Fortnox Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortnox Bundle

Curious about Fortnox's product portfolio performance? This glimpse into their BCG Matrix highlights key areas, but to truly unlock strategic growth, you need the full picture. Understand which products are driving cash flow and which require careful consideration.

The complete Fortnox BCG Matrix report provides a detailed breakdown of each product's position as a Star, Cash Cow, Dog, or Question Mark. Don't miss out on actionable insights and data-driven recommendations for your investment strategy.

Purchase the full BCG Matrix now to gain a comprehensive understanding of Fortnox's market standing and equip yourself with the strategic clarity needed to make informed decisions and outmaneuver the competition.

Stars

Fortnox's core cloud-based platform, offering accounting, invoicing, and administrative tools, is a strong contender in the Swedish SME market. This segment is experiencing robust growth, and Fortnox is well-positioned to capitalize on it.

The company's market dominance is evident in its impressive financial performance. In the first quarter of 2025, Fortnox reported a significant 21% increase in net sales year-over-year, underscoring its expanding reach and the continued demand for its integrated cloud solutions.

Fortnox's financial services, such as invoice factoring and business cards, are a significant growth driver. This segment is their fastest-growing area, with lending revenue alone jumping 41% in the fourth quarter of 2024.

These offerings are quickly capturing more of Fortnox's existing customers, proving to be a key contributor to their expanding revenue streams.

Fortnox's integrated ecosystem, powered by its open API, is a significant strength. This allows businesses to connect with hundreds of external partners, creating a highly customizable and scalable ERP solution. This extensive network of integrations directly translates to a more valuable platform for customers, fostering deeper engagement and loyalty.

In 2024, Fortnox reported a substantial increase in API usage, with over 5 million API calls per month, demonstrating the platform's robust integration capabilities. This high level of connectivity not only enhances the core offering but also acts as a strong retention driver, as customers become more embedded in the Fortnox ecosystem.

Increasing Average Revenue Per Customer (ARPC)

Fortnox has demonstrated a strong ability to increase its Average Revenue Per Subscription Customer (ARPC). In the first quarter of 2025, this figure reached SEK 304, exceeding their initial five-year goal a full year ahead of schedule.

This achievement highlights Fortnox's success in capturing a significant portion of their customers' spending within the market. It also points to effective strategies in upselling premium features and fostering deeper platform engagement among their existing customer base, driving sustained revenue growth.

- ARPC Growth: Fortnox's ARPC hit SEK 304 in Q1 2025, surpassing a five-year target early.

- Market Share Indicator: This suggests a strong wallet share within their customer base.

- Upselling Success: The increase is attributed to successful upselling of premium features.

- Customer Engagement: Deeper platform engagement also contributes to the rising ARPC.

High-Growth Transaction-Based Products

Fortnox's People (payroll) and E-invoicing products are prime examples of high-growth transaction-based offerings. Their increasing transaction volumes highlight robust customer adoption and expanding utilization within the Fortnox ecosystem. These products are actively capturing a greater share of market activity, acting as significant engines for the company's current growth trajectory.

The success of these products is directly linked to their transactional nature, where revenue scales with customer engagement. For instance, the number of payroll runs processed or invoices issued directly translates to revenue. This model allows Fortnox to benefit from the increasing digitalization of business processes.

- People (Payroll): This product sees revenue growth tied to the number of employees managed and payroll cycles processed, indicating a strong uptake as businesses streamline HR functions.

- E-invoicing: Growth here is driven by the volume of invoices sent and received electronically, reflecting a shift towards more efficient and automated financial communication.

- Transaction-Based Revenue: This segment is crucial as it demonstrates direct correlation between product usage and financial performance, a hallmark of successful, scalable software solutions.

- Market Adoption: The increasing transaction rates for these specific products suggest Fortnox is effectively meeting market demand for essential business management tools.

Fortnox's Stars, representing offerings with high market share in high-growth sectors, are exemplified by their core cloud-based platform and financial services. These segments demonstrate strong customer adoption and revenue expansion, positioning Fortnox for continued market leadership.

The company's financial services, such as invoice factoring, are a significant growth driver, with lending revenue alone jumping 41% in Q4 2024. This rapid growth, coupled with the core platform's increasing Average Revenue Per Subscription Customer (ARPC) to SEK 304 in Q1 2025, highlights their Star status.

Furthermore, transaction-based products like People (payroll) and E-invoicing are experiencing robust growth due to increasing digitalization and efficient business processes. This indicates a strong market demand and Fortnox's ability to capture it effectively.

