Fenix Outdoor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fenix Outdoor Bundle

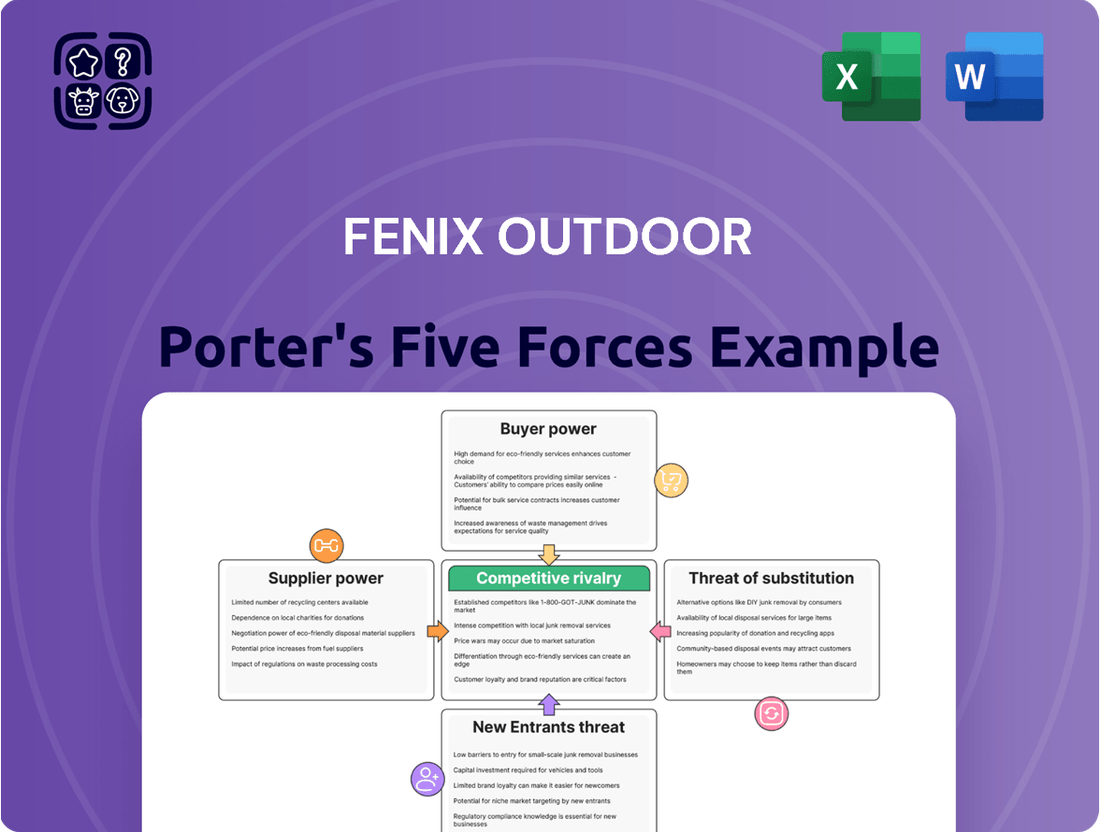

Fenix Outdoor operates in a dynamic market shaped by intense competition and evolving consumer preferences. Understanding the forces of buyer power, supplier leverage, threat of new entrants, and substitute products is crucial for navigating this landscape. The existing rivalry within the outdoor apparel and equipment sector significantly impacts pricing and innovation strategies.

The complete report reveals the real forces shaping Fenix Outdoor’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Fenix Outdoor's reliance on specialized, high-performance materials such as advanced waterproof-breathable membranes or durable, lightweight alloys can concentrate its supplier base. If only a few manufacturers globally produce these critical components to the required quality standards, their bargaining power increases significantly. This limited availability allows these suppliers to dictate terms and pricing, potentially impacting Fenix Outdoor's cost of goods sold and profit margins.

The company's increasing emphasis on sustainability and ethical sourcing, a trend observed across the outdoor apparel industry, further refines its supplier options. Seeking out suppliers who meet stringent environmental and social governance (ESG) criteria can narrow the pool of potential partners. For instance, a report from the Textile Exchange in 2023 indicated that while demand for recycled and bio-based materials is growing, the number of certified suppliers capable of meeting large-scale production needs remains relatively concentrated, especially for cutting-edge innovations.

