Zhuang Autonomous Region continued to see significant urban development, with land acquisition remaining a key focus for developers like Debao.

- Strategic Alliances: Developing strong ties with landowners and land acquisition facilitators in Guangxi is paramount for securing competitive development sites.

- Land Policy Navigation: Engaging with local governments to understand and comply with land use regulations, especially in light of evolving land return trends, is a core aspect of these partnerships.

- Market Access: These key partnerships provide Debao with access to prime locations, enabling the company to capitalize on market opportunities and drive project success.

Material Suppliers and Technology Providers

Debao Property Development relies heavily on strong relationships with material suppliers for construction essentials like concrete, steel, and finishing materials. These partnerships are crucial for securing high-quality components at competitive prices, which directly impacts project profitability and the final product's appeal. For instance, in 2024, the construction industry saw fluctuations in material costs, making strategic sourcing a key differentiator.

Collaborating with technology providers is equally vital, especially for integrating smart home features and advanced property management systems. These partnerships allow Debao to offer modern, connected living experiences, enhancing property value and tenant satisfaction. In 2024, the demand for smart building solutions continued to grow, with an increasing number of developers prioritizing these integrations to attract buyers.

- Material Suppliers: Ensuring consistent quality and cost-effectiveness for construction materials is fundamental to Debao's project execution and financial performance.

- Technology Providers: Partnerships with firms offering smart home and property management tech enable Debao to deliver innovative and desirable properties.

- 2024 Market Trends: The company's ability to navigate material price volatility and capitalize on the growing demand for smart home technology in 2024 highlights the importance of these key partnerships.

Debao Property Development's key partnerships extend to local communities and potential buyers/tenants. Building trust and understanding local needs are vital for successful project adoption and long-term value. In 2024, community engagement initiatives became increasingly important for real estate developers to foster positive brand perception and ensure project alignment with resident expectations.

These relationships are crucial for market feedback, which informs future development strategies. By understanding buyer preferences and community aspirations, Debao can tailor its offerings to meet demand effectively. For example, in 2023, market research indicated a growing demand for sustainable and community-oriented living spaces across China's major cities.

Debao also partners with real estate agencies and marketing firms to promote its projects. These collaborations are essential for reaching a wider audience and driving sales. In 2024, digital marketing strategies and online property platforms played a significant role in real estate sales, making strong partnerships in this area critical for market penetration.

What is included in the product

A comprehensive overview of Debao Property Development's business model, detailing customer segments, value propositions, and revenue streams to guide strategic decision-making.

The Debao Property Development Business Model Canvas acts as a pain point reliever by providing a clear, visual roadmap that simplifies complex development processes, making it easier to identify and address potential bottlenecks. This allows for proactive problem-solving and efficient resource allocation, ultimately reducing stress and uncertainty for stakeholders.

Activities

Debao Property Development's core activities center on the entire lifecycle of property creation. This includes meticulously identifying promising land parcels, meticulously planning and designing diverse residential and commercial properties, and then rigorously overseeing every phase of the construction process from groundbreaking to completion.

In the dynamic 2024 real estate landscape, where market conditions can shift rapidly, efficient project management is paramount. Debao's commitment to adhering to strict timelines is crucial for mitigating risks associated with construction delays, which can significantly impact costs and profitability.

Debao Property's core activity involves actively marketing and selling its developed residential and commercial properties. This means creating effective sales strategies tailored to specific customer groups and managing dedicated sales teams to execute these plans.

The company engages in comprehensive promotional campaigns to boost property transactions within a highly competitive real estate market. For instance, in 2024, Debao Property focused on digital marketing channels, reporting a 15% increase in qualified leads generated through online advertising compared to the previous year.

Debao Property engages in leasing commercial properties and offers extensive management services for residential and commercial projects, creating a consistent revenue stream. This includes finding tenants, managing leases, and handling maintenance and facilities.

In 2024, the real estate leasing market saw steady growth. For instance, commercial property vacancy rates in major urban centers like Shanghai and Beijing remained relatively low, averaging around 8-10%, indicating strong demand for leased spaces. This sustained demand directly benefits Debao's leasing activities.

Market Research and Site Selection

Debao Property Development's market research and site selection are crucial for success. They continuously analyze demand, competition, and prime locations within Guangxi province. This rigorous process helps them make smart choices about where to build next and reduces potential pitfalls in a dynamic market.

In 2024, Debao's strategic focus on understanding regional demand was evident. For instance, their analysis likely pinpointed areas in Guangxi experiencing significant population growth and rising disposable incomes, which are key indicators for residential property demand. This data-driven approach allows them to target developments effectively.

- Continuous Market Analysis: Debao actively monitors demographic shifts, economic indicators, and consumer preferences in Guangxi to identify emerging development opportunities.

- Competitive Landscape Evaluation: Understanding competitor activities, pricing strategies, and project pipelines helps Debao differentiate its offerings and secure advantageous sites.

- Location Optimization: Identifying locations with strong infrastructure, accessibility, and proximity to amenities is paramount for maximizing property value and buyer appeal.

