Flowtech Fluidpower PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flowtech Fluidpower Bundle

Flowtech Fluidpower operates within a dynamic external environment, influenced by political stability, economic fluctuations, evolving social attitudes, technological advancements, environmental regulations, and legal frameworks. Understanding these PESTLE factors is crucial for strategic planning and identifying potential opportunities and threats. This comprehensive analysis dives deep into how these forces are shaping Flowtech Fluidpower's present and future. Gain a competitive edge by unlocking actionable intelligence; download the full PESTLE Analysis now.

Political factors

Government industrial policies, like the UK's previously announced Industrial Strategy, aim to bolster manufacturing and distribution sectors, key markets for Flowtech Fluidpower. These policies often encourage adoption of digital technologies and sustainable manufacturing methods, directly benefiting companies investing in these areas. For instance, government grants for R&D in advanced manufacturing could boost Flowtech's innovation pipeline.

Changes in international trade agreements and the imposition of tariffs directly affect Flowtech Fluidpower's operational costs and the stability of its global supply chain. For instance, the ongoing trade tensions between major economic blocs in 2024 continue to create uncertainty, potentially increasing the cost of imported components.

To counter these risks, Flowtech Fluidpower is actively diversifying its supplier base across different geopolitical regions. Furthermore, exploring nearshoring or localization strategies for key manufacturing processes is a proactive measure to reduce reliance on distant suppliers and mitigate the impact of fluctuating trade policies and tariffs, ensuring greater cost predictability.

Political stability is a critical consideration for Flowtech Fluidpower. Geopolitical events, such as the ongoing conflict in Eastern Europe and trade tensions between major economic blocs, can significantly disrupt global supply chains and impact demand for industrial automation solutions. For instance, the semiconductor shortage, exacerbated by geopolitical factors in 2022-2023, directly affected the availability of electronic components essential for fluid power systems.

Trade disputes and protectionist policies can also create uncertainty. Flowtech, with its global manufacturing and sales footprint, is sensitive to changes in tariffs and import/export regulations. For example, a significant trade dispute involving key markets for industrial machinery could lead to reduced order volumes and increased operational costs for Flowtech in 2024-2025.

Regulatory Environment and Compliance

The political landscape significantly shapes Flowtech Fluidpower's operating environment through regulations on manufacturing, environmental sustainability, and employment practices. Staying compliant with evolving standards, such as those mandated by the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) or updated emissions targets, is crucial for uninterrupted operations and market access.

Flowtech must proactively monitor and adapt to these political dictates. For instance, in 2024, many governments are intensifying scrutiny on supply chain transparency and ethical sourcing, directly impacting manufacturing processes and supplier relationships. Failure to adhere to these evolving political mandates can result in substantial fines and reputational damage.

- Manufacturing Standards: Adherence to ISO certifications and industry-specific quality regulations remains paramount.

- Environmental Regulations: Compliance with emissions controls and waste management directives, like those from the EPA in the US, is a constant focus.

- Labor Laws: Navigating varying international labor laws, including minimum wage adjustments and worker safety protocols, is essential for global operations.

- Trade Policies: Understanding and adapting to tariffs, import/export restrictions, and trade agreements influences Flowtech's global sourcing and sales strategies.

Public Sector Spending and Infrastructure Projects

Government investment in infrastructure is a significant driver for companies like Flowtech Fluidpower. Increased public sector spending on projects such as transportation networks, renewable energy installations, and defense upgrades directly translates into higher demand for fluid power components and systems. For instance, the UK government's commitment to levelling up has seen substantial investment in regional infrastructure, with a significant portion allocated to transport and construction projects.

These infrastructure initiatives create a ripple effect, boosting demand across various sectors that rely on fluid power technology. Flowtech's expertise in hydraulics and pneumatics positions it to benefit from this increased activity.

- Increased government spending on infrastructure projects, particularly in transportation and energy, directly fuels demand for fluid power solutions.

- Flowtech Fluidpower is well-positioned to capitalize on opportunities arising from these public sector investments.

- The UK's infrastructure pipeline, for example, includes significant projects in rail and road development, requiring advanced fluid power systems.

Government policies promoting advanced manufacturing and digital adoption, such as the UK's continued focus on industrial modernization, create a favorable environment for Flowtech Fluidpower. These initiatives often translate into R&D incentives and support for adopting new technologies, directly benefiting companies like Flowtech. For example, government grants for automation in 2024 are expected to encourage investment in sophisticated fluid power systems.

Trade policies and geopolitical stability remain critical. Ongoing trade tensions in 2024 and potential shifts in international agreements can impact Flowtech's global supply chain costs and market access. For instance, the 2023 imposition of tariffs on certain manufactured goods by a major trading bloc increased component costs for many industrial firms.