Fenix Outdoor faces potential supplier bargaining power if it has invested in specialized machinery or processes tied to a specific supplier's components. The financial outlay, coupled with the risk of production disruptions, quality control challenges, and delayed product launches, makes switching suppliers a costly endeavor. For instance, a significant capital investment in proprietary textile treatment machinery linked to a single chemical supplier would create high switching costs.

Suppliers offering highly differentiated or patented materials, technologies, or manufacturing processes can significantly increase their bargaining power. For Fenix Outdoor, this means that if a supplier provides an exclusive waterproof-breathable membrane or a unique insulation material that directly contributes to the performance and brand reputation of Fjällräven or Hanwag, their leverage grows. Fenix Outdoor's commitment to durable, high-quality products inherently suggests a dependence on these specialized inputs. In 2024, the outdoor apparel market saw continued demand for innovative, performance-enhancing materials, making unique supplier offerings even more critical.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Fenix Outdoor's operations, meaning they start producing their own apparel or equipment, could significantly impact the company. This is particularly relevant if a supplier of a critical component possesses the expertise and sees a strategic advantage in entering the finished goods market, directly competing with Fenix. For example, a highly specialized fabric manufacturer could potentially leverage their material science knowledge to launch their own line of outdoor gear.

While this risk might be less pronounced in industries with highly fragmented or commoditized supply chains, it warrants consideration for Fenix Outdoor. The company's robust portfolio of brands and its well-established global distribution network serve as key mitigating factors. These strengths create significant barriers to entry for any supplier contemplating such a move, as they would need to replicate Fenix's market presence and customer loyalty.

For context, in 2024, the global outdoor apparel market was valued at approximately $16 billion, with a projected compound annual growth rate of 5.5% through 2030. This growth signals a dynamic market where suppliers might be tempted to capture more value by moving downstream. However, Fenix Outdoor's diversified brand strategy, including names like Fjällräven and Tierra, provides a strong competitive moat.

- Supplier Forward Integration Risk: Suppliers entering Fenix Outdoor's market by producing their own apparel or equipment.

- Potential Scenario: A specialized component supplier using its expertise to compete directly in the finished goods market.

- Mitigating Factors: Fenix Outdoor's strong brand portfolio and established global distribution channels.

- Market Context (2024): Global outdoor apparel market valued at ~$16 billion, with strong projected growth, potentially incentivizing supplier forward integration.

Supplier Importance to Fenix Outdoor's Quality and Innovation

Fenix Outdoor's strong reputation for producing high-quality, durable, and functional outdoor gear, evident in brands like Fjällräven and Hanwag, makes its suppliers' contributions vital. The performance and innovative capacity of these suppliers directly impact Fenix Outdoor's product excellence and market standing.

Suppliers who consistently provide superior materials, actively participate in product development, or meet rigorous sustainability mandates are exceptionally valuable. For instance, in 2024, Fenix Outdoor continued its commitment to sustainable sourcing, with a significant portion of its materials coming from certified suppliers.

This reliance on specialized suppliers for critical components or unique materials can shift negotiation power. If a supplier offers a unique, high-performance fabric or a specialized manufacturing process that is difficult to replicate, they gain leverage.

- Supplier Dependency: Fenix Outdoor's commitment to premium quality necessitates reliance on suppliers who can consistently meet exacting standards.

- Innovation Contribution: Suppliers who drive innovation in materials or manufacturing processes become indispensable, enhancing Fenix Outdoor's product differentiation.

- Sustainability Standards: Adherence to strict environmental and ethical guidelines by suppliers is crucial for Fenix Outdoor's brand image and corporate responsibility, granting these suppliers increased influence.

The bargaining power of suppliers for Fenix Outdoor hinges on the uniqueness and specialization of the components they provide. If a supplier offers materials, like advanced waterproof-breathable membranes or specialized insulation, that are critical for Fenix Outdoor's high-performance products and are difficult for competitors to source, their leverage increases significantly. In 2024, the demand for innovative, eco-friendly materials in the outdoor sector continued to grow, potentially empowering suppliers who can meet these evolving needs.

The cost and complexity of switching suppliers also play a crucial role. If Fenix Outdoor has invested heavily in machinery or processes specifically designed to work with a particular supplier's materials, the cost and disruption associated with changing suppliers can be substantial. This dependence grants suppliers greater power to negotiate terms and pricing.

