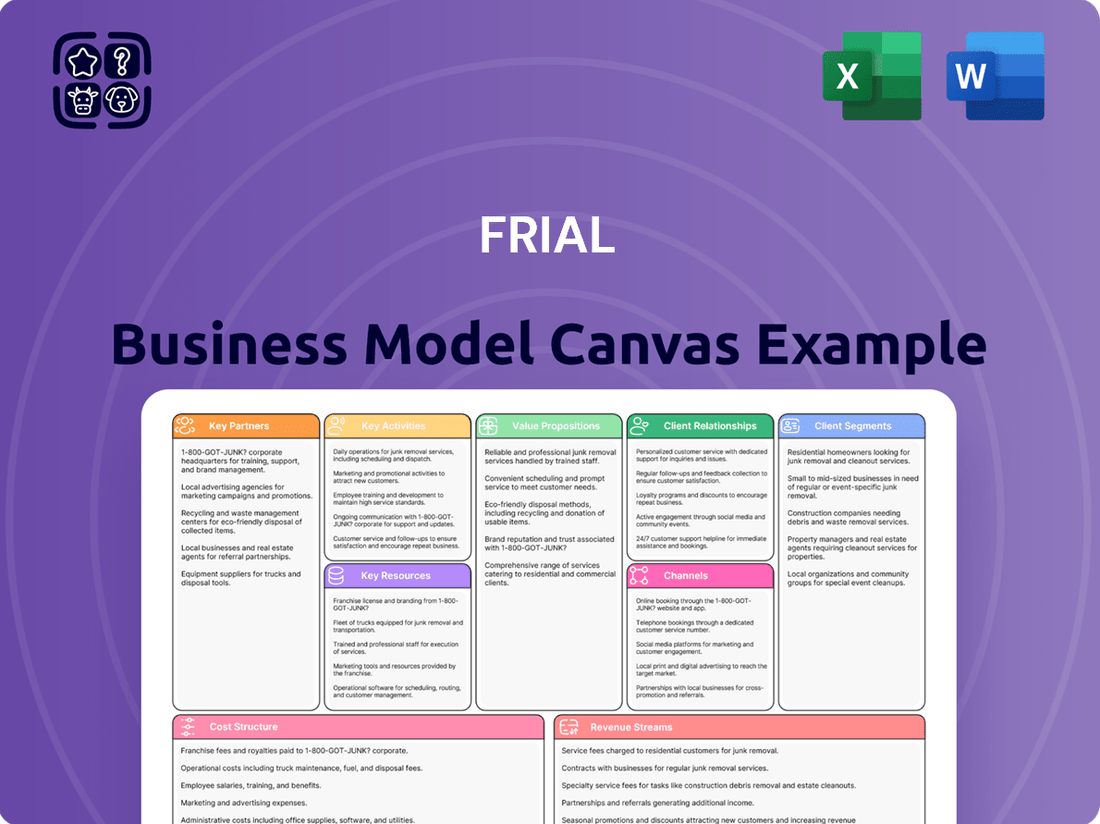

Frial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Frial Bundle

Unlock the complete strategic blueprint behind Frial's innovative business model. This detailed Business Model Canvas breaks down how Frial creates value, reaches its customers, and generates revenue, offering a clear roadmap for success. Perfect for anyone looking to understand and replicate Frial's winning formula.

Partnerships

Frial sources its diverse seafood from a worldwide network of fishing zones and aquaculture farms, with a strong focus on sustainability. These vital relationships ensure a steady flow of premium raw materials, underpinning Frial's dedication to traceability and ecological responsibility.

In 2024, the global aquaculture market was valued at approximately $225 billion, demonstrating the scale and importance of these partnerships for companies like Frial. These collaborations are essential for maintaining product quality and adhering to increasingly stringent environmental regulations.

Maintaining the quality of frozen seafood is paramount for Frial, and this relies heavily on strong partnerships with specialized logistics and cold chain providers.

These crucial collaborators ensure that Frial's products are kept at consistent, optimal temperatures throughout their journey, from the fishing grounds to the end consumer. This rigorous temperature control is vital for preserving freshness, taste, and safety, especially given the global nature of seafood sourcing and distribution.

In 2024, the global cold chain logistics market was valued at an estimated $285 billion and is projected to grow significantly, highlighting the increasing importance of these specialized services. Frial's success is directly tied to the reliability and efficiency of these partners in safeguarding product integrity across its vast distribution network.

Frial's strategic alliances with major retail chains and supermarkets are crucial for its success in the consumer market. These partnerships act as the primary conduit for getting Frial's frozen seafood, both its own brands and those produced for private labels, directly into shoppers' hands.

By securing shelf space in prominent supermarkets, Frial significantly broadens its market reach and boosts brand recognition. For instance, in 2024, major grocery retailers like Walmart and Kroger reported substantial growth in their frozen food sections, with frozen seafood sales increasing by an estimated 5% year-over-year, highlighting the immense opportunity for Frial within these established distribution networks.

Foodservice Distributors

Collaborating with foodservice distributors is crucial for Frial to effectively reach professional kitchens, restaurants, and institutional clients. These partnerships act as a vital conduit for Frial to penetrate the foodservice market, offering a comprehensive range of prepared seafood dishes and bulk frozen products. The distributors ensure these tailored offerings meet the specific demands of various industry segments.

These alliances are instrumental in expanding Frial's market reach and operational efficiency within the foodservice sector. For instance, in 2024, the global foodservice distribution market was valued at approximately $240 billion, highlighting the significant scale and importance of these partnerships for companies like Frial aiming for broad market penetration.

- Market Access: Distributors provide Frial with established networks, enabling access to a vast number of potential B2B customers in the hospitality and institutional sectors.

- Logistics and Warehousing: Key partners handle the complex logistics, including cold chain management and warehousing, ensuring product quality and timely delivery to end-users.

- Product Customization: Distributors facilitate feedback loops, allowing Frial to refine and customize its product lines, such as portion-controlled items or specific packaging formats, to better suit restaurant and institutional requirements.

