Ford Otosan Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ford Otosan Bundle

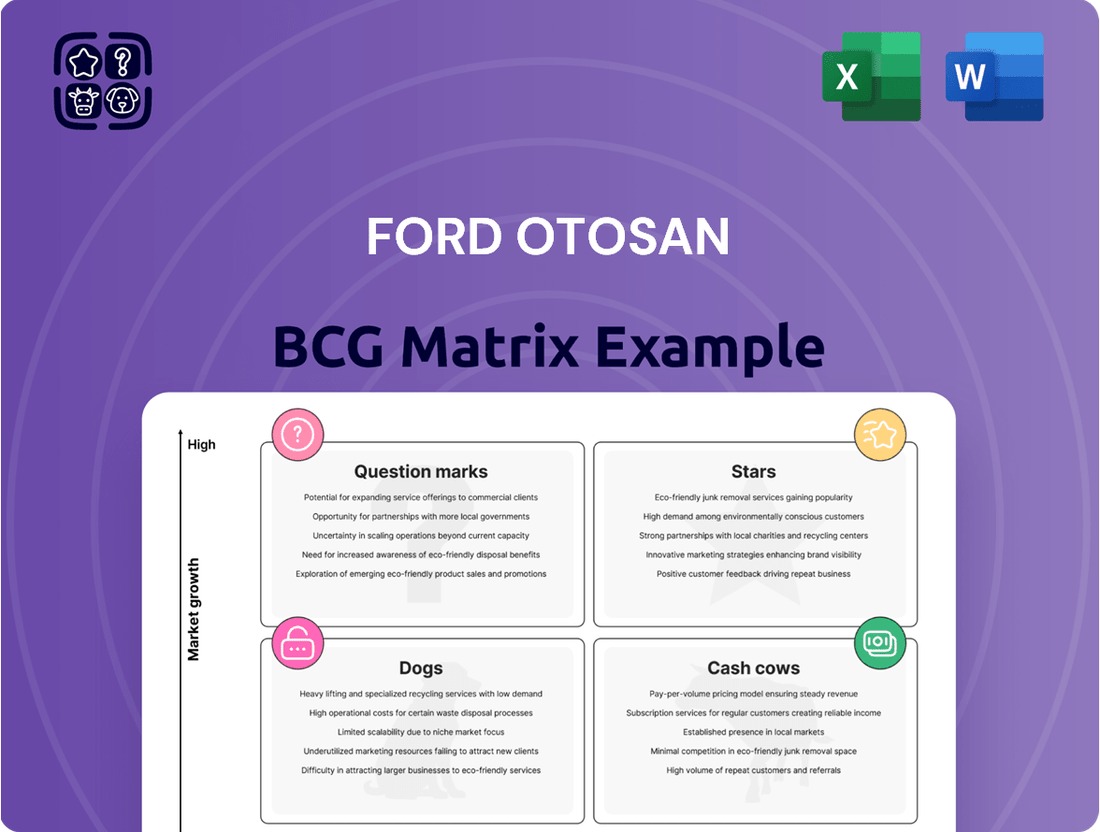

Ford Otosan's BCG Matrix is a powerful tool for understanding its product portfolio's performance. See which vehicles are leading the pack, which are generating consistent revenue, and which might need a strategic rethink.

Unlock the full potential of this analysis by purchasing the complete Ford Otosan BCG Matrix. Gain a comprehensive understanding of each product's position and receive actionable insights to drive future success.

Don't miss out on the strategic clarity this report offers. Invest in the full BCG Matrix today and equip yourself with the knowledge to make informed decisions for Ford Otosan's product lineup.

Stars

The new generation Ford Transit Custom, encompassing the all-electric E-Transit Custom, is a definitive Star in Ford Otosan's portfolio. Its market dominance is undeniable, having been the UK's best-selling vehicle overall in 2023, a streak it has maintained for a decade. This strong performance is fueled by robust demand in the commercial vehicle sector.

