F.P.E.E. Industries PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

F.P.E.E. Industries Bundle

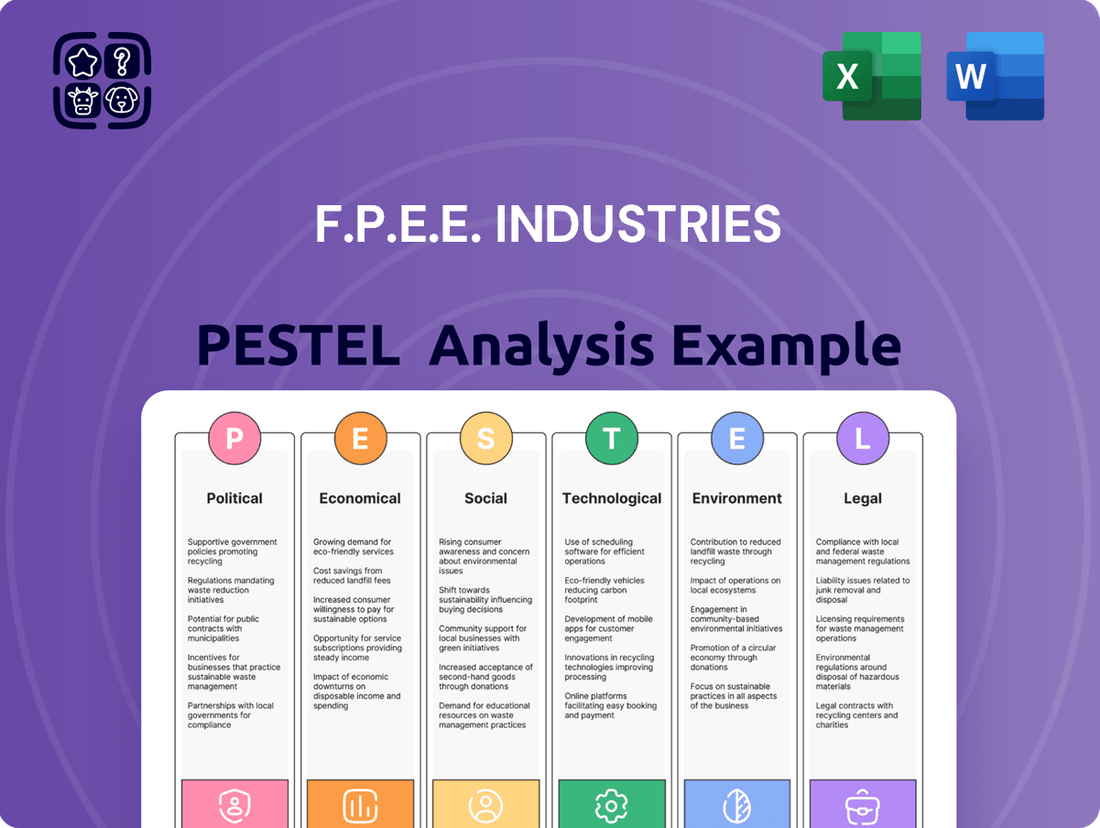

Gain a strategic advantage with our comprehensive PESTLE Analysis of F.P.E.E. Industries. Understand the intricate political, economic, social, technological, legal, and environmental factors that are currently shaping its market landscape and influencing its future trajectory. This in-depth report provides the critical intelligence you need to anticipate challenges and capitalize on emerging opportunities. Don't be left in the dark; unlock actionable insights that can inform your own strategic decisions. Purchase the full PESTLE analysis now and empower your business with foresight.

Political factors

Governments worldwide are channeling significant funds into infrastructure development, with projects like new highway networks and bridge replacements driving demand for construction materials. For instance, the United States' Infrastructure Investment and Jobs Act, enacted in 2021, allocates over $1.2 trillion, a substantial portion of which directly supports road and bridge construction, areas where precast concrete is a key component.

These large-scale government initiatives often favor precast concrete elements due to their inherent efficiency and durability. The ability to accelerate construction timelines and ensure consistent quality makes precast solutions particularly appealing for public works, leading to increased adoption in civil engineering projects.

This sustained public investment creates a predictable and robust market for companies like F.P.E.E. Industries. The focus on modernizing transportation networks and public facilities ensures ongoing demand for precast concrete, particularly benefiting F.P.E.E.'s involvement in civil engineering sectors.

Evolving building codes and safety regulations, particularly those concerning fire safety and structural integrity, directly influence F.P.E.E. Industries' product design and manufacturing processes. For instance, the UK's Building Safety Act 2022 and subsequent updated fire safety guidance mandate stricter compliance, impacting precast concrete solutions.

Adherence to these increasingly stringent requirements, like the enhanced fire resistance standards being implemented across various regions, is paramount for F.P.E.E. Industries to ensure its products meet critical safety benchmarks. Failure to adapt could hinder market competitiveness and product adoption.

