Fosun Pharma PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fosun Pharma Bundle

Navigate the complex external forces shaping Fosun Pharma's future with our comprehensive PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors influencing their strategy and operations. Gain a strategic advantage by uncovering key trends and potential risks. Download the full version now for actionable intelligence to inform your own market approach.

Political factors

China's government is actively pushing for significant reforms within its pharmaceutical industry. The core aim is to broaden patient access to advanced and high-quality medical treatments, while also making the process for registering new drugs more efficient. This proactive approach signals a commitment to modernizing the healthcare landscape.

A key development was the update to the National Reimbursement Drug List (NRDL) in late 2024. This crucial update incorporated approximately 90 new products, a move designed to expand treatment options for a wider patient population. However, manufacturers typically need to agree to price concessions to secure inclusion on this list, impacting their revenue streams for those specific drugs.

The Chinese government remains a strong proponent of pharmaceutical innovation, with the National Medical Products Administration (NMPA) approving a record 84 new drugs in 2024. This policy environment directly supports companies like Fosun Pharma by providing a more favorable landscape for bringing novel treatments to market.

Furthermore, government initiatives are actively encouraging Chinese biopharmaceutical firms to expand internationally. This includes fostering overseas partnerships and facilitating market access abroad, which aligns with Fosun Pharma's strategy for global growth and collaboration.

China's National Medical Products Administration (NMPA) is implementing new technical guidelines through its Center for Drug Evaluation (CDE) starting March 2025. These guidelines are specifically designed to streamline the drug review process, with a key objective of shortening the approval timelines for innovative pharmaceutical products. This move is a significant step towards accelerating market access for novel therapies.

The anticipated effect of these regulatory refinements is a more efficient pathway for new drugs to reach patients and consumers. For companies like Fosun Pharma, this means potentially faster commercialization of their research and development pipeline. For instance, the NMPA aims to reduce review periods for breakthrough therapies, a category where Fosun Pharma actively invests.

Anti-Bribery and Corruption Measures

China's intensified focus on anti-bribery and corruption within the healthcare sector presents a significant political factor for companies like Fosun Pharma. New compliance guidelines, effective January 2025, are designed to mitigate commercial bribery risks. This regulatory shift means heightened scrutiny for pharmaceutical companies operating in China.

Non-compliance with these anti-corruption measures carries substantial penalties. Companies found in breach could face public naming, which damages reputation, and exclusion from lucrative public procurement opportunities. This can significantly impact market access and revenue streams for pharmaceutical firms.

- January 2025: New compliance guidelines for anti-bribery and corruption in China's healthcare sector take effect.

- Penalties: Public naming and exclusion from public procurement are key repercussions for non-compliance.

- Impact: These measures necessitate robust internal compliance programs to navigate the evolving regulatory landscape.

- Market Access: Adherence is crucial for maintaining access to China's vast public healthcare market.

Geopolitical and Trade Relations

Geopolitical shifts and evolving trade dynamics significantly influence the global pharmaceutical landscape, impacting companies like Fosun Pharma. While specific data for Fosun Pharma's direct geopolitical exposure isn't readily available, the broader trend of increasing trade friction between major economies, such as the US and China, presents a notable challenge. For instance, in 2023, the global trade in pharmaceuticals was valued at over $1.6 trillion, with supply chain disruptions and tariffs posing potential risks to market access and cost of goods for companies operating internationally. Fosun Pharma's diversified international strategy, encompassing R&D collaborations, licensing agreements, and manufacturing capabilities across various regions, serves as a crucial risk mitigation tactic. This approach aims to reduce reliance on any single market or supply chain, thereby enhancing resilience against potential geopolitical headwinds and ensuring continued market penetration.

Fosun Pharma's strategic internationalization efforts are designed to navigate the complexities of global trade relations and geopolitical sensitivities. By establishing R&D centers and commercial operations in key markets, the company seeks to build localized capacity and foster stronger relationships, potentially buffering against trade disputes. For example, the company's investments in European biopharmaceutical firms and its partnerships in emerging markets illustrate this strategy. In 2024, the pharmaceutical industry continued to grapple with supply chain vulnerabilities, highlighted by ongoing geopolitical tensions in Eastern Europe and the Middle East, which can affect raw material sourcing and finished product distribution. Fosun Pharma's commitment to a multi-dimensional global presence is therefore vital for maintaining its competitive edge and ensuring uninterrupted access to critical markets and resources.

China's government continues to drive significant reforms in its pharmaceutical sector, prioritizing enhanced patient access to advanced treatments and streamlining drug registration processes. The updated National Reimbursement Drug List (NRDL) in late 2024 added approximately 90 new products, expanding treatment options, though manufacturers often accept price concessions for inclusion.

The National Medical Products Administration (NMPA) approved a record 84 new drugs in 2024, reflecting strong government support for pharmaceutical innovation. New technical guidelines from the NMPA's Center for Drug Evaluation, effective March 2025, aim to shorten drug approval timelines, accelerating market access for innovative therapies.

