F.P.E.E. Industries Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

F.P.E.E. Industries Bundle

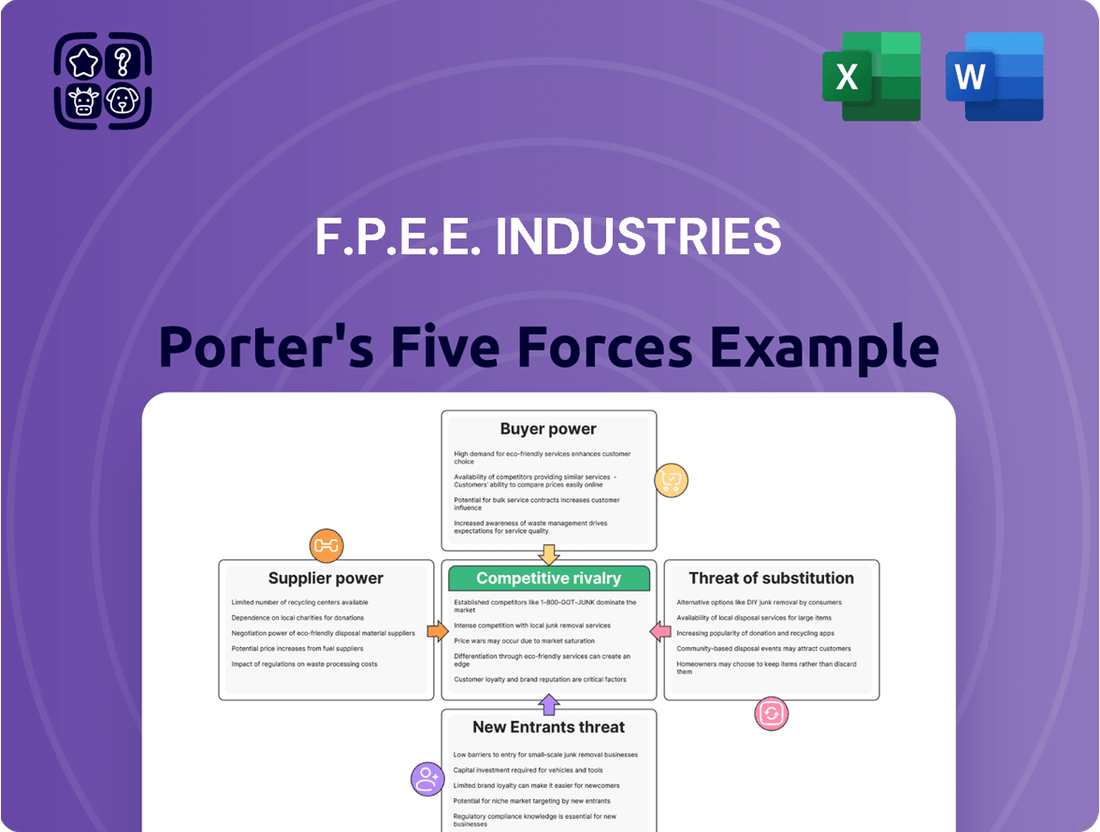

F.P.E.E. Industries navigates a landscape shaped by intense rivalry and the looming threat of new entrants. Understanding the bargaining power of both buyers and suppliers is crucial for its market position. The specter of substitute products also demands strategic attention.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore F.P.E.E. Industries’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The precast concrete sector, including companies like F.P.E.E. Industries, is significantly influenced by the concentration of its key raw material suppliers. The industry's dependence on materials such as cement, aggregates, and steel reinforcement means that if only a few large producers dominate these markets, their bargaining power naturally increases.

This concentration leaves F.P.E.E. Industries with fewer viable options for sourcing essential inputs, potentially leading to higher material costs. For example, the global cement market saw price increases in early 2024, with some regions experiencing rises of 5-10% due to energy costs and supply chain disruptions.

Furthermore, external factors like geopolitical events and trade policies can amplify supplier leverage. The imposition of a 25% tariff on cement imports from Canada and Mexico in February 2025, for instance, directly impacts the cost and availability of this critical material, thereby strengthening the position of domestic suppliers.

For F.P.E.E. Industries, the availability of substitute materials for suppliers of core construction inputs like cement and steel presents a mixed picture. In the realm of large-scale structural concrete, direct substitutes for these fundamental materials are often limited, which naturally bolsters the bargaining power of their suppliers. While the market for sustainable alternatives, such as those incorporating fly ash or slag to reduce cement content, is growing, their current widespread adoption and cost-competitiveness may not yet significantly diminish the leverage held by traditional material providers. For example, by 2024, the global market for supplementary cementitious materials (SCMs) was projected to reach over $50 billion, indicating a growing but still developing segment.