The success of these products is directly linked to their transactional nature, where revenue scales with customer engagement, a key characteristic of Star products in the BCG matrix.

| Product Category | Market Growth | Fortnox Market Share | BCG Category | Key Performance Indicator |

|---|---|---|---|---|

| Core Cloud Platform | High | High | Star | ARPC SEK 304 (Q1 2025) |

| Financial Services (Lending) | High | High | Star | Revenue Growth 41% (Q4 2024) |

| People (Payroll) | High | High | Star | Increasing Transaction Volumes |

| E-invoicing | High | High | Star | Increasing Transaction Volumes |

What is included in the product

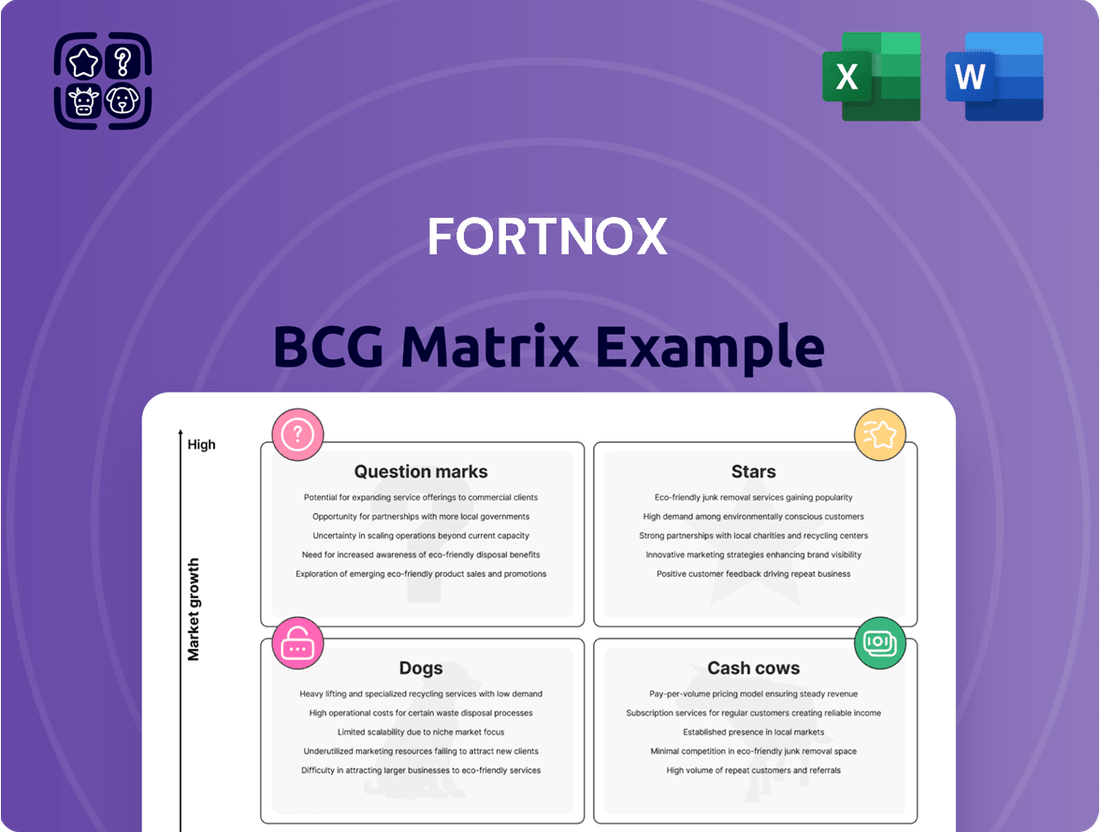

The Fortnox BCG Matrix offers a strategic overview of its product portfolio, categorizing each unit into Stars, Cash Cows, Question Marks, and Dogs.

A clear visual of Fortnox's business units in the BCG matrix, simplifying complex strategic decisions.

Cash Cows

Fortnox's established accounting and bookkeeping software is a prime example of a cash cow. These foundational modules have secured a significant market share within the Swedish small and medium-sized enterprise (SME) sector, a market that is now quite mature.

The consistent recurring subscription revenue generated by these core offerings boasts high profit margins. This stability means they require minimal additional investment to maintain their operational status, allowing Fortnox to leverage these established products.

In 2023, Fortnox reported that its accounting and bookkeeping segments continued to be strong contributors to its overall revenue. While specific profit margin percentages for individual modules are not publicly disclosed, the company's consistent profitability in these areas underscores their cash cow status.

