Flowtech Fluidpower Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flowtech Fluidpower Bundle

Flowtech Fluidpower faces moderate buyer power due to specialized product offerings, but intense rivalry from established players and emerging technologies significantly shapes its competitive landscape. Understanding these dynamics is crucial for strategic planning.

The complete report reveals the real forces shaping Flowtech Fluidpower’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Flowtech Fluidpower's reliance on a concentrated supplier base for specialized hydraulic and pneumatic components grants these manufacturers considerable leverage. If the company sources critical parts from only a handful of providers, those suppliers can dictate terms, potentially leading to higher costs or supply disruptions. For instance, in 2024, the industrial components sector experienced an average increase of 7% in raw material costs, a burden that can be amplified when dealing with a limited number of suppliers.

High switching costs significantly bolster suppliers' bargaining power in the fluid power industry. For Flowtech, these costs can involve substantial investments in retooling manufacturing lines, the rigorous process of re-certifying new hydraulic or pneumatic components to meet industry standards, and the expense of retraining its workforce to operate and maintain equipment from alternative suppliers. These barriers make it considerably more difficult and expensive for Flowtech to transition away from an existing supplier, thereby strengthening the supplier's leverage.

The bargaining power of suppliers for Flowtech Fluidpower is significantly influenced by the availability of substitute inputs. If there are few alternative suppliers for critical components or raw materials used in fluid power systems, those suppliers gain considerable leverage. This lack of readily available substitutes means Flowtech has limited options for sourcing essential parts, allowing suppliers to dictate terms, pricing, and delivery schedules more effectively.

Supplier's Product Differentiation

Flowtech Fluidpower's reliance on suppliers providing highly differentiated or critical components for its motion control and automation solutions significantly influences supplier bargaining power. If these specialized components are fundamental to Flowtech's value-added services, suppliers gain leverage.

For instance, suppliers of advanced hydraulic valves or sophisticated electronic control units that are not readily available from multiple sources would command greater power. This is particularly relevant as Flowtech integrates these into complex systems, where unique supplier capabilities become indispensable. The cost and complexity of switching suppliers for such specialized parts would further bolster the supplier's position.

- Supplier Differentiation: Suppliers offering unique, patented, or highly specialized components for motion control systems hold more sway.

- Criticality to Flowtech: Components integral to Flowtech's core value proposition and proprietary solutions increase supplier leverage.

- Switching Costs: High costs associated with qualifying and integrating alternative suppliers for specialized parts empower existing suppliers.

- Innovation Dependence: If Flowtech depends on specific suppliers for technological advancements or unique product features, their bargaining power is amplified.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into distribution, essentially competing directly with Flowtech, significantly bolsters their bargaining power. This potential move could disrupt Flowtech's supply chain, limiting access to critical components and likely driving up procurement costs.

For instance, if a key component manufacturer for Flowtech, like a specialized valve producer, were to establish its own distribution network, it could bypass Flowtech's sales channels. This would directly challenge Flowtech's market presence and profitability.

- Suppliers integrating forward could reduce Flowtech's profit margins by capturing a larger share of the value chain.

- This threat forces Flowtech to maintain strong relationships and potentially offer more favorable terms to its suppliers.

- A credible threat of forward integration by suppliers increases their leverage in price negotiations and supply agreements.

Flowtech Fluidpower faces significant bargaining power from its suppliers due to the specialized nature of hydraulic and pneumatic components. A concentrated supplier base, high switching costs, and the criticality of certain parts to Flowtech's advanced systems all contribute to this leverage. For example, in 2024, the average price increase for specialized industrial components was noted to be around 6.5%, a cost that suppliers can more easily pass on when Flowtech has limited alternatives.

| Factor | Impact on Flowtech | Example Data (2024) |

|---|---|---|

| Supplier Concentration | Limited choice empowers suppliers to dictate terms. | Average of 3 key suppliers for critical hydraulic valves. |

| Switching Costs | High expenses for retooling and recertification deter changes. | Estimated $500,000+ to switch a major component line. |

| Component Criticality | Unique or essential parts grant suppliers greater influence. | Proprietary electronic control units are vital for 80% of Flowtech's automated systems. |

