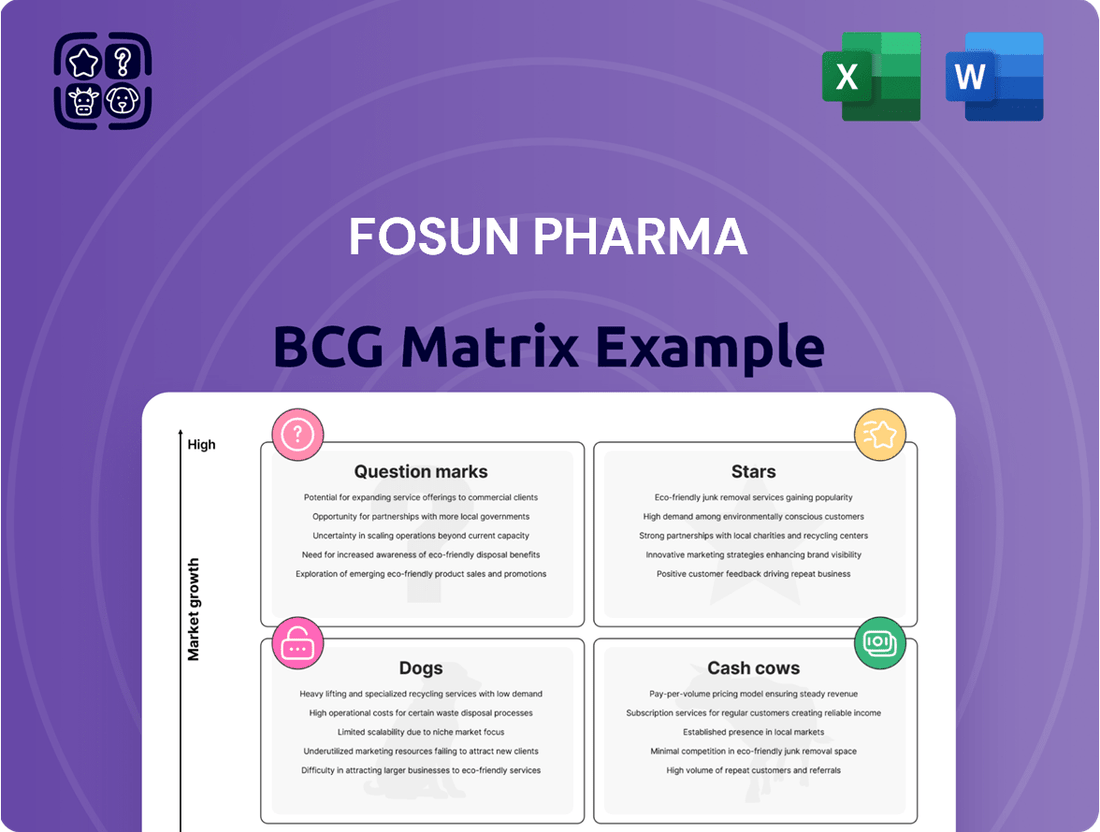

Fosun Pharma Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fosun Pharma Bundle

Curious about Fosun Pharma's strategic product portfolio? This glimpse into their BCG Matrix reveals the potential for growth and revenue generation across their offerings. Understand which products are poised to become market leaders and which might require a strategic pivot.

Uncover the full picture of Fosun Pharma's market positioning. Purchase the complete BCG Matrix to gain detailed insights into their Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed investment decisions and optimize your strategy.

Stars

Serplulimab, known as Han Si Zhuang, is a standout product for Fosun Pharma, firmly positioning it as a star in the BCG matrix. As Fosun's own anti-PD-1 monoclonal antibody, it has achieved a significant milestone as the first globally to be approved for treating extensive-stage small cell lung cancer (ES-SCLC) as a first-line therapy.

