Frontier Services Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Frontier Services Group Bundle

Frontier Services Group faces moderate bargaining power from buyers, with a limited number of suppliers for specialized services. The threat of new entrants is somewhat constrained by capital requirements and established relationships. However, the availability of substitutes and the intensity of rivalry within its niche are key areas to scrutinize.

The complete report reveals the real forces shaping Frontier Services Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Frontier Services Group (FSG) frequently relies on suppliers of highly specialized equipment, such as advanced aviation components or sophisticated security technology. These providers often possess significant bargaining power due to the unique nature and critical importance of their offerings in FSG's challenging operating environments.

The limited availability of alternative suppliers for such specialized assets means these providers can often dictate terms and pricing. For instance, a company needing bespoke helicopter parts for remote operations might find only one or two manufacturers capable of producing them, giving those manufacturers considerable leverage.

The operational success of FSG is heavily dependent on the reliability and cutting-edge features of this equipment. This dependency further amplifies the bargaining power of suppliers, as FSG has little room to compromise on quality or technological capability, even if it means higher costs.

The provision of integrated security, logistics, and aviation services in high-risk environments, like those Frontier Services Group (FSG) operates in, demands highly skilled personnel. Think pilots, security specialists, and logistics experts. These aren't your everyday hires; they require specialized training and extensive experience.

Suppliers of this specialized human capital, or the institutions that provide the necessary training programs, often hold considerable bargaining power. This is largely due to the scarcity of these niche skill sets and the substantial costs involved in recruiting, retaining, and continuously upskilling such talent. For instance, specialized aviation training can cost tens of thousands of dollars per individual.

FSG's commitment to delivering world-class services in complex and often dangerous environments means they are inherently dependent on these specialized suppliers. This reliance grants these suppliers leverage, as FSG needs to ensure the quality and availability of its workforce to maintain operational integrity and client satisfaction.

For Frontier Services Group (FSG), which operates in aviation and ground logistics, fuel represents a significant operational expense. The volatility of global fuel prices, coupled with a concentrated market of dependable suppliers in some remote areas where FSG operates, can grant these suppliers substantial leverage. For instance, in 2024, the average price of jet fuel saw considerable fluctuations, impacting airlines and logistics providers globally. Any interruption in fuel supply or a sharp rise in its cost directly affects FSG's bottom line and ability to maintain competitive pricing.

Local Infrastructure and Support Services

Frontier Services Group's (FSG) reliance on local infrastructure and support services in frontier markets significantly influences supplier bargaining power. In regions with limited or underdeveloped infrastructure, such as remote airfields requiring specialized ground handling, local providers can command higher prices due to a lack of alternatives. This scarcity can lead to increased operational costs and potential delays for FSG.

The availability of local security intelligence and support is another critical factor. In volatile frontier markets, where FSG operates, the need for reliable local security can empower these service providers. For instance, in regions with ongoing security concerns, companies offering specialized security services might leverage their unique capabilities to negotiate more favorable terms. The limited pool of qualified and trusted local security firms can therefore translate into substantial bargaining power.

FSG's operational efficiency is directly tied to the capabilities and reliability of these local suppliers. When few providers exist, or when they possess specialized knowledge or assets crucial for FSG's operations, their bargaining power increases. This can manifest in several ways:

- Higher pricing: Limited competition allows local suppliers to charge premium rates for essential services.

- Contractual inflexibility: Suppliers may dictate terms and conditions, leaving FSG with less room for negotiation.

- Potential for service disruption: Dependence on a few key local providers creates vulnerability if those services are interrupted.

Insurance and Risk Mitigation Service Providers

Frontier Services Group (FSG) relies heavily on specialized insurance and risk mitigation providers, especially given its operations in high-risk regions. The niche expertise required for these services, particularly in frontier markets, can grant these providers significant leverage. For instance, in 2024, the global political risk insurance market was projected to see continued growth, indicating a strong demand for such specialized coverage.

The necessity for FSG to secure comprehensive coverage against political instability, security threats, and operational disruptions means that insurers with a proven track record in challenging geographies hold considerable bargaining power. These providers often dictate terms and premiums based on the unique risks FSG undertakes.