Suppliers who are also investing in forward integration, aiming to produce finished goods themselves, pose a potential threat. However, Fenix Outdoor's strong brand portfolio, including Fjällräven and Hanwag, and its established global distribution network provide a significant competitive advantage, acting as a deterrent for suppliers considering direct competition.

| Factor | Impact on Fenix Outdoor | 2024 Context/Data |

| Supplier Specialization | Increases supplier bargaining power if components are unique and critical to product performance. | Continued demand for advanced, sustainable materials in outdoor gear. |

| Switching Costs | High costs associated with changing suppliers increase supplier leverage. | Investment in specialized manufacturing processes can tie Fenix Outdoor to specific suppliers. |

| Forward Integration Risk | Potential for suppliers to enter Fenix Outdoor's market directly. | Global outdoor apparel market valued at ~$16 billion in 2024, with growth potentially incentivizing integration. |

| Brand Strength & Distribution | Mitigates supplier power by creating high barriers to entry for competitors. | Fenix Outdoor's diversified brand portfolio provides a strong competitive moat. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Fenix Outdoor's position in the outdoor apparel and equipment market.

Quickly identify competitive threats and opportunities by visualizing the intensity of each force, allowing for more targeted strategic responses.

Customers Bargaining Power

Fenix Outdoor's customers, encompassing both wholesale partners and individual shoppers, possess considerable bargaining power, largely shaped by their sensitivity to pricing and the array of competing outdoor brands available. In 2024, the outdoor equipment market continued to see intense competition, with numerous brands vying for consumer attention, potentially forcing Fenix Outdoor to maintain competitive pricing strategies.

The availability of substitutes for Fenix Outdoor's products, such as Fjällräven backpacks or Haglöfs jackets, directly impacts customer leverage. If consumers can easily find similar quality or functionally equivalent products from other established or emerging outdoor companies at lower price points, their ability to negotiate or seek better deals increases.

The broader economic climate and retail conditions observed in 2024 highlighted a general trend of increased price consciousness among consumers. This environment suggests that customers are more likely to compare prices across different brands and are less willing to pay a premium if comparable alternatives exist, thereby strengthening their bargaining position.

Today's customers, particularly those engaging with direct-to-consumer (DTC) brands like those under Fenix Outdoor, are incredibly well-informed. The internet provides them with a wealth of product details, user reviews, and readily available price comparisons, significantly boosting their knowledge.

This heightened transparency directly translates to increased bargaining power for consumers. They can easily identify the best value and are less likely to overpay for a product, forcing brands to compete more aggressively on price and quality.

Fenix Outdoor's strategic growth in online sales channels places it directly within this transparent marketplace. For instance, in 2024, the global e-commerce market reached an estimated $6.3 trillion, highlighting the sheer volume of online transactions and the intense competition for customer attention.

With customers able to instantly compare Fenix Outdoor's offerings, such as Fjällräven backpacks or Primus stoves, against numerous competitors, the brand must ensure its value proposition is clear and compelling to maintain its market position.

Fenix Outdoor's wholesale customer concentration poses a significant factor in their bargaining power. If a few major retailers account for a large chunk of Fenix's sales, those retailers can use their purchasing volume to negotiate better prices, more favorable payment terms, or increased marketing assistance. This concentration amplifies the leverage these key customers hold.

The cautious inventory management observed from retailers in 2025, indicated by their reliance on reorders rather than large upfront purchases, further bolsters their bargaining position. This suggests retailers are managing their stock tightly, giving them the flexibility to demand more favorable terms from suppliers like Fenix Outdoor if they feel the need to reduce risk or optimize their own cash flow.

Switching Costs for Customers

For most outdoor equipment, the direct financial cost of switching brands is quite low. Consumers can readily explore alternatives for their next purchase without significant penalties. This ease of transition generally weakens the bargaining power of customers.

However, Fenix Outdoor cultivates strong brand loyalty through its well-regarded brands like Fjällräven and Hanwag. This loyalty, fostered by a reputation for quality, durability, and a deep commitment to sustainability, can act as a de facto switching cost. Customers who trust these brands may hesitate to switch to competitors, even if alternatives exist.

Consider the impact of brand reputation on purchasing decisions. For instance, Fjällräven's iconic Kånken backpack, first introduced in 1978, continues to be a bestseller, demonstrating enduring customer preference. This sustained demand suggests that the emotional and experiential aspects of owning these products create a barrier to switching for a significant customer base.

