Flutter Entertainment Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flutter Entertainment Bundle

Flutter Entertainment navigates a dynamic online gambling landscape, facing intense competition from rivals and a growing threat from new entrants eager to capture market share. Understanding the power of buyers and the availability of substitutes is crucial for their sustained success.

The complete report reveals the real forces shaping Flutter Entertainment’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Flutter Entertainment's reliance on a concentrated group of specialized technology providers for its betting platforms significantly influences the bargaining power of these suppliers. The global online gambling market, projected to exceed $80 billion in 2024, features a limited number of firms offering critical software and infrastructure. This scarcity grants these key technology providers considerable leverage, potentially limiting Flutter's negotiating flexibility when sourcing new solutions or renewing existing contracts.

Flutter Entertainment's reliance on specialized software developers for its unique platform features and extensive brand portfolio can significantly impact its bargaining power with these suppliers. The global software development market was valued at around $638 billion in 2024, indicating a substantial and competitive landscape for talent.

If these highly skilled developers are in high demand across the tech industry, Flutter may face increased costs to attract and retain them, directly affecting its operational expenses and overall profitability.

Data suppliers wield considerable influence in the sports betting and gaming sector, as accurate and timely information is the bedrock of operations. This data directly impacts everything from setting competitive odds to understanding market trends and crafting personalized customer experiences. Flutter Entertainment, like its competitors, relies heavily on these specialized providers for its core business functions.

The critical nature of this data means suppliers can dictate terms, impacting Flutter's costs and access to essential information. For instance, real-time odds feeds from major sports leagues are a prime example of a data source where suppliers have significant leverage. Without this, Flutter's ability to offer competitive betting markets would be severely hampered.

Availability of Alternative Suppliers

Flutter Entertainment's bargaining power with suppliers is influenced by the availability of alternatives. While certain critical technology and data providers exist, Flutter's substantial scale and existing strong relationships provide a degree of leverage. This allows them to explore alternative solutions or secure more favorable contract terms.

Furthermore, Flutter's strategic investment in internal technology development and its broad network of diverse content providers effectively mitigates the power of any single supplier. This diversification strategy is crucial in preventing an over-reliance on a limited number of external entities, thereby strengthening Flutter's negotiating position.

- Flutter's scale and established relationships may offer leverage in supplier negotiations.

- Internal technology development reduces reliance on external providers.

- A diverse range of content providers limits the power of any single supplier.

- Diversification enhances Flutter's ability to negotiate favorable terms.

Switching Costs for Flutter

For Flutter Entertainment, the bargaining power of suppliers is significantly influenced by the switching costs associated with its technology and data providers. Transitioning from a current major supplier to a new one can incur substantial expenses. These include the costs of integrating new systems, the potential for operational disruptions during the transition period, and the need to retrain staff on new platforms. These factors collectively make it less appealing for Flutter to frequently change its technology partners, thereby bolstering the bargaining power of incumbent suppliers.

The inherent complexity involved in integrating new technological systems presents a considerable barrier for Flutter. This complexity can manifest in extended implementation timelines and unforeseen technical challenges, all of which contribute to higher switching costs. For example, if Flutter relies on a specialized data analytics platform, migrating to an alternative could require extensive data reformatting, API adjustments, and rigorous testing to ensure seamless operation. These technical hurdles directly enhance the leverage of the existing supplier.

- High Integration Expenses: Costs associated with integrating new software, hardware, or data feeds can be substantial, often running into millions of dollars for large-scale operations.

- Operational Disruption Risk: A poorly managed transition can lead to downtime, impacting customer experience and revenue generation, a risk that suppliers can exploit.

- Staff Retraining Needs: Employees require training on new systems, adding to the overall cost and time investment for Flutter.

Flutter Entertainment faces considerable bargaining power from its suppliers, particularly in specialized technology and data provision. The scarcity of providers for critical software and real-time data feeds grants these suppliers significant leverage. These essential components are the backbone of Flutter's operations, influencing everything from odds setting to customer engagement.

