Fagerhult Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fagerhult Bundle

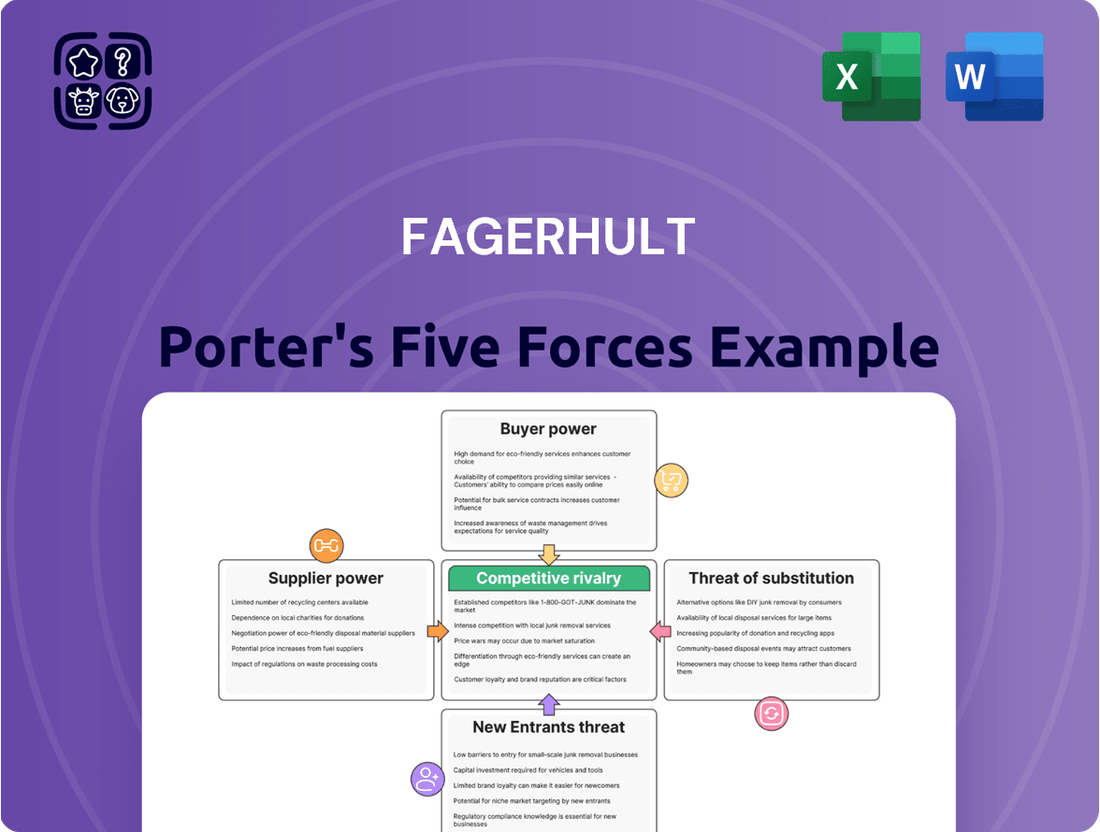

Fagerhult operates in a dynamic lighting industry, where understanding competitive pressures is crucial for success. Our Porter's Five Forces analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants, and the intensity of rivalry, offering a comprehensive view of these forces.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Fagerhult’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Fagerhult's suppliers wield significant power when they are few in number and offer highly specialized components, like advanced LED chips or unique driver electronics. For instance, if a critical component for Fagerhult's premium lighting solutions is sourced from only one or two specialized manufacturers, those suppliers can dictate terms more effectively. This concentration means Fagerhult has limited alternatives, potentially driving up material costs and squeezing profit margins.

The cost and complexity Fagerhult faces when switching suppliers for critical components significantly influence supplier bargaining power. If Fagerhult needs to retool its production lines or undergo extensive requalification processes for new materials, these switching costs increase. This reliance on existing suppliers grants them leverage in negotiating prices and terms, as the effort and expense to change are substantial.