- Low direct financial switching costs for general outdoor gear.

- Strong brand loyalty to Fenix Outdoor brands (e.g., Fjällräven, Hanwag) acts as a switching barrier.

- Quality, durability, and sustainability commitments enhance brand loyalty.

- Customer reluctance to abandon trusted products mitigates the power of customers to switch easily.

Direct-to-Consumer (DTC) Channels and Customer Engagement

Fenix Outdoor's strategic push into direct-to-consumer (DTC) channels, including its own retail stores and e-commerce platforms, is a key move to curb the bargaining power of wholesale partners. By cultivating direct relationships, Fenix aims to capture more of the value chain and build stronger customer loyalty. This approach allows for greater control over brand messaging and customer experience, potentially leading to enhanced pricing power and reduced reliance on intermediaries.

In 2024, while Fenix Outdoor continued to invest in its DTC strategy, digital sales channels experienced a slowdown, underperforming relative to its physical retail operations. This highlights the ongoing importance of brick-and-mortar for customer engagement and sales conversion within the company's portfolio. The company's sustainability initiatives, often communicated directly through these channels, also play a role in fostering deeper customer connections and brand advocacy.

- DTC Investment: Fenix Outdoor is actively expanding its own retail footprint and e-commerce capabilities to foster direct customer relationships.

- Wholesale Power Mitigation: This strategy aims to lessen the influence of traditional wholesale buyers by creating a more direct sales pipeline.

- Customer Engagement: Direct interaction allows Fenix to build brand loyalty through experiences and sustainability messaging.

- 2024 Digital Performance: Digital sales channels lagged behind brick-and-mortar performance in 2024, indicating the continued significance of physical retail for the company.

Customers hold significant bargaining power due to the competitive nature of the outdoor market, where numerous brands offer comparable products, forcing Fenix Outdoor to remain price-competitive. The ease with which consumers can switch between brands, coupled with readily available information about pricing and quality, further amplifies their leverage. While Fenix cultivates loyalty through quality and sustainability, the low financial cost of switching for many items means customers can often dictate terms by seeking better deals or alternative products.

| Factor | Impact on Fenix Outdoor | 2024 Context |

|---|---|---|

| Price Sensitivity | High; customers compare prices across many brands. | Continued price consciousness in the retail environment. |

| Availability of Substitutes | Significant; many competitors offer similar quality. | Intense competition with numerous outdoor brands. |

| Switching Costs | Generally low financial cost for most products. | Customers can easily explore alternatives without penalty. |

| Brand Loyalty | Moderate; Fenix brands (Fjällräven, Hanwag) build loyalty through quality and sustainability. | Enduring preference for established products like the Kånken backpack. |

Preview the Actual Deliverable

Fenix Outdoor Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Fenix Outdoor provides an in-depth examination of industry attractiveness and competitive dynamics. You'll gain a clear understanding of the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the outdoor goods sector. This exact document, fully formatted and ready for your strategic planning, will be yours instantly upon purchase.

Rivalry Among Competitors

The outdoor equipment and apparel sector is a crowded space, featuring a multitude of global and regional companies catering to diverse outdoor pursuits. Fenix Outdoor navigates this landscape by contending with established premium and heritage brands as well as more agile, fast-fashion oriented outdoor wear providers.

In 2024, the market has presented significant challenges, with many countries experiencing subdued growth. For instance, the global outdoor apparel market saw a modest increase of around 2.5% in 2023, with projections for 2024 indicating continued, albeit slow, expansion in key regions.

While the global outdoor gear and equipment market is expected to see continued growth, 2024 presented distinct challenges for the industry, diverging from earlier recessionary growth periods. This deceleration in growth can naturally heighten competitive rivalry as firms battle more fiercely for a smaller piece of the pie.

The outdoor industry is increasingly entering a phase of market maturity. This transition typically signals a more saturated market, leading to intensified competition among established players and new entrants alike.

Fenix Outdoor stands out by nurturing a robust portfolio of distinct brands, including Fjällräven, Hanwag, Primus, and Royal Robbins. These brands are widely recognized for their commitment to high-quality, long-lasting, and environmentally conscious products, which is a key differentiator in a competitive market.

