Fenix Outdoor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fenix Outdoor Bundle

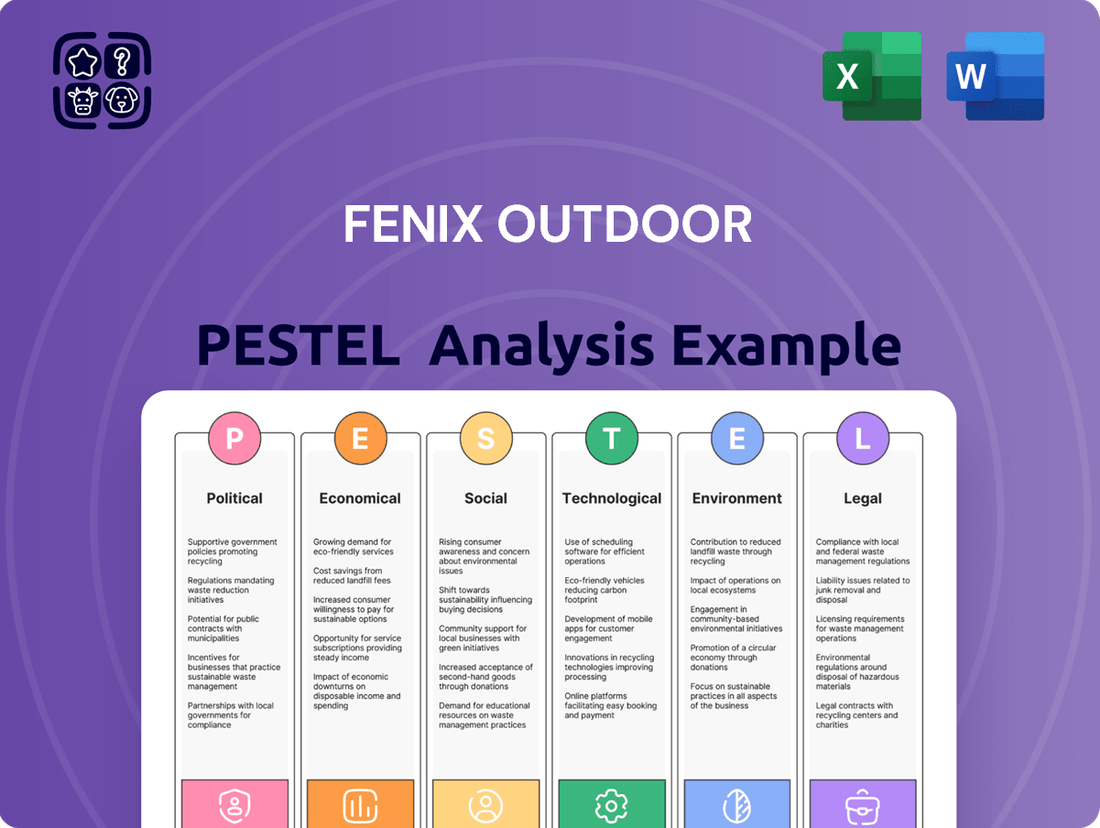

Uncover the critical Political, Economic, Social, Technological, Environmental, and Legal factors shaping Fenix Outdoor's trajectory. Understand how evolving consumer preferences and sustainability demands are impacting the outdoor industry. This comprehensive PESTLE analysis provides the strategic intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now for actionable insights to guide your business decisions.

Political factors

Geopolitical instability, exemplified by the prolonged conflict in Ukraine and ongoing Middle Eastern crises, casts a significant shadow over global commerce, directly impacting Fenix Outdoor's operational landscape. This pervasive uncertainty can manifest as tangible disruptions to its intricate supply chains, leading to notable delays in product shipments destined for key markets like Europe and the United States. The ripple effect also extends to a dampening of global consumer confidence, a critical factor for discretionary spending on outdoor goods.

Looking ahead to 2025, Fenix Outdoor faces the tangible threat of heightened tariffs, particularly concerning trade with the USA. While the immediate impact on consumer sentiment is a primary concern, the potential for cascading tariff implications in 2026 remains a complex and difficult variable to accurately forecast, adding another layer of strategic challenge.

Fenix Outdoor navigates a dense web of evolving legal requirements affecting its products, packaging, and transparency, especially within the European Union. Compliance with directives such as the EU Market Abuse Regulation and national laws like the Swedish Securities Markets Act and Swedish Financial Instruments Trading Act creates significant administrative overhead.

The company is actively preparing for new EU mandates, notably the Corporate Sustainability Reporting Directive (CSRD), which will necessitate more extensive and standardized sustainability disclosures starting in 2024 for many companies, with Fenix Outdoor likely falling under its scope in subsequent reporting periods.

This proactive stance aims to ensure Fenix Outdoor can meet the stringent reporting standards and avoid potential penalties, while also leveraging enhanced transparency to build trust with stakeholders. For instance, the CSRD aims to harmonize sustainability reporting across the EU, impacting how companies like Fenix Outdoor communicate their environmental and social impact.