- Sales and Marketing Support: Many distributors offer sales support and marketing initiatives, further promoting Frial's products within their existing client base.

Certification Bodies and Industry Associations

Frial's strategic alliances with certification bodies such as the Marine Stewardship Council (MSC) and the Aquaculture Stewardship Council (ASC) are fundamental to its business model. These partnerships directly support Frial's pledge to uphold superior quality and ensure complete traceability throughout its supply chain.

Collaborations with organic certification bodies further solidify Frial's dedication to sustainable and ethical sourcing. These recognized certifications serve as a powerful tool for validating Frial's practices and fostering deep consumer trust.

For instance, the MSC certification, a globally recognized standard for sustainable fishing, is increasingly sought after by consumers. In 2024, reports indicated a significant rise in consumer preference for MSC-certified seafood, with studies showing over 70% of consumers in key markets willing to pay a premium for sustainably sourced fish.

- MSC and ASC Certifications: These validate Frial's commitment to environmentally responsible fishing and aquaculture practices.

- Organic Certifications: Partnerships with organic bodies assure consumers of Frial's adherence to strict organic farming standards.

- Consumer Trust and Brand Reputation: Recognized certifications enhance Frial's credibility and appeal to a growing segment of eco-conscious consumers.

- Market Access and Differentiation: Certifications can open doors to premium markets and differentiate Frial from competitors lacking such endorsements.

Frial's key partnerships are critical for its operational success and market penetration. These include its global network of seafood suppliers and specialized cold chain logistics providers, ensuring product quality and availability. Furthermore, strong relationships with major retailers and foodservice distributors are vital for market access and reaching diverse customer segments.

| Partner Type | Role in Frial's Business Model | 2024 Market Context/Data |

|---|---|---|

| Seafood Suppliers (Fishing Zones & Aquaculture Farms) | Ensures steady flow of premium, traceable, and sustainably sourced raw materials. | Global aquaculture market valued at ~$225 billion in 2024. |

| Cold Chain Logistics Providers | Maintains product quality and freshness through specialized temperature-controlled transportation and warehousing. | Global cold chain logistics market valued at ~$285 billion in 2024, with significant growth projected. |

| Retail Chains & Supermarkets | Provides direct consumer market access for Frial's brands and private label products. | Frozen seafood sales in major US grocery retailers grew ~5% year-over-year in 2024. |

| Foodservice Distributors | Facilitates access to professional kitchens, restaurants, and institutional clients with tailored product offerings. | Global foodservice distribution market valued at ~$240 billion in 2024. |

| Certification Bodies (MSC, ASC, Organic) | Validates Frial's commitment to sustainability, ethical sourcing, and enhances consumer trust. | Over 70% of consumers in key markets willing to pay a premium for MSC-certified seafood in 2024. |

What is included in the product

A pre-built, strategically aligned business model designed to showcase a company's operational framework and growth potential.

This model details customer segments, value propositions, and channels, offering a clear roadmap for strategic planning and stakeholder communication.

The Frial Business Model Canvas acts as a pain point reliever by providing a structured, visual framework that simplifies complex business strategy into easily understandable components.

It alleviates the pain of disorganized thinking and communication by offering a single, cohesive page to map out key business elements, fostering clarity and alignment within teams.

Activities

Frial's key activities in sustainable sourcing and procurement revolve around partnering with fisheries and farms committed to responsible practices, often evidenced by certifications like MSC or ASC. This ensures the seafood they use is caught or farmed in ways that minimize environmental impact and promote long-term ocean health.

A significant focus is placed on sourcing raw materials as locally as possible, with a particular emphasis on French suppliers. This not only supports regional economies but also enhances traceability throughout the supply chain, allowing Frial to track the origin and journey of their ingredients with greater certainty.

In 2024, Frial continued to strengthen its commitment to these practices. For instance, their reliance on French sourcing for a substantial portion of their raw materials underscores their dedication to local partnerships. This approach is crucial for maintaining quality and transparency, aligning with growing consumer demand for ethically produced food.

Frial's core activity is the constant creation of new frozen seafood products, encompassing fish, shellfish, and ready-to-eat meals. This includes developing custom private label options for retailers, showcasing their adaptability.

A dedicated team of chefs spearheads this innovation, closely monitoring consumer preferences. They prioritize 'clean label' ingredients, meaning fewer artificial additives, and focus on sustainable packaging solutions to align with growing environmental concerns.

This commitment to product development is crucial for Frial to stay competitive. For instance, in 2024, the frozen food market saw continued growth, with a particular emphasis on convenience and healthier options, areas Frial actively addresses through its innovation pipeline.

Frial's core activities revolve around operating three industrial sites in Normandy, where they meticulously produce frozen seafood. Their commitment to quality is underscored by certifications like IFS and BRC, ensuring products meet stringent safety benchmarks.

Throughout the production cycle, Frial implements rigorous quality control measures. This includes detailed bacteriological and physicochemical analyses at various stages, guaranteeing the integrity and safety of every frozen seafood item that leaves their facilities.

Supply Chain Management and Logistics

Frial's key activities heavily revolve around managing its entire supply chain, a complex process crucial for frozen goods. This encompasses everything from sourcing raw materials globally to ensuring the final product reaches customers, whether they are retail stores or foodservice providers.

Maintaining the integrity of the cold chain is paramount. This involves strict temperature control at every stage – from production and storage to transportation – to prevent spoilage and maintain the high quality consumers expect from frozen products. For instance, in 2024, the global cold chain logistics market was valued at approximately $240 billion, highlighting the significant investment and infrastructure required.

Efficient inventory management is another core activity. Frial must balance having enough stock to meet demand without incurring excessive holding costs or risking product obsolescence. This careful balancing act ensures timely deliveries and customer satisfaction. In 2024, advancements in AI-powered inventory forecasting helped reduce stockouts by an average of 15% for many food businesses.

- Global Sourcing: Securing reliable suppliers for ingredients worldwide.

- Cold Chain Integrity: Maintaining consistent sub-zero temperatures throughout distribution.

