Frontier Services Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Frontier Services Group Bundle

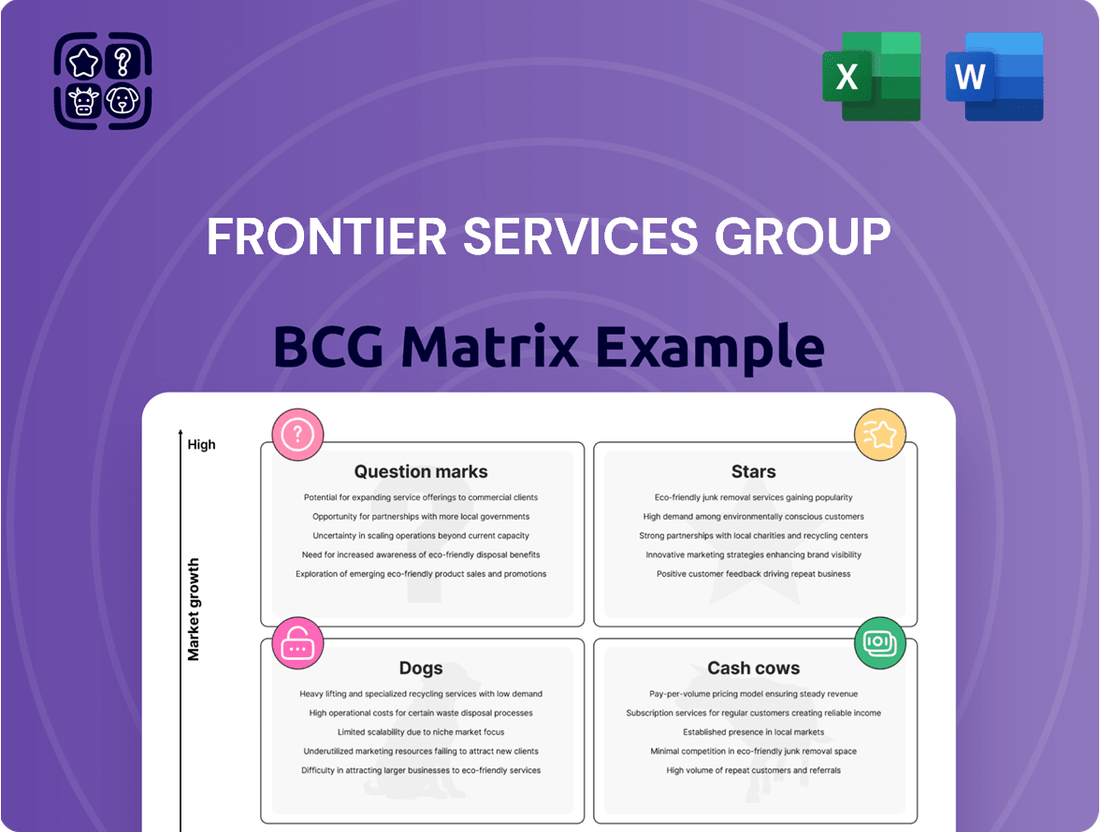

Unlock the strategic potential of Frontier Services Group with a comprehensive BCG Matrix analysis. Understand which of their offerings are market leaders, which are generating consistent profits, and which require careful consideration for future investment. This preview offers a glimpse into their product portfolio's current standing.

Dive deeper into Frontier Services Group's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Frontier Services Group's integrated security solutions are making a significant impact in high-growth regions, particularly across Africa and Asia. These areas, often characterized by geopolitical complexities, are experiencing a heightened need for robust risk management. FSG's ability to deploy multinational and multilingual teams ensures effective operations, making them a go-to provider for clients navigating these challenging environments.

Frontier Services Group’s aviation and ground logistics operations, especially in Africa and Central Asia, are positioned as a strong contender in growing markets. These services benefit from significant demand drivers, including infrastructure development projects linked to initiatives like the Belt and Road Initiative, and the general increase in the need for dependable supply chains in emerging economies.

The company's strategic advantage lies in its capacity to provide comprehensive 'last mile' logistics solutions and integrated project management. This capability is crucial in frontier markets where infrastructure can be challenging, allowing FSG to offer end-to-end support for complex operations.