The bargaining power of suppliers for F.P.E.E. Industries is amplified by substantial switching costs. For instance, if F.P.E.E. Industries needs to change its primary cement supplier, the process of qualifying new materials and retooling production lines could incur millions in upfront expenses and lost operational time. This complexity in adopting new aggregates or specialized binders inherently strengthens the position of existing, trusted suppliers who already meet stringent quality and compatibility standards.

Furthermore, long-term supply agreements, often a necessity for large-scale construction projects managed by F.P.E.E. Industries, can create significant lock-in effects. These contracts typically involve price stability and guaranteed delivery, making early termination or renegotiation costly. This dependence means suppliers can dictate terms, especially for unique or proprietary material blends critical to F.P.E.E. Industries' project specifications, thereby increasing their leverage.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers can significantly bolster their bargaining power within the precast concrete industry. If suppliers of critical raw materials, like cement or specialized aggregates, possess the capability and strategic intent to move into precast concrete production themselves, they effectively transform into direct competitors. This scenario would grant them leverage as they could dictate terms or even capture market share previously held by existing precast manufacturers.

While this threat is generally less pronounced for suppliers of basic commodities, larger, more diversified construction material conglomerates represent a notable exception. These entities, with their substantial capital reserves and existing distribution networks, are better positioned to absorb the complexities of precast manufacturing and installation. For instance, a major cement producer might acquire or establish its own precast facilities to secure an outlet for its core product and capture higher margins further down the value chain.

- Increased Competition: Suppliers entering the precast market directly increase competition, potentially driving down prices and margins for existing players.

- Supply Chain Control: Companies that can integrate forward gain greater control over their supply chain, from raw materials to finished products.

- Barriers to Entry: The capital intensity and specialized knowledge required for precast production can act as a barrier, limiting the number of suppliers capable of effective forward integration.

- Market Dynamics: The strategic decisions of large material suppliers, such as Holcim or Cemex, to diversify into precast solutions, could reshape market dynamics. For example, in 2024, reports indicated increased investment by major material suppliers into value-added construction components, including precast elements, to capture a larger share of project revenues.

Importance of F.P.E.E. Industries as a Customer to Suppliers

F.P.E.E. Industries' significance as a customer directly impacts the bargaining power of its suppliers. When F.P.E.E. accounts for a substantial percentage of a supplier's overall sales, that supplier is more likely to be accommodating with pricing and contract terms to retain such a valuable client. Conversely, if F.P.E.E. constitutes a minor portion of a supplier's business, the supplier holds greater leverage, benefiting from its broader customer base and the ability to impose less favorable conditions.

For instance, consider a supplier of specialized electronic components. If F.P.E.E. represents 25% of that supplier's annual revenue, they will likely prioritize F.P.E.E.'s needs and be open to negotiation. However, if F.P.E.E. only makes up 2% of the supplier's revenue, the supplier has less incentive to bend on terms, as they can easily replace F.P.E.E.'s business with orders from larger or more numerous clients.

This dynamic is crucial. In 2024, companies that are significant revenue drivers for their suppliers often secure better input costs. For example, if F.P.E.E. is one of the top three clients for a key raw material provider, it could translate to cost savings of 5-10% compared to smaller buyers, directly enhancing F.P.E.E.'s profit margins.

- Customer Dependence: The degree to which suppliers depend on F.P.E.E. for their revenue.

- Revenue Share: A higher revenue share for F.P.E.E. with a supplier weakens that supplier's bargaining power.

- Negotiating Leverage: F.P.E.E.'s importance allows for greater negotiation on price, quality, and delivery terms.

- Supplier Concentration: If a supplier serves many customers, F.P.E.E.'s individual importance diminishes, increasing supplier power.

The bargaining power of suppliers to F.P.E.E. Industries is elevated by the limited availability of substitutes for critical inputs like cement and steel. While efforts are underway to incorporate supplementary cementitious materials, their widespread adoption and cost-competitiveness in 2024 still lagged behind traditional inputs, leaving suppliers of cement and steel with considerable leverage. For instance, the global market for supplementary cementitious materials, though projected to exceed $50 billion by 2024, still represents a developing segment compared to the established dominance of traditional materials.

