Foster Farms Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Foster Farms Bundle

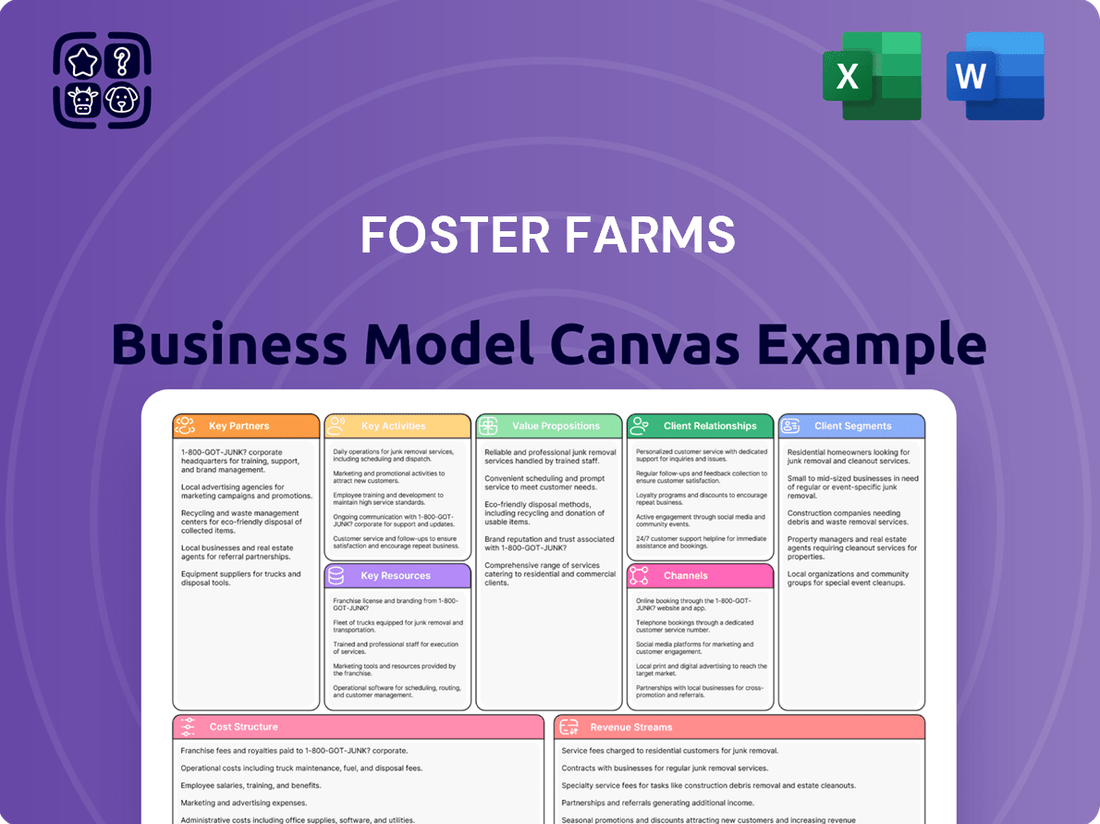

Unlock the strategic blueprint behind Foster Farms's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering invaluable insights into their market dominance. Discover how they build value and maintain a competitive edge.

Partnerships

Foster Farms relies heavily on its network of over 425 family farms spanning nine states. This extensive partnership base is fundamental to their vertically integrated model, ensuring a consistent supply of high-quality poultry.

The company demonstrated a commitment to expanding this crucial network, onboarding 125 new family farms during fiscal year 2024. These collaborations are vital for sourcing and raising the poultry that forms the backbone of Foster Farms' operations.

Major grocery stores and supermarket chains are crucial partners for Foster Farms, acting as the primary conduits to reach a broad consumer base. These relationships are fundamental to their market penetration and brand visibility.

The significance of these partnerships is underscored by the fact that retail sales represented 66.3% of Foster Farms' total sales channels in 2024. This substantial reliance on grocery and retail chains emphasizes their role in the company's overall success and distribution strategy.

Foster Farms' key partnerships heavily involve foodservice distributors and establishments. These partners are crucial for distributing Foster Farms' fresh and prepared poultry products to a vast network of restaurants and other hospitality businesses.

In 2024, this foodservice segment represented a significant portion of Foster Farms' business, accounting for 22.2% of their total sales channels. This highlights the vital role these partnerships play in their overall market reach and revenue generation.

Logistics and Transportation Companies

Foster Farms leans heavily on logistics and transportation companies to get its fresh and frozen poultry products across the country. This is crucial for maintaining product quality and ensuring availability. In 2024, the company continued to leverage these partnerships for its extensive distribution network, which includes over 30,000 retail locations.

These partnerships are vital for managing the cold chain, using specialized refrigerated trucks to keep products at optimal temperatures from farm to fork. This ensures that consumers receive high-quality, safe poultry. For instance, a significant portion of Foster Farms' distribution relies on third-party logistics providers who specialize in temperature-controlled freight.

- Nationwide Reach: Partnerships facilitate delivery to thousands of retail stores and distribution centers across the United States.

- Cold Chain Integrity: Essential for maintaining product freshness and safety through refrigerated transport.

- Efficiency and Timeliness: Ensures products arrive at their destinations promptly, minimizing spoilage and meeting demand.

Technology and Engineering Service Providers

Foster Farms relies on key partnerships with technology and engineering service providers to optimize its operations. These collaborations are crucial for implementing advanced solutions that improve efficiency and sustainability across its processing facilities.