The company benefits from significant brand loyalty, especially with Fjällräven, which has cultivated a strong reputation for sustainability. This customer devotion effectively lessens the pressure from direct price wars, allowing Fenix Outdoor to maintain its value proposition.

While Fenix Outdoor excels in differentiation, it’s important to note that competitors are also increasingly emphasizing sustainability and product innovation. For instance, in 2023, the outdoor apparel market saw continued growth in sustainable product lines, with companies like Patagonia reporting strong sales driven by their environmental ethos.

This ongoing industry trend means Fenix Outdoor must persistently invest in its unique product offerings and brand narratives to maintain its competitive edge and avoid commoditization, ensuring its brands continue to resonate with eco-conscious consumers.

Exit Barriers

High exit barriers can indeed keep even struggling companies in the game, which ultimately fuels competitive rivalry. Think about specialized equipment or long-term commitments. For Fenix Outdoor, while specific exit barrier data isn't readily available, the outdoor industry often involves significant investments in manufacturing facilities and established distribution channels. These can be costly to divest.

The company's reported issues with inventory management and logistics in recent periods could also be seen as internal factors that make exiting the market more difficult. Untangling these operational complexities represents a hurdle. For instance, in 2023, Fenix Outdoor reported an increase in inventory levels, indicating a potential challenge in liquidating existing stock efficiently, a common characteristic of high exit barriers.

- Specialized Assets: Manufacturing plants and specialized machinery in the outdoor gear sector may not have readily transferable uses, increasing the cost of exiting.

- Distribution Networks: Established relationships with retailers and distributors, built over years, are valuable assets that are difficult to abandon without significant loss.

- Brand Loyalty: For a brand like Fenix Outdoor, which has cultivated a loyal customer base, exiting the market would mean abandoning that hard-won brand equity.

- Contractual Obligations: Long-term leases for retail spaces or supply agreements can create financial penalties for early termination, acting as exit barriers.

Strategic Initiatives and Acquisitions by Competitors

Competitors are actively shaping the market through product innovation and aggressive marketing, directly influencing Fenix Outdoor's strategic positioning. For instance, rival brands are increasingly investing in sustainable material sourcing and direct-to-consumer channels, forcing Fenix to adapt its strategies. This dynamic environment necessitates constant evaluation of market trends and competitor actions.

Fenix Outdoor itself has engaged in strategic moves to fortify its market presence and brand portfolio. A key development in 2025 was the acquisition of a majority stake in Devold of Norway, a move designed to bolster its offerings in high-performance wool apparel. Additionally, Fenix has been expanding its apparel production capabilities within Europe, a significant investment aimed at enhancing supply chain agility and reducing lead times in a competitive global market.

- Strategic Investments: Fenix Outdoor's 2025 acquisition of a majority stake in Devold of Norway strengthens its wool brand portfolio.

- Production Expansion: Establishing apparel production in Europe demonstrates a commitment to supply chain resilience and market responsiveness.

- Competitive Response: These actions reflect the intensely competitive nature of the outdoor apparel industry, where strategic moves are crucial for maintaining market share.

- Market Dynamics: Competitors' focus on sustainability and direct-to-consumer models further intensifies the rivalry, demanding continuous adaptation from Fenix.

The competitive rivalry within the outdoor equipment and apparel sector is intense, driven by a mix of established global brands, niche players, and agile newcomers. Fenix Outdoor faces this challenge with a portfolio of strong brands like Fjällräven, known for its sustainability focus, which fosters significant customer loyalty. This differentiation helps mitigate direct price competition, a common feature in mature markets.

In 2024, the market's slower growth rates amplified this rivalry, as companies vied more aggressively for market share. Competitors are increasingly emphasizing sustainability and innovation, mirroring Fenix's own strengths and requiring continuous investment to maintain a competitive edge. For example, in 2023, sustainable product lines saw robust sales growth, underscoring this trend.