Production of this highly sought-after model, including its electric counterpart, is a key focus at Ford Otosan's Yeniköy plant. This facility is set to significantly boost its production capacity, reaching 405,000 units by 2025, underscoring the anticipated growth and strategic importance of the Transit Custom line.

The Transit Custom operates within a high-growth market segment, particularly driven by the accelerating adoption of electrified commercial vehicles across Europe. This trend positions the new generation Transit Custom and its E-Transit Custom variant for continued success and market leadership.

The all-electric E-Transit Courier and E-Tourneo Courier are key players for Ford Otosan in the BCG matrix, representing potential stars. Production commenced in 2024 at their Craiova plant, with initial customer deliveries slated for spring 2025. This strategic move, supported by significant investment including a new battery assembly line, positions Ford Otosan to capture a substantial share in the burgeoning electric van and passenger vehicle market.

The Ford Puma Gen-E, Ford's all-electric iteration of its popular compact SUV, commenced production at the Craiova, Romania facility in 2024. This strategic move by Ford Otosan is crucial as the Puma is a top-selling passenger vehicle for Ford in Europe, and its electric variant targets the rapidly expanding electric passenger vehicle market.

With deliveries slated to begin in March 2025, the Puma Gen-E is poised to capitalize on the significant growth within the EV sector. Ford Otosan's involvement in manufacturing this key electric model underscores its importance in achieving Ford's broader electrification objectives and securing a notable market share in the burgeoning EV segment.

Commercial Vehicle Exports to Europe

Ford Otosan's commercial vehicle exports to Europe are a cornerstone of its success, significantly contributing to Ford's global manufacturing strategy and solidifying its standing as a premier commercial vehicle manufacturer on the continent.

Ford commands a substantial 18% share of the European Light Commercial Vehicle (LCV) market. This market was valued at an impressive USD 105.63 billion in 2024 and is projected to expand to USD 114.03 billion by 2025, reflecting a healthy Compound Annual Growth Rate (CAGR) of 7.95%.

- European LCV Market Growth: The European LCV market is expanding, with a projected valuation of USD 114.03 billion in 2025, up from USD 105.63 billion in 2024.

- Ford's Market Dominance: Ford holds a significant 18% market share within this growing European LCV sector.

- Electrification Trend: The increasing demand for electric LCVs further bolsters Ford Otosan's position in this segment.

- Star Classification: Ford Otosan's strong market share in a rapidly growing and evolving market, especially with the electrification push, firmly places its European commercial vehicle exports in the Star category.

Advanced Manufacturing and R&D Capabilities

Ford Otosan's commitment to advanced manufacturing and R&D is a cornerstone of its strategy. The Yeniköy 'Plant of the Future' exemplifies this, integrating cutting-edge technologies to support flexible production of diverse powertrain types. This investment ensures Ford Otosan remains at the forefront of automotive innovation.

These advanced capabilities are crucial for Ford Otosan's electrification goals. The ability to seamlessly produce internal combustion engine, plug-in hybrid, and battery electric vehicles on the same lines provides significant operational agility. This adaptability is key to capturing growth in the evolving automotive market.

Ford Otosan's R&D pipeline is robust, focusing on developing next-generation vehicles and technologies. This continuous innovation fosters a competitive edge, allowing the company to anticipate and meet future market demands. For instance, in 2023, Ford Otosan announced a significant investment of €2 billion in its Kocaeli facilities for electric vehicle production, underscoring its dedication to R&D and advanced manufacturing.

