Franklin Electric Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Franklin Electric Bundle

Franklin Electric navigates a competitive landscape shaped by moderate buyer power and the constant threat of substitutes. Understanding these forces is crucial for strategic planning.

The full Porter's Five Forces Analysis provides a comprehensive, data-driven framework to dissect Franklin Electric's market position, revealing key vulnerabilities and untapped opportunities. Gain actionable insights to drive smarter decision-making and stay ahead of the curve.

Suppliers Bargaining Power

Supplier concentration is a key factor in assessing bargaining power. For Franklin Electric, if critical components like specialized motors or advanced electronics are sourced from a limited number of providers, these suppliers gain significant leverage. This concentration means they can potentially dictate higher prices or impose less favorable terms, directly impacting Franklin Electric's manufacturing expenses and overall profit margins.

The costs and complexities Franklin Electric faces when switching suppliers can significantly bolster supplier bargaining power. These include expenses for retooling manufacturing equipment, the time and effort required to re-certify components, and the administrative burden of renegotiating contracts. High switching costs, therefore, create a dependency, making it more difficult and costly for Franklin Electric to move to alternative suppliers, thus strengthening the hand of existing ones.

Franklin Electric's reliance on suppliers offering highly differentiated or proprietary components significantly influences supplier bargaining power. For instance, if a key supplier provides a unique motor technology essential for Franklin Electric's submersible pump efficiency, that supplier gains leverage. This is especially true if alternative, equally effective technologies are scarce or nonexistent in the market. In 2023, the global market for specialized electric motors, a core component for Franklin Electric, saw continued demand driven by industrial automation and energy efficiency initiatives, potentially strengthening the position of key suppliers in this niche.

Threat of Forward Integration by Suppliers

If suppliers possess the capability and a strong incentive to move into Franklin Electric's business, perhaps by producing their own pumps or integrated systems, this represents a significant threat. Such a move would directly increase competition within Franklin Electric's operating space.

This forward integration by suppliers could diminish Franklin Electric's dependence on their components, potentially leading to better pricing or terms. However, it simultaneously introduces new, potentially formidable competitors who already understand the supply chain.

Consider the scenario where a key component supplier, like a specialized motor manufacturer, decides to assemble complete pump units. This would not only challenge Franklin Electric's market share but could also leverage their existing expertise and established relationships within the industry to their advantage.

- Supplier Forward Integration Risk: Suppliers moving into Franklin Electric's core business (e.g., manufacturing finished pumps) directly increases competitive intensity.

- Impact on Reliance: This threat can reduce Franklin Electric's dependence on external suppliers, potentially shifting bargaining power.

- Competitive Landscape Change: Forward integration by suppliers can transform the competitive environment by introducing new players with existing supply chain knowledge.

Importance of Franklin Electric to Suppliers

Franklin Electric's significant presence in the market means many suppliers rely heavily on the company for a substantial portion of their sales. For instance, if a key component manufacturer derives over 20% of its annual revenue from Franklin Electric, it inherently weakens that supplier's leverage. This reliance makes suppliers more inclined to offer favorable pricing and terms to retain Franklin Electric's business, thereby reducing their bargaining power.

This dynamic is crucial when evaluating the bargaining power of suppliers within Franklin Electric's industry. When suppliers are dependent on a major customer like Franklin Electric, their ability to dictate terms, such as price increases or altered payment schedules, is diminished. This dependence can be a significant factor in Franklin Electric's cost management and overall profitability.

- Supplier Dependence: Many suppliers depend on Franklin Electric for a significant percentage of their revenue, limiting their negotiation power.

- Reduced Leverage: This dependence means suppliers are less likely to push for higher prices or less favorable contract terms.

- Cost Advantage: Franklin Electric can leverage this situation to secure more competitive pricing for its raw materials and components.

The bargaining power of Franklin Electric's suppliers is influenced by the concentration of the supplier base. If a few key suppliers dominate the market for critical components, they hold more leverage. For example, specialized motor manufacturers are crucial for Franklin Electric's pump systems. In 2023, the global market for electric motors, particularly those used in industrial applications, experienced robust demand, potentially strengthening the position of major suppliers in this segment.

