Ford Otosan PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ford Otosan Bundle

Navigate the complex external landscape affecting Ford Otosan with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, technological advancements, environmental regulations, and socio-cultural shifts are shaping the automotive giant's trajectory. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities.

Gain a critical edge by delving into the detailed PESTLE factors impacting Ford Otosan. This analysis provides the crucial insights needed to refine your business strategy and investment decisions. Download the full version now and unlock a deeper understanding of the forces driving the automotive industry.

Political factors

The Turkish government is strongly backing its automotive sector, especially with significant incentives for electric vehicle (EV) and battery production. A notable $5 billion package is in place to help increase EV output to a million vehicles per year.

These government initiatives are designed to make Turkey a more attractive location for EV manufacturing. This policy direction directly supports Ford Otosan's strategic push into electrification and its broader expansion goals within the country.

Ford Otosan's substantial export operations, particularly to European markets, are significantly shaped by Turkey's trade agreements and its customs union membership with the European Union. This preferential access, established through frameworks like the Association Agreement, allows for reduced tariffs and streamlined customs procedures, bolstering Ford Otosan's competitive edge.

In 2023, Turkey's total exports reached $257.5 billion, with the EU remaining its largest trading partner. Ford Otosan, a major contributor to these figures, leverages this existing free trade infrastructure. For instance, the company's Kocaeli plants are pivotal in supplying vehicles and parts across Europe, benefiting directly from these long-standing trade arrangements.

However, any shifts in these international trade relations, such as the imposition of new tariffs or the renegotiation of existing agreements, could directly affect Ford Otosan's export volumes and profitability. The company's strategic planning must therefore account for potential changes in trade policy that could alter its market access and cost structure in key European markets.

Political stability in Turkey directly impacts investor confidence and foreign direct investment, crucial for Ford Otosan's long-term growth. A stable political landscape fosters a predictable operating environment, essential for strategic planning and production targets.

Government continuity and consistent policy frameworks are vital for businesses like Ford Otosan. For instance, changes in economic policies or trade agreements stemming from political shifts can significantly alter operational costs and market access.

Political uncertainties in Turkey could lead to fluctuating exchange rates and inflation, affecting Ford Otosan's profitability and investment decisions. For example, in early 2024, ongoing geopolitical tensions in the region have underscored the importance of a stable political climate for attracting and retaining foreign capital.

Government support for automotive industry

The Turkish government's commitment to bolstering the automotive sector extends beyond electric vehicle (EV) subsidies. It actively provides comprehensive support and incentives for new investments, with the strategic goal of positioning Turkey as a key regional manufacturing hub. This proactive stance encourages major global players, including Ford Otosan, to channel investments into new technologies and operational expansions within the country.

This sustained government backing is instrumental in driving sector growth and fostering technological innovation. For instance, Turkey's automotive sector received significant support through various investment incentive schemes. In 2023, the Ministry of Industry and Technology reported that incentives worth billions of Turkish Lira were allocated to automotive projects, facilitating advancements in production and R&D.

- Government's Vision: To establish Turkey as a prominent automotive production base in the region.

- Investment Incentives: Broad-based support beyond EVs, encouraging new technology and expansion.

- Impact on Ford Otosan: Facilitates new technology investments and operational growth within Turkey.

- Sectoral Growth: Fosters overall advancement and competitiveness in the Turkish automotive industry.

International relations and market access

Ford Otosan's global manufacturing and export activities are deeply intertwined with Turkey's international relations. Fluctuations in diplomatic ties directly impact market access, influencing trade agreements and tariff structures. For instance, maintaining robust relationships with European Union countries is crucial, as the EU remains a primary export destination for Ford Otosan vehicles. In 2023, Ford Otosan's export sales reached 266,000 units, with a significant portion destined for European markets.

Geopolitical stability and evolving trade policies are key considerations. Developments in Turkey's relationships with regions like the Middle East and North Africa also shape export opportunities. The company's strategic presence in Romania, with its Craiova plant, diversifies its European manufacturing footprint and enhances its ability to serve regional markets efficiently, mitigating some risks associated with a singular export focus.

- Export Dependence: Ford Otosan exported 75% of its total production in 2023, highlighting its reliance on international market access.

- EU Market Share: The European Union accounts for a substantial portion of Ford Otosan's export revenue, making EU trade relations critical.

- Romanian Operations: The Craiova facility in Romania, acquired by Ford in 2008, plays a vital role in Ford Otosan's European production and sales strategy.

- Geopolitical Sensitivity: Trade disputes or political tensions can lead to tariffs or restrictions, directly affecting export volumes and profitability.

The Turkish government's strategic focus on the automotive sector, particularly its robust incentives for electric vehicle (EV) and battery production, significantly benefits Ford Otosan. A substantial $5 billion package aims to boost EV output to one million vehicles annually, directly aligning with Ford Otosan's electrification strategy and expansion plans within Turkey.

