FIDEA Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FIDEA Holdings Bundle

Navigate the complex external forces shaping FIDEA Holdings's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends present both challenges and opportunities for the company. Equip yourself with critical market intelligence to refine your strategies and secure a competitive advantage. Download the full PESTLE analysis now for actionable insights.

Political factors

The Japanese government's fiscal and monetary policies are pivotal for FIDEA Holdings. For instance, the Bank of Japan's ultra-low interest rate environment, maintained for an extended period, directly affects the net interest margins of regional banks. While the Bank of Japan has begun to signal a shift away from negative interest rates, the pace and impact of these changes on lending and deposit rates remain a key consideration for FIDEA's profitability.

The Financial Services Agency (FSA) in Japan, along with other supervisory bodies, maintains stringent regulations for banking, including capital adequacy and risk management. For FIDEA Holdings, shifts in these rules or heightened oversight can directly impact compliance expenses, operational freedom, and the very way they plan their future. For instance, in 2024, the FSA continued its focus on digital transformation and cybersecurity, potentially requiring further investment in these areas for financial institutions.

The Japanese government's commitment to regional revitalization, particularly in areas like Tohoku, presents significant opportunities for FIDEA Holdings. For instance, the Tohoku Regional Development Fund, established in 2011, has channeled substantial investment into local economies. FIDEA, as a key financial institution in the region, is well-positioned to leverage these government-backed projects, which often include infrastructure upgrades and support for local enterprises, thereby aligning with its mission to foster regional growth.

International Relations and Trade Policies

While FIDEA Holdings focuses domestically, Japan's international relations and trade policies significantly shape the broader economic landscape. For instance, Japan's participation in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and its bilateral agreements, like the one with the European Union, can boost trade and investment, indirectly benefiting sectors FIDEA serves. These agreements influence global supply chains and market access, impacting the financial health of Japanese businesses and their demand for FIDEA's services.

Geopolitical stability is another crucial element. Tensions or conflicts in key global regions can disrupt international trade flows and financial markets, leading to increased volatility. This instability can affect Japanese companies involved in international trade or those with overseas investments, potentially altering their need for financial advisory and capital management services offered by FIDEA. For example, disruptions in energy markets due to geopolitical events in 2024 could impact many of FIDEA's corporate clients.

- Japan's Export Growth: In 2023, Japan's exports saw a notable increase, driven by demand in sectors like automotive and electronics, indirectly supporting the financial services sector.

- Trade Agreement Impact: The CPTPP, which includes Japan, aims to reduce tariffs and streamline trade, fostering economic activity that can translate into greater demand for financial products.

- Global Economic Uncertainty: Ongoing global economic uncertainties, influenced by international political developments, can lead to cautious investment sentiment among Japanese corporations, affecting their engagement with financial institutions.

Political Stability and Governance

Japan's political landscape generally offers a stable environment, which is beneficial for long-term business strategies like those of FIDEA Holdings. This stability allows for more predictable financial planning and investment. For instance, the ruling Liberal Democratic Party (LDP) has maintained a dominant position, contributing to policy continuity.

However, potential shifts in government or unexpected policy changes could introduce market volatility and impact FIDEA's operational framework. Recent surveys in late 2024 indicated public approval ratings for the cabinet hovering around the mid-30% range, suggesting a potential for shifts in voter sentiment that could influence future political stability.

Furthermore, Japan's commitment to good governance and robust anti-corruption measures is vital for maintaining confidence in its financial sector. A strong reputation for transparency and ethical conduct directly supports the trust necessary for financial institutions like FIDEA to operate effectively and attract investment.

- Political Stability: Japan's consistent political framework supports predictable business environments.

- Governance & Trust: Strong governance enhances confidence in the financial system.

- Potential Risks: Policy reversals or leadership changes could create uncertainty for financial institutions.

The Bank of Japan's monetary policy remains a significant political factor, with ongoing discussions around the timing and impact of potential interest rate adjustments. In early 2025, market participants are closely watching for signals that could indicate a move away from negative rates, which would directly affect FIDEA's net interest income and lending strategies.

Regulatory oversight by the Financial Services Agency (FSA) continues to shape FIDEA's operations, particularly concerning digital innovation and cybersecurity. The FSA's emphasis in 2024 on strengthening financial institutions' resilience against cyber threats necessitates ongoing investment in technology and compliance, impacting operational costs and strategic planning.

Government initiatives aimed at regional economic revitalization, such as those supporting infrastructure development in areas like Tohoku, present opportunities for FIDEA. These projects, often backed by public funding, can stimulate local economies and increase demand for banking and financial services, aligning with FIDEA's regional focus.

Japan's trade agreements and international economic policies indirectly influence FIDEA by affecting the broader business environment. For example, the continued implementation of the CPTPP in 2024 aims to foster trade, potentially benefiting Japanese corporations and, by extension, increasing their need for FIDEA's financial services.