The high switching costs associated with integrating new technological systems, including potential operational disruptions and retraining needs, further solidify supplier power. For instance, migrating a complex data analytics platform could involve millions in integration expenses and significant downtime risks.

| Supplier Type | Impact on Flutter | Example Leverage Point |

|---|---|---|

| Specialized Technology Providers | High | Limited alternatives for critical platform software |

| Data Providers (e.g., Odds Feeds) | High | Essential for competitive market offerings |

| Skilled Software Developers | Moderate to High | High demand across the tech industry |

What is included in the product

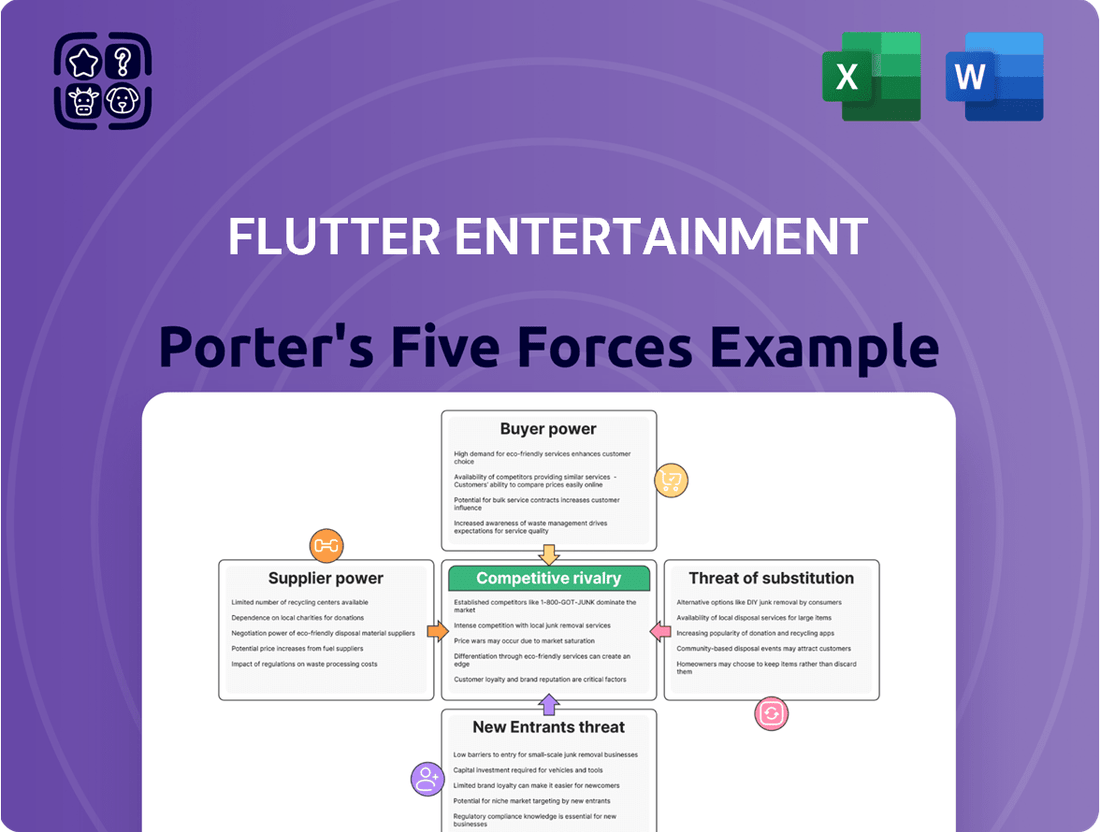

This Porter's Five Forces analysis for Flutter Entertainment dissects the competitive intensity, buyer and supplier power, threat of new entrants and substitutes within the online betting and gaming industry, providing strategic insights into its market position.

Instantly identify and mitigate competitive threats with a dynamic Porter's Five Forces analysis, allowing Flutter Entertainment to proactively address industry pressures and maintain market leadership.

Customers Bargaining Power

Customers in the online betting arena are quite keen on price and readily jump to different platforms if they find better odds or more appealing bonuses. This means companies like Flutter Entertainment must constantly offer competitive deals to attract and keep their players. For instance, in 2023, the global online gambling market was valued at over $70 billion, highlighting the intense competition for customer attention and loyalty.