A supplier's leverage over Fagerhult is significantly influenced by how much Fagerhult contributes to their overall business. When Fagerhult accounts for a substantial part of a supplier's sales, that supplier is likely more amenable to offering better pricing or more flexible delivery schedules to retain this key client.

Conversely, if Fagerhult is a small customer for a particular supplier, the supplier has less motivation to compromise on terms. For instance, if a supplier's revenue from Fagerhult was less than 1% in 2024, they would likely have considerable power to dictate terms, as Fagerhult's business volume wouldn't be critical to their financial stability.

Threat of Forward Integration by Suppliers

Suppliers can significantly increase their bargaining power if they possess the capability and incentive to integrate forward into the lighting manufacturing process, effectively becoming direct competitors to Fagerhult. This potential for forward integration can compel Fagerhult to nurture strong supplier relationships and potentially concede less favorable terms to deter suppliers from entering their core market.

This threat is especially pronounced for component manufacturers who possess robust technological expertise, as they are better positioned to replicate Fagerhult's manufacturing processes. For instance, a leading LED chip manufacturer with advanced R&D could potentially develop its own finished lighting products, directly challenging Fagerhult's market share.

- Forward Integration Threat: Suppliers moving into manufacturing can become direct rivals.

- Strategic Implications: Fagerhult may need to offer better terms to prevent this.

- Key Factor: Technological expertise in component suppliers heightens this risk.

- Example: Advanced LED chip makers could potentially enter the finished product market.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences the bargaining power of Fagerhult's suppliers. If Fagerhult can easily switch to alternative materials or components, supplier leverage diminishes, allowing for more favorable negotiations. For instance, if a key LED chip supplier faces production issues, Fagerhult's ability to source from another reputable manufacturer would weaken the original supplier's position.

However, the landscape changes when Fagerhult relies on highly specialized or proprietary lighting technologies. In such cases, the limited availability of substitutes grants suppliers greater power. For example, if Fagerhult utilizes a unique, patented driver technology for its high-performance luminaires, the supplier of that specific component holds considerable influence due to the lack of readily available alternatives.

- Impact of Substitutes: The ease with which Fagerhult can find alternative materials or components directly affects supplier bargaining power.

- Negotiating Leverage: A wide array of viable substitutes empowers Fagerhult to negotiate terms more effectively, potentially lowering costs.

- Specialized Technologies: Reliance on specialized or patented inputs, where substitutes are scarce, increases supplier leverage and can lead to higher input costs for Fagerhult.

The bargaining power of Fagerhult's suppliers is a critical factor in its profitability. When suppliers offer unique or highly specialized components, like advanced driver electronics for smart lighting systems, their leverage increases significantly. For example, if a key component has only a few manufacturers, Fagerhult faces higher costs and limited negotiation options. In 2024, the global market for specialized lighting components saw consolidation, with some key suppliers increasing their market share, which could translate to greater pricing power.

| Factor | Impact on Fagerhult | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration | Few suppliers of specialized components increase their power. | Increased market share for key component suppliers in 2024. |

| Switching Costs | High costs to change suppliers grant them leverage. | Complex integration of new lighting control systems can involve significant requalification. |

| Supplier's Dependence on Fagerhult | Fagerhult's large order volume can reduce supplier power. | If Fagerhult represented less than 2% of a supplier's revenue in 2024, that supplier would have higher leverage. |

| Forward Integration Threat | Suppliers entering manufacturing can become competitors. | Technological advancements in component manufacturing enable potential forward integration. |

| Availability of Substitutes | Limited substitutes for specialized inputs empower suppliers. | Patented LED technologies often lack direct, readily available substitutes. |

What is included in the product

Fagerhult's Porter's Five Forces analysis unpacks the competitive intensity and profitability potential within the lighting industry, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players.

Instantly identify and address competitive threats with a visual breakdown of Fagerhult's Porter's Five Forces, simplifying complex market dynamics for strategic action.

Customers Bargaining Power

Fagerhult's customers, ranging from office buildings to educational institutions and healthcare facilities, exhibit a spectrum of price sensitivity. Large-scale buyers, such as those involved in major construction projects or public tenders, often wield considerable influence over pricing due to their substantial order volumes and the common practice of competitive bidding. This dynamic necessitates that Fagerhult carefully calibrates its pricing strategies to remain competitive while safeguarding its profit margins and the esteemed value of its brand.