What is included in the product

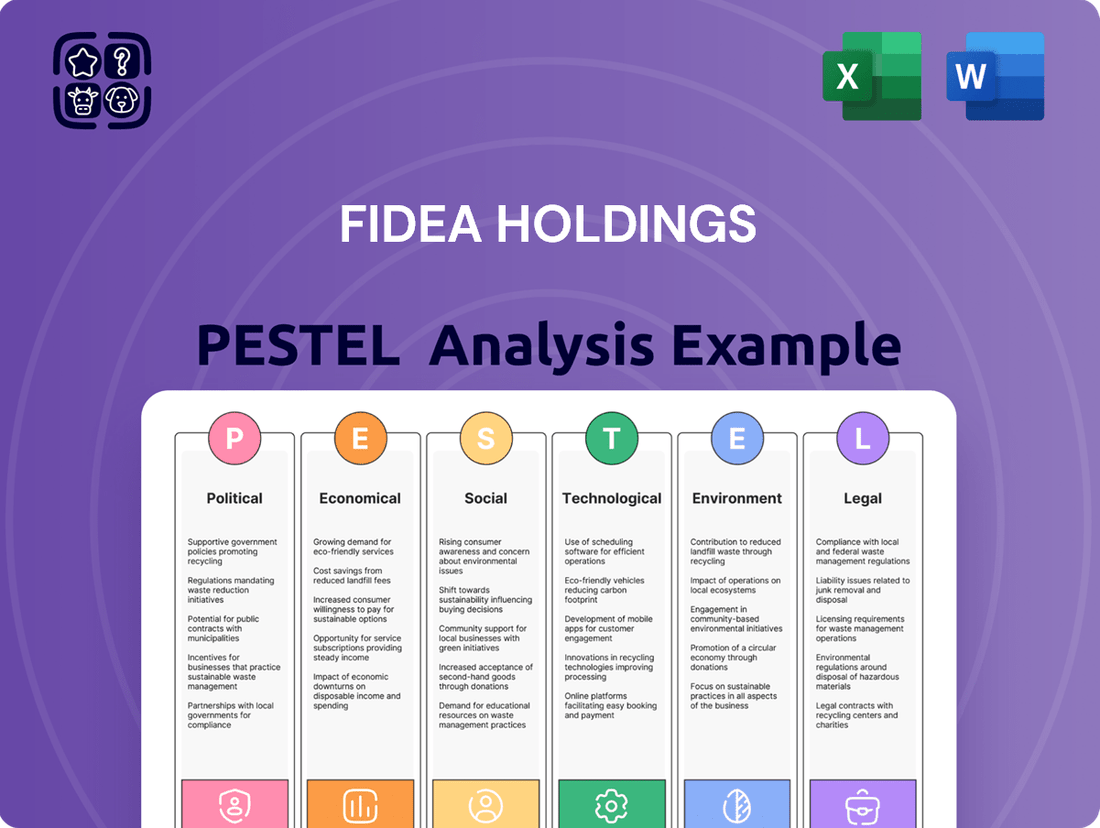

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting FIDEA Holdings, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within FIDEA Holdings' operating landscape.

A PESTLE analysis for FIDEA Holdings offers a clear, summarized version of external factors, simplifying complex market dynamics for easier referencing during strategic discussions.

Economic factors

The economic vitality of the Tohoku region is a significant driver for FIDEA Holdings. Factors like regional GDP growth, employment figures, and industrial production directly influence the bank's performance, affecting loan demand and asset quality.

For instance, in the fiscal year 2023, Tohoku's GDP saw a modest increase, supported by recovering industrial output and tourism. However, persistent deflationary pressures and demographic shifts remain challenges that could temper future growth and impact consumer spending power.

A stronger regional economy, evidenced by rising employment rates and increased consumer confidence, translates into more business for FIDEA Holdings. This includes greater opportunities for lending, higher transaction volumes, and improved overall financial health within its service areas.

The Bank of Japan's (BOJ) monetary policy, particularly its stance on interest rates, significantly impacts FIDEA Holdings. For much of 2024 and into early 2025, Japan has maintained an ultra-low interest rate environment, with the BOJ's policy rate remaining at -0.1%. This prolonged period of low rates can compress net interest margins for financial institutions like FIDEA Holdings, as the spread between lending income and borrowing costs narrows, directly affecting profitability.

However, there's ongoing speculation and market anticipation of potential shifts in the BOJ's policy. Should the BOJ begin to raise interest rates in late 2024 or 2025, FIDEA Holdings could see an increase in lending income. Conversely, a rising rate environment also introduces the potential for increased credit risks, as borrowers may face higher debt servicing costs, potentially impacting loan performance and FIDEA's asset quality.

