Founder Securities PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Founder Securities Bundle

Discover how political stability, economic growth, and technological advancements are shaping Founder Securities's trajectory. Our PESTLE analysis provides a critical look at the external forces impacting the company's operations and future. Equip yourself with actionable intelligence to navigate this dynamic market.

Political factors

China's State Council unveiled the 'new National Nine Articles' in April 2024, a pivotal policy aimed at significantly bolstering capital market oversight and cultivating a more competitive and inclusive market by 2035. This directive provides a strategic roadmap that influences all financial entities, including Founder Securities, by shaping market development and prioritizing investor protection.

These reforms are designed to elevate the caliber of publicly traded companies and promote greater market stability, directly impacting Founder Securities' core businesses in investment banking and brokerage services. For instance, enhanced regulations on initial public offerings (IPOs) and delistings can alter deal flow and underwriting fees, while measures to protect retail investors may influence trading volumes and commission structures.

China is actively pursuing financial sector liberalization, with significant policy updates in 2024 and 2025 designed to draw in foreign investment. These initiatives include enhancements to the Qualified Foreign Institutional Investor (QFII) scheme and the relaxation of entry barriers for international financial firms.

Founder Securities, operating as a full-service securities firm, stands to gain from these developments through increased foreign capital inflows and greater access for overseas investors to China's capital markets. This could lead to an expansion of its client portfolio and the diversification of its service offerings to cater to a global investor base.

For instance, in the first half of 2024, foreign holdings in Chinese onshore bonds and equities saw a notable increase, reflecting the positive impact of these opening-up measures, with net inflows reaching billions of dollars, providing a fertile ground for securities firms like Founder Securities to grow.

The China Securities Regulatory Commission (CSRC) has significantly ramped up its oversight in 2024 and 2025, introducing tougher rules for initial public offerings (IPOs), listed firms, and brokerage houses. This intensified scrutiny, including a crackdown on financial fraud, means Founder Securities must ensure its compliance and risk management systems are exceptionally strong.

For instance, the CSRC's enhanced vetting process for IPOs and more rigorous monitoring of trading activities directly impact how Founder Securities operates. Failing to adapt to these stricter guidelines, which aim to improve market integrity, could expose the company to regulatory penalties and damage its standing in China's financial sector.

Geopolitical Influences on Market Stability

Geopolitical shifts significantly impact China's financial markets, and by extension, companies like Founder Securities. Evolving trade relations and global economic realignments create an environment of volatility that directly affects market stability. For instance, in 2024, China's financial policy aimed for stability through prudent and progressive measures, including counter-cyclical adjustments. This focus is vital as it underpins investor confidence and the overall trading volume in both equity and bond markets, areas where Founder Securities operates.

The stability fostered by China's 2024 financial policies, which emphasized counter-cyclical and cross-cyclical adjustments, is a direct response to global economic uncertainties. This approach is crucial for Founder Securities as it directly influences:

- Investor Sentiment: A stable market environment encourages both domestic and international investors to participate, boosting trading volumes and asset valuations.

- Market Activity: Predictable policy frameworks reduce uncertainty, leading to more consistent activity in stock and bond trading, which are core to Founder Securities' business.

- Foreign Investment: Geopolitical stability and clear economic policies attract foreign capital, further enhancing liquidity and opportunities within China's financial sector.

Government Support for Strategic Financial Areas

The Chinese government is strategically backing crucial financial sectors, notably green finance, digital finance, and inclusive finance, through a series of policy initiatives. This proactive governmental stance presents significant opportunities for Founder Securities to innovate and deliver specialized financial products and services tailored to these growth areas.

For example, the ongoing expansion of green financial infrastructure and the accelerated digital transformation within the financial industry directly complement Founder Securities' existing comprehensive service portfolio and signal strong potential for future expansion. By 2023, China's green finance market reached an estimated RMB 2.5 trillion, demonstrating substantial government commitment and market readiness.

- Government Focus: Prioritization of green, digital, and inclusive finance by Chinese authorities.

- Opportunity for Founder Securities: Development of specialized products and services in these supported sectors.

- Market Growth Indicators: Significant expansion in green finance, with market size exceeding RMB 2.5 trillion in 2023.

- Alignment with Strategy: Government push for digital transformation in finance aligns with the company's digital service offerings.