This constant need to offer incentives, such as welcome bonuses or enhanced odds, directly affects Flutter's bottom line. A significant portion of their operating expenses goes into marketing and promotional activities aimed at acquiring new customers and preventing existing ones from switching. These investments are crucial for maintaining market share in a sector where loyalty can be fleeting.

The ease with which users can switch between online betting platforms significantly boosts their bargaining power. There are typically no financial penalties for customers to change providers, allowing them to easily explore competitors such as DraftKings or BetMGM. This low friction environment means customers can readily seek out better odds, promotions, or user experiences.

This low switching cost is a key driver of customer power in the online gambling industry. A recent industry survey indicated that 67% of online bettors have switched platforms at least once, often citing superior promotions or features as the primary reason for their move. This high rate of customer churn underscores the need for Flutter Entertainment to continuously offer competitive advantages to retain its user base.

The online gambling arena is incredibly crowded, with countless platforms offering very similar services. This sheer volume of choices means customers are in the driver's seat, able to easily shop around for the best deals and odds. For instance, in 2023, the global online gambling market was valued at over $70 billion, highlighting the intense competition.

This saturation directly translates to significant bargaining power for customers. They can readily compare prices, promotions, and user experiences across various sites, forcing operators to compete aggressively on value. Flutter Entertainment, with its robust portfolio of brands like FanDuel and Paddy Power, aims to counter this by cultivating strong brand loyalty, making customers less likely to switch based solely on price.

Increased Information and Transparency

Customers today have unprecedented access to information about betting odds, promotional offers, and independent platform reviews. This readily available data significantly boosts their bargaining power, enabling them to compare offerings and identify the most advantageous deals. For instance, comparison websites and forums allow users to quickly assess operator performance and pricing, driving competition.

The digital landscape facilitates the rapid dissemination of information, compelling operators like Flutter Entertainment to maintain transparency and competitive pricing to retain customers. In 2024, the online gambling market continued to see a surge in comparison tools and review platforms, with many users actively consulting these resources before placing bets. This heightened transparency means that operators must constantly innovate and offer compelling value propositions.

- Informed Decisions: Customers can easily research and compare odds, bonuses, and user experiences across multiple platforms.

- Price Sensitivity: Increased transparency makes customers more sensitive to price differences and promotional value.

- Rapid Information Flow: Online reviews and social media ensure that information about operator performance and offerings spreads quickly, pressuring operators to stay competitive.

- Platform Loyalty: While information empowers customers, operators can build loyalty through superior user experience and consistent value, mitigating some of this power.

Impact of Responsible Gaming Initiatives

Flutter Entertainment's commitment to responsible gaming initiatives, such as deposit limits and self-exclusion tools, directly impacts customer bargaining power. By empowering players to manage their spending and engagement, these measures can subtly shift influence towards the customer, allowing them greater control over their betting activities.

This proactive stance on safer gambling practices, while beneficial for player welfare, can also lead to adjustments in betting volumes and overall player engagement. For instance, in 2023, Flutter reported a 16% increase in the use of responsible gambling tools across its platforms, indicating a growing customer preference for control.

- Customer Empowerment: Tools like deposit limits and self-exclusion grant players more control over their spending, increasing their bargaining power.

- Influence on Betting Volumes: Increased use of these tools can lead to reduced betting activity, giving customers more leverage in managing their engagement with Flutter's services.

- Industry Trend: Responsible gaming is a growing focus across the industry, making it a key consideration for customer retention and satisfaction.

- Data Insight: In 2023, Flutter saw a significant rise in the utilization of responsible gambling features, highlighting customer demand for such controls.

Customers in the online betting market wield considerable power due to the ease of switching between platforms and the abundance of readily available information. This allows them to readily compare odds, bonuses, and user experiences, forcing companies like Flutter Entertainment to maintain highly competitive offerings. In 2023, the global online gambling market exceeded $70 billion, underscoring the intense competition for customer attention and loyalty.

The low cost of switching providers means customers can easily move to competitors without financial penalty, seeking better value or promotions. This dynamic is a significant factor in Flutter's operational strategy, necessitating continuous investment in marketing and customer retention initiatives to combat potential churn. Industry data from 2024 indicates that a substantial percentage of online bettors have switched platforms, often citing better deals as the primary motivator.