Turkey's strong trade ties, especially its customs union with the EU, provide Ford Otosan with preferential market access, reducing tariffs and streamlining customs for its substantial exports. In 2023, Turkey's exports totaled $257.5 billion, with the EU as its largest trading partner, a framework Ford Otosan actively leverages from its Kocaeli plants.

Political stability is paramount for investor confidence and foreign direct investment, which are crucial for Ford Otosan's growth. Consistent government policies and continuity ensure a predictable operating environment, mitigating risks associated with potential shifts in economic or trade policies that could impact profitability and market access.

Ford Otosan's export performance, with 75% of its 2023 production exported, is heavily influenced by geopolitical factors and trade relations. The company's significant reliance on the EU market, which accounted for a large portion of its export revenue in 2023, makes it sensitive to trade disputes or political tensions that could impose tariffs or restrictions.

What is included in the product

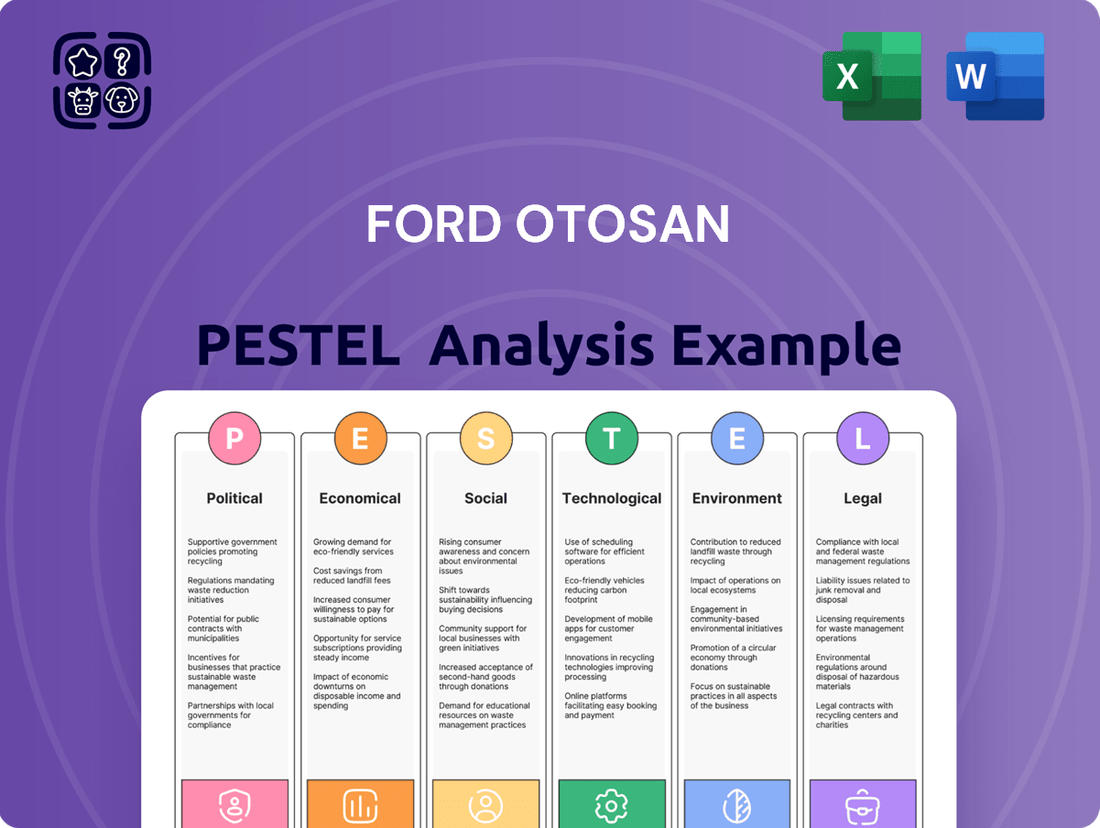

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing Ford Otosan's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by highlighting key trends and potential impacts relevant to Ford Otosan's market position.

Provides a concise version of the Ford Otosan PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

High inflation rates in Turkey, which saw the annual inflation rate reach 75.45% in May 2024 according to official statistics, directly pressure Ford Otosan's production expenses and profitability.

The Turkish Lira's significant depreciation, trading around 32 Lira to the Euro in mid-2024, impacts Ford Otosan's export earnings and the cost of essential imported parts, creating a complex financial environment.

Effectively navigating these inflationary pressures and currency fluctuations is paramount for maintaining Ford Otosan's financial stability and competitive edge in the automotive sector.

The Turkish automotive market is a significant driver for Ford Otosan, with projections indicating it will surpass one million units sold annually by 2025. This growth trajectory is closely watched by the company.