China's proactive stance in financial liberalization, exemplified by policy updates in 2024 and 2025, aims to attract foreign investment through enhanced schemes like QFII and relaxed entry barriers for international firms. Founder Securities is positioned to benefit from these shifts, potentially expanding its client base and service offerings to cater to a global investor audience, as evidenced by the billions in net inflows into Chinese onshore markets in the first half of 2024.

The intensified regulatory oversight by the China Securities Regulatory Commission (CSRC) in 2024 and 2025, with stricter rules for IPOs, listed companies, and brokerages, necessitates robust compliance and risk management for Founder Securities. This heightened scrutiny, including a crackdown on financial fraud, directly impacts the firm's operational procedures and market standing.

Geopolitical dynamics and China's 2024 financial policies, emphasizing counter-cyclical adjustments, aim to foster market stability and investor confidence. This stable environment is crucial for Founder Securities, influencing trading volumes, asset valuations, and the attraction of foreign capital.

What is included in the product

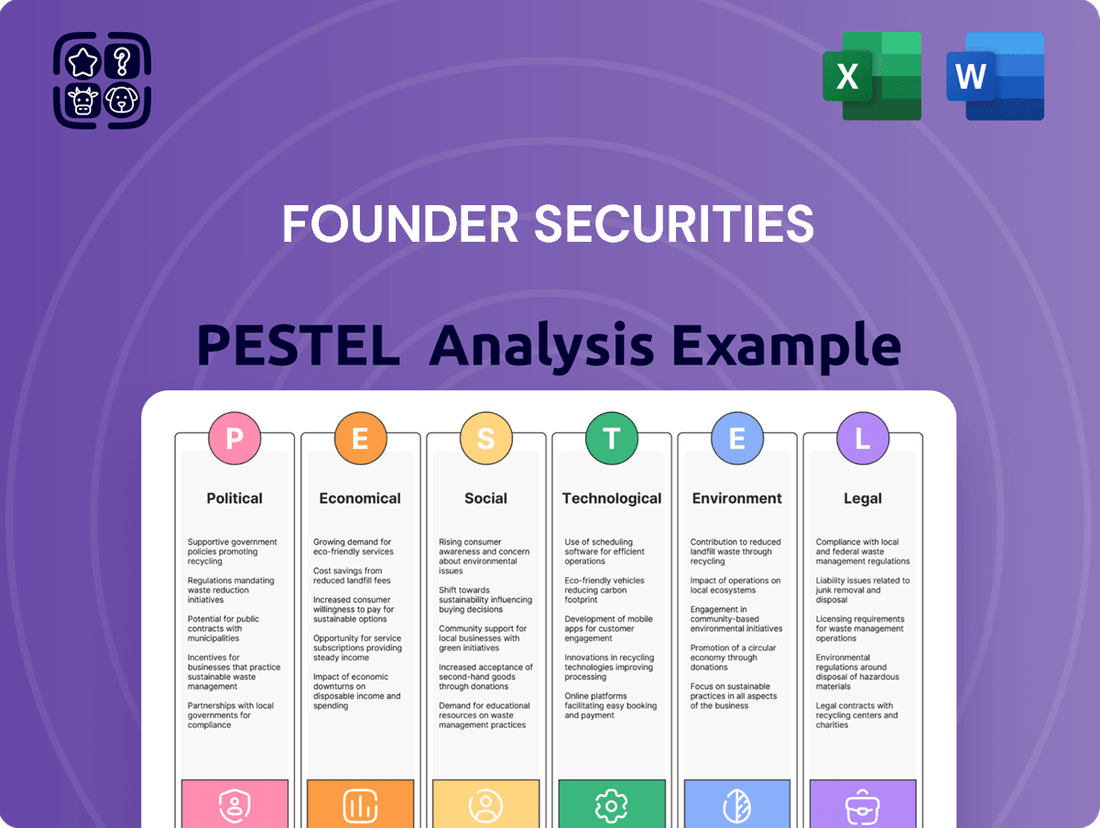

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Founder Securities across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It highlights key opportunities and threats stemming from these factors, offering actionable insights for strategic decision-making and future planning.

Provides a clear, actionable summary of Founder Securities' PESTLE analysis, offering a quick reference to navigate complex external factors and mitigate potential risks.

Helps support discussions on external risk and market positioning during planning sessions by distilling the PESTLE analysis into easily digestible insights.