The sheer volume of online betting platforms, many offering similar services, places customers in a strong position to shop around. This saturation compels operators to compete aggressively on value, with Flutter aiming to build brand loyalty through superior user experience to mitigate price-driven switching. The increasing prevalence of comparison tools and review sites in 2024 further amplifies customer awareness and bargaining power.

| Factor | Impact on Flutter Entertainment | Supporting Data (2023/2024) |

|---|---|---|

| Ease of Switching | High customer bargaining power, necessitates competitive pricing and promotions. | Industry surveys show high customer churn rates, often driven by better offers. |

| Information Availability | Empowers customers to compare and choose the best deals, increasing price sensitivity. | Growth in comparison websites and user review platforms in 2024. |

| Market Saturation | Intensifies competition, forcing operators to differentiate beyond price. | Global online gambling market valued over $70 billion in 2023. |

Preview the Actual Deliverable

Flutter Entertainment Porter's Five Forces Analysis

This preview showcases the complete Flutter Entertainment Porter's Five Forces Analysis, offering a deep dive into competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You can trust that the insights and detailed breakdown of Flutter's market position are precisely what you will receive, enabling informed strategic decision-making.

Rivalry Among Competitors

The online sports betting and gaming arena is incredibly crowded, with many companies fighting for the same customers. This high saturation means that growth often comes at the expense of rivals, fueling aggressive competition. For instance, Flutter Entertainment, a major player, reported revenues of $14.05 billion in 2024, underscoring the scale of operations and the financial stakes involved.

This intense rivalry is further amplified by ongoing consolidation within the industry. Larger entities are acquiring smaller ones, creating even more dominant forces like Flutter Entertainment, Entain, DraftKings, BetMGM, and Bet365. These consolidated giants possess greater resources, allowing them to invest heavily in marketing, technology, and customer acquisition, thereby intensifying the pressure on all market participants.

Competitors in the gambling industry, including Flutter Entertainment, frequently engage in aggressive marketing and promotional activities. These campaigns often feature enticing sign-up bonuses, risk-free bets, and referral incentives designed to attract new customers and keep existing ones engaged. For instance, one prominent platform disclosed spending upwards of $200 million on marketing efforts in 2022 alone.

In the competitive landscape of online betting and gaming, product innovation and user experience are paramount for differentiation. Companies are pouring resources into technology to create engaging platforms. Flutter Entertainment, through brands like FanDuel, is a prime example, focusing on proprietary content and seamless cross-selling between sports betting and iGaming to attract and keep users.

FanDuel's strategic emphasis on enhancing user experience, including personalized recommendations and intuitive interfaces, has been a significant driver of its success. In 2023, FanDuel reported revenue growth of 19% year-over-year, reaching $4.1 billion, underscoring the effectiveness of its innovation strategy in capturing and retaining market share.

Market Share Dynamics in Key Regions

Flutter Entertainment navigates a highly competitive landscape, particularly in the United States and the United Kingdom. In the US, its brand FanDuel is locked in a fierce battle with DraftKings for market dominance in online sports betting and casino gaming.

FanDuel's strong performance is evident, capturing 43% of online sports gaming revenue and 26% of online casino revenue in the fourth quarter of 2024. This fierce rivalry directly impacts Flutter's revenue streams and necessitates continuous innovation and strategic marketing to maintain its market position.

The UK market also presents significant competitive pressures, with multiple established operators vying for customer attention. This intense rivalry across key geographies underscores the dynamic nature of the online gambling industry and the constant need for Flutter to adapt its strategies to stay ahead.

- US Market Share: FanDuel held 43% of US online sports gaming revenue and 26% of US online casino revenue in Q4 2024.

- Key Competitor: DraftKings is FanDuel's primary rival in the US market.

- UK Competition: Flutter faces strong competition from established players in the UK.

- Impact on Performance: Intense rivalry in these key regions significantly influences Flutter's overall financial results.

Regulatory and Tax Considerations

The competitive rivalry within the online gambling sector is significantly shaped by the evolving regulatory and tax landscape across different jurisdictions. States like Ohio, Illinois, and Maryland have seen or are considering changes to their tax structures and operational regulations, directly influencing how companies like Flutter Entertainment compete and manage their profitability. These shifts require constant adaptation of market strategies to remain competitive.