- Specialized Expertise: Providers with unique knowledge of frontier market risks are in high demand.

- Risk Necessity: FSG's need for mitigation against political and operational hazards strengthens supplier power.

- Market Conditions: The growing global political risk insurance market in 2024 highlights the essential nature of these services.

- Premium Influence: Insurers can leverage their specialized capabilities to influence premium rates.

The bargaining power of suppliers for Frontier Services Group (FSG) is considerable, particularly for specialized aviation components and advanced security technology. These suppliers often have unique offerings with limited alternatives, allowing them to dictate terms and pricing, as seen with bespoke helicopter parts where only a few manufacturers exist. FSG's dependence on the quality and technological advancement of these critical assets further amplifies supplier leverage, as compromising on these aspects is not an option.

Similarly, suppliers of specialized human capital, such as highly trained pilots and security experts, wield significant power due to the scarcity of these niche skill sets. The high costs associated with recruiting and training, exemplified by aviation training costing tens of thousands per individual, reinforce this leverage. FSG's reliance on this specialized workforce to maintain operational integrity in challenging environments makes them susceptible to supplier demands.

Fuel suppliers also hold substantial power, especially in remote areas where FSG operates, exacerbated by the volatility of global fuel prices. For instance, jet fuel prices in 2024 experienced significant fluctuations, directly impacting FSG's operational costs and pricing competitiveness. This dependence on a limited number of reliable fuel providers in certain regions grants them considerable influence over pricing and supply.

Local infrastructure and support service providers in frontier markets, alongside specialized security intelligence firms, also possess strong bargaining power. The lack of alternatives and the critical need for reliable local support in volatile regions allow these suppliers to command higher prices and impose less flexible contract terms. This can lead to increased operational costs and potential service disruptions for FSG.

Specialized insurance and risk mitigation providers are another key area where supplier power is pronounced. Given FSG's operations in high-risk regions, the demand for unique expertise in political risk insurance, which saw growth in 2024, empowers these providers. Their ability to offer comprehensive coverage against political instability and operational hazards allows them to influence premiums and terms significantly.

| Supplier Category | Key Factors Influencing Power | Impact on FSG |

|---|---|---|

| Specialized Aviation Components | Unique offerings, limited alternatives, critical importance | Higher pricing, potential for supply chain inflexibility |

| Specialized Human Capital | Scarcity of niche skills, high training costs | Increased labor costs, dependency on provider quality |

| Fuel Suppliers (Remote Areas) | Price volatility, limited reliable providers | Operational cost fluctuations, vulnerability to supply disruptions |

| Local Infrastructure/Support Services | Lack of alternatives, underdeveloped infrastructure | Higher service costs, potential operational delays |

| Specialized Insurance/Risk Mitigation | Niche expertise, necessity of coverage in high-risk areas | Higher insurance premiums, dictated terms and conditions |