Factors such as the purchasing power of Turkish consumers, prevailing interest rates, and the general economic stability within the country directly impact domestic sales volumes for vehicles. Ford Otosan actively tracks these economic indicators.

By closely monitoring these domestic market trends, Ford Otosan is better positioned to refine and adjust its sales targets for the Turkish market, ensuring strategic alignment with economic realities.

Ford Otosan's export revenue is a cornerstone of its financial health, with exports making up a substantial 77% of its total revenues in 2024. This heavy reliance on international markets underscores the critical importance of its global sales performance.

The company's success is intrinsically linked to the demand dynamics within key European commercial vehicle markets and other export destinations. Consequently, any shifts in economic conditions or consumer spending in these regions directly translate into fluctuations in Ford Otosan's top-line figures.

Investment and capital expenditure plans

Ford Otosan is making substantial investments to bolster its future. For 2025, the company has earmarked approximately €750-€850 million for capital expenditure, a slight increase from the €739 million invested in 2024. These significant outlays are strategically focused on expanding production capabilities, particularly for electric vehicles, and modernizing its manufacturing sites in Turkey and Romania. Such robust capital allocation is essential for maintaining a competitive edge and driving technological advancement in the automotive sector.

Key investment areas include:

- Expansion of Electric Vehicle (EV) Production: A core focus is increasing the capacity to produce next-generation electric vehicles.

- Facility Upgrades: Investments are being made to modernize and enhance the efficiency of plants in Turkey and Romania.

- Technological Advancement: Capital is being deployed to adopt new manufacturing technologies and improve overall operational capabilities.

Cost of raw materials and supply chain economics

The cost of raw materials and components, heavily influenced by global commodity prices and the efficiency of supply chains, directly impacts Ford Otosan's manufacturing expenses. For instance, the price of steel, a key component in vehicle production, saw fluctuations throughout 2024, impacting overall production costs.

High inflation, a persistent economic factor in many regions where Ford Otosan operates, can significantly exacerbate these material and component costs. This, in turn, puts pressure on the profitability of vehicles sold, especially when price increases cannot be fully passed on to consumers.

Effective supply chain management, including strategic sourcing and building resilience, alongside localization efforts to reduce reliance on long-distance transport, are crucial for Ford Otosan to mitigate these economic pressures. By increasing local sourcing of parts, the company can better manage currency fluctuations and shipping costs.

- Global commodity prices: Steel prices, a major input for Ford Otosan, experienced volatility in 2024, with some benchmarks showing a 5-10% increase in certain periods compared to 2023 averages.

- Inflationary impact: Turkey's inflation rate remained elevated, averaging around 40-50% for much of 2024, directly increasing the cost of labor and domestically sourced components.

- Supply chain disruptions: While easing from previous years, shipping costs for certain components still presented challenges, with freight rates for key Asian routes showing a 3-7% increase in the latter half of 2024.

- Localization benefits: Ford Otosan's ongoing efforts to increase local content in its vehicles, aiming for over 70% by 2025, are designed to buffer against these external economic shocks.

Turkey's high inflation, reaching 75.45% in May 2024, and the Lira's depreciation to around 32 to the Euro in mid-2024, significantly increase Ford Otosan's production costs and impact export earnings. The domestic market is expected to exceed one million units sold annually by 2025, but consumer purchasing power and interest rates remain key factors. Ford Otosan's substantial investments, projected at €750-€850 million for 2025, focus on EV production and facility upgrades to navigate these economic challenges.

| Economic Factor | 2024 Data/Projection | Impact on Ford Otosan |

|---|---|---|

| Annual Inflation Rate (Turkey) | 75.45% (May 2024) | Increased production costs, pressure on profitability |

| Turkish Lira to Euro Exchange Rate | ~32 TRY/EUR (Mid-2024) | Reduced export earnings, higher import costs for parts |

| Projected Turkish Auto Market Sales | > 1 million units by 2025 | Potential for increased domestic sales, dependent on purchasing power |

| Capital Expenditure (Ford Otosan) | €739 million (2024), €750-€850 million (2025) | Investment in EV production and facility modernization to enhance competitiveness |

Preview the Actual Deliverable

Ford Otosan PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Ford Otosan delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a clear understanding of the external forces shaping Ford Otosan's business landscape, enabling informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights into opportunities and threats, crucial for any stakeholder interested in Ford Otosan's future.

Sociological factors

Consumer preferences in key markets like Turkey and Europe are rapidly shifting towards smaller, more fuel-efficient vehicles, with a significant surge in demand for electrified options. This pivot is largely fueled by government incentives aimed at promoting cleaner transportation and a growing public consciousness regarding environmental impact. For instance, in 2023, electric vehicle sales in the European Union saw a substantial increase, making up over 14% of the total passenger car market, a trend that continues to accelerate into 2024.