Economic factors

China's economy showed impressive strength, achieving a 5.4% GDP growth in the first quarter of 2025. This robust performance signals a stable and supportive environment for financial services firms like Founder Securities.

This consistent economic expansion directly benefits Founder Securities by fostering client investment activities and bolstering overall market confidence. A healthy economy typically leads to higher trading volumes and increased demand for investment banking and asset management services.

China's economic strategy for 2024 involves a 'moderately loose' monetary policy, designed to inject liquidity and encourage borrowing, alongside an increased fiscal deficit ceiling of 4% of GDP. This dual approach aims to spur domestic consumption and investment, crucial for sustained growth.

While these measures are intended to stimulate the economy, their immediate effect on consumer and business confidence could be limited, as seen in recent consumer sentiment surveys showing cautious optimism rather than robust recovery. Founder Securities needs to track how these policies translate into actual economic activity and investor sentiment.

The effectiveness of these policies will directly impact Founder Securities by influencing market liquidity, interest rate environments, and overall investor appetite for risk. A looser monetary stance typically lowers borrowing costs, potentially boosting trading volumes and asset valuations, while fiscal stimulus can support infrastructure and consumer spending, creating opportunities for investment banking services.

The Chinese capital market is increasingly attracting global attention, with a notable surge in foreign capital flowing into yuan assets and mainland stocks observed in the latter half of April 2025. This influx signals a growing appetite among international investors for Chinese financial instruments, translating into a more dynamic trading environment.

Founder Securities, as a key player facilitating transactions across diverse financial products, is well-positioned to capitalize on this trend. The firm's ability to support trading in these growing markets directly benefits from the renewed confidence of foreign investors and the broader trend of capital market liberalization in China.

Interest Rate Environment and Bank Margins

The interest rate environment in China is poised for a more measured approach in 2025, which should offer some relief to bank margins. By the third quarter of 2024, these margins had settled at 1.53%. While Founder Securities, as a securities firm, experiences these influences differently than traditional banks, the overall interest rate landscape significantly shapes the profitability of fixed-income investments and the cost of capital for businesses seeking funding.

Founder Securities' operations, particularly its bond trading and underwriting activities, will need to be agile and responsive to these evolving interest rate dynamics. A stable or gradually adjusting rate environment can create more predictable conditions for these services.

- Interest Rate Outlook: Expect more cautious interest rate adjustments in China during 2025.

- Bank Margin Impact: Bank net interest margins, at 1.53% in Q3 2024, may see reduced downward pressure.

- Securities Firm Relevance: The broader interest rate environment affects fixed-income trading profitability and corporate borrowing costs.

- Founder Securities' Adaptation: Bond trading and underwriting services must adjust to these rate shifts.

Company-Specific Financial Performance

Founder Securities is demonstrating robust internal financial health, projecting a substantial 70-80% year-on-year increase in net income for the first half of 2025. This impressive growth trajectory highlights the effectiveness of their strategic initiatives and their strong standing within the financial services sector.

This positive financial outlook directly translates to enhanced stability and a more appealing profile for a broad range of clients, from individual investors to large institutions. Such performance underpins the company's capacity to support and expand its diverse service offerings.

- Projected Net Income Growth (H1 2025): 70-80% year-on-year increase.

- Implication: Strong internal management and market adaptation.

- Client Impact: Increased confidence and attractiveness for investors.

- Strategic Advantage: Supports expansion and sustainability of services.

China's economic trajectory in 2024-2025 presents a dynamic environment for Founder Securities. The nation's GDP growth, projected at a solid 5.4% for Q1 2025, indicates a stable backdrop for financial services. This expansion fuels client investment and boosts market confidence, directly benefiting firms like Founder Securities through increased trading volumes and demand for investment banking services.

The government's strategy for 2024, featuring a moderately loose monetary policy and a 4% fiscal deficit ceiling, aims to stimulate consumption and investment. While initial consumer sentiment surveys show cautious optimism, Founder Securities must monitor how these policies translate into tangible economic activity and investor behavior.