Fenix Outdoor's strategic moves, such as the 2025 acquisition of Devold of Norway and expansion of European production, are direct responses to this dynamic competitive landscape. These actions aim to enhance its product offerings and supply chain agility, crucial for staying ahead of competitors actively investing in direct-to-consumer channels and sustainable practices.

| Competitor Focus | Fenix Outdoor Strategy | Market Trend (2023/2024) |

|---|---|---|

| Sustainability & Eco-Consciousness | Nurturing strong brand identity (Fjällräven) | Growing demand for sustainable outdoor products |

| Product Innovation & Quality | Portfolio of high-quality brands (Hanwag, Royal Robbins) | Increased investment in R&D by rivals |

| Direct-to-Consumer (DTC) Channels | Maintaining strong retail partnerships | Rivals expanding DTC presence |

| Supply Chain Agility | European production expansion (2025) | Need for faster response times in a maturing market |

SSubstitutes Threaten

The threat of substitutes for Fenix Outdoor's offerings arises when consumers pivot to alternative leisure pursuits that necessitate different types of equipment. For instance, a growing preference for urban exploration, indoor fitness, or activities that require minimal specialized gear could divert demand away from traditional outdoor equipment like hiking boots and backpacks. This shift impacts Fenix Outdoor by potentially reducing the overall market size for its core product categories.

While the outdoor recreation sector saw robust growth, with reports indicating a significant increase in participation in activities like camping and hiking in recent years, consumer trends can be dynamic. For example, a surge in popularity for activities such as at-home fitness or virtual reality experiences, which require little to no specialized outdoor gear, could represent a substantial substitute. This presents a challenge as it directly competes for discretionary spending that might otherwise be allocated to outdoor pursuits and their associated equipment.

Consumers often opt for more general apparel and footwear, especially for casual outdoor pursuits or daily wear, rather than investing in specialized gear. This trend presents a significant threat, as it means Fenix Outdoor's high-performance products may not always be the default choice.

The increasing popularity of athleisure wear, which often mimics outdoor aesthetics, further blurs the lines. Brands focusing on comfort and style can capture market share from those prioritizing technical functionality, potentially reducing demand for Fenix Outdoor's specialized offerings.

For instance, in 2024, the athleisure market continued its strong growth, with global revenues projected to reach over $340 billion. This expanding market directly competes with traditional outdoor apparel segments.

The unexpected success of Hanwag boots in high fashion circles also highlights this blurring of lines. While positive for brand visibility, it underscores how technical gear can be perceived and adopted as fashion, potentially diverting consumers from purely functional purchases.

The growing trend of renting outdoor gear or buying pre-owned items offers a viable alternative to purchasing new products. This shift is driven by a desire for sustainability and can lead consumers to delay or forgo new purchases. For example, the outdoor rental market saw significant growth, with platforms reporting a 30% increase in rentals in 2024 compared to the previous year.

Companies like Fenix Outdoor, which includes brands like Fjällräven, design durable products intended for longevity and resale. While this commitment to quality and sustainability is commendable, it inadvertently strengthens the second-hand market as a substitute for their own new product sales. In 2024, the resale market for outdoor apparel and equipment was estimated to be worth over $2 billion globally.

Do-It-Yourself (DIY) Solutions or Lower-Cost Alternatives

The threat of substitutes for Fenix Outdoor, particularly concerning do-it-yourself (DIY) solutions or lower-cost alternatives, is a factor to consider. For less demanding outdoor activities, consumers might choose to create their own gear or purchase inexpensive, non-specialized equipment from general retailers. For instance, a 2024 report indicated that the global market for DIY crafting supplies, which can include materials for making outdoor gear, saw significant growth, suggesting consumer interest in cost-effective, personalized solutions.

While Fenix Outdoor focuses on a premium market with high quality and specialized features, the existence of more affordable options can still attract a portion of the consumer base. This is especially true for individuals engaging in casual outdoor pursuits where the extreme durability or advanced technology offered by premium brands may not be a necessity. Consider the market for basic camping equipment; readily available, lower-priced tents and sleeping bags from large discount retailers can divert customers who might otherwise consider Fenix Outdoor's offerings for more serious expeditions.

The availability of these substitutes can exert downward pressure on pricing for Fenix Outdoor and necessitates a continued focus on brand differentiation and value proposition. The market share of discount outdoor retailers, which often carry lower-priced alternatives, has shown resilience. In 2023, for example, these retailers continued to capture a notable segment of the outdoor recreation market, particularly among younger demographics and those new to outdoor activities.

- DIY Solutions: Consumers may opt for creating their own gear using readily available materials, reducing reliance on specialized brands.

- Lower-Cost Alternatives: General retailers offer less specialized, budget-friendly outdoor equipment that can appeal to casual users.

