Flutter Entertainment PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flutter Entertainment Bundle

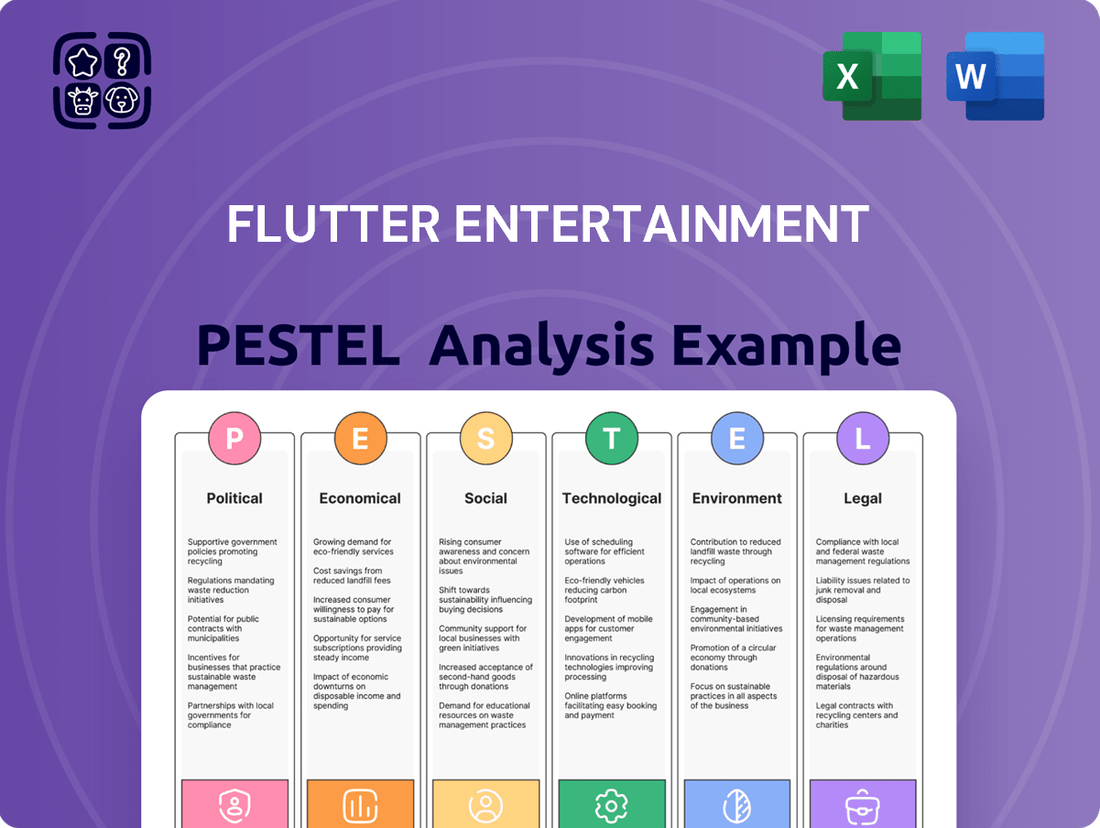

Flutter Entertainment operates in a dynamic global landscape, influenced by a complex interplay of political, economic, social, technological, legal, and environmental factors. Understanding these external forces is crucial for any stakeholder aiming to forecast market trends and identify strategic opportunities or risks. Our comprehensive PESTLE analysis dives deep into these critical areas, offering actionable intelligence tailored for Flutter Entertainment.

Gain a competitive edge by leveraging our expert-crafted PESTLE analysis. Discover how evolving regulations, economic shifts, and technological advancements are shaping Flutter Entertainment's operational environment and future growth prospects. Download the full version now to unlock strategic insights and make informed decisions.

Political factors

Flutter Entertainment operates within a complex web of government regulations and licensing requirements that significantly shape its business. Recent shifts, particularly in the United States, have seen states like New York introduce new tax structures and advertising restrictions. For instance, New York's 51% tax on gross gaming revenue for online sports betting, implemented in early 2022, directly impacts profitability for operators like Flutter's FanDuel.

Adapting to these diverse and dynamic regulatory landscapes is crucial for Flutter's continued success. The company must navigate varying licensing fees, responsible gambling mandates, and data privacy laws across its key markets, including the UK and Australia. Failure to comply can result in substantial fines or even loss of operating licenses, underscoring the need for proactive and flexible compliance strategies.

Geopolitical stability significantly impacts Flutter Entertainment's global operations. For instance, the company's substantial presence in the United States, a key growth market, is influenced by the evolving regulatory landscape and the broader political climate. Trade policies and international relations can affect cross-border transactions and data flow, potentially creating hurdles for expansion into new territories or impacting existing market access.

Flutter's ability to navigate international relations is crucial for its market access. Political stability in regions where Flutter operates or seeks to expand, such as Australia or parts of Europe, directly influences its operational continuity and investment decisions. For example, in 2024, ongoing geopolitical tensions in Eastern Europe have continued to highlight the importance of risk assessment for companies with diverse international footprints.