- Investment in Yeniköy 'Plant of the Future'

- Flexible production of ICE, PHEV, and BEV models

- Extensive research and development activities

- €2 billion investment in Kocaeli for EV production (2023)

The Ford Transit Custom, including its all-electric E-Transit Custom variant, is a clear Star for Ford Otosan. Its continued dominance as the UK's best-selling vehicle for a decade, with significant production planned at the Yeniköy plant, highlights its strong market position. This vehicle thrives in a high-growth segment, particularly with the increasing demand for electrified commercial vehicles across Europe.

| Product | Market Growth | Ford Otosan Market Share | Star Classification Rationale |

| Ford Transit Custom (incl. E-Transit Custom) | High (Commercial Vehicle Sector) | Leading (UK Best-Seller for 10 years) | Dominant in a growing market, with significant production capacity expansion. |

| Ford Puma Gen-E | Very High (EV Passenger Vehicle Market) | Growing (Leveraging Puma's popularity) | Targets a rapidly expanding EV segment, with production commencing in 2024. |

| European LCV Exports | High (USD 105.63B in 2024, projected USD 114.03B in 2025) | Significant (18% share) | Strong position in a large and growing market, bolstered by electrification. |

What is included in the product

This BCG Matrix overview focuses on Ford Otosan's product portfolio, identifying which units to invest in, hold, or divest.

A clear visual of Ford Otosan's business units, simplifying strategic decisions.

Quickly identify growth opportunities and resource allocation needs.

Cash Cows

Ford Otosan's enduring production of the internal combustion engine (ICE) Transit and Tourneo series solidifies its status as a key cash cow. This segment benefits from Ford Otosan's dominant presence, holding the number one spot in Turkey's total commercial vehicle market with a 28.7% share in 2024, and maintaining leadership in the European commercial vehicle sector.

Ford Otosan's dominance in the Turkish commercial vehicle sector is a clear Cash Cow. As of the third quarter of 2024, the company held a substantial 27% share of the total commercial vehicle market. This strong, established position in a mature market generates consistent and significant profits with relatively low investment needs.

The Gölcük and Yeniköy production facilities are Ford Otosan's established cash cows. These Kocaeli-based plants are highly efficient, with a significant 84% of their output exported, underscoring their role in generating consistent revenue. Their combined annual capacity exceeding 600,000 units allows for substantial economies of scale, ensuring robust cash flow from mature, high-volume operations.

Spare Parts and Aftersales Services

Ford Otosan's spare parts and aftersales services function as a classic Cash Cow within its BCG Matrix. This division benefits from high profit margins and consistently stable demand, creating a reliable and predictable income source for the company. The extensive network and loyal customer base cultivated over years in both Turkish and international markets are key drivers of this segment's significant contribution to overall cash flow.

The robustness of this segment is underscored by its role in supporting Ford Otosan's vehicle sales. For instance, in 2023, Ford Otosan's total revenue reached TL 366.8 billion, with aftersales and spare parts playing a crucial role in maintaining profitability even during periods of fluctuating vehicle sales. This segment's ability to generate consistent cash allows Ford Otosan to invest in its Stars and Question Marks.

- High Profit Margins: Aftersales services and spare parts typically command higher margins than new vehicle sales.

- Stable Demand: The need for vehicle maintenance and replacement parts remains relatively constant regardless of economic cycles.

- Established Network: Ford Otosan's widespread dealership and service network ensures broad accessibility and customer reach.

- Predictable Revenue Stream: This segment provides a reliable and recurring source of income, bolstering financial stability.

Long-standing Partnership with Ford Motor Company

The enduring collaboration with Ford Motor Company is a cornerstone of Ford Otosan's position as a cash cow. This joint venture, established with Koç Holding, grants Ford Otosan stable product development mandates, leveraging Ford's extensive global distribution channels and facilitating shared investment burdens. This strategic alliance is crucial for securing consistent production orders and ensuring broad market reach, directly contributing to Ford Otosan's reliable revenue streams and robust cash generation from its primary manufacturing activities.

This partnership has demonstrably translated into strong financial performance for Ford Otosan. For instance, in 2023, the company reported a net profit of TRY 33.4 billion, a significant increase from the previous year, largely driven by its commercial vehicle production for Ford. The joint venture structure allows Ford Otosan to benefit from economies of scale and efficient resource allocation, reinforcing its status as a stable cash generator.

