Fortnox Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortnox Bundle

Fortnox operates within a dynamic software-as-a-service landscape, where understanding competitive pressures is paramount. This analysis highlights the influence of new entrants and the bargaining power of buyers, key factors shaping Fortnox's market position.

The complete report reveals the real forces shaping Fortnox’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Fortnox, operating in the cloud software space, depends on essential technology infrastructure like hosting and development tools. The market for these foundational technologies is quite competitive, with numerous providers available. This broad availability, including major cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, significantly reduces the bargaining power of any single technology supplier.

The ability for Fortnox to easily switch between these providers if contract terms become unfavorable is a key factor. For instance, AWS reported revenue of $24.2 billion in the first quarter of 2024, demonstrating the scale and availability of such services. This ease of switching means that individual technology suppliers have limited influence over Fortnox's operational costs and strategic decisions.

The bargaining power of suppliers for standardized software components is generally low. Many essential software building blocks and development frameworks are readily available, often as open-source options. This widespread availability means Fortnox isn't tied to a single, high-cost supplier for these foundational elements, allowing for greater flexibility and cost control.

Fortnox's extensive partnership ecosystem, featuring hundreds of integrations with external parties and development partners, significantly dilutes the bargaining power of individual suppliers. This vast network of apps and services means Fortnox isn't overly reliant on any single third-party software or integration provider. For example, in 2023, Fortnox reported over 400 active integrations, showcasing the breadth of its ecosystem.

Potential for in-house development

Fortnox possesses the strategic advantage of developing certain critical functionalities in-house. This internal development capability significantly reduces its dependence on external suppliers for core product features, thereby acting as a strategic buffer against potential price hikes or supply disruptions.

This capacity for in-house development is typically reserved for highly strategic components that are integral to Fortnox's competitive edge. For instance, in 2024, Fortnox continued to invest in its proprietary technology stack, aiming to enhance its core accounting and invoicing software. While specific figures on in-house development versus outsourced components are not publicly detailed, the company's consistent focus on product innovation underscores its commitment to internal capabilities.

- Internal Development Capacity: Fortnox can build key software modules internally, lessening reliance on third-party providers.

- Strategic Buffer: This capability mitigates risks associated with supplier power, such as increased costs or delivery delays.

- Focus on Core Competencies: In-house development is prioritized for features that define Fortnox's unique value proposition.

- Investment in Technology: Ongoing investment in proprietary technology in 2024 supports this strategic approach to managing supplier relationships.

Pricing trends in enterprise software

While enterprise software broadly experienced price hikes in 2024-2025, driven by the ongoing transition to subscription-based models, Fortnox's significant market presence and established relationships likely grant it more advantageous supplier agreements than smaller competitors.

Despite this, the overall cost of essential software components and development resources, influenced by broader market dynamics, could still exert upward pressure on Fortnox's operational expenses.

- Supplier Concentration: The bargaining power of suppliers in the enterprise software sector can be considerable if a few key providers control essential components or technologies.

- Switching Costs for Fortnox: Fortnox's ability to negotiate favorable terms is enhanced by the high switching costs associated with changing core software infrastructure or critical third-party integrations.

- Market Trends: General inflation and increased demand for specialized software development talent in 2024 contributed to rising input costs across the industry.

Fortnox benefits from a competitive supplier landscape for its core technology needs, particularly cloud hosting and development tools. The presence of major players like AWS, with Q1 2024 revenues reaching $24.2 billion, means Fortnox can leverage scale and readily switch providers, thereby limiting individual supplier leverage.

The company's ability to develop critical functionalities in-house, as demonstrated by its continued investment in its proprietary technology stack in 2024, further reduces its dependence on external suppliers. This internal capacity acts as a crucial buffer against potential price increases or supply chain disruptions.

Fortnox's extensive ecosystem of over 400 active integrations in 2023 also dilutes the power of any single partner, as the company is not overly reliant on one specific third-party service. This broad network enhances Fortnox's negotiating position with its suppliers.