Flutter Entertainment's profitability is directly influenced by government taxation policies across its global markets. Fluctuations in gambling duties, corporate tax rates, and consumption taxes in key regions like the UK, Australia, and the US can significantly impact its financial performance. For instance, an increase in the UK's Remote Gaming Duty could reduce Flutter's net profit margins in that crucial market.

Political Lobbying and Industry Influence

Flutter Entertainment actively engages with political stakeholders to shape the regulatory landscape for the gaming industry. This involves significant investment in lobbying efforts, often channeled through industry associations, to advocate for policies that support growth and mitigate risks. For instance, in 2023, the American Gaming Association, of which Flutter is a member, spent over $1.5 million on federal lobbying, highlighting the financial commitment to influencing policy.

The importance of these activities cannot be overstated. By participating in industry groups and directly lobbying, Flutter aims to foster a favorable regulatory environment, which can include advocating for clear licensing frameworks and fair taxation. This proactive approach is crucial for safeguarding business interests against potentially adverse legislative proposals that could impact revenue or operational flexibility.

- Lobbying Expenditure: Flutter, through its membership in industry bodies, indirectly contributes to significant lobbying budgets, such as the estimated $1.5 million spent by the American Gaming Association in 2023.

- Policy Influence: Engagement aims to shape regulations concerning online gambling, advertising standards, and responsible gaming measures.

- Risk Mitigation: Proactive political involvement helps anticipate and counter legislative threats that could negatively affect Flutter's market position.

- Industry Collaboration: Working with associations allows for a unified voice on critical issues, amplifying the impact of individual company efforts.

Government Stance on Responsible Gaming

Governments worldwide are increasingly focusing on responsible gaming, which directly influences Flutter Entertainment's operational landscape. This growing emphasis translates into potential mandates for stricter consumer protection measures. For instance, the UK government's Gambling Act review, ongoing through 2024 and into 2025, is exploring tighter regulations on advertising and affordability checks, which could impact Flutter's marketing spend and customer acquisition strategies.

Flutter must navigate a delicate balance between its commercial objectives and the social responsibility agenda pushed by political bodies. Initiatives like deposit limits or enhanced age verification processes, while aimed at consumer protection, can affect revenue streams. In 2023, Flutter reported significant investment in responsible gambling tools and initiatives, a trend likely to accelerate as political pressure mounts.

- Stricter Advertising Regulations: Governments may impose limitations on how gambling operators can advertise, impacting Flutter's brand visibility and customer outreach efforts.

- Mandatory Affordability Checks: Political pressure for enhanced player protection could lead to mandatory affordability checks, potentially restricting player spending and affecting Flutter's revenue.

- Increased Compliance Costs: Adhering to evolving responsible gaming legislation often requires investment in new technologies and processes, increasing operational expenses for Flutter.

- Focus on Player Protection: Political agendas prioritize safeguarding vulnerable individuals, pushing companies like Flutter to invest more in tools and support for responsible gambling.

Flutter Entertainment's operations are heavily influenced by government policies and political stability across its global markets. The company navigates a complex regulatory environment, with significant developments in the United States, such as New York's 51% tax on online sports betting revenue implemented in early 2022, directly impacting profitability. Geopolitical tensions, as seen in Eastern Europe in 2024, underscore the need for robust risk assessment for Flutter's international footprint.

Governments worldwide are increasingly prioritizing responsible gaming, leading to potential mandates for stricter consumer protection measures. The UK's ongoing Gambling Act review, extending into 2025, is examining tighter advertising and affordability regulations, which could affect Flutter's marketing strategies and revenue streams. Flutter's proactive engagement with political stakeholders, including significant lobbying efforts through industry associations like the American Gaming Association, which spent over $1.5 million on federal lobbying in 2023, is crucial for shaping a favorable regulatory landscape.

| Market | Key Political Factor | Impact on Flutter | Relevant Data/Event |

|---|---|---|---|

| United States | State-level regulation, Taxation | Revenue, Operational costs | New York's 51% sports betting tax (2022) |

| United Kingdom | Responsible Gaming Review, Advertising restrictions | Marketing spend, Player acquisition | UK Gambling Act review ongoing (2024-2025) |

| Global | Geopolitical stability, Trade policies | Market access, Operational continuity | Eastern European tensions impacting international risk assessment (2024) |

| Industry-wide | Lobbying and Policy Influence | Regulatory environment, Risk mitigation | American Gaming Association lobbying expenditure: ~$1.5M (2023) |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Flutter Entertainment, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, enabling Flutter Entertainment to navigate opportunities and mitigate risks within its operating landscape.

A concise PESTLE analysis of Flutter Entertainment, distilled into actionable insights, serves as a pain point reliever by simplifying complex external factors for strategic decision-making.

This analysis, presented in an easily digestible format, helps alleviate the pain of information overload by providing a clear overview of political, economic, social, technological, legal, and environmental influences impacting Flutter Entertainment.