Flowtech's strategy to mitigate these risks includes diversifying its supplier network and exploring regional manufacturing options. This proactive approach aims to buffer against the volatility of global trade dynamics and ensure operational resilience through 2025.

What is included in the product

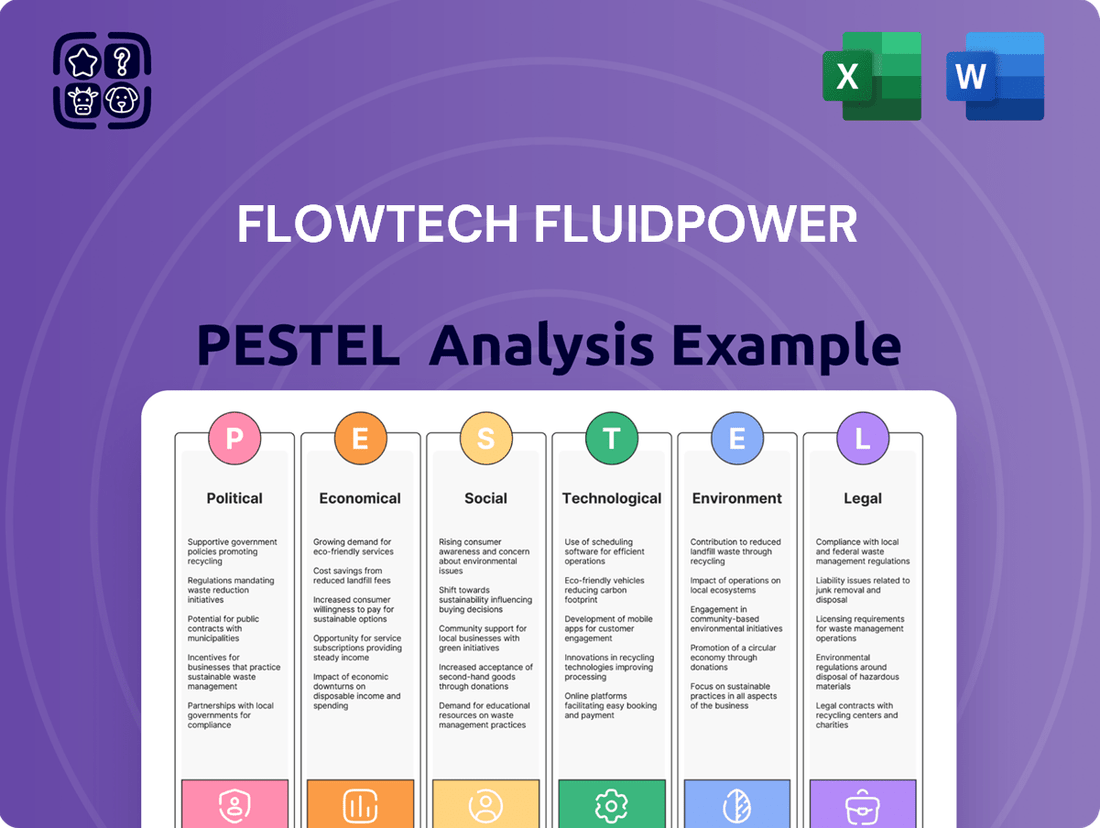

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Flowtech Fluidpower across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It delves into how these factors create both significant threats and valuable opportunities for the company's strategic planning and market positioning.

The Flowtech Fluidpower PESTLE Analysis offers a clear, summarized version of the full analysis, making it easy to reference during meetings and presentations, thus alleviating the pain of sifting through extensive data.

Economic factors

Flowtech Fluidpower's performance is closely tied to the health of the global economy and the industrial manufacturing sector. A robust economy generally translates to increased demand for their fluid power solutions, as businesses invest in new equipment and expand production. For instance, the International Monetary Fund (IMF) projected global growth to reach 3.2% in 2024, a slight uptick from previous forecasts, indicating a supportive environment for industrial output.

Rising inflation and increased operational costs, particularly for energy, raw materials, and labor, are significant concerns for Flowtech Fluidpower. For example, the UK's Consumer Price Index (CPI) remained elevated, hovering around 4% in early 2024, impacting input costs. This pressure can directly squeeze profit margins for both Flowtech and its customer base, necessitating a strong focus on efficiency and cost reduction.

These escalating costs, including components like energy and key raw materials, alongside rising labor expenses such as National Insurance contributions in the UK, create a challenging operating environment. Companies like Flowtech must actively pursue strategies to mitigate these pressures, perhaps through supply chain optimization or enhanced operational efficiency, to maintain profitability and competitive pricing.