The political climate in Fenix Outdoor's primary markets, including Sweden, Norway, Germany, the UK, and the USA, significantly impacts consumer confidence and spending. Political stability fosters a predictable environment for retail operations and investment. For example, Fenix Outdoor's first quarter of 2025 results indicated that the company's performance was indeed influenced by the prevailing macroeconomic and political conditions across Europe.

International Relations and Supply Chain Resilience

International relations have a significant impact on Fenix Outdoor's global supply chain. Geopolitical events, such as ongoing conflicts or trade disputes, can disrupt the flow of goods, leading to increased costs and delivery delays. For instance, the crisis in the Middle East in late 2023 and early 2024 caused significant disruptions to shipping routes, resulting in a shortage of containers and longer transit times, directly affecting companies like Fenix Outdoor that rely on international logistics.

To counter these vulnerabilities, Fenix Outdoor is strategically diversifying its production base. A key initiative involves establishing apparel manufacturing closer to its core markets in Europe. This includes collaborations such as the one with Maloja, with production facilities in Bulgaria, aiming to reduce reliance on distant manufacturing hubs and build a more resilient supply chain. This shift is crucial for maintaining consistent product availability and mitigating the financial impact of international instability.

The ongoing global trade environment, characterized by shifting alliances and potential protectionist measures, further emphasizes the need for supply chain flexibility. Fenix Outdoor's proactive approach to nearshoring and regionalizing production is a direct response to these evolving political and economic landscapes. This strategy not only addresses potential disruptions but also allows for quicker adaptation to market demands and potentially reduces transportation-related carbon emissions.

- Geopolitical Instability: Disruptions from regions like the Middle East impacted container availability and shipping times in late 2023/early 2024.

- Nearshoring Strategy: Fenix Outdoor is moving apparel production to Europe, exemplified by its partnership with Maloja in Bulgaria.

- Supply Chain Resilience: Diversifying production helps mitigate risks associated with international relations and global logistics challenges.

- Market Responsiveness: Regionalized production allows for faster adaptation to consumer demand and potential shifts in trade policies.

Government Support for Sustainable Business

Fenix Outdoor benefits from a political climate increasingly prioritizing environmental, social, and governance (ESG) transparency. This focus translates into a supportive environment for sustainable business models. For instance, by 2024, many European nations have strengthened ESG reporting mandates, directly benefiting companies like Fenix Outdoor that already embrace these principles.

The company's adherence to international frameworks such as the UN Global Compact and UN Climate Action initiative demonstrates a strategic alignment with global and governmental efforts to promote corporate social responsibility. This proactive stance is crucial in navigating evolving political landscapes. In 2025, expect continued governmental pressure on businesses to adopt and report on sustainability targets, which Fenix Outdoor is well-positioned to meet.

This alignment with political priorities opens doors for potential advantages. These can include:

- Access to green financing and subsidies: Governments are increasingly offering financial incentives for businesses demonstrating strong sustainability performance.

- Favorable regulatory treatment: Companies proactively meeting or exceeding environmental and social standards may face less stringent regulatory oversight in certain areas.

- Enhanced brand reputation and consumer trust: Political endorsement of sustainable practices can positively influence public perception, boosting brand loyalty.

Fenix Outdoor's operations are significantly shaped by geopolitical stability and evolving trade policies, particularly its reliance on global supply chains. The company's first quarter 2025 performance indicated sensitivity to macroeconomic and political conditions across Europe, reinforcing the need for strategic diversification. For example, disruptions from the Middle East in late 2023 and early 2024 led to shipping delays and increased costs, impacting Fenix Outdoor's logistics.

To counter these risks, Fenix Outdoor is actively pursuing nearshoring strategies, such as establishing apparel production closer to its European markets, exemplified by its collaboration with Maloja in Bulgaria. This move aims to enhance supply chain resilience and improve responsiveness to market demands amidst shifting international relations and potential protectionist measures.

Furthermore, Fenix Outdoor benefits from a political climate increasingly focused on ESG transparency and sustainability. Many European nations strengthened ESG reporting mandates by 2024, aligning with Fenix Outdoor's existing commitments to frameworks like the UN Global Compact. This positions the company favorably for potential access to green financing and favorable regulatory treatment in 2025.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Fenix Outdoor, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces shape the company's strategic landscape.

A concise summary of Fenix Outdoor's PESTLE analysis, highlighting key external factors, simplifies complex market dynamics for faster strategic decision-making.

This analysis provides a clear overview of the political, economic, social, technological, environmental, and legal forces impacting Fenix Outdoor, enabling proactive strategy development.