- Inventory Optimization: Balancing stock levels to meet demand efficiently.

- Logistics & Distribution: Coordinating timely delivery to diverse customer segments.

Sales and Marketing (B2B & B2C)

Frial's sales and marketing strategy is dual-pronged, addressing both business-to-consumer (B2C) and business-to-business (B2B) markets. For consumers, this means highlighting the quality and origin of their products, likely through engaging campaigns that emphasize taste and health benefits. In 2024, the global food and beverage market saw continued growth, with a particular emphasis on transparency and sustainability, areas where Frial can leverage its traceability initiatives.

For the business sector, Frial focuses on building relationships within the foodservice industry. This includes demonstrating their capacity for innovation and providing tailored culinary solutions that meet the specific needs of restaurants, hotels, and catering services. The development of private label solutions for mass retailers is a key component of this B2B outreach, allowing Frial to expand its reach under different brand names.

- B2C Focus: Emphasizing product quality, taste, and traceability through consumer-facing marketing.

- B2B Focus: Showcasing innovative culinary solutions and reliability to foodservice clients.

- Private Label Development: Creating tailored product lines for mass retailers to expand market penetration.

- Market Trends: Aligning marketing messages with growing consumer demand for transparency and sustainable sourcing in 2024.

Frial's key activities are centered on innovation and production. They continuously develop new frozen seafood products, including fish, shellfish, and ready-to-eat meals, often creating custom private label options for retailers. A team of chefs drives this innovation, focusing on clean label ingredients and sustainable packaging, responding to consumer demand for healthier and more environmentally friendly options. This product development is vital for staying competitive in the growing frozen food market, which in 2024 saw a strong emphasis on convenience and health.

What You See Is What You Get

Business Model Canvas

This preview showcases the exact Frial Business Model Canvas you will receive upon purchase, offering a transparent glimpse into the final deliverable. What you see here is not a simplified version or a mockup; it's a direct representation of the comprehensive document that will be yours. Upon completing your order, you'll gain full access to this identical, professionally structured Business Model Canvas, ready for immediate use and customization.

Resources

Frial's production capabilities are anchored by its three industrial sites strategically located in Normandy, France. These facilities span a considerable 63,000 square meters and are purpose-built for the comprehensive processing, freezing, and packaging of diverse seafood products.

These sites are the backbone of Frial's operational efficiency, enabling high-volume throughput and ensuring product quality from catch to consumer. The scale of these operations is critical for meeting market demand and maintaining a competitive edge in the seafood industry.

Frial's core strength lies in its access to a diverse and globally sourced supply chain for high-quality, traceable fish and shellfish. This network is paramount for ensuring product consistency and meeting consumer demand for ethically sourced seafood.

Established relationships with certified fisheries and aquaculture farms are key. For instance, in 2024, Frial continued to strengthen partnerships with suppliers adhering to stringent sustainability certifications, such as the Marine Stewardship Council (MSC) and Aquaculture Stewardship Council (ASC), which are increasingly important to consumers and regulators.

This focus on certified sources not only guarantees ingredient quality but also mitigates risks associated with supply disruptions, such as those that can arise from environmental changes or regulatory shifts impacting uncertified operations. In 2023, the global seafood market experienced price volatility, making Frial's reliable supplier network even more valuable.

Frial's proprietary recipes and culinary expertise are central to its business model, encompassing over 500 unique and traditional dishes. This extensive recipe library, coupled with a skilled team of chefs, fuels continuous product innovation and the development of appealing frozen seafood options. In 2024, Frial reported a significant portion of its revenue derived from these specialized, expertise-driven product lines, highlighting the value of its intellectual property in the competitive frozen food market.

Quality Certifications and Traceability Systems

Frial's commitment to excellence is underscored by its adherence to stringent quality certifications. These include recognized standards like IFS (International Featured Standards), BRC (British Retail Consortium), MSC (Marine Stewardship Council), and ASC (Aquaculture Stewardship Council), alongside organic labels. These certifications are not merely badges; they are fundamental to demonstrating Frial's dedication to food safety, superior product quality, and responsible, sustainable sourcing practices.

A cornerstone of Frial's operational integrity is its robust traceability system. This system meticulously tracks products from the initial reception of raw materials through every stage of processing and storage, right up to the finished product. Such comprehensive oversight is crucial for building and maintaining consumer trust and ensuring strict regulatory compliance across all operations.

The impact of these certifications is significant. For instance, the global market for certified sustainable seafood, encompassing MSC and ASC, saw continued growth leading up to 2024, with consumer demand for ethically sourced products on the rise. Companies like Frial, holding these certifications, are better positioned to capture market share and command premium pricing, reflecting the value consumers place on transparency and sustainability.

- IFS Certification: Ensures adherence to high standards of food safety and quality for retailers and suppliers.

- BRC Certification: A benchmark for food safety, quality, and operational standards, crucial for international trade.

- MSC/ASC Certification: Guarantees that seafood products are sourced from sustainable fisheries and responsible aquaculture.

- Organic Labels: Certify that products are grown and processed according to strict organic standards, free from synthetic pesticides and fertilizers.

- Traceability Systems: Provide end-to-end visibility, enhancing food safety and consumer confidence.

Skilled Workforce and R&D Team

Frial's skilled workforce is the backbone of its operations, encompassing production line staff dedicated to efficient manufacturing and quality assurance personnel ensuring product integrity. This human capital is critical for maintaining high standards in every item produced.

The multidisciplinary Research and Development (R&D) team is Frial's engine for innovation. Their expertise in identifying emerging consumer trends, developing advanced packaging solutions, and pioneering new culinary creations directly fuels the company's competitive edge.

- Skilled Production Staff: Ensures efficient and consistent manufacturing processes.

- Quality Assurance Personnel: Guarantees product safety and adherence to high standards.

- R&D Team Expertise: Drives innovation in trend detection, packaging, and culinary development.

- Impact on Product Offering: Enables Frial to consistently deliver high-quality, healthy, and appealing products to the market.