The company has partnered with specialized vendors to drive operational enhancements, notably in areas like energy efficiency. For example, Foster Farms collaborated with Energy Resource Company (ERC), Nexus Engineering, and Solecon on a significant project aimed at reducing natural gas consumption and greenhouse gas (GHG) emissions.

- Energy Efficiency Upgrades Foster Farms partners with specialized vendors for projects like upgrading processing facilities with energy-efficient technologies.

- GHG Emission Reduction Projects Collaborations with firms such as Energy Resource Company (ERC), Nexus Engineering, and Solecon focus on reducing environmental impact.

- Natural Gas Usage Reduction These partnerships have directly led to decreased natural gas consumption in their operations.

- Operational Optimization By leveraging external expertise, Foster Farms enhances the overall efficiency and sustainability of its business model.

Foster Farms' key partnerships extend to its extensive network of over 425 family farms, a critical component of its vertically integrated model, ensuring a consistent supply of high-quality poultry. The company actively expanded this network, onboarding 125 new family farms in fiscal year 2024. These agricultural alliances are fundamental to sourcing and raising the poultry that is central to Foster Farms' operations.

Grocery stores and supermarket chains are vital partners, serving as the primary channels to reach consumers. These relationships are essential for market penetration and brand visibility, with retail sales accounting for 66.3% of Foster Farms' total sales in 2024.

Foodservice distributors and establishments represent another crucial partnership segment, facilitating the distribution of Foster Farms' products to restaurants and hospitality businesses. This foodservice channel contributed 22.2% to Foster Farms' total sales in 2024, underscoring its importance for market reach.

Logistics and transportation companies are indispensable partners, ensuring the timely and quality delivery of fresh and frozen poultry products to over 30,000 retail locations nationwide in 2024. These collaborations are key to maintaining cold chain integrity and product freshness.

Foster Farms also collaborates with technology and engineering service providers to enhance operational efficiency and sustainability. Partnerships with firms like Energy Resource Company (ERC), Nexus Engineering, and Solecon have been instrumental in projects aimed at reducing natural gas consumption and greenhouse gas emissions.

| Partner Type | Key Role | 2024 Impact/Data |

| Family Farms | Poultry Sourcing & Raising | 425+ farms in network; 125 new farms onboarded in FY24 |

| Grocery Retailers | Consumer Distribution | 66.3% of total sales channels |

| Foodservice Sector | B2B Distribution | 22.2% of total sales channels |

| Logistics Providers | Nationwide Distribution & Cold Chain | Serving over 30,000 retail locations |

| Tech/Engineering Services | Operational Efficiency & Sustainability | Projects reducing natural gas consumption & GHG emissions |

What is included in the product

A comprehensive, pre-written business model tailored to Foster Farms' strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of Foster Farms, organized into 9 classic BMC blocks with full narrative and insights.

Foster Farms' Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their operations, enabling quick identification of inefficiencies and areas for improvement in their complex supply chain and distribution networks.

Activities

Foster Farms' key activity is its comprehensive, vertically integrated poultry production. This means they manage everything from hatching chicks and raising them on their farms to providing feed and finally processing the birds for market. This control over the entire supply chain is crucial for maintaining high standards.

This integrated approach allows Foster Farms to ensure quality and consistency at every stage. For instance, in 2024, the company continued its focus on animal welfare and sustainable farming practices, which directly impacts the end product's quality and consumer trust. Their commitment to controlling the process from start to finish is a core element of their business model.

A crucial activity for Foster Farms is the intricate process of transforming raw poultry into a diverse range of products. This includes everything from whole chickens and turkeys to precisely cut parts and convenient prepared meals, all meticulously packaged for both grocery store shelves and restaurant kitchens.

The company's operational backbone consists of its extensive network of major processing facilities strategically located throughout several states. This infrastructure is vital for managing the volume and variety of their poultry offerings, ensuring they can meet broad market demand.

In 2024, Foster Farms continued to emphasize efficiency and quality in these processing and packaging operations. While specific operational data for 2024 is proprietary, the company's historical investment in advanced processing technologies underscores its commitment to maintaining high standards in product safety and shelf-life, crucial for consumer trust.

Foster Farms' key activities heavily involve meticulous supply chain management and rigorous quality control. This ensures that every product meets their high standards for safety and consistency, a critical factor for consumer trust. The company dedicates substantial resources to food safety initiatives and conducts extensive internal testing throughout its operations.

In 2024, Foster Farms continued its commitment to food safety, investing millions in advanced technologies and protocols to prevent contamination. Their internal quality control measures include regular audits of farms, processing facilities, and distribution networks, aiming to catch any potential issues before they reach consumers. This proactive approach is fundamental to maintaining brand reputation and product integrity.

Product Development and Innovation

Foster Farms actively pursues product development, launching new poultry options that align with shifting consumer tastes for fresh, frozen, and convenient items. This commitment is evident in their expansion into categories like antibiotic-free and organic chicken, responding to growing demand for healthier and more ethically produced food.

In 2024, the company continued to innovate within its product lines. For instance, they focused on expanding their range of value-added products, such as marinated and pre-seasoned chicken, to meet the needs of busy consumers seeking quick meal solutions.

- New Product Launches: Continued introduction of antibiotic-free and organic chicken options throughout 2024.

- Value-Added Offerings: Expansion of marinated, pre-seasoned, and ready-to-cook chicken products.