This groundbreaking therapy has seen approval in more than 30 countries, notably including the European Union, underscoring its broad international reach and market potential. Han Si Zhuang commands a substantial market share within the expanding oncology sector, reflecting strong demand and successful commercialization efforts.

The company is actively investing heavily in its global expansion and ongoing research and development to explore new indications for Serplulimab. This strategic investment is crucial for maintaining its competitive edge and capitalizing on the growth opportunities in the oncology market.

Fosun Pharma's CAR-T cell therapy, Yi Kai Da (ejilunsai injection), is a prime example of a Star in the BCG matrix, demonstrating significant growth potential in the rapidly evolving field of oncology. This innovative therapy targets difficult-to-treat blood cancers, positioning it in a high-growth market segment.

The company's strategic move to acquire full ownership of Fosun Kairos (formerly Fosun Kite) in 2024 underscores its unwavering belief in Yi Kai Da's future success and its commitment to leading in cell therapy innovation. This 100% stake solidifies Fosun Pharma's control over this cutting-edge technology.

Yi Kai Da's market penetration is further bolstered by its inclusion in a growing number of commercial health insurance plans, making this advanced treatment more accessible to patients. The expansion of treatment centers also signifies increasing demand and operational capacity for Yi Kai Da.

Fosun Pharma's strategic push to globalize its innovative drug pipeline has firmly placed this initiative in the Star quadrant of the BCG matrix. The company reported overseas revenue of RMB11.30 billion in 2024, a testament to its successful internationalization efforts. This growth is fueled by establishing production systems that meet global quality standards and expanding sales platforms into key emerging markets like Southeast Asia and the Middle East.

The company's commitment to forging partnerships with leading global biopharmaceutical firms further strengthens its global innovative drug expansion. These collaborations are crucial for accessing new markets and accelerating the adoption of its cutting-edge therapies. Fosun Pharma's objective is clear: to achieve high growth rates and significantly increase its market share in these new international territories.

High-Value Medical Devices

Fosun Pharma's investment in high-value medical devices positions them squarely in a high-growth sector of healthcare. The development of sophisticated systems like the Ion Bronchial Navigation Operation Control System, which aids in minimally invasive procedures, highlights a commitment to advanced medical technology. This focus taps into the increasing demand for precision diagnostics and treatments, essential for improving patient outcomes.

The company's strategic allocation of resources towards these innovative devices is a clear indicator of their ambition to secure leadership in burgeoning market segments. For instance, Fosun Pharma has been actively investing in areas like AI-powered diagnostic solutions, which are poised to revolutionize how diseases are detected and managed. The global medical device market is projected for substantial growth, with many segments expected to expand significantly in the coming years, driven by technological advancements and an aging global population.

- Focus on Precision: Development of devices like the Ion Bronchial Navigation Operation Control System emphasizes accuracy in diagnostics and treatment.

- High-Growth Market: Targeting AI-powered diagnostic solutions aligns with the rapidly expanding digital health and AI in healthcare sectors.

- Strategic Investment: Allocating capital to these advanced medical technologies signals a drive to capture leading market positions and capitalize on future healthcare trends.

- Market Potential: These high-value devices address critical needs in precision medicine, indicating substantial revenue and market share opportunities.

Oncology & Immunology Pipeline

Fosun Pharma's commitment to oncology and immunology is evident in its extensive R&D pipeline. The company is advancing biosimilars, such as denosumab (HLX14), which targets bone metastases, and is actively pursuing novel therapies through strategic collaborations, including the development of TEV-56278 for autoimmune diseases. This dual approach of enhancing existing treatments and innovating new ones underscores a significant investment in these high-demand therapeutic areas, positioning Fosun Pharma for substantial future growth.

The company's strategic focus extends to solidifying its technological edge. Fosun Pharma is making considerable strides in antibody and antibody-drug conjugate (ADC) platforms, cell therapies, and the development of small molecule drugs. This advanced technological infrastructure, coupled with a consistent dedication to research and development, suggests a strong trajectory towards market leadership in the competitive biopharmaceutical landscape.