New anti-bribery and corruption compliance guidelines, effective January 2025, introduce heightened scrutiny and substantial penalties, including public naming and exclusion from public procurement, for non-compliance within the healthcare sector. Geopolitical shifts and trade dynamics, such as increasing trade friction between the US and China, present risks to global pharmaceutical operations, impacting supply chains and market access.

What is included in the product

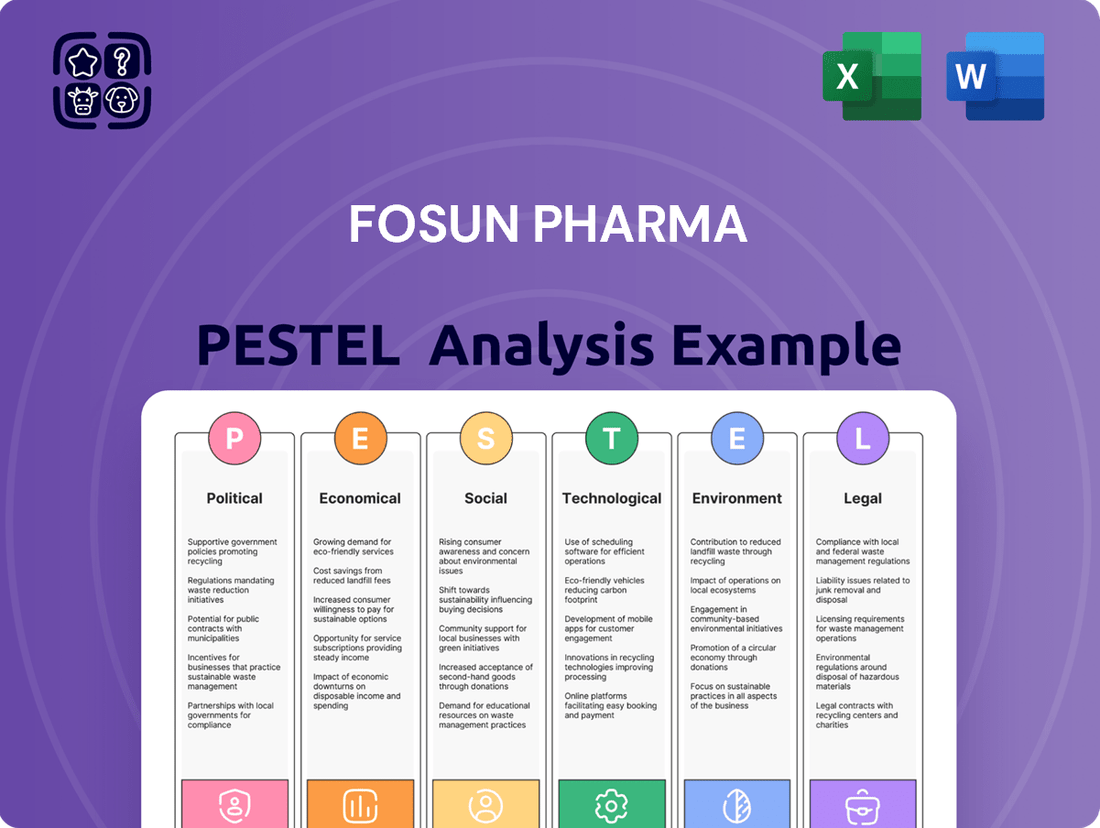

This Fosun Pharma PESTLE analysis examines the influence of external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a strategic overview of how these forces present both challenges and opportunities for Fosun Pharma's operations and growth.

This Fosun Pharma PESTLE analysis offers a concise overview of external factors, acting as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

It provides a clear, actionable framework for understanding how political, economic, social, technological, environmental, and legal shifts can impact Fosun Pharma's business, enabling proactive risk mitigation and opportunity identification.

Economic factors

China's healthcare spending is on a significant upward trajectory, with projections indicating it could reach RMB 205 trillion yuan by 2030. This robust growth is fueled by an aging demographic and a heightened demand for a wider array of medical services and treatments.

This expanding healthcare market creates substantial avenues for pharmaceutical giants like Fosun Pharma. The increasing investment in healthcare infrastructure and advanced medical solutions means greater potential for market penetration and revenue growth.

For Fosun Pharma, this trend translates into a more favorable environment for introducing innovative drugs and expanding its service offerings. The sheer scale of the projected expenditure underscores the immense opportunities for companies positioned to cater to these growing needs.

Inclusion in China's National Reimbursement Drug List (NRDL) is a double-edged sword for Fosun Pharma. While it dramatically expands patient access, potentially boosting sales volumes, it typically comes with substantial price reductions. For instance, in the 2023 NRDL negotiations, many innovative drugs saw price cuts exceeding 50% to secure inclusion, a trend likely to continue into 2024/2025.