- Consumer Trend Alignment: Focus on products catering to health-conscious and convenience-seeking consumers.

Distribution and Logistics Coordination

Foster Farms' distribution and logistics coordination is critical for getting its fresh and frozen poultry products to market. This involves managing a vast network of refrigerated trucks and delivery schedules to ensure timely arrival at grocery stores, delis, and restaurants across a wide geographical area. For instance, in 2024, the company continued to optimize its supply chain, aiming to reduce transit times and spoilage.

The company's logistics operations are complex, requiring careful planning to maintain product integrity from farm to fork. This includes coordinating with third-party carriers and internal fleet management to cover extensive delivery routes efficiently. Foster Farms' commitment to freshness means that a significant portion of its distribution efforts are focused on rapid movement of perishable goods.

- Refrigerated Fleet Management: Operating and managing a substantial fleet of refrigerated vehicles is a core activity to maintain the cold chain.

- Route Optimization: Utilizing advanced software to plan the most efficient delivery routes, minimizing fuel consumption and delivery times.

- Warehouse and Distribution Centers: Maintaining strategically located facilities for product storage, consolidation, and dispatch to various retail and foodservice partners.

- Inventory Control: Implementing robust systems to track inventory levels across the distribution network, preventing stockouts and minimizing waste.

Foster Farms' key activities revolve around its vertically integrated poultry production, encompassing everything from hatching and raising chickens to processing and distributing a wide array of poultry products. This end-to-end control is fundamental to their quality assurance and brand reputation.

In 2024, the company continued to prioritize efficient processing and packaging, investing in technologies to ensure product safety and extend shelf life. Their operations are supported by a robust network of processing facilities designed to handle significant volumes and diverse product formats, catering to both retail and foodservice sectors.

A significant focus for Foster Farms in 2024 was product innovation, particularly in expanding their range of value-added and healthier options like antibiotic-free chicken. This strategic product development aligns with evolving consumer preferences for convenience and wellness.

Furthermore, meticulous supply chain management and stringent quality control remain paramount. Foster Farms dedicates substantial resources to food safety initiatives, including extensive testing and audits across their operations, reinforcing consumer trust through consistent product integrity.

Delivered as Displayed

Business Model Canvas

The Foster Farms Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering full transparency and eliminating any guesswork. You can trust that when you complete your order, you'll gain immediate access to this exact, ready-to-use business model canvas for Foster Farms.

Resources

Foster Farms' extensive network of over 425 affiliated family farms is a cornerstone of its business. This vast agricultural infrastructure, coupled with the substantial poultry livestock raised on these farms, forms the primary physical asset base. This robust network is crucial for ensuring a consistent and reliable supply of raw materials, directly supporting the company's production capabilities.

Foster Farms leverages a network of modern processing and production facilities strategically located across key states including California, Oregon, Washington, Alabama, Louisiana, Colorado, and Arkansas. These extensive operations are the backbone of their vertically integrated business model, enabling control from farm to table.

These facilities are designed for efficiency and scale, handling significant volumes of poultry processing. For instance, their Livingston, California facility is one of the largest poultry processing plants in the United States, underscoring the substantial capacity of their infrastructure.

The company's commitment to modernizing these plants ensures adherence to high food safety standards and allows for the efficient production of a wide range of chicken and turkey products. This infrastructure is vital for meeting consumer demand and maintaining competitive pricing.

Foster Farms boasts nearly a century of history, solidifying its position as a premier brand for fresh chicken, particularly in the Western United States. This deep-rooted presence translates into significant brand equity, a crucial intangible asset that cultivates strong consumer trust and enduring loyalty.

This established reputation directly impacts customer acquisition and retention, reducing marketing costs and providing a competitive edge. In 2024, the poultry industry continues to see consumers prioritize trusted brands, making Foster Farms' long-standing recognition a powerful differentiator.

Skilled Workforce and Management Team

Foster Farms relies on a substantial and skilled workforce, typically numbering between 10,000 and 12,000 employees, to manage its complex poultry operations from farm to table. This dedicated team is crucial for ensuring product quality, operational efficiency, and adherence to safety standards across all facets of the business.

The company's strategic direction and day-to-day execution are guided by an experienced management team. The appointment of a new CEO in March 2024 signifies a commitment to evolving leadership and adapting to market dynamics. This experienced leadership is key to navigating industry challenges and capitalizing on growth opportunities.

Key aspects of Foster Farms' skilled workforce and management team include:

- Dedicated Workforce: Approximately 10,000 to 12,000 employees form the backbone of daily operations.

- Experienced Leadership: A management team with deep industry knowledge guides strategic decisions.

- Leadership Transition: The appointment of a new CEO in March 2024 highlights ongoing leadership development.

- Operational Expertise: Skills range from agricultural practices to food processing and distribution management.

Proprietary Processes and Supply Chain Expertise

Foster Farms' proprietary processes and deep supply chain expertise are cornerstones of its business model. This vertical integration, controlling everything from chick hatching to final distribution, is a significant intellectual asset. For instance, in 2024, the company continued to emphasize its rigorous food safety protocols, a direct benefit of this end-to-end oversight.

This control allows Foster Farms to maintain exceptional product consistency, quality, and safety standards. Their ability to manage each stage of production, from feed sourcing to processing, translates into a reliable and high-quality product for consumers. This operational efficiency was a key factor in their market presence throughout 2024.

- Vertical Integration: Control over the entire production chain, from farm to table.

- Supply Chain Expertise: Decades of experience optimizing logistics and distribution.