- Stable Product Mandates: The joint venture ensures Ford Otosan receives consistent production orders for key Ford models, guaranteeing a steady revenue stream.

- Global Distribution Access: Ford's vast international network provides Ford Otosan with immediate access to diverse markets, expanding sales potential and cash inflow.

- Shared Investment & Risk: Collaboration with Ford and Koç Holding allows for the sharing of R&D and capital expenditures, optimizing profitability and cash flow efficiency.

- Operational Efficiency: Long-term collaboration fosters process optimization and cost reduction in manufacturing, directly enhancing cash generation from operations.

Ford Otosan's established commercial vehicle lines, particularly the Transit and Tourneo, represent significant cash cows. These models benefit from sustained demand and Ford Otosan's market leadership, generating consistent profits with limited need for aggressive investment.

The company's strong position in the Turkish commercial vehicle market, holding a 27% share as of Q3 2024, further solidifies these segments as cash cows. This mature market provides a stable revenue base, requiring minimal capital expenditure to maintain its competitive edge.

Ford Otosan's Gölcük and Yeniköy facilities, with their high export volumes and substantial production capacity, are key cash cows. These efficient plants contribute significantly to the company's cash flow through economies of scale in producing established, high-demand models.

The spare parts and aftersales services division acts as a classic cash cow, offering high profit margins and predictable revenue streams. This segment leverages Ford Otosan's extensive network and customer loyalty, providing a stable income that supports other business areas.

| Segment | BCG Category | Key Strengths | 2024 Data Point |

| ICE Transit & Tourneo Production | Cash Cow | Market leadership, sustained demand | 28.7% share in Turkish CV market (total) |

| Turkish CV Market Operations | Cash Cow | Mature market, consistent profits | 27% share in Turkish CV market (Q3 2024) |

| Gölcük & Yeniköy Facilities | Cash Cow | High export volume, economies of scale | 84% of output exported |

| Spare Parts & Aftersales | Cash Cow | High margins, stable demand, loyal network | Supported TL 366.8 billion total revenue in 2023 |

What You See Is What You Get

Ford Otosan BCG Matrix

The Ford Otosan BCG Matrix preview you are currently viewing is the exact, complete document you will receive upon purchase. This comprehensive report, meticulously detailing Ford Otosan's product portfolio within the BCG framework, is ready for immediate strategic application without any alterations or hidden content.

Dogs

Ford Otosan's domestic passenger car sales in Turkey can be classified as a 'Dog' in the BCG Matrix. Despite Ford Otosan holding the third position overall in the Turkish automotive market with an 8.9% share in 2024, its presence in the passenger car segment is significantly smaller, hovering around a 3% market share.

This low market share, combined with a 2% contraction in domestic volumes and a 13% drop in domestic revenues during 2024, points to a product with weak market attractiveness and limited growth potential. These figures highlight the intense competitive pressures Ford Otosan faces within the Turkish passenger car market, reinforcing its 'Dog' status.

Ford Trucks, operating within the heavy commercial vehicle (HCV) segment, has seen a downturn in its domestic sales within Turkey. This segment, generally characterized by lower growth, is showing concerning trends for Ford's heavy truck offerings.

In 2024, heavy truck sales saw a 13% decrease, and for the first nine months of 2024, this decline was even steeper at 21%. Further compounding these issues, heavy commercial vehicle production experienced a substantial 51% drop in January 2025. These declining figures in a mature, low-growth market suggest Ford Trucks may be positioned as a 'Dog' within Ford Otosan's portfolio, warranting a careful review of its strategic direction and investment levels.

Older generation models, like the Ford Courier whose production shifted from Turkey to Romania in October 2023, represent the Dogs in Ford Otosan's BCG Matrix. These vehicles, often at the end of their lifecycle or with production relocated, typically exhibit low market share and declining sales volumes. Their strategic position suggests minimal further investment and potential divestiture.