| Factor | Fortnox's Position | Impact on Supplier Bargaining Power |

|---|---|---|

| Availability of Cloud Services | High (AWS, Azure, Google Cloud) | Low |

| In-house Development Capacity | Significant (ongoing investment in 2024) | Low |

| Ecosystem Integrations | Extensive (400+ in 2023) | Low |

| Standardized Software Components | High (many open-source options) | Low |

What is included in the product

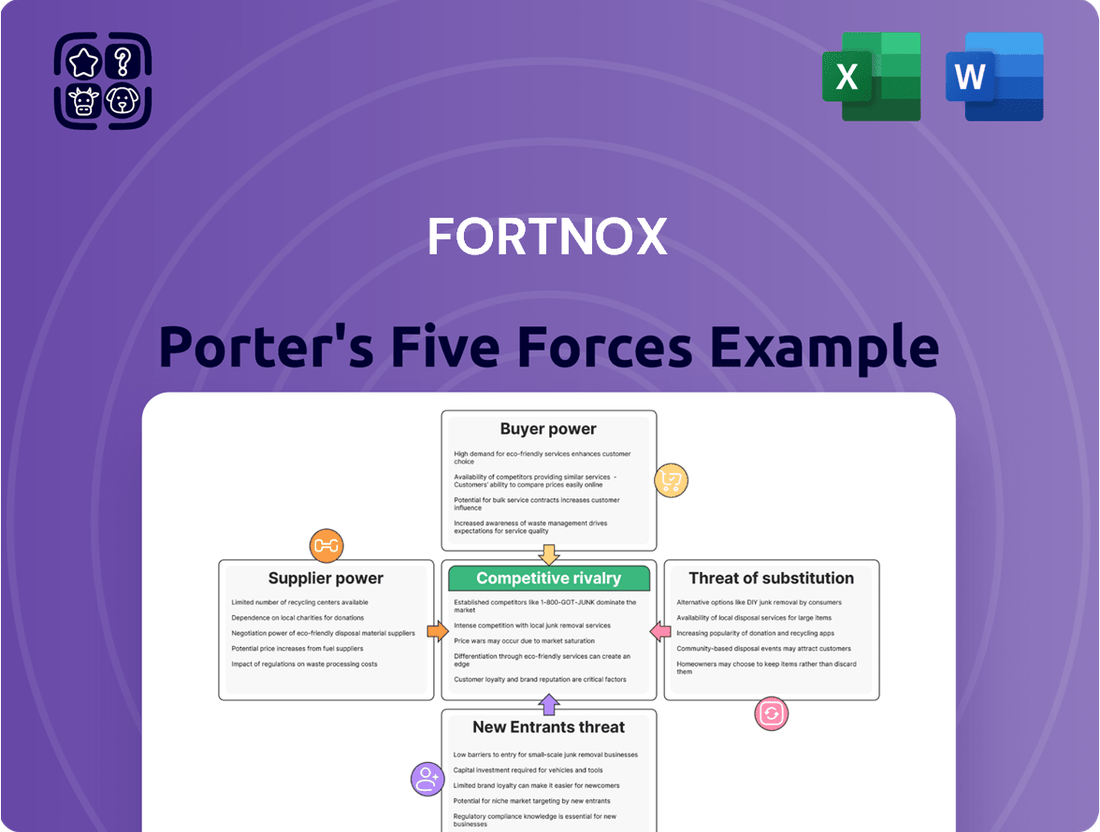

This analysis dissects the competitive forces impacting Fortnox, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry, to inform strategic decision-making.

Instantly identify and quantify competitive pressures with a dynamic, interactive framework, making complex market analysis accessible and actionable.

Customers Bargaining Power

Small and medium-sized enterprises (SMEs) often face substantial switching costs when considering a change in their accounting and business administration software. These costs include the complex process of data migration, the necessity for employee retraining on a new system, and the potential disruption to established operational workflows. For instance, a study in late 2023 indicated that the average cost for an SME to switch ERP systems could range from $5,000 to $50,000, depending on the complexity and size of the business.

This high level of investment in time, resources, and potential downtime creates significant customer stickiness for providers like Fortnox. The sheer effort and expense involved in migrating critical business data and retraining staff can be a powerful deterrent, making existing customers less likely to seek out alternative solutions, thereby strengthening Fortnox's bargaining power.

Fortnox's integrated platform, offering a comprehensive suite of functions like accounting, invoicing, and payroll, creates significant customer lock-in. This integration means businesses rely on Fortnox for multiple core operations, making a switch a complex undertaking.

As of 2024, Fortnox serves over 150,000 active customers, many of whom leverage multiple modules. The deeper a customer integrates into the Fortnox ecosystem, the more data and processes become intertwined, substantially increasing the switching costs and effort involved in migrating to a competitor.

Fortnox's robust market presence in Sweden significantly dampens customer bargaining power. With over 598,000 customers, they hold a dominant position in the cloud-based business administration sector for small and medium-sized enterprises (SMEs).

