Franklin Electric Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Franklin Electric Bundle

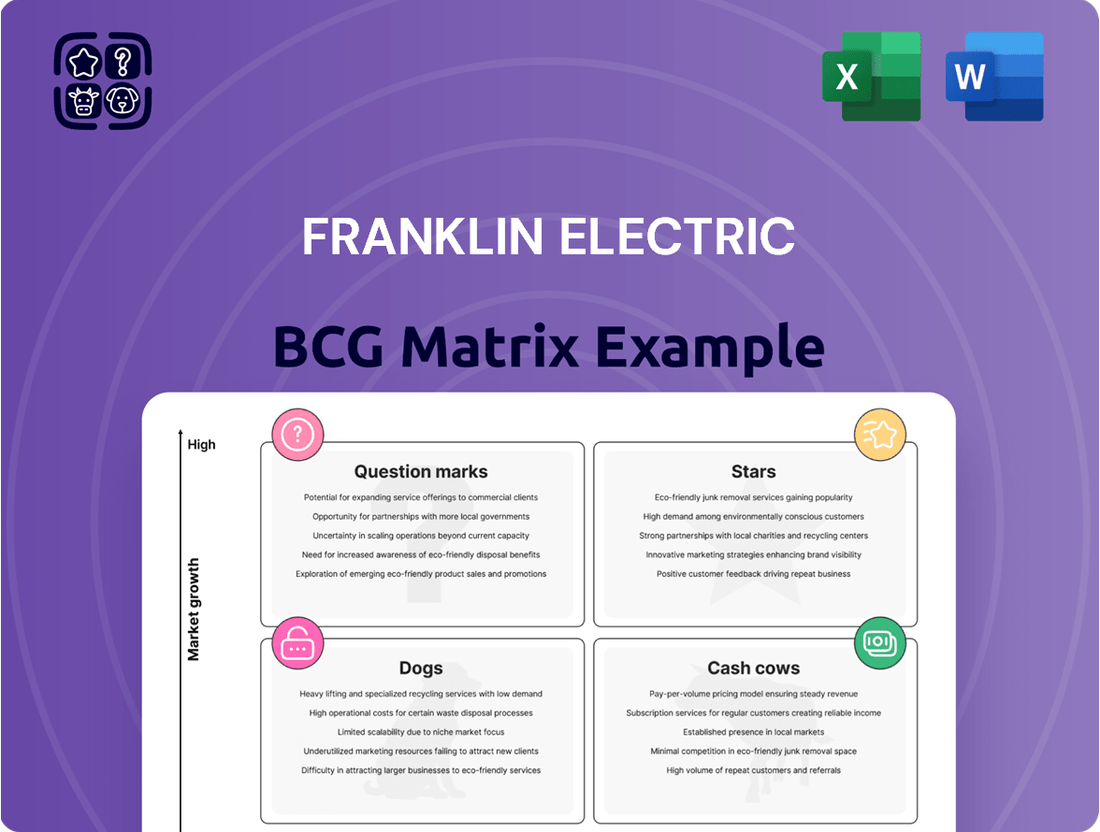

Franklin Electric's strategic positioning is laid bare in its BCG Matrix, revealing a dynamic portfolio of products. Understand which segments are fueling growth and which require careful management to optimize resource allocation.

This preview offers a glimpse into the core of Franklin Electric's product strategy. For a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, along with actionable insights, purchase the full BCG Matrix report.

Unlock the complete strategic blueprint of Franklin Electric's product portfolio. The full BCG Matrix provides detailed quadrant analysis and data-driven recommendations to guide your investment decisions and sharpen your competitive edge.

Stars

The Energy Systems segment is a star performer for Franklin Electric. Sales saw a healthy 8% jump in Q1 2025 and continued with a 6% increase in Q2 2025. This growth is underpinned by record operating income and margins, signaling strong market demand for their fuel transfer and monitoring solutions.

This segment’s strategic rebranding from ‘Fueling Systems’ to ‘Energy Systems’ reflects a forward-looking approach, acknowledging a broader scope in diverse energy solutions. This repositioning is expected to fuel its continued high growth trajectory.

Franklin Electric is making significant strides in advanced water management, a key area within its portfolio. Their investment in smart solutions, such as electronic variable frequency drives with IoT capabilities launched in 2024, positions them to capitalize on emerging trends. These technologies are designed to optimize water usage and system performance.