- Quality Assurance: Rigorous standards applied at every production step, ensuring food safety and product integrity.

Foster Farms' key resources include its vast network of over 425 family farms, which provide a consistent supply of poultry. This agricultural infrastructure, combined with its modern processing facilities across multiple states, forms a robust operational base. The company's nearly century-long history has built significant brand equity and consumer trust, a vital intangible asset, especially in the current market where brand recognition is paramount.

The company's approximately 10,000 to 12,000 employees, supported by experienced management, including a new CEO appointed in March 2024, ensure operational efficiency and adherence to high standards. Furthermore, Foster Farms' proprietary processes and deep supply chain expertise, demonstrated through rigorous food safety protocols in 2024, are crucial intellectual assets that guarantee product quality and consistency.

| Key Resource | Description | Significance |

| Farm Network | 425+ affiliated family farms | Ensures consistent raw material supply |

| Processing Facilities | Modern plants in CA, OR, WA, AL, LA, CO, AR | Enables vertical integration and efficient production |

| Brand Equity | Nearly 100 years of history, strong consumer trust | Differentiator, reduces marketing costs, fosters loyalty |

| Workforce & Management | 10,000-12,000 employees, experienced leadership | Drives operational efficiency and strategic direction |

| Proprietary Processes & Expertise | Vertical integration, supply chain optimization, food safety protocols | Guarantees product quality, consistency, and safety |

Value Propositions

Foster Farms is dedicated to delivering poultry that meets high-quality and consistent standards, whether fresh or frozen. This focus is maintained through meticulous oversight of their entire supply chain, from farm to table.

This rigorous control ensures that consumers and business partners, like restaurants and grocery stores, can depend on the reliability of Foster Farms products. For instance, in 2024, the company continued its investment in advanced processing technologies aimed at enhancing food safety and product uniformity across its vast product lines.

Foster Farms positions itself to be a leading provider of affordable and accessible poultry, ensuring a reliable protein source for a wide range of consumers. This commitment to value makes their products a staple across diverse household budgets.

By maintaining competitive pricing, Foster Farms enhances its market reach, allowing families from various socioeconomic backgrounds to incorporate nutritious protein into their diets. This strategy is crucial for broad market penetration.

In 2024, the average US household spent approximately $70 per week on groceries, with poultry being a significant component. Foster Farms' focus on affordability directly addresses this consumer need for cost-effective protein options.

Foster Farms offers customers a broad spectrum of poultry products, from fresh whole chickens and convenient cut parts to a variety of ready-to-cook and fully prepared meals. This extensive selection ensures that consumers can find options that perfectly suit their culinary preferences and time constraints.

In 2023, the U.S. poultry market saw robust demand, with per capita consumption of chicken reaching an estimated 101.6 pounds. Foster Farms' diverse product line, encompassing everything from traditional fresh cuts to value-added items like marinated breasts and pre-seasoned roasts, directly taps into this broad consumer interest.

Assured Food Safety and Supply Chain Control

Foster Farms' vertically integrated approach grants it meticulous oversight across the entire food journey, from the initial farm stages right through to the consumer's plate. This comprehensive control is fundamental to guaranteeing product safety and ensuring full traceability for every item.

This deep level of oversight delivers significant peace of mind, not only to individual consumers but also to the commercial clients who rely on Foster Farms for their supply needs. Knowing exactly where their food comes from and how it's handled builds substantial trust.

In 2024, Foster Farms continued to emphasize its commitment to food safety, a critical factor in the poultry industry. For instance, their rigorous internal standards aim to exceed regulatory requirements, a strategy that resonates strongly in a market increasingly focused on health and wellness.

- Farm-to-Fork Traceability: Foster Farms' model allows for the tracking of products from the farm, through processing, to the final sale, ensuring accountability at every step.

- Enhanced Food Safety Protocols: The company implements stringent safety measures at all operational levels, minimizing risks and ensuring consumer confidence.

- Supply Chain Reliability: Vertical integration reduces reliance on external suppliers, leading to a more stable and predictable supply chain for both retail and foodservice partners.

Commitment to Responsible and Sustainable Practices

Foster Farms emphasizes its strong commitment to responsible and sustainable practices. This includes a significant focus on animal welfare, ensuring humane treatment throughout their operations. The company is also actively engaged in environmental stewardship, implementing programs for water conservation and working to reduce its greenhouse gas emissions.

These initiatives directly address the growing consumer demand for ethically sourced and environmentally friendly products. For instance, by 2024, the company aims to reduce water usage by 15% across its facilities compared to a 2020 baseline. This dedication not only appeals to a broader customer base but also aligns with evolving regulatory landscapes that increasingly prioritize sustainability.

- Animal Welfare: Adherence to rigorous standards for humane animal care.

- Environmental Stewardship: Focus on water conservation and greenhouse gas emission reduction.

- Consumer Resonance: Meeting the demand for ethically and sustainably produced food.

- Regulatory Alignment: Proactive approach to comply with and exceed environmental regulations.

Foster Farms provides a wide array of poultry options, catering to diverse consumer needs and preferences, from fresh cuts to convenient prepared meals. This broad product portfolio ensures accessibility and choice for households and businesses alike.

Their commitment to affordability makes nutritious protein accessible across various income levels, a key factor in market penetration. In 2024, with US households spending an average of $70 weekly on groceries, Foster Farms' value proposition remains highly relevant.