Switching costs for F.P.E.E. Industries are also significant, as qualifying new material suppliers and adapting production lines can involve substantial capital expenditure and operational downtime. This creates a lock-in effect, particularly with long-term supply agreements that offer price stability but make early termination costly, further empowering established suppliers. The threat of forward integration by large material conglomerates, such as major cement producers acquiring precast facilities, also looms, potentially reshaping market dynamics by 2024 as these entities seek to capture more value.

| Factor | Impact on Supplier Bargaining Power | Example/Data (2024) |

|---|---|---|

| Supplier Concentration | High | Few dominant producers of cement and steel |

| Availability of Substitutes | Low for core materials | Growing but not yet dominant market for SCMs (over $50 billion projected by 2024) |

| Switching Costs | High | Costly requalification and production line adjustments |

| Forward Integration Threat | Moderate to High for diversified suppliers | Major material suppliers investing in precast facilities |

| Customer Dependence (F.P.E.E.'s importance to supplier) | Variable | If F.P.E.E. is a top 3 client, power is lower; could yield 5-10% cost savings. |

What is included in the product

This analysis of F.P.E.E. Industries reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and F.P.E.E.'s strategic positioning within its industry.

F.P.E.E. Industries' Porter's Five Forces Analysis provides a clear, one-sheet summary of all five forces—perfect for quick decision-making and understanding competitive pressures.

Easily swap in your own data, labels, and notes to reflect current business conditions, making the analysis highly customizable and relevant to your specific market.

Customers Bargaining Power

F.P.E.E. Industries operates within the building and civil engineering sectors, where projects are typically large and involve substantial purchase volumes. This means that a few major contractors or developers can represent a significant portion of F.P.E.E.'s overall revenue.

When a small number of customers account for a large chunk of sales, their ability to negotiate for lower prices, more favorable payment terms, or specialized product modifications becomes considerably stronger. This customer concentration directly translates into increased bargaining power for these key clients.

For instance, in 2024, the top five construction firms in Europe accounted for over 40% of all new infrastructure project awards, highlighting the potential for significant customer concentration in this sector.

The precast concrete market is quite fragmented, with many companies operating both nationally and regionally. This sheer number of suppliers means customers usually have plenty of choices when looking for precast concrete elements.

For larger, heavier precast items, the cost of transportation is a significant factor. This often makes locally sourced precast more economical for construction projects. Therefore, customers can readily switch to a different nearby supplier if prices or terms aren't favorable, increasing their bargaining power.

In 2024, the precast concrete industry saw continued growth, with projections indicating a market size of over $140 billion globally by the end of the year. This competitive landscape, fueled by numerous regional players, directly translates to stronger customer leverage.

Customers generally face low switching costs when selecting a new precast concrete supplier for upcoming projects, as they can easily compare bids from multiple providers. This ease of comparison means customers can prioritize cost-effectiveness and supplier capabilities without significant disruption.

However, if a customer decides to switch suppliers midway through an existing project, the costs can escalate. These costs might include expenses related to integrating a new supplier's designs, adjusting project schedules, and potentially losing benefits from established relationships with the original supplier.

The growing integration of Building Information Modeling (BIM) across the construction industry is a significant factor in further lowering switching costs for customers. By standardizing design and integration processes, BIM makes it simpler for clients to transition between precast concrete suppliers with less friction and fewer associated expenses.

Threat of Backward Integration by Customers

The threat of backward integration by customers poses a significant consideration for F.P.E.E. Industries. Large entities, particularly in the construction and civil engineering sectors, might contemplate producing their own precast concrete elements. This is more likely to occur when undertaking exceptionally large or highly repetitive projects where in-house production could offer cost efficiencies or greater control over supply chains.

However, this threat is somewhat tempered by the substantial barriers to entry in precast concrete manufacturing. These include the considerable capital required for specialized plant and equipment, the need for precise manufacturing expertise, and the rigorous quality control standards that must be maintained. These factors make backward integration a complex and often cost-prohibitive undertaking for most potential customers.

Despite these challenges, the mere possibility of backward integration can still empower major customers. It provides them with a degree of leverage during negotiations, allowing them to potentially secure more favorable terms or pricing from F.P.E.E. Industries. This bargaining power is a direct consequence of the customers' potential to internalize production if demands are not met satisfactorily.

For context, the global precast concrete market was valued at approximately $210 billion in 2023 and is projected to grow steadily. Even a small percentage of large buyers considering in-house production could impact market dynamics for suppliers like F.P.E.E. Industries.