- Regulatory Scrutiny: Increased regulatory oversight in key markets like the US, where Flutter operates brands such as FanDuel, demands substantial compliance investment, impacting operational costs and competitive positioning.

- Taxation Impact: Potential tax increases, as seen in discussions or implementations in various US states, directly affect profit margins. For instance, a hypothetical 10% increase in state gaming taxes could reduce Flutter's EBITDA by hundreds of millions of dollars annually, depending on revenue exposure in those specific states.

- Market Entry Barriers: Stringent licensing requirements and high tax rates in newly regulated markets can act as barriers to entry for smaller competitors, potentially consolidating market share among larger, well-capitalized players like Flutter.

- Strategic Adaptation: Flutter's diversified portfolio and strong market presence, particularly in the US, position it to absorb and adapt to these regulatory and tax headwinds more effectively than many rivals, allowing for continued strategic investment and growth.

The online betting and gaming industry is intensely competitive, with numerous companies vying for customer attention. Flutter Entertainment, a major operator, generated $14.05 billion in revenue in 2024, highlighting the significant financial stakes. This fierce rivalry is exacerbated by industry consolidation, with large entities like Flutter, Entain, and DraftKings leveraging their resources for aggressive marketing and technological advancements.

| Company | 2024 Revenue (USD Billions) | Key Markets | Competitive Strategy Example |

|---|---|---|---|

| Flutter Entertainment | 14.05 | US, UK, Australia | Brand diversification (FanDuel, Paddy Power), focus on user experience |

| DraftKings | ~4.0-4.5 (estimated) | US | Aggressive marketing, expansion into new US states |

| Entain | ~10.0-11.0 (estimated) | UK, Europe, US | Acquisitions, integration of technology |

SSubstitutes Threaten

The burgeoning popularity of fantasy sports and esports poses a considerable threat of substitutes for Flutter Entertainment. These digital entertainment forms offer engaging alternatives that can siphon consumer attention and discretionary spending away from traditional sports betting. The global fantasy sports market is anticipated to experience robust growth, with projections indicating a substantial expansion between 2023 and 2030, highlighting a clear shift in consumer engagement patterns.

Furthermore, the esports sector is demonstrating impressive financial momentum. Esports revenue is on track to approach $2 billion by 2024, underscoring the rapid ascent and increasing market share of this substitute entertainment. This growth signifies a growing preference among consumers for interactive, digital-first experiences.

Decentralized betting platforms and crypto casinos are gaining traction, presenting a significant threat of substitutes for traditional operators like Flutter Entertainment. These platforms, built on blockchain technology, offer enhanced user control, transparency, and swift transactions, appealing to a growing segment of the market. For instance, the global blockchain gaming market, a sector encompassing these decentralized betting services, is projected for substantial growth, with some estimates suggesting it could reach tens of billions of dollars by 2025, underscoring a clear consumer migration towards these alternative models.

The rise of free online betting platforms presents a significant threat of substitutes for Flutter Entertainment. These platforms offer a simulated betting experience without any financial risk, directly competing for user attention and engagement. Indeed, over 50% of online bettors in the U.S. have explored these no-cost alternatives, a figure that often climbs during economic downturns when consumers are more budget-conscious.

This growing preference for free, risk-free engagement can divert potential real-money bettors away from platforms like Flutter's. As these free options become more sophisticated and widely adopted, they can condition users to prioritize entertainment value over the thrill of actual wagering, potentially impacting Flutter's revenue streams in the long run.

Traditional Leisure and Entertainment Options

Traditional leisure and entertainment options present a significant threat of substitution for Flutter Entertainment. Consumers have a vast array of choices for their free time and money, including streaming services like Netflix and Disney+, immersive video games, and ever-evolving social media platforms. A 2024 report indicated that the average American spends over 4.5 hours daily on digital entertainment alone, a figure that continues to rise.

This broad spectrum of alternatives directly competes for the same consumer attention and discretionary spending that Flutter's offerings target. As these substitutes become more sophisticated and accessible, the dedicated time available for activities like sports betting may naturally decrease. For instance, the global video game market was projected to reach over $200 billion in 2024, highlighting the immense draw of these digital pastimes.