Frontier Services Group's (FSG) strategic partnerships and acquisitions are a core element of its expansion. By acquiring stakes in companies like Phoenix Aviation and Transit Freight Forwarding, FSG aims to consolidate its position and broaden its operational reach. These moves are designed to leverage existing networks and local knowledge, thereby boosting FSG's capacity to cater to a wider range of clients and capitalize on growth in developing economies.

Infrastructure Development Support in Emerging Economies

Frontier Services Group's engagement in infrastructure development support, particularly across Africa, represents a significant growth opportunity fueled by substantial infrastructure deficits. In 2024, the African Development Bank projected that Africa requires approximately $130 billion to $170 billion annually for infrastructure development, highlighting the immense potential for FSG.

By strategically utilizing its established government relationships and integrating its expertise in finance, construction, and project management, FSG is well-positioned to secure substantial, nation-building projects. This approach directly addresses the critical need for improved infrastructure in developing nations, aligning with global trends of increased investment in emerging market infrastructure.

- Growing Demand: Africa's infrastructure needs are projected to reach $170 billion annually by 2025, creating a vast market for development support.

- Integrated Approach: FSG's combination of finance, construction, and project management allows it to tackle complex, large-scale infrastructure projects.

- Government Partnerships: Strong relationships with host nation governments are crucial for securing and successfully executing these vital development initiatives.

- Emerging Market Focus: This segment capitalizes on the increasing global focus and investment flowing into infrastructure projects within emerging economies.

Security Training and Specialized Personnel Services

Frontier Services Group's Security Training and Specialized Personnel Services, exemplified by institutions like the International Security and Defense College (ISDC), represent a strategic move to address the growing global need for skilled security professionals. This focus allows FSG to offer premium security solutions, particularly for clients operating in challenging and high-risk regions.

The demand for such specialized services is substantial. For instance, the global private security services market was valued at approximately USD 240 billion in 2023 and is projected to grow significantly. FSG's investment in training infrastructure and expertise positions it to capture a share of this expanding market.

- Market Growth: The global private security market is experiencing robust growth, driven by increasing security concerns worldwide.

- Specialized Skills: FSG's training programs, like those at ISDC, equip personnel with critical skills for complex operational environments.

- Client Needs: This capability directly addresses the evolving requirements of clients operating in high-risk areas, demanding advanced security solutions.

- Competitive Advantage: By investing in specialized personnel, FSG differentiates itself and builds a strong competitive edge in the security services sector.

Frontier Services Group's aviation and logistics operations, particularly in Africa and Asia, are classified as Stars due to their high growth potential and strong market position. These services are benefiting from increasing infrastructure development and the need for reliable supply chains in emerging economies.

FSG's integrated security solutions also fall into the Star category. The demand for specialized security personnel and training is robust, with the global private security market valued at approximately USD 240 billion in 2023 and projected for significant future growth. FSG's investment in institutions like ISDC positions it to capitalize on this expanding market.

The company's infrastructure development support, especially in Africa, is another Star. Africa's infrastructure needs are estimated to require between $130 billion to $170 billion annually, presenting a substantial opportunity for FSG's combined finance, construction, and project management expertise.

FSG's strategic partnerships and acquisitions further bolster its Star position by expanding its operational reach and leveraging local knowledge in high-growth emerging markets.

| FSG Business Segment | BCG Category | Key Growth Drivers | Market Data (2023/2024) |

|---|---|---|---|

| Aviation & Ground Logistics | Star | Infrastructure development, Belt and Road Initiative, emerging market supply chains | Growing demand in Africa and Central Asia |

| Integrated Security Solutions | Star | Global security concerns, need for specialized personnel and training | Global private security market valued at ~USD 240 billion (2023) |

| Infrastructure Development Support | Star | Africa's infrastructure deficit, government partnerships | Africa requires $130-$170 billion annually for infrastructure |

| Strategic Partnerships & Acquisitions | Star | Market consolidation, expanded operational reach | Acquisitions in aviation and logistics |

What is included in the product

Frontier Services Group's BCG Matrix provides a tailored analysis of its product portfolio, highlighting which units to invest in, hold, or divest.