Economic factors

Fenix Outdoor navigated a subdued global economic landscape through 2024 and into early 2025, marked by sluggish growth and heightened economic uncertainty in key markets. This environment fostered cautious consumer behavior, translating into reduced spending on discretionary items like outdoor gear and impacting overall demand across both wholesale and direct-to-consumer segments.

While the outdoor sector has historically shown resilience, even thriving during economic downturns as consumers shift to more affordable, local activities, 2024 presented a deviation from this trend. Consumers, potentially having already invested in outdoor equipment during the COVID-19 pandemic, prioritized travel and other experiences, diminishing the usual recessionary boost for the industry.

For instance, the IMF's projections for global GDP growth in 2024 were revised downwards to 3.2% in April 2024, reflecting ongoing inflationary pressures and geopolitical risks. This macroeconomic backdrop directly influenced consumer confidence, with the Conference Board Consumer Confidence Index showing a dip in early 2025 compared to the previous year in several major economies, indicating a reluctance to spend on non-essential goods.

Fenix Outdoor is navigating persistent inflation and escalating structural costs, including salaries and energy. While cost-saving initiatives implemented in 2023 began yielding results in early 2024, the first quarter of 2025 saw a notable impact on the company's operating performance due to a lower gross profit. This situation highlights the ongoing economic challenge of balancing rising expenses with the need to maintain competitive product pricing in the market.

The retail landscape in 2024 and early 2025 is marked by high inventory levels across the board. This has created a difficult environment, leading to price drops and unpredictable trading conditions for many companies. Retailers are hesitant to hold significant stock themselves, preferring to place smaller, more frequent orders directly with brands.

This shift in strategy means that brands like Fenix Outdoor are shouldering more of the inventory risk. Retailers’ cautious approach to stocking means they are less likely to overcommit, pushing the burden of holding unsold goods back onto the manufacturers and suppliers. This dynamic requires brands to be more agile and efficient in their own inventory planning.

Fenix Outdoor has been proactive in managing its inventory. The company reported that efforts to optimize its stock levels had a positive effect on its cash flow in 2024. This focus on efficient inventory management is crucial for navigating the current market where retailers are actively minimizing their own stock-holding risks.

Currency Fluctuations and Exchange Rates

Currency fluctuations pose a significant risk for a global player like Fenix Outdoor, which operates in diverse markets including Germany, the Americas, and the Nordics. When earnings from these regions are translated back into the company's reporting currency, the Euro, shifts in exchange rates can directly affect reported revenues and overall profitability. For instance, if the Euro strengthens against other currencies, foreign earnings will appear smaller when converted.

The impact of currency volatility can be substantial. For example, in 2023, the Euro experienced fluctuations against the US Dollar and various Nordic currencies. A stronger Euro in 2024 could potentially reduce the reported value of sales made in USD or SEK, impacting Fenix Outdoor's top-line figures. Conversely, a weaker Euro could boost these reported figures, but might also increase the cost of imported raw materials or components.

Fenix Outdoor's financial performance is therefore sensitive to these movements. Management must actively monitor exchange rate trends and potentially employ hedging strategies to mitigate adverse currency impacts. The company's ability to manage this exposure is crucial for maintaining stable and predictable financial results across its international operations.

- Exchange Rate Impact: Changes in the Euro's value against currencies like the US Dollar and Swedish Krona can alter the reported value of Fenix Outdoor's international sales and profits.

- 2023/2024 Volatility: The Euro saw significant movements in 2023 and early 2024, highlighting the ongoing risk exposure for companies with global revenue streams.

- Hedging Importance: Effective currency risk management, potentially through financial instruments, is vital for Fenix Outdoor to safeguard its earnings against unfavorable exchange rate shifts.

E-commerce vs. Brick-and-Mortar Performance

A notable economic trend in 2024 and early 2025 highlights a shift in consumer spending, with digital sales channels underperforming compared to physical brick-and-mortar stores. While overall direct-to-consumer sales experienced a dip, the decline was more pronounced in online channels, largely attributed to aggressive discounting strategies. This contrasts with physical retail locations, which demonstrated greater resilience, with some markets, like the USA, even reporting slight increases in like-for-like sales.

This divergence suggests a potential recalibration of consumer preferences, where the tangible shopping experience or perceived value of in-store purchases may be regaining traction. For instance, reports indicate that while e-commerce growth slowed significantly in 2024, brick-and-mortar sales showed a more stable, albeit low, growth trajectory in key Western markets.

- E-commerce Growth Slowdown: Global e-commerce growth, which had surged during the pandemic, saw a noticeable deceleration in 2024, with some projections indicating single-digit growth compared to double-digit figures in prior years.

- Discount Dependency: The online channel's reliance on heavy promotions in 2024 and Q1 2025 to drive sales indicates a potential erosion of brand loyalty and a heightened price sensitivity among online shoppers.

- Physical Store Resilience: In markets like the USA, brick-and-mortar stores, particularly those offering unique experiences or essential goods, experienced a smaller decline or even modest growth on a like-for-like basis in 2024, defying earlier expectations of continued online dominance.