The company's vertically integrated model guarantees exceptional quality and safety through meticulous oversight of the entire supply chain. This end-to-end control fosters trust and reliability for all customers.

Foster Farms also prioritizes responsible sourcing and sustainability, addressing growing consumer demand for ethically produced food. Their initiatives in animal welfare and environmental stewardship, such as a 2024 goal to reduce water usage by 15% from a 2020 baseline, underscore this commitment.

| Value Proposition | Description | Supporting Data/Fact |

| Quality & Consistency | High-quality, consistent poultry products from farm to table. | Continued investment in advanced processing technologies in 2024 for enhanced food safety and uniformity. |

| Affordability & Accessibility | Reliable and affordable protein source for diverse consumers. | Addresses consumer need for cost-effective protein, aligning with average US household grocery spend in 2024. |

| Product Variety | Extensive range of poultry products, from fresh to prepared meals. | Taps into robust demand in the U.S. poultry market, where per capita chicken consumption reached an estimated 101.6 pounds in 2023. |

| Farm-to-Fork Traceability & Safety | Meticulous oversight ensures product safety and traceability. | Emphasis on rigorous internal food safety standards in 2024, often exceeding regulatory requirements. |

| Sustainability & Ethics | Commitment to animal welfare and environmental stewardship. | Aims to reduce water usage by 15% by 2024 (vs. 2020 baseline) and focuses on reducing greenhouse gas emissions. |

Customer Relationships

Foster Farms cultivates strong ties with its retail and foodservice clients, like major grocery chains and restaurant suppliers, via specialized sales and account management teams. This direct approach facilitates personalized service and streamlined order processing, crucial for maintaining product availability and customer satisfaction.

Foster Farms cultivates brand trust through its unwavering commitment to quality and safety, a promise underscored by its decades-long presence in the poultry industry. This consistent delivery builds a strong foundation for consumer loyalty. For instance, in 2024, the company continued to emphasize its rigorous food safety protocols, a key differentiator in the market.

The company actively engages consumers and fosters loyalty through its digital channels, offering exclusive deals and sharing an array of recipes. These initiatives not only provide value but also create a sense of community around the brand, encouraging repeat purchases and deeper engagement with their products.

Foster Farms actively engages in community outreach, demonstrating a commitment beyond product sales. In 2024, the company continued its tradition of food donations, contributing over 2 million pounds of protein to food banks across its operating regions, directly addressing food insecurity.

Furthermore, their scholarship programs, which supported 50 students pursuing agricultural and veterinary sciences in 2024, foster long-term goodwill and invest in future industry talent. These initiatives build a strong, positive brand image and create a deeper connection with stakeholders.

Online Presence and Direct Consumer Communication

Foster Farms leverages its website and active social media presence to connect directly with consumers. This digital approach allows them to share valuable content like recipes and company news, while also actively soliciting customer feedback. In 2024, for instance, their website saw an average of 1.2 million unique monthly visitors, with social media platforms like Facebook and Instagram collectively reaching over 3 million followers. This direct channel is crucial for building brand loyalty and providing timely customer support.

- Website Engagement: Foster Farms' website serves as a hub for product information, recipes, and company updates, facilitating a rich user experience.

- Social Media Interaction: Active engagement on platforms like Facebook and Instagram allows for direct communication, customer service, and community building.

- Consumer Feedback Loop: The company actively encourages and utilizes customer feedback gathered through its online channels to improve products and services.

- Digital Reach: In 2024, Foster Farms' digital platforms reached millions of consumers, underscoring the importance of online presence for direct consumer relationships.

Addressing Consumer and Advocacy Group Concerns

Foster Farms actively addresses public and advocacy group concerns, particularly those surrounding animal welfare and environmental stewardship. This engagement is crucial for maintaining brand reputation and consumer trust.

The company's commitment to addressing these issues is exemplified by its participation in legal settlements. For instance, a lawsuit concerning water conservation and animal care practices highlighted the need for transparency and proactive measures in these areas. In 2024, the agricultural sector, including poultry producers, faced increased scrutiny regarding sustainability. Foster Farms' response to such concerns demonstrates a willingness to adapt to evolving societal expectations and regulatory landscapes.

- Animal Welfare Initiatives: Foster Farms has implemented various programs to enhance animal living conditions and handling practices, responding to advocacy group recommendations.

- Environmental Stewardship: The company is focused on improving water usage efficiency and reducing its environmental footprint, aligning with broader sustainability goals prevalent in 2024.

- Community Engagement: Building trust involves open communication with consumers and advocacy groups about their operational practices and improvements.

Foster Farms prioritizes direct engagement with its retail and foodservice partners through dedicated sales teams, ensuring efficient order processing and product availability. This approach fosters strong, collaborative relationships essential for sustained business. The company also cultivates consumer loyalty by highlighting its commitment to quality and safety, a cornerstone of its brand identity. In 2024, Foster Farms continued to invest in digital channels, offering consumers recipes and promotions, while simultaneously engaging with advocacy groups on animal welfare and environmental practices to build trust and transparency.

| Relationship Type | Key Engagement Methods | 2024 Data/Focus |

|---|---|---|

| Retail & Foodservice Clients | Dedicated Sales & Account Management | Streamlined order processing, personalized service, product availability focus |

| Consumers | Website, Social Media, Promotions, Recipes | Over 1.2 million unique monthly website visitors, 3 million+ social media followers; emphasis on food safety protocols and community donations (2 million+ lbs protein) |

| Advocacy Groups & Public | Open Communication, Sustainability Initiatives | Addressing animal welfare and environmental stewardship concerns; adapting to evolving societal expectations and regulatory landscapes. |

Channels

Retail grocery stores and supermarkets represent Foster Farms' most crucial distribution channel, serving as the direct link to individual consumers nationwide. This channel is vital for both their fresh and frozen poultry offerings, ensuring widespread availability.