Ford Otosan is actively responding to this evolving landscape by strategically adjusting its product development. The company is placing a greater emphasis on its electric vehicle lineup, with models such as the Puma Gen-E and the E-Transit Courier demonstrating this commitment. This focus on electrification is crucial for maintaining market relevance and capturing a larger share of the growing green automotive segment.

Turkey's ongoing urbanization, with a significant portion of its population residing in cities, presents a strong foundation for the automotive sector. This trend, coupled with a comparatively lower vehicle ownership rate than many European Union nations, signals substantial growth potential for domestic vehicle sales. For instance, in 2023, Turkey's vehicle ownership was around 170 vehicles per 1,000 people, considerably less than the EU average of over 500.

This demographic landscape creates a long-term opportunity for companies like Ford Otosan to expand their market share. By focusing on vehicles designed for urban environments and diverse mobility needs, Ford Otosan can effectively tap into this growing demand. The increasing concentration of people in urban centers naturally drives the need for personal transportation solutions.

Ford Otosan’s success hinges on its Turkish and Romanian workforce, encompassing design, engineering, and manufacturing. Labor availability and education levels are key, especially with the growing need for expertise in electric vehicle (EV) technology and sophisticated manufacturing processes. For instance, in 2023, Ford Otosan announced plans to hire 3,000 new employees in Turkey, many of whom will require specialized training in these emerging fields.

Customer expectations for safety and technology

Modern consumers are increasingly prioritizing advanced safety features and seamless connectivity in their vehicles. This trend is evident in the growing demand for driver-assistance systems and integrated infotainment. For instance, by 2024, the global automotive safety systems market was projected to reach over $35 billion, with advanced driver-assistance systems (ADAS) being a significant driver of this growth.

Regulatory bodies are also playing a crucial role. The European Union's General Safety Regulation II, which came into full effect in July 2024, mandates several advanced safety features, including intelligent speed assistance and emergency lane keeping systems, on all new vehicle types. This regulatory push aligns with and amplifies consumer expectations for enhanced vehicle safety.

Ford Otosan is responding to these evolving customer expectations and regulatory landscapes by integrating cutting-edge safety and technology into its new models. This strategy not only ensures compliance but also significantly boosts the appeal and competitiveness of its product offerings in the 2024-2025 market. For example, the introduction of new connected services and enhanced ADAS capabilities in their latest commercial vehicle lines aims to capture a larger market share.

- Consumer Demand: Growing preference for integrated tech and advanced safety features like adaptive cruise control and lane keeping assist.

- Regulatory Mandates: EU's General Safety Regulation II (effective July 2024) requires features such as autonomous emergency braking and driver drowsiness detection.

- Ford Otosan's Response: Strategic integration of these technologies to meet market needs and ensure regulatory adherence, enhancing vehicle attractiveness.

- Market Impact: Increased product appeal and potential for higher sales volumes driven by safety and technology advancements in the 2024-2025 period.

Brand perception and social responsibility

Ford Otosan's brand perception is significantly shaped by its dedication to sustainability and innovation. The public increasingly recognizes companies that prioritize environmental responsibility, making Ford Otosan's investments in electrification and eco-friendly manufacturing crucial for its reputation. For instance, in 2023, Ford Otosan announced a €2 billion investment in its Gölcük and Eskişehir plants to support electric vehicle production, demonstrating a tangible commitment to a greener future.

Public awareness of these initiatives directly impacts how consumers and potential employees view the company. A positive perception, bolstered by transparent reporting on environmental, social, and governance (ESG) metrics, is essential for attracting both customers and skilled talent in the highly competitive automotive sector. Ford Otosan's ongoing efforts to enhance its social responsibility profile, including community engagement programs and ethical labor practices, further solidify its standing.

Key aspects influencing Ford Otosan's brand perception include:

- Commitment to Sustainability: Investments in electric vehicle technology and reduced environmental footprint.

- Innovation in Mobility: Development of new technologies and forward-thinking solutions for transportation.

- Social Responsibility Initiatives: Engagement with local communities and adherence to ethical business practices.

- Transparency in Operations: Clear communication regarding ESG performance and corporate citizenship.

Societal attitudes towards vehicle ownership are evolving, with a growing emphasis on shared mobility and sustainability. This shift, particularly pronounced in urban areas, influences consumer purchasing decisions and necessitates adaptable business models. For instance, ride-sharing services continued to gain traction across Europe in 2023 and 2024, impacting traditional car sales patterns.

Ford Otosan's strategic response includes exploring diverse mobility solutions and reinforcing its commitment to environmentally friendly practices. This proactive approach aims to align the company with changing societal values and maintain its competitive edge in a dynamic market. The company's investments in electric vehicle production, such as the E-Transit Courier, directly address this societal trend.