In 2024, the global construction sector is seeing a heightened focus on sustainability and resilience, with building codes increasingly reflecting these priorities. This means F.P.E.E. Industries must continue to innovate its precast concrete formulations and designs to meet these evolving environmental and safety mandates, potentially incorporating new fire-retardant materials or advanced structural designs.

Governments worldwide are increasingly incentivizing sustainable construction. For instance, in 2024, the U.S. Inflation Reduction Act continues to offer tax credits for energy-efficient building upgrades, directly benefiting materials like precast concrete that contribute to longevity and reduced lifecycle emissions. These policies, including grants and preferential zoning, encourage developers to adopt eco-friendly building methods.

F.P.E.E. Industries can leverage these governmental pushes by emphasizing precast concrete's inherent sustainability. Its durability means less frequent replacement, and manufacturing processes can be optimized for waste reduction. Furthermore, research continues into precast concrete's potential for carbon sequestration, aligning perfectly with climate goals and making it an attractive option for projects seeking green certifications and associated financial benefits.

Public Procurement Act Changes

Changes in public procurement laws, like the UK's Procurement Act 2023 set to fully commence in February 2025, will significantly alter the landscape for tendering public sector projects. These reforms are designed to prioritize value for money, demonstrable public benefit, and robust supplier performance tracking. For F.P.E.E. Industries, this means a strategic shift in how bids are formulated and presented, particularly for government contracts.

Adapting to these new procurement processes is crucial for F.P.E.E. Industries to successfully secure public sector work. The emphasis on transparency and measurable outcomes will likely require more detailed proposals outlining social value contributions and performance metrics. For instance, central government procurement spending in the UK was estimated at £209 billion in 2023-24, highlighting the substantial opportunities available within the public sector.

- Increased focus on value for money and public benefit in tenders.

- Emphasis on supplier performance and accountability.

- Potential for new bidding frameworks and evaluation criteria.

- Greater transparency in the procurement process.

Political Stability and Trade Policies

Political stability in F.P.E.E. Industries' key markets directly impacts operational continuity and investment decisions. For instance, in 2024, ongoing geopolitical shifts in Eastern Europe, a significant region for construction materials, have heightened the risk of supply chain disruptions. Changes in trade policies, such as potential tariffs on imported steel or cement, could significantly increase input costs. The International Monetary Fund (IMF) in its April 2025 World Economic Outlook highlighted that trade fragmentation could slow global GDP growth by 0.5% in 2024-2025, directly affecting demand for precast concrete products.

F.P.E.E. Industries must actively monitor these evolving trade landscapes to mitigate procurement risks. For example, if the European Union were to implement new regulations on construction material imports in late 2024, it could necessitate a rapid pivot in sourcing strategies. This proactive approach is crucial for maintaining competitive pricing, especially as construction projects often operate on tight margins. The company's ability to adapt to these political and trade-related uncertainties will be a key determinant of its financial performance and market position through 2025.

- Political instability in regions like the Middle East, a key market for infrastructure development, could delay large-scale precast concrete projects, impacting F.P.E.E.'s order book for 2025.

- Changes in US trade policy, such as potential re-evaluation of tariffs on steel imports in early 2025, could increase the cost of a critical raw material for precast concrete manufacturing.

- The World Trade Organization (WTO) forecasts a 1.7% growth in global merchandise trade for 2024, but notes that geopolitical tensions could lead to significant revisions downwards, affecting material availability.

- F.P.E.E. Industries' strategic sourcing efforts must account for potential disruptions caused by nationalistic economic policies or trade bloc realignments expected to continue through 2025.

Governmental commitment to infrastructure upgrades, like the US Bipartisan Infrastructure Law allocating $1.2 trillion, directly boosts demand for precast concrete in 2024-2025. Stricter building codes, such as the UK's Building Safety Act 2022, necessitate enhanced safety features in F.P.E.E. Industries' products, impacting design and compliance. Furthermore, global trade policy shifts and political stability in key markets, as noted by the IMF's projected 0.5% impact of trade fragmentation on global GDP in 2024-2025, create both opportunities and risks for material sourcing and project execution.

| Factor | Impact on F.P.E.E. Industries | 2024/2025 Data/Trend | Actionable Insight |

| Infrastructure Spending | Increased demand for precast concrete | US Infrastructure Investment and Jobs Act ($1.2T) | Leverage ongoing public works for project pipeline. |

| Building Regulations | Need for product adaptation to safety standards | UK Building Safety Act 2022, updated fire safety guidance | Invest in R&D for compliant and innovative solutions. |

| Trade Policy & Geopolitics | Supply chain volatility, cost fluctuations | IMF: Trade fragmentation may reduce global GDP by 0.5% (2024-2025) | Diversify suppliers and monitor geopolitical risks closely. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting F.P.E.E. Industries, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights and forward-looking perspectives to empower strategic decision-making and identify emerging opportunities and threats.

The F.P.E.E. Industries PESTLE Analysis offers a pain point reliever by providing a clear, summarized version of the full analysis for easy referencing during meetings or presentations, ensuring everyone is aligned on external factors.