- Shifting Consumer Behavior: The economic climate of 2024-2025 appears to be fostering a return to more traditional shopping habits for some consumer segments, favoring the immediate gratification and tactile interaction offered by physical stores.

Fenix Outdoor faced a challenging economic environment in 2024 and early 2025, characterized by subdued global growth and persistent inflation. This led to cautious consumer spending, particularly on discretionary items, impacting sales across all channels. The company also contended with rising operational costs, including salaries and energy, which compressed gross profit margins, despite cost-saving measures implemented in 2023.

The retail sector experienced high inventory levels in 2024, forcing price reductions and creating volatile trading conditions. Retailers shifted to smaller, more frequent orders, increasing inventory risk for brands like Fenix Outdoor. Currency fluctuations also presented a significant challenge, with the Euro's movement against currencies like the US Dollar and Swedish Krona impacting reported international revenues. E-commerce growth slowed in 2024, with a greater reliance on discounts, while physical retail showed more resilience.

| Economic Factor | 2024/2025 Data/Trend | Impact on Fenix Outdoor |

|---|---|---|

| Global GDP Growth | Projected at 3.2% for 2024 (IMF, April 2024), indicating sluggish growth. | Reduced consumer spending on discretionary goods. |

| Inflation & Costs | Persistent inflation and escalating structural costs (salaries, energy). | Compressed gross profit margins, impacting operating performance. |

| Consumer Confidence | Dipped in early 2025 in key economies (Conference Board). | Increased consumer caution and reluctance to spend. |

| Retail Inventory Levels | High across the sector in 2024, leading to price drops. | Difficult trading conditions and increased inventory risk for brands. |

| E-commerce vs. Physical Retail | E-commerce growth slowed; physical retail showed more resilience. | Shift in sales channel performance, requiring strategic adjustments. |

| Currency Fluctuations | Notable volatility in 2023/2024 for EUR vs. USD, SEK. | Potential impact on reported international revenues and profitability. |

Preview Before You Purchase

Fenix Outdoor PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Fenix Outdoor provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain insights into market trends, competitive landscapes, and strategic considerations for Fenix Outdoor.

Sociological factors

The outdoor industry saw a notable shift in consumer behavior during 2024. Instead of sticking to local pastimes, as seen in earlier slow-growth phases, consumers increasingly opted for travel, often already outfitted with gear acquired during the COVID-19 pandemic. This trend suggests a maturing market and highlights the necessity for companies like Fenix Outdoor to adjust to changing leisure desires and the underlying reasons people pursue outdoor activities.

Consumers are increasingly prioritizing sustainability and ethical practices when making purchasing choices, a trend significantly impacting the outdoor recreation market. This growing demand for environmentally friendly and socially responsible products is a key sociological factor for companies like Fenix Outdoor.

Fenix Outdoor's dedication to sustainability, fair labor, animal welfare, and ethical sourcing, as detailed in their 'The Fenix Way' initiative and corporate social responsibility reports, directly addresses this consumer sentiment. For instance, their 2023 CSR report highlighted a 15% reduction in CO2 emissions across their operations compared to 2022, demonstrating tangible progress in environmental stewardship that resonates with conscious consumers.

This alignment with ethical consumerism provides a competitive advantage, as brands perceived as responsible are more likely to attract and retain customers. In 2024, surveys indicated that over 60% of outdoor enthusiasts consider a brand's sustainability credentials when deciding on purchases, reinforcing the importance of Fenix Outdoor's established ethical framework.

The growing societal focus on health and wellness, particularly the desire for physical activity and spending time outdoors, remains a significant boon for the outdoor sector. This trend directly aligns with Fenix Outdoor's core business of providing gear and apparel for outdoor pursuits, effectively capitalizing on the public's increasing interest in well-being derived from nature.

Data from 2024 indicates a continued surge in outdoor recreation participation. For instance, national park visits saw a 5% increase in the first half of 2024 compared to the same period in 2023, demonstrating sustained consumer engagement. This heightened activity translates into greater demand for quality outdoor equipment, a market Fenix Outdoor is well-positioned to serve.

Demographic Shifts and Market Diversification

Global demographic shifts are reshaping the outdoor recreation landscape, requiring Fenix Outdoor to adapt its strategies. As populations age in many developed nations, there's a growing interest in less strenuous, nature-focused activities. Conversely, younger generations, particularly in emerging markets, are increasingly drawn to adventure sports and experiential travel, presenting new avenues for growth. For instance, the United Nations projects that by 2050, one in six people globally will be over 65, a significant increase from one in eleven in 2019.

Fenix Outdoor is actively addressing these demographic trends through strategic portfolio diversification. The acquisition of Devold of Norway AS, a heritage wool apparel brand, caters to consumers seeking quality, durability, and a connection to traditional outdoor pursuits. Simultaneously, collaborations like the one with Maloja, known for its stylish and performance-oriented activewear, appeal to a younger, fashion-conscious demographic interested in both functionality and aesthetics. This dual approach allows Fenix Outdoor to capture a wider market share.