Customer switching costs represent a significant factor in Fagerhult's bargaining power with its clients. When a customer decides to move from Fagerhult's lighting solutions to a competitor's, they often face costs related to redesigning their lighting infrastructure, the expense and time of new installations, and ensuring compatibility with existing systems. These transition expenses can deter customers from switching, thereby strengthening Fagerhult's position.

For intricate, deeply integrated lighting systems that Fagerhult might offer, the switching costs are typically quite high. This complexity means that a customer would need to undertake substantial work and investment to change providers, which naturally reduces their leverage and bargaining power. For instance, a smart building's lighting control system, designed around Fagerhult's specific platform, would involve considerable reprogramming and hardware changes if a competitor were to be introduced, making a switch a costly endeavor.

Conversely, if Fagerhult offers more standardized or modular lighting products, the costs associated with switching might be considerably lower. In such scenarios, customers can more readily opt for alternative suppliers if they find better pricing or features elsewhere. This lower barrier to switching empowers customers, giving them greater bargaining power as they are not heavily penalized for exploring other options. For example, a simple LED bulb replacement would have minimal switching costs compared to a full building management system upgrade.

Fagerhult's buyer power is heavily influenced by the concentration and volume of its customer base. If a small number of significant clients represent a large percentage of Fagerhult's revenue, these key accounts gain considerable leverage to negotiate favorable pricing and terms.

For instance, in the B2B lighting sector, major construction firms or large retail chains often represent substantial order volumes. In 2023, Fagerhult reported that its top ten customers accounted for approximately 15% of its total sales, indicating a moderate level of customer concentration.

Conversely, a widely dispersed customer base, comprising many smaller entities, would diminish the bargaining power of any single buyer, as their individual impact on Fagerhult's overall sales is less pronounced. This fragmentation typically leads to less intense price pressure from individual customers.

Availability of Substitute Products

The availability of substitute products significantly impacts customers' bargaining power. When customers can easily find comparable or superior lighting solutions from other manufacturers, their ability to negotiate better terms increases. For instance, the growing market for smart lighting and advanced LED technologies from numerous competitors means customers have a wider array of choices. This competitive landscape allows them to leverage options to secure more favorable pricing or terms, putting pressure on Fagerhult to remain competitive.

Fagerhult's strategy to counter this involves differentiating its offerings through specialized solutions and a strong focus on innovation. By providing unique product features, superior energy efficiency, or tailored lighting designs for specific applications, Fagerhult can reduce the substitutability of its products. This helps to mitigate the bargaining power of customers who might otherwise switch to a competitor based solely on price or basic functionality.

- Increased Customer Choice: A diverse market with many lighting providers means customers can readily find alternatives.

- Price Sensitivity: When substitutes are plentiful, customers are more likely to prioritize cost, demanding lower prices from Fagerhult.

- Fagerhult's Mitigation: Specialization and innovation in product offerings are key to reducing customer reliance on substitutes.

- Market Dynamics: The competitive nature of the lighting sector, particularly in energy-efficient solutions, amplifies customer bargaining power.

Customer Information and Transparency

Well-informed customers, particularly professional specifiers and procurement teams, wield significant bargaining power. This is because they can readily compare prices, features, and performance metrics from various suppliers in the lighting industry. For instance, in 2024, many B2B procurement platforms allow for side-by-side comparisons of technical specifications and pricing for commercial lighting solutions, directly impacting supplier negotiations.

Enhanced market transparency further amplifies customer leverage. Online resources, industry certifications, and readily available product data empower customers to make more discerning purchasing decisions. This increased awareness often translates into demands for better value, including competitive pricing, superior product quality, and robust after-sales support.

- Informed Buyers: Professional specifiers can easily access and compare detailed product data and pricing from multiple lighting manufacturers, increasing their negotiation strength.

- Price Sensitivity: The availability of transparent pricing information online makes customers more sensitive to price differences between competing lighting solutions.