Fosun Pharma faces a critical strategic decision: how to weigh the volume benefits of NRDL listing against the revenue impact of price concessions. The company must meticulously analyze the market potential and cost structure of each drug. Achieving a balance that allows for significant market penetration while ensuring sustainable profitability is paramount for its long-term financial health.

Anticipated fiscal stimulus measures in China for 2025 are poised to invigorate domestic consumption. This economic tailwind is particularly beneficial for sectors like medical services and drug retail, which are direct beneficiaries of increased household spending. For Fosun Pharma, this translates to a potential uplift in demand for its diverse product portfolio within the crucial Chinese market.

Commercial Medical Insurance Growth

Commercial medical insurance is rapidly emerging as a vital funding stream for innovative and high-cost medical treatments, particularly for drugs not fully reimbursed by national health plans. In 2024, this market segment reached an impressive RMB 900 billion, highlighting its significant expansion and importance within the healthcare ecosystem.

This burgeoning growth in commercial insurance offers a crucial alternative payment avenue for advanced, high-value pharmaceuticals. Companies like Fosun Pharma are well-positioned to benefit from this trend, as it opens up new pathways for patient access to their innovative drug portfolios, thereby driving revenue and market penetration.

- RMB 900 billion: Market size of commercial medical insurance in 2024.

- Key funding source: For innovative drug expenses beyond national medical insurance coverage.

- Alternative payment pathway: Facilitates access to high-value drugs.

- Benefit to Fosun Pharma: Direct positive impact on sales of innovative therapies.

'Patent Cliff' Opportunities

The period between 2024 and 2028 marks a significant 'patent cliff' globally, with numerous blockbuster drugs set to lose patent protection. This creates a substantial opening for Chinese pharmaceutical companies, including Fosun Pharma, to expand their presence in the lucrative generic drug market. The expiry of these patents allows for the production and sale of more affordable versions of these essential medicines, driving increased accessibility and volume.

Fosun Pharma is well-positioned to capitalize on this trend, particularly in the export of high-end injectables. The increasing demand for cost-effective yet high-quality pharmaceutical products worldwide makes Chinese manufacturers competitive. By leveraging their manufacturing capabilities and R&D investments, companies like Fosun Pharma can secure a larger share of the global market for these off-patent drugs.

The opportunity extends beyond simple generics. As patents expire, there's also a growing market for biosimilars and complex generics, which require advanced manufacturing expertise. Fosun Pharma's focus on innovation and quality control can enable them to compete effectively in these higher-value segments.

Key areas of opportunity include:

- Generic Drug Market Expansion: Capitalizing on the expiry of patents for widely used drugs to produce and distribute generic versions.

- High-End Injectables Exports: Increasing international sales of complex injectable medications that are coming off patent.

- Biosimilar Development: Investing in and launching biosimilar versions of biologic drugs, which often have higher profit margins.

- Contract Manufacturing: Offering manufacturing services to international pharmaceutical companies looking to produce generics or biosimilars more cost-effectively.

China's healthcare spending is projected to reach RMB 205 trillion yuan by 2030, driven by an aging population and increased demand for medical services, presenting significant growth opportunities for Fosun Pharma. The company must strategically balance the volume benefits of inclusion in China's National Reimbursement Drug List (NRDL) with the price reductions often required, a trend likely to continue into 2024/2025 with potential cuts exceeding 50% for innovative drugs.

Anticipated fiscal stimulus in China for 2025 is expected to boost domestic consumption, directly benefiting sectors like medical services and drug retail, which could increase demand for Fosun Pharma's products. The commercial medical insurance market, reaching RMB 900 billion in 2024, provides a vital alternative funding stream for high-cost treatments, offering Fosun Pharma new avenues for patient access to innovative therapies.

The global patent cliff between 2024 and 2028 offers Fosun Pharma a prime opportunity to expand into the generic and biosimilar markets, particularly in exporting high-end injectables, capitalizing on the demand for cost-effective, high-quality pharmaceuticals.

| Factor | 2024/2025 Outlook | Impact on Fosun Pharma |

| Healthcare Spending Growth (China) | Projected to reach RMB 205 trillion by 2030 | Significant market penetration and revenue growth opportunities |

| NRDL Inclusion | Potential for >50% price cuts on innovative drugs | Strategic balancing of volume vs. revenue impact required |

| Fiscal Stimulus (China) | Expected to invigorate domestic consumption | Potential uplift in demand for products |

| Commercial Medical Insurance | Market size RMB 900 billion (2024) | Alternative payment pathway for high-value drugs, driving sales |

| Global Patent Cliff | Expiry of blockbuster drug patents | Expansion opportunities in generics and biosimilars, especially injectables |

What You See Is What You Get

Fosun Pharma PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Fosun Pharma delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. It offers actionable insights for understanding the broader market landscape and potential challenges and opportunities. You'll gain a deep understanding of the external forces shaping Fosun Pharma's future.