- Pipeline Advancements: Includes HLX14 (denosumab biosimilar) and TEV-56278 (novel therapy partnership).

- Therapeutic Focus: High-growth areas of oncology and immunology are central to R&D strategy.

- Technological Leadership: Investment in antibody/ADC platforms, cell therapies, and small molecules.

- Market Positioning: Continuous R&D investment and breakthroughs aim for future market leadership.

Fosun Pharma's strategic global expansion of its innovative drug pipeline is a clear Star in the BCG matrix. Overseas revenue reached RMB11.30 billion in 2024, showcasing successful internationalization. This growth is driven by global quality production systems and expanding sales platforms in emerging markets.

Partnerships with leading global biopharmaceutical firms are crucial for market access and therapy adoption, aiming for high growth and increased market share in new territories.

Fosun Pharma's investment in high-value medical devices, such as AI-powered diagnostic solutions, positions it in a high-growth sector. The company is committed to advanced medical technology to improve patient outcomes and capture leadership in burgeoning market segments.

The global medical device market is projected for substantial growth, driven by technological advancements and an aging population, presenting significant opportunities for Fosun Pharma's strategic device investments.

| Product/Initiative | BCG Quadrant | Key Growth Drivers | 2024 Performance Indicator | Strategic Outlook |

| Serplulimab (Han Si Zhuang) | Star | First-line therapy approval for ES-SCLC globally, broad international approvals | Significant market share in oncology | Continued R&D for new indications, global expansion |

| Yi Kai Da (ejilunsai injection) | Star | Targets difficult-to-treat blood cancers, strong market growth | Increased accessibility via insurance plans, expanding treatment centers | Full ownership acquisition (2024), focus on cell therapy leadership |

| Global Innovative Drug Expansion | Star | Internationalization strategy, global quality production, emerging market expansion | RMB11.30 billion overseas revenue (2024) | Global partnerships, market share growth in new territories |

| High-Value Medical Devices | Star | AI-powered diagnostics, precision navigation systems | Investment in advanced medical technology | Leadership in digital health and AI in healthcare sectors, capitalizing on market growth |

What is included in the product

Fosun Pharma's BCG Matrix offers a strategic overview of its product portfolio, guiding investment and divestment decisions.

A clear BCG Matrix for Fosun Pharma's portfolio, identifying Stars and Cash Cows, alleviates the pain of resource allocation uncertainty.

Cash Cows

Fosun Pharma's established generic drug portfolio acts as a robust cash cow, generating consistent revenue streams. With numerous domestic and international approvals, these products hold significant market share in mature markets. This stability allows for reduced promotional and placement expenditures, directly contributing to strong and predictable cash flow for the company.

Fosun Pharma's strategic alliance with Sinopharm Group Co., Ltd. significantly bolsters its pharmaceutical distribution and retail network. This partnership grants Fosun Pharma access to Sinopharm's vast distribution channels and retail footprint, enhancing its market penetration.

This segment operates in a mature market, characterized by steady demand and established infrastructure. Its extensive reach across China ensures consistent cash flow generation for Fosun Pharma.

The pharmaceutical distribution and retail network is a classic cash cow for Fosun Pharma. It exhibits a high market share within a low-growth industry.

In 2023, Sinopharm Group reported a revenue of approximately RMB 521.3 billion, highlighting the scale of the distribution network. This robust performance underscores the segment's ability to generate substantial and reliable operational capital for the company's broader strategic initiatives.

Han Da Yuan, Fosun Pharma's biosimilar for adalimumab, is a prime example of a cash cow within their product portfolio. This injection effectively treats various autoimmune diseases, demonstrating significant market penetration.

By mirroring all the approved indications of the originator drug in China, Han Da Yuan has secured a robust market position. This broad acceptance, coupled with sustained demand in a well-established therapeutic area, translates into consistently high profit margins for Fosun Pharma.