A clear BCG Matrix visualizes Frontier Services Group's portfolio, easing the pain of strategic resource allocation.

Cash Cows

Frontier Services Group's (FSG) logistics operations in Africa, established in 2013, represent a mature business segment likely functioning as a cash cow. This long-standing presence has cultivated extensive networks and deep client relationships across the continent.

The inherent operational expertise gained over a decade allows FSG to navigate Africa's unique logistical challenges efficiently, translating into consistent cash flow generation. This segment requires minimal new investment for expansion or market penetration, allowing it to contribute significantly to the group's overall financial health.

Frontier Services Group's core security and risk advisory services, provided to long-standing clients in stable operational areas, represent a significant cash cow. These offerings are crucial for mitigating risks and ensuring project safety, tapping into a consistent demand for specialized expertise.

The high profit margins associated with these services stem from the unique skill sets involved and the ongoing necessity for security and risk management. For instance, in 2024, the global security services market was valued at approximately $200 billion, with advisory segments showing steady growth due to increasing geopolitical instability and complex operational environments.

Frontier Services Group's aviation platforms in Europe and Central Asia, boasting a fleet exceeding 20 aircraft, are firmly positioned as cash cows. These established assets are designed to deliver consistent revenue streams, leveraging existing infrastructure for operational efficiency.

While these mature markets may exhibit slower growth trajectories compared to emerging regions, the established operational framework ensures reliable cash generation for FSG. For instance, in 2024, the European aviation sector saw passenger traffic recover significantly, with some regions reporting numbers close to pre-pandemic levels, indicating stable demand for established services.

Existing Client Base in Oil & Gas and Mining Sectors

Frontier Services Group's (FSG) established presence in the oil and gas and mining sectors, especially within Africa, forms a significant Cash Cow. These industries, characterized by their capital-intensive nature and the ongoing need for specialized support, provide FSG with a consistent and predictable revenue stream.

The demand for logistics and security services in these sectors is not typically cyclical but rather a constant requirement, underpinning FSG's stable income. This stability is often bolstered by long-term contracts, ensuring a reliable flow of business. For instance, in 2024, the African mining sector alone was projected to attract significant investment, highlighting the sustained operational needs that FSG caters to.

- Stable Revenue: FSG's deep involvement in oil and gas and mining in Africa ensures a predictable income.

- Essential Services: The continuous need for logistics and security in these industries creates ongoing demand for FSG's offerings.

- Long-Term Contracts: These agreements provide a reliable financial foundation for the company.

- Industry Support: FSG's role in facilitating operations in these vital sectors solidifies its position.

Long-term Contracts and Recurring Revenue Streams

Long-term contracts for integrated security, logistics, or aviation services with stable multinational corporations or international organizations are prime examples of Frontier Services Group's cash cows. These agreements are vital because they offer a predictable and substantial cash flow, a direct result of their extended duration and how deeply FSG's services are integrated into the client's ongoing operations.

- Predictable Revenue: Contracts with durations of 5+ years for major clients in sectors like mining or oil & gas ensure consistent income.

- High Market Share: FSG's established presence in niche markets, often with limited competition for these integrated services, solidifies their position.

- Low Investment Needs: Once established, these service lines typically require minimal additional capital expenditure to maintain, freeing up cash.

- Stable Profitability: The predictable nature of these contracts allows for efficient resource allocation and stable profit margins, contributing significantly to overall cash generation.

Frontier Services Group's (FSG) established logistics operations, particularly in Africa, represent significant cash cows. These segments benefit from deep-rooted networks and extensive client relationships cultivated over years of operation.

The inherent operational expertise allows FSG to efficiently manage complex logistical challenges, translating into consistent cash generation with minimal need for new investment.

FSG's core security and risk advisory services are also strong cash cows, driven by consistent demand from long-standing clients in stable regions.