What is included in the product

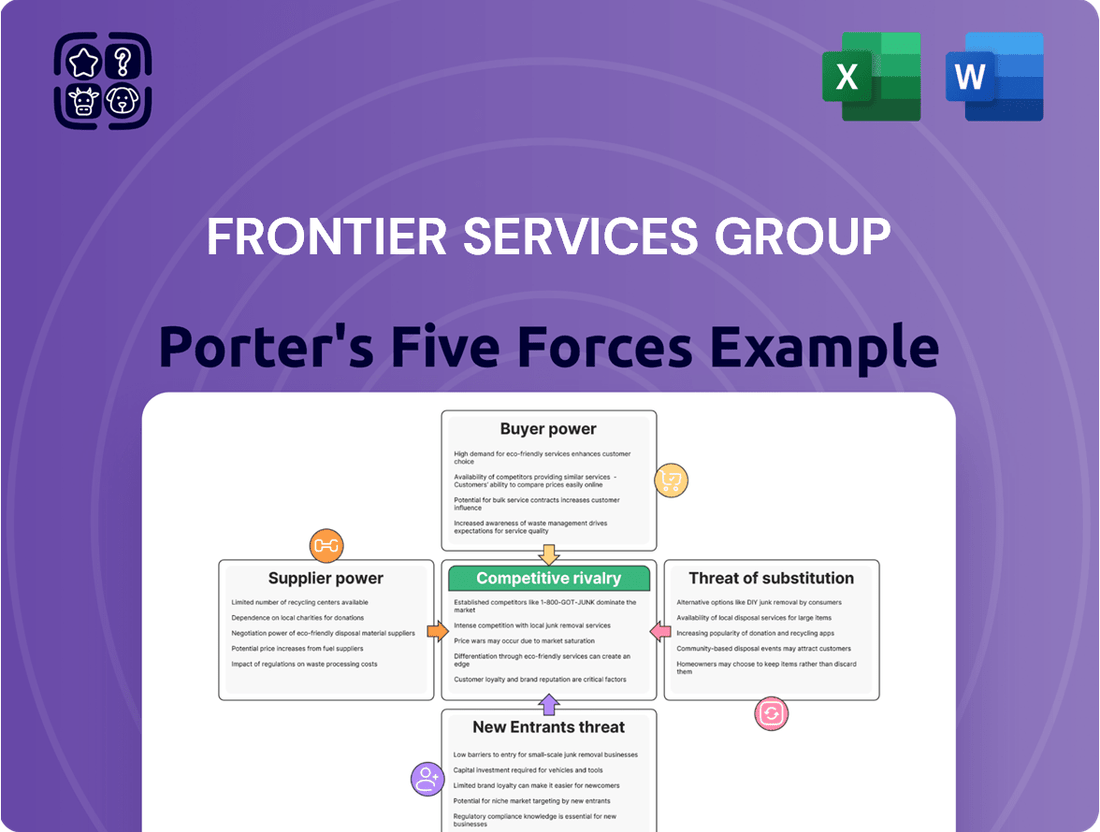

This Porter's Five Forces analysis for Frontier Services Group dissects the competitive intensity, buyer and supplier power, threat of new entrants, and the impact of substitutes specific to its operational environment.

Instantly visualize competitive intensity across all five forces, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

Frontier Services Group (FSG) caters to a broad range of clients across sectors like oil & gas, mining, finance, and international organizations. These clients operate in demanding, often remote locations, each presenting distinct risk profiles and operational needs. This diversity means their collective bargaining power isn't uniform.

While large, established clients might possess greater leverage due to their scale and potential for long-term contracts, FSG's provision of highly specialized, integrated services in challenging environments can mitigate this power. For instance, in 2024, FSG's focus on complex logistics and security solutions for the energy sector, where disruptions can be incredibly costly, likely gives them an advantage in negotiations with individual clients.

For clients needing integrated security, logistics, and aviation services, switching providers is a costly endeavor. These integrated solutions demand extensive time and resources for onboarding, building trust, and syncing systems, significantly diminishing a customer's leverage once a contract with Frontier Services Group (FSG) is secured.

In frontier markets, where security and logistical efficiency are paramount for mission success and personnel safety, clients place a significant premium on reliability and trust. This is especially true for organizations operating in high-risk zones.

Frontier Services Group's (FSG) established track record and deep expertise in these demanding environments directly bolster its value proposition. This proven capability can lead to reduced customer price sensitivity, as clients prioritize dependable service over cost alone, thereby increasing their reliance on FSG's specialized offerings.

Government and International Organization Influence

Frontier Services Group (FSG) faces considerable bargaining power from government and international organization clients, especially those operating in volatile regions. These entities often represent large-volume contracts, giving them significant leverage in negotiations. For instance, in 2024, major international aid organizations and national defense ministries continued to dominate procurement in the security and logistics sectors, frequently utilizing competitive bidding processes that drive down service costs.

These powerful clients can dictate terms through stringent tender requirements and by influencing the regulatory landscape within which FSG operates. Their ability to award or withhold substantial contracts means FSG must remain highly competitive to secure and retain this business. The competitive nature of government contracts is evident in the bid-to-award ratios seen in many public tenders, where multiple providers vie for a single contract, often pushing margins lower.

- Government and international organizations are key clients for FSG, particularly in high-risk areas.

- Their large contract volumes grant them significant bargaining power.