The increasing demand for corporate social responsibility (CSR) also plays a significant role, with consumers and stakeholders expecting businesses to contribute positively to society. Ford Otosan's initiatives in community development and ethical operations are vital for building trust and enhancing its brand image. By focusing on sustainable manufacturing and employee well-being, Ford Otosan strengthens its societal license to operate.

| Societal Factor | Trend in 2023-2025 | Impact on Ford Otosan |

|---|---|---|

| Shared Mobility | Continued growth in ride-sharing and car-sharing platforms | Need for flexible vehicle offerings and potential partnerships |

| Sustainability Awareness | Increased consumer preference for eco-friendly products and ethical brands | Emphasis on EV production and reduced environmental footprint |

| Corporate Social Responsibility | Growing expectation for businesses to contribute to societal well-being | Importance of community engagement and transparent ESG reporting |

Technological factors

Ford Otosan dedicates significant resources to research and development, acting as a crucial innovation engine within Ford's worldwide operations. In 2023, the company continued its focus on enhancing vehicle efficiency, advancing safety features, and pioneering new models, particularly in the electric and connected commercial vehicle segments. This commitment to R&D fuels their product pipeline and strengthens their market position.

Ford Otosan is making significant investments in electric vehicle (EV) production, a move that positions it at the forefront of automotive industry shifts. The company is establishing a new battery assembly line at its Craiova plant, a critical step in securing its EV supply chain. This investment underscores a commitment to electrifying its model lineup, with all-electric versions of popular vehicles like the Transit Courier and Puma already in development or production.

These strategic investments are designed to solidify Ford Otosan's role in Ford's broader European electrification strategy. By focusing on EV production, the company is not only adapting to changing consumer demand and regulatory pressures but also laying the groundwork for future growth. For instance, Ford has committed billions to EV development globally, with European operations like Ford Otosan being central to achieving these ambitious electrification targets by 2030.

Ford Otosan is heavily invested in digitalization and Industry 4.0, integrating automation, robotics, and data analytics into its manufacturing. This commitment is evident in their ongoing investments; for instance, the company allocated approximately €2 billion for its Gölcük and Eskişehir facilities in 2022, a significant portion of which is directed towards advanced manufacturing technologies. These initiatives are designed to boost production efficiency and lower operational costs, crucial for maintaining a competitive edge in the evolving automotive landscape.

The adoption of Industry 4.0 principles directly supports Ford Otosan's drive towards a greener automotive industry. By optimizing production processes, reducing waste through data-driven insights, and enabling more efficient energy consumption, these technologies contribute to a more sustainable manufacturing footprint. This strategic focus on technological advancement not only enhances operational excellence but also positions Ford Otosan as a leader in environmentally conscious automotive production.

Development of new vehicle platforms and partnerships

Ford Otosan's strategic alliances, notably its collaboration with Volkswagen on commercial vehicle production utilizing a common platform, are crucial for achieving economies of scale and capitalizing on shared technological know-how. This partnership is a key driver for expanding production capacity and market penetration.

The company's commitment to designing and engineering new vehicle generations underscores its robust product development pipeline. In 2023, Ford Otosan's investment in research and development reached approximately €300 million, highlighting its focus on innovation.

- Shared Platform Efficiency: The Volkswagen partnership allows Ford Otosan to leverage shared platform development, reducing R&D costs and accelerating time-to-market for new commercial vehicles.

- Enhanced Production Capacity: By collaborating on vehicle platforms, Ford Otosan can significantly increase its production volumes, aiming for over 1 million vehicles annually across its joint ventures.

- Expanded Market Reach: These partnerships facilitate access to new markets and customer segments, bolstering Ford Otosan's global presence in the commercial vehicle sector.

- Technological Advancement: The joint development of new vehicle platforms fosters the integration of cutting-edge technologies, improving vehicle performance, efficiency, and connectivity.

Focus on connected and autonomous driving technologies

Ford Otosan is actively developing its expertise in connected and autonomous driving technologies, a move that mirrors the broader shifts occurring in the global automotive industry. This strategic focus is driven by the anticipated improvements these advancements will bring to vehicle safety, operational efficiency, and the overall user experience for drivers and passengers alike.

By investing heavily in these cutting-edge areas, Ford Otosan is positioning itself to maintain a leading role in the ongoing technological transformation of the automotive sector. For instance, the global market for Advanced Driver-Assistance Systems (ADAS), a precursor to full autonomy, was valued at approximately $26.5 billion in 2023 and is projected to reach over $70 billion by 2030, highlighting the significant growth potential and industry commitment to these technologies. Ford Otosan's commitment aligns with this trajectory, aiming to integrate sophisticated systems into its future vehicle platforms.

Key developments and implications include:

- Enhanced Safety Features: Autonomous driving systems, even at lower levels of automation, significantly reduce human error, which is a factor in over 90% of road accidents. Ford Otosan's investment aims to leverage this to create safer vehicles.