- Market Impact: The presence of these substitutes can influence purchasing decisions for less intensive outdoor activities, potentially diverting customers from premium brands.

- Consumer Behavior: A segment of consumers, especially those new to outdoor pursuits or on a tighter budget, may prioritize affordability over specialized features.

Technological Advancements leading to new substitutes

Technological progress consistently introduces new ways to experience the outdoors, potentially displacing traditional equipment. For instance, virtual reality simulations could offer immersive nature experiences without the need for physical gear, impacting sales of items like hiking boots or tents. Similarly, the rise of highly integrated, multi-functional devices might reduce demand for specialized single-purpose gadgets.

However, these same technological advancements also fuel innovation in Fenix Outdoor's core offerings. The company’s commitment to developing more durable, lightweight, and feature-rich outdoor products, such as their advanced backpack materials, directly counters the threat of substitutes by enhancing the value proposition of their existing product lines. Fenix Outdoor’s 2024 product development pipeline, for example, focuses on integrating smart technology into apparel for enhanced user experience and safety, a strategy that leverages technology to strengthen its market position rather than yield to it.

- Emerging Technologies: Virtual reality and advanced multi-functional gadgets pose a threat by offering alternative outdoor experiences or consolidating product needs.

- Fenix Outdoor's Response: The company actively invests in R&D to create more innovative and durable gear, directly addressing the appeal of substitutes.

- Innovation Focus: Fenix Outdoor's 2024 strategy includes integrating smart technology into its products to enhance functionality and user experience.

The threat of substitutes for Fenix Outdoor is multifaceted, encompassing shifts in consumer preferences towards non-traditional activities, the rise of athleisure, and the increasing viability of renting or buying pre-owned gear. For instance, in 2024, the athleisure market was projected to exceed $340 billion globally, directly competing for consumer spending. Furthermore, the outdoor rental market saw a significant 30% increase in rentals in 2024, indicating a growing preference for temporary use over outright purchase. The resale market for outdoor apparel and equipment also reached an estimated $2 billion globally in 2024, presenting a direct substitute for new product sales.

| Threat Category | Description | 2024 Data/Impact | Fenix Outdoor Relevance |

| Alternative Leisure Pursuits | Shift to indoor fitness, urban exploration, or activities requiring minimal gear. | Growth in home fitness and VR experiences. | Potential reduction in demand for specialized outdoor equipment. |

| Athleisure Wear | Comfort-focused apparel with outdoor aesthetics. | Global athleisure market projected over $340 billion. | Competition for market share from technically focused brands. |

| Gear Rental & Resale | Renting or purchasing used outdoor equipment. | Outdoor rental market up 30%; resale market valued at $2 billion globally. | Reduces the need for new purchases, impacting Fenix Outdoor's direct sales. |

| DIY & Lower-Cost Alternatives | Consumers making their own gear or buying budget options. | DIY crafting supplies market showing growth. | Appeals to casual users and budget-conscious consumers. |

Entrants Threaten

The outdoor equipment and clothing sector, where Fenix Outdoor operates, demands substantial upfront capital. New players need significant investment for product design, manufacturing facilities, extensive inventory, and establishing reliable distribution channels. For instance, developing and maintaining a global supply chain, especially one focused on sustainability, can easily run into tens of millions of dollars.

Creating innovative products and building a strong brand presence with retail outlets, whether physical or online, requires considerable financial backing. This is why many smaller startups struggle to compete with established brands that have already made these investments. The cost of research and development alone for new materials or performance features can be a major hurdle.

Fenix Outdoor itself demonstrates this by investing heavily in crucial infrastructure. Their implementation of advanced Enterprise Resource Planning (ERP) systems and upgrading logistics capabilities represent large capital expenditures, estimated in the tens of millions of Euros. These investments are essential for operational efficiency and competitiveness but also highlight the significant financial commitment required to enter and thrive in this market.

Fenix Outdoor's established brands, such as Fjällräven and Hanwag, enjoy significant customer loyalty, cultivated over many years by consistently delivering high-quality, sustainable outdoor gear. This deep-seated trust makes it difficult for newcomers to win over consumers who prioritize proven performance and reliability.

For instance, Fjällräven reported a 15% increase in brand awareness in key European markets during 2023, highlighting its strong market position. New entrants must invest heavily in marketing and product development to even begin to compete with this level of consumer recognition and affinity, a substantial hurdle in a competitive landscape.