The proliferation of these entertainment avenues means that consumers can easily shift their engagement away from sports betting. This dynamic is particularly relevant as platforms offer highly personalized and engaging experiences, potentially capturing a larger share of leisure hours. Consider that the subscription video-on-demand (SVOD) market is expected to surpass 1.5 billion subscribers globally by the end of 2024.

The threat of substitutes is amplified by the low switching costs associated with these entertainment options. Consumers can readily move between streaming services, gaming platforms, or social media with minimal effort or financial penalty. This ease of transition makes it simpler for consumers to opt out of sports betting in favor of other engaging activities.

Increasing Legalization and Accessibility of Other Gambling Forms

The increasing legalization and accessibility of other gambling forms present a significant threat of substitutes for Flutter Entertainment. As more jurisdictions embrace online casinos and lotteries, these alternatives offer consumers diverse wagering options outside of Flutter's core sports betting and iGaming offerings. For instance, the global online gambling market, excluding sports betting, was projected to reach over $70 billion in 2024, indicating substantial growth in these substitute sectors.

This expansion means customers have readily available alternatives for entertainment and betting. The online casino segment, in particular, is experiencing robust growth, driven by immersive experiences and a wider array of games. This trend directly impacts Flutter by potentially diverting customer spend and attention from its existing products to these increasingly competitive substitute markets.

- Expanding Legal Gambling Landscape: Jurisdictions are increasingly legalizing and regulating online casinos, poker, and lotteries, providing consumers with more choices.

- Growth in Online Casino Market: The online casino sector is a key substitute, with projections indicating significant revenue growth, potentially exceeding $100 billion globally by 2025, offering immersive and diverse gaming experiences.

- Customer Choice Diversification: As more regulated gambling forms become accessible, customers have a broader spectrum of options for their entertainment and wagering, impacting Flutter's market share.

The threat of substitutes for Flutter Entertainment is multifaceted, encompassing digital entertainment, alternative gambling forms, and even traditional leisure activities. Fantasy sports and esports are rapidly growing, drawing consumer attention and spending away from traditional sports betting, with esports revenue alone projected to approach $2 billion in 2024. Decentralized betting platforms and crypto casinos also present a growing challenge, offering enhanced user control and transparency. Furthermore, the increasing legalization of other gambling forms, like online casinos, diversifies customer options, with the global online gambling market (excluding sports betting) expected to exceed $70 billion in 2024.

| Substitute Category | Key Characteristics | Market Data/Projections (2024) | Impact on Flutter |

|---|---|---|---|

| Fantasy Sports & Esports | Digital, engaging, interactive | Esports revenue near $2 billion | Siphons attention and spending from sports betting |

| Decentralized Platforms/Crypto Casinos | Blockchain-based, transparent, user control | Blockchain gaming market growing significantly | Attracts users seeking alternative models |

| Other Legalized Gambling (Online Casinos, Lotteries) | Diverse wagering options, immersive experiences | Online gambling market (excl. sports betting) > $70 billion | Diversifies customer spend and attention |

| General Digital Entertainment (Streaming, Gaming) | High accessibility, personalized content | Avg. US digital entertainment time > 4.5 hours/day; Video game market > $200 billion | Competes for leisure time and discretionary spending |

Entrants Threaten

Entering the online sports betting and gaming arena demands significant upfront capital. Newcomers need to invest heavily in robust technology infrastructure, secure necessary operating licenses, and fund aggressive marketing campaigns to gain traction. This financial hurdle is substantial.

For context, Flutter Entertainment dedicates around £1.5 billion annually to marketing. Furthermore, FanDuel, a key Flutter brand, anticipates substantial revenue and adjusted EBITDA for 2025, underscoring the immense financial scale required to even enter, let alone compete effectively, in this market.

The online gambling sector is a minefield of regulations, with each country and even individual states within countries having their own unique licensing rules. For instance, in the United States, the landscape is fragmented, with states like New Jersey, Pennsylvania, and Michigan having distinct regulatory frameworks that require separate approvals and adherence to specific operational standards. This complexity means that new companies must invest heavily in legal expertise and compliance infrastructure just to get their foot in the door.