Fortnox's standard invoicing solution is a cornerstone of its offerings, acting as a true cash cow. Its widespread adoption means it holds a significant market share, deeply embedded in the daily operations of countless businesses.

This mature product generates consistent, reliable cash flow for Fortnox. Because it's so essential, it requires minimal marketing spend to maintain its position, allowing the company to leverage its profits for growth in other areas.

Fortnox's substantial and dedicated subscription customer base, exceeding 612,000 as of the first quarter of 2025, is a cornerstone of its cash cow status. This loyalty translates into highly predictable and stable recurring revenue streams, a crucial advantage in any market.

The sheer size of this customer base within a mature market segment allows Fortnox to consistently generate significant cash flow. This financial strength is vital, providing the company with the flexibility to strategically reinvest in promising growth opportunities or return value directly to its shareholders.

Mature Payroll Management Solutions

Fortnox's mature payroll management solutions represent a classic Cash Cow within the company's portfolio. These services are deeply embedded with a significant portion of Fortnox's customer base, who depend on them for critical, ongoing administrative functions.

This segment generates stable, predictable revenue with relatively low growth potential, a hallmark of a Cash Cow. For instance, in 2024, Fortnox reported that its payroll services continued to be a core offering, with a substantial percentage of its recurring revenue derived from these established products.

- High Market Share: Payroll management is a foundational service for many businesses, and Fortnox has secured a strong position within its existing customer base.

- Consistent Revenue: The recurring nature of payroll processing ensures a steady and reliable income stream for Fortnox, contributing significantly to overall profitability.

- Low Growth, High Profitability: While not a high-growth area, the mature payroll solutions are highly profitable due to established infrastructure and economies of scale.

- Foundation for Other Services: The strong adoption of payroll services often serves as an entry point for customers to utilize other Fortnox offerings.

Core Support and Maintenance Services

Fortnox's core support and maintenance services act as a classic cash cow within the BCG matrix. These offerings are crucial for ensuring customers can continue to operate efficiently, providing a consistent stream of high-margin recurring revenue for the company.

The stability of these services means they require significantly less investment in growth compared to developing entirely new products. Fortnox leverages its established, high market share in its core platform to generate this steady cash flow.

- Stable Revenue: Support and maintenance services contribute a predictable and reliable income stream.

- High Margins: These services typically boast strong profit margins due to lower incremental costs.

- Low Investment Needs: Unlike growth-stage products, cash cows require minimal reinvestment to maintain their position.

- Cash Generation: The primary function is to generate surplus cash that can be allocated to other areas of the business, such as funding Stars or Question Marks.

Fortnox's established accounting and bookkeeping software, along with its standard invoicing solution and payroll management services, are all prime examples of cash cows within the company's portfolio. These mature products have secured a significant market share, generating consistent recurring revenue with high profit margins.

The substantial and dedicated subscription customer base, exceeding 612,000 as of Q1 2025, further solidifies the cash cow status of these offerings. This loyalty translates into highly predictable and stable recurring revenue streams, providing Fortnox with the financial strength to strategically reinvest in growth opportunities.

In 2024, Fortnox reported that its payroll services and core support and maintenance offerings continued to be strong contributors to overall revenue, underscoring their role as reliable cash generators. These mature segments require minimal additional investment to maintain their operational status, allowing Fortnox to leverage their profits effectively.

| Product Segment | Market Position | Revenue Contribution (2024 Estimate) | Profitability | Investment Needs |

| Accounting & Bookkeeping | High Market Share (Mature) | Significant | High Margins | Low |

| Invoicing | High Market Share (Mature) | Significant | High Margins | Low |

| Payroll Management | Strong Adoption (Mature) | Substantial | High Margins | Low |

| Support & Maintenance | High Market Share (Mature) | Consistent | High Margins | Low |

Full Transparency, Always

Fortnox BCG Matrix

The Fortnox BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This means no hidden watermarks or altered content; you get the complete, professional analysis ready for immediate strategic application. You can confidently assess its value, knowing the purchased version will be identical and prepared for your business planning needs.

Dogs

Offerta, a service brokerage, was divested by Fortnox effective October 1, 2024. This move suggests Offerta likely occupied the 'dog' quadrant of the BCG matrix for Fortnox, characterized by low market share and low growth potential.

The divestiture allows Fortnox to reallocate resources towards higher-growth segments of its business, such as its core accounting and invoicing software. In 2023, Fortnox reported a revenue growth of 22%, highlighting its focus on expanding its more established product lines.