Economic factors

Elevated interest rates in 2024 and early 2025 have presented a significant hurdle for F.P.E.E. Industries, as higher borrowing costs directly inflate the expense of undertaking new construction projects. This can lead to a slowdown in development, consequently dampening the demand for precast concrete solutions.

However, projections for the latter half of 2024 and into 2025 indicate a potential easing of interest rates. A projected decrease from the current highs, for instance, could lower the financial burden on developers, stimulating investment in both public infrastructure and private building ventures, which would directly benefit F.P.E.E. Industries' sales volume.

Persistent inflation and elevated material costs remain significant headwinds for F.P.E.E. Industries. For instance, the Producer Price Index for construction materials saw a notable increase, with some categories experiencing double-digit percentage rises in late 2023 and early 2024, impacting the cost of essentials like cement and steel.

While there have been indications of cost stabilization in certain sectors, the interplay of ongoing global supply chain complexities and potential economic stimulus measures in major economies could reignite upward price pressures on raw materials throughout 2024 and into 2025.

To navigate this volatility, F.P.E.E. Industries must implement stringent supply chain management protocols and sophisticated cost control measures. This proactive approach is crucial for buffering the company's profit margins against the unpredictable nature of material pricing.

The global construction market is projected for steady growth in 2024 and 2025, with infrastructure and non-residential projects leading the charge. This upward trend is supported by an expected 3.5% global GDP growth in 2024, according to the IMF, which directly fuels construction activity.

While higher mortgage rates caused a dip in residential construction during 2024, forecasts suggest a recovery in 2025 as economic conditions stabilize and interest rates potentially ease. This rebound will likely translate into renewed demand for building materials and services.

F.P.E.E. Industries' performance is intrinsically tied to these macroeconomic trends. The company's revenue is directly influenced by the overall health of the economy and the specific demand within its key construction sectors.

Labor Costs and Availability

The construction sector, crucial for F.P.E.E. Industries' operations, is grappling with a substantial labor deficit. Projections indicate a need for hundreds of thousands of new workers in the coming years, a situation that directly impacts wages. Average hourly wages for construction laborers saw an increase of approximately 5% year-over-year by early 2024, reflecting this scarcity.

This skilled labor shortage translates to heightened operational expenses for F.P.E.E. Industries, affecting both its manufacturing processes and on-site installation activities. The increased cost of labor can directly erode profit margins if not managed effectively. For instance, a 10% rise in labor costs without corresponding price adjustments could significantly impact profitability.

To mitigate these rising labor costs and availability issues, F.P.E.E. Industries should consider strategic investments. These could include expanding automation within its manufacturing facilities to reduce reliance on manual labor and implementing robust workforce training programs. Such initiatives can help bridge skill gaps and improve overall productivity, ensuring the company remains competitive.

- Labor Shortage: An estimated 546,000 additional construction workers will be needed nationwide by 2026, according to industry forecasts.

- Wage Growth: Average hourly earnings in construction rose by 4.8% in the 12 months ending April 2024.

- Cost Impact: Rising labor expenses can add 1-3% to project costs, impacting F.P.E.E. Industries' bottom line.

- Mitigation Strategies: Investment in automation and targeted training programs are key to addressing these challenges.

Market Size and Growth of Precast Concrete

The global precast concrete market is experiencing robust expansion, with projections indicating a Compound Annual Growth Rate (CAGR) between 4.16% and 6.4% for the period spanning 2025 to 2033/2034. This growth trajectory is expected to propel the market value beyond USD 200 billion. Such significant market size and anticipated growth, fueled by ongoing urbanization and substantial infrastructure development initiatives worldwide, create a fertile ground for F.P.E.E. Industries to capitalize on emerging opportunities for increased market penetration and revenue generation.

Key statistics highlighting this market dynamic include:

- Projected Global Precast Concrete Market Value: Expected to exceed USD 200 billion by 2033/2034.

- Estimated CAGR (2025-2033/2034): Ranging from 4.16% to 6.4%.

- Primary Growth Drivers: Urbanization and increasing investments in infrastructure projects globally.

- Opportunity for F.P.E.E. Industries: Significant potential for market share expansion and revenue growth.

The economic landscape for F.P.E.E. Industries in 2024 and early 2025 is a mixed bag of challenges and opportunities, heavily influenced by interest rate movements and inflation. While higher borrowing costs have initially impacted construction project viability, a projected easing of rates later in the period could stimulate demand. Persistent inflation, however, continues to pressure material costs, necessitating robust cost management strategies.