Economic factors

Global economic growth directly impacts Flutter Entertainment's revenue streams, as consumer discretionary spending on betting and gaming is highly sensitive to economic cycles. During periods of economic expansion, increased disposable income typically leads to higher player engagement and average spend per user.

Conversely, economic downturns can dampen consumer confidence and reduce the funds available for non-essential activities like gambling. For instance, while specific 2024/2025 projections vary, historical trends show a correlation between GDP growth rates and online betting market expansion, with a slowdown in economic activity often translating to more cautious consumer spending.

Inflation significantly impacts Flutter Entertainment's operational expenses. Rising costs for essential inputs like technology infrastructure, digital marketing campaigns, and skilled personnel can directly squeeze profit margins. For instance, increased wages to retain talent in a competitive market or higher cloud computing costs due to general price hikes can add substantial pressure.

These inflationary pressures can erode profitability if Flutter cannot pass on increased costs to consumers through pricing adjustments. In the competitive online betting and gaming sector, price elasticity of demand is a critical consideration. Failure to manage these cost increases effectively through operational efficiencies or strategic pricing could lead to a noticeable decline in profit margins throughout 2024 and into 2025.

Flutter Entertainment operates globally, meaning currency exchange rate fluctuations directly impact its financial performance. For instance, a stronger US Dollar against the Australian Dollar could reduce the reported value of Flutter's Australian operations when converted to its primary reporting currency, likely GBP. This volatility affects both revenue earned in foreign markets and expenses incurred abroad, requiring careful management.

In 2024, major currency pairs like GBP/USD and EUR/USD experienced notable volatility. For Flutter, a significant portion of its revenue comes from the US (through FanDuel) and Europe. If the Pound Sterling strengthens considerably against the Euro, Flutter's reported European earnings would appear lower. Conversely, a weaker Pound might boost reported international profits.

To mitigate these risks, Flutter employs hedging strategies, such as forward contracts and options, to lock in exchange rates for anticipated transactions. This helps to stabilize reported earnings and cash flows, providing greater predictability for investors despite the inherent volatility in international markets. For example, if Flutter expects to repatriate significant earnings from the US in the coming months, it might enter into forward contracts to sell USD for GBP at a predetermined rate.

Competition and Market Share

Flutter Entertainment operates in a highly competitive global sports betting and gaming market. The economic impact of this intense rivalry is significant, directly affecting Flutter's market share and pricing power.

New entrants, ongoing mergers, and aggressive marketing campaigns from competitors like DraftKings and BetMGM necessitate continuous innovation and differentiation for Flutter to maintain its edge. For instance, the US sports betting market, a key growth area, saw significant investment in marketing and promotions throughout 2024, putting pressure on established players.

- Intense Competition: The global online betting and gaming sector is characterized by numerous established players and new entrants, leading to price wars and increased customer acquisition costs.

- Market Share Dynamics: Competitors' strategic moves, such as mergers and acquisitions, can rapidly alter market share distribution, impacting Flutter's revenue streams.

- Pricing Power Erosion: Aggressive promotional activities and competitive pricing by rivals can limit Flutter's ability to command premium pricing, affecting profit margins.

- Innovation Imperative: To counter competitive pressures, Flutter must invest heavily in technological advancements, product development, and unique customer experiences to retain and grow its user base.

Interest Rates and Access to Capital

Interest rates directly influence Flutter Entertainment's borrowing costs. For instance, if central banks like the Federal Reserve or the Bank of England raise benchmark rates, Flutter's cost of debt for new loans or refinancing existing debt will likely increase. This impacts their ability to fund major initiatives.

Higher interest rates can make strategic acquisitions or significant technology investments more expensive. For example, if Flutter was considering a major acquisition in 2024, and interest rates rose by 1%, the financing cost for that deal could add tens of millions to their annual interest expenses. This directly affects their investment decisions and potential returns.

The availability and cost of capital are crucial for Flutter's growth. In a high-interest-rate environment, accessing capital might become more challenging or come with a higher price tag. This can influence their financial leverage, potentially slowing down expansion plans or requiring a more conservative approach to debt financing for new ventures.

- Impact on Borrowing Costs: Rising interest rates, such as the Bank of England's base rate which has seen increases through 2023 and into 2024, directly increase Flutter's cost of servicing existing variable-rate debt and the cost of new debt.

- Investment Financing: A hypothetical 0.5% increase in interest rates could add an estimated £10-20 million annually to Flutter's interest payments on a significant portion of its debt, potentially making large-scale tech upgrades or acquisitions less attractive.

- Capital Availability: In periods of tighter monetary policy, lenders may become more cautious, potentially reducing the overall availability of capital for companies like Flutter, impacting their strategic flexibility.

- Financial Leverage: Higher borrowing costs can discourage Flutter from taking on substantial new debt, potentially moderating its financial leverage and influencing the pace of aggressive growth strategies.