In 2024, a significant 66.3% of Foster Farms' total sales were generated through these retail outlets. This highlights the immense reliance on supermarkets and grocery stores to move their product volume and connect with the end-user.

Foster Farms leverages a robust network of specialized foodservice distributors to get its poultry products into the hands of various businesses. These distributors are crucial for reaching sectors like restaurants, delis, schools, and other institutional kitchens that require consistent and reliable supply chains.

This particular channel proved to be a significant contributor to Foster Farms' overall performance, accounting for 22.2% of their total sales in 2024. This highlights the importance of these partnerships in their business model, demonstrating their effectiveness in reaching a broad customer base within the foodservice industry.

Foster Farms utilizes its own and a network of partnered distribution centers, equipped with refrigerated delivery trucks. This dual approach ensures the efficient and temperature-controlled transport of their poultry products from processing facilities directly to retail locations and other points of sale.

This robust logistics network is critical for maintaining product freshness and quality. For instance, in 2024, the company continued to invest in optimizing its cold chain management, a vital component for perishable goods like poultry, aiming to minimize spoilage and maximize shelf life.

Online Presence and Digital Marketing

Foster Farms leverages its website and active social media presence to connect directly with consumers. These digital platforms are crucial for sharing brand stories, highlighting product offerings, and providing valuable content like recipes. In 2024, the company continued to utilize these channels for promotions and disseminating important news.

The company's digital strategy extends to offering tangible benefits to online visitors. Consumers can access exclusive online coupons, driving traffic and encouraging purchases. This approach also facilitates timely updates on new products and company initiatives, keeping the audience informed and engaged.

- Website: Foster Farms' official website acts as a central hub for product information, recipes, and company news.

- Social Media: Platforms like Facebook and Instagram are used for consumer engagement, promotions, and visual storytelling.

- Promotions: Online coupons and special offers are regularly featured to incentivize purchases and build customer loyalty.

- Information Dissemination: The channels serve as a direct line for sharing company updates, new product launches, and relevant industry news.

International Export Markets

Foster Farms actively participates in international export markets, extending its brand presence and sales reach beyond its core domestic operations. This global strategy diversifies revenue streams and taps into new consumer bases. In 2024, international sales accounted for a significant 11.5% of Foster Farms' total revenue, demonstrating the growing importance of these markets.

The company's export strategy focuses on key regions where demand for poultry products is strong and where Foster Farms can leverage its reputation for quality and safety. This international expansion is a crucial component of their long-term growth plan.

- Global Reach: Foster Farms' products are available in numerous countries, broadening their market footprint.

- Revenue Contribution: International sales represented 11.5% of total sales in 2024, highlighting their economic significance.

- Market Diversification: Exporting allows Foster Farms to reduce reliance on any single domestic market.

- Brand Expansion: Global presence enhances brand recognition and consumer trust worldwide.

Foster Farms' distribution strategy is multifaceted, encompassing direct-to-consumer digital engagement and robust wholesale partnerships. The company's website and social media platforms serve as vital touchpoints for brand building and direct sales, complemented by a strong presence in traditional retail and foodservice sectors.

In 2024, retail grocery stores remained the dominant channel, accounting for 66.3% of sales. The foodservice sector followed, contributing 22.2%, while international exports made up 11.5% of total revenue, showcasing a balanced approach to market penetration.

| Channel | 2024 Sales Contribution | Key Functions |

|---|---|---|

| Retail Grocery Stores | 66.3% | Direct consumer access, broad product availability |

| Foodservice Distributors | 22.2% | Supplying restaurants, schools, institutional kitchens |

| Website & Social Media | N/A (Direct Engagement) | Brand storytelling, promotions, online coupons |

| International Exports | 11.5% | Market diversification, global brand expansion |

Customer Segments

Mass market consumers and households represent Foster Farms' largest customer base, seeking fresh, frozen, and prepared poultry for their daily meals. In 2024, the average American household spent approximately $600 annually on poultry products, highlighting the significant demand within this segment for quality and value.

These consumers prioritize convenience and affordability when making purchasing decisions, often choosing brands that offer reliable taste and easy preparation options. Foster Farms' commitment to providing accessible, family-friendly poultry products directly addresses these core needs, making them a staple in many kitchens.

Grocery retailers and supermarket chains are the primary distribution channel for Foster Farms, serving as the crucial link to end consumers. These large entities, stocking Foster Farms' diverse poultry and prepared foods, drive significant sales volume. For instance, in 2024, major U.S. grocery chains like Kroger and Albertsons continued to be key partners, representing a substantial portion of Foster Farms' market reach.

Foster Farms' foodservice operator segment is broad, encompassing everything from bustling restaurants and quick-service delis to large institutions like schools and hospitals. These businesses rely on a steady, dependable supply of poultry to craft their menus and satisfy their customers. For instance, in 2024, the U.S. foodservice industry was projected to reach over $1 trillion in sales, with poultry being a staple protein across many of these establishments.

Value-Conscious Shoppers

Value-conscious shoppers represent a significant customer segment for Foster Farms. These consumers actively seek out products that offer a good balance between price and quality, making affordability a primary driver in their purchasing decisions. Foster Farms aims to meet this demand by providing high-quality poultry at competitive price points.