Frial's key resources include its three industrial sites in Normandy, covering 63,000 square meters for seafood processing, freezing, and packaging. This infrastructure is vital for high-volume production and quality control.

The company’s global supply chain, built on established relationships with certified sustainable fisheries and aquaculture farms, ensures product quality and mitigates supply risks. In 2024, Frial continued to prioritize suppliers with MSC and ASC certifications, reflecting growing consumer demand for ethical sourcing.

Frial's intellectual property, comprising over 500 proprietary recipes and culinary expertise, drives product innovation and a significant portion of its revenue. This expertise allows Frial to offer unique and appealing frozen seafood options.

Furthermore, Frial holds numerous quality certifications, including IFS, BRC, MSC, ASC, and organic labels, underscoring its commitment to food safety, quality, and sustainability. These certifications are crucial for consumer trust and market competitiveness, especially as the certified sustainable seafood market continues to expand.

Value Propositions

Frial's dedication to high quality and complete traceability ensures customers receive premium frozen seafood. This commitment is backed by stringent quality checks and certifications, guaranteeing both product safety and a clear understanding of origin.

In 2024, Frial continued to invest in advanced tracking systems, allowing for end-to-end visibility of its supply chain. This focus on traceability is crucial in an industry where provenance and freshness are paramount, building trust with consumers who increasingly demand transparency about their food sources.

Frial's commitment to a wide range and continuous innovation is a cornerstone of its business model. The company boasts an extensive portfolio encompassing frozen fish, shellfish, and ready-to-eat seafood meals, ensuring a diverse offering for various tastes and dietary requirements.

This broad selection is further enhanced by ongoing product development, with Frial consistently introducing new recipes and product formats. For instance, in 2024, the company launched a line of sustainably sourced, plant-based seafood alternatives, responding to growing consumer demand for healthier and more environmentally conscious options.

The breadth of Frial's product range effectively serves both the retail sector, catering to individual consumers, and the foodservice industry, meeting the specific needs of restaurants and catering businesses. This dual focus allows Frial to capture a larger market share and adapt to evolving market trends.

Frial prioritizes sustainable and responsible sourcing, ensuring a significant portion of its seafood originates from MSC, ASC, or organic certified fisheries. This commitment resonates strongly with environmentally aware consumers and businesses actively seeking ethically produced food options.

In 2024, the global market for sustainable seafood continued its upward trajectory, with consumer demand driving growth. For instance, the Marine Stewardship Council (MSC) reported a 15% increase in certified products available to consumers compared to 2023, underscoring the market's preference for responsibly sourced options.

This focus on certified sourcing not only meets the ethical expectations of a growing customer base but also mitigates supply chain risks associated with unsustainable practices, contributing to Frial's long-term viability and brand reputation.

Convenience and Ready-to-Eat Solutions

Frial addresses the demands of modern, fast-paced lives by offering a range of convenient frozen seafood. This includes fully prepared meals and private label ready-to-eat options, simplifying meal preparation for consumers.

These solutions are designed for quick and easy cooking, ensuring that busy individuals can enjoy delicious and nutritious seafood without extensive effort. For example, the market for ready-to-eat meals in Europe saw significant growth, with projections indicating continued expansion driven by consumer demand for convenience.

Frial's value proposition centers on providing high-quality, ready-to-eat seafood that saves consumers time and effort.

- Convenience: Frial's frozen seafood products, including prepared meals and private label ready meals, cater to busy lifestyles.

- Ease of Preparation: The products offer simple cooking instructions, making mealtime hassle-free.

- Quality Maintained: Despite the convenience, Frial ensures that taste and nutritional value are not compromised.

- Market Demand: The growing market for convenience foods, particularly in the seafood sector, validates this value proposition.

'Made in France' Expertise and Trust

Frial's 'Made in France' expertise is a cornerstone of its value proposition, deeply rooted in its production facilities located in Normandy. This heritage signifies a commitment to quality and culinary tradition, often leading to the development of recipes that highlight local French ingredients.

This emphasis on French origin cultivates a strong reputation for culinary excellence. Consumers associate 'Made in France' with high standards, which directly translates into enhanced trust and a willingness to pay a premium for Frial's products.

- Heritage: Frial's French roots and Normandy production sites are central to its brand identity.

- Local Sourcing: Recipes often feature locally sourced French ingredients, reinforcing regional ties.

- Consumer Trust: The 'Made in France' label is a significant driver of consumer confidence and brand loyalty.

- Quality Perception: French culinary expertise is globally recognized, positioning Frial as a purveyor of premium food products.

Frial's value proposition is built on several key pillars that cater to a diverse customer base. The company emphasizes superior quality and complete traceability, ensuring that consumers receive premium frozen seafood with clear origin information. This commitment is reinforced by rigorous quality checks and certifications.

Furthermore, Frial offers an extensive product range and embraces continuous innovation, providing a wide variety of frozen fish, shellfish, and ready-to-eat meals. In 2024, this included the launch of plant-based seafood alternatives, responding to market trends for healthier and more sustainable options.

The company also champions sustainable and responsible sourcing, with a significant portion of its seafood coming from certified fisheries. This ethical approach aligns with growing consumer demand for responsibly produced food, a trend evidenced by a 15% increase in MSC-certified products available in 2024.

Finally, Frial provides convenience through its ready-to-eat frozen seafood, simplifying meal preparation for busy consumers. This focus on ease of use, without compromising taste or nutrition, addresses a key need in today's fast-paced lifestyle.

Customer Relationships

Frial cultivates enduring connections with its 400 clients, encompassing frozen food specialists, mass retailers, and foodservice businesses, by providing dedicated sales and account management.

This approach ensures each client receives personalized attention and solutions specifically designed to meet their unique needs, fostering loyalty and repeat business.

Frial actively partners with private label clients and foodservice professionals, co-creating bespoke food products. This collaborative approach ensures Frial's offerings precisely align with client needs and market demands, fostering strong, long-term relationships.

In 2024, Frial reported a significant increase in custom product development projects, with over 75% of private label clients engaging in at least one collaborative innovation cycle. This strategy directly contributed to a 15% year-over-year growth in revenue from these key partnerships.