The aviation platforms in Europe and Central Asia, with a fleet exceeding 20 aircraft, are positioned as cash cows, leveraging existing infrastructure for reliable revenue streams.

| FSG Business Segment | BCG Category | Key Characteristics | 2024 Data/Context |

|---|---|---|---|

| African Logistics | Cash Cow | Mature, established networks, high operational expertise | Stable demand from industries like mining and oil & gas |

| Security & Risk Advisory | Cash Cow | Specialized skills, consistent demand, high profit margins | Global security services market valued at ~$200 billion in 2024 |

| European & Central Asian Aviation | Cash Cow | Established fleet, operational efficiency, stable markets | European aviation passenger traffic showing strong recovery in 2024 |

Full Transparency, Always

Frontier Services Group BCG Matrix

The Frontier Services Group BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis is ready for immediate integration into your strategic planning, offering clear insights without any watermarks or demo content.

Dogs

Frontier Services Group's aviation assets that are underperforming or have been divested can be categorized as dogs in the BCG matrix. These are typically aircraft with high maintenance costs and low operational use, representing a drain on resources.

An example illustrating this is the disposal of an aircraft in May 2024. This particular asset incurred substantial overhaul expenses and was sold at a price lower than its market value, clearly marking it as a cash-consuming liability for the group.

Infrastructure projects that have reached completion with no subsequent phases or new contracts in the pipeline are prime candidates for being classified as Dogs in the BCG Matrix. These completed ventures, by their nature, cease to contribute to ongoing revenue streams.

Frontier Services Group's interim report for 2024 highlights a significant drop in revenue, directly attributed to the completion of its sole infrastructure project in 2023. This situation strongly suggests that the infrastructure segment, as it stands, is not generating new or sustained revenue, a classic characteristic of a Dog.

Certain security businesses within Frontier Services Group (FSG) that saw a revenue decline in 2024 might be classified as Dogs in the BCG Matrix. For instance, if a specific security service offering experienced a year-over-year revenue drop of 15% in 2024, and operates within a market projected for only 2% annual growth, it fits this category. Such segments may be resource-intensive without yielding substantial profits, potentially hindering overall company performance.

Non-Core or Low-Performing Direct Investments

Frontier Services Group's non-core or low-performing direct investments represent potential 'dogs' in their BCG matrix. These are assets or ventures that aren't generating the anticipated profits or aren't strategically aligned with the company's primary business operations.

For instance, if Frontier Services Group had invested in a niche logistics operation in a declining industrial region, and that operation only captured a small market share with minimal growth prospects, it would likely be classified as a dog. Such investments drain resources without contributing meaningfully to overall growth or profitability.

Divesting these underperforming assets is often the recommended strategy. This frees up capital and management attention to focus on more promising areas of the business. As of early 2024, many companies are actively reviewing their portfolios to shed non-essential or poorly performing divisions to streamline operations and improve financial health.

- Low Return on Investment: Direct investments failing to meet predefined profitability targets.

- Strategic Misalignment: Ventures not contributing to Frontier Services Group's core competencies or long-term vision.

- Market Stagnation: Holdings in sectors with little to no expected growth, coupled with a weak competitive position.

- Divestiture Potential: Assets that could be sold to redeploy capital into more strategic or higher-growth opportunities.

Operations in Highly Saturated or Competitive Markets

Within Frontier Services Group's (FSG) portfolio, segments operating in highly saturated or intensely competitive markets, where the company possesses a low market share, would be classified as Dogs. These ventures typically face significant hurdles in generating substantial profits and may necessitate considerable investment simply to maintain their existing, albeit minimal, market presence.

For instance, if FSG were involved in a highly competitive logistics sector in a mature market, like last-mile delivery in major European cities, and held a market share below 5%, it would likely fall into the Dog category. Such operations often struggle with thin profit margins due to intense price competition and high operational costs.

- Low Market Share: FSG's presence in these markets is often minimal, making it difficult to achieve economies of scale.

- Profitability Challenges: High competition leads to price wars, eroding profit margins and making these segments less attractive.

- High Investment Needs: Maintaining even a small foothold requires ongoing investment in technology, marketing, and operational efficiency, often with little return.

- Example Scenario: A hypothetical FSG division focused on specialized freight forwarding in a region with numerous established players and limited differentiation could represent a Dog.