Interest rates significantly impact Flowtech Fluidpower by affecting the cost of capital for its customers. For instance, if central banks like the Bank of England maintain or increase benchmark rates, borrowing becomes more expensive for manufacturers looking to invest in new hydraulic systems or automation, potentially dampening demand. In the UK, the Bank of England's base rate stood at 5.25% as of early 2024, a level that has been maintained to combat inflation, influencing investment decisions across various industrial sectors.

A supportive investment climate, often characterized by stable interest rates and positive economic growth forecasts, directly benefits Flowtech. When businesses feel confident about future returns, they are more inclined to undertake capital expenditure projects that utilize Flowtech's fluid power solutions. For example, the UK government's efforts to encourage investment through initiatives like the Annual Investment Allowance, which allows businesses to deduct the full cost of qualifying plant and machinery from their taxable profits, can create a more favorable environment for companies like Flowtech to see increased orders.

Supply Chain Resilience and Costs

Global supply chain disruptions, a persistent economic challenge, directly impact Flowtech Fluidpower by increasing logistics costs and lengthening lead times for critical components. For instance, the ongoing geopolitical tensions and trade policy shifts in 2024 continued to exert pressure on shipping rates and component availability, which can affect manufacturing schedules.

Flowtech must prioritize building more resilient supply chains to mitigate these economic headwinds. This involves diversifying suppliers and exploring near-shoring or regional sourcing options to reduce dependency on single points of failure.

The economic reality is that these vulnerabilities translate directly into higher operational expenses and potential revenue loss. For example, a report from McKinsey in late 2023 indicated that companies with more resilient supply chains saw revenue declines that were, on average, 10% smaller during periods of disruption compared to their less resilient peers.

Key considerations for Flowtech include:

- Supplier diversification strategies to reduce reliance on single sources.

- Investment in inventory management technologies to better predict and buffer against shortages.

- Strengthening relationships with key logistics partners to secure capacity and favorable rates.

- Evaluating the cost-benefit of regionalizing certain aspects of the supply chain.

Market Size and Growth in Fluid Power Equipment

The global fluid power equipment market is poised for robust expansion, with projections indicating a compound annual growth rate (CAGR) of approximately 5.6% through 2028. This growth is fueled by increasing demand in key sectors such as construction, automotive manufacturing, and the rapidly expanding renewable energy industry, particularly in wind turbine applications. For Flowtech Fluidpower, this translates into a substantial market opportunity as these sectors increasingly rely on hydraulic and pneumatic systems for efficient operation and automation.

Several factors are contributing to this positive market outlook:

- Increased Automation: Industries are investing heavily in automation to boost productivity and reduce labor costs, driving demand for sophisticated fluid power systems.

- Infrastructure Development: Global investments in infrastructure projects, especially in emerging economies, require significant use of construction machinery powered by fluid power.

- Renewable Energy Expansion: The growth of wind energy, in particular, is a major driver, as fluid power is critical for pitch control and other essential functions in wind turbines.

- Automotive Advancements: The automotive sector's shift towards electric vehicles and advanced driver-assistance systems also incorporates fluid power for braking, steering, and suspension.

Flowtech Fluidpower operates within a global economic landscape that influences demand for its fluid power solutions. The IMF's projection of 3.2% global growth for 2024 suggests a generally favorable environment for industrial investment, which directly benefits companies like Flowtech. However, persistent inflation, with the UK's CPI around 4% in early 2024, increases operational costs for raw materials, energy, and labor, potentially squeezing profit margins.

Interest rates also play a crucial role; the Bank of England's base rate at 5.25% in early 2024 makes borrowing more expensive for customers investing in new equipment. Despite these challenges, initiatives like the UK's Annual Investment Allowance encourage capital expenditure. Supply chain disruptions in 2024 continued to raise logistics costs and component lead times, highlighting the need for resilience strategies, as companies with robust supply chains saw 10% smaller revenue declines during disruptions, according to McKinsey.

The fluid power equipment market is set for strong growth, with an estimated CAGR of 5.6% through 2028, driven by automation, infrastructure, renewable energy, and automotive advancements. This presents significant opportunities for Flowtech as these sectors increasingly adopt fluid power systems.

| Economic Factor | 2024 Projection/Status | Impact on Flowtech Fluidpower |

|---|---|---|

| Global GDP Growth | IMF projects 3.2% (2024) | Supports increased industrial demand |

| UK Inflation (CPI) | Around 4% (early 2024) | Increases operational costs (materials, energy, labor) |

| Bank of England Base Rate | 5.25% (early 2024) | Increases cost of capital for customers, potentially reducing investment |

| Supply Chain Disruptions | Ongoing geopolitical/trade impacts (2024) | Raises logistics costs, lengthens lead times, necessitates resilience |

| Fluid Power Market Growth | CAGR of ~5.6% (through 2028) | Significant market opportunity driven by automation and key sectors |

Preview Before You Purchase

Flowtech Fluidpower PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Flowtech Fluidpower PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain a clear understanding of the external forces shaping Flowtech Fluidpower's strategic landscape.