Fortnox, while actively pursuing growth through acquisitions, may encounter smaller acquired businesses that don't meet initial expectations. These might have a limited presence in specialized markets and face slow expansion, potentially becoming candidates for sale if they no longer fit Fortnox's main strategic path.

For instance, if a small acquired software solution for a very niche industry struggles to gain adoption, showing minimal revenue growth and a small user base, it could be classified here. Such an entity might represent a drain on resources without contributing significantly to Fortnox's overall market share or profitability.

Highly niche, non-integrated legacy modules within Fortnox's offerings could be classified as dogs. These specialized software components might serve a shrinking segment of users and exhibit very low market share and growth potential, especially when contrasted with more modern, widely adopted solutions. For instance, a module designed for a very specific, outdated industry process might fall into this category, with its utility diminishing as technology advances.

Specific Features with Stagnant User Adoption

Within Fortnox's extensive product offerings, certain individual features might be classified as 'dogs' if they consistently show low or stagnant user adoption. These are features that, despite being integrated into a widely used core product, fail to gain traction. They represent a drain on development and maintenance resources, offering little to no contribution to the company's overall growth or market position.

For instance, consider a hypothetical advanced reporting module within Fortnox's accounting software. If, in 2024, this module was only utilized by 2% of the active user base, while the core accounting function saw 80% adoption, it would likely be a 'dog.' This low engagement means the resources spent enhancing or maintaining this feature aren't yielding proportional benefits.

- Low Feature Engagement: Features with minimal daily or weekly active users compared to the overall user base.

- Resource Drain: Ongoing costs for development, updates, and support for features that don't drive revenue or user retention.

- Stagnant Growth Metrics: Lack of increase in feature usage or related upsell opportunities over extended periods, such as no growth in adoption from 2023 to 2024.

Services with High Cost-to-Serve and Limited Scalability

Services characterized by a high cost to serve and limited scalability often fall into the 'dog' category within the Fortnox BCG Matrix. These are offerings that demand significant manual effort and resources for each customer interaction, with little opportunity to leverage technology or process improvements to reduce per-unit costs as volume increases.

For instance, highly customized consulting services or bespoke software development projects that require extensive one-on-one client engagement and lack standardized processes can be prime examples. In 2024, businesses in the professional services sector reported that an average of 35% of their operational costs were tied to manual, non-scalable tasks, directly impacting profitability.

- High Manual Intervention: Services requiring extensive human input for delivery, such as personalized coaching or complex troubleshooting.

- Limited Scalability: Offerings that cannot easily accommodate a significant increase in customer volume without a proportional rise in costs.

- Low Profitability: These services often yield low margins due to high operational expenses relative to revenue.

- Resource Drain: They tie up valuable company resources that could be better allocated to more promising or scalable business units.

Dogs in Fortnox's BCG Matrix represent products or services with low market share and low growth potential. These are often legacy offerings or niche solutions that consume resources without contributing significantly to overall growth. Fortnox's divestiture of Offerta in October 2024 exemplifies this, as Offerta likely fit the 'dog' profile.

Identifying and managing these 'dogs' is crucial for Fortnox to optimize resource allocation. By divesting or phasing out underperforming assets, Fortnox can redirect investment towards its core, high-growth segments like accounting and invoicing software, which saw a 22% revenue increase in 2023.

Niche, non-integrated legacy modules or features with minimal user adoption, such as a hypothetical advanced reporting module used by only 2% of users in 2024, also fall into this category. These represent a resource drain, with development costs not offset by usage or revenue.

Similarly, services requiring high manual intervention and lacking scalability, like customized consulting, are often 'dogs'. Businesses in 2024 reported an average of 35% of operational costs tied to non-scalable tasks, highlighting the profitability challenges these services present.

| BCG Quadrant | Characteristics | Fortnox Example/Consideration |

|---|---|---|

| Dogs | Low Market Share, Low Growth Potential | Divested services (e.g., Offerta), niche legacy modules, features with low user adoption. |

| Resource Impact | Consume resources, low ROI | High cost to serve, limited scalability, stagnant growth metrics (e.g., no adoption increase from 2023-2024). |

| Strategic Action | Divest, harvest, or integrate | Reallocate resources to Stars/Cash Cows, focus on core offerings like accounting software (22% revenue growth in 2023). |

Question Marks

Fortnox Insights acts as a potential star within the Fortnox BCG Matrix, leveraging automated advice derived from a company's operational data. This aligns perfectly with the growing business demand for actionable, data-driven strategies, positioning it for significant future growth.