The increasing inflow of foreign capital into Chinese yuan assets and mainland stocks, particularly noted in late April 2025, underscores growing international investor confidence. Founder Securities is strategically positioned to leverage this trend, facilitating transactions and benefiting from a more liberalized capital market.

| Economic Indicator | Value/Projection | Period | Implication for Founder Securities |

|---|---|---|---|

| China GDP Growth | 5.4% | Q1 2025 | Stable market environment, increased client activity |

| Fiscal Deficit Ceiling | 4% of GDP | 2024 | Stimulus for domestic consumption and investment |

| Foreign Capital Inflow | Notable Surge | Late April 2025 | Increased trading opportunities, dynamic market |

| Bank Net Interest Margin | 1.53% | Q3 2024 | Indicates a measured interest rate environment |

Same Document Delivered

Founder Securities PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Founder Securities delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing actionable insights for strategic planning.

Sociological factors

The Chinese investment landscape is rapidly changing, with a younger, more digitally inclined population entering the market. By the end of 2024, it's estimated that over 60% of new retail investors in China are under 35, a significant increase from previous years. This demographic shift necessitates a move towards more intuitive, mobile-first financial platforms and personalized investment guidance.

Founder Securities must adapt its offerings to cater to these evolving preferences, emphasizing digital accessibility and tailored advice for individual clients. The demand for robo-advisory services and user-friendly trading apps is soaring, with fintech adoption rates in China reaching new heights in early 2025, exceeding 75% among urban millennials.

As China's financial markets mature, there's a noticeable surge in financial literacy. For instance, by the end of 2023, the number of retail investors in China's A-share market surpassed 220 million, indicating a broad base seeking financial knowledge. This growing awareness means investors are making more informed decisions and demanding greater transparency from financial institutions.

This trend directly benefits Founder Securities. As more people understand the importance of sound financial planning, the demand for sophisticated research and expert advisory services escalates. Founder Securities' ability to provide deep market insights and reliable guidance becomes a critical differentiator, attracting clients who are actively seeking to navigate the complexities of investment with professional support.

Societal awareness of Environmental, Social, and Governance (ESG) principles is surging in China, with government policies actively encouraging better and more frequent ESG disclosures. This growing emphasis is directly influencing investment strategies, as evidenced by the increasing demand from investors, including those managing private pensions, to incorporate ESG considerations into their portfolios.

Founder Securities has a clear opportunity to leverage this trend by creating and marketing financial products and services that are specifically tied to ESG performance. By aligning with this rising investor preference for sustainable options, the firm can tap into a significant and expanding market segment.

Impact of Social Stability and Trust

Social stability is a cornerstone of China's economic growth, directly influencing the operating environment for financial firms like Founder Securities. A secure society fosters confidence among investors, leading to more predictable market behavior and a greater willingness to participate in financial markets. For instance, China's commitment to social order has been a key factor in its sustained economic development over the past decades.

Trust is equally critical for Founder Securities. Maintaining high ethical standards and transparent operations is essential to build and preserve public confidence, especially as regulatory oversight in China's financial sector intensifies. The China Securities Regulatory Commission (CSRC) has been actively promoting stricter compliance and investor protection measures, underscoring the importance of trust in market functioning.

- Social Stability: China's sustained economic momentum is underpinned by its stable social and political environment, which provides a predictable landscape for financial institutions.

- Investor Confidence: Social stability directly correlates with investor confidence, a crucial element for market liquidity and the growth of securities firms like Founder Securities.

- Public Trust: Ethical conduct and transparency are paramount for Founder Securities to maintain public trust, especially in light of increased regulatory focus on financial market integrity in China.

- Regulatory Environment: The CSRC's ongoing efforts to enhance market regulation and investor protection highlight the critical role of trust and stability in the financial sector.

Wealth Accumulation and Demand for Asset Management

China's burgeoning middle class is a key driver for asset management services. As more individuals accumulate wealth, the need for sophisticated financial planning and investment solutions grows. This trend presents a substantial opportunity for Founder Securities to expand its asset management division by offering tailored services.

The increasing disposable income and savings rates among Chinese households, particularly the middle class, directly fuel demand for wealth accumulation strategies. For instance, by the end of 2023, China's household savings rate saw a notable increase, indicating a larger pool of capital seeking investment. This demographic shift is a powerful catalyst for Founder Securities' growth.

- Growing Middle Class: China's middle-income population is projected to reach over 600 million people by 2025, a significant increase from previous years.

- Increased Savings: Household savings in China have consistently risen, with reports indicating a substantial uptick in 2023, surpassing previous benchmarks.

- Demand for Services: This wealth accumulation translates into a direct demand for diversified asset management products and personalized financial advice.