This segment is particularly important given current economic trends. For instance, in 2024, inflation continued to impact household budgets, driving more consumers to seek value. Foster Farms' commitment to efficient production and supply chain management helps them deliver on this promise.

- Focus on Affordability: Consumers in this segment prioritize cost-effectiveness when buying poultry products.

- Quality Expectation: Despite a focus on price, they still expect a certain standard of quality and freshness.

- Market Sensitivity: This group is highly responsive to sales, promotions, and private label alternatives.

- Brand Loyalty Potential: When a brand consistently delivers value, it can foster strong customer loyalty within this segment.

Health-Conscious and Ethically Minded Consumers

This growing consumer group actively seeks out food options that support their well-being and values. They are particularly drawn to products like antibiotic-free chicken, a trend that saw significant market growth. In 2024, the demand for poultry raised without antibiotics continued to climb, with a substantial percentage of consumers indicating a willingness to pay a premium for such products.

Their purchasing decisions are heavily influenced by a brand's commitment to ethical practices, including transparent animal welfare standards and sustainable sourcing. This segment is increasingly scrutinizing supply chains and favoring companies that demonstrate a clear dedication to reducing environmental impact and ensuring humane treatment of livestock.

Key attributes attracting this segment include:

- Antibiotic-Free Certification: A primary driver for purchasing poultry.

- Animal Welfare Standards: Consumers prioritize brands with demonstrable humane practices.

- Sustainability Initiatives: Interest in eco-friendly farming and reduced environmental footprint.

- Organic and Non-GMO Options: Preference for products free from synthetic pesticides and genetic modification.

Foster Farms serves a broad spectrum of customers, from everyday households seeking convenient and affordable poultry to specialized segments prioritizing health and ethical sourcing. This diverse customer base requires tailored product offerings and marketing approaches to meet varying needs and preferences.

The company also caters to the foodservice industry, supplying restaurants, schools, and institutions with consistent, high-quality poultry products. Additionally, grocery retailers act as a crucial intermediary, ensuring Foster Farms' products reach the mass market effectively.

| Customer Segment | Key Characteristics | 2024 Relevance |

|---|---|---|

| Mass Market Consumers | Seek fresh, frozen, prepared poultry for daily meals; prioritize convenience and affordability. | Average U.S. household spent ~ $600 annually on poultry. |

| Value-Conscious Shoppers | Prioritize price and quality balance; responsive to promotions and sales. | Inflation in 2024 increased demand for cost-effective options. |

| Health & Ethically-Minded Consumers | Seek antibiotic-free, sustainably sourced, and humanely raised products. | Demand for antibiotic-free poultry continued to grow significantly in 2024. |

| Foodservice Operators | Restaurants, schools, hospitals requiring a steady supply of poultry. | U.S. foodservice industry sales projected over $1 trillion in 2024, with poultry a staple. |

| Grocery Retailers | Primary distribution channel; key partners for market reach. | Major chains like Kroger and Albertsons remain vital distribution partners. |

Cost Structure

Poultry rearing and feed costs represent a substantial portion of Foster Farms' expenses, as feed is a critical input for raising chickens. The company's recent expansion, adding 125 family farms to its network in 2024, highlights its ongoing commitment and investment in this core operational area.

Foster Farms' processing and manufacturing expenses are significant, encompassing the operational costs of hatcheries, feed mills, and large-scale processing plants. These include essential utilities, ongoing equipment maintenance, and factory overheads, all contributing to the substantial portion of their cost structure.

In 2024, the poultry industry, including companies like Foster Farms, faced increased input costs. For example, feed costs, a major component of manufacturing expenses, saw fluctuations due to global grain markets. Utilities, especially electricity and water for processing, also represent a considerable outlay, impacting overall operational expenditure.

Labor and personnel costs are a significant expenditure for Foster Farms, given its substantial workforce of roughly 10,000 to 12,000 employees. These costs encompass wages, comprehensive benefits packages, and ongoing training programs essential for maintaining operational efficiency and product quality across all facets of the business.

Recent negotiations with unions underscore the dynamic nature of these labor expenses, with current discussions focusing on adjustments to wages and benefits. These conversations are critical in shaping the company's financial outlook and its ability to attract and retain a skilled workforce in the competitive poultry industry.

Distribution and Logistics Costs

Foster Farms faces significant expenses in getting its products from farm to table. This involves the complex and costly process of moving fresh and frozen chicken and turkey across an extensive network. Think about the fuel for trucks, keeping those vehicles running smoothly, and the specialized warehouses needed to maintain the cold chain, ensuring product quality and safety from processing plant to retail shelf.

These distribution and logistics costs are a major part of their operational spending. For example, in 2024, the trucking industry alone saw fuel costs fluctuate, impacting the overall expense of transportation. Warehousing expenses also remain high due to the specialized refrigeration requirements for perishable goods.

- Fuel Expenses: Significant portion of transportation budget, subject to market volatility.

- Fleet Maintenance: Ongoing costs for maintaining a large fleet of refrigerated vehicles.

- Warehousing: Expenses for temperature-controlled storage facilities across various locations.

- Cold Chain Management: Investment in technology and processes to maintain product integrity during transit and storage.

Compliance and Regulatory Costs

Foster Farms faces significant expenses related to compliance and regulatory adherence. These costs are driven by strict food safety standards, animal welfare protocols, and environmental regulations impacting their operations.