- Improved Traffic Flow and Efficiency: Connected vehicle technology allows for real-time data sharing, optimizing traffic management and fuel efficiency. This could translate to lower operating costs for commercial vehicles produced by Ford Otosan.

- New Revenue Streams: The development of sophisticated software and data services related to connected and autonomous driving presents opportunities for recurring revenue beyond traditional vehicle sales.

Ford Otosan's technological trajectory is marked by substantial R&D investment, with approximately €300 million allocated in 2023 alone, focusing on electrification and advanced commercial vehicles. The company is actively integrating Industry 4.0 principles, evident in its €2 billion investment in advanced manufacturing technologies for its Gölcük and Eskişehir facilities. This drive towards digitalization enhances production efficiency and supports sustainability goals.

The strategic collaboration with Volkswagen on commercial vehicle platforms is a key technological enabler, fostering economies of scale and shared know-how. Ford Otosan is also heavily invested in connected and autonomous driving technologies, recognizing their potential to boost safety, efficiency, and create new revenue streams, aligning with the projected significant growth in the Advanced Driver-Assistance Systems (ADAS) market, which was valued at approximately $26.5 billion in 2023.

| Technology Focus Area | Key Initiatives / Investments | Impact / Data Point |

|---|---|---|

| Research & Development | 2023 R&D Investment | €300 million |

| Electrification | New Battery Assembly Line (Craiova) | Securing EV supply chain, development of electric Transit Courier and Puma |

| Industry 4.0 / Digitalization | Investment in Gölcük & Eskişehir Facilities | €2 billion (approx. 2022) for advanced manufacturing technologies |

| Platform Collaboration | Partnership with Volkswagen | Leveraging shared platforms for commercial vehicles, aiming for over 1 million annual production |

| Connected & Autonomous Driving | Integration of ADAS | Aligning with global ADAS market growth (valued at $26.5 billion in 2023) |

Legal factors

Ford Otosan navigates a complex landscape of automotive safety regulations, particularly those mirroring EU standards such as the General Safety Regulation (GSR II). These rules require the integration of sophisticated safety technologies into all new vehicles.

For instance, GSR II mandates features like intelligent speed assistance and emergency lane keeping systems in new vehicle types from July 2022 and all new registrations from July 2024. Ford Otosan's commitment to these evolving mandates is paramount for continued market access and legal compliance in key markets like Turkey and Europe.

Changes in Turkey's Special Consumption Tax (ÖTV) directly affect vehicle affordability and sales. For instance, a 2024 adjustment might see lower ÖTV rates for electric vehicles (EVs) compared to internal combustion engine (ICE) vehicles, encouraging EV adoption. Ford Otosan needs to align its product portfolio and pricing to capitalize on these incentives.

These fiscal policies shape market demand. If ÖTV on larger engine vehicles increases, demand might shift towards smaller, more fuel-efficient, or electric models. Ford Otosan's sales volumes in Turkey, a significant market for them, will be directly influenced by how well they adapt to these evolving tax structures and consumer preferences driven by them.

Turkey's updated vehicle import and certification regulations necessitate adherence to technical standards, verified by the Turkish Standards Institution (TSE). This means Ford Otosan must ensure all imported vehicles meet these specific requirements.

Furthermore, new customs duties have been imposed on vehicles originating from countries like China. For instance, as of early 2024, Turkey has implemented an additional 40% customs duty on vehicles imported from China, impacting cost structures and the competitive pricing of imported models.

These regulatory shifts directly influence Ford Otosan's import strategies and the overall competitiveness of its imported vehicle offerings within the Turkish market, potentially affecting sales volumes and profit margins.

Intellectual property and licensing agreements

Ford Otosan's operations are heavily reliant on intellectual property and trademark license agreements, primarily with Ford Motor Company, especially concerning its heavy truck manufacturing and sales. These agreements are crucial as they outline the specific rights for production and distribution, alongside the financial obligations for utilizing Ford's product development and intellectual property. For instance, in 2023, Ford Otosan's revenue from licensing and royalty fees related to these agreements contributed significantly to its financial performance, reflecting the ongoing value of these partnerships.

Maintaining strict adherence to these long-term contractual obligations is not just a legal necessity but a cornerstone of Ford Otosan's business strategy. These licenses grant access to established brand recognition and technological advancements, enabling Ford Otosan to compete effectively in the global automotive market. The company's ability to successfully navigate and uphold these agreements directly impacts its operational continuity and market positioning.

- License Agreements: Ford Otosan holds key license agreements with Ford Motor Company for the manufacturing and sale of Ford-branded heavy trucks.

- Revenue Contribution: In 2023, licensing and royalty fees from these agreements were a notable component of Ford Otosan's overall revenue.