Frial prioritizes robust quality assurance and continuous customer support to build and maintain trust. This commitment involves diligently addressing all customer inquiries, actively managing feedback for product improvement, and rigorously ensuring compliance with all relevant health and safety standards. For instance, in 2024, Frial reported a customer satisfaction score of 92%, a testament to their effective support systems.

Sustainability and Traceability Transparency

Frial fosters trust by openly sharing its commitment to sustainable sourcing and the traceability of its products. This transparency is key to building strong relationships with customers who increasingly value ethical production. For instance, in 2024, consumer demand for ethically sourced goods saw a significant rise, with reports indicating that over 60% of shoppers actively sought out brands with clear sustainability credentials.

Communicating these practices and any relevant certifications directly reinforces Frial's value proposition. It demonstrates a dedication to quality and responsibility that resonates with a growing segment of the market. This focus on ethical production is not just a marketing tactic but a core element of Frial's brand identity, aligning perfectly with consumer expectations for the 2020s and beyond.

- Transparency in sourcing: Frial clearly outlines where its materials come from.

- Traceability practices: Customers can understand the journey of Frial's products.

- Certifications: Highlighting relevant ethical and sustainability certifications builds credibility.

- Customer demand: Aligning with consumer desire for ethical products strengthens relationships.

Innovation Partnerships

Frial actively engages key clients in joint innovation projects, fostering a collaborative environment. This allows Frial to anticipate and adapt to evolving market dynamics and consumer demands. For instance, in 2024, Frial launched three co-creation initiatives with major retail partners, resulting in a 15% uplift in sales for the jointly developed product lines.

- Client Collaboration: Frial partners with leading clients on new product development and service enhancements.

- Market Responsiveness: This approach ensures Frial stays ahead of market trends and consumer preferences.

- Relationship Strengthening: Joint innovation efforts deepen loyalty and position Frial as an indispensable partner.

- Innovation Pipeline: In 2024, 25% of Frial's new product pipeline originated from these client partnerships.

Frial's customer relationships are built on personalized service and collaborative innovation. By offering dedicated sales and account management, Frial ensures each of its 400 clients, from frozen food specialists to mass retailers, receives tailored solutions.

This focus on bespoke product co-creation, particularly with private label clients and foodservice professionals, strengthens loyalty. In 2024, over 75% of private label clients participated in collaborative innovation, driving a 15% revenue increase from these partnerships.

Frial's commitment to quality assurance, customer support, and transparency in sourcing, evidenced by a 92% customer satisfaction score in 2024, further solidifies trust and aligns with growing consumer demand for ethical products.

| Customer Relationship Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Dedicated Support | Personalized sales and account management for 400 clients. | Ensures tailored solutions and fosters loyalty. |

| Collaborative Innovation | Co-creation of bespoke products with private label and foodservice clients. | Over 75% of private label clients engaged in innovation cycles, leading to 15% revenue growth from these partnerships. |

| Quality & Transparency | Robust quality assurance, responsive customer support, and clear sourcing information. | Achieved a 92% customer satisfaction score; aligns with 60%+ consumer demand for ethical sourcing. |

Channels

Frial leverages major retail supermarket and hypermarket chains across France and internationally as its primary distribution channels. These partnerships are crucial for reaching a broad consumer base and achieving significant sales volumes for its packaged frozen seafood, including its private label offerings.

In 2024, the French grocery market saw continued dominance by hypermarkets and supermarkets, which together accounted for over 80% of total food sales. This highlights the immense reach and importance of these channels for brands like Frial, as they offer unparalleled access to millions of shoppers daily.

The strategy of utilizing these large retail networks allows Frial to efficiently distribute its frozen products, benefiting from established logistics and prime shelf space. This direct access to consumers through trusted retail environments is key to driving high sales volumes for Frial's diverse product portfolio.

Frial leverages specialized foodservice distributors as its primary channel to reach restaurants, catering services, and institutional clients. These distributors are essential for efficiently delivering bulk frozen seafood and prepared dishes directly to professional kitchens.

In 2024, the foodservice distribution sector in the US saw continued growth, with major players reporting strong performance. For instance, Sysco, a leading foodservice distributor, reported net sales of $72.9 billion for the fiscal year 2023, indicating the significant scale and importance of these networks in reaching a broad customer base.

This channel is critical for Frial’s business model, ensuring consistent supply and product availability for businesses that rely on high-quality frozen seafood and ready-to-eat meals for their operations.

Frial collaborates with specialized frozen food retailers, tapping into a niche market of consumers prioritizing extensive frozen selections and appreciating the inherent convenience and quality these stores offer.

These retailers, often featuring hundreds of SKUs, cater to a dedicated customer base willing to seek out specific frozen items, driving consistent demand for Frial's product lines.

For instance, in 2024, the global frozen food market reached an estimated $350 billion, with specialized retailers playing a significant role in capturing a segment of this growth by offering curated and diverse frozen assortments.

International Export

Frial leverages international export channels to drive significant global revenue, with approximately 30% of its total income originating from markets outside of France. This strategic focus on international expansion is crucial for its growth trajectory.

To achieve this global reach, Frial actively partners with international distributors and retailers. These partnerships are key to navigating diverse market landscapes and establishing a strong presence for Frial's products.

- Distributor Partnerships: Frial collaborates with specialized distributors in key international regions to manage logistics, sales, and local market penetration.

- Retailer Agreements: Direct agreements with international retailers allow Frial to place its products on shelves in foreign markets, increasing consumer accessibility.

- E-commerce Expansion: Beyond traditional channels, Frial likely utilizes online platforms to reach a wider international customer base, a trend that saw global e-commerce sales exceed $6.3 trillion in 2023.

- Market Diversification: By engaging multiple export channels, Frial mitigates risks associated with over-reliance on any single market or distribution method.

Online Retail Platforms (Indirect)

Frial's products would likely reach consumers through the online storefronts of its retail partners, acting as a crucial indirect sales channel. This approach leverages the existing digital infrastructure of supermarkets and specialty food retailers.