High switching costs for Franklin Electric also empower suppliers. These costs include retooling, component re-certification, and contract renegotiation. If suppliers offer unique technologies, like proprietary motor designs, their bargaining power increases significantly, especially if alternatives are scarce.

Supplier forward integration, where suppliers begin manufacturing finished products like pumps, poses a direct competitive threat. This can alter the industry landscape by introducing new players with established supply chain knowledge, potentially impacting Franklin Electric's market share and pricing power. Conversely, if suppliers depend heavily on Franklin Electric for a substantial portion of their sales, their bargaining power is diminished, allowing Franklin Electric to negotiate more favorable terms.

| Factor | Impact on Franklin Electric | 2023/2024 Relevance |

|---|---|---|

| Supplier Concentration | High concentration grants suppliers more leverage. | Continued demand in specialized motor markets may consolidate supplier power. |

| Switching Costs | High costs make it difficult for Franklin Electric to change suppliers. | Investment in advanced manufacturing processes can increase these costs. |

| Component Differentiation | Unique components give suppliers significant power. | Innovation in pump technology relies on specialized, often proprietary, components. |

| Supplier Forward Integration | Threatens Franklin Electric's market share and pricing. | The trend towards integrated solutions could see suppliers entering finished product markets. |

| Supplier Dependence on Franklin Electric | Low dependence strengthens supplier bargaining power. | Franklin Electric's scale can create dependence, reducing supplier leverage. |

What is included in the product

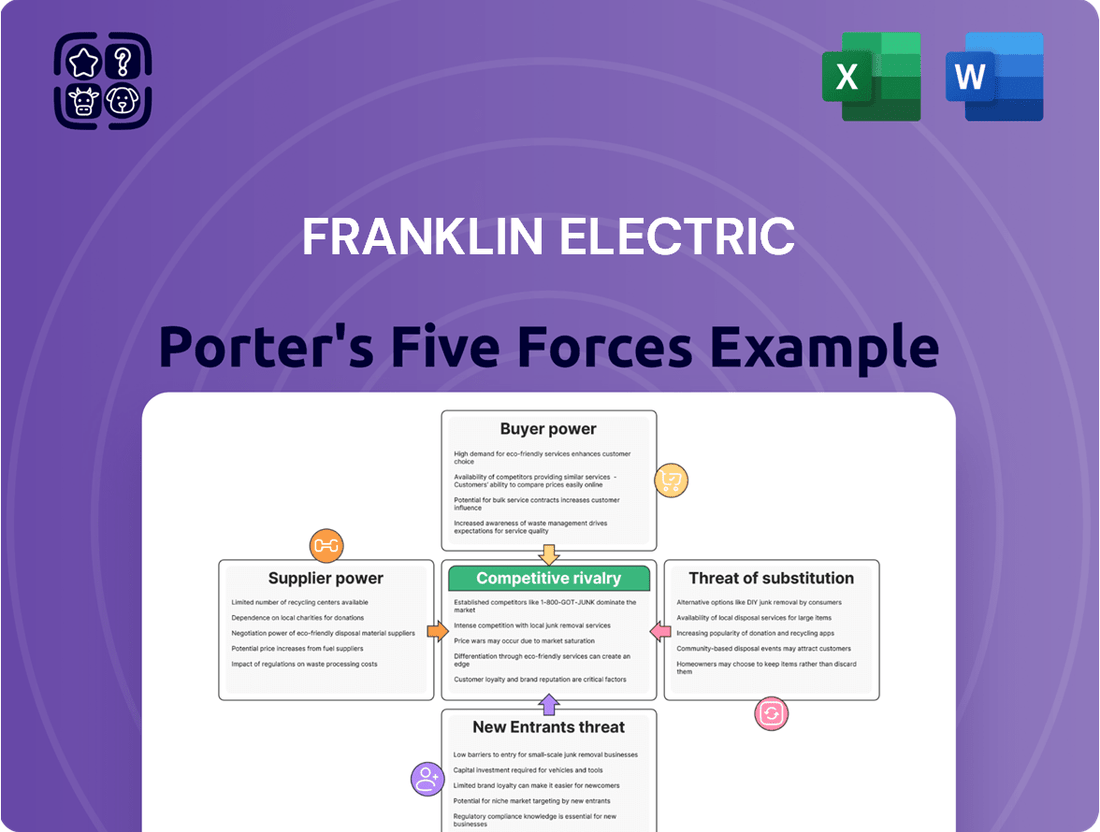

Tailored exclusively for Franklin Electric, this analysis dissects the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Instantly grasp Franklin Electric's competitive landscape with a visual, easy-to-understand representation of each force, simplifying complex strategic analysis.