Flutter Entertainment's financial results are directly tied to global economic health, with consumer spending on gaming fluctuating with economic cycles. During 2024, while many economies showed resilience, concerns about inflation and interest rates created some headwinds, potentially impacting discretionary spending on entertainment.

The company's diverse geographic presence means currency fluctuations significantly impact reported earnings. For instance, the relative strength of the US Dollar against the Pound Sterling in early 2024 could have influenced the translation of FanDuel's substantial US-based revenues into Flutter's consolidated financial statements.

Flutter faces intense competition in key markets, particularly the US, where significant marketing spend by rivals like DraftKings and BetMGM in 2024 aimed to capture market share. This competitive pressure necessitates ongoing investment in product innovation and customer acquisition, impacting profitability.

Rising interest rates, a trend observed through 2023 and into 2024, increase Flutter's borrowing costs. This affects the affordability of new debt for strategic initiatives and the cost of servicing existing variable-rate debt, potentially influencing capital allocation decisions.

| Economic Factor | Impact on Flutter Entertainment | 2024/2025 Relevance |

|---|---|---|

| Global Economic Growth | Influences discretionary consumer spending on gaming. | Resilience in some economies, but inflation concerns could temper spending. |

| Inflation | Increases operational costs (technology, marketing, wages). | Potential pressure on profit margins if costs cannot be passed on. |

| Currency Exchange Rates | Affects reported revenue and expenses from international operations. | Volatility in GBP/USD and EUR/USD impacts translation of earnings from key markets like the US and Europe. |

| Interest Rates | Impacts borrowing costs for debt financing and investments. | Higher rates increase the cost of capital, potentially affecting acquisition and expansion plans. |

Full Version Awaits

Flutter Entertainment PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Flutter Entertainment delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. It provides critical insights for understanding the external landscape in which Flutter Entertainment operates.

Sociological factors

Societal views on gambling, particularly online and sports betting, are shifting. Increased acceptance, driven by demographic changes and a more relaxed public discourse, is leading to higher participation rates. For instance, in the UK, the Gambling Commission reported that in the year to September 2023, 42% of adults had gambled in the past four weeks, a slight increase from previous periods, with online gambling being a significant driver.

Flutter Entertainment must actively manage its brand reputation and customer acquisition strategies in light of these evolving attitudes. As the stigma around gambling diminishes, the company has opportunities to attract a broader customer base, but this also necessitates a focus on responsible gambling initiatives to align with changing societal expectations and regulatory scrutiny.

Societal expectations are increasingly demanding that companies like Flutter Entertainment actively promote responsible gaming. This includes implementing robust self-exclusion tools and comprehensive player protection measures to combat problem gambling. For instance, Flutter reported a 10% increase in customer interactions related to safer gambling tools in 2024, highlighting this growing focus.

Proactive social responsibility initiatives are crucial for building public trust and reducing the likelihood of stringent regulatory intervention. By investing in community outreach programs and demonstrating a genuine commitment to player well-being, Flutter can mitigate risks and enhance its brand reputation. In 2023, Flutter allocated over £50 million globally to responsible gambling initiatives and research.

Flutter Entertainment's user engagement is significantly shaped by demographic shifts. For instance, the growing Gen Z population, characterized by high digital literacy and a preference for mobile-first experiences, demands innovative and interactive gaming formats. As of 2024, global internet penetration stands at an estimated 66%, with younger demographics leading adoption, directly influencing Flutter's digital product development and marketing strategies to cater to this tech-savvy audience.

Urbanization trends also play a crucial role, concentrating potential users in areas with greater access to technology and disposable income, which can boost engagement with Flutter's platforms. Conversely, tailoring offerings for aging populations or those in less urbanized regions requires different approaches, potentially focusing on simpler interfaces or localized content to ensure broad appeal and sustained user interest across diverse socioeconomic segments.

Influence of Social Media and Public Opinion

Social media profoundly influences public perception of Flutter Entertainment and the wider gambling sector. Trends and influencer campaigns can rapidly shape brand image and attract new customers. For instance, in 2024, a significant portion of the 18-34 demographic reported making purchasing decisions based on social media recommendations, a key demographic for online gaming.

Managing online reputation is a critical challenge and opportunity for Flutter. The rapid spread of information, both positive and negative, necessitates proactive engagement with online communities. In 2023, Flutter reported increased investment in digital marketing and community management, aiming to leverage social platforms for customer acquisition and brand loyalty.

- Social Media Reach: Flutter Entertainment's brands collectively boast millions of followers across platforms like X (formerly Twitter), Instagram, and Facebook, providing a direct channel for public opinion shaping.

- Influencer Impact: In 2024, the effectiveness of influencer marketing in the gaming sector saw continued growth, with studies indicating a 15% higher engagement rate for sponsored content compared to traditional advertising.

- Reputation Management: Negative sentiment on social media can quickly escalate, impacting customer acquisition. Flutter's proactive approach includes rapid response teams to address customer concerns and feedback in real-time.