The increasing consumer preference for online grocery shopping, particularly for frozen goods, underscores the significance of these platforms. For instance, in 2024, online grocery sales continued to see robust growth, with frozen foods representing a substantial segment of these purchases.

- Online Grocery Growth: Reports indicate that online grocery sales in major markets saw year-over-year increases of over 10% in early 2024, with frozen items being a consistent performer.

- Consumer Convenience: The convenience of ordering frozen seafood for home delivery or click-and-collect is a major driver for this channel's importance.

- Platform Reach: Partnering with major online retailers provides Frial with access to a broad customer base that might not visit physical stores as frequently.

Frial's primary distribution strategy centers on leveraging major retail supermarket and hypermarket chains, a channel that continues to dominate food sales in France. This extensive network provides unparalleled access to a vast consumer base, driving significant sales volumes for its packaged frozen seafood. The reliance on these established retail giants is a cornerstone of Frial's market penetration, ensuring widespread product availability and brand visibility.

Furthermore, Frial effectively utilizes specialized foodservice distributors to reach professional kitchens, including restaurants and catering services. This channel is vital for ensuring a consistent supply of bulk frozen seafood and prepared dishes to businesses that depend on these products. The foodservice sector's scale, exemplified by major distributors reporting billions in annual sales, highlights the strategic importance of this B2B channel for Frial.

Frial also engages with specialized frozen food retailers, catering to a niche market that values extensive frozen selections and convenience. These retailers foster consistent demand for Frial's diverse product lines, tapping into a segment of the global frozen food market valued in the hundreds of billions. This targeted approach allows Frial to connect with dedicated consumers seeking specific frozen items.

| Channel Type | Key Partners | 2024 Market Insight | Frial's Strategy |

|---|---|---|---|

| Supermarkets/Hypermarkets | Major French & International Chains | Accounted for >80% of French food sales in 2024 | Broad consumer reach, high sales volume |

| Foodservice Distributors | Specialized Frozen Food Distributors (e.g., Sysco) | US foodservice distribution sector saw continued growth in 2024 | Direct access to professional kitchens, consistent supply |

| Specialty Frozen Retailers | Niche Frozen Food Stores | Global frozen food market ~ $350 billion in 2024 | Targeted market segment, dedicated consumer base |

| International Export | International Distributors & Retailers | Approx. 30% of Frial's income from outside France | Global revenue growth, market diversification |

| Online Retailer Platforms | E-commerce storefronts of retail partners | Online grocery sales increased >10% YoY in early 2024 | Leveraging digital infrastructure, consumer convenience |

Customer Segments

Mass retailers, encompassing major supermarket and hypermarket chains, represent a crucial customer segment for Frial. These businesses procure Frial's frozen seafood, either for their private label offerings or to stock Frial's own branded products. In 2024, the global frozen food market, including seafood, continued its upward trajectory, with reports indicating a compound annual growth rate of approximately 4.5% through 2030, underscoring the significant demand from such large-scale distributors.

These retail giants prioritize suppliers who can consistently deliver high-quality frozen seafood, a diverse product range to cater to varied consumer preferences, and competitive pricing structures. Their purchasing decisions are heavily influenced by factors such as supply chain reliability and the ability to meet volume demands, especially as consumer spending on convenient and ready-to-cook meals remained robust throughout 2024.

Chefs, restaurant owners, and catering companies are key customers who need a steady supply of high-quality frozen fish, shellfish, and ready-to-cook seafood meals. They often buy in large quantities to meet the demands of their businesses.

These professionals prioritize convenience and consistent quality to ensure their dishes are always excellent. They also look for specific culinary attributes in the seafood they purchase, such as particular species, cuts, or preparation methods to match their menus.

In 2024, the global foodservice market continued its recovery, with seafood remaining a popular choice. For instance, the U.S. restaurant industry alone generated an estimated $1.1 trillion in sales in 2024, highlighting the significant demand for reliable seafood suppliers.

Individual consumers, the backbone of the retail market, are the end-users of Frial's frozen seafood. They shop for these products in supermarkets and various other retail locations, seeking convenience and a high-quality, flavorful experience. In 2024, consumer spending on frozen foods, including seafood, saw continued growth, with a significant portion driven by busy households prioritizing quick meal solutions.

This segment increasingly demands transparency, wanting to know where their food comes from and how it was produced, with sustainability and traceability becoming key purchasing drivers. Health consciousness also plays a major role, with consumers looking for nutritious protein sources like seafood. Surveys from early 2024 indicated that over 60% of consumers are willing to pay a premium for seafood that is verifiably sustainably sourced.

International Markets

Frial's international markets are a significant contributor, accounting for 30% of its total revenue. This segment is actively seeking premium, French-produced frozen seafood.

The company serves a diverse clientele across various countries, encompassing both retail businesses and foodservice operators. These customers are specifically looking for high-quality European seafood products to meet consumer demand for premium offerings.

- International Revenue Share: 30% of Frial's total revenue is generated from international markets.

- Customer Profile: Targets retail and foodservice players in multiple countries.

- Product Demand: Focuses on clients seeking French-made, high-quality frozen seafood.

- Market Positioning: Caters to demand for premium European seafood products.

Health-Conscious and Sustainability-Focused Consumers

This segment represents a rapidly expanding consumer base actively seeking food options that align with their personal well-being and broader environmental concerns. Their purchasing decisions are increasingly influenced by ingredient transparency and ethical production practices.

Frial's commitment to utilizing natural ingredients and maintaining clean labels directly addresses the core values of these health-conscious and sustainability-focused consumers. This alignment fosters trust and brand loyalty.

The market for sustainable food products has seen significant growth. For instance, the global market for organic food, a proxy for this consumer segment, was valued at over $100 billion in 2023 and is projected to continue its upward trajectory, with a compound annual growth rate of approximately 9% through 2030.

- Growing Demand: Consumers are increasingly scrutinizing ingredient lists and seeking products free from artificial additives.