- High Capital Investment: Setting up a precast concrete facility requires significant upfront capital, often in the tens of millions of dollars, for molds, batching plants, and curing equipment.

- Specialized Expertise: Successful precast production demands skilled labor in areas like formwork design, concrete mix optimization, reinforcement detailing, and quality assurance.

- Quality Control Demands: Meeting stringent industry standards for strength, durability, and dimensional accuracy is critical and requires robust quality management systems.

- Economies of Scale: Customers often find it more economical to purchase from specialized manufacturers who benefit from economies of scale rather than investing in their own smaller-scale operations.

Price Sensitivity of Customers

Customers in the building and civil engineering sectors, especially for large-scale projects, exhibit significant price sensitivity. This is largely due to stringent budget limitations and the highly competitive nature of bidding processes. In 2024, the global construction market continued to see intense competition, with material costs playing a crucial role in project profitability. For instance, fluctuations in steel and cement prices directly impact the final cost of concrete structures, making price a primary consideration for buyers.

The cost-effectiveness of precast concrete is a major factor driving its adoption by these customers. They actively seek the most competitive pricing available. Data from 2024 indicated that projects where precast concrete offered a 10-15% cost saving over traditional cast-in-place methods saw higher adoption rates. This highlights the direct correlation between cost advantages and customer purchasing decisions.

F.P.E.E. Industries can effectively differentiate its offerings by emphasizing aspects beyond just price. While competitive pricing is essential, highlighting the durability, sustainability, and efficient installation of its precast solutions can create added value. For example, in 2024, many large infrastructure projects prioritized lifecycle cost savings and reduced construction timelines, areas where precast concrete excels, thus allowing F.P.E.E. Industries to justify its pricing through superior long-term performance and project efficiency.

- Price Sensitivity: Customers in civil engineering are highly price-conscious due to project budgets and competitive bidding.

- Cost-Effectiveness Driver: The economic advantages of precast concrete are a key reason for its selection.

- Competitive Pricing Demand: Buyers continuously search for the most advantageous pricing structures.

- Differentiation Beyond Price: F.P.E.E. Industries can leverage durability, sustainability, and installation efficiency as competitive advantages.

Customers in the building and civil engineering sectors, particularly those undertaking large projects, demonstrate significant price sensitivity. This stems from tight project budgets and the fiercely competitive bidding environment. In 2024, the global construction market experienced intense competition, with material costs critically influencing project profitability, making price a paramount consideration for buyers.

The cost-effectiveness of precast concrete is a primary driver for customer adoption, with buyers actively seeking the most competitive pricing. Data from 2024 showed that projects realizing 10-15% cost savings with precast concrete compared to traditional methods saw increased uptake, illustrating the direct link between cost advantages and purchasing decisions.

F.P.E.E. Industries can enhance its value proposition by highlighting benefits beyond price, such as durability, sustainability, and installation efficiency. In 2024, major infrastructure projects prioritized lifecycle cost savings and reduced construction timelines, areas where precast concrete excels, enabling F.P.E.E. Industries to justify pricing through superior long-term performance and project efficiency.

| Factor | Impact on Customer Bargaining Power | 2024 Relevance |

|---|---|---|

| Customer Concentration | High, few large clients dominate sales | Top 5 European construction firms secured over 40% of infrastructure awards in 2024. |

| Switching Costs | Low for new projects, high mid-project | BIM integration further reduces switching friction for clients. |

| Threat of Backward Integration | Moderate, due to high capital barriers | Global precast market valued around $210 billion in 2023, a small shift to in-house production by large buyers could be impactful. |

| Price Sensitivity | Very High | Precast concrete adoption grew where it offered 10-15% cost savings over traditional methods in 2024. |

What You See Is What You Get

F.P.E.E. Industries Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the F.P.E.E. Industries Porter's Five Forces Analysis, covering the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. This comprehensive analysis is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

The precast concrete sector is quite fragmented, featuring both large national companies and a multitude of smaller regional players. This means there are many businesses competing for customers, especially for heavy precast items where transportation costs make local suppliers more attractive. For instance, in 2024, the global precast concrete market was valued at approximately $150 billion, with a significant portion of this revenue generated by numerous smaller, geographically focused firms alongside the major national manufacturers.