- Data-Driven Engagement: By analyzing social media sentiment and engagement metrics, Flutter can refine its marketing strategies, ensuring campaigns resonate with target audiences and positively influence public opinion.

Health and Well-being Trends

Societal focus on mental health and well-being is increasingly influencing the gambling industry. Growing awareness of mental health challenges means problem gambling is more likely to be viewed through this lens, demanding responsible practices from operators.

Flutter Entertainment's commitment to player well-being, including initiatives for safer gambling, directly aligns with these broader societal trends. This proactive approach not only addresses ethical considerations but also fosters trust and contributes to the company's long-term sustainable growth by mitigating reputational and regulatory risks.

- Increased Mental Health Awareness: Public discourse around mental health has amplified, leading to greater scrutiny of industries that can impact psychological well-being.

- Problem Gambling as a Health Issue: There's a growing perception of problem gambling not just as a behavioral issue, but as a public health concern with potential links to underlying mental health conditions.

- Flutter's Responsible Gambling Investments: For example, in 2023, Flutter reported investing £10 million in its "Doing the Right Thing" strategy, which includes significant allocations to player protection measures and research into gambling-related harm.

Societal attitudes towards gambling are evolving, with increased acceptance of online and sports betting, particularly among younger demographics. This shift, evidenced by a 42% adult gambling rate in the UK in the year to September 2023, presents Flutter Entertainment with opportunities for broader customer acquisition. However, this also heightens the need for robust responsible gambling initiatives to align with public expectations and regulatory oversight.

The growing emphasis on mental health and well-being is reshaping perceptions of problem gambling, increasingly viewed as a public health concern. Flutter's investment in player protection, such as its £10 million allocation in 2023 to its "Doing the Right Thing" strategy, directly addresses this trend, fostering trust and mitigating reputational risks.

Demographic changes, especially the digital-native Gen Z population, are driving demand for innovative, mobile-first gaming experiences. With global internet penetration at an estimated 66% in 2024, Flutter must tailor its digital products and marketing to this tech-savvy audience.

Social media significantly influences public perception, with influencer marketing showing a 15% higher engagement rate in 2024. Flutter's proactive reputation management and data-driven engagement strategies across platforms with millions of followers are crucial for positive brand image and customer loyalty.

| Sociological Factor | Impact on Flutter Entertainment | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Evolving Gambling Attitudes | Increased acceptance and participation, especially online. | UK adult gambling rate: 42% (year to Sep 2023). |

| Mental Health Awareness | Greater scrutiny on problem gambling; need for player well-being focus. | Flutter's £10M "Doing the Right Thing" investment (2023). |

| Demographic Shifts (e.g., Gen Z) | Demand for digital-first, interactive gaming formats. | Global internet penetration: ~66% (2024); younger demographics lead adoption. |

| Social Media Influence | Shaping brand image and customer acquisition. | Influencer marketing engagement up 15% (2024); millions of followers across Flutter brands. |

Technological factors

Continuous advancements in mobile technology, including faster processors and enhanced battery life in smartphones, directly benefit Flutter Entertainment by enabling more sophisticated and engaging betting experiences. The proliferation of 5G networks, with widespread adoption expected to continue through 2024 and 2025, significantly improves connectivity, allowing for smoother live streaming of events and real-time betting, which is critical for user retention.

App development innovations, such as the increasing use of AI for personalized recommendations and improved user interfaces, are vital for Flutter. In 2024, Flutter reported that over 90% of its customer interactions occur via mobile devices, underscoring the need for intuitive, high-performance apps that drive customer engagement and expand market reach.

Flutter Entertainment is heavily investing in data analytics and AI to personalize customer experiences, a key differentiator in the competitive online betting market. By analyzing vast datasets, they can better understand player behavior, leading to more tailored promotions and product offerings. For instance, AI helps in identifying at-risk players for responsible gaming interventions, with platforms increasingly using machine learning to detect anomalous betting patterns, thereby enhancing player safety and platform integrity.

Flutter Entertainment faces significant technological challenges related to cybersecurity and data privacy. The company must maintain robust defenses against an ever-evolving landscape of cyber threats, protecting vast amounts of sensitive customer information. Failure to do so risks not only financial penalties but also severe damage to its reputation and customer trust.

In 2023, the global average cost of a data breach reached $4.45 million, a figure that underscores the financial imperative for strong security. Flutter's commitment to investing in advanced security infrastructure is therefore crucial for business continuity and regulatory compliance, especially with stringent data protection laws like GDPR in effect across key markets.

Emerging Technologies (e.g., Blockchain, VR/AR)

Emerging technologies like blockchain, virtual reality (VR), and augmented reality (AR) hold significant potential to reshape the online gaming landscape. Blockchain, for instance, could introduce greater transparency and security through decentralized ledger technology, potentially impacting how transactions and ownership of in-game assets are managed. Flutter Entertainment must actively monitor these advancements to understand how they might influence player trust and operational efficiency.