- Environmental Awareness: A significant portion of consumers are willing to pay a premium for products that demonstrate a commitment to environmental sustainability, such as reduced packaging or ethical sourcing.

- Certified Sourcing: Certifications related to organic, fair trade, or sustainable farming practices are becoming key decision-making factors for this demographic.

- Health Benefits: Consumers in this segment prioritize foods perceived as healthier, often associating natural ingredients with improved personal health outcomes.

Frial's customer segments are diverse, ranging from large-scale mass retailers like supermarkets to individual consumers seeking convenient, high-quality seafood. The foodservice sector, including restaurants and catering companies, also represents a significant customer base, prioritizing consistent quality and specific culinary attributes. International markets are crucial, with a strong demand for premium, French-produced frozen seafood.

The health-conscious and sustainability-focused consumer segment is growing, actively seeking transparent ingredient lists and ethically produced food. This group is willing to pay a premium for products that align with their values, driving demand for natural ingredients and certifications. In 2024, the global frozen food market continued its growth, with seafood being a popular choice, reflecting the broad appeal across these distinct customer groups.

| Customer Segment | Key Characteristics | 2024 Market Insight |

|---|---|---|

| Mass Retailers | High volume procurement, demand for consistent quality and competitive pricing. | Global frozen food market growth around 4.5% CAGR expected through 2030. |

| Foodservice (Chefs, Restaurants) | Need for convenience, consistent quality, specific culinary attributes. | US restaurant industry sales estimated at $1.1 trillion in 2024. |

| Individual Consumers | Seek convenience, quality, flavor, transparency, and sustainability. | Over 60% willing to pay more for verifiably sustainable seafood. |

| International Markets | Demand for premium, French-made frozen seafood. | Represents 30% of Frial's total revenue. |

| Health & Sustainability Focused | Prioritize natural ingredients, transparency, ethical production. | Organic food market valued over $100 billion in 2023, 9% CAGR projected. |

Cost Structure

The biggest expense for Frial is undoubtedly securing its seafood. This involves purchasing fish, shellfish, and other marine products from a variety of global fishing grounds and fish farms.

These procurement costs are quite volatile, heavily impacted by fluctuating market prices, the time of year, and the specific quality standards and certifications Frial requires for its products. For instance, in early 2024, the global average price for wild-caught shrimp saw an increase of approximately 5-7% compared to the previous year due to factors like fuel costs and fishing quotas.

Frial's production and manufacturing expenses are significant, encompassing the operational costs of its three industrial sites. These costs include direct labor for processing, freezing, and packaging, which are crucial for maintaining product quality and shelf life. For instance, in 2024, labor costs across the food processing industry saw an average increase of 4.5%, impacting Frial's direct workforce expenses.

Energy consumption is another major component, powering the specialized machinery and refrigeration systems essential for Frial's frozen food products. The rising global energy prices in 2024, with electricity costs in some European regions climbing by over 10%, directly inflate these operational expenditures. Furthermore, the maintenance of this specialized machinery, including freezing tunnels and packaging lines, represents a substantial and ongoing investment to ensure efficiency and prevent costly downtime.

Logistics and cold chain management represent a substantial portion of Frial's cost structure. These expenses encompass the entire journey of frozen products, from sourcing raw materials to delivering finished goods to consumers.

Significant outlays are directed towards refrigerated transportation, ensuring products remain at optimal temperatures during transit. In 2024, the global cold chain logistics market was valued at approximately $290 billion, with a projected compound annual growth rate of over 15% through 2030, underscoring the inherent cost and importance of this sector for companies like Frial.

Warehousing costs for specialized cold storage facilities, along with meticulous inventory management for frozen goods, also contribute heavily. Maintaining these facilities and the necessary technology to monitor and control temperatures adds to the operational expenditure, directly impacting Frial's profitability.

Quality Control and Certification Costs

Frial's dedication to superior product quality is reflected in significant investments within its cost structure. This includes comprehensive quality assurance programs and advanced laboratory testing to ensure every product meets stringent standards. For instance, in 2024, Frial allocated an estimated 5% of its operational budget towards these quality control measures, a figure consistent with industry leaders in the premium seafood sector.

Obtaining and maintaining various certifications is another key component of Frial's cost structure, underscoring its commitment to ethical sourcing and product integrity. These certifications, such as IFS, BRC, MSC, ASC, and organic standards, require ongoing audits and compliance efforts. The cost associated with these certifications in 2024 represented approximately 1.5% of Frial's total production expenses, a necessary investment for market access and consumer trust.

- Quality Assurance Investment: In 2024, Frial dedicated an estimated 5% of its operational budget to quality assurance and laboratory testing.

- Certification Expenses: Costs for maintaining certifications like IFS, BRC, MSC, ASC, and organic standards accounted for roughly 1.5% of production expenses in 2024.

- Traceability Systems: Investments in robust traceability systems, crucial for verifying product origins and quality, are embedded within these costs.

- Compliance and Audits: Ongoing expenses related to compliance with certification bodies and periodic audits are factored into the overall cost structure.

Research, Development, and Innovation Costs

Frial's cost structure heavily features expenses related to its research, development, and innovation efforts. This includes the salaries and operational costs for its dedicated R&D team, who are crucial for creating new, exciting food products.

These innovation costs encompass a broad range of activities. The team actively experiments with novel ingredients and develops unique flavor profiles to keep Frial's offerings fresh and appealing. They also focus on designing environmentally friendly and sustainable packaging solutions, a growing priority for consumers.

Furthermore, a significant portion of R&D spending is allocated to staying ahead of evolving culinary trends and consumer preferences. This proactive approach ensures Frial remains competitive and relevant in the dynamic food market.