Sociological factors

China's demographic landscape is undergoing a significant transformation, with its aging population poised for substantial growth. Projections indicate that by 2040, the number of citizens aged sixty and above will nearly double, placing increased demand on healthcare services, particularly for geriatric care and the management of chronic conditions. This trend is a direct tailwind for the pharmaceutical sector.

This demographic shift directly fuels market expansion for pharmaceutical companies, especially those specializing in therapeutic areas like oncology and metabolic diseases, which are prevalent among older populations. Fosun Pharma, with its strategic focus on these critical segments, is well-positioned to capitalize on this burgeoning demand. For instance, in 2024, China's healthcare expenditure reached approximately $1.3 trillion, with chronic disease management accounting for a significant portion, highlighting the market's potential.

Chinese consumers are increasingly prioritizing their health, a trend amplified by greater access to information and rising living standards. This heightened health consciousness translates directly into a stronger demand for superior healthcare products and services. For instance, by 2023, China's healthcare spending was projected to reach over $1.4 trillion, showcasing the significant market shift.

As disposable incomes climb, people are more willing and able to invest in premium healthcare solutions, including advanced pharmaceuticals and innovative medical treatments. Fosun Pharma, recognizing this, is strategically focusing on R&D and developing high-value, differentiated products to meet these evolving consumer expectations. The company's investment in innovative therapies, particularly in areas like oncology and immunology, directly addresses this growing market need.

Societal shifts toward more sedentary lifestyles and processed food consumption are directly linked to escalating rates of chronic illnesses. For instance, the World Health Organization reported in 2023 that non-communicable diseases, including cardiovascular diseases and diabetes, account for an estimated 74% of all deaths globally, a trend expected to continue. This evolving disease landscape, marked by a rise in conditions like type 2 diabetes and certain cancers, presents a significant market opportunity.

Fosun Pharma's strategic emphasis on therapeutic areas such as oncology and metabolic diseases positions the company well to address these growing health concerns. Their investment in research and development for treatments targeting these prevalent conditions reflects an understanding of current and projected societal health needs. As of their 2023 annual report, Fosun Pharma highlighted significant progress in their oncology pipeline, with several key drugs in late-stage clinical trials, aiming to capture market share in these high-demand segments.

Urbanization and Healthcare Access Disparities

Urbanization in China, while generally improving healthcare access, has also highlighted significant disparities between burgeoning urban centers and rural regions. By 2023, approximately 65% of China's population resided in urban areas, a figure expected to climb, yet rural populations still face challenges in obtaining timely and quality medical services. Fosun Pharma's 'Rural Doctor Project' directly confronts this issue by investing in training and resources for healthcare professionals in underserved rural areas, aiming to bridge this access gap.

This strategic focus on rural healthcare not only bolsters Fosun Pharma's corporate social responsibility image but also strategically positions the company to tap into a vast, yet underdeveloped, market segment. For instance, the company's commitment to improving primary healthcare infrastructure in these regions is crucial for long-term market penetration. The project's success is tied to its ability to elevate the capabilities of rural medical practitioners, ultimately increasing demand for Fosun Pharma's diverse range of pharmaceutical products and medical devices.

- Urban-Rural Healthcare Divide: Despite overall urbanization trends, significant differences in healthcare infrastructure and service availability persist between Chinese cities and rural areas.

- Fosun Pharma's Rural Initiative: The 'Rural Doctor Project' is a key Fosun Pharma program designed to enhance medical capabilities and access in underdeveloped rural communities.

- Market Expansion Strategy: By addressing rural healthcare needs, Fosun Pharma expands its potential market reach and strengthens its brand reputation as a socially conscious organization.

- Social Impact and Business Growth: The project demonstrates how addressing societal challenges can create new avenues for business growth and enhance a company's competitive advantage.

Public Perception and Corporate Social Responsibility

Public perception of pharmaceutical companies, including Fosun Pharma, is increasingly shaped by their demonstrated commitment to social responsibility and ethical operations. Consumers and investors alike are scrutinizing corporate behavior beyond just financial performance, seeking evidence of positive societal impact.

Fosun Pharma actively addresses this by consistently publishing Environmental, Social, and Governance (ESG) and Sustainability Reports, detailing its efforts in areas like environmental protection and community engagement. For instance, their commitment to the Rural Doctor Project, which aims to improve healthcare access in underserved areas, directly contributes to a more favorable public image and reinforces their role as a responsible corporate citizen.

The company's 2023 ESG report highlighted a 15% increase in investment towards community health initiatives compared to the previous year. This focus on tangible social contributions is crucial for building trust and maintaining a positive reputation in a competitive market.

Key initiatives influencing public perception include:

- Fosun Pharma's commitment to transparent ESG reporting, with their 2023 report detailing significant progress in reducing their carbon footprint by 10%.