The global precast concrete market is expected to see solid growth, with projections indicating a compound annual growth rate (CAGR) between 4.2% and 6.75% from 2025 through 2033 or 2035. This expansion is fueled by key drivers like increasing urbanization, significant investments in infrastructure, and a rising demand for eco-friendly and modular building solutions.

However, this promising growth trajectory also acts as a magnet, attracting new companies to enter the market and encouraging existing players to broaden their operations. This dynamic can lead to a more competitive landscape as companies vie for market share and resources.

While precast concrete offers benefits like consistent quality and quicker project timelines, the degree of product differentiation among competitors can fluctuate. F.P.E.E. Industries' strategic focus on bespoke solutions, coupled with an emphasis on long-term durability and environmental sustainability, serves as a key differentiator.

However, if the market perceives precast concrete products as largely interchangeable, or commoditized, competitive rivalry intensifies. This often leads to a pricing-centric competition, potentially squeezing profit margins for all players in the industry.

In 2024, the global precast concrete market was valued at approximately $230 billion, with projections indicating steady growth. This size suggests a significant number of players, increasing the likelihood of commoditization if innovation or unique value propositions are not actively pursued.

High switching costs for customers can mitigate this rivalry. For instance, if a customer has invested in specific molds or has integrated F.P.E.E. Industries' unique structural designs into their projects, the effort and expense to switch to another supplier can be substantial, fostering customer loyalty.

Fixed Costs and Capacity Utilization

The precast concrete industry is characterized by substantial fixed costs, primarily stemming from investments in manufacturing plants, specialized machinery, and custom molds. These significant overheads compel F.P.E.E. Industries and its competitors to strive for high capacity utilization. Operating at near-full capacity is crucial for spreading these fixed costs over a larger production volume, thereby lowering the per-unit cost.

When demand softens, the pressure to maintain high utilization intensifies. This often triggers aggressive pricing tactics as companies aim to secure orders and keep their production lines running. For instance, if a company faces a 20% dip in demand, they might lower prices by 5-10% to capture market share and avoid the significant financial impact of underutilized assets. This dynamic directly fuels competitive rivalry among players like F.P.E.E. Industries.

- High Fixed Costs: Investments in plants, machinery, and molds create significant overhead for precast concrete manufacturers.

- Capacity Utilization Drive: Companies are incentivized to operate at high utilization to amortize these fixed costs effectively.

- Aggressive Pricing in Slowdowns: Reduced demand can lead to price wars as firms fight to maintain production volumes and cover fixed expenses.

- Impact on Profitability: This cycle of high fixed costs and fluctuating demand can severely impact profit margins during downturns.

Exit Barriers for Competitors

Exit barriers in the precast concrete sector are significant, primarily due to the substantial capital tied up in manufacturing plants and specialized machinery. This high investment makes it difficult for companies to simply close down operations, even when facing financial difficulties. Consequently, even underperforming firms often remain in the market, contributing to persistent overcapacity and intensifying competitive pressures.

This situation can lead to a prolonged period of aggressive pricing and reduced profit margins across the industry. For instance, companies might continue production to cover at least their variable costs, avoiding the substantial write-offs associated with liquidating specialized assets. This dynamic means that the industry might not see a natural consolidation driven by market forces, as unprofitable players are incentivized to stay afloat.

- High Capital Intensity: The precast concrete industry requires significant upfront investment in factories, molds, and heavy machinery, creating a substantial financial hurdle for exit.

- Specialized Equipment: Much of the equipment used is highly specialized for precast production, with limited resale value or alternative applications, increasing the cost of exiting.

- Continued Operation Incentive: Even unprofitable firms may continue operating to recoup some of their investment or cover variable costs, preventing a smooth exit from the market.

- Market Overcapacity: The reluctance of firms to exit due to high barriers contributes to sustained overcapacity, fueling aggressive competition and price wars.

Competitive rivalry in the precast concrete sector is intense, driven by a fragmented market with numerous players, from large national firms to smaller regional ones. This fragmentation, coupled with a growing market valued at approximately $230 billion in 2024, means companies constantly battle for market share, often through pricing strategies, especially when demand fluctuates.

High fixed costs associated with manufacturing plants and specialized machinery compel companies to maintain high capacity utilization. When demand drops, as seen in recent economic cycles, this pressure intensifies, leading to aggressive price cuts to keep production lines running and cover overheads, thus squeezing profit margins industry-wide.

Significant exit barriers, stemming from substantial capital investments in specialized assets, mean even struggling companies often remain operational. This persistence contributes to overcapacity and perpetuates aggressive competition and price wars, making it challenging for any single player to gain a sustainable competitive advantage through price alone.