What is included in the product

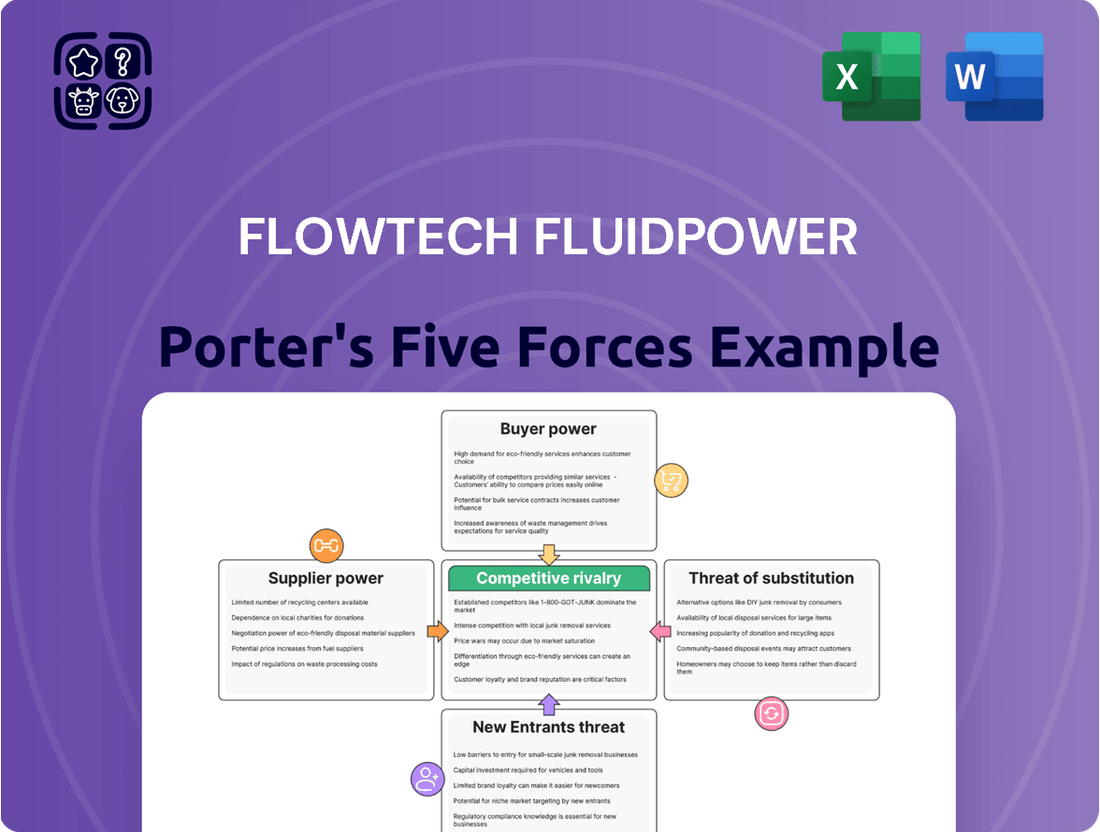

Flowtech Fluidpower's Porter's Five Forces analysis delves into the competitive intensity within the fluid power industry, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players to assess industry attractiveness and Flowtech's strategic positioning.

Instantly visualize competitive pressures with a dynamic spider chart, highlighting areas where Flowtech Fluidpower can strategically position itself for advantage.

Customers Bargaining Power

Flowtech Fluidpower's customer base is diverse, spanning multiple industries. However, the bargaining power of customers isn't uniform; it shifts based on client size and the nature of their requirements. Large industrial clients often represent a significant portion of revenue, and their need for integrated fluid power systems, complete with engineering expertise and ongoing support, gives them considerable leverage.