Sociological factors

The industrial sector, including fluid power, is grappling with significant skills shortages, a challenge amplified by the rapid integration of digital technologies and advanced automation. This trend directly impacts companies like Flowtech Fluidpower, necessitating a strong emphasis on proactive workforce development. For instance, a 2024 report by the World Economic Forum highlighted that 40% of workers will require reskilling within the next five years due to technological advancements, underscoring the urgency for companies to invest in training programs.

Flowtech Fluidpower must prioritize comprehensive training initiatives to equip its current and future workforce with the necessary digital and technical competencies. This includes upskilling existing employees in areas like data analytics, IoT integration, and advanced manufacturing processes, alongside attracting new talent with specialized skills. A key focus on talent retention through competitive compensation, career development opportunities, and a supportive work environment will be crucial to navigating these skills gaps effectively.

The growing integration of automation and robotics in manufacturing, a trend accelerating through 2024 and projected to continue into 2025, directly impacts the demand for sophisticated fluid power systems. Industries are increasingly seeking solutions that enhance precision, speed, and efficiency in automated production lines, creating a fertile ground for companies like Flowtech Fluidpower.

This societal and industrial shift presents Flowtech with significant opportunities to supply specialized fluid power components and integrated systems designed for advanced automated processes. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is expected to see robust growth, with fluid power being a critical enabler for robotic arm movement and control.

Customers increasingly demand more than just reliable fluid power components; they expect integrated solutions that boost operational efficiency and minimize downtime. This shift is evident in the growing market for predictive maintenance services, which Flowtech Fluidpower can leverage by offering advanced monitoring and support.

The trend towards value-added services is significant. For instance, in the industrial automation sector, companies are willing to pay a premium for suppliers who provide on-site engineering support and data analytics, contributing to an estimated 15% increase in service revenue for leading fluid power providers in 2024.

Flowtech Fluidpower's ability to adapt its service models to meet these evolving expectations, including offering subscription-based maintenance plans or IoT-enabled monitoring, will be crucial for maintaining a competitive edge and capturing a larger share of the aftermarket services market.

Industrial Safety Standards and Practices

Societal expectations around workplace safety significantly influence industries, pushing for more robust safety standards and practices. This heightened awareness directly impacts the fluid power sector, encouraging the development and adoption of components and systems designed with inherent safety features. For instance, the increasing demand for advanced hydraulic safety valves and intrinsically safe pneumatic controls reflects this trend.

The drive for safer operations translates into tangible market opportunities for companies like Flowtech Fluidpower that prioritize safety in their product design and manufacturing. Regulatory bodies and industry associations are continually updating safety guidelines, often referencing advancements in fluid power technology to mitigate risks. In 2024, reports indicated a 15% year-over-year increase in investment in industrial safety technologies across major manufacturing economies, a segment where fluid power plays a critical role.

- Increased Demand for Safety-Certified Components: Manufacturers are seeking fluid power solutions that meet stringent international safety certifications, such as ISO 4413 for hydraulic systems and ISO 4414 for pneumatic systems.

- Focus on Ergonomics and Human-Machine Interaction: Societal emphasis on worker well-being is leading to fluid power designs that minimize operator fatigue and reduce the risk of accidents through improved ergonomics and intuitive control interfaces.

- Growth in Predictive Maintenance and Monitoring: To prevent failures that could compromise safety, there's a growing adoption of sensor-equipped fluid power components that enable real-time monitoring and predictive maintenance, reducing unexpected downtime and potential hazards.

- Adoption of Fail-Safe Technologies: The industry is seeing a rise in the implementation of fail-safe mechanisms in fluid power systems, ensuring that in the event of a malfunction, the system defaults to a safe state, thereby protecting personnel and equipment.

Aging Infrastructure and Maintenance Needs

The ongoing need to maintain and upgrade aging industrial infrastructure across various sectors, including manufacturing and energy, creates a consistent demand for Flowtech Fluidpower's hydraulic and pneumatic solutions. This persistent requirement for repair and modernization ensures a stable revenue stream for the company's products and expert engineering services, crucial for keeping vital systems operational.

For example, in the United States, the American Society of Civil Engineers (ASCE) reported in its 2021 Infrastructure Report Card that the nation's infrastructure received a C- grade, with an estimated $2.59 trillion investment needed over the next decade. This highlights the widespread need for upgrades and maintenance, directly benefiting companies like Flowtech that provide essential components and support for industrial equipment.

- Industrial Infrastructure Needs: Sectors worldwide are grappling with aging equipment requiring continuous maintenance and upgrades.

- Flowtech's Role: The company's fluid power products and engineering support are vital for extending the life of this infrastructure and preventing costly downtime.