Customers Bargaining Power

Franklin Electric's customer base spans various sectors like residential, commercial, agricultural, industrial, and municipal, indicating a broad market reach. However, if a significant portion of its revenue comes from a small number of large distributors or major municipal contracts, these concentrated customers gain considerable bargaining power. This means they can leverage their purchase volume to negotiate lower prices or more favorable contract terms, potentially impacting Franklin Electric's profit margins.

Customers wield significant bargaining power when a wide array of substitute products exist, offering comparable functionality to Franklin Electric's specialized submersible systems. The presence of alternative pumping technologies or solutions for fluid and fuel transfer empowers buyers to switch suppliers if Franklin Electric's pricing or terms become unfavorable. For instance, in the broader water management sector, while Franklin Electric is a leader, the availability of above-ground pumps or different fluid handling mechanisms can present viable alternatives for certain applications, thereby increasing customer leverage.

If the costs for customers to switch from Franklin Electric's products to a competitor's are low, their bargaining power increases. Low switching costs could involve minimal re-installation efforts, no significant retraining, or easily transferable warranties, making it easier for customers to move to other brands.

For instance, in the broader pump industry, which Franklin Electric serves, switching can sometimes involve significant upfront investment in new equipment and integration, but for certain product lines, especially those with standardized interfaces, these costs can be relatively low. This ease of transition directly empowers customers to demand better pricing or terms.

Customer Price Sensitivity

Franklin Electric's customers, particularly those in sectors like agriculture and certain commercial markets, often exhibit high price sensitivity. This means they are very focused on the cost of products, making them more likely to switch to competitors if prices aren't perceived as competitive. For instance, in the agricultural pump market, which is often driven by commodity prices and farm profitability, customers may delay purchases or seek lower-cost alternatives during economic downturns.

This price sensitivity directly impacts Franklin Electric's ability to maintain its profit margins. When customers are highly price-conscious, the company may be compelled to offer discounts or lower its prices to secure sales. This can put pressure on profitability, especially if input costs remain high or if competitors engage in aggressive pricing strategies. For example, in 2023, while Franklin Electric reported strong revenue growth, managing pricing in diverse global markets with varying economic conditions remained a key focus.

- Customer Price Sensitivity: High in cost-conscious sectors like agriculture and certain commercial applications.

- Impact on Franklin Electric: Potential need to lower prices or offer discounts, affecting profitability.

- Market Dynamics: Economic downturns can exacerbate price sensitivity, leading to delayed purchases or shifts to lower-cost alternatives.

- Profitability Pressure: Managing pricing effectively is crucial to offset potential margin erosion due to customer price demands.

Threat of Backward Integration by Customers

Large customers, especially those in industrial or municipal sectors, possess the potential to engage in backward integration, essentially meaning they could manufacture their own pumps or essential components. This capability, while not always exercised, significantly bolsters their bargaining power. It presents Franklin Electric with a credible alternative if negotiations falter.

For instance, a major municipal water authority might evaluate the cost-effectiveness of producing its own submersible pumps versus continuing to purchase from Franklin Electric. If the analysis shows a clear cost advantage or strategic benefit to in-house production, their leverage in pricing discussions with Franklin Electric would undoubtedly increase.

- Customer Integration Threat: Large industrial and municipal clients may explore backward integration, producing their own pumps or components.

- Increased Bargaining Power: This potential for self-production gives customers a powerful alternative, enhancing their negotiation leverage.

- Strategic Consideration: Customers might weigh the costs and benefits of in-house manufacturing against continued reliance on suppliers like Franklin Electric.