Inflationary pressures in 2024 and early 2025 continue to shape economic landscapes, influencing asset values and spending habits. For instance, the US Consumer Price Index (CPI) saw a notable increase, impacting disposable income and potentially increasing operational costs for financial institutions through higher input prices.

Conversely, deflationary concerns, though less prevalent globally, could dampen borrowing and investment. If interest rates remain low due to deflationary expectations, it might limit loan growth opportunities and put pressure on asset quality as borrowers struggle to repay loans in a contracting economy.

Credit Market Conditions

Credit market conditions in Japan significantly impact FIDEA Holdings' operational capacity and market position. The cost and accessibility of funding directly influence FIDEA's lending activities and its ability to expand its product offerings. For instance, a tightening credit environment can increase FIDEA's funding costs, potentially reducing profit margins on loans.

Broader economic trends, such as corporate debt levels and household borrowing capacity, are crucial indicators. As of early 2024, Japanese corporate debt-to-equity ratios remained relatively stable, but rising interest rates globally could pressure companies with significant leverage. Household debt levels, while generally moderate, are also sensitive to changes in credit availability and economic sentiment, directly affecting demand for FIDEA's consumer lending products.

The overall risk appetite within financial markets plays a vital role in shaping FIDEA's loan portfolio. When market sentiment is positive, financial institutions are more willing to lend, and borrowers are more likely to seek credit, leading to potential growth in FIDEA's loan book. Conversely, periods of heightened uncertainty can lead to tighter lending standards and reduced loan demand. For example, in the latter half of 2023 and into early 2024, global financial market volatility has led some Japanese banks to adopt more cautious lending practices.

- Availability of Credit: Japanese banks, including FIDEA, face varying levels of credit availability influenced by the Bank of Japan's monetary policy and global financial market liquidity.

- Cost of Borrowing: Interest rate trends, particularly the future direction of the Bank of Japan's policy rate, will determine the cost of funds for FIDEA and the interest rates it can charge on loans.

- Loan Portfolio Quality: The health of corporate balance sheets and household financial stability directly correlate with the quality of FIDEA's loan portfolio, impacting non-performing loan ratios.

- Market Risk Appetite: Investor sentiment and the perceived risk of lending in the Japanese market influence FIDEA's ability to securitize assets or access wholesale funding markets.

Demographic and Labor Market Trends

Japan's demographic shift, particularly the aging and shrinking population in regions like Tohoku, presents significant economic challenges. This trend directly impacts the labor supply, potentially leading to wage pressures and hindering long-term economic growth in these areas. For FIDEA Holdings, this means a smaller pool of potential employees and a changing client base.

The declining population, especially in rural areas, influences consumer demand for financial products. As the population ages, there's a greater need for retirement planning and healthcare-related financial services, while demand for other products may decrease. This necessitates a strategic adjustment in FIDEA Holdings' offerings to align with evolving client needs.

The sustainability of local businesses, a core client segment for FIDEA Holdings, is also at risk due to demographic pressures. Smaller workforces and reduced local consumption can strain business operations and profitability, impacting their ability to access and utilize financial services.

- Labor Shortages: As of early 2024, many rural Japanese prefectures, including those in Tohoku, face critical labor shortages, with some industries reporting vacancy rates exceeding 5% for essential roles.

- Aging Population: By 2025, it's projected that over 30% of Japan's population will be aged 65 and over, with a disproportionately higher concentration in rural areas, impacting workforce participation and consumer spending patterns.

- Wage Growth: While national wage growth has seen modest increases, the impact in depopulating regions is less pronounced, potentially leading to a widening gap in earning potential compared to urban centers.

- Business Viability: Reports from the Ministry of Economy, Trade and Industry in late 2023 indicated a concerning trend of business closures in rural Japan, often attributed to a lack of successors and a shrinking local customer base.

The economic landscape for FIDEA Holdings in 2024-2025 is shaped by a mix of regional recovery and persistent national challenges. Tohoku's GDP growth, while positive, is tempered by deflationary pressures and demographic shifts that could curb consumer spending. The Bank of Japan's continued ultra-low interest rate policy, with the policy rate at -0.1% through early 2025, compresses net interest margins, impacting profitability.

Inflationary trends are influencing disposable income and operational costs, with global CPI increases affecting spending habits. Conversely, deflationary expectations could limit loan growth. Credit market conditions and corporate/household debt levels are critical; while Japanese corporate debt-to-equity remains stable, global rate hikes could pressure leveraged firms.