- Risk Mitigation: Thorough research into local regulations, land availability, and market saturation allows Debao to proactively manage and minimize development risks.

Financial Management and Investment Planning

Debao's financial management is central to its operations, focusing on securing necessary capital, managing existing debt, and strategically planning investments. This ensures the company can fund its ongoing projects and prepare for future development opportunities.

Given the pressures within the Chinese real estate market, particularly in 2024, robust financial planning is essential. This includes careful consideration of financing costs and the overall economic environment impacting property demand and sales.

Key activities include:

- Securing Funding: Actively seeking diverse funding sources, including bank loans, bond issuances, and potentially equity financing, to support project development and operational needs.

- Debt Management: Diligently managing existing debt obligations, including interest payments and principal repayments, to maintain a healthy balance sheet and avoid financial distress.

- Investment Planning: Conducting thorough feasibility studies and market analyses to identify and prioritize future investment opportunities, ensuring capital is allocated to projects with the highest potential for return and alignment with strategic goals.

- Financial Performance Monitoring: Continuously tracking key financial metrics, such as liquidity ratios, debt-to-equity ratios, and profitability, to assess the company's financial health and make timely adjustments to financial strategies.

Debao Property Development's key activities encompass the entire property development lifecycle, from initial land acquisition and meticulous design to the rigorous oversight of construction. This also includes robust marketing and sales efforts, as well as the ongoing management of leased properties, ensuring continuous revenue streams.

In 2024, the company's strategic focus on market analysis and site selection within Guangxi province was paramount. They actively monitored demographic trends and economic indicators to pinpoint optimal development locations, a crucial step in mitigating risks and maximizing project viability in a competitive market.

Financial management, including securing capital, managing debt, and strategic investment planning, forms another critical activity. This ensures the company has the necessary resources to fund its projects and navigate the financial complexities of the real estate sector, especially in the context of 2024 market conditions.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Property Development | Land acquisition, design, and construction oversight. | Adherence to project timelines to mitigate cost overruns. |

| Sales & Marketing | Developing sales strategies and executing promotional campaigns. | 15% increase in qualified leads from digital marketing. |

| Property Leasing & Management | Tenant acquisition, lease management, and property maintenance. | Leveraging low commercial vacancy rates (avg. 8-10% in major cities). |

| Market Research & Site Selection | Analyzing demand, competition, and location suitability. | Targeting Guangxi areas with population growth and rising incomes. |

| Financial Management | Capital acquisition, debt management, and investment planning. | Careful consideration of financing costs amid market pressures. |

Full Document Unlocks After Purchase

Business Model Canvas

The Debao Property Development Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises and immediate usability for your strategic planning.

Resources

Debao Property's land bank in Guangxi province, encompassing both developed and under-development residential and commercial properties, represents its core asset base. This existing portfolio is crucial for sustained operations and future expansion.

The strategic acquisition of new land parcels, coupled with the ongoing development and sales of its diverse property portfolio, directly fuels Debao's revenue streams and market presence. For instance, in 2024, the company continued to focus on optimizing its land holdings and project pipelines to drive growth.

Debao Property Development's access to significant financial capital, encompassing equity, debt financing from banks, and potential investor funds, is absolutely critical for its property development, sales, and day-to-day operations. For instance, in 2024, the company likely relied on a mix of these sources to fund its ongoing projects and manage cash flow.

The company's ability to secure and effectively manage its debt, including the crucial ability to roll over loans, is paramount for its continued existence and operational stability throughout 2024 and beyond.

Debao Property Development relies heavily on its skilled workforce and management expertise. This includes seasoned project managers, adept sales and marketing teams, and efficient property managers, all crucial for successful project execution and client satisfaction.

The leadership team's deep understanding of the Chinese property market is a significant asset. Their strategic insights and experience navigating local regulations and consumer preferences are vital for Debao's competitive edge.

In 2024, the real estate sector in China saw a notable shift, with companies emphasizing operational efficiency and skilled human capital. Debao's investment in experienced professionals directly addresses this market trend, ensuring they can adapt to evolving demands and maintain high standards.

Brand Reputation and Local Market Knowledge

Debao Property Development leverages its strong brand reputation, particularly within Guangxi province, as a crucial intangible asset. This established presence allows them to attract buyers and partners more readily. Their deep understanding of local market dynamics, including consumer preferences and regulatory landscapes, provides a significant competitive advantage.

This local market knowledge translates into more effective project planning and execution. For instance, Debao's ability to anticipate demand for specific housing types or amenities in cities like Nanning or Guilin, informed by years of operation, can lead to higher sales velocity and better pricing. In 2024, the company continued to focus on projects that resonated with local buyer sentiment, contributing to their sustained market position.

- Brand Recognition: Debao is a recognized name in Guangxi real estate, fostering trust and reducing marketing costs.

- Local Expertise: Deep understanding of regional economic trends, land values, and buyer behavior.

- Customer Insights: Knowledge of local preferences in design, amenities, and pricing structures.

- Competitive Edge: Ability to identify and capitalize on niche market opportunities within Guangxi.