Franklin Electric faces significant customer bargaining power due to a diverse customer base where large distributors or municipal contracts can wield considerable influence. Their ability to negotiate lower prices or favorable terms is amplified by the availability of substitutes and low switching costs for certain product lines. This price sensitivity, particularly in sectors like agriculture, pressures Franklin Electric to manage pricing strategically to maintain profitability, as seen in their 2023 revenue growth amidst varied global economic conditions.

| Factor | Impact on Franklin Electric | Evidence/Example |

|---|---|---|

| Customer Concentration | High if a few large customers dominate revenue. | Large municipal contracts or major distributor relationships can lead to concentrated power. |

| Availability of Substitutes | Increases if comparable alternative technologies exist. | Other fluid handling mechanisms or above-ground pumps can serve as alternatives in some markets. |

| Switching Costs | Lowers customer power if it's easy to change suppliers. | Standardized interfaces and minimal re-installation efforts reduce barriers to switching. |

| Price Sensitivity | High in cost-driven sectors like agriculture. | Farm profitability linked to commodity prices can lead to demand for lower-cost alternatives during downturns. |

| Threat of Backward Integration | Significant for large customers who can produce components internally. | Municipal water authorities might assess the cost-effectiveness of in-house pump manufacturing. |

Same Document Delivered

Franklin Electric Porter's Five Forces Analysis

This preview showcases the complete Franklin Electric Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. You're looking at the actual document; once purchased, you'll receive instant access to this exact, professionally formatted file. This comprehensive analysis is ready for your immediate use, providing valuable insights without any surprises or placeholders.

Rivalry Among Competitors

The water and fuel movement systems market is quite competitive, featuring several significant global players. Companies like Grundfos Group, Sulzer AG, and Flowserve Corp are major forces, each vying for market share and seeking to set their products apart.

This intense rivalry among numerous large and capable competitors means that innovation and efficiency are constantly being pushed. For instance, in 2023, the global pump market, a key segment within this industry, was valued at approximately $50 billion, indicating the substantial scale of operations and the fierce competition to capture a piece of this market.

The submersible pumps market is expected to expand at a compound annual growth rate of 5.73% between 2025 and 2033. This growth rate suggests a healthy market, but it's not so rapid that it would significantly dilute competitive pressures. In markets with more moderate growth, companies often find themselves vying more aggressively for existing market share.

While the overall market growth is steady, specific segments like wastewater treatment and industrial processing are experiencing higher demand. This creates opportunities, but also means that companies operating in these more dynamic areas will likely face heightened competition as they seek to capitalize on the increased demand.

Franklin Electric stands out by offering highly specialized submersible motors, pumps, drives, and controls. Their commitment to energy-efficient and smart pump technologies, incorporating IoT capabilities, sets them apart in a competitive landscape. For instance, their submersible motor efficiency can be up to 10% higher than standard models, translating to significant operational cost savings for users.

This strong product differentiation helps to lessen the pressure of direct price wars. However, maintaining this edge demands constant innovation, especially as rivals increasingly introduce similar advanced solutions. In 2023, Franklin Electric invested $118 million in research and development, a 7% increase from 2022, underscoring their dedication to staying ahead.

Exit Barriers

Franklin Electric faces a competitive landscape influenced by high exit barriers. These barriers can include specialized manufacturing equipment, significant investments in research and development, and long-term customer contracts that make it costly and difficult for companies to leave the industry.

When exit barriers are high, firms might continue operating even if profitability is low. This is because the cost of shutting down operations or selling off specialized assets could be substantial, potentially leading to greater losses than continuing to compete. This situation can intensify rivalry as companies strive to maintain market share and cover their fixed costs.

For instance, in the submersible pump market, a sector where Franklin Electric is a major player, the specialized nature of the machinery and the established distribution networks create significant hurdles for new entrants and make exiting difficult for existing firms. This persistence in a low-profit environment fuels ongoing competitive pressure.

- High Exit Barriers: Specialized assets, long-term contracts, and significant emotional attachments to the industry can trap companies.