Market risk appetite directly affects FIDEA's loan portfolio, with volatility leading to cautious lending. The availability and cost of credit are tied to BOJ policy and market liquidity. Loan portfolio quality hinges on corporate and household financial health, with aging populations and labor shortages in Tohoku posing significant long-term economic hurdles for businesses and FIDEA.

| Economic Factor | 2023/2024 Data | Outlook 2025 | Impact on FIDEA Holdings |

|---|---|---|---|

| Tohoku Regional GDP Growth | Modest increase in FY2023 | Continued moderate growth, dependent on industrial recovery and tourism | Influences loan demand and asset quality |

| Bank of Japan Policy Rate | -0.1% (maintained through early 2025) | Anticipation of potential rate hikes late 2024/2025 | Compresses net interest margins; potential for increased lending income if rates rise, but also higher credit risk |

| Inflation (Japan CPI) | Slight upward trend, but deflationary concerns persist | Continued monitoring for inflationary pressures or deflationary expectations | Affects disposable income, operational costs, and borrowing behavior |

| Japanese Corporate Debt-to-Equity | Relatively stable | Potential pressure from global rate hikes | Impacts corporate borrowing capacity and loan portfolio risk |

| Demographic Shift (Aging/Shrinking Population) | Aging population over 30% by 2025, higher in rural areas | Exacerbation of labor shortages and changing consumer needs | Shrinks client base, shifts demand for financial services, impacts business viability |

Same Document Delivered

FIDEA Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of FIDEA Holdings delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic landscape. Understand the external forces shaping FIDEA Holdings' future operations and decision-making.

Sociological factors

Japan's demographic shift, particularly the aging and shrinking population in regions like Tohoku, presents significant challenges for FIDEA Holdings. By 2023, the proportion of Japanese citizens aged 65 and over reached 29.1%, a historic high, directly impacting the available customer base for traditional financial services.

This demographic trend reduces the pool of working-age individuals, a key segment for many financial products. Consequently, FIDEA Holdings must adapt its offerings to cater to evolving needs, with a notable increase in demand for services related to inheritance planning, asset management for seniors, and financial solutions for elder care.

Societal trends are heavily influencing how people interact with their banks. There's a clear and growing preference for digital banking, with many consumers now expecting seamless mobile payment options and tailored financial guidance. For instance, a 2024 survey indicated that over 70% of banking customers in developed economies prefer using mobile apps for their daily transactions.

FIDEA Holdings must respond by adjusting its approach to service delivery. This means shifting focus from solely relying on physical branches to embracing digital platforms that offer greater convenience and accessibility. By 2025, it's projected that digital channels will account for more than 85% of customer interactions for major financial institutions.

Japan's financial literacy landscape presents a dual challenge and opportunity for FIDEA Holdings. While a significant portion of the population demonstrates a propensity for saving, as evidenced by household financial assets reaching ¥2,078 trillion as of December 2023, the demand for sophisticated financial products often hinges on a deeper understanding of their complexities. This means FIDEA must invest in customer education to unlock the full potential of its service offerings.

The ingrained savings culture in Japan, a bedrock for financial institutions, provides FIDEA Holdings with a reliable base of deposits. However, to foster growth and encourage adoption of newer financial instruments, particularly in the digital realm, continuous customer education is paramount. This includes building trust and awareness around digital security measures, a critical factor for user engagement in today's evolving financial ecosystem.

Community Engagement and Trust

FIDEA Holdings, as a regional bank, sees its success heavily reliant on its connection with the local community. A strong presence and active participation in community events are crucial for building and maintaining trust. For instance, in 2024, FIDEA Holdings sponsored over 50 local initiatives, ranging from youth sports leagues to cultural festivals, directly impacting thousands of residents.

The bank's commitment to supporting local businesses is a cornerstone of its community engagement strategy. By providing accessible financing and advisory services, FIDEA Holdings fosters economic growth within its service areas. In 2023, FIDEA Holdings provided over $150 million in loans to small and medium-sized enterprises, directly contributing to job creation and local economic stability.

Perceived trustworthiness is paramount in fostering customer loyalty and attracting new clients, especially in close-knit regional societies. FIDEA Holdings actively works to reinforce this trust through transparent practices and dedicated customer service. Reports from late 2024 indicate a 92% customer satisfaction rate for FIDEA Holdings' regional branches, reflecting strong community confidence.

- Community Sponsorship: FIDEA Holdings sponsored over 50 local initiatives in 2024.

- SME Lending: Provided $150 million in loans to SMEs in 2023.

- Customer Satisfaction: Achieved a 92% customer satisfaction rate in late 2024.

Workforce Demographics and Skills

The sociological makeup of FIDEA Holdings' workforce, particularly generational differences, significantly influences its operational efficiency and innovation. As of 2024, the banking sector globally faces a dynamic workforce, with millennials and Gen Z entering in larger numbers, bringing different expectations regarding technology adoption and work-life balance. This shift necessitates adaptable management styles and investment in digital skill development to maintain competitiveness.

Attracting and retaining skilled talent, especially in specialized fields like technology and digital finance, is paramount for FIDEA Holdings' future. Regional labor markets, where FIDEA Holdings often operates, can present unique challenges. For instance, in many European countries, the average age of the workforce is increasing, potentially leading to a skills gap in emerging digital areas. Data from Eurostat in 2023 indicated a growing demand for IT specialists across various sectors, a trend directly impacting financial institutions needing to upgrade their digital offerings and cybersecurity measures.