- Aging Population: Increased demand for comfort-oriented, accessible outdoor activities.

- Youth Engagement: Growing interest in adventure sports and sustainable outdoor experiences.

- Urbanization: Rise in demand for nature-based escapes and city-friendly outdoor gear.

- Cultural Diversity: Need for inclusive marketing and product offerings reflecting varied backgrounds.

Impact of Social Media and Influencer Culture

The pervasive influence of social media and influencer culture profoundly shapes consumer preferences and purchasing behaviors within the outdoor industry. Fenix Outdoor's strategic emphasis on building brand loyalty and maintaining consumer trust, evident in their digital transformation initiatives, underscores their recognition of these platforms' power in influencing perceptions. For instance, by mid-2024, influencer marketing spending in the global digital advertising market was projected to reach over $21 billion, highlighting the significant investment brands are making in this area.

This digital engagement is crucial for Fenix Outdoor, as it allows them to directly communicate their brand values and product benefits to a wider audience, fostering a sense of community and authenticity. The ability to leverage relatable personalities to showcase their products in aspirational, real-world settings can significantly boost brand visibility and credibility. In 2023, studies indicated that over 70% of consumers trust influencer recommendations as much as those from friends or family.

- Increased Brand Visibility: Social media allows for direct consumer engagement and trend amplification.

- Influencer Marketing ROI: Brands see significant returns from strategic influencer collaborations.

- Authenticity and Trust: Consumers increasingly value genuine endorsements from influencers they follow.

- Digital Transformation: Fenix Outdoor’s focus on digital channels is a direct response to evolving consumer communication preferences.

Societal trends indicate a growing preference for experiences over material possessions, with outdoor activities gaining traction as a primary leisure pursuit. This shift, particularly evident in 2024, benefits companies like Fenix Outdoor by driving demand for durable, high-quality gear. Furthermore, an increasing awareness of mental and physical well-being fuels participation in nature-based activities, a trend Fenix Outdoor is well-positioned to leverage.

Technological factors

Fenix Outdoor is actively driving digital transformation, highlighted by its new ERP system and logistics overhaul in Europe. This strategic initiative is designed to boost operational efficiency and enhance R&D capabilities by standardizing data and moving away from manual processes. Full savings from these changes are anticipated by fall 2025 into early 2026, signifying a major shift towards a more data-driven, self-service reporting environment.

Fenix Outdoor is actively embracing technological advancements to bring greater clarity and accountability to its supply chain. A key initiative involves their collaboration with TextileGenesis, a move that leverages cutting-edge Fiber-to-Retail (FTR) technology. This partnership employs a digital token-based system designed to meticulously follow materials from their origin as a fiber all the way to the point of sale.

This technological integration directly addresses the growing consumer and regulatory pressure for sustainable and ethically sourced products. By providing verifiable traceability, Fenix Outdoor can assure customers about the origins and journey of their garments, a critical factor in today's conscious consumer market. For example, by 2024, the global market for supply chain traceability software was projected to reach $3.7 billion, indicating a strong industry trend.

Fenix Outdoor is actively working to enhance its e-commerce platforms, even with recent online sales lagging behind physical stores. This focus includes optimizing the digital customer journey for brands like Fjällräven, which is crucial for adapting to the dynamic online retail landscape.

The company's commitment to digital channels is evident in its ongoing investments. For example, Fenix Outdoor saw its online sales represent a significant portion of its total revenue in recent periods, though the exact percentage can fluctuate based on market trends and specific brand performance.

Adapting to volatile online market conditions means Fenix Outdoor must continuously refine its strategies, from user interface design to logistics, to ensure a seamless and competitive shopping experience for its customers.

Product Lifecycle Management (PLM) Solutions

Fenix Outdoor's strategic adoption of Centric PLM is a significant technological factor, designed to streamline its product development cycle. This move is intended to accelerate the creation of new styles and enhance research and development, directly impacting their ability to innovate and respond to market demands more swiftly. For instance, by standardizing data and improving accuracy, the company aims to cut down on the typical 12-18 month product development timelines seen in the outdoor industry, especially when catering to niche markets.

The implementation of PLM solutions like Centric PLM directly supports Fenix Outdoor's digital transformation goals. It facilitates faster product iterations by providing a centralized platform for all product-related information, from initial design concepts to final production. This improved data management and communication flow are crucial for adapting to the specific requirements of diverse markets, such as the rapidly evolving Chinese consumer landscape, where speed to market is paramount.

- Accelerated Product Development: Centric PLM aims to reduce the time taken to bring new products to market, a critical advantage in the fast-paced fashion and outdoor gear sectors.