This strong foothold means that customers in Sweden have limited access to similarly established and localized competitors. Consequently, switching costs can be perceived as higher, and the availability of comparable alternatives is reduced, thereby diminishing the collective bargaining leverage of the customer base.

Diverse customer base reduces individual power

Fortnox's broad customer base, encompassing a wide spectrum of businesses from sole proprietorships to medium-sized enterprises across numerous sectors, significantly dilutes individual customer bargaining power. This widespread adoption means that Fortnox is not overly reliant on any single client or a small cluster of clients for its revenue. Consequently, the ability of any one customer to unilaterally influence pricing or service terms is substantially diminished.

For instance, as of early 2024, Fortnox reported serving hundreds of thousands of customers. This sheer volume prevents any individual customer from wielding significant leverage. The diverse nature of its clientele, ranging from startups to established SMEs, further ensures that no particular segment can collectively dictate terms. This broad market penetration is a key factor in maintaining Fortnox's pricing flexibility and service delivery standards.

- Broad Customer Reach: Fortnox serves hundreds of thousands of customers across various industries and business sizes.

- Reduced Reliance on Single Clients: The diverse customer base minimizes dependence on any one customer or small group, limiting their individual bargaining power.

- No Dominant Customer Segment: The variety of businesses using Fortnox prevents any single industry or size category from collectively dictating terms.

- Maintained Pricing Flexibility: This widespread adoption allows Fortnox to maintain its pricing structures and service level agreements without undue pressure from individual customers.

Subscription-based revenue model

Fortnox's subscription-based revenue model fosters recurring income and strong customer ties, but it also means clients are always assessing the value they receive. This continuous evaluation puts pressure on Fortnox to consistently deliver high-quality services to maintain customer loyalty.

While Fortnox benefits from relatively high switching costs for its customers, the ongoing subscription nature necessitates a persistent focus on value proposition. Failure to consistently meet customer expectations could lead to churn, even with initial integration hurdles.

- Customer Retention Focus: The subscription model inherently requires Fortnox to continuously prove its worth to customers, as they can reassess their needs and the value provided at each renewal period.

- Value Perception: Customers subscribing to Fortnox's services are likely to be price-sensitive and actively compare the benefits received against the ongoing subscription fees.

- Switching Inertia vs. Value: Although switching might involve effort, if customers perceive a superior alternative or a decline in Fortnox's service quality, they may still be motivated to switch.

Fortnox's strong market position in Sweden, serving over 598,000 customers as of 2024, significantly limits customer bargaining power by reducing the availability of comparable alternatives. The company's broad customer base, numbering in the hundreds of thousands, prevents any single client or segment from wielding substantial influence over pricing or terms. This widespread adoption means Fortnox isn't reliant on any few customers, reinforcing its ability to maintain pricing flexibility.

| Factor | Fortnox's Position | Impact on Customer Bargaining Power |

|---|---|---|

| Market Dominance (Sweden) | Over 598,000 customers (2024) | Lowers customer bargaining power due to limited viable alternatives. |

| Customer Base Size & Diversity | Hundreds of thousands of diverse customers | Dilutes individual customer power; no single client or segment dictates terms. |

| Switching Costs | High due to data migration, retraining, workflow disruption | Reduces customer willingness to switch, strengthening Fortnox's position. |

What You See Is What You Get

Fortnox Porter's Five Forces Analysis

This preview showcases the complete Fortnox Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its industry. The document you see here is the exact, professionally formatted file you will receive instantly upon purchase, ensuring no discrepancies or missing information. You can confidently use this comprehensive analysis to understand Fortnox's strategic positioning and competitive landscape.

Rivalry Among Competitors

Fortnox operates in a highly competitive landscape, facing pressure from both established global software giants and significant local players. Intuit’s QuickBooks, Xero, and Sage are prominent international competitors, offering comprehensive cloud-based accounting and business management tools that directly challenge Fortnox’s market share. These global brands bring substantial resources and brand recognition to the table.

Within its primary markets, Fortnox also contends with strong local competitors like Visma, Bokio, and SpeedLedger AB. These companies are deeply familiar with regional regulations and business practices, allowing them to tailor their cloud-based accounting and business administration solutions effectively. For instance, Visma, a major Nordic player, has a significant presence and a broad suite of business solutions that compete with Fortnox’s offerings.