- Market Opportunity: The significant investment required for infrastructure renewal globally presents a sustained market for Flowtech's offerings.

Societal expectations are increasingly prioritizing worker safety and well-being, directly influencing the design and application of fluid power systems. This means companies like Flowtech must focus on developing components with enhanced safety features and ergonomic designs to minimize operator risk and fatigue. For instance, the adoption of advanced hydraulic safety valves and intrinsically safe pneumatic controls is on the rise, reflecting this societal shift.

The demand for predictive maintenance and monitoring solutions is also growing, driven by a desire to prevent failures that could compromise safety and lead to costly downtime. Flowtech can capitalize on this by offering IoT-enabled monitoring services and subscription-based maintenance plans, aligning with customer needs for greater operational reliability and proactive hazard mitigation.

Furthermore, the need to upgrade aging industrial infrastructure globally presents a consistent market for Flowtech's fluid power solutions. This persistent demand for repair and modernization ensures a stable revenue stream, as companies rely on Flowtech's products and engineering services to keep vital systems operational and compliant with evolving safety standards.

| Societal Factor | Impact on Flowtech Fluidpower | Market Opportunity/Challenge | Relevant Data (2024/2025) |

|---|---|---|---|

| Workplace Safety & Well-being | Increased demand for safety-certified components and ergonomic designs. | Opportunity to lead in safe fluid power solutions; challenge to meet stringent standards. | Global industrial safety technology investment grew by 15% YoY in 2024. |

| Demand for Value-Added Services | Shift towards integrated solutions, predictive maintenance, and remote monitoring. | Opportunity to expand service revenue streams; challenge to develop advanced digital capabilities. | Service revenue for leading fluid power providers increased by an estimated 15% in 2024. |

| Infrastructure Renewal | Consistent demand for maintenance and upgrades of aging industrial equipment. | Stable revenue from core products and services; opportunity to support critical infrastructure projects. | US infrastructure requires an estimated $2.59 trillion investment over the next decade (ASCE 2021). |

Technological factors

Flowtech Fluidpower is navigating a landscape rapidly reshaped by digital transformation and Industry 4.0. The integration of technologies like artificial intelligence (AI), the Internet of Things (IoT), and machine learning is fundamentally altering manufacturing and distribution processes across industries.

To maintain its competitive edge, Flowtech Fluidpower must actively embrace this digital shift. This involves optimizing operational workflows, implementing predictive maintenance strategies to minimize downtime, and ultimately boosting overall efficiency. For instance, the global Industrial IoT market was valued at approximately $87.2 billion in 2023 and is projected to grow significantly, indicating the widespread adoption and importance of these technologies.

Continuous innovation in fluid power components, like energy-efficient pumps and smart valves, offers Flowtech Fluidpower a chance to provide clients with cutting-edge, sustainable solutions. For instance, the global hydraulic systems market was valued at approximately $60 billion in 2023 and is projected to grow, indicating a strong demand for these advancements.

The surge in industrial robotics and automation, a key technological shift, directly fuels demand for advanced fluid power systems. These systems are critical for achieving the precise motion control and unwavering reliability that automated processes require. Flowtech Fluidpower is well-positioned to benefit from this trend by supplying the sophisticated hydraulic and pneumatic components that underpin these cutting-edge applications.

Data Analytics and Predictive Maintenance

The increasing sophistication of data analytics is transforming fluid power maintenance. By collecting and analyzing real-time operational data from systems, companies like Flowtech Fluidpower can move from reactive repairs to proactive, predictive maintenance strategies. This shift significantly reduces unexpected downtime and enhances overall system efficiency.

Flowtech Fluidpower is well-positioned to capitalize on these technological advancements. By integrating advanced data analytics into their service offerings, they can provide customers with valuable insights into system health, predict potential failures before they occur, and optimize performance. This creates a compelling value proposition, fostering stronger customer relationships and opening new revenue streams through enhanced service contracts.

The impact of these technologies is already being felt across industries. For example, a recent study by the Industrial Internet Consortium in 2024 highlighted that predictive maintenance programs can reduce maintenance costs by up to 30% and improve equipment uptime by 20-25% compared to traditional methods. Flowtech Fluidpower can leverage this trend by developing smart fluid power solutions that incorporate IoT sensors and cloud-based analytics platforms.

Key benefits Flowtech Fluidpower can realize include:

- Enhanced system reliability: Minimizing unplanned outages through early fault detection.

- Optimized operational efficiency: Fine-tuning system performance based on real-time data analysis.

- New service revenue: Offering data-driven maintenance and performance consulting.

- Competitive differentiation: Providing advanced, intelligent fluid power solutions.