The construction sector's overall health, with projected global GDP growth of 3.5% in 2024, provides a foundational positive outlook. Recovery in residential construction is anticipated for 2025, benefiting F.P.E.E. Industries. The precast concrete market itself is demonstrating strong growth, with an expected CAGR between 4.16% and 6.4% from 2025 to 2033/2034, driven by urbanization and infrastructure investments.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on F.P.E.E. Industries |

| Interest Rates | Elevated, potentially easing later in the year | Easing from highs | Higher borrowing costs initially, followed by potential stimulation of projects |

| Inflation/Material Costs | Persistent, impacting raw material prices | Potential stabilization but risk of renewed pressure | Increased operational expenses, requiring cost control |

| Global GDP Growth | Projected 3.5% | Continued growth expected | Supports overall construction market demand |

| Residential Construction | Dip due to mortgage rates | Projected recovery | Increased demand for building materials |

| Precast Concrete Market Growth | Steady | Strong, CAGR 4.16%-6.4% (2025-2033/2034) | Significant opportunity for market penetration and revenue growth |

What You See Is What You Get

F.P.E.E. Industries PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of F.P.E.E. Industries covers Political, Economic, Social, Technological, Legal, and Environmental factors. You'll find detailed insights into each category, providing a thorough strategic overview. This is the real product; after purchase, you’ll instantly receive this exact file, offering immediate value for your business planning.

Sociological factors

Global population is projected to reach 9.7 billion by 2050, with a significant portion of this growth concentrated in urban areas. This ongoing urbanization fuels a constant need for new homes, offices, and essential infrastructure, directly benefiting industries that can deliver construction solutions quickly and efficiently. F.P.E.E. Industries’ precast concrete offerings are perfectly suited to meet this demand for rapid and scalable development.

The United Nations reported that in 2023, over 57% of the world's population lived in urban areas, a figure expected to rise to 68% by 2050. This demographic shift creates a substantial market for construction materials and methods that can accelerate project timelines and handle large-scale builds. F.P.E.E. Industries is positioned to leverage this trend by providing durable, high-quality precast concrete components essential for the expansion of cities worldwide.

Societal awareness for sustainable construction is rapidly increasing, influencing consumer and developer choices. This shift directly benefits materials like precast concrete, valued for waste reduction and energy efficiency. For example, in 2024, the global green building market was projected to reach over $3.9 trillion, underscoring the significant demand for eco-friendly solutions.

Businesses and consumers are increasingly prioritizing buildings with a lower carbon footprint throughout their lifecycle. Precast concrete aligns with this by offering benefits like reduced construction waste and enhanced energy performance in finished structures. Studies in 2023 indicated that buildings incorporating sustainable materials can see up to a 15% reduction in operational energy costs.

F.P.E.E. Industries is well-positioned to capitalize on this growing preference for green building practices. By highlighting its sustainable manufacturing processes and the inherent environmental advantages of precast concrete, the company can meet this evolving market demand. The company’s commitment to sustainability, evidenced by its 2024 certifications in ISO 14001, further strengthens its appeal to environmentally conscious clients.

The construction sector faces a significant challenge with an aging workforce, as many experienced professionals are approaching retirement age. This trend directly impacts F.P.E.E. Industries by reducing the pool of skilled labor available for critical manufacturing and installation tasks.

In the US, the median age for construction workers was around 41 in recent years, with projections indicating a continued increase. This demographic shift exacerbates existing skill shortages, making it harder to find qualified personnel.

To address these issues, F.P.E.E. Industries should consider robust investment in training and apprenticeship programs. These initiatives are crucial for developing new talent and upskilling the existing workforce to meet industry demands.

Furthermore, exploring automation technologies can help mitigate the impact of labor shortages and improve efficiency in manufacturing processes, ensuring F.P.E.E. Industries remains competitive despite demographic pressures.

Public Perception of Construction Materials

Public sentiment towards construction materials significantly shapes project selection, with environmental impact and visual appeal being key drivers. Concrete, despite its historical carbon footprint concerns, is gaining traction due to the controlled, waste-reducing manufacturing of precast elements and their inherent durability.

F.P.E.E. Industries can leverage this evolving perception. By highlighting the sustainable attributes and superior quality of its precast concrete solutions, the company can solidify its market standing. For instance, the global precast concrete market was valued at approximately $190 billion in 2023 and is projected to grow, indicating a positive market trend driven by these factors.

- Environmental Consciousness: Growing public demand for sustainable building practices favors materials with lower embodied carbon and reduced site impact.

- Aesthetic Considerations: The visual integration of construction materials into urban and natural landscapes is increasingly important for public acceptance.

- Durability and Lifecycle Value: Perceptions of longevity and reduced maintenance costs associated with materials like precast concrete can influence purchasing decisions.

- Advocacy for Precast: F.P.E.E. Industries can proactively educate stakeholders on the environmental benefits of precast, such as reduced construction waste and energy efficiency in production, which can improve public perception and drive demand.

Health and Safety Awareness

Health and safety awareness is significantly shaping the construction industry. In 2024, regulatory bodies and societal demands are pushing for stricter safety protocols on job sites. This heightened focus directly influences operational procedures and the methods companies adopt.

F.P.E.E. Industries benefits from this trend as precast concrete manufacturing, conducted in a controlled factory setting, inherently offers a safer environment than traditional on-site casting. This reduces the potential for worker injuries, a key concern for employees and employers alike.

The company can leverage its commitment to superior safety standards as a distinct competitive advantage. In 2025, with labor shortages potentially persisting in construction, a strong safety record can be a major draw for skilled workers.