- Enhanced R&D and Innovation: By standardizing data and improving communication, the PLM system empowers Fenix Outdoor to foster greater innovation and explore new product possibilities more efficiently.

- Market Adaptability: The technology provides the agility needed to tailor product offerings for specific regional markets, ensuring relevance and competitiveness.

- Data Accuracy and Standardization: A single source of truth for product data minimizes errors and improves collaboration across different teams and departments involved in product creation.

Data Analytics and Business Intelligence

Technological advancements in data analytics and business intelligence are significantly shaping Fenix Outdoor's strategic direction. The company is actively enhancing its data architecture to facilitate more robust analysis and is promoting self-service reporting capabilities. This focus aims to provide deeper business insights, enabling quicker, more informed decision-making across the organization.

Fenix Outdoor is implementing a strategy to consolidate data from various enterprise resource planning (ERP) systems and external sources, including Google Analytics. This integration is designed to create comprehensive sales reports, boosting data processing speed and overall operational flexibility. For instance, by 2024, many companies are reporting significant ROI from data analytics initiatives, with some seeing improvements in efficiency by over 20%.

- Data Architecture Enhancement: Fenix Outdoor is investing in its data infrastructure to support advanced analytics.

- Self-Service BI Adoption: The company is encouraging the use of self-service reporting tools for faster insights.

- Data Integration: Plans include merging data from multiple ERPs and external platforms like Google Analytics.

- Improved Decision-Making: The ultimate goal is to achieve increased data processing speed and flexibility for better business intelligence.

Fenix Outdoor's technological focus is on digital transformation, including a new ERP system and logistics overhaul in Europe, aiming for full savings by fall 2025 into early 2026. This initiative enhances R&D and promotes a data-driven reporting environment.

The company is leveraging Fiber-to-Retail (FTR) technology through a partnership with TextileGenesis to ensure supply chain traceability, addressing growing demands for sustainable and ethically sourced products. This verifiable traceability is crucial in a market where supply chain transparency software was projected to reach $3.7 billion by 2024.

Fenix Outdoor is enhancing its e-commerce platforms, exemplified by efforts for Fjällräven, to optimize the digital customer journey. Continued investment in digital channels is key, as online sales represent a significant, albeit fluctuating, portion of total revenue.

The adoption of Centric PLM is a core technological strategy to accelerate product development and foster innovation, aiming to shorten typical industry timelines of 12-18 months. This improves data accuracy and market adaptability, vital for swiftly responding to diverse consumer needs.

Legal factors

Fenix Outdoor is proactively preparing for the EU's Corporate Sustainability Reporting Directive (CSRD), which will require more detailed and standardized sustainability disclosures starting in fiscal year 2024 for many companies. This directive aims to enhance transparency around environmental, social, and governance (ESG) performance, impacting how Fenix Outdoor communicates its impact and progress.

The company is also keeping a close watch on evolving chemical regulations, such as potential updates to California's Proposition 65, which has previously addressed substances like BPA and BPS. Furthermore, Fenix Outdoor is monitoring the increasing scrutiny and anticipated stricter regulations surrounding PFAS (per- and polyfluoroalkyl substances) in consumer products, particularly within the textile and outdoor gear sectors, as these chemicals face growing environmental and health concerns globally.

New laws like the German Supply Chain Due Diligence Act (LkSG), effective January 1, 2023, are placing significant legal pressure on companies regarding their supply chains. This act mandates that businesses with over 3,000 employees identify and address human rights and environmental risks within their direct supply chains, and by 2024, also in indirect supply chains.

Fenix Outdoor's collaboration with TextileGenesis, utilizing blockchain technology to track materials, is a proactive measure. This partnership aims to build greater transparency and traceability, directly addressing the compliance demands of legislation like the LkSG and mitigating potential legal repercussions. This move is crucial as companies face growing liability for violations occurring anywhere in their value chain.

The EU's proposed Corporate Sustainability Due Diligence Directive (CSDDD) further signals this trend, aiming to impose similar obligations across the European Union. With Fenix Outdoor's global operations, anticipating and aligning with these evolving legal frameworks is essential for continued market access and risk management.

As a member of the Fair Labor Association (FLA), Fenix Outdoor is deeply committed to fair labor practices and human rights throughout its global supply chains. This commitment is reinforced by an internal Code of Conduct that applies to all employees and business partners, ensuring ethical operations. For instance, in 2023, Fenix Outdoor conducted 181 social compliance audits across its supplier base, with 98% of identified corrective actions addressed within the stipulated timelines, demonstrating proactive management of social risks.

Fenix Outdoor actively promotes diversity and inclusion, recognizing its importance in managing social risks and fostering a responsible business environment. The company's training programs are designed to equip both its workforce and partners with the knowledge to uphold these standards. In 2024, the company expanded its supplier training initiatives, reaching over 5,000 workers with sessions focused on labor rights and workplace safety, aiming to further embed human rights principles within its operations.