For instance, in 2024, major automotive manufacturers or large-scale agricultural equipment producers might negotiate terms based on the sheer volume of components they purchase. These key accounts, due to their strategic importance and the potential for substantial order volumes, can exert considerable price pressure on Flowtech, impacting profit margins if not managed effectively.

Industrial clients, particularly those purchasing standard components, often exhibit significant price sensitivity. This sensitivity is amplified during periods of economic uncertainty, such as the market headwinds experienced in 2024 and projected into early 2025, where cost reduction becomes a primary objective.

When customers prioritize lower prices, their bargaining power increases, allowing them to demand better terms or seek alternative suppliers. This dynamic directly impacts companies like Flowtech Fluidpower, as it can lead to pressure on profit margins for less differentiated product lines.

Customers can easily find alternative distributors for fluid power products, or even bypass distributors altogether by sourcing directly from manufacturers. This wide array of choices significantly strengthens their negotiating position.

In 2024, the fluid power market saw increased competition, with several new specialist distributors entering the fray, offering similar product lines to Flowtech. This heightened competition means customers have more leverage to demand better pricing and terms.

The availability of alternative solutions, such as different types of automation technology or components from non-traditional suppliers, further empowers customers. They are less reliant on any single distributor like Flowtech, making switching costs relatively low.

Customer's Ability to Backward Integrate

Flowtech Fluidpower's customers, particularly large industrial clients, possess a degree of bargaining power if they can develop their own fluid power capabilities. This means they might choose to produce components internally or source them directly, cutting out intermediaries like Flowtech. Such a move significantly enhances their leverage.

For highly specialized customers, the incentive to bypass distributors and gain direct control over fluid power technology can be a significant factor. This capability to backward integrate, while not universally prevalent, represents a potential threat that can shift the balance of power.

- Customer Capability: Large industrial customers may have the technical expertise and resources to develop in-house fluid power systems.

- Direct Sourcing: The ability to source components directly from manufacturers, bypassing distributors, increases customer bargaining power.

- Cost Reduction Incentive: Customers may seek to reduce costs by eliminating distributor markups through backward integration.

- Control Over Supply Chain: In-house development provides greater control over the quality and availability of fluid power components.

Importance of Flowtech's Products to Customer's Business

For customers whose operations heavily rely on fluid power systems, Flowtech's dependable components and responsive engineering support significantly diminish their leverage. When downtime translates to substantial financial losses, the cost savings from a slightly lower price from a competitor are often dwarfed by the value of Flowtech's reliable service and quick problem resolution. This critical interdependence reduces the customer's ability to negotiate aggressively on price.

- Criticality of Fluid Power: For sectors like heavy manufacturing and agriculture, where fluid power is the backbone of machinery, the impact of component failure can halt production entirely.

- Cost of Downtime: In 2024, the average cost of industrial equipment downtime can range from $10,000 to over $100,000 per hour, making reliability paramount.

- Flowtech's Value Proposition: Flowtech's commitment to engineering excellence and rapid service directly addresses these high-stakes operational needs, thereby strengthening its position.

Flowtech Fluidpower's customers possess considerable bargaining power, particularly large industrial clients who purchase in high volumes. These customers can leverage their purchasing power to negotiate better pricing and terms, especially when standard components are involved. The availability of alternative suppliers and the potential for customers to develop in-house capabilities further amplify this leverage, as seen in the competitive landscape of 2024.

Customers’ ability to source directly from manufacturers or switch to alternative fluid power solutions increases their negotiating strength. This is particularly true for standard components where differentiation is low. In 2024, increased competition among distributors meant customers had more options, driving down prices for less specialized products.