The cloud accounting software market is booming, with projections indicating continued robust expansion. This rapid growth, fueled by the ongoing digital transformation and a strong demand for flexible, cloud-based solutions, especially from small and medium-sized enterprises (SMEs), is a significant draw for new players.

This attractive market dynamic, while presenting opportunities for established companies like Fortnox, inevitably leads to increased competition. New entrants are entering the space, bringing fresh capital and innovative approaches, which naturally intensifies the rivalry within the sector.

For instance, the European cloud accounting market alone was valued at approximately €4.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 15% through 2028, according to various industry reports. This substantial growth signals a fertile ground for new businesses, thereby heightening the competitive landscape for Fortnox.

Competitive rivalry in the accounting software space is fierce, with companies like Fortnox locked in a perpetual race to enhance their platforms. This involves a constant stream of new features, often incorporating cutting-edge technologies like AI and automation, alongside crucial improvements to user experience and mobile accessibility.

Fortnox faces immense pressure to innovate continuously. For instance, in 2024, many competitors rolled out enhanced AI-driven invoice processing and automated reconciliation tools. Failing to keep pace means risking customer churn as users seek out more advanced, intuitive, or mobile-friendly solutions, directly impacting market share and revenue.

Price sensitivity in the SME segment

While Fortnox offers significant value, the Small and Medium-sized Enterprise (SME) segment can exhibit considerable price sensitivity. Competitors, especially those entering the market, may leverage aggressive pricing or even offer free introductory tiers to capture market share. This necessitates a careful balancing act for Fortnox, ensuring its pricing aligns with its robust value proposition.

For instance, in 2024, the average annual IT spending for SMEs in Sweden, Fortnox's primary market, was estimated to be around 50,000 SEK, with a notable portion allocated to software solutions. This highlights the budget constraints many SMEs operate under, making price a critical decision factor.

- Price Sensitivity: SMEs, despite potentially high switching costs, are often price-conscious, influencing their software choices.

- Competitive Pricing: Rivals may employ aggressive pricing or freemium models to attract new SME customers.

- Value-Price Balance: Fortnox must align its pricing with its comprehensive feature set to maintain competitiveness against lower-cost alternatives.

Geographic concentration in Sweden

Fortnox's intense competitive rivalry is largely shaped by its geographic concentration in Sweden. This focused market means that competitors are directly vying for the same Swedish customer base, intensifying head-to-head battles for market share.

The Swedish market is characterized by a robust presence of both established players and emerging fintech solutions, all targeting similar small and medium-sized businesses (SMBs). This creates a highly competitive environment where differentiation and customer retention are paramount.

- High Market Share in a Concentrated Area: Fortnox dominates the Swedish market for accounting and business management software, facing rivals who are also heavily focused on this region.

- Intensified Competition for Swedish SMBs: Competitors like Visma and newer cloud-based solutions are actively competing for the same Swedish small and medium-sized business customers.

- Impact on Pricing and Innovation: The concentrated competition necessitates continuous innovation and competitive pricing strategies from Fortnox to maintain its leading position.

Fortnox faces intense competition from global players like Intuit's QuickBooks and Xero, as well as strong local rivals such as Visma in its core Swedish market. This rivalry is amplified by the booming cloud accounting sector, projected to grow significantly, attracting new entrants. Companies are in a constant race to innovate, integrating AI and enhancing user experience to retain customers.

The price sensitivity of the Small and Medium-sized Enterprise (SME) segment in Sweden, where average annual IT spending for SMEs was around 50,000 SEK in 2024, forces Fortnox to balance its value proposition with competitive pricing. Aggressive pricing or freemium models from competitors are common tactics to capture market share.

| Competitor | Key Offerings | Market Focus | Estimated Market Share (Sweden, 2024) |

|---|---|---|---|

| Intuit QuickBooks | Cloud accounting, payroll, invoicing | Global, strong SME presence | ~5-10% |

| Xero | Cloud accounting, payroll, payments | Global, strong SME presence | ~7-12% |

| Visma | ERP, accounting, CRM, HR | Nordic region, strong in Sweden | ~25-30% |

| Bokio | Cloud accounting, invoicing | Sweden, UK | ~3-5% |

SSubstitutes Threaten

While cloud-based accounting software like Fortnox offers significant advantages, some extremely small businesses or sole proprietors might still lean towards manual methods or spreadsheets. This is often due to a perception of lower immediate cost or a gap in digital skills. However, this trend is diminishing as digital transformation accelerates.