The market for smart water management is experiencing robust growth. Projections indicate a compound annual growth rate of over 15% through 2030, reaching an estimated $35 billion globally. This expansion underscores the demand for innovative solutions that Franklin Electric is actively developing.

These advanced products offer enhanced efficiency and adaptability, crucial for meeting the evolving needs of customers in sectors like agriculture and municipal water supply. By integrating IoT features, Franklin Electric’s solutions provide real-time data and remote control, driving operational improvements and cost savings for users.

Franklin Electric has strategically enhanced its FPS Submersible Wastewater Pump portfolio, launching new models and updated designs throughout 2024. This focus on innovation directly addresses the growing global demand for water and wastewater solutions.

The company's proactive portfolio expansion aligns with a robust market outlook; the global water and wastewater pumps market is anticipated to expand at a compound annual growth rate of 5.22% until 2028. These advancements position Franklin Electric to capture increased market share within this vital and expanding industry.

Strategic Acquisitions for Market Expansion

Franklin Electric has strategically pursued acquisitions in 2024 and early 2025 to bolster its market presence, notably with Barnes de Colombia S.A. and FSHS Incorporated. These moves are specifically designed to broaden its product portfolio and extend its geographical footprint, with a keen focus on the burgeoning water treatment and industrial pump industries. The company anticipates these acquisitions will unlock significant market share growth through effective integration and synergy realization.

- Barnes de Colombia S.A. acquisition

- FSHS Incorporated acquisition

- Expansion into water treatment and industrial pumps

- Focus on geographic reach and product diversification

International Water Systems in Developing Markets

Franklin Electric's Water Systems business is strategically focusing on international markets, particularly in developing regions, to offset a sales dip experienced in the U.S. and Canada during 2024. This pivot recognizes the significant unmet demand for water infrastructure in these burgeoning economies.

The company's international water systems are positioned as strong contenders within the BCG matrix, likely categorized as Stars or Question Marks, given their high growth potential. For instance, the global water and wastewater treatment market is projected to grow substantially, with some estimates suggesting a compound annual growth rate (CAGR) of over 6% leading up to 2027, driven by increasing urbanization and industrialization in developing nations.

- International Growth Drivers: Developing markets present a compelling opportunity due to increasing populations and a growing need for reliable water supply and sanitation systems.

- 2024 Performance Context: While North American Water Systems sales saw a decline in 2024, Franklin Electric's global strategy aims to leverage international expansion for overall business growth.

- Strategic Investment: Investments in these regions are designed to capture market share and establish a strong presence in areas with high future demand for water solutions.

- Market Potential: The global water infrastructure market is robust, with significant growth anticipated in regions like Asia-Pacific and Africa, aligning with Franklin Electric's strategic focus.

Franklin Electric's Energy Systems segment, encompassing fuel transfer and monitoring, is a clear Star. Sales growth of 8% in Q1 2025 and 6% in Q2 2025, coupled with strong operating income, highlights its market leadership. The strategic rebranding to Energy Systems signals a broader focus on evolving energy solutions, positioning it for sustained high growth.

The company's advancements in smart water management, including IoT-enabled variable frequency drives launched in 2024, are also driving Star performance. This segment benefits from a rapidly expanding market, projected to reach $35 billion globally by 2030 with a CAGR exceeding 15%. Franklin Electric's focus on efficiency and remote control technologies directly addresses this demand.

Furthermore, strategic acquisitions in 2024 and early 2025, such as Barnes de Colombia S.A. and FSHS Incorporated, are bolstering its position in water treatment and industrial pumps. This expansion, particularly into international markets experiencing high demand for water infrastructure, further solidifies its Star status by diversifying revenue streams and capturing new growth opportunities.

| Segment | BCG Category | Key Growth Drivers | 2024/2025 Performance Indicators |

|---|---|---|---|

| Energy Systems | Star | Strong market demand for fuel transfer and monitoring, evolving energy solutions | 8% Q1 2025 sales growth, 6% Q2 2025 sales growth, record operating income |

| Water Systems (International) | Star/Question Mark | Increasing urbanization and industrialization in developing nations, unmet water infrastructure demand | Targeting high growth in regions with >6% CAGR water treatment market growth (to 2027) |

| Smart Water Management | Star | Growing demand for efficiency and IoT capabilities in water usage | Launched IoT-enabled VFDs in 2024, market projected to reach $35B by 2030 |

What is included in the product

This BCG Matrix analysis categorizes Franklin Electric's business units by market share and growth, guiding strategic decisions.