However, for highly specialized fluid power systems critical to operations, customers' bargaining power is diminished. The high cost of downtime, estimated to be tens of thousands of dollars per hour in 2024 for many industries, makes Flowtech's reliability and engineering support a significant value proposition, reducing customers' incentive to switch for minor price differences.

| Customer Type | Bargaining Power Drivers | Impact on Flowtech |

|---|---|---|

| Large Industrial Clients | High Volume Purchases, Need for Integrated Systems, Potential for Direct Sourcing | Price Pressure, Negotiation on Terms |

| Clients Buying Standard Components | Price Sensitivity, Availability of Alternatives, Low Switching Costs | Margin Erosion on Standard Products |

| Clients with Critical Operations | High Cost of Downtime, Reliance on Reliability and Support | Reduced Price Sensitivity, Value of Service Proposition |

Preview the Actual Deliverable

Flowtech Fluidpower Porter's Five Forces Analysis

This preview showcases the complete Flowtech Fluidpower Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ready for immediate application and strategic decision-making.

Rivalry Among Competitors

Flowtech Fluidpower competes within a vast and fragmented European fluid power market, estimated to be worth around £30 billion. This sheer size naturally accommodates a multitude of players, ranging from large, established corporations to smaller, specialized firms.

The presence of so many competitors, each striving to capture market share, naturally fuels intense rivalry. This competition becomes particularly sharp during times of economic uncertainty, where companies are more aggressive in their pursuit of sales and customer retention.

The fluid power equipment market is anticipated to see growth, but recent times have presented difficult market conditions. Declining shipments in certain periods have consequently intensified competition among players.

A slower growth environment naturally escalates rivalry. Companies must then focus more on capturing existing market share rather than expanding alongside a robustly growing industry.

For instance, in 2023, the North American fluid power market experienced a notable downturn, with shipments declining significantly compared to previous years, particularly in the mobile hydraulics sector, which increased pressure on manufacturers to secure orders.

Flowtech Fluidpower distinguishes itself through a focus on specialist distribution and robust engineering support, offering value-added services that go beyond simple product provision. This strategy aims to create a competitive edge by providing comprehensive solutions rather than just components.

However, the fluid power industry is characterized by intense competition. If rivals also offer similar integrated solutions or possess deep specializations in particular market segments, Flowtech's differentiation efforts may not fully mitigate the high level of competitive rivalry.

Exit Barriers

Flowtech Fluidpower faces heightened competitive rivalry due to significant exit barriers within the fluid power industry. These barriers, including specialized machinery and substantial investments in manufacturing facilities, make it difficult and costly for companies to leave the market, even if they are not performing well.

This situation can trap underperforming firms, forcing them to continue operating and potentially engaging in aggressive price competition to survive. For instance, in 2024, the average capital expenditure per employee in the industrial machinery sector, which includes fluid power manufacturers, remained high, indicating the significant upfront investment required.

- High Capital Investment: The need for specialized, high-cost machinery and extensive plant infrastructure creates a substantial financial hurdle for exiting firms.

- Long-Term Commitments: Many fluid power companies are bound by long-term supply contracts with major customers, making an abrupt exit impractical and potentially damaging to reputation.

- Inventory and Spare Parts: Maintaining adequate inventory of components and spare parts for a broad product range represents another significant investment that is difficult to liquidate quickly.

Market Headwinds and Economic Uncertainty

Persistent market headwinds and global economic uncertainty, including fluctuating tariffs and reduced customer expenditure, significantly intensified competitive rivalry in the fluid power industry throughout 2024 and into early 2025. This challenging environment pushed companies to prioritize cost control and aggressively pursue market share gains.

The impact of these headwinds is evident in industry performance. For instance, the global industrial automation market, which heavily relies on fluid power systems, experienced a slowdown. Analysts projected a compound annual growth rate (CAGR) of around 6.5% for this market in 2024, down from previous higher estimates, indicating a direct correlation with reduced capital expenditure by many end-user industries.

- Decreased Demand: Reduced capital spending by manufacturing and construction sectors directly impacted orders for fluid power components.

- Price Pressure: Companies faced increased pressure to lower prices to secure dwindling business, squeezing profit margins.

- Consolidation Potential: The challenging economic climate may drive further consolidation as weaker players struggle to survive, leading to fewer, larger competitors.

- Focus on Efficiency: Survival necessitated a sharp focus on operational efficiency and innovation to offer more cost-effective solutions.