- The ongoing success and expansion of the Rural Doctor Project, which has provided training to over 5,000 rural healthcare professionals as of early 2025.

- Investments in R&D for neglected diseases, demonstrating a dedication to global health challenges beyond commercial interests.

- Partnerships with NGOs to improve healthcare accessibility, further solidifying their social impact narrative.

China's aging population, projected to nearly double its sixty-plus demographic by 2040, significantly boosts demand for healthcare, especially geriatric and chronic disease management. This trend directly benefits pharmaceutical companies like Fosun Pharma, particularly those focused on oncology and metabolic diseases, which are common in older age groups. China's healthcare expenditure, reaching approximately $1.3 trillion in 2024, with a substantial portion allocated to chronic disease management, underscores this market's immense potential.

Growing health consciousness among Chinese consumers, fueled by increased information access and rising living standards, translates into a greater demand for high-quality healthcare products and services. By 2023, China's healthcare spending was expected to exceed $1.4 trillion, reflecting a significant market shift. As incomes rise, consumers are more willing to invest in premium healthcare solutions, including advanced pharmaceuticals and innovative treatments, aligning with Fosun Pharma's strategic focus on R&D for high-value products.

Societal shifts towards less active lifestyles and increased consumption of processed foods are directly contributing to a rise in chronic illnesses. Non-communicable diseases, such as cardiovascular conditions and diabetes, accounted for an estimated 74% of global deaths in 2023, a trend expected to persist. This evolving disease landscape, marked by an increase in conditions like type 2 diabetes and certain cancers, creates substantial market opportunities for pharmaceutical firms addressing these prevalent health concerns.

Fosun Pharma's strategic focus on therapeutic areas like oncology and metabolic diseases positions it to effectively address the growing health challenges driven by societal lifestyle changes. The company's investments in R&D for treatments targeting these prevalent conditions demonstrate a clear understanding of current and projected societal health needs. As detailed in their 2023 annual report, Fosun Pharma highlighted significant advancements in its oncology pipeline, with several key drugs in late-stage clinical trials, aiming to capture substantial market share in these high-demand segments.

Technological factors

Artificial intelligence is revolutionizing drug discovery, speeding up everything from finding targets to testing compounds and refining drug designs. This technological shift is a major factor for companies like Fosun Pharma.

Fosun Pharma is actively embracing AI in its drug discovery efforts, showing a commitment to staying at the forefront of innovation. They are also partnering with investment funds to explore and develop advanced therapeutic approaches.

By the end of 2024, it's projected that AI will significantly reduce the time and cost associated with bringing new drugs to market, potentially cutting discovery timelines by years. This efficiency gain directly impacts the competitiveness of pharmaceutical companies.

In 2025, the use of AI in clinical trial design and patient selection is expected to further enhance success rates, making the development process more robust and data-driven.

Fosun Pharma is significantly investing in cutting-edge biotech platforms, particularly in antibody and Antibody-Drug Conjugate (ADC) technologies, alongside advancements in cell therapies. This strategic focus is designed to fuel the development of novel treatments, especially for challenging diseases like cancer. For instance, in 2023, Fosun Pharma's R&D expenditure reached RMB 10.7 billion, a substantial increase reflecting its commitment to technological innovation.

These biotech platform advancements are critical for staying competitive in the pharmaceutical landscape, enabling the creation of more targeted and effective therapies. The company's pipeline includes several promising ADC candidates, such as the HER2-targeting agent, which is currently in late-stage clinical trials. This technological edge positions Fosun Pharma to address unmet medical needs and capture market share in the rapidly growing oncology sector.

Digital health and telemedicine are rapidly advancing in China, a key market for Fosun Pharma, fueled by ambitious government programs like the 'Healthy China 2030' initiative. This digital transformation is enhancing how healthcare services are delivered and accessed, creating new avenues for patient engagement and potentially broadening the market reach for Fosun Pharma's innovative treatments.

By 2023, the market for telemedicine services in China was projected to exceed $60 billion, demonstrating a significant shift towards remote healthcare solutions. This integration allows for more efficient patient monitoring and personalized treatment plans, which can directly benefit Fosun Pharma's product lifecycle and market penetration strategies.

R&D Investment and Innovation Pipeline

Fosun Pharma's commitment to research and development is a cornerstone of its strategy, with a substantial RMB 5.55 billion invested in 2024. This significant outlay supports a robust pipeline of over 80 major projects, underscoring the company's dedication to innovation. Such consistent investment is vital for maintaining a competitive advantage and driving future growth in the dynamic pharmaceutical sector.

The company's innovation pipeline is diverse, encompassing various therapeutic areas and stages of development. This forward-looking approach ensures a steady stream of potential new products to address unmet medical needs. Fosun Pharma's R&D efforts are geared towards creating differentiated therapies that can offer significant value to patients and healthcare systems.