VR and AR technologies offer immersive experiences that could lead to entirely new game formats and engagement models within the online betting and gaming sector. Imagine placing a bet within a virtual casino environment or interacting with sports data through AR overlays. Companies like Flutter need to explore integration strategies to tap into these evolving consumer preferences and maintain a competitive edge in user experience.

The integration of these nascent technologies presents both opportunities and challenges. For example, the adoption of VR could require significant investment in new platforms and content development. Flutter's strategic planning must account for the potential disruption and innovation these technologies bring, ensuring they are positioned to leverage them effectively. As of late 2024, the global VR/AR market is projected to reach hundreds of billions of dollars by the end of the decade, indicating a substantial future opportunity.

- Blockchain for enhanced security and transparency in transactions.

- VR/AR for immersive gaming experiences and new betting formats.

- Need for Flutter to monitor and potentially integrate these innovations.

- Market growth projections for VR/AR signal significant future potential.

Cloud Computing and Infrastructure Scalability

Cloud computing is fundamental to Flutter Entertainment's ability to manage its vast global operations. It allows the company to scale its infrastructure up or down rapidly, ensuring it can handle massive transaction volumes, especially during peak events like major sporting competitions. This flexibility is crucial for maintaining smooth user experiences across its diverse brands and markets.

The adoption of cloud infrastructure directly translates into efficiency and agility for Flutter. By leveraging cloud services, Flutter can quickly deploy new features and updates to its platforms, enabling faster innovation and response to market demands. This also means they can manage fluctuating loads efficiently, avoiding the need for over-provisioning hardware and reducing operational costs. For instance, in 2024, companies heavily reliant on cloud services saw operational cost savings of up to 30% compared to on-premise solutions, a benefit Flutter likely experiences.

- Global Reach: Cloud platforms enable Flutter to operate seamlessly across numerous countries, adapting to local regulations and user preferences.

- Scalability for Peaks: Infrastructure can instantly expand to accommodate millions of concurrent users during high-traffic events, ensuring service continuity.

- Cost Efficiency: Pay-as-you-go cloud models optimize spending, aligning IT costs with actual usage and demand.

- Rapid Deployment: Cloud environments facilitate quicker development cycles and the swift rollout of new products and features across Flutter's portfolio.

Flutter Entertainment's technological advantage hinges on its mobile-first strategy and robust cloud infrastructure. With over 90% of customer interactions occurring via mobile in 2024, the company prioritizes app innovation and seamless connectivity, amplified by the ongoing 5G rollout. Investments in AI and data analytics are crucial for personalized experiences and player safety, with machine learning actively used to detect anomalous betting patterns.

The company must also navigate cybersecurity threats, as the average cost of a data breach reached $4.45 million in 2023. Emerging technologies like blockchain, VR, and AR present future opportunities for enhanced transparency and immersive gaming. Cloud computing underpins Flutter's global scalability and cost efficiency, enabling rapid deployment of new features and managing peak loads effectively.

| Technology Area | Impact on Flutter | Key Data/Trend (2024/2025) |

| Mobile Technology & 5G | Enhanced betting experiences, improved live streaming and real-time betting. | Over 90% of Flutter customer interactions via mobile (2024); 5G adoption continues to grow. |

| AI & Data Analytics | Personalized customer experiences, improved player safety, fraud detection. | AI used for tailored promotions and responsible gaming interventions. |

| Cybersecurity | Protection of customer data, maintaining trust and regulatory compliance. | Average cost of data breach: $4.45 million (2023). |

| Emerging Tech (Blockchain, VR/AR) | Potential for increased transparency, new game formats, and immersive experiences. | Global VR/AR market projected for significant growth by 2030. |

| Cloud Computing | Scalability, cost efficiency, rapid deployment of new features. | Cloud-reliant companies saw up to 30% operational cost savings (2024). |

Legal factors

Flutter Entertainment operates within a highly complex and fragmented legal framework for gambling, which varies significantly across its global markets. This includes navigating diverse licensing requirements, advertising restrictions, and limitations on product offerings in numerous countries and U.S. states, demanding substantial legal investment and ongoing compliance efforts.

For instance, in the U.S., while sports betting has seen widespread legalization, regulations differ by state; as of early 2024, over 30 states and the District of Columbia have legalized some form of online sports betting. This patchwork of laws necessitates tailored compliance strategies for each jurisdiction, contributing to significant operational costs.

Flutter Entertainment must navigate a complex web of data protection and privacy laws, significantly impacting its operations. Regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States mandate strict protocols for collecting, storing, and processing customer information. For instance, GDPR, implemented in 2018, requires explicit consent for data usage and grants individuals rights over their personal data, with fines for non-compliance reaching up to 4% of global annual revenue or €20 million, whichever is higher.