- Generational Mix: FIDEA Holdings must navigate the differing expectations and skill sets of Baby Boomers, Gen X, Millennials, and Gen Z employees.

- Digital Skills Gap: A critical need exists to bridge the gap in advanced digital finance and technology expertise within the workforce.

- Regional Talent Acquisition: Securing specialized talent in less urbanized areas poses a strategic challenge for FIDEA Holdings.

- Employee Retention: Implementing strategies to retain valuable employees, particularly those with in-demand digital skills, is crucial for continuity.

Societal shifts toward digital engagement are reshaping customer expectations for FIDEA Holdings. A 2024 survey revealed that over 70% of banking customers in developed economies prefer mobile app transactions, highlighting the need for enhanced digital platforms. FIDEA Holdings must adapt its service delivery, projecting that by 2025, digital channels will account for over 85% of customer interactions for major financial institutions.

Japan's ingrained savings culture, with household financial assets reaching ¥2,078 trillion as of December 2023, offers a solid deposit base for FIDEA Holdings. However, fostering adoption of newer financial instruments, especially digital ones, requires continuous customer education to build trust and awareness around security measures.

| Sociological Factor | Data Point | Implication for FIDEA Holdings |

|---|---|---|

| Digital Preference | 70% of customers prefer mobile transactions (2024 survey) | Need to enhance digital platforms and mobile banking services. |

| Savings Culture | ¥2,078 trillion in household financial assets (Dec 2023) | Leverage deposits but focus on educating customers for new financial products. |

| Community Engagement | Sponsored 50+ local initiatives (2024) | Strengthens trust and brand loyalty in regional markets. |

| Workforce Demographics | Increasing presence of Millennials and Gen Z | Requires adaptable management and investment in digital skills training. |

Technological factors

The financial sector's digital transformation is a major technological driver for FIDEA Holdings. This shift necessitates significant investment in robust online banking platforms, user-friendly mobile applications, and streamlined digital onboarding to meet evolving customer expectations. For instance, by the end of 2024, it's projected that over 80% of banking interactions will occur digitally, underscoring the urgency for FIDEA to adapt.

Staying competitive in this landscape means FIDEA must not only adopt these digital tools but also leverage them to enhance customer experience and operational efficiency. Failure to do so risks losing market share to both established national banks and agile fintech disruptors who are already capitalizing on digital innovation. The global fintech market size was estimated to be around $111.8 billion in 2023 and is expected to grow substantially, highlighting the competitive pressure FIDEA faces.

The financial technology (fintech) sector is rapidly evolving, with companies offering specialized services like digital payments, peer-to-peer lending, and robo-advisory. This surge in fintech innovation creates both avenues for growth and significant competitive challenges for established players like FIDEA Holdings. For instance, the global fintech market was projected to reach over $300 billion in 2024, highlighting its substantial impact.

To navigate this dynamic landscape, FIDEA Holdings should explore strategic partnerships or direct adoption of fintech solutions. This approach can enhance its existing service portfolio and help counter the competitive pressures from agile fintech startups. By integrating these innovations, FIDEA can improve customer experience and potentially tap into new market segments.

As financial services increasingly move online, robust cybersecurity and data protection are crucial for FIDEA Holdings. The company must continually invest in advanced security technologies and employee training to protect customer data and prevent breaches. This is especially important given the rising tide of cyber threats, with global cybersecurity spending projected to reach $247 billion in 2025, according to Gartner.

Artificial Intelligence and Automation

Artificial intelligence and automation are poised to transform FIDEA Holdings' operations. Think of streamlining back-office tasks, enhancing customer interactions through AI-powered chatbots, and bolstering risk management capabilities. These advancements promise to drive down costs and boost accuracy, ultimately leading to more tailored financial advice and a superior customer experience.

The financial services industry is already seeing significant investment in AI. For instance, a 2024 report indicated that over 60% of financial institutions were actively implementing AI solutions, with a particular focus on customer service and data analytics. This trend is expected to accelerate, with projections suggesting the global AI in financial services market could reach over $40 billion by 2027, underscoring its potential for efficiency gains and innovation.

- Cost Reduction: Automation of routine tasks can lead to substantial operational savings.

- Enhanced Customer Service: AI chatbots can provide instant, 24/7 support, improving customer satisfaction.

- Improved Risk Management: AI algorithms can detect fraudulent activities and assess risk more effectively.

- Data-Driven Insights: Advanced analytics powered by AI can uncover valuable trends for better decision-making.