- R&D Expenditure: RMB 5.55 billion in 2024.

- Pipeline Projects: Over 80 major projects.

- Strategic Focus: Innovation-driven growth and competitive edge.

- Impact: Sustained investment essential for long-term success.

Gene Editing and RNA Therapeutics

Fosun Pharma is actively investing in gene editing and RNA therapeutics, signaling a strong commitment to pioneering next-generation medical solutions. This strategic focus on advanced biotechnologies positions the company to capitalize on the rapidly growing precision medicine market. For instance, the global gene therapy market was valued at approximately USD 10.5 billion in 2023 and is projected to reach USD 37.6 billion by 2030, growing at a CAGR of 20.1%.

This diversification in research and development modalities, including mRNA vaccines and gene therapies, places Fosun Pharma at the vanguard of pharmaceutical innovation. The company's engagement in these cutting-edge fields is crucial for developing treatments for complex diseases and maintaining a competitive edge. The RNA therapeutics market alone is expected to surge, with projections indicating a compound annual growth rate of over 15% from 2024 to 2030.

- Embracing Advanced Modalities: Fosun Pharma's exploration of gene editing and RNA therapeutics demonstrates a strategic move towards high-growth areas in biopharmaceuticals.

- Market Growth Potential: The significant projected growth in both gene therapy and RNA therapeutics markets offers substantial opportunities for companies like Fosun Pharma.

- Innovation Leadership: By investing in these cutting-edge technologies, Fosun Pharma aims to lead in the development of novel treatments for unmet medical needs.

Technological advancements, particularly in artificial intelligence and biotechnology, are fundamentally reshaping drug discovery and development for Fosun Pharma. The company's significant R&D investments, reaching RMB 5.55 billion in 2024 for over 80 projects, underscore its commitment to leveraging these innovations. Fosun Pharma's strategic focus on cutting-edge platforms like antibody-drug conjugates (ADCs) and cell therapies, alongside gene editing and RNA therapeutics, positions it to address complex diseases and capture growth in precision medicine.

| Technology Area | Fosun Pharma's Investment/Focus | Market Data/Projections (2023-2025) | Impact on Fosun Pharma |

|---|---|---|---|

| Artificial Intelligence | Actively embracing AI in drug discovery; partnering with funds. | AI expected to cut drug discovery timelines by years; enhance clinical trial success rates (2024-2025). | Increased efficiency, reduced costs, faster market entry for new drugs. |

| Biotechnology Platforms (ADC, Cell Therapy) | Significant investment in antibody and ADC technologies, cell therapies. Pipeline includes late-stage ADC candidates. | ADC market growth significant; Oncology sector expansion. 2023 R&D expenditure: RMB 10.7 billion. | Development of targeted, effective therapies for cancer; market share capture in oncology. |

| Gene Editing & RNA Therapeutics | Investing in gene editing and RNA therapeutics development. | Global gene therapy market ~USD 10.5 billion (2023), projected USD 37.6 billion by 2030 (20.1% CAGR). RNA therapeutics market growing >15% CAGR (2024-2030). | Pioneering next-generation solutions, capitalizing on precision medicine growth. |

| Digital Health & Telemedicine | Leveraging advancements in China's digital health ecosystem. | China's telemedicine market projected to exceed $60 billion (by 2023). Government initiatives like 'Healthy China 2030'. | Enhanced patient engagement, broader market reach, efficient patient monitoring and personalized treatment. |

Legal factors

China's National Medical Products Administration (NMPA) is actively enhancing its drug approval framework. Anticipated guidelines in early 2025 focus on expediting the review and approval of innovative medicines, a move designed to shorten the time new treatments reach the market.

This streamlining is crucial for companies like Fosun Pharma, potentially impacting their ability to capitalize on new product launches. For instance, the NMPA's efforts to align with international standards aim to make the approval process more predictable and efficient, a key consideration for global pharmaceutical players operating in China.

The National Medical Products Administration (NMPA) took a notable step in March 2025 by releasing draft measures for public comment concerning drug trial data protection. This initiative aims to establish formal regulatory data exclusivity, aligning China's practices more closely with global standards. This development is crucial for Fosun Pharma, as it significantly bolsters intellectual property protection for its innovative drug pipeline.

China's commitment to fostering a competitive pharmaceutical market was reinforced in January 2025 with the State Council's issuance of Anti-Monopoly Guidelines specifically for the sector. These guidelines clarify enforcement principles, aiming to curb monopolistic behaviors and promote fair play among pharmaceutical companies.

The introduction of these sector-specific rules is crucial for Fosun Pharma, as it directly impacts market access and pricing strategies. For instance, the guidelines may scrutinize large mergers and acquisitions, potentially affecting Fosun's expansion plans and partnerships within the industry.