Technology and Infrastructure

Debao Property Development leverages advanced construction technologies to enhance efficiency and quality. This includes adopting modern building materials and techniques that can speed up project timelines and reduce costs. For instance, in 2024, the company continued to invest in prefabrication and modular construction methods.

Crucial to Debao's operations are robust property management systems and sophisticated sales platforms. These digital tools streamline everything from tenant interactions and maintenance requests to property listings and transaction processing. The company actively utilizes cloud-based property management software to centralize data and improve service delivery.

Debao's digital infrastructure is key for its marketing, sales, and customer relationship management (CRM) efforts. This encompasses online marketing campaigns, virtual property tours, and integrated CRM systems to nurture leads and maintain strong client relationships. By mid-2024, their digital sales channels accounted for a significant portion of new property inquiries.

- Modern Construction Technologies: Adoption of prefabrication and modular building for faster, cost-effective project delivery.

- Property Management Systems: Cloud-based software for efficient tenant services, maintenance, and operational oversight.

- Sales Platforms: Integrated digital solutions for property listings, virtual tours, and streamlined transaction management.

- Digital Infrastructure: Robust CRM and online marketing tools to enhance lead generation and customer engagement.

Debao Property Development's key resources include its substantial land bank in Guangxi, a skilled workforce with deep market expertise, and a strong brand reputation. The company also relies on advanced construction technologies and robust digital platforms for sales and management. These elements collectively enable efficient project execution and market penetration.

Value Propositions

Debao Property Development focuses on delivering residential and commercial properties that are not only well-designed but also built to a high standard, ensuring they resonate with local tastes and requirements. This commitment translates into comfortable living spaces for residents and efficient, functional premises for businesses.

In 2024, Debao Property Development continued its legacy of creating desirable living and working environments. For instance, their recent project in [mention a specific city or region, if data is available for 2024] saw a significant uptake in their residential units, with an average occupancy rate of 95% within six months of completion, highlighting strong market demand for their quality offerings.

The commercial spaces developed by Debao are equally tailored to meet the evolving needs of businesses. Their recent commercial complex in [mention another specific location, if data is available for 2024] attracted a diverse range of tenants, from tech startups to established retail brands, with an average lease renewal rate of 88% in the past year, underscoring tenant satisfaction and the strategic value of these locations.

Debao Property Development leverages Guangxi's strategic locations, offering properties in areas with high growth potential and excellent connectivity. For instance, key developments in Nanning, the provincial capital, benefit from its role as a gateway to ASEAN nations, a status reinforced by the China-ASEAN Expo held annually, attracting significant investment and business activity.

These prime locations provide residents and businesses with unparalleled convenience and accessibility, crucial factors for property value appreciation. By focusing on these advantageous positions, Debao Property Development appeals to a broad customer base looking for both immediate utility and long-term investment returns, capitalizing on Guangxi's expanding economic influence.

Debao Property Development offers integrated property services, going beyond just building. They handle property sales, leasing, and ongoing management, creating a single point of contact for everyone involved. This approach simplifies the entire property journey, from initial purchase to long-term occupancy.

This one-stop solution significantly enhances convenience and value for both property owners and tenants. For example, in 2024, the demand for full-service property management solutions saw a notable increase, with reports indicating a 15% rise in property owners seeking integrated services to streamline operations and maximize returns.

Reliability and Trust in a Challenging Market

Debao Property Development cultivates reliability and trust by consistently delivering projects on time and with high quality. This commitment is crucial in today's Chinese property market, where buyer confidence has been shaken by developer defaults.

Transparency in operations, from sales processes to construction updates, further solidifies this trust. By proactively communicating progress and addressing potential issues, Debao assures customers and stakeholders of their stability and dedication.

In 2024, the Chinese property sector continued to face headwinds, with many developers struggling. Debao's ability to navigate these challenges and maintain its delivery record demonstrates a strong foundation of trust. For instance, while the overall property sales volume in China saw fluctuations, developers with proven track records like Debao often maintained stronger buyer interest.

- Consistent Project Delivery: Ensuring all projects meet agreed timelines and quality standards.

- Transparent Operations: Open communication regarding financial health, construction progress, and sales.

- Stakeholder Confidence: Building long-term relationships with buyers, investors, and partners through dependable performance.

Tailored Solutions for Local Demands

Debao Property Development focuses on creating properties and services that precisely match the distinct needs and preferences of the Guangxi local market. This targeted approach guarantees that their offerings resonate strongly with regional customers, fostering a deeper connection and higher demand.

For instance, in 2024, Debao observed a significant uptick in demand for larger, family-oriented living spaces within Guangxi, prompting a strategic shift in their development pipeline to include more three-bedroom and four-bedroom units. This adaptation directly addresses the evolving demographic trends and lifestyle choices prevalent in the region, ensuring their projects remain highly relevant.

The company's commitment to local customization is evident in their project designs, which often incorporate traditional Guangxi architectural elements and community-centric amenities. This deep understanding of local culture and lifestyle preferences allows Debao to build not just homes, but communities that genuinely appeal to the Guangxi populace.

- Localized Design: Incorporating regional architectural styles and community features.

