Fagerhult Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fagerhult Bundle

Unlock the strategic potential of Fagerhult's product portfolio with a clear understanding of its position within the BCG Matrix. See which products are driving growth, which are sustaining the business, and which require careful consideration. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize your investment strategy.

Stars

Fagerhult's smart lighting solutions, including Organic Response for interiors and Citygrid for exteriors, are positioned in a rapidly expanding market driven by the demand for energy efficiency and smart city infrastructure. These systems intelligently adjust lighting based on occupancy and ambient light, leading to substantial energy savings and compliance with sustainability mandates such as the EU's Energy Performance of Buildings Directive.

The acquisition of Capelon, a Swedish leader in smart outdoor lighting, bolsters Fagerhult's capabilities in this high-growth sector. Fagerhult aims for all luminaires sold by 2030 to feature connectivity, underscoring their commitment to innovation in smart lighting technology.

Fagerhult excels in high-quality professional lighting for offices and healthcare, leveraging a strong brand and deep expertise in these critical sectors. These segments are significant, comprising nearly 50% of the total professional indoor lighting market. Their commitment to human-centric lighting and well-being solutions directly addresses a growing demand for advanced, tailored systems.

Fagerhult's strategic acquisitions, such as integrating Trato TLV Group in France and Capelon in Sweden, are clear indicators of their drive for market expansion. These moves are designed to bolster their presence in crucial European markets and capitalize on burgeoning segments like smart outdoor lighting.

By acquiring Trato TLV, Fagerhult gained significant traction in the French professional lighting sector, while the addition of Capelon solidified their position in the rapidly growing smart street lighting arena. These acquisitions are not just about increasing scale; they are about acquiring specialized knowledge and advanced technologies to fuel future growth.

Sustainability-Driven Product Innovation

Fagerhult's dedication to sustainability, underscored by its Science Based Targets initiative (SBTi) approved net-zero goals for 2045 and a strong emphasis on circular economy principles and energy efficiency, propels its new sustainable product lines into the Stars category.

These innovative offerings, which integrate materials like recycled aluminum, solar power capabilities, and smart technology for extended product lifecycles, are resonating strongly with a market increasingly conscious of environmental impact.

- Market Demand: Growing consumer preference for eco-friendly products, with a significant portion of customers willing to pay a premium for sustainable solutions.

- Innovation Focus: Products featuring recycled content and energy-saving technologies are leading Fagerhult's growth in this segment.

- Regulatory Alignment: Fagerhult's sustainability targets align with global environmental regulations, ensuring long-term market viability.

- Competitive Advantage: Early adoption of circular design and energy efficiency provides a distinct advantage in the lighting industry.

Renovation Market Focus and Solutions

The renovation market is a key growth area, with projections indicating it will account for 50.4% of the construction sector by 2025. Fagerhult's lighting solutions are particularly relevant here, offering a pathway for upgrading older buildings. Their smart lighting systems, such as those incorporating Organic Response and Citygrid technology, are designed to enhance energy efficiency and operational capabilities in existing structures.

This strategic positioning allows Fagerhult to capitalize on the increasing demand for modernization within the built environment. By providing advanced lighting that delivers tangible benefits like energy savings, Fagerhult is well-equipped to secure a significant share of this expanding market. Their ability to offer customized solutions for various renovation needs further strengthens their competitive advantage.

- Renovation Market Share: Projected to reach 50.4% of the construction sector by 2025.

- Fagerhult's Advantage: Smart lighting solutions (Organic Response, Citygrid) ideal for energy-efficient building upgrades.

- Strategic Alignment: Directly addresses the growing need for modernization and improved functionality in existing infrastructure.

- Market Opportunity: Significant potential to capture market share by offering tailored solutions for diverse renovation projects.