- Competitive tender processes often result in price concessions for FSG.

- Regulatory frameworks established by these clients can also impact FSG's operational terms.

Cost-Consciousness in a Challenging Economic Climate

Even when operating in high-risk regions, Frontier Services Group's clients are keenly aware of their budgets. This cost-consciousness is amplified by the current cautious global economic climate. In 2024, many industries, including logistics, are seeing heightened competition. This pressure forces clients to demand more value for every dollar spent on services.

The logistics sector, in particular, is experiencing this trend. Shippers are actively seeking ways to optimize their supply chains and reduce expenditures. This often translates into clients scrutinizing their service providers more closely.

- Increased Price Sensitivity: Clients are more likely to compare prices and negotiate terms, putting pressure on service providers like Frontier Services Group to remain competitive.

- Consolidation of Suppliers: To gain leverage and potentially better pricing, customers may reduce the number of vendors they work with, thereby increasing the bargaining power of the remaining suppliers.

- Demand for Value-Added Services: Beyond just cost, clients are looking for comprehensive solutions that offer efficiency and cost savings throughout their operations, making price a critical factor in provider selection.

Frontier Services Group's (FSG) customers, particularly large government and international organizations, wield significant bargaining power. Their substantial contract volumes and the competitive nature of tender processes in 2024 often compel FSG to offer price concessions. These clients can also influence operational terms through stringent requirements and regulatory frameworks, underscoring the need for FSG to remain highly competitive to secure and retain their business.

| Client Type | Bargaining Power Factor | Impact on FSG | 2024 Trend Example |

|---|---|---|---|

| Government & International Orgs | Large Contract Volume | Price negotiation leverage | Dominant procurement in security/logistics |

| Government & International Orgs | Tender Processes | Pressure for cost reduction | High bid-to-award ratios |

| All Clients | Budget Consciousness | Increased price sensitivity | Heightened competition in logistics |

Preview the Actual Deliverable

Frontier Services Group Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Frontier Services Group, offering a thorough examination of competitive forces within its industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no discrepancies or missing information. This detailed analysis is ready for your immediate use, providing actionable insights into Frontier Services Group's strategic positioning and competitive landscape.

Rivalry Among Competitors

The global private security and logistics markets, particularly in challenging frontier regions, are characterized by fragmentation. This means there are many companies, both small local outfits and larger international ones, vying for business. Frontier Services Group (FSG) aims to stand out by offering integrated solutions, combining security, logistics, and aviation.

However, even with this integrated approach, each of these service segments faces a multitude of competitors. For instance, the global security services market alone was valued at approximately $240 billion in 2023 and is projected to grow, but it's populated by thousands of firms. Similarly, the logistics sector is vast and diverse.

This intense competition across individual service lines can drive down prices, putting pressure on FSG's profit margins. Companies often compete aggressively on cost, especially in regions where operational expenses can be high and demand might fluctuate.

Frontier Services Group (FSG) carves out a competitive edge by concentrating on integrated services within challenging and frontier markets. This specialization inherently limits direct rivalry from broader security or logistics companies that lack FSG's focused expertise.

However, competition isn't absent. FSG still faces rivals from other specialized providers, including private military companies (PMCs), that operate with similar capabilities in high-risk environments. For instance, in 2023, the global private security market was valued at approximately $240 billion, with a significant portion attributed to specialized services in volatile regions.

Large, established international logistics and security firms, even those not solely focused on frontier markets, represent a significant competitive threat. Their vast resources, extensive global networks, and capacity to subsidize services across different regions allow them to enter or bolster their presence in FSG's operating territories. This can intensify competitive pressure, as these players leverage their scale and existing infrastructure.

Reputation and Track Record as Key Differentiators

In the challenging world of frontier operations, a company's reputation is paramount. Frontier Services Group (FSG) leverages its established track record in complex regions as a significant differentiator. This history builds trust and signals reliability to clients operating in high-risk environments.

FSG's experience, particularly in areas like logistics and security, directly translates into a competitive edge. Clients prioritize partners with proven success in navigating the unique operational and security challenges inherent in frontier markets. This is crucial for sectors such as resource extraction and infrastructure development.