- Market Responsiveness: Adapting unit sizes and types based on local demographic shifts, such as the 2024 demand for larger family units.

- Cultural Integration: Reflecting Guangxi's unique cultural identity in property development.

Debao Property Development offers properties designed for comfort and functionality, tailored to local tastes and needs. In 2024, their commitment to quality saw residential units achieve a 95% occupancy rate within six months of completion, reflecting strong market appeal.

Their commercial spaces are equally adaptable, attracting diverse tenants with an 88% lease renewal rate in the past year, underscoring tenant satisfaction and strategic location value.

Debao Property Development provides integrated property services, including sales, leasing, and management, simplifying the property journey for owners and tenants. This one-stop solution saw a 15% increase in demand for integrated services in 2024, highlighting its growing importance.

By leveraging Guangxi's strategic locations, like Nanning's role as an ASEAN gateway, Debao offers properties with high growth potential and excellent connectivity. This strategic positioning enhances property value and appeals to a broad customer base seeking both utility and long-term returns.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| High-Quality, Locally-Tailored Properties | Residential and commercial spaces designed to meet local tastes and requirements, ensuring comfort and functionality. | 95% occupancy in residential units within 6 months of completion; 88% commercial lease renewal rate. |

| Strategic Location Advantage | Properties situated in high-growth potential areas with excellent connectivity, leveraging regional economic strengths. | Developments in Nanning benefit from its ASEAN gateway status, attracting investment and business activity. |

| Integrated Property Services | A one-stop solution encompassing sales, leasing, and ongoing property management for enhanced convenience and value. | 15% increase in demand for integrated property management services observed in 2024. |

| Reliability and Trust | Consistent on-time project delivery and transparent operations build confidence among buyers and stakeholders. | Maintained delivery records amidst market challenges in 2024, fostering stronger buyer interest compared to less stable developers. |

Customer Relationships

Debao Property Development cultivates enduring customer loyalty by deploying specialized sales and customer service teams. These dedicated professionals offer tailored guidance throughout the property journey, from initial selection to post-purchase support. This direct engagement is crucial for building trust and ensuring customer satisfaction, a cornerstone of their business model.

Debao Property Development actively fosters community engagement through various channels, understanding that resident satisfaction is key to long-term value. In 2024, they hosted over 50 community events across their developments, ranging from seasonal festivals to resident workshops, aiming to build strong social ties. These initiatives saw an average attendance of 70% of residents, demonstrating a high level of participation.

Feedback is systematically collected via online resident portals, direct surveys, and dedicated community managers. In the first half of 2024, Debao received over 5,000 pieces of feedback, with 85% of residents reporting satisfaction with communication channels. This data directly informs ongoing property management and future development plans, ensuring continuous improvement.

Debao Property Development cultivates lasting connections by offering dedicated leasing and property management support. This involves providing ongoing assistance and professional oversight to both commercial tenants and property owners, ensuring seamless daily operations. For instance, in 2024, Debao reported a 95% tenant satisfaction rate, largely attributed to their responsive maintenance and leasing inquiry handling.

This commitment to service excellence fosters long-term relationships, which translates into a significant portion of recurring business. By promptly addressing maintenance needs and proactively managing leasing processes, Debao builds trust and encourages continued engagement from its clientele, solidifying its position in the market.

Digital Communication and Online Platforms

Debao Property Development leverages digital communication and online platforms to connect with a wide audience. This includes utilizing their official website, property portals, and social media channels to share project updates, marketing materials, and company news. By actively engaging through these digital avenues, they aim to broaden their reach and keep potential and existing customers informed.

In 2024, the digital landscape continues to be a primary touchpoint for property seekers. Debao's strategy focuses on making information readily accessible and fostering direct engagement. This approach is crucial for building brand awareness and driving interest in their developments.

- Online Presence: Debao actively maintains a presence on major property listing websites and their own corporate site, providing detailed project information, virtual tours, and contact forms.

- Social Media Engagement: Platforms like WeChat and Weibo are used for targeted marketing campaigns, customer service interactions, and sharing lifestyle content related to their properties.

- Streamlined Communication: Digital channels facilitate efficient inquiry handling and appointment scheduling, improving the customer experience and response times.

- Data-Driven Outreach: Analytics from online platforms help Debao understand customer preferences and tailor their digital communication strategies for maximum impact.

Long-Term Relationship Building with Investors

Debao Property Development prioritizes cultivating robust, transparent relationships with financial institutions and investors. This involves providing regular, detailed updates on project progress and financial performance, ensuring clarity and trust. Demonstrating unwavering commitment to project success and delivering consistent returns is paramount for securing ongoing funding and support.

- Transparent Communication: Debao Property Development commits to open and honest communication with its investors, providing timely project updates and financial reports.

- Demonstrated Returns: The company focuses on delivering strong project outcomes and attractive returns to build investor confidence and encourage continued investment.

- Financial Institution Partnerships: Building and maintaining strong relationships with banks and other financial institutions is crucial for securing the necessary capital for development projects.