- Continued Operation at Low Profitability: Firms may endure low profits to avoid substantial exit losses, prolonging competitive pressure.

- Intensified Rivalry: The reluctance to exit due to high barriers leads to sustained competition among existing players.

Diversity of Competitors

Franklin Electric faces a diverse competitive landscape where rivals pursue distinct strategies. Some competitors prioritize cost leadership, aiming for high-volume sales through aggressive pricing, while others carve out niches by focusing on specialized products or superior customer service. This divergence in approach means that direct comparisons can be challenging, as each competitor leverages different strengths and targets different market segments.

For instance, while Franklin Electric might compete on integrated system solutions, a rival could be aggressively expanding its market share through acquisitions of smaller, regional players. Another competitor might be heavily investing in R&D to capture emerging technologies, altering the competitive dynamics over time. This multifaceted nature of competition requires Franklin Electric to constantly adapt its strategies to address a spectrum of rival approaches.

- Diverse Strategic Focus: Competitors vary in their primary strategies, ranging from cost leadership to niche market specialization and technological innovation.

- Varied Origins and Objectives: The differing backgrounds and goals of competitors contribute to a complex and dynamic competitive environment.

- Impact on Competition: This diversity means that competitive pressures can arise from multiple angles, requiring Franklin Electric to monitor a broad range of rival activities and capabilities.

Franklin Electric operates in a highly competitive market with numerous established global players like Grundfos and Sulzer. This rivalry intensifies due to high exit barriers, such as specialized equipment and R&D investments, which discourage companies from leaving the market, even during periods of low profitability. Competitors employ diverse strategies, from cost leadership to niche specialization, requiring Franklin Electric to continuously innovate and adapt.

| Competitor | Key Strategy | 2023 R&D Investment (approx.) |

| Grundfos Group | Integrated solutions, sustainability focus | $300 million+ (estimated) |

| Sulzer AG | High-performance pumps, industrial services | $250 million+ (estimated) |

| Flowserve Corp | Engineered fluid motion products | $200 million+ (estimated) |

| Franklin Electric | Specialized submersible motors/pumps, smart tech | $118 million |

SSubstitutes Threaten

The threat of substitutes for Franklin Electric's water and fuel movement solutions is a significant consideration. These substitutes aren't necessarily direct competitors but rather alternative ways to achieve the same end goal. For instance, in some scenarios, simple gravity-fed systems might suffice for water transfer, bypassing the need for powered pumps altogether. Similarly, for fuel movement, alternative energy sources or even manual transfer methods could be considered, especially in niche or low-volume applications.

Emerging technologies also pose a potential threat. Atmospheric water generators, for example, offer a way to produce potable water without traditional pumping infrastructure, though their scalability and cost-effectiveness vary greatly by region and application. In the fuel sector, advancements in energy storage and localized generation could reduce reliance on traditional fuel transfer methods that utilize specialized pumps. The ongoing development in renewable energy and decentralized systems continues to broaden the landscape of potential substitutes.

The threat of substitutes for Franklin Electric's products, particularly in the water pumping and fueling solutions sectors, hinges significantly on the relative price-performance of alternative offerings. If substitute products or services, perhaps from emerging competitors or through technological advancements, begin to offer comparable or even superior performance at a notably lower cost, this poses a direct challenge.

Consider the water pumping market: should new, more energy-efficient pump designs emerge from non-traditional manufacturers, or if entirely different water management solutions become substantially more affordable and equally effective, the threat of substitution escalates. For example, advancements in gravity-fed systems or micro-irrigation technologies that require less mechanical pumping could reduce demand for traditional electric pumps.

In 2024, the global water pump market was valued at approximately $48.5 billion, with a projected compound annual growth rate (CAGR) of around 4.5% through 2030. This growth indicates a robust market, but also highlights the potential for disruption if cheaper, equally performing substitutes gain traction. Similarly, the global fuel dispenser market, a key area for Franklin Electric, was valued at roughly $5.9 billion in 2023 and is expected to grow, but innovations in alternative fuel delivery or dispensing technologies could introduce substitute threats.