Frontier Services Group's (FSG) aviation assets that are underperforming or have been divested can be categorized as dogs in the BCG matrix. These are typically aircraft with high maintenance costs and low operational use, representing a drain on resources, such as the disposal of an aircraft in May 2024 after incurring substantial overhaul expenses.

Infrastructure projects that have reached completion with no subsequent phases or new contracts in the pipeline are prime candidates for being classified as Dogs. FSG's interim report for 2024 highlights a significant revenue drop attributed to the completion of its sole infrastructure project in 2023, indicating no ongoing contribution from this segment.

Certain security businesses within FSG that saw a revenue decline in 2024 might be classified as Dogs. For instance, a specific security service offering experiencing a year-over-year revenue drop of 15% in 2024, operating in a market projected for only 2% annual growth, fits this category.

FSG's non-core or low-performing direct investments, such as a niche logistics operation in a declining industrial region with minimal growth prospects and a small market share, represent potential dogs. These ventures drain resources without contributing meaningfully to overall growth or profitability.

| FSG Business Segment | BCG Category | Rationale | 2024 Data/Observation |

|---|---|---|---|

| Underperforming Aviation Assets | Dog | High maintenance, low utilization, divested. | Aircraft disposal in May 2024 due to high overhaul costs. |

| Completed Infrastructure Projects | Dog | No subsequent phases or new contracts, cease revenue contribution. | Significant revenue drop in 2024 due to sole project completion in 2023. |

| Low-Growth Security Services | Dog | Declining revenue, low market growth, resource intensive. | 15% YoY revenue drop in a segment with 2% projected market growth. |

| Non-Core Direct Investments | Dog | Low profitability, poor strategic alignment, stagnant markets. | Niche logistics in declining region with minimal market share and growth. |

Question Marks

Frontier Services Group's (FSG) ventures into emerging markets like Southeast Asia and Iraq are classic examples of question marks in the BCG matrix. These regions often present a tantalizing prospect of high future growth, but FSG's current presence and market share are typically nascent, meaning they are starting from a low base.

Significant investment is usually required to build brand recognition, establish operational infrastructure, and navigate the unique regulatory and cultural landscapes of these new territories. For instance, expanding into Southeast Asia involves understanding diverse consumer behaviors across countries like Vietnam and Indonesia, while Iraq presents challenges related to political stability and security, demanding substantial capital outlay to secure contracts and operations.

Frontier Services Group's development of new, specialized security services likely falls into the question mark category of the BCG matrix. These offerings, designed to address evolving threats or cater to specific, high-growth market segments, represent potential future stars but currently possess a low market share.

For instance, the increasing demand for cybersecurity solutions tailored to the burgeoning fintech sector, a market projected to grow by over 20% annually through 2028, could be an example. While the market is expanding rapidly, Frontier Services Group's new specialized service might have only a small initial foothold, necessitating significant investment in research, development, and aggressive marketing to establish its presence and viability.

Frontier Services Group's investments in advanced tracking systems and AI-driven risk assessment platforms for logistics and security are prime examples of question marks on the BCG matrix. These initiatives target rapidly expanding technology sectors, offering significant future potential.

However, they demand substantial upfront capital for development and integration, making their path to market share and profitability uncertain. For instance, the global AI in logistics market was valued at approximately $2.8 billion in 2023 and is projected to reach $13.7 billion by 2028, indicating high growth but also intense competition and R&D costs.

Infrastructure Development in Untapped or High-Risk Areas

Infrastructure development in untapped or high-risk areas represents the question marks in the BCG matrix for Frontier Services Group. These ventures, often in frontier markets, demand significant upfront capital and face considerable political and operational risks. For instance, a project to build renewable energy infrastructure in a region with unstable governance could fall into this category.

The potential for substantial future returns is the allure, but the low probability of success and the sheer scale of investment required make them highly speculative. Consider the development of a new port facility in a politically volatile nation; while it could unlock significant trade routes, the risks of expropriation or project failure are substantial. In 2024, global foreign direct investment into infrastructure projects in emerging markets, particularly those with higher risk profiles, saw a notable increase, driven by the need for modernization and the potential for outsized returns, though specific figures for high-risk zones remain difficult to isolate due to data limitations.