- Founder Securities Opportunity: The company is well-positioned to capture this demand by offering a spectrum of services, from basic investment accounts to complex wealth preservation strategies.

Societal shifts in China, such as a younger, digitally savvy investor base and a growing middle class, are reshaping demand for financial services. Founder Securities must cater to these evolving preferences by enhancing digital platforms and offering personalized advice, as fintech adoption among urban millennials exceeded 75% in early 2025.

The increasing financial literacy and demand for ESG-compliant investments present opportunities for Founder Securities to provide sophisticated research and sustainable financial products. Social stability and public trust, bolstered by regulatory oversight from bodies like the CSRC, are crucial for investor confidence and market participation.

| Sociological Factor | Description | Impact on Founder Securities | Supporting Data (2024/2025 Estimates) |

|---|---|---|---|

| Demographic Shift | Younger, digitally native population entering investment markets. | Need for intuitive, mobile-first platforms and personalized digital advice. | Over 60% of new retail investors in China under 35 by end of 2024. |

| Financial Literacy | Increased investor awareness and demand for informed decision-making. | Opportunity to provide deep market insights and expert advisory services. | Retail investors in A-share market surpassed 220 million by end of 2023. |

| ESG Awareness | Growing societal emphasis on Environmental, Social, and Governance principles. | Demand for ESG-focused financial products and services. | Government policies actively encouraging ESG disclosures; increasing investor demand for ESG integration. |

| Social Stability & Trust | Foundation for investor confidence and predictable market behavior. | Requirement for high ethical standards, transparency, and regulatory compliance. | China's commitment to social order supports sustained economic development; CSRC enhancing investor protection measures. |

Technological factors

China's financial sector is undergoing a significant digital transformation, with a national action plan targeting a highly digitalized financial system by the close of 2027. This initiative focuses on bolstering digital management and enhancing digital financial products and services. Founder Securities must prioritize substantial investments in its digital infrastructure and capabilities to maintain its competitive edge. This includes developing seamless online brokerage platforms, advanced digital advisory tools, and highly efficient asset management solutions to meet evolving client demands.

The financial sector is rapidly adopting advanced technologies like cloud computing and artificial intelligence (AI) to drive digital transformation, with regulators increasingly supporting this trend. AI is fundamentally reshaping how financial services operate, impacting everything from decision-making processes to risk management frameworks.

Founder Securities can harness AI's capabilities for sophisticated data analysis, enabling more precise algorithmic trading strategies and personalized client experiences. Furthermore, AI integration can significantly bolster risk assessment accuracy, ultimately enhancing operational efficiency and strengthening the firm's competitive standing in the evolving market landscape.

China's FinTech market is experiencing explosive growth, valued at an estimated USD 4.59 trillion in 2024. This sector is forecast to nearly double, reaching USD 9.97 trillion by 2030, fueled by rapid technological advancements and changing consumer demands. Founder Securities can capitalize on this by innovating in areas like digital payments and personal finance solutions.

Cybersecurity and Data Security Requirements

The increasing reliance on digital platforms within the financial sector, particularly for firms like Founder Securities, makes robust cybersecurity and data security paramount. China's commitment to data protection is evident through its Personal Information Protection Law (PIPL) and Data Security Law (DSL), enacted to govern data handling and privacy. Failure to adhere to these regulations can result in significant penalties, impacting operational continuity and market reputation.

Founder Securities must invest heavily in advanced security infrastructure to protect sensitive client data and financial transactions from evolving cyber threats. This includes implementing multi-factor authentication, regular security audits, and employee training programs. By prioritizing these measures, the company can build and maintain client trust, a critical factor for sustained growth in the competitive FinTech landscape.

The financial implications of a data breach can be severe. For instance, in 2023, the global average cost of a data breach reached $4.45 million, according to IBM's Cost of a Data Breach Report. Founder Securities needs to factor in these potential costs when allocating resources to cybersecurity, ensuring compliance and operational resilience.

Key considerations for Founder Securities regarding cybersecurity and data security include:

- Compliance with PIPL and DSL: Ensuring all data processing activities align with China's stringent data protection laws.

- Investment in Advanced Security Technologies: Deploying cutting-edge solutions to detect and prevent cyberattacks.

- Client Data Protection: Implementing robust measures to safeguard personal and financial information against unauthorized access.