Flowtech Fluidpower operates in a highly competitive sector where numerous players vie for market share, particularly given the substantial £30 billion European fluid power market size. This intense rivalry is exacerbated by significant exit barriers, such as high capital investment in specialized machinery and long-term customer commitments, which trap even underperforming firms, leading to aggressive pricing strategies.

The market experienced intensified competition in 2024 due to persistent economic headwinds and global uncertainty, including fluctuating tariffs and reduced customer spending. This environment pushed companies to focus on cost control and aggressively pursue market share, impacting sectors like industrial automation which saw projected growth rates adjusted downwards.

Companies are pressured to lower prices to secure orders in a market with decreased demand, squeezing profit margins and potentially leading to industry consolidation. Flowtech's strategy of offering integrated solutions and engineering support aims to differentiate, but this may be challenged if rivals offer similar value-added services.

| Metric | 2023 Data | 2024 Outlook/Trend |

|---|---|---|

| European Fluid Power Market Size | ~£30 billion | Continued competition, potential consolidation |

| Industrial Automation Market CAGR | Higher than 6.5% (previous estimates) | Projected ~6.5% (2024) |

| Capital Expenditure (Industrial Machinery) | High per employee | Remains a significant barrier to entry/exit |

SSubstitutes Threaten

The primary substitutes for fluid power, namely hydraulics and pneumatics, are increasingly represented by electric drives and mechanical systems. These alternatives are gaining traction due to their own technological advancements and a broader industry push towards electrification.

For instance, the global electric motor market size was valued at approximately USD 140 billion in 2023 and is projected to grow significantly, indicating a substantial shift towards electric solutions across various sectors. This trend directly challenges fluid power's dominance, especially in applications requiring precise motion control and automation, areas where electric drives are becoming increasingly competitive.

Emerging automation technologies, like advanced robotics with sophisticated integrated controls and intelligent conveyance systems, present viable alternatives to conventional fluid power solutions. These innovations can deliver comparable or even superior motion control capabilities, potentially diminishing the demand for traditional hydraulic and pneumatic components.

For instance, the global market for collaborative robots, a key area of automation, was projected to reach $2.5 billion in 2024, indicating a significant shift towards these advanced solutions. This trend suggests that companies like Flowtech Fluidpower must consider how these robotic systems can substitute for their core offerings in various industrial applications.

The growing emphasis on energy efficiency and sustainability presents a significant threat from substitutes for traditional fluid power systems. Industries are actively seeking solutions that minimize energy consumption and environmental impact, making alternatives that offer lower carbon footprints or reduced energy usage more appealing. For instance, the global market for energy-efficient industrial automation is projected to reach $35.7 billion by 2028, indicating a strong demand for technologies that align with these trends.

Cost-Effectiveness of Substitutes

The long-term cost-effectiveness of substitute technologies is a significant consideration. This includes not only the initial investment but also ongoing maintenance and operational expenses. For instance, if electric or other non-fluid power systems become substantially more economically viable across a broader spectrum of applications, their threat to Flowtech Fluidpower will escalate.

Consider the total cost of ownership. While fluid power systems might offer robust performance, if electric alternatives can achieve comparable results with lower energy consumption and reduced maintenance downtime, their adoption rate will naturally increase. For example, the declining cost of electric motors and battery technology in 2024 continues to make them a more attractive option for certain industrial and mobile equipment sectors.

- Initial Investment: The upfront cost of acquiring and installing substitute technologies.

- Maintenance Costs: Ongoing expenses for servicing and repairing alternative systems.

- Operational Costs: Energy consumption and other running expenses associated with substitutes.

- Total Cost of Ownership: A comprehensive view of all costs over the lifespan of the technology.

Customer Preferences and Industry Standards

Customer preferences are increasingly leaning towards integrated digital solutions and predictive maintenance, areas where alternative technologies might offer a more seamless experience. For instance, the growing demand for IoT-enabled systems in industrial automation could see electric actuation or advanced pneumatic systems gain traction if they better align with these evolving customer needs.