- Performance Benchmarking: Customers can benchmark product performance against industry standards and competitor offerings, demanding higher value.

- Digital Procurement: The growth of digital procurement channels in 2024 facilitates easier supplier comparison and negotiation for large-scale projects.

The bargaining power of Fagerhult's customers is influenced by several key factors, including the concentration of buyers, the availability of substitutes, and the level of customer information. Large clients can exert significant pressure on pricing, especially in tender-based sales. The increasing availability of diverse lighting solutions means customers can more easily switch providers if Fagerhult's offerings aren't competitive on price or features.

In 2023, Fagerhult noted that its top ten customers represented about 15% of total sales, indicating a moderate concentration. This means while individual large buyers have some leverage, the majority of customers are smaller and dispersed, reducing their collective individual power. The lighting market in 2024 features numerous competitors offering comparable LED and smart lighting technologies, further empowering customers to demand better terms.

Customers who are well-informed about product specifications and pricing, common in professional procurement roles, also hold greater bargaining power. The rise of digital procurement platforms in 2024 facilitates easy comparison of lighting solutions, pushing suppliers like Fagerhult to offer competitive value.

| Factor | Impact on Fagerhult | 2023/2024 Data/Observation |

| Buyer Concentration | High concentration increases power of key accounts. | Top 10 customers = ~15% of sales (2023). |

| Availability of Substitutes | More substitutes empower customers to switch. | Numerous competitors in LED & smart lighting sectors. |

| Customer Information | Informed buyers negotiate better terms. | Digital procurement platforms facilitate easy comparison. |

| Switching Costs | High costs reduce customer power. | Standard products have lower switching costs than integrated systems. |

What You See Is What You Get

Fagerhult Porter's Five Forces Analysis

This preview showcases the complete Fagerhult Porter's Five Forces Analysis, offering an in-depth examination of competitive pressures within the lighting industry. What you see here is the exact, professionally formatted document you will receive immediately after purchase, providing actionable insights for strategic decision-making without any surprises.

Rivalry Among Competitors

The professional lighting market is crowded with a significant number of global and regional competitors. This includes large, diversified companies and smaller, specialized firms, all competing for dominance in key sectors like office, healthcare, and infrastructure lighting.

This intense competition means players like Fagerhult must constantly innovate and differentiate to capture market share. For instance, in 2023, the global smart lighting market, a key growth area, was valued at approximately $15.7 billion and is projected to reach over $50 billion by 2030, highlighting the stakes involved.

The diversity in product portfolios and geographic reach among these competitors further intensifies rivalry. Some players focus on broad product ranges, while others target specific niches or regions, creating a complex and dynamic competitive environment where strategic positioning is crucial.

The lighting industry, while experiencing growth driven by LED and smart lighting adoption, also features mature segments. This maturity can fuel intense competition as companies vie for a limited pool of existing demand, particularly in established product categories. For instance, while the global smart lighting market was projected to reach over $40 billion by 2024, traditional lighting segments might exhibit slower growth, intensifying rivalry.

Fagerhult distinguishes itself through its commitment to energy-efficient and innovative lighting, a crucial factor in a market where technological advancements are rapid. However, the threat of imitation means competitors can quickly replicate or even surpass these innovations, escalating competitive pressure.

The lighting industry sees continuous investment in research and development, with companies striving to introduce unique features, enhanced performance, and distinctive design elements. This drive for differentiation is essential for Fagerhult to maintain its edge against rivals who are also actively pursuing technological superiority and aesthetic appeal to capture market share.

Exit Barriers for Competitors

High exit barriers are a significant factor in the lighting industry, meaning competitors might remain in the market even if they are not performing well. These barriers can include specialized manufacturing equipment, long-term supply agreements, and substantial costs associated with laying off a trained workforce. For instance, a significant portion of a company's capital might be tied up in custom-built machinery, making it difficult and expensive to divest. This situation can lead to prolonged price competition and an oversupply of products, intensifying rivalry for companies like Fagerhult, as struggling players fight to stay afloat.