- Building Trust through Transparency: Communicating security protocols and data handling practices openly with clients.

Development of Digital Public Service Platforms

The development of digital public service platforms is a significant technological factor for Founder Securities. These platforms aim to provide shared technological infrastructure and resources, specifically supporting the digital transformation of financial institutions within the securities and futures sectors. For instance, by mid-2024, China's Securities Regulatory Commission (CSRC) has been actively promoting the integration of digital technologies to enhance efficiency and compliance across the industry.

Founder Securities can leverage these platforms to potentially reduce its own development costs associated with digital initiatives. By integrating with these shared resources, the company can gain access to advanced capabilities for trading systems and market data provision, thereby improving its service delivery to clients. This move aligns with broader industry trends, as evidenced by the increasing investment in fintech solutions by major financial institutions globally, with many seeking to enhance customer experience through digital channels.

The strategic adoption of these digital public service platforms could enable Founder Securities to:

- Accelerate digital transformation efforts by utilizing pre-built infrastructure and services.

- Reduce operational costs through shared resources and economies of scale offered by the platforms.

- Enhance service offerings by integrating advanced trading and real-time market data capabilities.

- Improve regulatory compliance by adopting standardized digital solutions promoted by public platforms.

Technological advancements are reshaping China's financial landscape, with a national push for a highly digitalized system by 2027. Founder Securities must invest in digital infrastructure, including online platforms and AI-driven tools, to remain competitive and meet evolving client expectations. The firm can leverage AI for enhanced data analysis, algorithmic trading, and personalized client experiences, while also strengthening risk management.

China's FinTech market is booming, projected to reach USD 9.97 trillion by 2030 from USD 4.59 trillion in 2024, presenting opportunities for Founder Securities in areas like digital payments. However, the increasing reliance on digital platforms necessitates robust cybersecurity measures, with China's PIPL and DSL laws emphasizing data protection. The global average cost of a data breach in 2023 was $4.45 million, highlighting the financial imperative for Founder Securities to invest in advanced security to protect client data and maintain trust.

The development of digital public service platforms offers Founder Securities a chance to reduce costs and accelerate its digital transformation by utilizing shared infrastructure. These platforms can provide advanced trading systems and market data, improving service delivery and regulatory compliance. By mid-2024, the CSRC is actively promoting digital integration, aligning with global trends of fintech investment aimed at enhancing customer experience.

| Key Technological Factors | Impact on Founder Securities | Data/Statistics |

|---|---|---|

| Digital Transformation Push | Need for investment in digital infrastructure and services | Target: Highly digitalized financial system by 2027 |

| AI and Advanced Technologies | Opportunities for enhanced trading, risk management, and client experience | AI adoption is reshaping financial services operations |

| FinTech Market Growth | Potential for innovation in digital payments and personal finance | Market valued at USD 4.59 trillion in 2024, projected to reach USD 9.97 trillion by 2030 |

| Cybersecurity and Data Protection | Critical need for robust security to comply with PIPL/DSL and prevent breaches | Global average cost of data breach in 2023: $4.45 million |

| Digital Public Service Platforms | Cost reduction and accelerated digital adoption through shared resources | CSRC promoting digital integration mid-2024 |

Legal factors

The China Securities Regulatory Commission (CSRC) has significantly reshaped the capital markets landscape through a series of new regulations introduced in 2024 and continuing into 2025. These measures, including the influential 'new National Nine Articles' and targeted directives on program trading, directly impact the operational environment for companies like Founder Securities.

These new guidelines are designed to bolster oversight for initial public offerings (IPOs), enhance transparency for listed companies, and refine the operational standards for brokerage firms. Founder Securities' compliance with these evolving rules, such as those affecting capital requirements and information disclosure, is critical for maintaining its operating licenses and avoiding potential sanctions.

China's ongoing efforts to refine its foreign investment landscape, including revised measures in November 2024, are significantly reducing barriers and expanding market access for international players. These legal adjustments aim to foster greater foreign participation in the nation's capital markets, lowering investment thresholds for listed companies.

Founder Securities needs to be acutely aware of these evolving foreign investment regulations. Understanding and adapting to these legal shifts is crucial for the firm to effectively attract and serve a growing international client base, thereby unlocking significant cross-border business expansion opportunities.