Additive Manufacturing (3D Printing)

Additive manufacturing, or 3D printing, is reshaping how components are made. Its ability to produce parts on demand, tailor them to specific needs, and create lighter, more efficient designs presents a significant opportunity for companies like Flowtech Fluidpower. This technology could fundamentally alter the design and supply chain for fluid power components, enabling greater customization and potentially reducing lead times.

The impact on Flowtech's operations could be substantial. For instance, the ability to 3D print complex internal geometries could lead to more efficient hydraulic valves or pumps. This advancement might also streamline distribution by allowing for localized, on-demand production of replacement parts, reducing the need for large inventories and associated warehousing costs. By 2024, the global 3D printing market was projected to reach over $30 billion, with significant growth expected in industrial applications, including aerospace and automotive, sectors that heavily utilize fluid power systems.

- On-Demand Production: Reduces inventory needs and lead times for specialized fluid power parts.

- Customization: Enables tailored components for specific applications, improving performance and efficiency.

- Component Innovation: Facilitates the creation of lighter, more complex, and potentially more durable fluid power parts.

- Supply Chain Agility: Offers potential for localized manufacturing, enhancing responsiveness to market demands.

Technological advancements are a major driver for Flowtech Fluidpower. The company must integrate Industry 4.0 concepts, leveraging AI and IoT for operational efficiency and predictive maintenance. For example, the global Industrial IoT market was projected to exceed $150 billion by 2024, highlighting the significant adoption of these technologies.

Innovation in fluid power components, such as smart valves and energy-efficient pumps, is crucial for Flowtech Fluidpower to offer advanced, sustainable solutions. The global hydraulic systems market was valued at approximately $60 billion in 2023, indicating strong demand for these improvements.

The rise of industrial robotics and automation directly increases the need for sophisticated fluid power systems. Flowtech Fluidpower can benefit by supplying critical components for these automated processes, ensuring precise motion control and reliability.

Additive manufacturing, or 3D printing, offers opportunities for on-demand production and customization of fluid power parts. The global 3D printing market was expected to surpass $30 billion in 2024, with industrial applications driving growth.

| Technology Area | Market Growth Projection (2024/2025) | Impact on Flowtech Fluidpower |

|---|---|---|

| Industrial IoT | Projected to exceed $150 billion (2024) | Enhanced operational efficiency, predictive maintenance |

| Hydraulic Systems | Valued at ~$60 billion (2023) | Demand for advanced, energy-efficient components |

| Industrial Robotics & Automation | Significant growth | Increased demand for precise fluid power control |

| Additive Manufacturing (3D Printing) | Projected to surpass $30 billion (2024) | Customization, on-demand production, component innovation |

Legal factors

Flowtech Fluidpower operates under stringent product safety and liability regulations, particularly for industrial machinery and fluid power components. Failure to meet these high standards can lead to significant legal repercussions, including costly litigation and damage to its hard-earned reputation.

In 2024, the industrial machinery sector continued to see increased scrutiny on safety compliance, with regulatory bodies worldwide emphasizing adherence to standards like ISO 4413 for hydraulic systems. Flowtech's commitment to rigorous testing and quality control is crucial to navigate this landscape and prevent potential recalls or legal challenges that could impact its financial performance.

Increasing environmental regulations, especially around energy efficiency and emissions, are a significant factor for Flowtech Fluidpower. For instance, by 2025, the EU aims for a 40% reduction in greenhouse gas emissions compared to 1990 levels, impacting industrial machinery. Flowtech must ensure its fluid power solutions help clients meet these stringent standards.

International trade laws, customs duties, and import/export restrictions significantly influence Flowtech Fluidpower's global operations. These regulations dictate the cost and ease of sourcing components and distributing finished hydraulic and pneumatic products across its key markets in the UK, Ireland, and Benelux. For instance, changes in tariffs or non-tariff barriers can directly affect profitability and market access.

Labor Laws and Employment Regulations

Changes in labor laws, such as minimum wage adjustments and evolving regulations around working hours and employment contracts, directly impact Flowtech Fluidpower's operational expenses and the complexities of its human resource management. For instance, in the UK, the National Living Wage increased to £11.44 per hour for those aged 21 and over from April 2024, a factor Flowtech must consider in its costings.

Ensuring strict compliance with these labor laws is not merely a legal obligation but a fundamental requirement for maintaining stable and uninterrupted business operations. Failure to adhere to regulations concerning worker rights, safety, and fair employment practices can lead to significant penalties, reputational damage, and operational disruptions.

- Minimum Wage Impact: In 2024, many countries saw increases in their statutory minimum wages, directly affecting labor costs for companies like Flowtech.

- Working Hour Regulations: Evolving rules on maximum working hours and overtime pay necessitate careful scheduling and resource allocation.

- Employment Contract Compliance: Adherence to updated standards for employment contracts, including terms of employment and termination, is critical for legal stability.