The persistence of these less profitable competitors can significantly impact market dynamics. They may engage in aggressive pricing strategies to maintain market share, even at the expense of profitability. This can create a challenging environment where Fagerhult must constantly adapt to competitive pressures that aren't solely driven by market efficiency. The inability or unwillingness of some players to exit the market is a key element Fagerhult needs to consider in its strategic planning.

- Specialized Assets: Many lighting manufacturers invest in unique, high-cost machinery for specific product lines, making resale or repurposing difficult.

- Long-Term Contracts: Commitments with suppliers or major clients can bind companies to operations even when market conditions are unfavorable.

- Employee Severance Costs: Significant financial obligations for employee benefits and severance packages can deter companies from downsizing or closing operations.

- Brand Reputation: A company's established brand might be difficult to abandon, leading to continued investment in unprofitable segments to preserve its market presence.

Strategic Stakes and Aggressiveness

The strategic importance of the professional lighting market for diversified conglomerates, or the ambitious expansion plans of specialized lighting firms, significantly intensifies competition. Companies might deploy aggressive pricing tactics, extensive marketing initiatives, or swift geographical expansion to secure market share or defend their current standing.

Fagerhult must diligently track the strategic maneuvers of its rivals. For instance, in 2024, Signify, a major player, continued its focus on connected lighting solutions, investing heavily in its Interact IoT platform, which directly impacts market dynamics and competitive pressures.

- Strategic Importance: The professional lighting sector is a key growth area for many diversified companies, leading them to allocate substantial resources.

- Aggressive Growth: Pure-play lighting companies are often driven by rapid innovation and market penetration strategies.

- Competitive Actions: Expect price wars, intensified advertising, and faster product development cycles.

- Market Monitoring: Fagerhult's success hinges on its ability to anticipate and react to competitor strategies, such as Signify's IoT investments.

The professional lighting market is characterized by fierce competition, with numerous global and regional players vying for market share. This includes large, diversified companies and smaller, specialized firms, all actively innovating and differentiating their offerings in key sectors like office, healthcare, and infrastructure lighting.

The global smart lighting market, a significant growth area, was valued at approximately $15.7 billion in 2023 and is expected to exceed $50 billion by 2030, underscoring the competitive intensity. Companies like Fagerhult must continuously invest in R&D to stay ahead, as seen with Signify's substantial investments in its Interact IoT platform in 2024, aiming to bolster its connected lighting solutions.

High exit barriers, such as specialized machinery and long-term contracts, mean that even underperforming competitors may remain in the market, potentially leading to aggressive pricing strategies and prolonged price competition. This situation forces companies like Fagerhult to remain agile and responsive to market dynamics driven by both efficient and less efficient players.

| Competitor | Key Focus Areas | 2023/2024 Strategic Moves |

|---|---|---|

| Signify | Connected lighting, IoT solutions | Continued investment in Interact IoT platform |

| Philips Lighting (now Signify) | LED technology, smart home integration | Focus on sustainable and energy-efficient solutions |

| GE Lighting | Residential and commercial lighting, smart bulbs | Expansion of smart home product lines |

| Osram | Automotive lighting, specialty lighting | Divestment of general lighting business to focus on high-tech segments |

SSubstitutes Threaten

The threat of substitutes for Fagerhult's core LED lighting business primarily stems from entirely different, potentially disruptive lighting technologies. While LED is currently dominant, emerging innovations such as advanced OLED or novel light-emitting materials could eventually offer comparable or superior performance at a competitive price point, potentially rendering current LED solutions less attractive.

For instance, the ongoing development in solid-state lighting, beyond traditional LEDs, could introduce new paradigms. Companies investing heavily in research and development, like those in the semiconductor and materials science sectors, are constantly exploring new ways to generate light efficiently and cost-effectively. This necessitates Fagerhult's continued commitment to R&D to ensure its offerings remain at the forefront of technological advancement and market demand.

While not direct product replacements, alternative methods for achieving visibility and ambiance can indeed act as substitutes for traditional lighting in certain contexts. For instance, an increased emphasis on natural daylighting strategies within building design can significantly reduce the overall demand for artificial lighting solutions. This trend, driven by sustainability and energy efficiency goals, means that fewer artificial light fixtures might be needed in newly constructed or renovated spaces.