Product Safety and Quality Standards

Fenix Outdoor operates within a legal landscape where product safety and quality are rigorously regulated. For its textile brands, this means adhering to stringent standards for materials, manufacturing, and labeling to ensure consumer protection and product integrity. For instance, regulations regarding the flammability of textiles and the absence of harmful chemicals are critical compliance areas.

The company's commitment to high-quality, durable products is underscored by its robust testing processes. This includes specific tests like microfiber shedding tests, which address growing environmental concerns and potential future regulations related to microplastic pollution from textiles. Such proactive testing helps Fenix Outdoor anticipate and meet evolving legal and consumer expectations.

In 2023, the global outdoor apparel market, a key sector for Fenix Outdoor, was valued at approximately USD 20.5 billion. This figure highlights the significant scale of the market and the associated legal responsibilities Fenix Outdoor manages to ensure its products are safe and meet quality benchmarks. Compliance in this sector is not just about avoiding penalties but also about building brand trust and market share.

- Compliance with textile safety regulations, such as REACH in Europe, is essential.

- Microfiber shedding tests, like those conducted by Fenix Outdoor, are increasingly important due to environmental awareness.

- Product liability laws hold manufacturers accountable for damages caused by unsafe products.

- International trade agreements often include product safety and quality provisions that Fenix Outdoor must navigate.

Intellectual Property Protection

Fenix Outdoor's strong portfolio of brands, including Fjällräven and Hanwag, relies heavily on robust intellectual property (IP) protection. Legal frameworks governing trademarks, design rights, and patents are vital to maintain brand integrity and prevent market dilution through counterfeit goods. For instance, in 2023, global customs authorities seized over 2.7 million counterfeit items, highlighting the ongoing threat to brands. Effective IP strategies are therefore fundamental to preserving Fenix Outdoor's market position and brand value.

The company must navigate varying international IP laws to safeguard its innovations and distinctive brand elements. This includes registering trademarks in key markets and potentially seeking patent protection for unique product designs or manufacturing processes. The legal landscape for IP is constantly evolving, with ongoing discussions around digital IP rights and enforcement in e-commerce environments, which Fenix Outdoor must actively monitor.

- Trademark Enforcement: Protecting brand names and logos like Fjällräven is critical for consumer recognition and trust.

- Design Patents: Safeguarding the unique aesthetic of products, such as Fjällräven's Kånken backpack, prevents unauthorized replication.

- Patent Protection: Innovations in materials or manufacturing techniques used by brands like Primus could be patentable.

- Counterfeiting Measures: Legal recourse against counterfeiters is essential to protect revenue and brand reputation.

Fenix Outdoor is navigating an increasingly complex legal environment, particularly concerning sustainability and supply chain transparency. The EU's Corporate Sustainability Reporting Directive (CSRD) is a prime example, mandating more detailed ESG disclosures from fiscal year 2024. Similarly, the German Supply Chain Due Diligence Act (LkSG), in effect since January 2023, imposes obligations on companies regarding human rights and environmental risks within their supply chains, with indirect supply chains coming under scrutiny by 2024.

The company is also proactively addressing regulations around harmful substances, such as potential updates to California's Proposition 65 and the growing scrutiny of PFAS in textiles. Fenix Outdoor's use of blockchain technology through its partnership with TextileGenesis is a direct response to these legal pressures, enhancing traceability and mitigating risks associated with supply chain violations. This focus on due diligence is further amplified by the EU's proposed Corporate Sustainability Due Diligence Directive (CSDDD), which signals a broader trend towards legal accountability across global value chains.

Product safety and quality remain paramount, with Fenix Outdoor adhering to stringent textile regulations like REACH in Europe. The company's commitment to robust testing, including microfiber shedding tests, anticipates future environmental regulations. In 2023, the global outdoor apparel market, valued at approximately USD 20.5 billion, underscores the significant scale of operations and the critical need for compliance to maintain consumer trust and market share.

Intellectual property protection is also a key legal consideration. Fenix Outdoor actively safeguards its brands, such as Fjällräven and Hanwag, through trademark and design rights, crucial in a market where global customs seized over 2.7 million counterfeit items in 2023. Navigating diverse international IP laws is essential for preserving brand value and preventing market dilution.

Environmental factors

Climate change poses a significant strategic risk to Fenix Outdoor, directly impacting sales through unpredictable weather. For instance, a lack of winter weather in parts of Europe during Q1 2025 led to reduced sales, highlighting the company's vulnerability to meteorological shifts.

Fenix Outdoor's proactive sustainability initiatives are intrinsically tied to combating climate change. These efforts aim to prevent or lessen the adverse effects of climate-related disruptions and align with the ambitious 1.5° Celsius target set by the Paris Agreement.

Fenix Outdoor is actively pursuing ambitious carbon reduction goals, demonstrating a strong commitment to environmental stewardship. They have set a target for a 40% absolute reduction in Scope 1 and Scope 2 emissions by 2025, using 2019 as their baseline year. This aligns with their broader objective of achieving net zero emissions for these scopes by 2050.