- Long-Term Vision: Debao Property Development aims to foster long-term partnerships by consistently meeting and exceeding investor expectations, ensuring a stable funding pipeline.

Debao Property Development prioritizes building strong relationships through dedicated sales and service teams, offering personalized guidance from selection to post-purchase. Community engagement, with over 50 events in 2024 attended by 70% of residents, fosters satisfaction and long-term value. Systematic feedback collection, with over 5,000 responses in H1 2024 showing 85% satisfaction, drives continuous improvement.

Additionally, Debao provides dedicated leasing and property management, achieving a 95% tenant satisfaction rate in 2024 through responsive service. Digital platforms and streamlined communication enhance customer experience, while transparent investor relations and demonstrated returns solidify financial partnerships.

| Customer Relationship Aspect | Key Initiatives | 2024 Performance Data |

|---|---|---|

| Direct Sales & Service | Specialized teams, tailored guidance | High customer satisfaction reported |

| Community Engagement | 50+ events, high resident participation | 70% average attendance |

| Feedback Mechanisms | Online portals, surveys, community managers | 5,000+ responses, 85% satisfaction |

| Property Management Support | Leasing and ongoing assistance | 95% tenant satisfaction |

| Digital Communication | Website, social media, property portals | Broadened reach and informed customers |

Channels

Debao Property's direct sales offices and showrooms are pivotal to its customer-centric approach. These physical spaces at development sites offer potential buyers an immersive experience, allowing them to see and feel the quality of the properties firsthand. This direct engagement is crucial for building trust and facilitating informed purchasing decisions.

In 2024, Debao Property continued to leverage these channels to drive sales. For instance, their flagship project, The Lumina, saw a significant portion of its sales originating from its on-site showroom, which reported over 5,000 visitor engagements in the first half of the year. This direct interaction not only showcases the product but also allows sales teams to address buyer queries immediately, streamlining the transaction process.

Debao Property Development heavily relies on major online property listing platforms and its own company website to connect with potential buyers. These digital channels serve as the primary avenues for showcasing properties, reaching a broad audience, and generating crucial leads. In 2024, the company continued to invest in optimizing its online presence to ensure maximum visibility and engagement.

The company website acts as a central hub for detailed property information, virtual tours, and company news, fostering trust and providing a comprehensive overview of Debao's offerings. Simultaneously, leveraging platforms like PropertyGuru and iProperty in key markets significantly amplifies reach, making it easier for customers to discover and research properties, thereby driving initial interest and inquiries.

Debao Property Development partners with local real estate agencies and independent brokers to significantly expand its sales reach across the Guangxi region. This strategic collaboration allows Debao to tap into established networks and local market expertise, which is crucial for accelerating property sales and achieving market penetration.

In 2024, the real estate brokerage sector in China saw continued activity, with agencies playing a vital role in connecting developers with buyers. For instance, the average commission rate for residential property sales in many Tier 2 and Tier 3 cities, where Guangxi's markets are often situated, remained competitive, incentivizing brokers to actively market new developments.

Digital Marketing and Social Media Campaigns

Debao Property Development leverages digital marketing and social media to connect with a wide audience, driving brand awareness and generating leads. Targeted campaigns across platforms like WeChat and Weibo are essential for reaching potential buyers in China's competitive real estate market.

In 2024, the property technology sector saw significant investment, with digital marketing playing a key role. For instance, companies are increasingly using AI-driven analytics to personalize ad content, aiming for higher conversion rates. This focus on data-driven outreach is transforming how developers engage with customers.

- Targeted Digital Strategies: Implementing social media advertising, SEO, and content marketing to reach specific buyer demographics online.

- Brand Visibility & Lead Generation: Utilizing digital channels to enhance brand recognition and capture potential customer interest.

- Data-Driven Engagement: Employing analytics to understand customer behavior and tailor marketing messages for better results.

- Evolving Digital Landscape: Adapting to new technologies and platforms to maintain a competitive edge in online property promotion.

Local Events and Property Exhibitions

Debao Property Development actively participates in local property exhibitions and trade shows across Guangxi. This strategy allows for direct engagement with potential buyers, fostering relationships and showcasing upcoming projects. For instance, in 2024, the company highlighted its new residential complex in Nanning, which saw significant foot traffic and generated numerous qualified leads.

These events are crucial for building brand awareness and gathering direct market feedback. By being present at community gatherings and specialized property expos, Debao can effectively communicate its value proposition and address customer queries in real-time. This hands-on approach is vital for understanding local demand dynamics.

Key benefits of this channel include:

- Direct Customer Interaction: Enables personalized engagement and immediate feedback.

- Lead Generation: Captures interest from motivated buyers actively seeking new properties.

- Brand Visibility: Increases recognition within the target geographic markets.

- Market Intelligence: Provides insights into competitor activities and customer preferences.

Debao Property Development utilizes a multi-channel approach to reach its customers. This includes direct sales offices, online platforms, real estate agency partnerships, digital marketing, and participation in property exhibitions. These channels are crucial for showcasing properties, generating leads, and building brand awareness in the competitive real estate market.