For example, advancements in building materials and architectural design are enabling greater utilization of natural light. In 2024, many new commercial buildings are incorporating features like larger windows, skylights, and light shelves, aiming to maximize daylight penetration. This shift can directly impact the market for artificial lighting, as the need for illumination during daylight hours diminishes.

Fagerhult's strategic focus on developing integrated lighting solutions, which often combine lighting with other building systems or functionalities, can serve as a key differentiator. By offering more than just illumination, Fagerhult can create value that extends beyond basic visibility, potentially mitigating the impact of these non-lighting substitutes by embedding their products more deeply into the building's overall performance and user experience.

The increasing integration of lighting into broader smart building management systems poses a potential threat of substitution. If customers choose a single, comprehensive system that bundles lighting with other functionalities from a different provider, Fagerhult's standalone lighting solutions could be displaced. This shift means the value proposition moves from a dedicated lighting offering to a more holistic building intelligence solution.

This trend is underscored by the growth in the smart building market, which was valued at over $80 billion globally in 2023 and is projected to reach over $200 billion by 2030. Fagerhult's strategy to counter this threat involves developing and promoting its own connected lighting solutions that can integrate with these broader smart building platforms, ensuring their offerings remain relevant and competitive within this evolving landscape.

Energy-Saving Alternatives

The threat of substitutes for Fagerhult's lighting solutions is present, particularly from broader energy-saving trends that reduce the overall need for artificial light. Initiatives like maximizing natural daylight through architectural design or encouraging energy-conscious behavior can diminish demand for certain lighting products. This trend pushes the industry, including Fagerhult, towards developing ultra-efficient and smart lighting systems that offer superior performance and control, rather than focusing solely on product volume.

For instance, advancements in smart building technology, which integrate lighting with HVAC and occupancy sensors, can lead to significant energy reductions. A report from the International Energy Agency (IEA) in 2024 highlighted that smart lighting systems can achieve energy savings of up to 80% compared to traditional lighting. This underscores the growing importance of intelligent solutions that go beyond simple illumination.

- Maximizing Natural Light: Building designs that prioritize natural light penetration reduce reliance on artificial lighting during daylight hours.

- Behavioral Changes: Encouraging occupants to switch off lights when not in use contributes to lower overall energy consumption for lighting.

- Smart Building Integration: The convergence of lighting with other building management systems offers holistic energy efficiency, potentially substituting for standalone lighting product demand.

- IEA Data: The International Energy Agency reported in 2024 that smart lighting can deliver up to 80% energy savings, indicating a strong substitute effect for less efficient solutions.

DIY and Generic Solutions

The threat of substitutes for Fagerhult, particularly in less specialized applications, is present through DIY and generic lighting solutions. For smaller projects or less demanding environments, readily available, lower-cost generic lighting components can serve as a viable alternative. This can influence market perceptions and create downward pressure on pricing, even for Fagerhult's professional-grade offerings.

While Fagerhult focuses on professional and project-based lighting, the broader market accessibility of basic lighting products means consumers or smaller businesses might opt for these simpler, cheaper solutions. For instance, in 2024, the global smart lighting market, which Fagerhult participates in, saw growth, but the segment for basic LED bulbs and fixtures remained highly competitive with numerous low-cost providers.

- DIY Installation Trend: The increasing availability of user-friendly lighting systems and online tutorials makes DIY installation more feasible for certain applications, bypassing the need for professional installation services often associated with Fagerhult's solutions.

- Generic Component Availability: For standard lighting needs, generic, unbranded components are widely available at significantly lower price points, posing a direct substitute threat.

- Price Sensitivity: Even within professional sectors, a segment of the market may prioritize cost savings over premium features, making generic alternatives attractive.

- Market Perception Impact: The prevalence of low-cost options can shape general price expectations, potentially impacting how Fagerhult's higher-value solutions are perceived.