A clear visual map of Franklin Electric's portfolio, alleviating the pain of strategic uncertainty.

Cash Cows

Franklin Electric's core submersible motors and pumps business is a true cash cow, forming the bedrock of the company. This segment accounted for a substantial 60% of Franklin Electric's total revenue in 2024, highlighting its critical importance.

Operating within the groundwater systems market, which exhibits stable growth at a 3.3% CAGR, these products command a high market share. This mature yet indispensable market allows the cash cow products to consistently generate robust cash flow with minimal reinvestment required.

Franklin Electric's residential water systems are a classic Cash Cow. They hold a significant market share in a mature industry, meaning demand is stable and predictable. This allows the company to generate consistent profits with relatively low investment needs.

These systems are a go-to for homeowners and builders alike, thanks to Franklin Electric's strong brand reputation. In 2023, the company reported significant revenue contributions from its Water Systems segment, demonstrating the enduring strength of these offerings.

Franklin Electric's Agricultural Pumping Solutions are a cornerstone of their business, providing essential equipment for irrigation systems that support global food production. This segment is characterized by a mature market, yet it consistently generates strong demand for new installations, replacements, and ongoing maintenance services.

The company's significant market share and long-standing reputation in agricultural pumping ensure a steady and predictable stream of revenue. For instance, in 2023, Franklin Electric reported that its Water Systems segment, which heavily features agricultural pumps, saw net sales increase by 11% year-over-year, reaching $1.3 billion, underscoring the consistent cash-generating power of this business.

Traditional Fuel Transfer Systems

Franklin Electric's traditional fuel transfer systems, a foundational element of their business since the late 1960s, remain robust cash cows. Despite the company's expansion into broader 'Energy Systems,' these pumps and hardware continue to dominate a mature market characterized by stable demand.

These established products generate consistent cash flow with limited need for reinvestment, a hallmark of a successful cash cow. For instance, in 2024, the fuel transfer segment contributed significantly to Franklin Electric's overall revenue, demonstrating its enduring strength in established markets.

- Market Dominance: Traditional fuel transfer systems maintain a strong hold in a mature market.

- Consistent Cash Generation: These products provide steady cash flow with low capital expenditure needs.

- Historical Significance: Pioneered by Franklin Electric in the late 1960s, they represent the company's origins.

- 2024 Performance: The segment continues to be a reliable revenue contributor for the company.

U.S. Groundwater Distribution Network

The U.S. Groundwater Distribution Network, a key part of Franklin Electric's portfolio, operates as a classic cash cow. This segment, focused on the professional groundwater market, benefits from a well-entrenched distribution system and consistent demand from contractors. Despite some sales volatility, such as a dip in Q1 2025 followed by record sales in Q2 2025, the segment's mature market position and recent margin enhancements solidify its role as a reliable cash generator for the company.

- Established Network: The segment leverages a robust and long-standing distribution infrastructure across the U.S.

- Consistent Demand: It benefits from steady demand from a loyal base of professional groundwater contractors.

- Margin Improvements: Recent operational efficiencies have led to enhanced profitability within this segment.

- Mature Market: Operating in a stable, mature market, the segment provides predictable cash flows.

Franklin Electric's submersible motors and pumps, a significant 60% of 2024 revenue, are prime cash cows within the stable 3.3% CAGR groundwater systems market. Their residential water systems and agricultural pumping solutions, which saw an 11% year-over-year increase in Water Systems segment net sales to $1.3 billion in 2023, exemplify this. These mature, high-market-share offerings generate consistent, strong cash flow with minimal reinvestment needs.

| Business Segment | Market Position | Cash Flow Generation | 2024 Relevance |

|---|---|---|---|

| Submersible Motors & Pumps | Dominant in mature groundwater systems | High, consistent | 60% of 2024 Revenue |

| Residential Water Systems | Strong share in stable industry | Predictable profits, low investment | Key contributor to Water Systems |

| Agricultural Pumping Solutions | Essential, consistent demand | Steady revenue stream | Drove 11% Water Systems growth (2023) |

| Traditional Fuel Transfer | Dominant in mature market | Steady, low capex | Reliable revenue contributor |

Preview = Final Product

Franklin Electric BCG Matrix

The Franklin Electric BCG Matrix preview you're currently viewing is precisely the final, unwatermarked document you will receive upon purchase. This means you're seeing the complete, professionally formatted analysis, ready for immediate strategic application without any additional editing or hidden content.