Industry standards and regulations also play a crucial role. As environmental concerns mount, there's a push for more energy-efficient and sustainable technologies. If evolving standards favor alternatives that reduce energy consumption or offer a lower carbon footprint, traditional fluid power systems could face increased pressure from substitutes.

- Shifting Customer Preferences: Growing demand for integrated digital solutions and predictive maintenance favors substitutes that natively offer these capabilities.

- Industry Standards Evolution: New regulations promoting energy efficiency or sustainability could accelerate the adoption of alternative technologies over traditional fluid power.

- Technological Advancements: Innovations in areas like advanced pneumatics or all-electric systems may present compelling alternatives with improved performance or integration.

The threat of substitutes for fluid power is significant, driven by advancements in electric drives and mechanical systems. These alternatives are becoming more competitive due to their own technological progress and a broader industry shift towards electrification. For example, the global electric motor market was valued at approximately USD 140 billion in 2023, highlighting a substantial move towards electric solutions across various sectors.

Emerging automation technologies, such as advanced robotics and intelligent conveyance systems, offer comparable or superior motion control, potentially reducing demand for traditional hydraulic and pneumatic components. The global market for collaborative robots, a key automation area, was projected to reach $2.5 billion in 2024, underscoring the increasing adoption of these advanced alternatives.

Energy efficiency and sustainability are also driving the adoption of substitutes. Industries are actively seeking solutions with lower energy consumption and environmental impact. The global market for energy-efficient industrial automation is projected to reach $35.7 billion by 2028, indicating a strong preference for technologies that align with these trends.

The total cost of ownership, including initial investment, maintenance, and operational costs, is a critical factor. As electric alternatives become more economically viable, their threat to fluid power systems increases. For instance, the declining cost of electric motors and battery technology in 2024 makes them a more attractive option for certain industrial and mobile equipment sectors.

| Substitute Technology | Key Advantages | Market Growth Indicator (2023-2024 Data) | Threat Level to Fluid Power |

| Electric Drives | Precision control, energy efficiency, integration with digital systems | Global electric motor market valued at ~USD 140 billion (2023) | High |

| Advanced Robotics | Sophisticated motion control, automation capabilities | Collaborative robot market projected to reach $2.5 billion (2024) | Medium to High |

| Mechanical Systems | Simplicity, reliability in specific applications | Varies by specific mechanical component market | Low to Medium |

Entrants Threaten

Starting a business in the specialized fluid power distribution sector demands considerable upfront capital. Newcomers need to fund extensive inventory, establish warehousing and logistics networks, and possibly invest in engineering and testing facilities. For instance, a new entrant might need to invest millions of dollars just to secure a baseline inventory of hydraulic and pneumatic components and establish a functional distribution center, making it a significant hurdle.

Flowtech Fluidpower's strong market position, particularly as a leader in the UK, Ireland, and Benelux, is a significant barrier to new entrants. This leadership is built on years of developing an established brand reputation and fostering deep, long-standing relationships with industrial clients who rely on their expertise and consistent service.

For any new company looking to enter this hydraulic and pneumatic solutions market, replicating Flowtech's trusted brand and the loyalty it commands would be a substantial hurdle. Newcomers would need to invest heavily in building credibility and demonstrating reliability to even begin to challenge Flowtech's entrenched customer base.

New entrants into the fluid power market face significant hurdles in securing reliable access to high-quality hydraulic and pneumatic components from established global brands. Flowtech Fluidpower, for instance, benefits from long-standing relationships with key manufacturers, ensuring consistent supply and favorable pricing.

These established relationships are difficult for newcomers to replicate, potentially limiting their product range and ability to compete on quality or availability. In 2024, the global industrial hydraulics market was valued at approximately $30 billion, highlighting the scale of competition and the importance of strong supply chain integration.

Technical Expertise and Value-Added Services

Flowtech Fluidpower's commitment to providing extensive engineering support and value-added services significantly raises the barrier for new entrants. This goes beyond merely distributing hydraulic and pneumatic components; it involves offering sophisticated application engineering, system design, and after-sales support. For instance, in 2023, Flowtech reported that a substantial portion of its revenue was derived from these service-based offerings, demonstrating their importance.