- Operational Dependency: Compliance with these IP and trademark licenses is fundamental to Ford Otosan's core business model and its ability to leverage the Ford brand.

Labor laws and employment regulations

Ford Otosan's manufacturing and operational footprint in Turkey and Romania means it must navigate distinct labor laws. These regulations cover everything from minimum wage and working hours to health and safety standards, and employee benefits. For instance, Turkey's labor law, Law No. 4857, sets the framework for employment contracts, termination procedures, and social security contributions, while Romania's Labor Code governs similar aspects for its workforce.

Adherence to these employment regulations is critical for Ford Otosan to ensure a productive and harmonious work environment. Non-compliance can lead to significant penalties, including fines and legal challenges, impacting operational continuity and reputation. For example, in 2023, Turkey's minimum wage was set at 11,402 Turkish Lira per month, a figure that directly influences labor costs and employment strategies.

Collective bargaining agreements also play a vital role, particularly in Turkey, where unions can negotiate terms of employment for their members. Ford Otosan's engagement with labor unions and its commitment to fair labor practices are therefore paramount. In 2024, discussions around potential updates to labor laws in both countries, focusing on areas like remote work policies and gig economy regulations, could influence Ford Otosan's human resource strategies.

- Turkish Labor Law (Law No. 4857): Dictates employment contracts, working conditions, and termination rights.

- Romanian Labor Code: Governs employment relationships, including wages, working hours, and employee leave.

- Minimum Wage Compliance: Adherence to national minimum wage rates, such as Turkey's 2024 rate of 17,002 Turkish Lira, is mandatory.

- Union Relations: Managing relationships with labor unions is crucial for collective bargaining and industrial peace.

Ford Otosan must navigate evolving automotive safety regulations, such as the EU's General Safety Regulation (GSR II), which mandates advanced safety features in new vehicles. Compliance with these standards, like the July 2024 deadline for all new registrations to have features such as intelligent speed assistance, is crucial for market access.

Changes in Turkey's tax structure, specifically the Special Consumption Tax (ÖTV), directly impact vehicle affordability and sales. For example, preferential ÖTV rates for electric vehicles (EVs) in 2024 encourage EV adoption, requiring Ford Otosan to align its product strategy accordingly.

New customs duties, such as the 40% levied on vehicles from China in early 2024, affect import costs and competitiveness. Ford Otosan's import strategies and pricing must adapt to these fiscal measures to maintain market position.

Intellectual property and licensing agreements, particularly with Ford Motor Company for heavy truck manufacturing, are vital. In 2023, these agreements significantly contributed to Ford Otosan's revenue, underscoring their importance for brand leverage and operational continuity.

Labor laws in Turkey and Romania dictate employment terms, from minimum wages to safety standards. Adherence to regulations like Turkey's Law No. 4857 and Romania's Labor Code is essential to avoid penalties and maintain a stable workforce. Turkey's minimum wage in 2024 was set at 17,002 Turkish Lira, impacting labor costs.

| Legal Factor | Regulation/Law | Impact on Ford Otosan | Example Data/Year |

|---|---|---|---|

| Safety Standards | GSR II | Mandates advanced safety features for market access. | July 2024 deadline for all new registrations. |

| Taxation | Turkey's ÖTV | Affects vehicle affordability and EV adoption. | Preferential rates for EVs in 2024. |

| Trade Policy | Chinese Import Duty | Impacts import costs and pricing competitiveness. | 40% duty implemented early 2024. |

| Intellectual Property | Licensing Agreements with Ford Motor Company | Crucial for brand leverage and revenue. | Significant revenue contribution in 2023. |

| Labor Law | Turkish Law No. 4857 / Romanian Labor Code | Governs employment, requires compliance with minimum wage and safety. | Turkey minimum wage 17,002 TRY in 2024. |

Environmental factors

Ford Otosan is actively pursuing carbon neutrality, aiming for its production facilities and R&D centers to reach this goal by 2030. This significant commitment extends to its entire European operations, including logistics and suppliers, with a target date of 2035.

Achieving these ambitious targets necessitates substantial financial commitments, with considerable investments being channeled into renewable energy sources and the implementation of broader sustainable operational practices. This strategic focus underscores Ford Otosan's dedication to aligning with international environmental objectives and fulfilling its corporate social responsibility mandates.

Ford Otosan is actively navigating the global shift towards zero-emission vehicles (ZEVs). The company has set ambitious targets, aiming for 100% ZEV sales in passenger, light, and medium commercial segments by 2035, and extending this to heavy commercial vehicles by 2040. This strategic pivot requires significant investment in expanding electric vehicle (EV) production capacity and developing essential charging infrastructure. Meeting these evolving emission standards and anticipating future market preferences are paramount to Ford Otosan's long-term success.