- Reduced On-Site Risks: Factory-controlled environments minimize exposure to weather, falling objects, and heavy machinery accidents common in traditional construction.

- Regulatory Compliance: Adherence to evolving health and safety regulations (e.g., OSHA's focus on silica dust control in 2024) is streamlined in a precast setting.

- Worker Attraction and Retention: A demonstrably safe workplace is increasingly a critical factor for employees, impacting F.P.E.E.'s ability to attract and retain talent.

- Potential for Lower Insurance Premiums: Improved safety records often translate to reduced insurance costs for businesses.

Societal trends like increasing urbanization and a growing demand for sustainable living are reshaping construction needs. The global population's move towards cities, with 68% expected to live in urban areas by 2050, necessitates rapid and efficient building solutions. F.P.E.E. Industries' precast concrete is ideal for this, offering speed and scalability to meet urban expansion demands.

Technological factors

Automation, particularly with advanced robotics, is revolutionizing precast concrete manufacturing. This technology allows for highly precise cutting and shaping of concrete elements, ensuring consistent quality that’s difficult to achieve with manual methods. By reducing human error and speeding up production cycles, these systems directly translate to lower labor costs. For F.P.E.E. Industries, embracing these automated solutions means a significant boost in operational efficiency and output capacity. The global market for industrial robots in construction is projected to reach $10.4 billion by 2027, highlighting the significant investment and adoption trend.

Building Information Modeling (BIM) is fundamentally reshaping construction, offering incredibly detailed 3D models that enhance teamwork, minimize mistakes, and boost financial efficiency. For F.P.E.E. Industries, this means more precise precast panel placement and better integration between design and production processes. The global BIM market was valued at approximately $8.2 billion in 2023 and is projected to reach over $22 billion by 2028, highlighting its growing importance. Embracing BIM is therefore critical for F.P.E.E. Industries to ensure smooth project planning, execution, and effective collaboration with architects and engineers, ultimately improving project outcomes and reducing waste.

Innovations in concrete technology are significantly boosting the precast industry. The development of low-carbon materials such as fly ash and slag is making concrete more sustainable, with a growing number of projects in 2024 and 2025 incorporating these alternatives to reduce their carbon footprint. Self-healing concrete and ultra-high-performance concrete are also entering the market, offering enhanced durability and specialized properties that allow companies like F.P.E.E. Industries to provide superior precast solutions.

These technological leaps directly translate into more resilient and environmentally conscious precast products. For instance, the global self-healing concrete market is projected to reach over $7.5 billion by 2027, indicating strong demand for these advanced materials. Furthermore, the increasing integration of recycled materials in precast manufacturing is a key trend, driven by both environmental regulations and cost-efficiency, with many construction firms in 2024 actively seeking suppliers who utilize recycled aggregates.

3D Printing for Concrete Elements

3D printing for concrete is rapidly advancing, offering innovative ways to construct complex and customized elements. This technology promises to significantly reduce lead times and material waste in construction projects, a key benefit for industries like F.P.E.E. Industries. For instance, by 2024, several pilot projects globally showcased the potential for 3D printed concrete structures to be built up to 70% faster than traditional methods.

This technological shift presents F.P.E.E. Industries with opportunities to develop unique architectural designs and accelerate product development through rapid prototyping. The ability to create intricate, on-demand concrete components could differentiate F.P.E.E. Industries in the market, allowing for more bespoke solutions and potentially opening new revenue streams. Market projections suggest the global 3D construction printing market could reach over $1 billion by 2025, indicating substantial growth potential.

- Reduced Construction Time: 3D printing can cut project timelines by up to 70% compared to conventional methods.

- Material Efficiency: The additive nature of 3D printing minimizes waste, often by 30-50%.

- Design Flexibility: Enables creation of complex geometries and customized elements not feasible with traditional methods.

- Market Growth: The 3D construction printing market is projected to exceed $1 billion by 2025.

IoT Sensors and Smart Construction

The integration of Internet of Things (IoT) sensors into precast construction elements is revolutionizing structural monitoring. These sensors provide real-time data on stress, temperature, and environmental conditions, especially crucial for structures subjected to significant loads or adverse weather. For instance, in 2024, projects utilizing smart sensors reported a 15% reduction in unexpected maintenance needs for critical infrastructure. This technology directly supports enhanced predictive maintenance strategies and guarantees the sustained performance of built assets.

F.P.E.E. Industries can strategically leverage IoT for robust quality assurance processes during manufacturing and installation. Beyond that, continuous structural health monitoring becomes feasible, allowing for early detection of potential issues. This not only mitigates risks but also enables F.P.E.E. Industries to offer innovative, value-added services to clients, such as long-term performance guarantees backed by data, thereby strengthening client relationships and market position.

Key benefits of IoT in construction include:

- Real-time structural health monitoring

- Improved predictive maintenance capabilities

- Enhanced quality control in precast element production

- Development of new data-driven client services

Technological advancements are a major driver for F.P.E.E. Industries, particularly in automation and advanced materials. The adoption of robotics in precast manufacturing is increasing efficiency, with the global industrial robot market in construction projected to reach $10.4 billion by 2027. Innovations in concrete, such as self-healing and low-carbon materials, are enhancing product durability and sustainability, with the self-healing concrete market expected to exceed $7.5 billion by 2027.