The implications for Flutter are substantial, requiring robust privacy frameworks and transparent data handling practices across its diverse markets. Failure to comply can lead to severe penalties, reputational damage, and loss of customer trust. As of early 2024, companies across various sectors have faced significant fines for data breaches and privacy violations, underscoring the critical need for ongoing vigilance and investment in data security and compliance measures.

Flutter Entertainment operates within a stringent legal framework concerning consumer protection and advertising standards, particularly in the online gaming sector. Regulations across its key markets, including the UK and Australia, mandate clear and honest communication regarding odds, bonus terms, and potential risks associated with gambling. For instance, the UK's Advertising Standards Authority (ASA) actively polices gambling advertisements to prevent misleading claims, with significant fines levied for non-compliance.

Adherence to these ethical advertising practices is paramount for Flutter. Misleading promotions, such as those that obscure wagering requirements or exaggerate winning probabilities, can lead to substantial penalties, regulatory sanctions, and severe damage to brand trust. In 2023, the UKGC reported a notable increase in fines for advertising breaches within the gambling industry, underscoring the critical need for meticulous compliance by operators like Flutter.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

Flutter Entertainment, like all major financial service providers, faces significant legal obligations under Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules mandate robust procedures for verifying customer identities, monitoring transactions for any suspicious patterns, and reporting potential illicit activities to regulatory bodies. For instance, in 2024, the UK’s Financial Conduct Authority (FCA) continued to emphasize stringent AML compliance, with fines for breaches remaining a substantial deterrent.

Implementing effective AML and KYC processes involves considerable operational complexity and financial investment. This includes developing sophisticated software for identity verification, training staff on compliance protocols, and maintaining detailed audit trails of all customer interactions and transactions. The cost of compliance can be significant, with industry reports from 2023 indicating that financial institutions globally spent billions annually on AML efforts alone.

- Customer Due Diligence: Verifying identities through official documentation and ongoing monitoring of customer behavior.

- Transaction Monitoring: Utilizing advanced analytics to detect and flag unusual or high-risk transactions.

- Suspicious Activity Reporting: Timely and accurate reporting of any identified suspicious activities to relevant financial intelligence units.

- Regulatory Scrutiny: Facing potential fines and reputational damage for non-compliance, as seen in various enforcement actions across jurisdictions in 2024.

Intellectual Property Rights and Brand Protection

Flutter Entertainment's robust legal framework is crucial for safeguarding its vast array of brands, software, and proprietary technology. The company actively utilizes trademark and copyright protections to prevent infringement across its global operations.

These legal measures are fundamental in preserving Flutter's intellectual assets, which are vital for maintaining its competitive advantage in the dynamic online betting and gaming sector. For instance, in 2023, Flutter reported significant investment in technology and product development, underscoring the importance of protecting these innovations.

- Trademark Protection: Securing exclusive rights to brand names like FanDuel, Paddy Power, and Betfair prevents unauthorized use and dilution of brand equity.

- Copyright Enforcement: Protecting unique software algorithms, website designs, and game content is essential to prevent competitors from replicating Flutter's offerings.

- Legal Defense: Proactive legal strategies and swift action against infringements are key to deterring future violations and preserving market share.

Flutter Entertainment operates under a complex and ever-evolving legal landscape globally, necessitating significant investment in compliance and licensing. As of early 2024, the U.S. market alone features over 30 states and the District of Columbia with legalized online sports betting, each with distinct regulatory frameworks.

Data privacy laws, such as GDPR and CCPA, impose stringent requirements on customer data handling, with GDPR fines potentially reaching up to 4% of global annual revenue. Advertising standards, enforced by bodies like the UK's ASA, also demand clear and honest communication, with penalties for misleading promotions a constant concern.

Furthermore, robust Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures are legally mandated, requiring substantial operational investment. Industry-wide AML compliance costs are estimated to be in the billions annually, highlighting the financial commitment required.

Intellectual property protection is also a critical legal factor, with Flutter actively safeguarding its brands and proprietary technology through trademarks and copyrights to maintain its competitive edge.

Environmental factors

Flutter Entertainment is increasingly focusing on its Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) commitments, a trend driven by growing investor and public demand for sustainable business practices. The company recognizes that robust ESG reporting is crucial for demonstrating accountability and building trust with its diverse stakeholder base, from shareholders to customers.

In 2023, Flutter reported a 13% reduction in its Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, highlighting tangible progress in its environmental strategy. This commitment to transparency extends to its social impact, with initiatives aimed at promoting responsible gambling and fostering diversity and inclusion across its global workforce, which numbered over 13,000 employees as of year-end 2023.

Flutter Entertainment, like many digital-first businesses, faces scrutiny over its carbon footprint, primarily driven by energy consumption in its data centers and offices. The company is actively working to measure and reduce this impact. For instance, in 2023, Flutter reported a reduction in its Scope 1 and 2 carbon emissions intensity by 16% compared to its 2019 baseline, partly through increased use of renewable energy sources for its operations.