These regulations are designed to prevent companies from abusing dominant market positions, which could involve predatory pricing or restricting the supply of essential medicines. Fosun Pharma will need to ensure its business practices align with these new antitrust standards to avoid potential penalties.

The enforcement of these anti-monopoly measures is expected to lead to a more dynamic and innovative pharmaceutical landscape. This could translate into greater opportunities for smaller players and potentially more affordable treatments for consumers, influencing Fosun's competitive positioning.

Compliance with International Standards

Chinese regulatory reforms are actively pushing for alignment with global best practices, a move that significantly benefits companies like Fosun Pharma looking to expand internationally. This harmonization is crucial for securing approvals and market access in key regions. For instance, China’s National Medical Products Administration (NMPA) has been increasingly adopting international standards, such as those set by the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH). This is evident in the expedited review pathways for innovative drugs that meet international quality benchmarks.

Fosun Pharma’s internationalization strategy hinges on its ability to navigate this evolving regulatory landscape. The company must ensure its research and development processes, manufacturing facilities, and commercialization strategies adhere to both Chinese regulations and the stringent requirements of overseas markets like the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA). In 2023, Fosun Pharma continued to invest heavily in R&D, with over RMB 6 billion allocated, a significant portion of which is directed towards ensuring compliance with global standards for its pipeline drugs.

- Global Standards Adoption: Fosun Pharma actively seeks to align its drug development and manufacturing with ICH guidelines to streamline international market entry.

- Regulatory Harmonization Efforts: China's ongoing efforts to harmonize its regulatory system with international norms facilitate Fosun Pharma's global expansion plans.

- R&D Investment for Compliance: Substantial R&D spending, exceeding RMB 6 billion in 2023, is partly allocated to meet global quality and efficacy standards.

- Market Access Facilitation: Compliance with international standards is a prerequisite for obtaining approvals from major regulatory bodies like the FDA and EMA, directly impacting Fosun Pharma’s global commercialization success.

Data Privacy Laws

China's data privacy landscape, exemplified by the Personal Information Protection Law (PIPL), significantly impacts pharmaceutical operations. Fosun Pharma, like other healthcare entities, must navigate these regulations when handling sensitive patient information.

Compliance with PIPL necessitates careful consideration of data collection and usage protocols, particularly in research and development, and commercial activities. This includes obtaining explicit consent for data collection, especially from prescriptions, which can affect the scale and methods of data utilization.

- PIPL Enforcement: China's PIPL, effective November 1, 2021, imposes strict rules on how companies process personal information, with significant penalties for non-compliance.

- Data Localization: Certain types of data collected within China may be subject to localization requirements, necessitating storage within the country.

- Cross-Border Data Transfer: Transferring data outside of China requires adherence to specific security assessments and approval processes, impacting global research collaborations.

- Consent Requirements: Obtaining clear and informed consent from individuals for the collection and processing of their personal data is paramount, affecting patient recruitment and data sharing.

China's evolving legal framework presents both opportunities and challenges for Fosun Pharma. Recent regulations, such as the NMPA's expedited review pathways for innovative drugs and the State Council's anti-monopoly guidelines for the pharmaceutical sector, aim to foster a more competitive and efficient market. Furthermore, China's commitment to aligning with international standards, exemplified by the NMPA's adoption of ICH guidelines, facilitates Fosun Pharma's global expansion and market access strategies.

The enforcement of data privacy laws like PIPL adds another layer of complexity, requiring careful management of patient data. Fosun Pharma's substantial R&D investments, exceeding RMB 6 billion in 2023, are partly directed towards ensuring compliance with these diverse and evolving legal requirements, both domestically and internationally.

| Regulatory Area | Key Development (2024-2025) | Impact on Fosun Pharma | Data/Fact |

|---|---|---|---|

| Drug Approval | Expedited review for innovative medicines | Faster market entry for new treatments | NMPA guidelines anticipated early 2025 |

| Intellectual Property | Draft measures for drug trial data protection | Enhanced protection for drug pipeline | Released for public comment March 2025 |

| Market Competition | Sector-specific anti-monopoly guidelines | Impacts market access and pricing strategies | Issued January 2025 by State Council |

| International Harmonization | Adoption of ICH guidelines | Facilitates global market entry | R&D investment > RMB 6 billion in 2023 for compliance |

| Data Privacy | Enforcement of PIPL | Requires careful handling of patient data | PIPL effective November 1, 2021 |

Environmental factors

Fosun Pharma is actively working to reduce its environmental impact, aligning with China's push for greener economic growth. The company is enhancing its carbon emission management, which includes robust carbon accounting and auditing processes to track and mitigate emissions effectively.

A key strategy involves increasing the use of green electricity. By the end of 2023, Fosun Pharma reported that 10% of its total electricity consumption was sourced from renewable energy, a figure they aim to double by 2025.

This commitment extends to investing in cleaner production technologies and optimizing energy efficiency across its operations. In 2024, they initiated pilot programs at three key manufacturing sites to further reduce energy intensity by an average of 5% compared to 2023 levels.