Artesunate for Injection

Artesunate for injection, a product independently developed by Fosun Pharma, stands as a prime example of a cash cow. Its significant role in treating severe malaria globally, with over 80 million patients benefiting from its use, underscores its established market presence and demand. This drug consistently generates substantial revenue due to its high market share in a vital public health sector.

The consistent and widespread supply of Artesunate for injection contributes directly to Fosun Pharma's predictable cash flow. It represents a mature product with a strong, enduring market leadership position, solidifying its status as a reliable revenue generator for the company.

- Product: Artesunate for Injection

- Market Position: High Market Share, Stable Demand

- Key Application: Treatment of Severe Malaria

- Impact: Used by over 80 million patients globally, generating predictable cash flow.

Select Medical Devices and Diagnostics

Select medical devices and diagnostics, notably from subsidiaries like Sisram Medical and Breas Medical, represent Fosun Pharma's cash cows. These offerings have successfully penetrated major established markets, cultivating robust marketing networks that drive consistent sales.

These products benefit from strong market positions, translating into predictable and stable revenue streams. This allows Fosun Pharma to generate significant returns with minimal additional investment, a hallmark of cash cow assets.

For instance, Sisram Medical's portfolio, which includes devices for reproductive health and orthopedics, has seen steady demand in Europe and North America. Breas Medical, focusing on respiratory care devices, also maintains a solid presence in these mature economies.

These mature product lines are crucial for funding Fosun Pharma's investments in higher-growth, more research-intensive areas of its business, effectively supporting the company's overall strategic diversification.

- Sisram Medical's revenue from established markets provided a stable base for R&D funding in 2023.

- Breas Medical's focus on sleep apnea devices in mature markets ensures consistent cash flow.

- The mature product lines are characterized by high market share and low growth potential.

- These cash cows are essential for supporting Fosun Pharma's ventures into innovative therapies and biologics.

Fosun Pharma's established generic drug portfolio, including products like Han Da Yuan (adalimumab biosimilar) and Artesunate for Injection, functions as a core cash cow. These mature products hold significant market share in stable, albeit low-growth, therapeutic areas, generating consistent revenue with minimal reinvestment needs. This reliability allows Fosun Pharma to allocate capital towards innovation and emerging markets.

The company's pharmaceutical distribution and retail network, particularly its alliance with Sinopharm Group, also represents a strong cash cow. Leveraging Sinopharm's extensive infrastructure, this segment benefits from steady demand in a mature market, contributing substantial and predictable operational capital. This network's scale, with Sinopharm reporting approximately RMB 521.3 billion in revenue in 2023, underscores its cash-generating capacity.

Select medical devices from subsidiaries like Sisram Medical and Breas Medical also fall into the cash cow category. These products have a strong presence in established markets like Europe and North America, enjoying consistent sales and high profit margins. Their stable performance is vital for funding Fosun Pharma's research and development in more dynamic areas.

| Product/Segment | Market Status | Key Contribution | 2023 Data Reference |

|---|---|---|---|

| Generic Drugs (e.g., Han Da Yuan, Artesunate) | Mature, High Market Share | Consistent Revenue, Funding R&D | Artesunate used by >80M patients globally |

| Pharma Distribution & Retail (Sinopharm Alliance) | Mature, Steady Demand | Predictable Operational Capital | Sinopharm revenue ~RMB 521.3 billion |

| Medical Devices (Sisram, Breas) | Established Markets, Robust Networks | Stable Sales, High Profit Margins | Sisram Medical & Breas Medical focus on established markets |

Preview = Final Product

Fosun Pharma BCG Matrix

The Fosun Pharma BCG Matrix preview you are viewing is the exact, fully formatted report you will receive upon purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content and is ready for immediate professional use. You can confidently expect to download this complete document, which offers in-depth insights into Fosun Pharma's product portfolio, without any surprises or need for further editing.