Investments in upgrading facilities and processes to meet these evolving requirements are substantial. For instance, in 2024, the food industry saw continued investment in advanced traceability systems and sanitation technologies, with companies allocating millions to ensure compliance and prevent recalls. These upgrades are crucial for maintaining consumer trust and market access.

- Food Safety Compliance: Costs for HACCP plan implementation, regular audits, and pathogen testing.

- Animal Welfare Standards: Investments in improved housing, handling, and veterinary care.

- Environmental Regulations: Expenses for waste management, water treatment, and emissions control.

- Potential Legal Settlements: Costs associated with resolving disputes arising from non-compliance or product issues.

Foster Farms' cost structure is heavily influenced by its core operations in poultry rearing and processing. Feed and labor are primary drivers, with significant investments in expanding its farm network and maintaining a large workforce. The company also incurs substantial costs related to distribution, compliance, and the necessary infrastructure for maintaining a cold chain.

| Cost Category | Key Components | Estimated Impact (2024) |

|---|---|---|

| Poultry Rearing & Feed | Feed ingredients, farm infrastructure, veterinary care | Major expense, subject to grain market volatility. Expansion in 2024 increased these costs. |

| Processing & Manufacturing | Utilities, equipment maintenance, factory overheads, hatcheries | Significant outlay for operational facilities. Utilities saw increased costs in 2024. |

| Labor & Personnel | Wages, benefits, training for ~10,000-12,000 employees | Substantial portion of expenses. Union negotiations in 2024 highlighted ongoing wage pressures. |

| Distribution & Logistics | Fuel, fleet maintenance, warehousing, cold chain management | High costs due to refrigerated transport and storage needs. Fuel prices impacted 2024 logistics budgets. |

| Compliance & Regulatory | Food safety, animal welfare, environmental standards, facility upgrades | Ongoing investment in systems and processes to meet strict regulations. 2024 saw continued spending on traceability and sanitation. |

Revenue Streams

Foster Farms' most significant revenue driver is the sale of fresh chicken and turkey products. This includes everything from whole birds to pre-cut pieces and ground meat, predominantly sold through grocery stores and various retailers.

In 2024, the fresh poultry market continued to be a cornerstone of the food industry, with consumers consistently seeking convenient and protein-rich options. Foster Farms' ability to supply a wide variety of fresh cuts directly to retail chains ensures a substantial and steady income stream.

Foster Farms generates revenue through the sale of a diverse range of frozen poultry products. This includes staple items like whole chickens and various cut parts, alongside convenient prepared meals such as chicken nuggets and strips. In 2024, frozen products represented a significant 45% of their overall product offerings, highlighting their importance to the company's revenue generation.

Foster Farms generates revenue from selling value-added and prepared foods. This includes items like pre-marinated chicken, fully cooked poultry products, and deli meats. These offerings appeal to consumers looking for convenient meal solutions, saving them preparation time.

Foodservice Sales Contracts

Foster Farms generates significant revenue through foodservice sales contracts, supplying poultry products to a wide range of establishments. This includes restaurants, cafeterias, and catering services that require bulk or specially prepared chicken and turkey. In 2024, this vital channel represented 22.2% of their total sales, highlighting its importance in their business model.

- Foodservice Channel Contribution: In 2024, foodservice sales contracts accounted for 22.2% of Foster Farms' revenue.

- Customer Base: This revenue stream is driven by partnerships with restaurants, delis, and other food service providers.

- Product Offering: Foster Farms supplies poultry in bulk and specific formats tailored to the needs of the foodservice industry.

International Export Sales

Foster Farms generates revenue by selling its poultry products to customers in various countries. These international export sales are a significant part of their business, contributing to their overall financial performance.

In 2024, international export sales accounted for 11.5% of Foster Farms' total sales channels. This demonstrates a notable reliance on global markets for revenue generation.

- International Market Reach: Foster Farms' products are available in numerous countries, expanding their customer base beyond domestic borders.

- Revenue Contribution: In 2024, 11.5% of Foster Farms' total revenue was derived from international export sales.

- Global Expansion Strategy: The company actively pursues opportunities to grow its presence in international markets, diversifying its revenue streams.

- Economic Impact: These export sales not only benefit Foster Farms but also contribute to the broader agricultural trade balance.

Beyond fresh and frozen poultry, Foster Farms diversifies revenue through value-added products like marinated meats and deli items, catering to consumer demand for convenience.

The foodservice sector is a significant contributor, with 22.2% of 2024 sales stemming from restaurant and institutional supply contracts.

International exports also play a role, representing 11.5% of total sales in 2024, highlighting the company's global market presence.

| Revenue Stream | Description | 2024 Contribution (Estimated) |

|---|---|---|

| Fresh Poultry Sales | Whole birds, cuts, ground meat sold via retail | Primary driver |

| Frozen Poultry Sales | Convenience items like nuggets, strips, and whole birds | 45% of product offerings |

| Value-Added & Prepared Foods | Marinated meats, deli products, fully cooked items | Appeals to convenience-seeking consumers |

| Foodservice Sales | Bulk and specialized poultry for restaurants, cafeterias | 22.2% of total sales |

| International Exports | Sales to customers in various countries | 11.5% of total sales |

Business Model Canvas Data Sources

The Foster Farms Business Model Canvas is built upon comprehensive market research, internal operational data, and financial disclosures. These diverse sources ensure each component, from customer segments to cost structure, is informed by accurate and relevant information.