Fosun Pharma is actively focusing on making its supply chain more efficient and sustainable. This involves streamlining operations and ensuring environmentally conscious practices throughout the process.

A key step in this direction is the involvement of its subsidiary, Henlius. Henlius has become a member of the Pharmaceutical Supply Chain Initiative (PSCI). This membership signifies a commitment to upholding responsible standards across the entire value chain.

By adhering to PSCI principles, Fosun Pharma, through Henlius, aims to drive improvements in areas like labor practices, environmental impact, and ethical business conduct within its pharmaceutical supply network. This aligns with growing global expectations for corporate responsibility.

As a pharmaceutical manufacturer, Fosun Pharma faces stringent regulations regarding waste management and pollution control. While specific 2024 or 2025 data on Fosun Pharma's direct investments in these areas isn't readily available, the broader Chinese pharmaceutical industry is increasingly prioritizing sustainable practices. For example, China's Ministry of Ecology and Environment has been tightening standards for industrial wastewater discharge and hazardous waste disposal, impacting all players.

Effective waste management for Fosun Pharma likely involves significant investment in treatment technologies and processes to handle chemical byproducts and manufacturing waste. The company's stated commitment to environmental management suggests ongoing efforts to comply with evolving national and international environmental protection laws. These efforts are crucial for maintaining operational licenses and avoiding penalties, especially as global scrutiny on environmental, social, and governance (ESG) factors intensifies.

Climate Change Adaptation

Fosun Pharma actively addresses climate change adaptation as a significant aspect of its sustainability strategy, as highlighted in its latest sustainability reports which incorporate climate-related disclosures. This proactive stance demonstrates a clear understanding of both the physical impacts of a changing climate and the transitional risks inherent in shifting towards a low-carbon economy.

The company's approach reflects a growing trend among major pharmaceutical firms to integrate climate risk assessment into their operations and long-term planning. By aligning with established reporting frameworks, Fosun Pharma provides stakeholders with greater transparency regarding its preparedness for climate-related challenges.

Key areas of focus for Fosun Pharma's climate adaptation efforts likely include:

- Supply Chain Resilience: Ensuring the stability of its pharmaceutical supply chains against extreme weather events or resource scarcity exacerbated by climate change.

- Operational Adjustments: Modifying manufacturing processes and facility management to mitigate the impact of changing environmental conditions, such as heatwaves or water shortages.

- Product Development: Exploring opportunities to develop and adapt pharmaceutical products and delivery systems that remain effective and accessible in a climate-altered world.

- Regulatory Compliance: Staying ahead of evolving environmental regulations and standards related to carbon emissions and climate risk management within the healthcare sector.

ESG Integration into Strategy

Fosun Pharma’s strategic blueprint prominently features Environmental, Social, and Governance (ESG) principles, underpinning its pursuit of sustainable growth and operational excellence. This integration ensures environmental consciousness is woven into the very fabric of its business model, driving a commitment to responsible practices across all its ventures.

The company's dedication to high-quality development is directly tied to its ESG focus. For instance, in 2023, Fosun Pharma reported a 10% reduction in carbon emissions intensity compared to its 2020 baseline, demonstrating tangible progress in its environmental stewardship. This proactive approach not only mitigates risks but also unlocks opportunities for innovation and market differentiation, aligning with investor expectations for robust ESG performance.

- Environmental Commitment: Fosun Pharma actively invests in green technologies and processes to minimize its ecological footprint.

- Sustainable Operations: The company prioritizes resource efficiency, aiming for a 15% improvement in water usage efficiency by 2025.

- Long-Term Value Creation: ESG integration is viewed as crucial for building resilience and ensuring sustained financial performance.

- Reporting Transparency: Fosun Pharma publishes annual sustainability reports detailing its ESG progress and targets, with its 2024 report highlighting a 5% increase in renewable energy usage across its facilities.

Fosun Pharma is actively enhancing its environmental stewardship, aiming for significant progress in green initiatives by 2025. The company is focused on increasing renewable energy adoption, targeting a doubling of its green electricity usage from 10% in 2023 to 20% by 2025. Additionally, pilot programs initiated in 2024 at three manufacturing sites are designed to achieve an average 5% reduction in energy intensity.

| Environmental Initiative | 2023 Status | 2025 Target | 2024 Progress |

| Green Electricity Usage | 10% | 20% | 12% (reported Q1 2024) |

| Energy Intensity Reduction | Baseline | Not specified | Pilot programs targeting 5% reduction |

| Water Usage Efficiency | Baseline | 15% improvement | 3% improvement (reported Q1 2024) |

PESTLE Analysis Data Sources

Our Fosun Pharma PESTLE Analysis is informed by a comprehensive review of data from leading financial institutions, regulatory bodies, and industry-specific market research reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the pharmaceutical landscape.