The degree of product differentiation also plays a role; if precast concrete products are perceived as commodities, rivalry escalates, focusing heavily on price. F.P.E.E. Industries' focus on bespoke solutions and durability aims to counter this commoditization, but the overall industry landscape remains highly competitive.

| Market Size (2024) | Projected CAGR (2025-2033) | Key Competitive Driver | Impact of Low Differentiation |

| ~$230 Billion | 4.2% - 6.75% | Capacity Utilization & Pricing | Intensified Rivalry & Margin Pressure |

SSubstitutes Threaten

The threat of substitutes for F.P.E.E. Industries' precast concrete products is significant, stemming from alternative construction materials like traditional cast-in-place concrete, steel, timber, and masonry.

Each substitute presents a unique value proposition; for instance, steel offers high strength-to-weight ratios, timber provides a renewable and often lower-cost option for certain applications, and traditional concrete allows for greater on-site customization. In 2024, the global construction market continued to see a dynamic interplay between these materials, with fluctuating raw material costs impacting the price competitiveness of each. For example, fluctuations in lumber prices can make timber more or less attractive relative to precast concrete, depending on the specific project's scale and design. Similarly, the availability and cost of steel rebar directly influence the overall cost of cast-in-place concrete versus precast alternatives.

The decision to use a substitute is often driven by project-specific needs, including the required speed of construction, design flexibility, structural performance demands, and overall budget constraints. For rapid residential projects, timber framing might be preferred for its speed and lower initial cost, while large-scale infrastructure projects may lean towards steel or even traditional concrete for their proven durability and adaptability on-site.

F.P.E.E. Industries must continually assess how shifts in the cost and performance of these substitutes, influenced by factors like global supply chain dynamics and evolving building codes, impact the demand for its precast concrete solutions. For example, a surge in global steel prices in late 2023 and early 2024 made precast concrete a more economically viable option for certain commercial building projects, a trend F.P.E.E. could leverage.

While precast concrete offers advantages such as faster construction, enhanced quality control, and superior durability, its initial investment in specialized machinery and molds can present a higher upfront cost compared to traditional cast-in-place concrete methods. This cost factor can be a significant deterrent for some projects, potentially limiting demand for precast solutions.

However, the long-term economic benefits of precast concrete, including reduced construction timelines, lower labor requirements, and minimized on-site waste, can offset the initial capital outlay. For instance, projects utilizing precast elements can see labor cost reductions of up to 30% and schedule compressions of 20-50%, making it a competitive option over the project lifecycle.

Furthermore, alternative construction materials like structural steel and engineered timber also present their own distinct cost-performance profiles. Steel framing, for example, can offer rapid erection and high strength-to-weight ratios, while timber provides sustainability benefits and aesthetic appeal, both of which compete with precast concrete based on specific project needs and market pricing trends.

Customers increasingly consider switching to substitute materials due to shifting priorities like project timelines, budget realities, and the growing demand for sustainable options. For instance, the global market for green building materials was valued at approximately $256 billion in 2023 and is projected to reach over $500 billion by 2030, indicating a significant customer shift.

Materials such as recycled steel, natural bamboo, and innovative eco-concrete are becoming more competitive, directly challenging traditional offerings by offering comparable or superior performance alongside environmental benefits. This trend is amplified as regulatory bodies and consumer preferences increasingly favor lower-carbon footprint building solutions.

Emerging Technologies as Substitutes

Advances in construction technology, like 3D-printed concrete, present a significant substitute for traditional precast concrete methods. These innovations allow for intricate designs and reduce material waste, potentially shortening project timelines. For instance, by 2024, the global 3D printing construction market was projected to reach approximately $5.1 billion, indicating substantial growth and adoption.

While these technologies are still developing, their potential to offer new efficiencies and capabilities poses a competitive threat to F.P.E.E. Industries' established precast concrete solutions. The ability to produce complex forms more economically could divert demand from conventional methods.

- 3D Printing Construction Market Growth: Projected to reach $5.1 billion globally by 2024.

- Efficiency Gains: 3D printing offers faster construction and reduced material waste compared to traditional methods.

- Design Flexibility: Enables the creation of complex architectural forms not easily achievable with precast concrete.

- Cost Competitiveness: Emerging technologies aim to lower construction costs, challenging established players.