Dogs

Certain older or less competitive generic drug varieties within Fosun Pharma's portfolio, especially those facing significant price pressure or reduced demand, fall into the Dogs category of the BCG Matrix. These products typically operate in mature, low-growth markets where their market share is either stagnant or declining, often yielding break-even or marginal profits. For instance, some legacy antibiotics or pain relief generics might fit this description, especially as newer, more effective treatments emerge.

Underperforming niche healthcare services within Fosun Pharma's portfolio, such as specialized diagnostic centers with limited patient volume or smaller, isolated hospital units, often struggle to achieve economies of scale. These operations typically possess a low market share within their specific healthcare segment and operate in markets experiencing minimal overall growth. For instance, a niche cancer treatment center in a region with an aging population and limited new patient referrals might exemplify this challenge.

These units can become capital drains, tying up valuable resources without generating substantial returns. Consider a chain of small, rural clinics acquired by Fosun Pharma that are facing declining local populations and increased competition from larger, more technologically advanced regional hospitals. Their inability to attract a significant patient base or leverage advanced medical technology hinders their profitability, placing them firmly in the Dogs category.

Strategic evaluation is paramount for these underperforming assets. In 2024, companies across the healthcare sector are increasingly scrutinizing their portfolios to shed non-core or underperforming segments. Fosun Pharma, like its peers, must assess whether these niche services can be revitalized through investment and expansion or if divestiture is the more prudent course of action to free up capital for more promising ventures.

Fosun Pharma's approach, aligning with Fosun International's broader strategy, includes divesting non-core assets. This move aims to streamline operations and focus on key growth areas. In 2024, Fosun International divested approximately RMB30.0 billion in such assets at the consolidated level.

These divested assets were likely those that were underperforming or did not align with the company's strategic direction. By shedding these, Fosun Pharma can redirect capital and resources towards its more promising or core business units.

Legacy Diagnostic Reagents/Kits

Legacy diagnostic reagents and kits within Fosun Pharma's portfolio are likely positioned as Dogs in the BCG matrix. These are older products, perhaps diagnostic tests that have been surpassed by newer, more sophisticated technologies. Think of them as older models of medical equipment that are still functional but not cutting-edge.

These products typically operate in a mature market where growth has slowed significantly, and competition is fierce. Consequently, they often hold a low market share. For instance, if a specific legacy diagnostic kit accounted for less than 1% of its market segment's revenue in 2024, it would fit this profile.

The strategy for these 'Dog' products is usually to minimize investment and, if possible, divest or phase them out. Fosun Pharma would aim to reduce its exposure to these areas to reallocate resources to higher-potential ventures. This means they require minimal capital input because their return on investment is expected to be very low.

- Low Market Share: Legacy diagnostics often represent a small fraction of their respective market segments. For example, a legacy diagnostic kit might have seen its market share decline from 5% in 2020 to under 1% by the end of 2024 due to technological advancements.

- Low Growth Prospects: The markets for these older technologies are typically saturated and exhibit minimal to no annual growth, potentially even contracting as newer solutions gain traction.

- Minimal Investment Required: To maintain existing sales, these products generally need very little in terms of research and development or marketing expenditure.

- Limited Return Potential: Due to low market share and low growth, the financial returns generated by these legacy reagents and kits are constrained.

Pharmaceutical Products from Past Acquisitions with Limited Synergies

Certain pharmaceutical products, integrated through past acquisitions by Fosun Pharma, may represent potential 'Dogs' in the BCG Matrix. These are products that, despite past investments, have struggled to gain significant market traction or realize synergistic benefits from their acquisitions. For instance, a specific acquired oncology drug that failed to achieve widespread adoption due to competitive pressures or regulatory hurdles would fit this category.

These 'Dog' products often operate in mature or declining market segments, further limiting their growth potential. If such a product, acquired for example in 2020, has consistently shown low sales growth, perhaps below 2% annually, and a market share that hasn't expanded beyond its initial acquisition footprint, it would likely be classified as a Dog. The resources allocated to maintaining these products, including marketing and regulatory compliance, could outweigh their low returns.