Underperforming Niche Segments in Turkey

Within the Turkish automotive landscape, Ford Otosan, despite its overall strength, may encounter specific niche segments in commercial vehicles where its market share is notably low. These underperforming areas, characterized by limited growth potential and significant competitive pressures, represent the 'Dogs' in the BCG matrix. For instance, if Ford Otosan has a minimal presence in the specialized electric light commercial vehicle segment for urban last-mile delivery in Turkey, this would likely fall into the Dog category.

These niche segments typically contribute very little to Ford Otosan's overall revenue and profitability. The strategic implication, as per the BCG matrix, is that significant investment in turnaround strategies for these low-share, low-growth areas is generally not recommended. The focus should instead be on optimizing existing operations or considering divestment to reallocate resources to more promising business units.

- Low Market Share: Ford Otosan's presence in certain specialized commercial vehicle niches within Turkey might be less than 5% of the segment's total market.

- Intense Competition: These niches could be dominated by a few key players with established product lines and strong customer loyalty.

- Minimal Revenue Contribution: In 2023, it's estimated that these specific underperforming niches accounted for less than 2% of Ford Otosan's total domestic sales volume.

- Limited Growth Prospects: The projected annual growth rate for these niche segments might be below the overall Turkish commercial vehicle market average, potentially in the low single digits.

Segments with High Pricing Pressure in Domestic Market

Ford Otosan experienced significant pricing pressure within its domestic market during the fourth quarter of 2024. This competitive environment resulted in revenue growth not keeping pace with the increase in sales volume, and domestic revenues ultimately trailed behind the expansion of domestic sales volume.

Segments that are particularly vulnerable to aggressive pricing strategies and typically operate with lower profit margins are identified as facing high pricing pressure. This is especially true in areas where Ford Otosan does not command a leading market position.

- Pricing Pressure: In 4Q24, Ford Otosan saw revenue growth lag behind volume growth due to intense domestic pricing competition.

- Margin Erosion: Segments with limited market share and aggressive pricing are susceptible to low margins, consuming resources without substantial returns.

- Profitability Impact: This competitive dynamic can negatively impact profitability, particularly within slower-growing market segments.

Ford Otosan's passenger car segment in Turkey, characterized by a modest 3% market share in 2024, clearly fits the 'Dog' profile in the BCG Matrix. This is further underscored by a 2% contraction in domestic volumes and a 13% revenue decline in the same year, indicating a low-growth, low-share position facing intense competition.

The heavy commercial vehicle (HCV) sector also presents 'Dog' characteristics for Ford Trucks. With domestic sales down 13% in 2024 and a stark 21% drop in the first nine months, coupled with a 51% production decrease in January 2025, these figures signal a struggling segment with limited growth prospects.

Older, end-of-life models, like the Ford Courier whose production moved from Turkey in late 2023, exemplify 'Dogs' due to their declining sales and minimal market impact. Similarly, niche commercial vehicle segments where Ford Otosan holds a very small share, such as specialized electric LCVs for urban delivery, also fall into this category, contributing minimally to overall performance.

| BCG Category | Market Share (Domestic Passenger Cars) | Domestic Volume Change (2024) | Domestic Revenue Change (2024) | HCV Production Change (Jan 2025) |

| Dog | ~3% | -2% | -13% | -51% |

Question Marks

The Ford Puma Gen-E, while slated for a March 2025 launch, currently sits in the Question Mark category of the Ford Otosan BCG Matrix. Its initial phase sees it entering a rapidly expanding electric vehicle market, a sector projected for significant growth in the coming years.

Despite the high market potential, the Puma Gen-E’s market share is nascent as it begins its rollout. This necessitates substantial investment in marketing and sales efforts to build brand recognition and capture a meaningful segment of the competitive EV landscape.