- Reputation for Safety and Reliability: FSG's ability to consistently deliver services safely and effectively in volatile regions is a core competitive asset.

- Proven Operational Experience: Decades of experience in frontier markets provide FSG with invaluable knowledge and established networks.

- Client Trust and Confidence: A strong track record fosters client loyalty and attracts new business, as clients seek dependable partners.

- Impact of Negative Incidents: Conversely, any safety lapses or operational failures can severely damage FSG's reputation and client relationships, creating opportunities for rivals.

Geopolitical Dynamics and Local Partnerships

Geopolitical shifts and the imperative for robust local alliances significantly shape competitive rivalry for companies like Frontier Services Group (FSG) operating in Africa and Asia. Those with deep-rooted connections to local governments and businesses often gain a competitive edge in securing vital contracts and smoothly navigating intricate regulatory environments.

FSG's strategic advantage is intrinsically linked to its capacity to cultivate and utilize relationships with governments across diverse global regions. For instance, in 2024, many African nations continued to prioritize local content policies, requiring foreign firms to demonstrate significant local participation and benefit sharing to win major infrastructure and resource development contracts.

- Geopolitical Influence: Political stability and government relations directly impact market access and operational feasibility.

- Local Partnerships: Strong ties with local entities are crucial for regulatory compliance and contract acquisition.

- FSG's Strategy: Leveraging global government relationships is central to FSG's competitive positioning.

- 2024 Trends: Increased emphasis on local content policies in emerging markets necessitates strong local integration.

Competitive rivalry for Frontier Services Group (FSG) is intense, stemming from a fragmented market with numerous specialized and generalist players. While FSG focuses on integrated solutions in frontier markets, it faces competition from private military companies and large international firms with broader capabilities and deeper pockets. For example, the global private security market, valued at approximately $240 billion in 2023, highlights the sheer scale of potential competitors. Companies that can offer similar specialized services in high-risk environments, or those leveraging vast resources to enter new territories, pose significant threats.

FSG's competitive edge relies heavily on its reputation for safety, reliability, and proven operational experience in volatile regions, which fosters client trust. Conversely, any operational missteps could quickly erode this advantage, opening doors for rivals. The company also navigates a landscape where geopolitical alliances and strong local partnerships are critical for securing contracts and operational success, particularly with the rise of local content policies in emerging markets, as seen in many African nations throughout 2024.

| Competitor Type | FSG's Advantage | Competitive Pressure | Example Data (2023/2024) |

|---|---|---|---|

| Specialized Providers (e.g., PMCs) | Integrated service offering | Direct competition in niche capabilities | Global private security market: ~$240 billion (2023) |

| Large International Firms | Focus on frontier markets | Resource advantage, ability to subsidize | Logistics market growth impacting all players |

| Local Entities | Global government relationships | Navigating local content policies, regulatory hurdles | African nations emphasizing local participation (2024) |

SSubstitutes Threaten

Large multinational corporations or government entities, especially those with significant and enduring operations in challenging regions, may choose to build their own security and logistics infrastructure. This strategic decision is often driven by the desire for greater control and cost-efficiency over the long haul, bypassing third-party providers like Frontier Services Group.

For instance, a major mining company with decades-long concessions in a remote African nation might find it more economical to invest in its own fleet of armored vehicles, specialized security personnel, and dedicated transport networks. Such in-house capabilities can offer tailored solutions that external providers might not be able to match in terms of customization or responsiveness to unique operational needs.

The substantial upfront capital expenditure for such internal setups can be a deterrent for smaller players, but for entities with deep pockets and a long-term commitment to a specific market, it represents a viable alternative to outsourcing. This trend can directly impact the market share and revenue potential for companies like FSG, as these large clients might otherwise represent significant contracts.

In certain frontier markets, clients may opt for local security forces or state-provided logistics, especially if these services are mandated or more economical. However, the inconsistent reliability and varying capabilities of these public alternatives frequently push clients towards specialized private security and logistics firms like Frontier Services Group (FSG). For instance, in regions where state infrastructure is underdeveloped, the premium FSG places on operational effectiveness and tailored solutions becomes a significant differentiator.