Ford Otosan is actively pursuing sustainable resource management, aiming to incorporate up to 30% recycled and renewable plastics into its vehicles by 2030. This ambitious target underscores a commitment to reducing reliance on virgin materials and fostering a more circular economy within its manufacturing processes.

Furthermore, the company is focused on water conservation, with a goal to decrease fresh water usage per vehicle by 40% by the same 2030 deadline. These initiatives are crucial for minimizing environmental impact and ensuring operational resilience in the face of growing resource scarcity concerns.

Renewable energy integration in operations

Ford Otosan is making significant strides in renewable energy integration. Currently, all electricity powering its facilities is sourced from renewables. This commitment is a key environmental factor influencing its operations and strategy.

Looking ahead, Ford Otosan aims for complete self-sufficiency in electricity generation, targeting 100% of its supply from its own renewable sources. This includes exploring innovative options like offshore solar farms. Such a move would drastically reduce operational carbon emissions and bolster energy security.

This strategic focus on renewable energy underscores Ford Otosan's dedication to sustainable manufacturing practices. For example, in 2023, the company announced investments aimed at increasing its renewable energy capacity, aligning with global environmental goals and potentially reducing energy costs in the long run.

Key aspects of Ford Otosan's renewable energy integration include:

- 100% Renewable Electricity Supply: All current electricity used by Ford Otosan facilities is sourced from renewable origins.

- Long-Term Self-Sufficiency Goal: The company plans to generate 100% of its electricity needs internally through renewable sources.

- Exploration of Offshore Solar: Potential projects, such as offshore solar farms, are being considered to achieve this self-sufficiency.

- Reduced Operational Emissions: This strategy directly contributes to lowering the company's carbon footprint and enhancing energy independence.

Supply chain sustainability and environmental standards

Ford Otosan is deeply committed to supply chain sustainability, setting ambitious targets for its partners. The company aims for its entire supply chain, including suppliers and logistics, to achieve carbon neutrality by 2035. This proactive stance reflects a growing industry trend and regulatory pressure to reduce the environmental footprint across all business operations.

To achieve these goals, Ford Otosan actively monitors the sustainability performance of its suppliers. This involves regular assessments and engagement to ensure alignment with environmental standards. For instance, in 2023, Ford Otosan conducted sustainability audits for over 70% of its key suppliers, identifying areas for improvement and collaboration.

Furthermore, Ford Otosan provides crucial support to its suppliers through training programs and detailed roadmaps. These initiatives help suppliers understand and implement sustainable practices, fostering a shared responsibility for environmental stewardship. This holistic approach ensures that environmental responsibility is integrated throughout Ford Otosan's entire value chain, not just its direct operations.

- Carbon Neutrality Target: Ford Otosan aims for its supply chain to be carbon neutral by 2035.

- Supplier Monitoring: Actively tracks and assesses supplier sustainability performance.

- Support and Training: Provides training and roadmaps to help suppliers adopt sustainable practices.

- Holistic Approach: Extends environmental responsibility across the entire value chain.

Ford Otosan is heavily investing in transitioning to zero-emission vehicles, targeting 100% ZEV sales by 2035 for passenger and light/medium commercial vehicles, and by 2040 for heavy commercial vehicles. This strategic shift is driven by increasing environmental regulations and consumer demand for sustainable transportation solutions.

The company is also focused on reducing its operational footprint, aiming for carbon neutrality in its production facilities and R&D centers by 2030, and extending this to its entire European operations, including logistics and suppliers, by 2035. This commitment necessitates significant investment in renewable energy and sustainable operational practices.

Ford Otosan is integrating recycled and renewable materials, with a goal of using up to 30% recycled and renewable plastics in vehicles by 2030, alongside a 40% reduction in fresh water usage per vehicle by the same year.

| Environmental Goal | Target Year | Current Status/Action |

|---|---|---|

| Carbon Neutrality (Production & R&D) | 2030 | Actively pursuing |

| Carbon Neutrality (European Operations) | 2035 | Actively pursuing |

| 100% ZEV Sales (Passenger, Light & Medium Commercial) | 2035 | Strategic pivot underway |

| 100% ZEV Sales (Heavy Commercial) | 2040 | Strategic pivot underway |

| Recycled/Renewable Plastics in Vehicles | 2030 | Target of 30% |

| Fresh Water Usage Reduction | 2030 | Target of 40% reduction |

| Renewable Electricity Supply | Ongoing | 100% of current electricity sourced from renewables |

| Supply Chain Carbon Neutrality | 2035 | Actively monitoring and supporting suppliers |

PESTLE Analysis Data Sources

Our PESTLE analysis for Ford Otosan is built on a comprehensive review of official Turkish government publications, international automotive industry reports, and reputable economic and market research data. We integrate insights from regulatory bodies, financial institutions, and technology trend forecasters to ensure a robust understanding of the macro-environment.