China's data protection landscape, shaped by the Personal Information Protection Law (PIPL) and Data Security Law (DSL), mandates strict protocols for financial institutions like Founder Securities. These regulations govern every stage of data handling, from collection to secure storage, impacting how sensitive client information is managed.

Founder Securities must adhere to these stringent requirements to safeguard client data, as non-compliance carries substantial legal penalties and can severely damage its reputation. For instance, the PIPL, enacted in November 2021, introduced significant fines, potentially reaching up to 5% of annual turnover or RMB 50 million for serious violations.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF)

As a securities firm, Founder Securities is subject to stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. While specific 2024-2025 data isn't provided, the company's operations necessitate robust systems to identify and report suspicious transactions, aligning with global financial crime prevention efforts. Failure to comply can result in significant penalties and reputational damage.

Founder Securities must continuously update its internal controls and training programs to meet evolving AML/CTF standards. This includes Know Your Customer (KYC) procedures and transaction monitoring. For instance, in 2023, global financial institutions reported billions in AML fines, highlighting the critical importance of robust compliance frameworks.

- Regulatory Scrutiny: Financial regulators worldwide, including those in China, impose strict AML/CTF requirements on securities companies.

- Compliance Costs: Maintaining effective AML/CTF programs involves significant investment in technology, personnel, and ongoing training.

- International Standards: Founder Securities must adhere to recommendations from bodies like the Financial Action Task Force (FATF) to ensure international compliance.

- Risk Management: Proactive AML/CTF measures are essential for mitigating legal, financial, and reputational risks associated with illicit financial activities.

Corporate Governance and Shareholder Obligations

The amended PRC Company Law, effective July 2024, significantly bolsters shareholder obligations and aims to foster a healthier capital market. This legal shift directly influences corporate governance standards for all listed entities, including those Founder Securities advises.

Founder Securities, especially within its investment banking and underwriting capacities, must ensure its advisory services are fully compliant with these elevated corporate governance mandates. This includes guiding clients to meet their newly defined legal responsibilities, a crucial aspect for maintaining market trust and regulatory adherence.

- Enhanced Shareholder Duties: The 2024 PRC Company Law revision places greater emphasis on the responsibilities of shareholders, moving beyond mere rights.

- Capital Market Soundness: The legislation is designed to promote stability and integrity within China's capital markets.

- Impact on Securities Firms: Firms like Founder Securities need to adapt their advisory models to reflect these stricter governance and shareholder accountability rules.

The evolving legal framework in China, particularly the 'new National Nine Articles' and directives on program trading effective in 2024 and 2025, directly shapes Founder Securities' operational environment. Adherence to updated IPO oversight, transparency requirements, and brokerage standards is vital for maintaining licenses and avoiding penalties.

China's revised foreign investment regulations, with significant adjustments in late 2024, are lowering market access barriers for international players. Founder Securities must navigate these changes to effectively serve a growing international client base and capitalize on cross-border opportunities.

Stringent data protection laws, including the PIPL and DSL, mandate strict protocols for handling sensitive client information, with substantial fines for non-compliance, potentially up to 5% of annual turnover. Founder Securities must maintain robust data security measures to protect client data and its reputation.

Environmental factors

China's commitment to green finance is accelerating, with 2024 seeing substantial policy advancements. Directives like the 'Opinions on Comprehensively Promoting the Construction of a Beautiful China' are fostering a supportive ecosystem for green financial systems. This includes a notable uptick in green bond issuance, with China's green bond market reaching approximately $140 billion in the first half of 2024, according to preliminary estimates.

This policy landscape actively encourages innovation in climate finance and the expansion of sustainable investment products. Founder Securities can capitalize on this momentum by broadening its portfolio to include a wider array of green bonds, green funds, and other environmentally conscious investment vehicles, aligning with both national objectives and growing investor demand for sustainable options.

China's ESG disclosure landscape saw significant evolution in 2024. Stock exchanges released sustainability reporting guidelines, and the Ministry of Finance finalized foundational principles that align with the International Sustainability Standards Board (ISSB). This sets the stage for mandatory ESG disclosures for specific companies starting in 2026, impacting Founder Securities' advisory services.

Founder Securities' research and investment banking arms will need to adapt to these changes. Analyzing and advising on ESG disclosures, and potentially aiding clients in meeting these new obligations, will become crucial. Integrating ESG factors into their investment analysis will be key to navigating this evolving regulatory environment.