Dogs

Large dewatering pumps presented a challenge for Franklin Electric's Water Systems segment in 2024. Sales were notably hampered by reduced volumes and a general softening in demand across key markets.

This performance suggests the product line is in a mature or declining phase, potentially facing strong competition or experiencing a slowdown in its primary industries. Such a situation typically places it in the 'Dog' quadrant of the BCG Matrix, indicating it might not be a strategic priority for resource allocation.

Franklin Electric's older, less energy-efficient pump models are likely facing declining demand as the market prioritizes newer, more efficient technologies. These products, struggling to compete on performance and cost-effectiveness, could be categorized as Dogs in the BCG matrix. For instance, if a significant portion of their 2024 sales volume came from these older units, it signals a potential need for strategic review.

Certain highly specialized or niche products within Franklin Electric's portfolio, especially those catering to regions experiencing significant market contraction, could be classified as Dogs. For instance, products tied to legacy technologies in areas where Franklin Electric's Energy Systems saw an 18% sales decline outside the U.S. and Canada in 2024, exemplify this category. These items likely generate low revenue and minimal profit, acting as cash traps rather than growth drivers.

Products Affected by Consistent Negative Pricing Trends

The Distribution segment of Franklin Electric saw sales decline in Q1 2025, a trend attributed to reduced sales volumes and ongoing negative pricing pressures. This situation points to specific product categories within this segment struggling with aggressive price competition, resulting in diminished market share and profitability, thus categorizing them as dogs in the BCG matrix.

These underperforming products are likely candidates for strategic review, potentially necessitating significant restructuring efforts or even divestiture to reallocate resources more effectively. For instance, if a particular line of pumps experienced a 15% price drop year-over-year in Q1 2025 while market share remained stagnant at 5%, it would strongly indicate a dog status.

- Negative Pricing Impact: Continued downward price trends are eroding revenue and profitability in certain distribution products.

- Low Market Share: Intense competition has led to a low market share for these products, hindering growth potential.

- Profitability Concerns: The combination of lower volumes and negative pricing directly impacts the profitability of these dog products.

- Strategic Options: Franklin Electric may need to consider restructuring or divesting these product lines to improve overall portfolio performance.

Underperforming Legacy Product Lines Post-Acquisition

Following acquisitions, Franklin Electric might identify legacy product lines that don't fit its core growth strategy. These could be in mature or declining markets, struggling with low market share and profitability. For instance, if an acquired company had a niche product line for an outdated industrial application, it might fall into the dog category.

These underperforming segments require careful evaluation. If integration efforts fail to yield positive results or there's no clear path to future growth, Franklin Electric would consider options like optimization to reduce costs or outright divestment. This strategic pruning helps focus resources on more promising areas.

- Stagnant Market Presence: Product lines operating in markets with minimal growth potential.

- Low Market Share: Difficulty competing effectively against established players or new entrants.

- Profitability Challenges: Inability to generate sufficient returns, potentially requiring ongoing investment without a clear payoff.

- Strategic Misalignment: Products that do not complement Franklin Electric's long-term vision or core competencies.

Franklin Electric's large dewatering pumps and certain legacy product lines within its Distribution segment represent potential "Dogs" in the BCG Matrix. These are characterized by low market share and low growth potential, often facing intense price competition and declining demand, as seen with the 18% sales decline in Energy Systems outside the U.S. and Canada in 2024.

Products struggling with negative pricing, like those in Distribution experiencing a 15% year-over-year price drop in Q1 2025 with stagnant market share, fit this category. These underperforming assets may require restructuring or divestment to optimize resource allocation towards more promising growth areas.

| Product Segment | BCG Category | Key Challenges (2024/Q1 2025) | Potential Strategic Action |

| Large Dewatering Pumps (Water Systems) | Dog | Reduced volumes, softening demand, mature/declining phase | Strategic review, potential restructuring |

| Legacy/Niche Products (Energy Systems) | Dog | Market contraction, low revenue/profit, tied to legacy tech | Divestment, cost optimization |

| Certain Distribution Products | Dog | Negative pricing, low market share, profitability concerns | Restructuring, divestment |

Question Marks

Franklin Electric's recent acquisitions, including Barnes de Colombia S.A. and other strategic purchases finalized in Q1 2025, are initially positioned as question marks within the BCG Matrix. These moves are designed to broaden their product portfolio, particularly in promising sectors like water treatment and industrial pumps, and to establish a stronger presence in new geographic markets.