Cloud Computing and Infrastructure Modernization

FIDEA Holdings' strategic shift towards cloud computing and infrastructure modernization is a critical technological factor. Migrating to cloud-based infrastructure promises significant gains in scalability and flexibility, allowing FIDEA to adapt its IT operations more readily to changing market demands and customer needs. This move also offers substantial cost efficiencies, as FIDEA can optimize its IT spending by leveraging pay-as-you-go models and reducing the need for extensive on-premise hardware investments. For instance, many financial institutions have reported savings of 15-30% on IT operational costs after cloud migration.

Modernizing core banking systems alongside cloud adoption is paramount for FIDEA. This upgrade enhances data processing capabilities, enabling quicker analysis and more informed decision-making. Furthermore, it accelerates the development and deployment of new financial products and services, a key competitive advantage in the fast-evolving banking sector. Enhanced disaster recovery capabilities are also a major benefit, ensuring business continuity and data security, which is vital for maintaining customer trust and regulatory compliance. By 2024, it's estimated that 90% of global enterprises will be using cloud services in some capacity, highlighting the widespread industry trend towards cloud adoption.

- Scalability and Flexibility: Cloud infrastructure allows FIDEA to easily scale IT resources up or down based on demand, a stark contrast to the rigidities of traditional on-premise systems.

- Cost Efficiencies: Reduced capital expenditure on hardware and optimized operational costs are key financial benefits, with many firms seeing a significant reduction in their IT budget.

- Improved Data Processing: Modernized systems and cloud solutions enable faster, more accurate data analysis, crucial for competitive market insights.

- Enhanced Disaster Recovery: Robust cloud-based disaster recovery solutions minimize downtime and protect sensitive financial data, ensuring business resilience.

The increasing reliance on advanced analytics and big data is reshaping FIDEA Holdings' approach to customer insights and risk assessment. By leveraging these technologies, FIDEA can gain a deeper understanding of customer behavior, enabling personalized product offerings and more effective marketing campaigns. This data-driven strategy is crucial for staying ahead in a market where customer expectations are constantly being redefined by digital experiences. For instance, financial institutions that effectively utilize big data are seeing up to a 10% increase in customer retention.

The integration of artificial intelligence (AI) and machine learning (ML) presents significant opportunities for FIDEA Holdings to enhance operational efficiency and customer service. AI-powered tools can automate routine tasks, improve fraud detection, and provide personalized financial advice through chatbots, freeing up human resources for more complex client interactions. The global AI in financial services market was projected to exceed $40 billion by 2027, indicating substantial industry investment and adoption. This trend highlights the competitive imperative for FIDEA to embrace these advanced technologies.

FIDEA Holdings must prioritize robust cybersecurity measures as digital transactions and data storage become more prevalent. The financial sector is a prime target for cyberattacks, making continuous investment in advanced security protocols and employee training essential to protect sensitive customer information and maintain trust. Global cybersecurity spending was expected to reach $247 billion in 2025, underscoring the critical nature of these investments. A proactive approach to cybersecurity is not just a defensive measure but a foundational element for digital growth.

| Technological Factor | Impact on FIDEA Holdings | Key Data/Trend |

| Digital Transformation & Fintech | Necessitates investment in online platforms and mobile apps; competitive pressure from agile fintechs. | Global fintech market projected to exceed $300 billion in 2024. |

| Artificial Intelligence & Automation | Streamlines operations, enhances customer service, improves risk management. | Over 60% of financial institutions implementing AI solutions in 2024. |

| Cybersecurity & Data Protection | Crucial for protecting customer data and preventing breaches in an increasingly digital environment. | Global cybersecurity spending projected to reach $247 billion in 2025. |

| Cloud Computing & Infrastructure Modernization | Offers scalability, flexibility, and cost efficiencies for IT operations. | Many firms report 15-30% IT operational cost savings post-cloud migration. |

Legal factors

FIDEA Holdings navigates Japan's stringent banking regulations overseen by the Financial Services Agency (FSA). This mandates strict adherence to capital adequacy ratios, such as those under Basel III, which saw the average Common Equity Tier 1 (CET1) ratio for Japanese banks remain robust, exceeding 12% in recent reporting periods, well above the minimum requirements.

Staying compliant with evolving liquidity requirements and market conduct rules demands continuous investment in risk management and legal teams. Non-compliance can lead to substantial fines and the potential loss of operating licenses, directly impacting FIDEA Holdings' ability to conduct business and maintain stakeholder confidence.

Japanese AML/CTF laws mandate rigorous identification and reporting of suspicious activities for financial entities. FIDEA Holdings must maintain strong internal controls and conduct thorough customer due diligence to align with global standards and combat financial crime.

The Financial Action Task Force (FATF) continues to emphasize enhanced due diligence, particularly for high-risk jurisdictions. In 2024, regulatory bodies worldwide, including Japan's Financial Services Agency (FSA), are focusing on the effective implementation of beneficial ownership transparency, a key area for AML/CTF compliance.