Technological advancements, particularly in surveillance and autonomous systems, present a significant threat of substitution for Frontier Services Group (FSG). For example, the increasing sophistication of drones and remote monitoring platforms could replace some of the need for on-site security personnel. In 2024, the global drone services market was valued at approximately $24.2 billion and is projected to grow substantially, indicating a strong trend towards automated solutions in various sectors.

Furthermore, the rise of automated logistics, such as self-driving vehicles, could substitute traditional human-driven transport services that FSG might offer. While these technologies are advancing rapidly, the challenging and often unpredictable nature of frontier environments means that human expertise and intervention remain crucial for many operations, mitigating the immediate impact of these substitutes.

Shift to Less Risky Operating Environments

A significant long-term strategic shift by clients towards operating in less risky or more stable environments could directly reduce the demand for specialized frontier services. This means companies that previously needed extensive support in challenging regions might seek opportunities elsewhere, diminishing the need for integrated risk management and operational support that Frontier Services Group (FSG) provides.

For instance, if global political and economic conditions see a marked improvement in traditionally challenging regions, the inherent need for FSG's core market offerings might decline. This could translate into fewer contracts and reduced revenue streams for companies specializing in these high-risk environments.

- Reduced Demand: Clients prioritizing stability over frontier operations directly impacts the market size for specialized support services.

- Market Shift: A global trend towards de-risking business operations could see companies divest from or avoid frontier markets altogether.

- Competitive Pressure: As the overall market for frontier services potentially shrinks, competition for remaining contracts could intensify.

- Impact on FSG: A sustained move to less risky environments could necessitate a strategic pivot for FSG to maintain its growth trajectory.

Alternative Risk Mitigation Strategies

Clients may opt for alternative risk mitigation strategies that bypass the need for comprehensive outsourced security and logistics. This could involve a greater reliance on intelligence gathering, diplomatic interventions, or a willingness to tolerate elevated risk levels.

For example, in 2024, the global intelligence services market was projected to reach over $100 billion, indicating a significant investment in non-physical security solutions. This trend suggests a potential shift away from traditional, integrated security providers like Frontier Services Group (FSG) if clients perceive these alternative methods as more cost-effective or suitable for their evolving risk profiles.

- Intelligence Gathering: Increased investment in data analytics and threat intelligence platforms.

- Diplomatic Solutions: Prioritizing negotiation and conflict resolution over physical security measures.

- Risk Acceptance: Companies may choose to self-insure or absorb certain risks rather than outsourcing mitigation.

- Technological Alternatives: Adoption of advanced surveillance and cybersecurity tools to manage threats internally.

Clients might develop their own in-house capabilities for security and logistics, especially large corporations with substantial resources. This allows for greater control and potentially lower long-term costs compared to outsourcing. For instance, a major resource extraction company operating in a remote region could establish its own security force and transportation network, bypassing third-party providers.

Technological advancements, such as sophisticated drones and autonomous vehicles, also present substitutes for traditional services. The global drone services market, valued at approximately $24.2 billion in 2024, highlights the growing adoption of automated solutions that can reduce the need for on-site personnel.

Furthermore, clients may shift their focus to less volatile regions, diminishing the demand for specialized frontier services. This strategic move away from high-risk environments can reduce the market for integrated risk management and operational support providers like Frontier Services Group (FSG).

Clients may also adopt alternative risk mitigation strategies, such as enhanced intelligence gathering or a higher tolerance for risk, thereby reducing reliance on outsourced security and logistics. The global intelligence services market, projected to exceed $100 billion in 2024, reflects a significant investment in non-physical security solutions.

Entrants Threaten

The integrated security, logistics, and aviation services sector demands a significant upfront capital outlay. Newcomers must acquire specialized aircraft, armored vehicles, and advanced tracking technology, easily running into tens of millions of dollars. For instance, a single mid-sized helicopter suitable for remote operations can cost upwards of $10 million, and a fleet would amplify this considerably.

Beyond initial investment, ongoing operational expenses are substantial. High salaries for skilled personnel, rigorous training programs, and comprehensive insurance premiums, particularly for operations in volatile frontier regions, create a high cost base. These elevated costs act as a powerful deterrent, making it challenging for smaller or less capitalized entities to compete effectively against established players like Frontier Services Group.