Securing and keeping these licenses isn't a one-time affair; it's an ongoing commitment involving substantial financial outlay and rigorous adherence to evolving legal mandates. Flutter Entertainment, for example, navigates a web of licenses across numerous global markets, a process that demands continuous monitoring and adaptation to new or amended regulations. This significant barrier effectively deters many potential new entrants who lack the capital and legal sophistication to manage such a complex operational environment.

Established brand loyalty and powerful network effects pose a significant barrier to new entrants in the online betting and gaming industry. Companies like Flutter Entertainment have cultivated strong brand recognition and deep customer relationships over years of operation, making it challenging for newcomers to gain traction.

Flutter's extensive portfolio, featuring brands such as FanDuel, Paddy Power, Betfair, PokerStars, and Sky Bet, fosters high customer loyalty across different segments and geographies. For example, FanDuel has secured a dominant market share in the rapidly growing US sports betting market, demonstrating the strength of its established brand and network.

Economies of Scale and Operational Efficiencies

Incumbent companies like Flutter Entertainment benefit immensely from economies of scale in technology, marketing, and overall operations. This allows them to offer more competitive pricing and invest heavily in product innovation, creating a cost advantage that new entrants struggle to overcome.

Flutter's substantial market capitalization, which stood at approximately £13.3 billion as of early 2024, and its significant revenue streams underscore this inherent advantage. These financial strengths enable continuous investment in proprietary technology and expansive marketing campaigns, further solidifying their market position.

- Economies of Scale: Flutter leverages its size for cost efficiencies in technology development and platform management.

- Marketing Prowess: Significant marketing budgets allow for broad reach and brand building, a costly endeavor for newcomers.

- Operational Efficiencies: Streamlined operations across multiple brands and geographies reduce per-unit costs.

- Financial Strength: A large market cap and revenue provide capital for aggressive pricing and R&D, deterring new entrants.

Technological Sophistication and Innovation Pace

The requirement for substantial investment in advanced technology, encompassing secure betting platforms, intricate algorithms for dynamic odds setting, and a relentless pace of product innovation, significantly deters new entrants. Established operators like Flutter Entertainment have already poured billions into developing and refining these capabilities. For instance, Flutter's 2023 annual report highlighted significant capital expenditure on technology and product development, underscoring the high entry cost.

Newcomers must commit considerable resources to research and development to even approach the sophisticated features and user experiences provided by industry leaders. The rapid integration of artificial intelligence and advanced analytics for personalized customer engagement and predictive modeling further elevates this barrier. By 2024, the competitive landscape demands not just functional platforms, but intelligent systems that can adapt and offer tailored experiences, a feat requiring deep technical expertise and substantial upfront investment.

- High R&D Investment: New entrants face immense pressure to invest heavily in R&D to match the technological sophistication of incumbents.

- AI and Analytics Integration: The increasing reliance on AI and data analytics for personalized experiences creates a significant technological hurdle.

- Platform Security and Scalability: Developing secure, scalable, and high-performance platforms requires advanced technical infrastructure and expertise.

- Pace of Innovation: The industry's rapid innovation cycle, particularly in areas like mobile gaming and in-play betting, necessitates continuous technological upgrades.

The threat of new entrants in the online sports betting and gaming industry is considerably low, largely due to the massive capital requirements for licensing, technology, and marketing. Established players like Flutter Entertainment benefit from significant economies of scale and strong brand loyalty, making it difficult for newcomers to compete effectively.

Flutter Entertainment's market capitalization, around £13.3 billion in early 2024, highlights the financial muscle needed. Furthermore, the fragmented and complex regulatory landscape across different jurisdictions, as seen in the US states like New Jersey and Pennsylvania, necessitates substantial investment in legal and compliance infrastructure. This creates a formidable barrier to entry.

The industry demands continuous, high investment in technology, including AI and advanced analytics, to offer competitive user experiences. Flutter's ongoing capital expenditure on product development, as noted in its 2023 reports, exemplifies this. Combined with the network effects and brand loyalty cultivated by incumbents, these factors significantly deter new market participants.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Flutter Entertainment is built upon a foundation of publicly available financial statements, investor relations disclosures, and reputable industry research reports. We also incorporate insights from market intelligence platforms and news archives to capture current competitive dynamics and emerging trends.