The transition to renewable energy is crucial for a business heavily reliant on digital infrastructure. Optimizing IT infrastructure efficiency and exploring greener data center solutions are key strategies. Flutter's commitment to sustainability is not just about environmental responsibility; it's increasingly important for stakeholder relations and long-term business resilience in a world prioritizing eco-conscious operations.

Flutter Entertainment is actively addressing waste management, with a particular focus on electronic waste generated by its IT infrastructure and general office waste across its global operations. The company is implementing initiatives to enhance resource efficiency, such as expanding recycling programs and reducing paper usage through digital transformation efforts.

These efforts in responsible waste management are integral to Flutter's commitment to environmental stewardship. For instance, in 2023, the company reported a reduction in waste sent to landfill by 15% compared to the previous year, demonstrating tangible progress in its resource efficiency goals.

Climate Change Adaptation and Risk Management

Climate change presents indirect risks to Flutter Entertainment, primarily through extreme weather events that could disrupt its digital infrastructure or the operations of its partners. For instance, severe storms or floods might impact data centers or cause widespread internet outages, affecting online betting services. Flutter's reliance on robust digital platforms necessitates contingency planning to ensure business continuity.

Developing resilience strategies is crucial for mitigating potential disruptions. This includes investing in geographically diverse data centers and building strong relationships with suppliers who also prioritize climate risk management. Flutter's long-term strategic planning must also consider how evolving environmental conditions might influence consumer behavior and regulatory landscapes.

For example, a significant heatwave in a key market could reduce outdoor leisure activities, potentially impacting in-person betting venues, though the primary impact on Flutter is likely to be digital. The company's 2024 sustainability report highlighted ongoing investments in energy efficiency across its operations, a step towards managing its environmental footprint.

- Infrastructure Resilience: Ensuring data centers and online platforms can withstand extreme weather events.

- Supply Chain Diversification: Reducing reliance on single points of failure that could be affected by climate-related disasters.

- Business Continuity Planning: Implementing robust plans to maintain operations during and after environmental disruptions.

- Long-Term Environmental Strategy: Adapting business models to account for gradual shifts in climate patterns and their societal impacts.

Stakeholder Pressure for Environmental Action

Stakeholders are increasingly demanding that companies like Flutter Entertainment take meaningful action on environmental issues. This pressure comes from investors looking for sustainable investments, employees who want to work for environmentally conscious organizations, and customers who prefer to support brands that align with their values. For instance, in 2023, ESG (Environmental, Social, and Governance) investments continued to grow, with global ESG assets projected to reach $50 trillion by 2025, indicating a strong investor appetite for sustainable practices.

Public perception and evolving stakeholder expectations directly influence Flutter Entertainment's environmental policies. Companies are aware that a strong environmental record can enhance brand image and attract a broader customer base, while a poor one can lead to reputational damage and boycotts. This is evident as consumer surveys consistently show a willingness to pay more for products from environmentally responsible companies.

Environmental advocacy groups play a crucial role in shaping corporate behavior. These organizations often highlight companies' environmental impacts and mobilize public opinion, pushing for greater transparency and accountability. Their efforts can lead to significant shifts in corporate strategy, compelling businesses to adopt more sustainable operational models and reporting frameworks.

Flutter Entertainment faces pressure to demonstrate its commitment through tangible initiatives:

- Investor Scrutiny: Growing demand for ESG integration in investment portfolios, with a significant portion of institutional investors now incorporating ESG factors into their decision-making processes.

- Employee Engagement: A rising trend of employees advocating for their employers to adopt greener practices and reduce their carbon footprint.

- Customer Loyalty: Consumers are increasingly choosing brands that demonstrate a clear commitment to environmental sustainability, impacting purchasing decisions.

- Regulatory Anticipation: Proactive adoption of environmental standards to mitigate future regulatory risks and gain a competitive advantage.

Flutter Entertainment's environmental strategy is increasingly shaped by stakeholder demands for sustainability and the physical risks posed by climate change. The company is actively reducing its carbon footprint, reporting a 16% decrease in Scope 1 and 2 carbon emissions intensity by 2023 compared to 2019, partly by increasing renewable energy use. Waste management, particularly e-waste, is also a focus, with a 15% reduction in waste to landfill achieved in 2023.

| Environmental Factor | Flutter's Action/Impact | Data/Metric |

|---|---|---|

| Greenhouse Gas Emissions | Reducing Scope 1 & 2 emissions | 16% reduction in intensity (2023 vs 2019) |

| Renewable Energy Usage | Increasing adoption for operations | Contributed to emissions reduction |

| Waste Management | Focus on e-waste and office waste | 15% reduction in waste to landfill (2023 vs 2022) |

| Climate Change Risks | Infrastructure resilience and business continuity planning | Ongoing investments in energy efficiency |

PESTLE Analysis Data Sources

Our PESTLE analysis for Flutter Entertainment is built on a robust foundation of data from leading financial news outlets, regulatory body publications, and market research firms. We integrate insights from economic indicators, technological advancements, and social trend reports to provide a comprehensive view.