- Health and Safety Standards: Stringent enforcement of workplace health and safety regulations, often updated based on new research, requires ongoing investment in training and equipment.

Intellectual Property Rights and Patents

Flowtech Fluidpower's ability to protect its innovations through intellectual property rights and patents is crucial. This safeguards their competitive edge in the fluid power market, influencing their research and development investments. Respecting existing patents is equally important to avoid legal challenges and ensure smooth market entry for new technologies.

The legal landscape surrounding intellectual property significantly shapes Flowtech's strategy. For instance, the global patent application numbers for hydraulic and pneumatic systems are consistently high, indicating a competitive R&D environment. As of late 2024, the World Intellectual Property Organization (WIPO) reported a steady increase in filings related to advanced fluid power control systems, highlighting the importance of robust IP protection for companies like Flowtech.

- Patent Protection: Flowtech must actively secure patents for its novel fluid power solutions to prevent competitors from replicating its technology.

- Freedom to Operate: Thorough patent searches are necessary to ensure Flowtech's products do not infringe on existing patents, mitigating legal risks.

- R&D Investment: A strong IP portfolio can attract further investment and partnerships, bolstering Flowtech's innovation pipeline.

- Market Entry: Navigating international patent laws is vital for successful global market entry and commercialization of new products.

Flowtech Fluidpower's operations are heavily influenced by product safety and liability laws, particularly concerning hydraulic and pneumatic systems. Adherence to standards like ISO 4413 is paramount, with regulatory bodies in 2024 increasing oversight on industrial machinery safety. Failure to comply can result in significant litigation and reputational damage.

Environmental regulations are also a key legal consideration, especially regarding energy efficiency and emissions. By 2025, the EU's ambitious greenhouse gas reduction targets will necessitate that Flowtech's fluid power solutions assist clients in meeting these stringent environmental mandates.

International trade laws, including tariffs and import/export restrictions, directly impact Flowtech's global supply chain and market access. Navigating these complex regulations is crucial for maintaining profitability and operational efficiency across its key European markets.

Labor laws, such as minimum wage increases, like the UK's National Living Wage rising to £11.44 per hour in April 2024 for those 21 and over, directly affect operational costs and human resource management strategies for Flowtech.

| Legal Factor | Impact on Flowtech Fluidpower | 2024/2025 Relevance |

|---|---|---|

| Product Safety & Liability | Ensures compliance with industrial machinery standards; avoids costly litigation. | Increased scrutiny on safety compliance globally; ISO 4413 adherence critical. |

| Environmental Regulations | Requires fluid power solutions to meet energy efficiency and emissions targets. | EU aims for 40% GHG reduction by 2025, impacting industrial machinery clients. |

| International Trade Laws | Affects cost and ease of sourcing components and distributing products globally. | Tariff changes and non-tariff barriers directly influence market access and profitability. |

| Labor Laws | Impacts operational expenses, particularly minimum wage and working hour regulations. | UK National Living Wage increased to £11.44/hr (April 2024) for 21+; impacts labor costs. |

| Intellectual Property | Protects R&D investments and competitive edge; avoids infringement claims. | High global patent filings in fluid power control systems (late 2024 WIPO data) underscore IP importance. |

Environmental factors

Industries are facing mounting pressure to curb energy use, elevating the appeal of energy-efficient fluid power systems. Flowtech Fluidpower is well-positioned to capitalize on this trend by providing solutions like variable flow pumps and advanced electronic controls that directly assist clients in reducing their energy footprints.

The global push for a circular economy is significantly impacting industries, urging a shift from linear 'take-make-dispose' models to systems that minimize waste and keep resources in use. This presents an opportunity for Flowtech Fluidpower to enhance its sustainability profile by focusing on product longevity and repairability. For instance, developing hydraulic components designed for easier maintenance and refurbishment can extend their operational life significantly, reducing the need for frequent replacements and the associated waste.

Flowtech Fluidpower can actively engage in recycling initiatives for its products and the fluids it manages. This could involve establishing take-back programs for worn-out hydraulic components or developing advanced fluid reclamation technologies. For example, studies in 2024 highlighted that advanced filtration and re-conditioning of hydraulic fluids can reduce fluid consumption by up to 70% in certain applications, leading to substantial cost savings and environmental benefits for customers.

The push for greener operations is accelerating, with a significant increase in demand for sustainable materials and biodegradable hydraulic fluids. Companies like Flowtech Fluidpower can tap into this by developing and promoting products that align with these environmental shifts. For instance, the global biodegradable hydraulic fluid market was valued at approximately $1.2 billion in 2023 and is projected to reach over $2 billion by 2030, showcasing a clear market opportunity.