Regulatory and Environmental Drivers for Substitutes

Increasing environmental regulations and a growing emphasis on green building practices are significantly boosting the attractiveness of substitutes for traditional concrete. For instance, by 2024, the global construction market is projected to see a substantial rise in demand for sustainable materials, driven by policies aimed at reducing carbon emissions. This regulatory push accelerates the adoption of alternatives that meet stricter environmental standards.

Materials with lower carbon footprints are gaining traction. These include innovative concrete mixes that incorporate captured CO2 or utilize recycled aggregates. By 2023, several regions reported a 15-20% increase in the use of recycled concrete aggregate in non-structural applications, a trend expected to continue as regulations tighten.

- Regulatory Push: Stricter environmental laws encourage the use of sustainable building materials.

- Green Building Demand: Growing preference for eco-friendly construction favors substitutes.

- Low-Carbon Materials: Innovations like CO2-infused concrete and recycled aggregates offer viable alternatives.

- Market Adoption: In 2024, expect continued growth in the market share of these sustainable substitutes.

The threat of substitutes for F.P.E.E. Industries' precast concrete products is substantial, with traditional cast-in-place concrete, steel, timber, and masonry offering compelling alternatives. In 2024, the fluctuating costs of raw materials like steel rebar and lumber directly impacted the price competitiveness of these substitutes against precast concrete. Project-specific needs, such as speed, design flexibility, and budget, often dictate the choice, with timber sometimes favored for rapid, lower-cost residential projects and steel for large infrastructure due to its strength.

Customer priorities are shifting towards sustainability and faster project timelines, making materials like recycled steel, bamboo, and innovative eco-concrete more attractive. The global market for green building materials, valued around $256 billion in 2023, highlights this trend. Furthermore, advancements like 3D-printed concrete are emerging as significant substitutes, offering intricate designs and reduced waste, with the global 3D printing construction market projected to reach approximately $5.1 billion by 2024.

| Substitute Material | Key Advantages | Considerations for F.P.E.E. | 2024 Market Influence Factor |

|---|---|---|---|

| Traditional Cast-in-Place Concrete | On-site customization, potentially lower upfront equipment cost | Longer construction timelines, quality control challenges | Cost-sensitive projects, availability of skilled labor |

| Steel | High strength-to-weight ratio, rapid erection | Volatile raw material prices, potential corrosion issues | Global steel price fluctuations impacting overall project costs |

| Timber | Renewable resource, aesthetic appeal, often lower cost | Fire resistance, durability concerns in certain climates | Lumber price volatility, increasing demand for sustainable options |

| 3D Printed Concrete | Design complexity, reduced waste, potential speed gains | Nascent technology, limited large-scale adoption, regulatory hurdles | Growing market share in niche applications, innovation potential |

Entrants Threaten

The precast concrete sector demands substantial initial capital for specialized plants, advanced machinery, and custom molds, creating a formidable entry barrier. For instance, establishing a modern precast facility can easily run into tens of millions of dollars, a figure that deters many aspiring competitors.

Established players in the industry, including F.P.E.E. Industries, benefit significantly from economies of scale. This means they can produce goods or services at a lower cost per unit due to larger production volumes, bulk purchasing of raw materials, and more efficient distribution networks. For instance, major manufacturers often negotiate better prices for components, translating to a cost advantage that is difficult for newcomers to match.

New entrants would need to rapidly achieve a similar scale to compete effectively on price. This is a substantial hurdle, requiring significant upfront investment in production capacity and marketing to generate the necessary sales volume. Without this scale, new entrants are likely to face higher per-unit costs, making it challenging to undercut established competitors.

The experience curve also plays a crucial role. As companies like F.P.E.E. Industries gain more experience in production, they become more efficient, reducing costs further through process improvements and learning-by-doing. By 2024, many mature industries saw companies with decades of operational experience holding a distinct cost advantage, often estimated to be around 10-20% lower than firms with less than five years of experience.

Newcomers to the F.P.E.E. Industries market face a significant hurdle in accessing established distribution channels. Incumbent players have cultivated deep ties with contractors, developers, and civil engineering firms over years, building trust and loyalty that are difficult for new entrants to replicate. For instance, a major distributor in the construction materials sector might have exclusive agreements with key manufacturers, limiting access for emerging brands. This dominance of existing networks means new entrants must invest heavily in building their own supply chains and sales forces, a costly and time-consuming endeavor.