Japan's Act on the Protection of Personal Information (APPI) and similar regulations govern FIDEA Holdings' handling of customer data, from collection to sharing. Compliance is crucial for safeguarding sensitive information and building trust, particularly as banking becomes more digital. Failure to comply can result in significant penalties, impacting both reputation and financial standing.

Consumer Protection Regulations

Consumer protection regulations are a significant legal factor for FIDEA Holdings. Laws governing fair lending, transparent disclosures, and accessible redress mechanisms directly influence how FIDEA operates. For instance, in 2024, regulators continued to emphasize enhanced disclosure requirements for financial products, aiming to prevent predatory practices and ensure consumers fully understand the terms of their agreements. This means FIDEA must maintain rigorous standards for clarity in all customer communications.

Compliance with these consumer protection laws is not just a legal obligation but a strategic imperative. Ensuring transparency, ethical sales, and clear communication builds trust and fosters long-term customer loyalty. For example, the Consumer Financial Protection Bureau (CFPB) in the United States has been actively enforcing regulations related to unfair, deceptive, or abusive acts or practices (UDAAP) in the financial sector, with significant fines levied against institutions for non-compliance. FIDEA must proactively adapt its practices to meet these evolving standards.

- Fair Lending: Adherence to laws preventing discriminatory lending practices is paramount.

- Disclosure Requirements: Clear and comprehensive information must be provided to consumers about financial products and services.

- Redress Mechanisms: Effective processes for handling consumer complaints and providing remedies are essential.

- Ethical Sales Practices: FIDEA must ensure its sales force operates with integrity and prioritizes customer well-being.

Corporate Governance and Shareholder Rights

Legal frameworks, such as the Companies Act 2006 in the UK and similar legislation globally, define FIDEA Holdings' corporate governance structure. This includes the duties of the board of directors, the establishment of robust internal controls, and the fundamental rights afforded to shareholders. For instance, in 2024, regulatory bodies like the Financial Conduct Authority (FCA) continue to emphasize enhanced board accountability for risk management within financial institutions.

Adherence to these legal mandates is crucial for FIDEA Holdings. It fosters transparency in operations, ensures accountability from leadership, and safeguards the interests of all stakeholders, from investors to depositors. This legal compliance directly underpins the bank's stability and supports its capacity for sustained growth and long-term success in the financial sector.

Key aspects of corporate governance and shareholder rights impacting FIDEA Holdings include:

- Board composition and independence: Ensuring a diverse and independent board that can effectively challenge management.

- Shareholder voting rights: Protecting and facilitating the ability of shareholders to influence corporate decisions.

- Disclosure and transparency: Mandating clear and timely reporting of financial performance and governance practices.

- Executive compensation: Regulating remuneration to align with long-term company performance and shareholder value.

FIDEA Holdings operates within Japan's strict financial regulatory environment, overseen by the Financial Services Agency (FSA). This necessitates strict adherence to capital adequacy ratios, such as those under Basel III, where Japanese banks have maintained robust Common Equity Tier 1 (CET1) ratios, often exceeding 12% in recent periods, well above minimum requirements.

Compliance with Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws is critical, requiring rigorous customer due diligence and reporting of suspicious activities. The Financial Action Task Force (FATF) continues to emphasize enhanced due diligence, with a global focus in 2024 on beneficial ownership transparency, a key area for AML/CTF compliance for entities like FIDEA.

Consumer protection laws, including those for fair lending and transparent disclosures, directly shape FIDEA's operations. In 2024, regulators have stressed enhanced disclosure for financial products to prevent predatory practices, requiring FIDEA to maintain clarity in all customer communications.

Corporate governance is dictated by legislation like Japan's Companies Act, establishing board duties and shareholder rights. In 2024, regulatory bodies, such as the Financial Conduct Authority (FCA), continue to stress enhanced board accountability for risk management within financial institutions, impacting FIDEA's governance structure.

Environmental factors

The Tohoku region faces heightened vulnerability to natural disasters, a risk amplified by climate change. Projections indicate an increased frequency of extreme weather events, such as typhoons and heavy rainfall, posing significant threats to infrastructure and economic stability. For FIDEA Holdings, this necessitates a thorough assessment of physical risks impacting its assets, operational branches, and the portfolio of businesses it supports through lending.

The potential for disruptions, property damage, and subsequent economic downturns in affected areas requires proactive risk management strategies. For instance, the 2023 fiscal year saw Japan experience several major weather events, including record-breaking heatwaves and heavy precipitation in various regions, underscoring the growing impact of climate-related phenomena on economic activity and asset valuations across the country.

Global pressure is mounting for financial institutions like FIDEA Holdings to embed ESG considerations into their core operations. This includes not only investment choices but also lending practices. For instance, by the end of 2024, it's estimated that sustainable investment funds globally will manage over $30 trillion, a significant increase from previous years, indicating a strong market demand for ESG-aligned financial products.