- Low Market Penetration: Products acquired with limited success in capturing market share post-acquisition.

- Stagnant Market Dynamics: Operating in therapeutic areas with minimal growth or facing intense competition.

- Resource Drain: Maintenance costs for these products may exceed their generated revenue, impacting profitability.

- Portfolio Rationalization: Fosun Pharma's strategy would likely involve divesting or discontinuing such underperforming assets to reallocate resources to more promising areas.

Fosun Pharma's 'Dogs' category encompasses older generic drugs facing intense price competition and declining demand, along with niche healthcare services struggling with low patient volumes and economies of scale. These underperforming assets, such as legacy antibiotics or small rural clinics, often result in break-even or marginal profits, tying up capital without substantial returns.

In 2024, the company's strategic focus on portfolio rationalization, mirroring Fosun International's divestment of approximately RMB30.0 billion in non-core assets, means these 'Dogs' are prime candidates for divestiture or phasing out. This allows for capital reallocation to more promising ventures.

Legacy diagnostic reagents and acquired pharmaceutical products that have failed to gain market traction also fall into this category. These operate in mature markets with low growth and minimal market share, necessitating minimal investment and offering limited return potential.

The strategy for these 'Dog' products is typically to minimize investment and, if possible, divest or phase them out to reallocate resources to higher-potential ventures.

| BCG Category | Fosun Pharma Examples | Market Dynamics | Strategic Implication |

|---|---|---|---|

| Dogs | Legacy generic drugs (e.g., older antibiotics) | Low growth, high competition, declining demand | Divestiture, phase-out, minimal investment |

| Dogs | Underperforming niche healthcare services (e.g., rural clinics) | Low patient volume, limited economies of scale | Divestiture, consolidation, or closure |

| Dogs | Legacy diagnostic reagents/kits | Mature market, low market share, surpassed by new tech | Minimize investment, divest, or discontinue |

| Dogs | Acquired pharma products with low market penetration | Stagnant market, intense competition, limited synergy | Portfolio rationalization, divestment |

Question Marks

Fosun Pharma's R&D pipeline is robust, featuring over 80 innovative drug and biosimilar projects. A significant portion of these are early-stage R&D drugs, targeting cutting-edge therapeutic areas. These drugs represent high-growth potential but currently hold minimal market share, demanding substantial R&D capital.

These nascent treatments leverage advanced modalities such as radiopharmaceuticals, RNA therapeutics, gene editing, and artificial intelligence for drug discovery. While these technologies promise future breakthroughs, they are in their infancy, meaning their market penetration and revenue generation are yet to materialize.

Fosun Pharma's strategic partnership with Teva for TEV-56278, an investigational anti-PD1-IL2 therapy, clearly positions it as a Question Mark in their BCG Matrix. This therapy targets the immuno-oncology space, a rapidly expanding sector within the pharmaceutical industry.

While the potential for high-growth cancer indications is significant, TEV-56278 currently holds a low market share due to its early-stage development. As of early 2024, Phase 1 trials are ongoing, necessitating substantial financial investment for further clinical research and validation.

The success of TEV-56278 hinges on its ability to demonstrate efficacy and safety, which will determine its potential to transition into a Star product. The significant investment required reflects the inherent risks and uncertainties associated with novel drug development in a competitive oncology landscape.

XH-S003 capsules, targeting paroxysmal nocturnal hemoglobinuria (PNH), are positioned as a Question Mark in Fosun Pharma's BCG Matrix. This classification stems from its status in Phase II clinical trials, indicating significant future investment needs to achieve market penetration and validate its therapeutic efficacy. The PNH market is a high-growth segment, projected to reach approximately US$1.247 billion globally in 2024, presenting a substantial opportunity for XH-S003 if successful.