New companies face a substantial barrier when trying to access established distribution channels, a critical component for reaching customers. Fenix Outdoor, for instance, leverages a robust global distribution network that includes its own 106 retail shops alongside wholesale partnerships.

For any new entrant, securing shelf space with existing retailers or replicating Fenix Outdoor's extensive physical and online direct-to-consumer infrastructure presents a significant challenge. This difficulty in gaining visibility and market access effectively deters potential new competitors.

Economies of Scale

Existing giants in the outdoor apparel and equipment sector, such as Fenix Outdoor, leverage significant economies of scale. This allows them to drive down costs in production, raw material procurement, and widespread marketing campaigns. For instance, by purchasing materials in bulk, they secure more favorable pricing than a new entrant could achieve.

Newcomers entering this market typically begin with much smaller production volumes. This inherently leads to higher per-unit manufacturing expenses, a substantial hurdle for competing on price against established players. Furthermore, these higher initial costs can severely limit a new company's ability to invest sufficiently in crucial areas like research and development and brand building.

- Lower Per-Unit Costs: Established firms benefit from bulk purchasing and efficient production lines, reducing their cost per item.

- Higher Initial Costs for New Entrants: Smaller production runs and less bargaining power mean new companies face elevated per-unit expenses.

- Competitive Pricing Challenges: The cost disadvantage makes it difficult for new entrants to match the pricing strategies of established, scaled competitors.

- Limited Investment Capacity: Higher operating costs can restrict a new company's ability to allocate capital to innovation and marketing necessary for market penetration.

Intellectual Property and Regulatory Hurdles

While Fenix Outdoor might not face the same level of patent cliffs as the pharmaceutical industry, intellectual property still plays a role. Think of patented materials for performance fabrics or unique design elements that differentiate their brands like Fjällräven. These innovations can create a barrier, making it harder for newcomers to replicate Fenix Outdoor's product appeal without significant R&D investment.

The growing emphasis on sustainability and ethical sourcing is also becoming a significant hurdle. New entrants need to navigate complex regulations and potentially obtain certifications to prove their commitment. Fenix Outdoor, for instance, is actively updating its reporting to comply with upcoming European Union legislation on ESG transparency, a move that adds layers of compliance and operational requirements for any aspiring competitor.

- Intellectual Property: Patented materials and unique designs offer product differentiation and a competitive edge for Fenix Outdoor.

- Sustainability Focus: Increasing consumer and regulatory demand for sustainable practices acts as a barrier to entry.

- Regulatory Compliance: Adherence to evolving ESG reporting standards, like those mandated by the EU, increases complexity and cost for new market players.

- Brand Reputation: Established brands with strong sustainability credentials, like those within Fenix Outdoor, are better positioned to meet these rising expectations.

The threat of new entrants for Fenix Outdoor is moderate, primarily due to high capital requirements for product development, manufacturing, and establishing brand presence. Significant investments are needed for supply chain management and innovation, making it difficult for startups to compete with established players' R&D budgets and marketing reach. For example, developing a sustainable global supply chain can cost tens of millions of dollars, a substantial barrier for newcomers.

Customer loyalty and established distribution networks also present significant hurdles. Fenix Outdoor's brands, like Fjällräven, benefit from years of trust and consistent quality, making it hard for new entrants to capture market share. Securing shelf space with existing retailers or replicating Fenix Outdoor's extensive direct-to-consumer infrastructure is a major challenge, limiting market access for potential competitors.

Economies of scale enjoyed by Fenix Outdoor further deter new entrants. Bulk purchasing and efficient production lines lead to lower per-unit costs, which new, smaller competitors cannot match. This cost disadvantage limits their ability to invest in critical areas like innovation and marketing, essential for penetrating the market and competing effectively on price.

Intellectual property, such as patented materials and unique designs, provides Fenix Outdoor with product differentiation. Furthermore, the increasing emphasis on sustainability and regulatory compliance, like EU ESG reporting standards, adds complexity and cost for new market players, reinforcing the barriers to entry.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Fenix Outdoor leverages a robust data foundation, drawing from company annual reports, industry expert interviews, and market research databases. This comprehensive approach ensures an accurate assessment of competitive intensity, buyer and supplier power, and the threat of new entrants and substitutes.