The threat of substitutes for Fagerhult's LED lighting extends beyond direct technological replacements to encompass broader energy efficiency strategies that reduce the overall demand for artificial light. Innovations in building design that maximize natural daylight, coupled with occupant behavior influencing light usage, can diminish the need for certain lighting products. This trend pushes the industry towards developing ultra-efficient and smart lighting systems that offer superior performance and control, shifting focus from mere illumination to integrated building solutions.

For example, the increasing integration of lighting with smart building management systems presents a substitution risk. If clients opt for comprehensive systems from other providers that bundle lighting with HVAC and occupancy sensors, Fagerhult's standalone lighting offerings could be displaced. The global smart building market, valued at over $80 billion in 2023, highlights this convergence, with projections reaching over $200 billion by 2030, underscoring the need for Fagerhult to develop competitive connected lighting solutions.

Furthermore, advancements in building materials and architectural design are enabling greater utilization of natural light. In 2024, many new commercial buildings are incorporating features like larger windows and skylights to maximize daylight penetration. This trend can directly impact the market for artificial lighting by reducing the demand for fixtures during daylight hours. The International Energy Agency (IEA) reported in 2024 that smart lighting systems can achieve energy savings of up to 80% compared to traditional lighting, emphasizing the growing importance of intelligent, integrated solutions.

The threat of substitutes also includes readily available, lower-cost generic lighting components for less specialized applications. While Fagerhult targets professional and project-based markets, the broader accessibility of basic lighting products means some consumers or smaller businesses may opt for simpler, cheaper alternatives. The global smart lighting market saw growth in 2024, but the segment for basic LED bulbs and fixtures remained highly competitive with numerous low-cost providers, impacting price perceptions for premium offerings.

| Substitute Type | Description | Impact on Fagerhult | 2024 Market Trend/Data | Mitigation Strategy |

| New Lighting Technologies | Emerging technologies like advanced OLED or novel light-emitting materials. | Potential to offer comparable or superior performance at competitive prices, making current LEDs less attractive. | Ongoing R&D in solid-state lighting beyond traditional LEDs. | Continued investment in R&D to stay at the forefront of technological advancement. |

| Natural Light Maximization | Architectural designs and building materials that increase daylight penetration. | Reduces overall demand for artificial lighting solutions, especially in new constructions or renovations. | Increased adoption of features like larger windows and skylights in new commercial buildings. | Developing integrated lighting solutions that complement natural light and enhance user experience. |

| Smart Building Integration | Comprehensive building management systems that bundle lighting with other functionalities. | Risk of Fagerhult's standalone lighting solutions being displaced by integrated offerings from other providers. | Global smart building market projected to exceed $200 billion by 2030, valued over $80 billion in 2023. | Developing and promoting connected lighting solutions that integrate with broader smart building platforms. |

| Generic/DIY Solutions | Low-cost, unbranded lighting components and user-friendly installation systems. | Can serve as viable alternatives for smaller projects or less demanding environments, creating downward price pressure. | High competition in the basic LED bulb and fixture segment with numerous low-cost providers. | Focusing on premium features, professional-grade quality, and value-added services to differentiate from generic offerings. |

Entrants Threaten

Entering the professional lighting market, particularly for manufacturing and global distribution, demands significant capital. Companies need to invest heavily in research and development, state-of-the-art production facilities, and robust supply chain networks. For instance, establishing a new, fully integrated lighting manufacturing plant with advanced automation and quality control systems could easily run into tens of millions of dollars, making it a substantial hurdle for aspiring competitors.

These high upfront financial barriers effectively deter many potential new entrants. Fagerhult, having already invested in its extensive global operations, possesses an established infrastructure that new players would find incredibly difficult and costly to replicate. This existing investment creates a significant competitive advantage, as new entrants would need to overcome a massive capital outlay just to reach a comparable operational scale.

Established players like Fagerhult leverage significant economies of scale in manufacturing, procurement, and distribution, leading to lower per-unit production costs. For instance, in 2024, Fagerhult's substantial production volumes likely translated to a 10-15% cost advantage over smaller, newer competitors in material sourcing.