Digital technologies like Building Information Modeling (BIM) are streamlining design and production, with the BIM market anticipated to grow from approximately $8.2 billion in 2023 to over $22 billion by 2028. Furthermore, 3D printing in construction is showing significant promise, with the market expected to surpass $1 billion by 2025, offering faster production and reduced waste for complex designs. IoT integration in precast elements is also improving quality control and enabling predictive maintenance.

| Technology | Market Projection/Value | Impact on F.P.E.E. Industries |

|---|---|---|

| Industrial Robotics in Construction | $10.4 billion by 2027 | Increased precision, lower labor costs, higher output |

| Building Information Modeling (BIM) | Over $22 billion by 2028 (from $8.2 billion in 2023) | Improved collaboration, reduced errors, better project planning |

| Self-Healing Concrete | Over $7.5 billion by 2027 | Enhanced durability, specialized solutions, longer product lifespan |

| 3D Construction Printing | Over $1 billion by 2025 | Faster production, reduced waste, complex design capabilities |

| IoT in Construction | Growing adoption | Real-time monitoring, predictive maintenance, enhanced quality assurance |

Legal factors

The legal framework governing construction contracts is dynamic. The JCT 2024 suite, for instance, introduces revised risk sharing and dispute resolution mechanisms, requiring F.P.E.E. Industries to stay abreast of these changes. Ensuring contractual alignment with evolving legislation is paramount for effective liability management and successful project delivery.

Navigating the complexities of insolvency laws and building safety regulations is critical for F.P.E.E. Industries. For example, changes in adjudication processes, as seen in some jurisdictions in 2024, can significantly impact cash flow and project timelines. Proactive legal counsel ensures compliance and mitigates potential financial and reputational damage.

F.P.E.E. Industries must navigate a landscape of strict health and safety regulations, diligently enforced by federal and state agencies. These laws, covering everything from site management to equipment operation, are critical for worker protection. Failure to comply can result in significant fines and operational disruptions, impacting F.P.E.E.'s ability to maintain its licenses and reputation.

In 2024, workplace safety violations in the construction sector, a key area for precast concrete products, led to an estimated $17 billion in direct and indirect costs in the US alone, highlighting the financial imperative for robust compliance. F.P.E.E.'s controlled factory setting for precast element production can provide a distinct advantage in meeting these rigorous standards, offering a more manageable environment for implementing safety protocols compared to dynamic construction sites.

Environmental protection laws are tightening, significantly affecting industries like concrete production and construction. F.P.E.E. Industries must navigate regulations concerning emissions, water consumption, and material recycling. For instance, the European Union's Green Deal aims for carbon neutrality by 2050, pushing for more sustainable construction practices and waste reduction. Failure to comply can result in substantial fines, such as those levied under the US Clean Air Act, which can amount to tens of thousands of dollars per day for violations.

Meeting these evolving environmental standards, including waste management and recycling mandates, is crucial for F.P.E.E. Industries. Proactive environmental stewardship, such as investing in cleaner production technologies and circular economy principles, not only mitigates legal risks but also bolsters the company's reputation for sustainability. Companies that demonstrate strong environmental compliance, like those meeting ISO 14001 standards, often find it easier to secure contracts and attract environmentally conscious investors.

Building Safety Legislation

The legal landscape for building safety is undergoing substantial transformation, with key legislation such as the Building Safety Act 2022 and revised fire safety directives seeing heightened enforcement. F.P.E.E. Industries, as a supplier of essential structural and architectural elements, is obligated to guarantee that its products and installation methodologies adhere strictly to these intricate and dynamic safety benchmarks, particularly for structures deemed higher risk.

Compliance with these evolving regulations is critical for F.P.E.E. Industries to mitigate risks associated with non-compliance, which can include hefty fines and reputational damage. For instance, the Building Safety Act 2022 introduced a new regime for building safety, with significant implications for designers, manufacturers, and those involved in construction, especially concerning fire performance and structural integrity.

- Building Safety Act 2022: Mandates stricter oversight and accountability throughout the lifecycle of higher-risk buildings.

- Fire Safety Guidance: Updates such as the Fire Safety Act 2021 and subsequent Approved Document B revisions place greater emphasis on fire resistance and means of escape.

- Product Certification: Manufacturers like F.P.E.E. Industries must ensure their components meet rigorous testing and certification standards to prove compliance with fire safety requirements.

- Supply Chain Responsibility: The legal framework extends responsibility across the supply chain, requiring F.P.E.E. Industries to demonstrate due diligence in sourcing and supplying compliant materials.

Labor Laws and Employment Regulations

Labor laws, encompassing minimum wage, workplace safety, and collective bargaining rights, significantly influence F.P.E.E. Industries' operational expenditures and human resource strategies. For instance, in the US, the Fair Labor Standards Act sets the federal minimum wage, which has seen various proposals for increases, potentially impacting F.P.E.E.'s labor costs.