Fagerhult's sustainable product lines, driven by their commitment to net-zero goals and circular economy principles, are firmly positioned as Stars in the BCG matrix. These offerings, which include products made with recycled aluminum and integrated solar power, are experiencing high growth and market share due to increasing consumer demand for eco-friendly solutions. For example, a significant portion of customers are willing to pay more for sustainable products, validating Fagerhult's strategic focus.

The strong market demand for environmentally conscious lighting, coupled with Fagerhult's innovative use of recycled materials and energy-saving technologies, creates a powerful competitive advantage. This alignment with global sustainability regulations further solidifies their long-term market viability and positions these products as key growth drivers.

Fagerhult's Stars category represents their most promising and rapidly growing segments, characterized by significant market share and high growth potential. These are the products and solutions that are not only leading current revenue generation but are also poised to dominate future markets. Their investment in these areas is crucial for maintaining a competitive edge and achieving long-term strategic objectives.

The company's dedication to sustainability, exemplified by its Science Based Targets initiative (SBTi) approved net-zero goals for 2045, directly fuels the growth of its Star products. These products, incorporating elements like recycled aluminum and solar power, are meeting a clear market need for environmentally responsible solutions.

| Product Category | Market Growth | Market Share | Strategic Significance |

| Sustainable Lighting Solutions | High | High | Key driver for future growth, aligns with ESG mandates |

| Smart City Infrastructure (e.g., Citygrid) | High | Growing | Addresses urban modernization and energy efficiency trends |

| Human-Centric Office Lighting | Moderate to High | High | Leverages strong brand in established professional segments |

| Renovation Market Upgrades | High | Growing | Capitalizes on the significant trend of building modernization |