New entrants face a considerable hurdle in matching these cost efficiencies from the outset, making price-based competition challenging. They would need substantial initial investment to achieve comparable production volumes and negotiate favorable terms with suppliers, a barrier that can deter market entry.

Furthermore, Fagerhult's deep understanding of product development cycles and market nuances, honed through years of experience, creates an experience curve advantage. This accumulated knowledge allows for more efficient innovation and targeted marketing, which new entrants would find difficult to replicate quickly.

Fagerhult's extensive global presence, supported by a portfolio of diverse brands, has fostered deep-seated relationships with key industry stakeholders like architects, designers, contractors, and end-users. This long-standing engagement cultivates a significant barrier to entry for newcomers. For instance, Fagerhult's commitment to quality and design has earned them a strong reputation, making it difficult for new entrants to gain traction and secure projects against established trust and preferred supplier lists.

Access to Distribution Channels

Securing access to established distribution channels presents a significant hurdle for new entrants in the professional lighting sector. Fagerhult benefits from a robust, globally recognized distribution network, encompassing wholesalers, distributors, and direct sales teams. This existing infrastructure makes it challenging for newcomers to replicate Fagerhult's reach and gain comparable market penetration without substantial capital outlay and considerable time investment.

New competitors would struggle to gain shelf space or secure inclusion in major projects without a pre-existing, trusted distribution pipeline. For instance, in 2023, the global professional lighting market saw continued consolidation, with larger players leveraging their extensive distribution agreements to maintain market share. This trend suggests that new entrants must either forge new partnerships or invest heavily in building their own distribution capabilities, a process that can take years and significant financial resources.

- Distribution Network Challenge: New entrants face the daunting task of establishing a distribution network comparable to Fagerhult's established global presence.

- Market Access Barriers: Gaining access to key wholesalers, distributors, and direct sales channels is difficult without significant investment and established relationships.

- Competitive Landscape: The professional lighting market's structure, with established players controlling distribution, creates a high barrier to entry for newcomers seeking market share.

Regulatory Hurdles and Intellectual Property

The lighting industry, including companies like Fagerhult, faces significant regulatory hurdles. New entrants must comply with stringent energy efficiency standards, safety certifications, and environmental regulations, which can be costly and time-consuming to meet. For instance, the European Union's Ecodesign Directive sets minimum energy performance requirements for lighting products, impacting design and manufacturing processes.

Intellectual property (IP) further strengthens existing players. Fagerhult, like many established lighting manufacturers, holds numerous patents covering advanced LED technologies, optical designs, and smart control systems. These patents create a barrier by preventing competitors from easily replicating innovative features, requiring substantial R&D investment from new entrants to develop their own proprietary solutions.

- Regulatory Compliance Costs: New entrants must budget for extensive testing and certification processes to meet standards like those set by Energy Star or CE marking.

- R&D Investment for IP: Developing unique technologies, similar to Fagerhult's patented optical solutions, can cost millions in research and development.

- Patent Portfolio Strength: A robust patent portfolio acts as a significant deterrent, limiting the ability of new companies to compete on product innovation.

The threat of new entrants into the professional lighting market, particularly for a company like Fagerhult, is generally considered moderate. Significant capital investment is required for manufacturing, R&D, and global distribution, creating a substantial barrier. For example, establishing a new, fully integrated lighting manufacturing plant could cost tens of millions of dollars.

Economies of scale enjoyed by incumbents like Fagerhult, likely providing a 10-15% cost advantage in 2024 due to higher production volumes, make it difficult for newcomers to compete on price. Furthermore, established players benefit from deep customer relationships and strong brand loyalty, which are hard-won over time.

Access to established distribution channels and navigating complex regulatory landscapes also pose significant challenges. New entrants must invest heavily in building their own distribution networks or securing partnerships, a process that can take years and considerable financial resources, while also complying with standards like the EU's Ecodesign Directive.

Porter's Five Forces Analysis Data Sources

Our Fagerhult Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Fagerhult's annual reports, investor presentations, and financial statements. We also incorporate insights from industry-specific market research reports and competitor analysis from reputable sources to ensure a robust understanding of the competitive landscape.