The challenge is compounded by customer relationships. Many clients in the F.P.E.E. sector prioritize reliability and established partnerships, often sticking with suppliers they know and trust. Winning over these customers requires not just competitive pricing but also a proven track record and strong personal connections, which new entrants lack. Consider the case of a large infrastructure project; the primary contractor is likely to source materials from a supplier with whom they have a long-standing, dependable relationship, rather than risk using an unproven new entrant.

Regulatory Hurdles and Quality Standards

The construction sector faces significant regulatory hurdles that deter new entrants. Stringent building codes, quality certifications, and safety mandates require substantial investment and expertise to comply with. For instance, in the United States, the International Building Code (IBC) is widely adopted, with local amendments adding further complexity. New companies must dedicate resources to understanding and adhering to these evolving standards, which can significantly increase their initial operating costs.

These barriers are not merely bureaucratic; they directly impact product quality and operational safety. F.P.E.E. Industries, like its competitors, must ensure all projects meet these rigorous specifications, a process that can delay market entry and drain capital. Failing to meet these standards can result in fines, project shutdowns, and reputational damage, making compliance a critical, albeit costly, aspect of establishing a presence in the industry.

- Stringent Building Codes: Compliance with codes like the IBC and local variations demands specialized knowledge and meticulous execution.

- Quality Standards: Meeting industry-specific quality benchmarks, such as those set by ISO, requires robust quality control systems.

- Safety Regulations: Adherence to occupational safety standards, like OSHA in the US, necessitates investment in training and safety equipment.

- Cost and Time Investment: Navigating these regulatory landscapes can add substantial time and financial burden for new businesses entering the construction market.

Product Differentiation and Brand Loyalty

While precast concrete elements might seem like standard products, F.P.E.E. Industries has cultivated a strong reputation for delivering high-quality, tailored solutions and ensuring dependable installation services. This focus on excellence helps build robust customer loyalty.

New competitors entering the market would face a significant hurdle in trying to match F.P.E.E. Industries' established brand recognition and existing customer preferences. They would likely need substantial investments in marketing and product development to effectively differentiate themselves.

- Brand Loyalty: F.P.E.E. Industries' commitment to quality and custom solutions fosters strong customer loyalty, making it difficult for new entrants to attract customers.

- Marketing Investment: New entrants must allocate considerable resources to marketing campaigns to build brand awareness and counter F.P.E.E.'s established market presence.

- Differentiation Challenge: Creating unique selling propositions beyond basic product features is crucial for new players to stand out in a market where F.P.E.E. already excels in customization and service.

- Customer Preference: Established customer relationships and satisfaction with F.P.E.E.'s service delivery represent a significant barrier to entry for newcomers.

The threat of new entrants in the precast concrete sector, including for F.P.E.E. Industries, is significantly mitigated by high capital requirements for specialized equipment and manufacturing facilities, often running into tens of millions of dollars. Established players also leverage economies of scale, achieving lower per-unit costs through bulk purchasing and efficient operations, a cost advantage that is difficult for newcomers to overcome. By 2024, companies with decades of experience often had production costs 10-20% lower than newer entrants. Furthermore, strong brand loyalty and established customer relationships, built on years of reliable service and tailored solutions, present a formidable barrier, requiring substantial marketing investment and differentiation efforts from any new competitor.

| Barrier Type | Description | Impact on New Entrants | Example Factor (2024) |

|---|---|---|---|

| Capital Requirements | High initial investment for plants, machinery, and molds. | Deters new companies due to substantial upfront costs. | Establishing a modern precast facility often exceeds $20 million. |

| Economies of Scale | Lower production costs due to larger volumes and bulk purchasing. | New entrants face higher per-unit costs and price competition challenges. | Major manufacturers negotiate component prices 5-10% lower than smaller firms. |

| Distribution Channels | Established ties with contractors and developers. | New entrants must build costly, time-consuming supply chains and sales networks. | Exclusive agreements with key material distributors limit access for emerging brands. |

| Brand Loyalty & Customer Relationships | Trust and preference for established suppliers. | New entrants struggle to attract customers without a proven track record and strong connections. | Large infrastructure projects favor suppliers with long-standing, dependable relationships. |

| Regulatory Hurdles | Compliance with building codes, quality, and safety standards. | Increases initial operating costs and time-to-market for new businesses. | Adherence to evolving standards like IBC and OSHA can add 5-15% to initial setup costs. |

Porter's Five Forces Analysis Data Sources

Our F.P.E.E. Industries Porter's Five Forces analysis is built upon a foundation of publicly available financial statements, industry-specific market research reports, and regulatory filings from key players within the sector.