The persistent skilled labor shortage, a trend observed across many developed economies, is prompting governments to consider policy shifts. In 2024, discussions around immigration reform and increased funding for vocational training programs are gaining traction, which could alleviate F.P.E.E.'s recruitment challenges.

Staying compliant with evolving labor regulations and proactively adapting to shifts in the labor market are essential for F.P.E.E. Industries to ensure workforce stability and mitigate potential legal or operational disruptions.

- Minimum Wage Impact: Changes to minimum wage laws directly affect F.P.E.E.'s payroll expenses. For example, a $15 federal minimum wage proposal in the US could increase labor costs by a substantial margin for entry-level positions.

- Workplace Safety Standards: Adherence to Occupational Safety and Health Administration (OSHA) standards in the US, or equivalent bodies globally, is critical to prevent accidents and associated fines.

- Unionization Trends: Rising unionization efforts in certain sectors, as seen with increased union activity reported by the Bureau of Labor Statistics in 2023-2024, could impact F.P.E.E.'s negotiation leverage and labor relations.

- Skills Gap Legislation: Government initiatives aimed at boosting vocational training and apprenticeships, such as those proposed in the 2025 budget cycles, could provide F.P.E.E. with a more readily available pool of skilled workers.

The legal environment significantly impacts F.P.E.E. Industries, particularly concerning building safety and environmental regulations. The Building Safety Act 2022, for instance, imposes stringent requirements on higher-risk buildings, necessitating F.P.E.E. to ensure product compliance with fire safety and structural integrity standards. Environmental laws, such as those driven by the EU's Green Deal aiming for carbon neutrality by 2050, push for sustainable practices, impacting concrete production and waste management for F.P.E.E. Industries.

Labor laws are also a critical consideration, affecting payroll and human resource strategies. For example, proposals for a $15 federal minimum wage in the US could substantially increase labor costs. Furthermore, evolving workplace safety standards, like those enforced by OSHA, are paramount for preventing accidents and avoiding significant fines, with US construction site violations costing billions annually.

Compliance with contract law, including updated JCT 2024 provisions, is essential for F.P.E.E. Industries to manage risk and ensure successful project delivery. Navigating insolvency laws and changes in adjudication processes, as seen in various jurisdictions in 2024, directly influences cash flow and project timelines, underscoring the need for proactive legal counsel.

Environmental factors

The concrete sector, a cornerstone of infrastructure, faces intense scrutiny regarding its substantial carbon footprint, largely attributed to cement manufacturing. Global cement production accounts for approximately 8% of worldwide CO2 emissions, a significant environmental challenge.

F.P.E.E. Industries can proactively address this by integrating sustainable practices, such as incorporating supplementary cementitious materials like fly ash and ground granulated blast furnace slag, which can replace up to 30% of traditional cement, thereby lowering embodied carbon.

Furthermore, optimizing energy efficiency within F.P.E.E.'s production facilities is crucial; for instance, adopting waste heat recovery systems can reduce energy consumption by up to 15% in cement plants.

Precast concrete offers a distinct environmental benefit, as studies indicate it can reabsorb as much as 40% of its initial production-related CO2 emissions throughout its operational lifecycle, making it a more sustainable building material choice.

Precast concrete manufacturing inherently minimizes waste due to its controlled factory setting and precise material utilization, a stark contrast to traditional on-site building methods. This efficiency is further amplified as reusable molds and the direct recycling of excess materials back into production bolster a circular economy model for F.P.E.E. Industries.

F.P.E.E. Industries' dedication to waste reduction and recycling directly supports evolving environmental regulations and promotes sustainable construction. For instance, in 2024, the construction industry globally faced increased scrutiny on landfill diversion rates, with many regions targeting over 75% of construction and demolition waste to be recycled or diverted from landfills.

The construction sector, a key market for F.P.E.E. Industries, faces growing pressure to source raw materials like aggregates and water sustainably. By 2024, demand for green building materials is projected to rise significantly, with estimates suggesting the global green building market could reach over $3.1 trillion by 2030.

F.P.E.E. Industries can bolster its environmental standing by verifying that its suppliers employ responsible extraction methods and by integrating more recycled content into its product lines. For instance, utilizing recycled aggregates in concrete can reduce reliance on virgin resources, a critical step as water scarcity impacts aggregate availability in many regions, with some areas already experiencing significant operational cost increases due to water management.

This commitment to sustainable sourcing directly aids in conserving natural resources and minimizing the overall environmental footprint of construction projects. Companies prioritizing these practices often see improved brand reputation and can benefit from government incentives or preferential treatment in tenders, as seen in the EU's growing emphasis on circular economy principles in construction.

Energy Efficiency in Production Facilities

Optimizing energy consumption within production facilities is a key environmental consideration for precast concrete manufacturers. This involves implementing energy-efficient curing methods and integrating more renewable energy sources to power operations. For instance, the precast concrete sector has seen a notable increase in renewable energy adoption, with some reports highlighting a 15% year-over-year growth in solar and wind power utilization for manufacturing processes in 2024.