Further strengthening their environmental strategy, Fenix Outdoor aims to cut emissions per product manufactured by 50% by 2025. This specific target places a significant emphasis on addressing emissions generated during upstream activities, which often represent a substantial portion of a company's overall carbon footprint.

The company has already achieved a notable milestone by becoming CO2 neutral in its own direct operations since 2015. This long-standing commitment to operational carbon neutrality underscores their proactive approach to managing their environmental impact and sets a precedent for their future emission reduction efforts.

Fenix Outdoor is actively pursuing responsible resource management, focusing on integrating circular production practices. This includes a commitment to zero-waste development and the implementation of circular business models.

Examples of these circular models include textile-to-textile recycling, product rental services, and offering repair options to extend product lifespans. These initiatives are central to their strategy.

In 2023, Fenix Outdoor reported that over 80% of their product portfolio was designed with sustainability in mind, with a significant portion incorporating recycled materials. This demonstrates a tangible shift towards circularity.

The company’s repair services, for instance, saw a 25% increase in usage in 2024 compared to the previous year, reflecting growing consumer interest in extending product life and reducing waste.

Chemical Management and Hazardous Substances

Fenix Outdoor is keenly focused on managing chemicals within its product lines, particularly concerning substances like PFAS. They are also addressing evolving regulations around chemicals such as BPA and BPS, demonstrating a commitment to product safety and environmental responsibility. This proactive stance is crucial in an industry where consumer and regulatory scrutiny of material composition is increasing.

The company has made significant strides in reducing hazardous chemicals, a testament to their dedication to sustainability. A key initiative has been the consolidation and streamlining of testing processes across all their textile brands. This unified approach ensures consistent quality and compliance, making their chemical management more efficient and effective.

- PFAS Monitoring: Fenix Outdoor actively monitors and manages per- and polyfluoroalkyl substances (PFAS) in its products, aligning with global efforts to reduce these persistent chemicals.

- Regulatory Compliance: The company addresses regulations concerning substances like Bisphenol A (BPA) and Bisphenol S (BPS), ensuring their products meet stringent safety standards.

- Chemical Reduction Initiatives: Fenix Outdoor is committed to reducing the presence of hazardous chemicals throughout its supply chain.

- Streamlined Testing: They have consolidated and optimized testing procedures for all textile brands, enhancing the efficiency and consistency of chemical safety assessments.

Waste Generation and Water Management

Fenix Outdoor actively monitors waste generation across its retail operations, a key component of its environmental stewardship. While granular data on water withdrawal targets isn't explicitly provided in recent reports, the company's broader commitment to resource management inherently includes efforts to improve water use efficiency. This focus is crucial as water scarcity becomes a more significant global concern, impacting supply chains and operational costs.

The company's approach to waste reduction involves data collection from its stores, enabling them to identify areas for improvement. For instance, in 2023, Fenix Outdoor reported a continued focus on reducing packaging waste, a common area of concern for retail businesses. Though specific water efficiency targets aren't public, it's understood that responsible water management is a growing priority for businesses in the apparel and outdoor sectors, especially in regions facing water stress.

Fenix Outdoor's environmental initiatives, which include waste management, are increasingly important given global trends:

- Waste Reduction Efforts: Fenix Outdoor collects data from its retail locations to track and reduce waste generation, a practice that gained momentum in 2023 and continues into 2024.

- Water Management Focus: While specific withdrawal reduction targets are not detailed, the company's overall environmental strategy emphasizes efficient resource management, encompassing water use.

- Industry Trends: The outdoor industry, like many others, is facing increasing scrutiny and regulatory pressure regarding water usage and waste management practices.

- Supply Chain Impact: Water availability and management are critical for raw material sourcing, particularly for cotton and other agricultural products used in apparel, impacting the company's supply chain.

Fenix Outdoor's environmental strategy is significantly shaped by climate change, influencing sales through weather volatility. Their commitment to sustainability, including a 40% reduction target for Scope 1 and 2 emissions by 2025 (from a 2019 baseline), directly addresses these risks and aligns with the Paris Agreement's goals.

The company is actively integrating circularity, with over 80% of its product portfolio designed with sustainability in mind as of 2023, and a 25% rise in repair service usage in 2024. This focus extends to chemical management, particularly concerning substances like PFAS, BPA, and BPS, demonstrating a commitment to product safety and environmental responsibility.

Fenix Outdoor is also focused on waste reduction, collecting data from its retail operations to drive improvements, and emphasizes efficient resource management, which includes water use, though specific water withdrawal targets are not yet detailed.

PESTLE Analysis Data Sources

Our Fenix Outdoor PESTLE analysis is constructed using a robust blend of official government publications, reputable industry research, and leading economic indicators. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in credible and current data.