Success in frontier markets, like those Frontier Services Group (FSG) operates in, hinges on specialized expertise in risk management, navigating local geopolitics, and tackling complex logistics. Newcomers must assemble a team possessing this rare and critical experience, a significant barrier to entry.

Building a team with proven track records in these challenging environments is not only difficult but also incredibly time-consuming, as personnel with the necessary skills are scarce. For instance, understanding the nuances of operating in regions with high political instability requires years of on-the-ground experience, something a new entrant cannot easily replicate.

Operating security and aviation services across Africa and Asia presents a substantial hurdle for new entrants due to stringent and varied regulatory landscapes. Frontier Services Group, for instance, must comply with a multitude of international aviation standards and specific national licensing requirements in each country of operation. These can include obtaining air operator certificates, security clearances, and adherence to diverse safety management systems, all of which demand significant investment in time and resources.

Reputation and Trust as Entry Barriers

In sectors where trust and a proven track record are crucial, like security and logistics, new entrants face a significant hurdle in establishing credibility with potential clients. Frontier Services Group (FSG) benefits from its long-standing relationships with governments and key clients, a testament to years of reliable service delivery.

This established trust acts as a substantial barrier for newcomers who lack FSG's historical performance and verified success. For instance, FSG's involvement in complex, high-stakes operations, often requiring government clearances and extensive due diligence, underscores the depth of trust required to operate effectively.

- Established Reputation: FSG's history of successful operations builds significant client confidence.

- Government Contracts: Securing and maintaining government contracts demonstrates a high level of trust and compliance, difficult for new firms to replicate quickly.

- Client Loyalty: Long-term client relationships are hard-won and represent a significant competitive advantage.

Limited Access to Local Networks and Partnerships

Operating effectively in frontier markets, like those Frontier Services Group (FSG) serves, is heavily dependent on robust local networks and partnerships. These include crucial relationships with local authorities, communities, and suppliers, which are essential for smooth operations and navigating complex environments.

New entrants face a significant hurdle in quickly establishing these critical connections. FSG has spent years cultivating these relationships, giving them a substantial competitive advantage. For instance, in many African frontier markets, securing necessary permits or logistics support without established local contacts can be exceptionally time-consuming and costly, potentially delaying operations by months or even years.

- Local Network Dependency: Frontier market success hinges on established ties with local governments, communities, and supply chains.

- FSG's Advantage: Years of cultivation have built FSG's critical local relationships, creating a barrier for newcomers.

- Time and Cost Barriers: New entrants would face substantial delays and increased expenses to replicate FSG's established network.

The threat of new entrants for Frontier Services Group (FSG) is generally considered low. This is primarily due to the immense capital required to enter the integrated security, logistics, and aviation services sector, especially in frontier markets. For example, acquiring a fleet of specialized aircraft and armored vehicles can easily exceed tens of millions of dollars, a significant barrier for any new player.

Beyond the initial investment, high operational costs, including specialized personnel salaries, extensive training, and comprehensive insurance for volatile regions, further deter new entrants. Furthermore, the need for deep expertise in risk management, local geopolitics, and complex logistics, coupled with the difficulty in building a trusted reputation and strong local networks, presents substantial challenges for newcomers aiming to compete with established entities like FSG.

| Barrier to Entry | Estimated Cost/Effort | Impact on New Entrants |

|---|---|---|

| Capital Investment (Aircraft, Vehicles) | $50M+ | Extremely High |

| Operational Costs (Salaries, Insurance) | High, ongoing | Significant Deterrent |

| Specialized Expertise & Risk Management | Years to develop | Major Hurdle |

| Regulatory Compliance & Licensing | Time-consuming, costly | Challenging |

| Building Trust & Reputation | Years of proven service | Difficult to replicate |

| Local Network Development | Years of cultivation | Significant Time/Cost Barrier |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Frontier Services Group is built upon a foundation of publicly available financial reports, industry-specific market research, and regulatory filings. We also incorporate insights from news articles and company press releases to capture current market dynamics.