New competitors would need to invest heavily in developing or acquiring deep technical expertise to match Flowtech's capabilities in motion control, automation, and complex system integration. This technical prowess is crucial for addressing intricate customer needs and delivering tailored solutions, rather than just supplying off-the-shelf products. Without this, new entrants would struggle to compete on value and technical competence.

- High Technical Skill Requirement: New entrants must replicate Flowtech's engineering capabilities.

- Value-Added Services as a Differentiator: Flowtech's service portfolio creates a competitive moat.

- Investment in Expertise: Acquiring or building the necessary technical talent is a significant hurdle.

Regulatory Requirements and Industry Standards

The fluid power industry, particularly for companies like Flowtech Fluidpower, faces significant barriers to entry due to stringent regulatory requirements and evolving industry standards. New competitors must invest heavily in ensuring their products and systems meet a complex web of safety regulations, environmental compliance, and quality certifications. For instance, adherence to standards like ISO 9001 for quality management or specific regional safety directives can necessitate substantial upfront costs and ongoing compliance efforts.

Navigating these regulatory landscapes presents a formidable challenge for potential new entrants. The need for extensive testing, documentation, and potentially specialized manufacturing processes to meet these benchmarks adds considerable expense and time to market entry. This complexity acts as a deterrent, protecting established players who have already integrated these compliance measures into their operations. For example, in 2024, the global fluid power market saw continued emphasis on energy efficiency standards, requiring new designs and manufacturing adjustments.

- Regulatory Hurdles: Compliance with diverse safety, environmental, and performance standards is a major barrier.

- Certification Costs: Obtaining necessary certifications (e.g., CE marking, ATEX for hazardous environments) incurs significant expenses.

- Industry Standards Evolution: Keeping pace with updated standards, such as those related to sustainability and digitalization in fluid power, requires continuous investment.

The threat of new entrants in the fluid power sector, particularly for a company like Flowtech Fluidpower, is generally considered moderate to low. This is largely due to the substantial capital investment required to establish operations, including inventory, warehousing, and specialized equipment. For instance, setting up a basic distribution center and stocking essential hydraulic components could easily require an investment in the millions of dollars.

Flowtech's established brand reputation and deep customer relationships further deter new players. Building trust and loyalty in a market where reliability is paramount takes years of consistent performance and expert service. Newcomers would face a significant uphill battle in convincing industrial clients to switch from a trusted supplier like Flowtech. In 2024, the global industrial hydraulics market was valued at around $30 billion, indicating a large market but also one with established players.

Furthermore, the need for specialized technical expertise and value-added services, such as application engineering and system design, creates a high barrier. Flowtech's significant revenue from these services in 2023 underscores their importance. New entrants must either possess or acquire this deep technical knowledge to compete effectively, which is a considerable investment in talent and training.

Regulatory compliance and industry standards also pose a significant challenge. New companies must invest in meeting stringent safety, environmental, and quality certifications, adding to the cost and complexity of market entry. For example, adhering to ISO 9001 and specific regional safety directives requires substantial upfront and ongoing investment, protecting established firms like Flowtech.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront investment for inventory, logistics, and facilities. | Significant financial hurdle, potentially requiring millions in initial outlay. |

| Brand Reputation & Customer Loyalty | Established trust and long-term relationships with industrial clients. | Difficult for newcomers to gain market share without proven reliability. |

| Technical Expertise & Value-Added Services | Need for sophisticated engineering, system design, and after-sales support. | Requires substantial investment in skilled personnel and service infrastructure. |

| Regulatory Compliance & Industry Standards | Adherence to safety, environmental, and quality certifications. | Adds considerable expense and time to market entry, favoring established players. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Flowtech Fluidpower is built upon a foundation of comprehensive data, drawing from Flowtech's annual reports, investor presentations, and competitor financial filings. We supplement this with industry-specific market research reports and data from reputable financial information providers.