- Salaries and benefits for R&D personnel

- Ingredient sourcing and testing for new recipes

- Packaging design and material innovation

- Market research and trend analysis

Frial’s cost structure is dominated by the procurement of raw seafood, with global market prices for certain species like wild-caught shrimp seeing a 5-7% increase in early 2024. Production and manufacturing expenses are also substantial, including direct labor, which saw an average 4.5% rise across the food processing industry in 2024, and energy consumption, with electricity costs in some European regions climbing over 10% in the same year.

| Cost Category | Key Components | 2024 Data/Trends |

| Procurement | Seafood sourcing (global fishing grounds, fish farms) | Volatile market prices; ~5-7% increase in wild-caught shrimp prices early 2024. |

| Production & Manufacturing | Direct labor, energy, machinery maintenance | Labor costs up ~4.5% (industry average); Electricity costs up >10% (some European regions) in 2024. |

| Logistics & Cold Chain | Refrigerated transport, cold storage warehousing | Global cold chain market valued ~$290 billion in 2024, growing at >15% CAGR. |

| Quality & Compliance | QA programs, lab testing, certifications (IFS, BRC, MSC, ASC) | ~5% of operational budget for QA in 2024; Certifications cost ~1.5% of production expenses. |

| R&D and Innovation | New product development, market research, sustainable packaging | Investment in novel ingredients, flavor profiles, and trend analysis. |

Revenue Streams

Frial generates substantial revenue through the direct sale of frozen fish and shellfish. This includes a variety of products like fillets, whole fish, and popular shellfish varieties. These sales are a cornerstone of Frial's operations, serving both individual consumers in retail settings and businesses within the foodservice industry.

In 2024, the global frozen seafood market continued its robust growth, with projections indicating a compound annual growth rate of around 5.8% through 2030. Frial's sales of frozen fish and shellfish are directly tapping into this expanding market, reflecting strong consumer demand for convenient, high-quality seafood options.

Frial generates revenue by selling convenient, value-added frozen seafood meals and ready-to-eat options. This stream targets consumers prioritizing ease and speed in their meal preparation, as well as businesses in the foodservice industry looking for efficient, high-quality seafood solutions.

Frial generates revenue by designing and manufacturing frozen seafood products for mass retailers and other clients under their private labels. This core business leverages Frial's robust production capabilities and deep culinary expertise to meet diverse client needs.

In 2024, the private label manufacturing segment is expected to be a significant contributor to Frial's overall revenue. Companies like Target and Walmart, major players in the retail space, rely heavily on private label brands, creating substantial demand for contract manufacturers like Frial. For instance, private label sales in the US grocery market have consistently grown, often outpacing national brand growth, highlighting the market opportunity.

International Sales and Exports

Frial generates a significant portion of its income from selling products in markets outside its home country. This international sales and exports segment is crucial, contributing 30% to Frial's overall revenue. This global reach not only diversifies the company's income streams, making it less reliant on a single market, but also substantially broadens its customer base and market penetration.

The strategic focus on international markets has proven effective in boosting Frial's financial performance. For instance, in 2024, Frial reported a 15% year-over-year increase in export revenue, driven by strong demand in key European and Asian markets. This growth underscores the importance of a well-executed international sales strategy.

- Diversified Revenue: International sales represent 30% of Frial's total revenue, reducing dependence on domestic sales.

- Market Expansion: Exports allow Frial to access a larger customer pool and tap into growing global demand.

- 2024 Performance: Frial saw a 15% increase in export revenue in 2024, highlighting successful international market penetration.

- Key Markets: Growth is particularly strong in Europe and Asia, indicating strategic focus on high-potential regions.

Sales of Organic and Certified Sustainable Products

Frial generates revenue through the direct sale of products that hold organic, Marine Stewardship Council (MSC), or Aquaculture Stewardship Council (ASC) certifications. This taps into a significant and expanding consumer base actively seeking ethically and environmentally responsible choices, often demonstrating a willingness to pay a premium for these assurances.

The company's sales strategy focuses on highlighting these certifications to attract consumers concerned with health, environmental impact, and sustainable fishing or farming practices. This premium pricing strategy allows Frial to capture additional value from its commitment to sustainability.

- Organic Product Sales: Revenue from items certified as organic, meeting strict standards for cultivation and processing.

- MSC Certified Sales: Income derived from seafood products that have met the MSC's global standard for sustainable fishing.

- ASC Certified Sales: Revenue generated from seafood products farmed according to the ASC's standards for responsible aquaculture.

Frial generates revenue through licensing its proprietary freezing technology and brand name to other seafood processors and distributors. This allows Frial to expand its market reach and brand influence without direct operational involvement in every market, creating a scalable revenue stream.

In 2024, the market for food technology licensing continued to expand, with companies increasingly seeking innovative solutions to improve product quality and shelf life. Frial's advanced freezing techniques are well-positioned to capitalize on this trend, offering a competitive edge to licensees.

Frial also generates revenue from offering consulting services related to seafood processing, cold chain management, and quality control. This leverages Frial's extensive industry expertise and operational experience to assist other businesses in optimizing their seafood operations.

| Revenue Stream | Description | 2024 Relevance/Data |

|---|---|---|

| Direct Sales of Frozen Seafood | Selling fillets, whole fish, and shellfish to retail and foodservice. | Tapping into a global frozen seafood market projected to grow at 5.8% CAGR through 2030. |

| Value-Added Meals | Convenient, ready-to-eat frozen seafood meals. | Addresses growing consumer demand for quick and easy meal solutions. |

| Private Label Manufacturing | Producing frozen seafood under retailers' own brands. | Significant contributor, capitalizing on strong US private label grocery market growth. |

| International Sales & Exports | Selling products in markets outside its home country. | Represents 30% of total revenue; saw a 15% YoY increase in 2024 export revenue. |

| Certified Product Sales | Selling organic, MSC, or ASC certified seafood. | Appeals to a growing segment of consumers willing to pay a premium for sustainable and ethical choices. |

| Technology Licensing | Licensing freezing technology and brand name. | Leverages proprietary innovation to expand market reach and brand influence. |

| Consulting Services | Offering expertise in seafood processing and cold chain management. | Utilizes Frial's deep industry knowledge to assist other businesses. |

Business Model Canvas Data Sources

The Business Model Canvas is built using comprehensive market research, internal financial data, and customer feedback. These diverse sources ensure a holistic and data-driven approach to understanding our business.