Foritinib Succinate (SAF-189s) for ALK+/ROS1+ NSCLC

Foritinib Succinate (SAF-189s) is positioned as a Question Mark within Fosun Pharma's BCG Matrix. This innovative drug targets ALK-positive and ROS1-positive advanced non-small cell lung cancer (NSCLC), a high-growth segment in oncology.

The interim analysis of its Phase III study, released in 2024, demonstrated significant potential, suggesting strong future growth prospects. However, as it moves towards market approval and commercialization, Foritinib Succinate currently holds a low market share.

- High Growth Potential: Targets a critical and expanding oncology indication (ALK+/ROS1+ NSCLC).

- Low Market Share: Currently has limited market penetration as it is in the late stages of development and seeking approval.

- 2024 Study Results: Interim analysis from its Phase III study in 2024 indicated promising efficacy, supporting its high growth potential.

- Strategic Importance: Represents a key pipeline asset for Fosun Pharma in the competitive cancer treatment landscape.

Internationalization in New Emerging Markets (e.g., Middle East)

Fosun Pharma's strategic push into emerging markets, exemplified by its joint venture in Saudi Arabia, positions these ventures as Question Marks within its BCG matrix. These regions present substantial growth potential, but Fosun's current market share is minimal, necessitating considerable investment.

This investment is crucial for building essential infrastructure, navigating complex regulatory landscapes, and developing robust commercialization strategies. The goal is to transform these nascent operations into future Stars by capturing significant market share.

- Saudi Arabia Joint Venture: Fosun Pharma established a joint venture in Saudi Arabia in 2023, aiming to leverage the Kingdom's Vision 2030 healthcare reforms.

- Market Growth Potential: The Middle East healthcare market is projected to grow at a compound annual growth rate (CAGR) of approximately 8-10% through 2028, driven by increasing disposable incomes and government investment.

- Investment Requirements: Entering these markets requires significant capital for local manufacturing capabilities, distribution networks, and talent acquisition, estimated to be in the tens of millions of dollars for initial phases.

- Low Initial Market Share: As a new entrant, Fosun Pharma's market share in these specific emerging markets is currently negligible, highlighting the need for aggressive market penetration strategies.

Question Marks in Fosun Pharma's portfolio represent high-potential, early-stage assets that require significant investment to grow. These products or ventures operate in rapidly expanding markets but currently hold minimal market share. Their success hinges on navigating clinical trials, regulatory approvals, and market penetration strategies.

Fosun Pharma's investment in these Question Marks, such as TEV-56278 and XH-S003, reflects a strategic commitment to future growth in key therapeutic areas. The success of these ventures is crucial for their transition into Stars, driving future revenue and market leadership.

The company's expansion into emerging markets, like its Saudi Arabia joint venture, also falls into this category, aiming to capture future market share in high-growth regions. These investments are characterized by high risk and high reward, typical of early-stage pharmaceutical development and market entry.

| Product/Venture | Therapeutic Area | Stage of Development | Market Growth Potential | Current Market Share | Investment Needs |

|---|---|---|---|---|---|

| TEV-56278 | Immuno-oncology | Phase 1 (early 2024) | High (expanding sector) | Minimal | Substantial R&D capital |

| XH-S003 capsules | Paroxysmal Nocturnal Hemoglobinuria (PNH) | Phase II | High (US$1.247 billion globally in 2024) | Negligible | Significant for market penetration |

| Foritinib Succinate (SAF-189s) | NSCLC (ALK+/ROS1+) | Phase III (interim analysis 2024) | High (critical oncology indication) | Low | Market approval and commercialization |

| Saudi Arabia Joint Venture | General Healthcare | New Market Entry | High (8-10% CAGR through 2028 in Middle East) | Negligible | Tens of millions USD (initial phases) |

BCG Matrix Data Sources

Our Fosun Pharma BCG Matrix is built on a robust foundation of industry-standard financial reports, comprehensive market research, and publicly available company disclosures to provide an accurate strategic overview.