While these newly acquired businesses hold significant potential for future growth, their current market share within Franklin Electric's consolidated operations is still nascent. The company's investment in integrating these entities and developing their market penetration is substantial, reflecting the inherent uncertainty and the need for further development to determine their long-term success and classification.

Franklin Electric's potential move into EV charging infrastructure aligns with a high-growth sector. The global EV charging infrastructure market was valued at approximately $25 billion in 2023 and is projected to reach over $100 billion by 2028, demonstrating substantial expansion.

This expansion necessitates significant investment for Franklin Electric to gain traction. Companies in this space typically invest heavily in research and development, manufacturing capabilities, and establishing a robust network of charging stations to compete effectively.

The strategic rebranding to 'Energy Systems' and focus on 'new mobility frontiers' and 'AI-adjacent energy infrastructure' signal a deliberate pivot. This suggests Franklin Electric is preparing to allocate resources to capture a share of this burgeoning market, likely starting from a low existing market share.

Franklin Electric's commitment to digital tools for predictive maintenance and energy-efficient systems, exemplified by the Q2 2025 launch of the EVO ONE fuel monitoring system, places them squarely in high-growth markets. These innovations cater to the increasing demand for digitized infrastructure and optimized operations.

While these digital solutions tap into a burgeoning market, their current market penetration is likely in its early stages. Significant investment will be crucial to scale these offerings and capture a leading position, moving them towards a Star classification within the BCG framework.

Emerging Water Treatment Technologies

Emerging water treatment technologies, such as advanced oxidation processes (AOPs) and novel membrane filtration systems, represent Franklin Electric's Question Marks. These innovations cater to a burgeoning global water treatment market, projected to reach $119.4 billion by 2027, but require substantial investment to gain traction.

These advanced solutions, while offering superior performance in contaminant removal, currently face challenges in market share due to higher initial costs and the need for customer education. Franklin Electric's strategic focus would be on building brand awareness and demonstrating the long-term cost-effectiveness of these technologies.

- High Growth Potential: The global advanced water treatment market is experiencing rapid expansion, driven by increasing regulatory stringency and growing demand for high-purity water.

- Low Market Share: As relatively new entrants, these technologies have not yet captured significant market share, necessitating aggressive marketing and sales strategies.

- Significant Investment Required: Substantial capital is needed for research and development, manufacturing scale-up, and market penetration efforts.

- Uncertain Profitability: While promising, the profitability of these emerging technologies is not yet established, making them a classic Question Mark in the BCG matrix.

Early-Stage R&D Projects for Disruptive Technologies

Franklin Electric's early-stage R&D projects for disruptive technologies are positioned as Stars in the BCG matrix. These initiatives, focused on creating novel solutions in water and energy movement, represent significant investments in areas with substantial future growth potential but currently minimal market penetration. The company's commitment to innovation is evident in its consistent R&D spending, which is crucial for nurturing these nascent technologies.

These projects require substantial capital and strategic oversight to navigate the inherent uncertainties of developing entirely new product categories. The goal is to transform these high-potential, low-market-share ventures into future market leaders. For instance, Franklin Electric's exploration into advanced water purification systems or novel energy storage solutions for off-grid applications exemplifies this strategic focus.

- Innovation Focus: Development of next-generation technologies in water and energy sectors.

- Market Position: High growth potential, low current market share.

- Investment Strategy: Significant R&D funding and strategic resource allocation.

- Objective: To establish market leadership in emerging technology segments.

Franklin Electric's recent acquisitions and strategic pivots into areas like EV charging infrastructure and advanced water treatment technologies are currently classified as Question Marks. These ventures are characterized by high growth potential but low current market share, necessitating significant investment to achieve success.

The company's focus on new mobility frontiers and AI-adjacent energy infrastructure, alongside innovations like the EVO ONE fuel monitoring system, highlights a move into rapidly expanding markets. However, these areas require substantial capital for development and market penetration to establish a strong foothold.

Emerging water treatment solutions, while addressing a growing global market, also fall into the Question Mark category due to initial cost challenges and the need for customer adoption. Franklin Electric's strategy involves building brand awareness and proving the long-term value of these advanced technologies.

The company's early-stage R&D projects for disruptive technologies are also considered Question Marks, requiring substantial investment to transform them into future market leaders. This strategic allocation of resources aims to capture market share in nascent but high-potential segments.

BCG Matrix Data Sources

Our Franklin Electric BCG Matrix is constructed using comprehensive data, including financial reports, market research, and internal sales figures, to accurately assess product performance and market share.