The market for green financial instruments is evolving, with green bond issuances experiencing a dip in 2024, while green loans demonstrated robust expansion. Transition-related bonds and green insurance saw notable increases in activity. Adding to this, China launched its inaugural sovereign RMB green bond in April 2025, signaling further diversification in this sector.

Climate Change Risk Management in Finance

The financial sector is increasingly prioritizing climate change, pushing for the integration of climate-related risk assessments into all investment and financing decisions. This shift is driven by a growing understanding of how environmental factors can impact financial stability and returns.

Financial institutions like Founder Securities are being encouraged to incorporate biodiversity considerations into their lending and investment strategies, alongside enhancing overall risk management frameworks. This holistic approach aims to build resilience against environmental shocks.

Founder Securities must cultivate specialized knowledge in evaluating climate risks and identifying green opportunities for its clientele and its own investment portfolio. This development is crucial for aligning with China's national objectives for a sustainable, low-carbon economic transition, a goal reinforced by significant government investment in green technologies and infrastructure throughout 2024 and projected into 2025.

- Green Finance Growth: The global green finance market is expanding rapidly, with sustainable bonds issuance projected to exceed $1 trillion in 2024, demonstrating a clear market trend towards environmentally conscious investing.

- Regulatory Push: Regulators worldwide, including those in China, are introducing stricter disclosure requirements for climate-related financial risks, compelling firms to actively manage these exposures.

- Biodiversity Impact: Studies from organizations like the World Economic Forum highlight that over half of global GDP has a moderate or high dependence on nature, underscoring the financial materiality of biodiversity loss.

Carbon Market Development and Carbon Finance

China's national carbon market is poised for significant growth, with plans to extend its reach beyond the power sector to include heavy emitters like steel, cement, and aluminum by 2025. This expansion is anticipated to inject considerable vitality into the market, fostering new avenues for carbon finance. The trading of China Certified Emission Reduction (CCER) units and associated financial instruments is expected to surge, offering lucrative opportunities.

Founder Securities can strategically position itself to capitalize on these developments by offering specialized carbon market services. These could include expert advisory for companies navigating compliance and participation, as well as brokerage services for facilitating the trading of carbon credits and related financial products. This proactive engagement aligns with the evolving environmental landscape and presents a clear path for revenue generation and market differentiation.

- Market Expansion: China's carbon market to cover steel, cement, and aluminum by 2025, significantly increasing covered emissions.

- Carbon Finance Growth: Anticipated surge in CCER trading and development of new financial products linked to carbon reduction.

- Founder Securities Opportunity: Potential to offer advisory and brokerage services for clients participating in the expanding carbon market.

China's commitment to environmental sustainability is driving significant policy shifts, with green finance and ESG disclosures becoming central. The nation's carbon market is set to expand, covering key industries like steel and cement by 2025, creating new financial opportunities. Founder Securities can leverage these trends by developing expertise in green finance, carbon trading, and ESG advisory services.

| Environmental Factor | 2024/2025 Trend | Impact on Founder Securities | Key Data/Projections |

|---|---|---|---|

| Green Finance & Investment | Accelerated policy support, increased green bond issuance, growth in green loans. | Opportunity to expand green product offerings, advise on sustainable investments. | Global sustainable bonds issuance projected to exceed $1 trillion in 2024. China's sovereign RMB green bond launched April 2025. |

| ESG Disclosure Requirements | Evolving regulatory landscape, new sustainability reporting guidelines, alignment with ISSB standards. | Need to adapt advisory services for ESG compliance, integrate ESG into investment analysis. | Mandatory ESG disclosures expected for some companies starting 2026. |

| Carbon Market Expansion | Extension of national carbon market to steel, cement, aluminum by 2025; surge in CCER trading. | Potential to offer specialized carbon market advisory and brokerage services. | China's carbon market to cover major industrial emitters by 2025. |

| Climate Risk Integration | Increased focus on integrating climate-related risk assessments into financial decisions. | Develop expertise in evaluating climate risks and identifying green opportunities. | Over half of global GDP has moderate to high dependence on nature (WEF). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Founder Securities draws from a diverse range of data sources, including official financial reports from regulatory bodies, economic indicators from reputable institutions like the IMF and World Bank, and industry-specific market research. We also incorporate insights from technological trend analyses and relevant legal and policy updates.