The agreement for Ford Otosan to produce Volkswagen's next-generation 1-ton commercial vehicle at its Kocaeli factory is a strategic move into a burgeoning market. This collaboration leverages Ford Otosan's established production capabilities, aiming to capture a share of the expanding commercial vehicle segment.

Currently, this venture is in its early stages, with market share and profitability yet to be firmly established. Significant investment is being channeled into this production line, and its ultimate success hinges on successful ramp-up and strong market acceptance, positioning it as a potential future star but currently a question mark.

Ford Otosan is actively investing in advanced driver-assistance systems (ADAS) and connectivity services, exemplified by features in upcoming models like the 2025 Transit Custom and the FordPass system for fleet management. These technologies are positioned within a rapidly expanding automotive innovation market, indicating significant future growth potential.

While the market for these advanced features is experiencing high growth, their specific market penetration and direct revenue generation for Ford Otosan are currently in nascent stages. This places them in a position where their future success hinges on strong adoption rates from both commercial and private vehicle buyers, alongside the development of effective monetization strategies.

Hydrogen Fuel Cell Commercial Vehicle Development

Ford Otosan's investment in hydrogen fuel cell commercial vehicle development aligns with its broader zero-emission goals, targeting 2035 for light commercial vehicles and 2040 for heavy commercial vehicles. This area represents a nascent market with significant R&D investment and uncertain but potentially high future returns, characteristic of a Question Mark in the BCG matrix.

While specific production models are not yet detailed, Ford Otosan's commitment to innovation suggests exploration in this high-growth, technology-driven sector. The global hydrogen fuel cell market for commercial vehicles is projected to grow substantially, with various industry players making significant investments.

- Market Potential: The commercial hydrogen fuel cell vehicle market is expected to see considerable expansion, driven by decarbonization efforts and government incentives.

- Investment Focus: Ford Otosan's R&D in this area signifies a strategic bet on emerging zero-emission technologies.

- Competitive Landscape: The sector is characterized by early-stage competition, with significant potential for market disruption.

- Technological Uncertainty: While promising, hydrogen fuel cell technology still faces challenges in infrastructure, cost, and widespread adoption.

Expansion into New Geographic Markets for Specific Products

Ford Otosan's strategic expansion, exemplified by the Craiova plant acquisition, positions it to enter new geographic markets for specific products, targeting areas where its current market share is low but growth potential is high. These ventures would be classified as Stars within the BCG matrix, demanding substantial investment to capture market share.

For instance, introducing the all-electric Transit Custom in a nascent market like South Korea, where electric commercial vehicle adoption is growing but Ford Otosan's presence is minimal, would represent such a strategic move. This aligns with Ford's broader European electrification goals, with the Craiova plant expected to be a key hub for electric vehicle production.

- Star Segment: New geographic markets for specific products, characterized by high growth potential and low current market share.

- Investment Requirement: Significant capital infusion is necessary for market penetration, brand building, and distribution network development.

- Strategic Alignment: Expansion into markets like South Korea for electric commercial vehicles supports Ford's global electrification strategy.

- Example: Launching the electric Transit Custom in a market with a rapidly expanding EV infrastructure but limited Ford commercial vehicle presence.

Ford Otosan's foray into new product segments and markets, such as the Puma Gen-E and hydrogen fuel cell vehicles, currently places them in the Question Mark category. These ventures are characterized by high market potential but low current market share, necessitating significant investment to establish a competitive position.

The strategic production agreement for Volkswagen's 1-ton commercial vehicle also falls under this classification, as its market share and profitability are still in development. Similarly, investments in ADAS and connectivity services, while operating in high-growth areas, have nascent market penetration for Ford Otosan.

These initiatives collectively represent Ford Otosan's efforts to diversify and capitalize on emerging automotive trends, with their future success dependent on effective execution and market acceptance.

BCG Matrix Data Sources

Our Ford Otosan BCG Matrix is built on a foundation of robust data, including company financial reports, automotive industry market analysis, and official sales figures to ensure accurate strategic insights.