The threat of substitutes for Franklin Electric's products is influenced by how easily and cheaply customers can switch to alternatives. If switching requires significant investment in new equipment, retraining of staff, or integration challenges, customers will be less inclined to move away from Franklin Electric. For instance, a water utility relying on Franklin Electric's submersible pumps would face substantial costs and operational disruption if they had to replace their entire pumping infrastructure with a different technology.

Customer Propensity to Substitute

Franklin Electric faces a moderate threat from substitutes, largely influenced by customer willingness to adopt alternative solutions. Factors such as growing environmental awareness, evolving regulations, and a desire for more integrated or simplified systems can drive this shift. For instance, a significant trend towards water conservation and sustainable practices might encourage customers to explore water harvesting or advanced recycling methods that reduce reliance on traditional pumping infrastructure.

The propensity for customers to switch to substitutes is also shaped by the perceived benefits and costs associated with these alternatives. If new technologies offer substantial cost savings, improved efficiency, or meet emerging environmental standards more effectively, the threat of substitution increases. In 2024, the global smart water management market, which includes non-pump solutions like rainwater harvesting systems and greywater recycling, was projected to reach over $30 billion, indicating a growing customer interest in alternatives.

- Environmental Concerns: Increasing focus on sustainability and water scarcity drives adoption of water-saving technologies.

- Regulatory Changes: Stricter water usage regulations can incentivize the exploration of substitute solutions.

- Technological Advancements: Innovations in water management offer potentially simpler or more efficient alternatives to traditional pumping.

- Cost-Benefit Analysis: Customer adoption hinges on whether substitutes offer compelling advantages in terms of cost, performance, or environmental impact.

Innovation in Related Industries

Innovation in adjacent industries can present significant threats to Franklin Electric. For instance, advancements in water treatment chemicals that reduce the need for extensive pumping or filtration could lessen demand for Franklin Electric's water management solutions. Similarly, the development of new, more efficient piping materials that minimize fluid resistance might reduce the reliance on powerful pumps, a core product for the company.

Breakthroughs in energy storage, particularly for off-grid applications, also pose a threat. Innovations that enable more efficient and cost-effective off-grid water management systems, potentially powered by integrated renewable energy sources and advanced battery technology, could offer viable alternatives to traditional pumping infrastructure that Franklin Electric serves. For example, by 2024, the global market for distributed renewable energy generation is projected to reach hundreds of billions of dollars, indicating a growing trend toward decentralized solutions that could bypass conventional pumping needs.

- Innovation in Water Treatment: New chemical treatments that reduce pumping requirements indirectly substitute for pump demand.

- Advanced Piping Materials: Lighter, more efficient pipes could lower the necessity for high-powered pumping systems.

- Energy Storage Breakthroughs: Enhanced off-grid energy storage could facilitate alternative water management solutions, impacting the need for traditional pumps.

- Market Trends: The expanding distributed renewable energy market highlights a shift towards decentralized systems that may reduce reliance on established infrastructure.

The threat of substitutes for Franklin Electric is moderate, as direct replacements for their specialized water and fuel movement solutions are limited. However, alternative methods that achieve similar outcomes, like gravity-fed water systems or manual fuel transfer, can pose a threat in specific niche applications. The global water pump market was valued at approximately $48.5 billion in 2024, indicating substantial demand, but also the potential for disruption if cost-effective, equally performing substitutes emerge.

| Substitute Type | Potential Impact on Franklin Electric | Key Considerations |

|---|---|---|

| Gravity-fed water systems | Low to Moderate | Applicable in specific low-pressure, short-distance scenarios; limited by elevation differences. |

| Manual fuel transfer | Low | Only viable for very small volumes and infrequent use; safety and efficiency concerns. |

| Atmospheric water generators | Low to Moderate | Scalability and cost-effectiveness vary; often supplementary rather than primary solutions. |

| Decentralized renewable energy solutions | Emerging Threat | Could reduce reliance on traditional grid-powered pumping infrastructure. |

Entrants Threaten

Franklin Electric operates in industries where significant upfront capital is essential. Entering the manufacturing and marketing of systems and components for water and fuel movement demands substantial investment in research and development, advanced manufacturing facilities, and robust global distribution networks. For instance, establishing a new, state-of-the-art manufacturing plant for electric motors, a core product for Franklin Electric, can easily run into tens of millions of dollars.