F.P.E.E. Industries can realize significant environmental benefits by focusing on these energy-efficient practices. Such initiatives not only reduce a company's carbon footprint but can also lead to operational cost savings. The industry is increasingly recognizing the financial and environmental advantages of sustainable energy solutions.

- Increased Renewable Energy Use: The precast concrete sector reported a 15% year-over-year increase in renewable energy adoption in 2024.

- Curing Method Efficiency: Innovations in low-energy curing technologies are being explored to cut energy usage by an estimated 20-25%.

- Operational Cost Reduction: Transitioning to renewable energy sources can lead to a projected 10-12% reduction in annual energy expenditure for manufacturing facilities.

- Environmental Impact Mitigation: Reducing reliance on fossil fuels directly lowers greenhouse gas emissions, contributing to climate change mitigation efforts.

Climate Change Resilience and Durability

Precast concrete products are intrinsically durable and long-lasting, making them a key component in building structures that can withstand the impacts of climate change. Their resilience against extreme weather events, such as heavy rainfall or high winds, is a significant advantage. For instance, precast concrete elements are designed to meet stringent building codes that account for seismic activity and severe weather, often exceeding the performance of traditional construction methods in these scenarios.

The reduced need for frequent repairs and maintenance over the lifespan of structures built with precast concrete directly translates to lower resource consumption and waste generation. This lifecycle advantage is increasingly important as global efforts focus on reducing the environmental footprint of the construction sector. Studies from organizations like the Portland Cement Association highlight that the durability of concrete can significantly extend the service life of infrastructure, thereby delaying the need for replacement and its associated environmental costs.

F.P.E.E. Industries plays a crucial role by supplying materials that bolster the long-term sustainability of infrastructure projects. Their products are integral to developing climate-resilient communities and adapting to changing environmental conditions. This commitment aligns with overarching climate adaptation strategies, where robust and enduring infrastructure is paramount for societal well-being and economic stability in the face of climate-related challenges.

Key benefits contributing to climate change resilience include:

- Enhanced durability: Precast concrete's inherent strength and resistance to environmental degradation provide a longer service life for structures.

- Reduced maintenance needs: Less frequent repairs mean lower consumption of materials and labor, contributing to resource efficiency.

- Superior weather resistance: Products are engineered to withstand extreme weather events, minimizing damage and downtime.

- Lower lifecycle carbon footprint: By extending building life and reducing maintenance, precast concrete contributes to a more sustainable built environment.

The environmental impact of concrete production, particularly cement's carbon footprint, remains a significant concern, with global cement output contributing roughly 8% to worldwide CO2 emissions. F.P.E.E. Industries can mitigate this by adopting sustainable practices, such as using supplementary cementitious materials like fly ash, which can replace up to 30% of cement, thereby lowering embodied carbon. Furthermore, optimizing energy efficiency in production, for example, through waste heat recovery systems that can reduce energy consumption by up to 15% in cement plants, is critical. Precast concrete itself offers environmental advantages, with some studies suggesting it can reabsorb up to 40% of its production-related CO2 emissions over its lifecycle.

| Environmental Factor | Impact on F.P.E.E. Industries | Mitigation Strategies/Opportunities | Relevant Data (2024/2025) |

| Carbon Emissions from Cement Production | Significant contributor to climate change; regulatory pressure and reputational risk. | Utilize supplementary cementitious materials (SCMs) like fly ash and slag (up to 30% replacement); improve energy efficiency in plants (e.g., waste heat recovery up to 15% savings). | Global cement production accounts for ~8% of CO2 emissions. |

| Waste Reduction and Recycling | Landfill costs, regulatory compliance, resource depletion. | Minimize waste in precast manufacturing (controlled environment, reusable molds); recycle excess materials; aim for >75% construction and demolition waste diversion rates. | Global construction industry targeting >75% waste diversion in 2024. |

| Sustainable Sourcing of Raw Materials | Water scarcity impacting aggregate availability; rising costs of virgin resources. | Source aggregates responsibly; increase recycled content in products; verify supplier sustainability practices. | Global green building market projected to exceed $3.1 trillion by 2030. |

| Energy Efficiency and Renewable Energy | Operational costs, greenhouse gas emissions. | Implement energy-efficient curing methods; integrate renewable energy sources (solar, wind); target 10-12% reduction in annual energy expenditure. | 15% year-over-year growth in solar/wind power adoption for manufacturing in 2024. |

| Climate Change Resilience | Demand for durable, weather-resistant infrastructure. | Supply durable precast concrete products that withstand extreme weather; reduce maintenance needs and lifecycle costs. | Precast concrete elements designed to meet stringent codes for seismic activity and severe weather. |

PESTLE Analysis Data Sources

Our F.P.E.E. Industries PESTLE Analysis is grounded in a comprehensive review of publicly available data from government bodies, international organizations, and reputable financial news outlets. This ensures a robust understanding of political stability, economic trends, and regulatory landscapes.