These projects require careful strategic assessment, often involving partnerships with local entities and robust risk mitigation strategies. The decision to invest hinges on a thorough analysis of the long-term market potential versus the immediate, potentially insurmountable, obstacles.

- High Capital Outlay: Projects demand substantial initial investment, often in the hundreds of millions or billions of dollars.

- Uncertainty of Success: Factors like political instability, regulatory changes, and local market acceptance create a low certainty of achieving projected returns.

- Potential for High Returns: If successful, these ventures can yield significantly higher profits than investments in more stable markets, due to first-mover advantages and unmet demand.

- Strategic Importance: Developing infrastructure in these areas can open up entirely new markets and supply chains for Frontier Services Group.

Diversification into Ancillary Services (e.g., Insurance, Healthcare)

Frontier Services Group's (FSG) expansion into ancillary services like insurance and healthcare, beyond its established security, logistics, and aviation operations, positions these ventures as potential question marks within its BCG Matrix. While these sectors represent significant growth opportunities, FSG's market share in these nascent areas is likely to be minimal. This necessitates substantial capital infusion and strategic investment to build competitive positioning and establish a foothold.

The global insurance market, for instance, was valued at approximately $6.9 trillion in 2023, with healthcare services being another rapidly expanding domain. FSG's entry into these markets, while potentially lucrative, would require considerable resources to overcome established players and gain traction.

- Market Entry Challenges: FSG faces intense competition from established players in insurance and healthcare, requiring significant investment to gain market share.

- Investment Requirements: Developing expertise, regulatory compliance, and customer acquisition in these new sectors will demand substantial capital outlay.

- Growth Potential: Despite the challenges, the growing demand for insurance and healthcare services presents a significant long-term opportunity for FSG if successful.

- Strategic Focus: FSG must carefully evaluate its resource allocation to ensure these question mark ventures receive adequate support without detracting from its core businesses.

Frontier Services Group's (FSG) ventures into new geographic markets, such as Southeast Asia and Iraq, are prime examples of question marks. These regions offer high growth potential but FSG's current market share is low, requiring significant investment to build brand awareness and navigate local complexities. For instance, expanding into Southeast Asia involves understanding diverse consumer behaviors across countries like Vietnam and Indonesia, while Iraq presents challenges related to political stability and security.

Specialized security services developed by FSG also fall into the question mark category. These offerings address evolving threats or specific market segments, representing potential future stars but currently holding minimal market share. The increasing demand for cybersecurity solutions in the fintech sector, projected to grow by over 20% annually through 2028, exemplifies this, requiring substantial R&D and marketing investment.

FSG's investments in advanced tracking and AI-driven risk assessment platforms for logistics and security are question marks targeting rapidly expanding tech sectors. These demand substantial upfront capital for development and integration, with uncertain paths to market share and profitability. The global AI in logistics market was valued at approximately $2.8 billion in 2023 and is projected to reach $13.7 billion by 2028.

Infrastructure development in untapped or high-risk areas represents question marks for FSG, demanding significant upfront capital and facing considerable political and operational risks. The allure is substantial future returns, but the low probability of success makes them speculative. In 2024, global foreign direct investment into infrastructure projects in emerging markets saw an increase, driven by modernization needs and potential for outsized returns.

| Venture Type | Market Growth Potential | FSG Market Share | Investment Needs | Risk Level |

|---|---|---|---|---|

| New Geographic Markets (e.g., Southeast Asia, Iraq) | High | Low | High | High |

| Specialized Security Services (e.g., Cybersecurity for Fintech) | High (e.g., Fintech cybersecurity 20%+ annual growth) | Low | High | Medium to High |

| Advanced Tech Platforms (e.g., AI in Logistics) | Very High (e.g., AI in Logistics market $2.8B in 2023 to $13.7B by 2028) | Low | Very High | High |

| Infrastructure in High-Risk Areas | Potentially Very High | Low | Very High | Very High |

BCG Matrix Data Sources

Our Frontier Services Group BCG Matrix is built on a foundation of verified market intelligence, integrating financial statements, industry research, and competitor analysis to provide strategic insights.