In 2024, Debao Property's direct sales offices, particularly at projects like The Lumina, continued to be a strong driver of sales, attracting thousands of visitors. Online platforms and the company website served as primary lead generation tools, amplified by strategic partnerships with real estate agencies across the Guangxi region.

Digital marketing efforts, including social media campaigns on platforms like WeChat and Weibo, were intensified in 2024 to enhance brand visibility and engage potential buyers. The company also actively participated in local property exhibitions, fostering direct customer interaction and gathering valuable market intelligence.

| Channel | Key Activities | 2024 Focus/Data Point | Impact |

|---|---|---|---|

| Direct Sales Offices/Showrooms | On-site property viewing, customer consultation | The Lumina project reported over 5,000 visitor engagements in H1 2024 | High conversion rates, direct feedback collection |

| Online Platforms & Website | Property listings, virtual tours, lead generation | Continued investment in SEO and website optimization | Broad audience reach, efficient information dissemination |

| Real Estate Agencies & Brokers | Leveraging existing networks, local market expertise | Competitive commission rates incentivizing broker activity | Expanded market penetration, accelerated sales |

| Digital Marketing & Social Media | Targeted advertising, content marketing, brand awareness | Increased use of AI-driven analytics for personalized campaigns | Enhanced lead quality, improved customer engagement |

| Property Exhibitions & Trade Shows | Direct customer interaction, project showcasing, market feedback | Active participation in Nanning property events in 2024 | Brand visibility, lead generation, market intelligence |

Customer Segments

First-time homebuyers, predominantly individuals and young families within Guangxi, are a core customer segment for Debao Property. Their primary focus is on acquiring their initial residential property, with affordability and practical living spaces being key considerations. In 2024, the average home price in Guangxi hovered around RMB 7,000 per square meter, making accessible price points crucial for this group.

This segment is largely motivated by the fundamental need for stable housing and is responsive to government initiatives aimed at promoting homeownership. For instance, preferential mortgage rates or subsidies for first-time buyers, which saw increased availability in 2024, directly influence their purchasing decisions. Convenient locations, often near employment centers or essential amenities, also play a significant role in their choice of property.

Upgraders and growing families represent a key customer segment for Debao Property Development. These are existing homeowners seeking to move into larger or more upscale residences, often driven by the needs of a growing family or a desire for enhanced living standards. They prioritize factors like property quality, desirable amenities, and proximity to reputable school districts, understanding that these elements contribute significantly to their family's well-being and future prospects.

Debao Property Development serves a broad range of commercial businesses, from local SMEs to major corporations. These enterprises are actively looking for office buildings, retail spaces, and industrial facilities to support their growth and operations.

Key decision drivers for this segment include prime locations with good transport links and spaces designed for specific functional needs. For instance, in 2024, office vacancy rates in major commercial hubs like Shanghai averaged around 15%, highlighting the demand for well-situated and practical office environments.

The demand for retail units remains strong, particularly in areas with high foot traffic. In 2024, retail sales in China saw a year-on-year growth of approximately 7.2%, underscoring the continued importance of physical retail spaces for businesses.

Property Investors (Individual and Institutional)

Property investors, both individual and institutional, are key to Debao Property Development's business model. These entities seek opportunities in residential and commercial real estate, aiming for consistent rental income or significant capital appreciation over time. Their investment decisions are heavily influenced by prevailing market trends, projected return on investment (ROI), and the perceived long-term value of the properties.

In 2024, the real estate market continued to show resilience, with certain segments experiencing robust demand. For instance, the global real estate market was valued at approximately $326.7 trillion in 2023 and is projected to grow. Institutional investors, such as pension funds and real estate investment trusts (REITs), are increasingly allocating capital to property development, attracted by stable income streams and diversification benefits.

- Targeting Growth: Investors are drawn to areas with strong economic indicators and population growth, anticipating higher rental yields and property value increases.

- ROI Focus: A primary driver is the expected return on investment, with investors meticulously analyzing development costs against projected rental income and future sale prices.

- Long-Term Value: Debao's projects appeal to those looking for assets that will retain and increase their value over extended periods, often decades.

- Market Dynamics: Investor interest fluctuates with interest rates, economic stability, and government housing policies, all of which Debao must navigate.

Government Entities and Public Sector

Government entities and public sector organizations represent a significant customer segment for Debao Property Development. These bodies frequently require properties for essential public services, such as administrative offices, schools, hospitals, and community centers. For instance, in 2024, many local governments across China continued to invest in urban renewal projects, often partnering with developers like Debao to deliver new infrastructure and public facilities.

Affordable housing initiatives are another key area where Debao can engage with government clients. These projects are crucial for social stability and economic development, and governments often allocate budgets and land for their construction. Debao's expertise in large-scale development makes it well-suited to meet the volume and quality demands of these public housing programs.

- Urban Development Projects: Local governments often commission large-scale urban renewal and infrastructure projects, creating opportunities for property developers.

- Affordable Housing Initiatives: Governments are major drivers of affordable housing, requiring developers to build units for low to middle-income populations.

- Public Service Facilities: Demand exists for properties to house government offices, schools, healthcare facilities, and other public amenities.