In Sweden, regulatory shifts are actively discouraging manual or paper-based accounting. For instance, requirements for digital record-keeping and paperless storage are making traditional methods less practical and compliant. This regulatory push directly undermines the appeal of these manual substitutes for businesses operating within Sweden.

For extremely basic administrative needs, some companies might opt for generic office software like Microsoft Excel for simple invoicing or rudimentary record-keeping, bypassing dedicated business administration platforms. However, these general tools often fall short, lacking the integrated functionalities, automation capabilities, and crucial compliance features that specialized platforms like Fortnox offer. For instance, while a small business might manage basic expenses in Excel, Fortnox provides integrated accounting, payroll, and project management, significantly streamlining operations and ensuring regulatory adherence.

The threat of specialized point solutions presents a significant challenge to integrated platforms like Fortnox. Businesses can opt for individual software for invoicing, payroll, or customer relationship management instead of a single, comprehensive system. This fragmentation can lead to data silos and increased management overhead.

For instance, while a business might find a niche invoicing tool with a slightly lower price point, integrating it with separate payroll and CRM systems can create operational friction. In 2024, the market for specialized business software remains robust, with many niche providers offering highly tailored functionalities. This flexibility, however, often comes at the cost of seamless integration and a unified view of business operations, which Fortnox aims to provide.

Outsourced accounting services

The threat of substitutes for in-house accounting software like Fortnox is significant, particularly from outsourced accounting services. Many businesses, especially small and medium-sized enterprises (SMEs), find it more cost-effective and efficient to delegate their entire accounting and administrative tasks to specialized accounting firms rather than maintaining internal systems.

Fortnox addresses this competitive pressure by strategically positioning itself not just for end-users but also as a platform for accounting firms themselves. This dual approach allows Fortnox to capture a broader market share by serving both the businesses that outsource and the firms that provide these outsourced services. For instance, in 2023, the global accounting services market was valued at approximately $560 billion, with outsourcing accounting functions being a major driver of this growth.

- Outsourced accounting services offer a compelling alternative, especially for SMEs seeking to reduce overhead and access specialized expertise.

- Cost-effectiveness is a primary driver, as businesses can often achieve economies of scale through outsourcing rather than investing in and maintaining in-house software and personnel.

- Fortnox's strategy of serving both businesses and accounting firms creates a symbiotic relationship, embedding its software within the outsourced service delivery model.

- Market trends indicate a continued rise in accounting outsourcing, with projections suggesting the market will grow further in the coming years, underscoring the importance of Fortnox's multi-faceted approach.

Emergence of AI-driven financial tools

The increasing sophistication of AI-driven financial tools presents a significant threat of substitutes for traditional accounting software like Fortnox. These new solutions can offer highly automated financial management, requiring minimal user intervention and potentially performing tasks with greater efficiency and accuracy.

While Fortnox is undoubtedly investing in AI integration, the emergence of fully autonomous, end-to-end financial management platforms could fundamentally alter the competitive landscape. For instance, by 2024, the global AI in accounting market was valued at over $1.5 billion, with projections indicating substantial growth, underscoring the rapid development and adoption of these technologies.

These AI substitutes could offer:

- Automated bookkeeping and reconciliation: AI algorithms can process transactions faster and with fewer errors than manual methods.

- Predictive financial analysis: Advanced AI can forecast cash flow, identify potential risks, and suggest strategic financial adjustments.

- Seamless integration with other business functions: AI-powered tools may offer more holistic integration capabilities than current offerings.

- Lower operational costs for users: Highly automated solutions could reduce the need for dedicated accounting staff or extensive software training.

The threat of substitutes for Fortnox primarily stems from outsourced accounting services and increasingly sophisticated AI-driven financial tools. Many businesses, especially SMEs, find outsourcing more cost-effective due to economies of scale, avoiding the overhead of in-house systems and personnel. Fortnox counters this by also serving accounting firms, creating a symbiotic model. In 2023, the global accounting services market reached approximately $560 billion, with outsourcing being a significant growth driver.