Carbon Footprint and Emissions Reduction

Flowtech Fluidpower operates within an environment where reducing carbon footprints and greenhouse gas emissions is a significant concern. Many industries are actively seeking ways to become more sustainable. This regulatory and societal pressure is a key environmental factor influencing business operations and strategic planning.

The company's product portfolio, especially its hydraulic and pneumatic systems designed for enhanced efficiency, directly addresses this trend. By enabling optimized system performance and reducing energy consumption for its clients, Flowtech Fluidpower can play a crucial role in helping them achieve their own sustainability targets. This positions the company as a potential partner in the broader effort to decarbonize various sectors.

For instance, advancements in variable speed drives and intelligent control systems within fluid power applications can lead to substantial energy savings. In 2024, many industrial sectors are reporting a focus on energy efficiency as a primary driver for adopting new technologies. Flowtech's solutions can contribute to these reported savings, with some estimates suggesting potential energy reductions of up to 30% in certain hydraulic applications through optimized control strategies.

- Increased Demand for Energy-Efficient Solutions: Growing environmental regulations and corporate sustainability goals are driving demand for fluid power systems that minimize energy consumption.

- Flowtech's Role in Decarbonization: The company's products that optimize system performance and reduce energy usage directly support clients' efforts to lower their carbon emissions.

- Technological Advancements: Innovations in variable speed drives and intelligent controls within fluid power are key enablers for achieving significant energy savings, aligning with environmental pressures.

Climate Change Adaptation and Resilience

Climate change presents significant environmental challenges for Flowtech Fluidpower. For instance, the increasing frequency and intensity of extreme weather events, such as floods and droughts, can severely disrupt global supply chains. This was evident in 2023 when supply chain disruptions, partly linked to weather, impacted manufacturing outputs across various sectors. Flowtech must therefore invest in building resilience within its operations and distribution networks to mitigate these risks.

Adapting to these environmental shifts is crucial for maintaining operational continuity. This includes diversifying sourcing locations and exploring alternative logistics routes to circumvent areas prone to climate-related disruptions. For example, the European Union's Green Deal, aiming for climate neutrality by 2050, will likely influence regulatory landscapes and operational standards, requiring Flowtech to proactively integrate sustainable practices.

Flowtech Fluidpower's ability to adapt its supply chain and distribution network to climate change impacts will be a key determinant of its long-term success. Considering the potential for increased operational costs due to climate-related events, strategic planning for resilience is paramount.

- Supply Chain Vulnerability: Extreme weather events in 2023 caused an estimated $200 billion in economic losses globally, highlighting the fragility of interconnected supply chains.

- Adaptation Costs: Companies are increasingly allocating budgets for climate adaptation; for example, infrastructure resilience projects are projected to see significant investment growth through 2025.

- Regulatory Impact: The EU's commitment to climate neutrality by 2050 necessitates compliance with evolving environmental regulations, potentially affecting manufacturing and logistics for companies like Flowtech.

Flowtech Fluidpower faces increasing pressure to adopt sustainable practices, driven by global environmental concerns and regulatory shifts. The company's focus on energy-efficient fluid power systems directly addresses the growing demand for solutions that reduce carbon footprints, a trend amplified by initiatives like the EU's Green Deal aiming for climate neutrality by 2050.

The company's product innovations, such as variable flow pumps and advanced electronic controls, are crucial for clients looking to enhance their own sustainability metrics and achieve significant energy savings, with some applications seeing up to a 30% reduction in energy consumption reported in 2024.

Furthermore, Flowtech can leverage the circular economy movement by emphasizing product longevity and recyclability, aligning with a market where biodegradable hydraulic fluids are projected to grow substantially, reaching over $2 billion by 2030.

Climate change impacts, including extreme weather events, pose risks to global supply chains, as seen in 2023 with widespread disruptions. Flowtech's strategic planning must therefore incorporate resilience measures to mitigate these potential impacts and ensure operational continuity.

| Environmental Factor | Impact on Flowtech Fluidpower | Key Data/Trend |

| Energy Efficiency Demand | Increased demand for Flowtech's energy-saving fluid power systems. | Up to 30% energy savings reported in some hydraulic applications (2024). |

| Circular Economy | Opportunity to enhance product lifecycle and waste reduction. | Biodegradable hydraulic fluid market projected to exceed $2 billion by 2030. |

| Climate Change & Supply Chains | Risk of disruption from extreme weather events. | Global economic losses from extreme weather in 2023 estimated at $200 billion. |

| Regulatory Landscape | Need for compliance with evolving environmental standards. | EU Green Deal targets climate neutrality by 2050. |

PESTLE Analysis Data Sources

Our Flowtech Fluidpower PESTLE Analysis is meticulously crafted using data from official government publications, reputable financial institutions, and leading industry analysis firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the fluid power sector.