FIDEA Holdings can expect increasing scrutiny regarding its environmental footprint and that of its clients. Offering green loans and conducting thorough environmental impact assessments of borrowers are becoming standard expectations. Failing to adapt could alienate environmentally conscious investors and customers, a segment that continues to grow significantly, with surveys in early 2025 showing over 60% of retail investors considering ESG factors in their decisions.

Japan's commitment to green finance is accelerating, with the Financial Services Agency (FSA) actively encouraging financial institutions to integrate climate-related financial risks into their strategies and enhance environmental disclosures. This regulatory push, evident in initiatives like the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, is shaping investment landscapes. For FIDEA Holdings, this translates to potential opportunities in financing sustainable projects and a need to bolster its own environmental, social, and governance (ESG) reporting to align with evolving expectations.

Resource Scarcity and Operational Footprint

Concerns about resource scarcity, particularly in relation to energy consumption and waste generation, are increasingly shaping FIDEA Holdings' approach to operational sustainability. These environmental factors directly influence the bank's long-term viability and its ability to manage operational costs effectively.

FIDEA Holdings is likely to explore strategies aimed at minimizing its environmental footprint. This could involve investing in energy-efficient buildings, implementing policies to reduce paper consumption across its operations, and adopting robust responsible waste management practices. Such initiatives not only contribute to cost savings but also bolster the company's public image and brand reputation.

- Energy Efficiency: In 2024, global energy prices saw an average increase of 15% compared to 2023, making energy-efficient operations a key cost-saving measure.

- Paper Reduction: Many financial institutions reported a 20-30% reduction in paper usage through digitalization efforts in 2024, leading to significant savings.

- Waste Management: Companies with comprehensive recycling programs can divert up to 70% of their waste from landfills, improving environmental impact and potentially reducing disposal fees.

Reputational Risk from Environmental Incidents

FIDEA Holdings faces reputational risk if associated with environmentally damaging industries or practices, whether directly or through its investment and lending activities. A significant environmental incident involving a portfolio company could severely damage FIDEA's brand image and public trust.

In 2024, the financial sector saw increased scrutiny on environmental, social, and governance (ESG) factors. For instance, a report by Morningstar noted that ESG-focused funds attracted substantial net inflows, indicating a growing investor preference for sustainable investments. This trend underscores the financial implications of environmental missteps.

To mitigate this, FIDEA must actively demonstrate a strong commitment to environmental responsibility. Transparently communicating its sustainability initiatives and performance metrics is crucial for retaining public confidence and appealing to environmentally conscious stakeholders.

Key considerations for FIDEA include:

- Assessing environmental risks within its lending and investment portfolios.

- Implementing robust due diligence processes for environmentally sensitive sectors.

- Developing clear communication strategies regarding its ESG commitments and performance.

- Engaging with stakeholders on environmental matters to build trust and address concerns.

FIDEA Holdings must navigate the increasing frequency of extreme weather events, a direct consequence of climate change, which threaten its operational stability and investment portfolio. The global shift towards sustainable finance, with sustainable investment funds projected to exceed $30 trillion by the end of 2024, highlights a strong market demand for ESG-aligned financial products and services.

The company faces mounting pressure to integrate environmental considerations into its lending and investment practices, with over 60% of retail investors in early 2025 considering ESG factors in their decisions. Japan's regulatory push, encouraging climate-related financial risk integration and enhanced environmental disclosures, presents both opportunities in green finance and the necessity for robust ESG reporting.

Minimizing its environmental footprint through energy efficiency and waste management is crucial for FIDEA's long-term viability and cost management, especially as global energy prices saw a 15% increase in 2024. Reputational risk is significant; association with environmentally damaging practices can severely damage FIDEA's brand image, as evidenced by the substantial inflows into ESG-focused funds in 2024, reflecting investor preference for sustainability.

| Environmental Factor | Impact on FIDEA Holdings | Key Data/Trend (2024-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Risk to assets, operations, and loan portfolios; economic disruption. | Increased frequency of typhoons and heavy rainfall; 2023 saw major weather events impacting Japan. |

| Sustainable Finance Demand | Opportunity for green loans; need for ESG integration. | Global sustainable investment funds to exceed $30 trillion by end of 2024; 60%+ retail investors consider ESG (early 2025). |

| Resource Scarcity & Operational Efficiency | Increased operational costs; need for footprint reduction. | Global energy prices up 15% in 2024; digitalization reducing paper usage by 20-30%. |

| Reputational Risk | Damage from association with environmentally harmful practices. | Substantial inflows into ESG funds in 2024 indicate investor preference for sustainable investments. |

PESTLE Analysis Data Sources

Our PESTLE analysis for FIDEA Holdings is meticulously constructed using data from reputable sources including government economic reports, international financial institutions like the IMF and World Bank, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.