AI-powered financial management platforms represent another potent substitute. These tools offer highly automated processes, potentially reducing user intervention and increasing efficiency. While Fortnox integrates AI, fully autonomous platforms could redefine the competitive landscape. The global AI in accounting market exceeded $1.5 billion in 2024, highlighting rapid advancements and adoption.

| Substitute Type | Key Advantages | Fortnox's Counter-Strategy | Market Context (2023/2024) |

|---|---|---|---|

| Outsourced Accounting Services | Cost-effectiveness, specialized expertise, reduced overhead | Platform for accounting firms, dual-market approach | Global accounting services market ~$560 billion (2023), outsourcing a major driver |

| AI-Driven Financial Tools | High automation, efficiency, accuracy, predictive analysis | AI integration, focus on user experience and comprehensive features | Global AI in accounting market >$1.5 billion (2024), rapid growth |

Entrants Threaten

Developing a comprehensive cloud-based business administration platform, akin to Fortnox's offering, demands substantial capital. This includes significant investment in research and development, building robust IT infrastructure, and extensive marketing campaigns to gain market traction. For instance, a company aiming to replicate Fortnox's integrated suite of accounting, invoicing, payroll, and CRM functionalities would likely need to allocate hundreds of millions of dollars in its initial stages.

This considerable financial outlay acts as a formidable barrier to entry for many aspiring competitors. The sheer scale of investment required to build a comparable platform, ensuring both functionality and user-friendliness, deters a large number of potential new entrants who may lack the necessary funding or risk appetite. This high capital requirement effectively shields established players like Fortnox from immediate, widespread competition.

Fortnox's established brand recognition and deep customer trust, cultivated over years serving Swedish small and medium-sized enterprises (SMEs), present a significant barrier to new entrants. Gaining this level of confidence, especially when dealing with sensitive financial data, requires substantial investment and time.

New competitors would need to replicate Fortnox's reputation for reliability and security, a feat that is particularly challenging in a market where trust is paramount. For instance, Fortnox reported a customer base exceeding 400,000 users in 2023, highlighting the scale of loyalty they have built.

Fortnox benefits significantly from powerful network effects, primarily driven by its vast ecosystem of over 500 development partners and integrated solutions. This extensive network makes it challenging for new entrants to offer comparable value and customization to Fortnox's existing user base.

Regulatory and compliance complexities

The accounting and payroll software sector, particularly in Sweden, faces significant regulatory hurdles. New companies entering this market must meticulously adhere to evolving data protection laws, tax regulations, and reporting standards. For instance, the General Data Protection Regulation (GDPR) imposes strict rules on handling personal financial data, requiring substantial investment in compliance infrastructure.

These compliance demands act as a substantial barrier to entry, as they necessitate specialized legal expertise and robust technological solutions. Established players have already invested heavily in systems to ensure ongoing compliance, making it difficult for newcomers to match their operational readiness. In 2024, the ongoing updates to Swedish tax legislation, such as changes in VAT reporting, further complicate the landscape for any new software provider aiming to offer compliant solutions.

- Navigating Swedish tax and accounting laws requires specialized knowledge.

- Compliance with GDPR for handling financial data is a significant cost for new entrants.

- Ongoing updates to regulations, like VAT reporting in 2024, add complexity and cost.

- Existing players have a compliance advantage due to prior investment.

Customer switching costs as a deterrent

High customer switching costs act as a significant barrier for new entrants looking to gain market share from Fortnox. The complexities involved in data migration, retraining staff, and potential disruption to established workflows discourage existing Fortnox users from moving to a competitor, even if the competitor offers slightly better pricing or features. This inertia is a powerful deterrent.

New entrants often find it more feasible to target nascent businesses or specific market segments that are not yet deeply embedded in existing solutions. For instance, in 2024, the cloud-based accounting software market saw continued growth, but established players like Fortnox benefit from the stickiness of their user base.

- Customer Loyalty: Fortnox's established customer base is less likely to switch due to the effort and cost associated with migrating data and retraining employees.

- Integration Complexity: Businesses often integrate accounting software deeply into their operations, making a switch disruptive and costly.

- New Entrant Strategy: New competitors typically focus on acquiring new customers or targeting niche markets where switching costs are lower.

- Market Inertia: The time and resources required to overcome existing customer inertia present a substantial hurdle for new entrants.

The threat of new entrants for Fortnox is relatively low due to substantial capital requirements for developing a comparable cloud-based business administration platform, estimated in the hundreds of millions of dollars for R&D, infrastructure, and marketing. This high initial investment deters many potential competitors lacking sufficient funding or risk tolerance, effectively protecting established players like Fortnox.

Porter's Five Forces Analysis Data Sources

Our Fortnox Porter's Five Forces analysis leverages a robust blend of data, including Fortnox's own financial reports, industry-specific market research from sources like Gartner and IDC, and broader economic indicators from organizations such as the World Bank.