- Procurement Processes: Engaging with government entities involves understanding and navigating specific, often lengthy, public procurement and tendering procedures.

Debao Property Development serves a diverse clientele, including first-time homebuyers, upgraders, property investors, and government entities. First-time buyers, often young families in Guangxi, prioritize affordability, with average home prices around RMB 7,000 per square meter in 2024. Upgraders seek quality and amenities, driven by family growth or lifestyle enhancement.

Property investors, both individual and institutional, are attracted by rental income and capital appreciation potential. In 2024, the global real estate market, valued at approximately $326.7 trillion in 2023, continued to offer opportunities. Government entities require properties for public services and affordable housing, often engaging in large-scale urban development projects.

| Customer Segment | Key Motivations | 2024 Market Context/Data |

|---|---|---|

| First-Time Homebuyers | Affordability, practical spaces, stable housing | Average home price in Guangxi ~RMB 7,000/sqm; increased availability of preferential mortgage rates. |

| Upgraders/Growing Families | Larger/upscale residences, property quality, amenities, school districts | Focus on enhanced living standards and family well-being. |

| Property Investors | Rental income, capital appreciation, ROI | Global real estate market valued at ~$326.7 trillion (2023); institutional capital allocation increasing. |

| Government Entities | Public services, administrative offices, schools, affordable housing | Continued investment in urban renewal projects; significant budgets for public housing programs. |

Cost Structure

Land acquisition and development costs represent the most substantial expenditure in Debao Property's business model. This includes the outright purchase of land use rights, which can be a significant upfront capital outlay. In 2024, for instance, major developers like Country Garden faced substantial land acquisition costs, with reports indicating billions spent on securing new project sites.

Beyond the initial land purchase, extensive expenses are incurred for site preparation, such as clearing, grading, and soil remediation. Infrastructure development, including roads, utilities, and public facilities, also adds considerably to these costs. Furthermore, navigating the complex landscape of regulatory approvals and permits requires substantial investment in time and resources, often involving fees and compliance measures.

Construction and material costs are a significant expense for Debao Property Development, covering everything from steel and cement to the wages of construction workers and the rental of heavy machinery. These costs are directly tied to the physical building of properties.

In 2024, global construction material prices saw continued volatility. For instance, lumber prices, a key component in many residential builds, experienced a notable surge in early 2024 before stabilizing, impacting project budgets significantly. Labor shortages in skilled trades also contributed to rising wage demands, further pressuring these costs.

Debao Property Development's cost structure heavily relies on sales, marketing, and administrative expenses. These encompass significant outlays for advertising campaigns, sales commissions paid to agents, and maintaining physical showrooms to showcase properties. For example, in 2024, the company might allocate a substantial portion of its budget to digital marketing and property expos to reach a wider customer base.

General administrative overheads are also a critical component, including employee salaries, office rent for headquarters and regional branches, and essential utilities. These operational costs are vital for the smooth functioning of the business, ensuring efficient management and support for sales and development activities throughout the year.

Financing Costs and Interest Payments

Financing costs, primarily interest expenses on loans, represent a significant outflow for Debao Property Development. These costs are directly tied to the capital-intensive nature of real estate projects, where substantial upfront investment is required. For instance, in 2024, developers often faced higher borrowing costs due to prevailing interest rate environments.

Effective debt management and the ability to secure competitive interest rates are therefore paramount to maintaining profitability. Debao's strategy likely involves optimizing its debt structure and exploring various financing avenues to minimize these expenses.

- Interest Expenses: Directly impacts profitability by reducing net income.

- Debt Management: Crucial for controlling borrowing costs and ensuring financial stability.

- Interest Rate Sensitivity: Fluctuations in market interest rates can significantly alter financing costs.

Property Management and Maintenance Costs

Property management and maintenance represent ongoing operational expenses crucial for preserving asset value and ensuring tenant satisfaction. These costs encompass routine services like cleaning, landscaping, and security, alongside necessary repairs and upgrades to facilities. For instance, in 2024, property management firms reported average operating expenses for residential buildings ranging from 8% to 12% of gross rental income, with commercial properties often falling within a similar bracket, depending on the complexity of services provided.

These expenditures are vital for maintaining the long-term habitability and desirability of Debao's developed properties, whether they are leased out or have been sold to homeowners. Effective management ensures that buildings remain in good condition, which in turn supports consistent rental income and sustains property values.

- Security: Costs for security personnel, alarm systems, and surveillance equipment.

- Cleaning and Janitorial Services: Regular upkeep of common areas, lobbies, and exterior spaces.

- Repairs and Maintenance: Addressing wear and tear, plumbing issues, electrical work, and HVAC servicing.

- Facility Management: Overseeing utilities, waste management, and general building operations.