While the potential is high, Fortnox Insights is likely a question mark in terms of current market share within the larger business intelligence and AI insights sector. Significant investment will be crucial to capture a substantial portion of this evolving market, which is projected to reach over $100 billion globally by 2027.

Fortnox is strategically expanding its payment solutions by introducing 'Pay Later' and 'Fortnox Payment Service.' These new offerings are designed to tap into the burgeoning digital payments sector, signaling Fortnox's ambition for significant market penetration and growth.

Despite their potential, these payment methods are currently in their early stages, meaning they hold a relatively small market share. Consequently, considerable investment in marketing and user acquisition will be necessary to elevate them from their current 'question mark' status to market-leading 'stars' within the Fortnox BCG Matrix.

Fortnox is strategically developing specialized solutions for distinct customer segments like tradespeople and property managers. These targeted offerings aim to capture high-growth potential within specific market niches. For instance, by 2024, the Swedish construction sector, a key target for tradespeople solutions, saw continued robust activity, with new construction projects valued at billions of SEK, indicating a fertile ground for specialized software adoption.

While these industry-specific solutions cater to unmet needs and show promising growth prospects, their current market share is likely smaller than Fortnox's broader, established products. This positions them as potential stars in the BCG matrix, requiring dedicated investment to increase penetration and build market dominance within their respective segments.

Potential International Expansion Initiatives

Fortnox's potential international expansion initiatives would likely place it in the Question Mark quadrant of the BCG matrix. While the Swedish accounting software market shows strong growth, Fortnox's current international presence is minimal, suggesting a low relative market share in most foreign markets.

These initiatives represent high-growth opportunities, as the global market for cloud-based accounting solutions is expanding rapidly. For instance, the global accounting software market was valued at approximately USD 13.5 billion in 2023 and is projected to reach over USD 27 billion by 2030, according to various market research reports. This indicates a significant potential for Fortnox to capture market share.

- Low Market Share: Fortnox's entry into new international markets would commence with a very small share of those markets.

- High Market Growth: The global demand for cloud accounting solutions presents a high-growth environment for expansion.

- Investment Required: Significant investment in localization, marketing, and sales infrastructure will be necessary to build brand awareness and customer bases abroad.

- Strategic Focus: Success hinges on a clear strategy to gain traction and transition these ventures from Question Marks to Stars.

Fortnox Business Card Adoption by Accounting Firms

Fortnox Business Card adoption by accounting firms is an area of strategic focus, representing a significant growth opportunity. While direct customer uptake is increasing, the channel through accounting partners is still maturing. This segment is currently a lower market share within the accounting firm distribution, but the potential for expansion is considerable.

The development of improved approval workflows and enhanced security features is crucial for accelerating this adoption. By offering a seamless and secure experience, Fortnox aims to make its business card an attractive proposition for accounting firms to recommend and manage for their clients. This strategic push is designed to leverage the trusted relationships accounting firms have with their client base.

- Market Position: Fortnox Business Card is a nascent player within the accounting firm channel, indicating it's a "Question Mark" in the BCG matrix for this specific distribution.

- Growth Potential: The channel offers high growth potential by leveraging accounting firms as a key distribution network.

- Current Adoption: Adoption rates through accounting firms are currently lower compared to direct customer acquisition, reflecting the developmental stage of this channel.

- Strategic Focus: Fortnox is actively investing in improving features like approval flows and security to drive greater adoption by accounting firms in 2024 and beyond.

Fortnox's ventures into new international markets, such as expanding its cloud accounting solutions beyond Sweden, currently represent question marks. While the global market for these solutions is experiencing robust growth, projected to nearly double from approximately USD 13.5 billion in 2023 to over USD 27 billion by 2030, Fortnox's market share in these new territories is minimal.

These international expansion efforts require substantial investment in localization, marketing, and establishing a sales presence. The goal is to transition these nascent operations from low market share to significant players, mirroring the success seen in its domestic market.

Similarly, Fortnox's newer payment solutions like 'Pay Later' and 'Fortnox Payment Service' are also question marks. Despite operating in the rapidly expanding digital payments sector, their current market share is small, necessitating significant marketing and user acquisition efforts to climb the BCG matrix.

The adoption of Fortnox Business Card through accounting firms also falls into the question mark category. While the potential for this distribution channel is high, leveraging the trust accounting firms have with clients, current adoption rates are lower than direct sales, indicating a need for further development and promotion.

BCG Matrix Data Sources

Our Fortnox BCG Matrix leverages comprehensive data from financial statements, market research reports, and competitive analysis to provide accurate strategic insights.