Franklin Electric, as an established leader in the submersible motor and fueling systems market, leverages significant economies of scale. This means they can produce their products more cheaply per unit because they buy materials in bulk and have highly efficient manufacturing processes. For example, in 2023, their revenue reached $2.01 billion, indicating substantial operational volume that underpins these cost advantages.

New companies entering this space would find it incredibly difficult to match Franklin Electric's per-unit cost structure. Without the same high-volume purchasing power and optimized production lines, new entrants would face higher manufacturing expenses, making it a real challenge to compete on price with established players.

Franklin Electric benefits from strong brand loyalty, cultivated over decades of specialization in submersible motors and pumps. This established reputation, bolstered by a focus on innovation and sustainability, makes it challenging for new entrants to gain market traction. For instance, in 2023, Franklin Electric reported net sales of $1.96 billion, demonstrating a significant market presence that new competitors would struggle to replicate quickly.

Access to Distribution Channels

Franklin Electric's strong relationships with a wide network of distributors across diverse markets present a significant barrier to entry. New competitors face considerable difficulty in replicating this established distribution infrastructure, which is crucial for reaching customers effectively.

Securing access to these established channels often requires substantial investment and time, as distributors may have exclusive agreements or prioritize proven suppliers. For instance, in the water systems market, distributors often have long-standing partnerships built on trust and volume, making it hard for newcomers to break in.

- Established Distributor Networks: Franklin Electric leverages extensive, long-term relationships with distributors, providing broad market reach.

- High Channel Access Costs: New entrants must invest heavily to gain similar access, often facing exclusivity clauses and high initial order requirements.

- Customer Trust and Relationships: Distributors often favor suppliers with a proven track record, making it challenging for new companies to build credibility.

- Market Penetration Challenges: Without established distribution, new entrants struggle to achieve the necessary sales volume and market penetration.

Government Policy and Regulations

Government policy and regulations present a substantial barrier to entry in the water and fuel movement sectors. New companies must navigate complex certifications and environmental standards, which can be costly and time-consuming. For instance, compliance with clean water systems and wastewater management regulations, critical for Franklin Electric's operations, requires significant upfront investment and expertise.

- Regulatory Hurdles: Stringent environmental standards and certifications in water and fuel industries create high compliance costs for new entrants.

- Time Delays: Obtaining necessary permits and approvals for operations, especially in sensitive areas like clean water systems, can lead to considerable delays.

- Capital Investment: Meeting these regulations often necessitates substantial capital for specialized equipment and processes, deterring smaller or less-funded competitors.

The threat of new entrants for Franklin Electric is considerably low due to substantial capital requirements for research, development, and manufacturing infrastructure, often in the tens of millions for advanced facilities. Economies of scale, driven by Franklin Electric's 2023 revenue of $2.01 billion, create a significant cost advantage that new players struggle to match.

Established brand loyalty and extensive distributor networks, supported by 2023 net sales of $1.96 billion, pose further challenges. New entrants face high channel access costs and must overcome customer trust built over years, making market penetration difficult without replicating Franklin Electric's deep-rooted relationships.

Additionally, stringent government regulations and certifications in water and fuel sectors necessitate significant upfront investment and expertise, acting as a substantial deterrent to new competition.

| Barrier to Entry | Impact on New Entrants | Franklin Electric's Advantage (2023 Data) |

|---|---|---|

| Capital Requirements | High (tens of millions for facilities) | Established infrastructure |

| Economies of Scale | Difficult to match cost structure | $2.01 billion revenue |

| Brand Loyalty & Distribution | Challenging to build trust and access channels | $1.96 billion net sales, extensive networks |

| Regulatory Compliance | Costly and time-consuming | Established compliance expertise |

Porter's Five Forces Analysis Data Sources

Our Franklin Electric Porter's Five Forces analysis is built upon a foundation of robust data, including Franklin Electric's annual reports and SEC filings, alongside industry-specific market research from firms like IBISWorld and Statista.