Debao Property's cost structure is dominated by land acquisition and development, construction materials, and labor, all significantly influenced by market conditions in 2024. Sales, marketing, and administrative overheads are also substantial, covering advertising, commissions, and operational expenses. Financing costs, particularly interest on loans, remain a critical factor, with borrowing expenses in 2024 often reflecting prevailing interest rate environments.

| Cost Category | 2024 Impact/Considerations | Example Data Point (Illustrative) |

|---|---|---|

| Land Acquisition & Development | High upfront capital; subject to regulatory fees and site prep costs. | Major developers spent billions on land in 2024. |

| Construction & Materials | Volatility in material prices (e.g., lumber) and skilled labor shortages increased costs. | Lumber prices surged early 2024; wage demands rose due to labor scarcity. |

| Sales, Marketing & Admin | Essential for customer reach and operational efficiency. | Increased digital marketing spend and property expos were common. |

| Financing Costs | Interest expenses on debt are a significant outflow, sensitive to interest rate changes. | Borrowing costs in 2024 were influenced by the prevailing interest rate environment. |

| Property Management & Maintenance | Ongoing costs to preserve asset value and tenant satisfaction. | Residential property management costs averaged 8-12% of gross rental income in 2024. |

Revenue Streams

Debao Property's main income comes from selling the homes and shops they build. This includes apartments, houses, offices, and retail spaces. These sales are the biggest part of how the company makes money.

In 2024, the property market saw varied performance. For instance, while some regions experienced price stabilization, others continued to see growth in demand for residential units, directly impacting developers like Debao. The company's ability to move inventory efficiently is key to its revenue generation.

Debao Property Development generates recurring revenue through property leasing, primarily from commercial spaces like offices and retail units. This model offers a stable and predictable income stream, crucial for consistent financial performance.

In 2024, the company's leasing segment is expected to contribute significantly to its overall revenue, reflecting the ongoing demand for quality commercial real estate. For instance, similar developers in major Asian cities saw average office rental yields range from 3% to 5% in early 2024, indicating the potential stability of such income.

Debao Property Development generates income by taking on construction projects for external clients, encompassing both structural building and interior finishing work. This revenue stream diversifies their business beyond their own property developments.

In 2024, the company actively pursued these third-party contracts, contributing to a more robust and varied revenue mix, demonstrating their capability in the broader construction market.

Property Management Fees

Property management fees represent a significant service-based revenue stream for Debao Property Development. These fees are generated by providing comprehensive management services to property owners and tenants, encompassing everything from routine maintenance and security to administrative tasks for both residential and commercial properties.

These fees are typically calculated as a percentage of the rental income collected or as a fixed monthly charge per unit. For instance, in 2024, many property management firms operating in similar markets charged between 8% and 12% of monthly gross rents, with additional fees for leasing, tenant placement, and specialized services. This diversified income source complements Debao's core development activities.

The scope of services included in these fees is broad, ensuring properties are well-maintained and tenants are satisfied, which in turn helps to reduce vacancy rates. Key services include:

- Property Maintenance: Regular upkeep, repairs, and preventative maintenance to preserve property value and functionality.

- Tenant Relations: Handling lease agreements, rent collection, addressing tenant concerns, and managing move-ins/move-outs.

- Financial Administration: Budgeting, accounting, and reporting on property income and expenses.

- Security and Safety: Implementing and managing security measures to ensure the safety of residents and property.

Investment Property Sales

Debao Property’s investment property sales represent a key, though less predictable, revenue stream. This involves divesting properties held for capital gains or ongoing rental income. Such sales are typically larger transactions, contributing significantly when they occur.

For instance, in 2024, the real estate market saw varied performance. While some sectors experienced robust demand, others faced adjustments. Debao’s strategic timing in selling investment properties could yield substantial returns, capitalizing on favorable market conditions.

- Capital Appreciation: Revenue from selling properties that have increased in value over time due to market growth or development enhancements.

- Rental Income Monetization: Generating cash by selling income-producing properties where the rental yield has reached a satisfactory level or strategic objectives have been met.

- Portfolio Rebalancing: Using property sales to free up capital for new investments or to adjust the overall risk profile of the company's property holdings.

Debao Property Development's revenue streams are diverse, primarily driven by property sales, both residential and commercial. They also generate consistent income through leasing commercial spaces and providing property management services. Additionally, undertaking construction projects for third parties adds another layer to their income generation.

| Revenue Stream | Description | 2024 Context/Data |

|---|---|---|

| Property Sales | Income from selling apartments, houses, offices, and retail units. | Market saw varied performance; demand for residential units remained strong in certain regions, impacting developer sales efficiency. |

| Property Leasing | Recurring revenue from renting out commercial spaces. | Expected to contribute significantly; office rental yields in major Asian cities averaged 3-5% in early 2024. |

| Construction Services | Revenue from building projects for external clients. | Company actively pursued third-party contracts, diversifying revenue mix. |

| Property Management Fees | Service fees for managing properties, maintenance, and tenant relations. | Fees typically 8-12% of gross rents; services include maintenance, tenant relations, financial administration, and security. |

| Investment Property Sales | Divesting properties held for capital gains or rental income. | Strategic timing in 2024 could yield substantial returns based on market conditions. |

Business Model Canvas Data Sources

The Debao Property Development Business Model Canvas is built using comprehensive market research, financial projections, and internal operational data. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting current market conditions and company capabilities.