What is included in the product

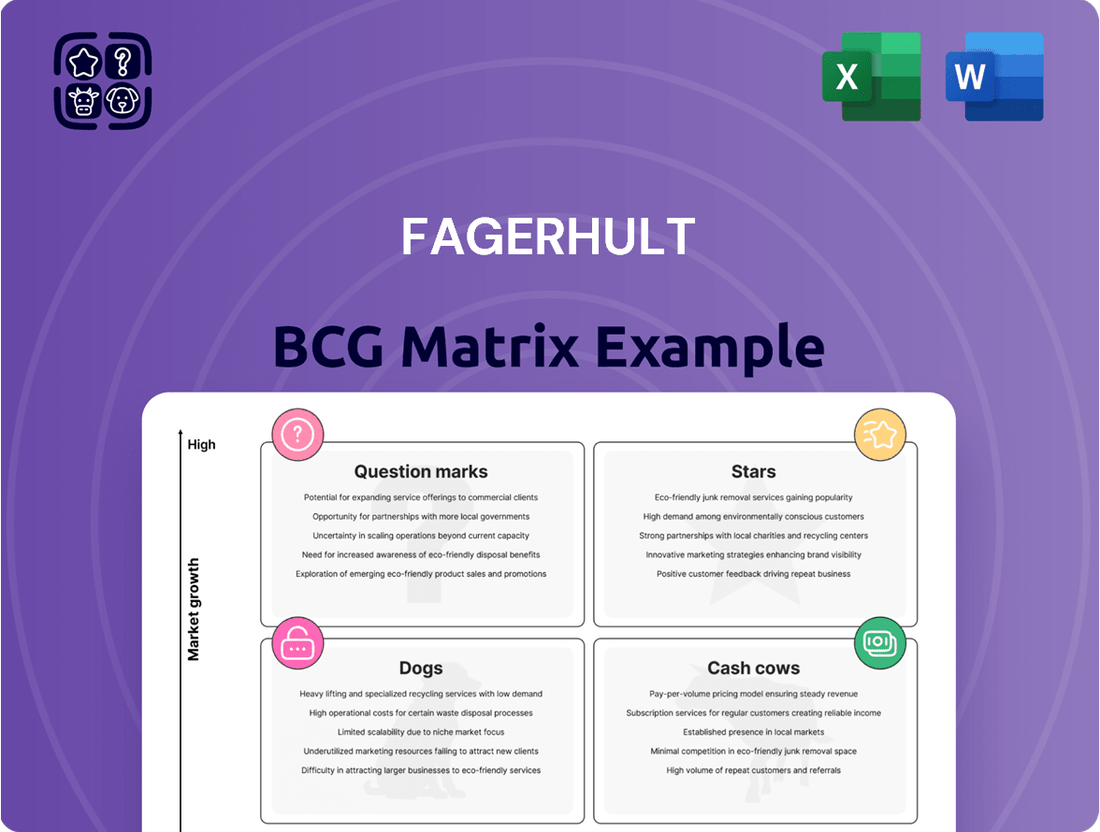

The Fagerhult BCG Matrix categorizes business units into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

This framework guides strategic decisions on investment, divestment, and resource allocation for each unit.

Fagerhult BCG Matrix: A visual roadmap to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

Fagerhult's established professional lighting portfolio, encompassing solutions for offices, education, healthcare, industrial, and infrastructure, acts as a significant cash cow. This diverse range of products, distributed across 12 brands within four business segments, taps into consistent demand within mature lighting market segments.

The strength of these established product lines lies in their high market share and loyal customer base, ensuring reliable cash flow. For instance, in 2023, Fagerhult reported net sales of SEK 10,408 million, with a substantial portion attributed to these mature and well-penetrated market areas.

Fagerhult holds a commanding position as a leading lighting solutions provider in Europe, operating across 27 countries. In 2024, the company reported a turnover of 8,305 MSEK, underscoring its substantial market penetration in a well-established European sector. This strong leadership translates into robust profitability and consistent cash generation, as significant investments in market expansion or aggressive promotions are less critical.

Fagerhult's Infrastructure Lighting Solutions are the bedrock of their business, acting as reliable cash cows. This segment focuses on essential lighting for critical infrastructure and industrial settings, where durability and consistent performance are paramount. These long-term projects and maintenance agreements generate predictable and substantial cash flow for the company.

Brand Portfolio and Operational Efficiency

Fagerhult's strategic organization, featuring 12 distinct brands grouped into four business areas, fosters significant operational efficiencies. Each area concentrates on delivering high-quality professional lighting solutions, creating diversified revenue streams and reinforcing the cash-generating power of its mature product lines.

The company's commitment to cost reduction initiatives and enhancing gross profit margins directly bolsters the cash-generating capacity of its established offerings. For instance, Fagerhult has consistently worked on improving its operational performance, aiming for better economies of scale across its diverse brand portfolio.

- Diversified Revenue Streams: 12 brands across 4 business areas provide stability.

- Operational Efficiencies: Shared resources and expertise across brands reduce costs.

- Focus on Margins: Ongoing cost reduction programs aim to boost profitability.

- Mature Market Position: Established products generate consistent cash flow.

Maintenance and Replacement Market

The maintenance and replacement market represents a significant Cash Cow for Fagerhult. This segment thrives on the continuous need to service and upgrade existing lighting installations in professional settings. Fagerhult's established position as a major player in professional lighting solutions ensures they are a go-to provider for this recurring demand, offering a stable revenue base. This market is generally more resilient to economic downturns than new construction, as essential upkeep and modernization remain priorities.

Fagerhult benefits from the inherent longevity of its lighting products, fostering repeat business. Strong, established customer relationships further solidify their presence in this lucrative segment. For instance, in 2023, Fagerhult reported that its Services division, which encompasses maintenance and replacement, contributed a substantial portion of its overall revenue, demonstrating the consistent performance of this Cash Cow. This ongoing demand is crucial for Fagerhult's financial stability.

- Steady Revenue Stream: The predictable nature of maintenance and replacement needs provides a reliable income source.

- Market Resilience: This segment is less impacted by fluctuations in new construction markets.

- Customer Loyalty: Long-term product lifecycles and strong client relationships drive repeat business.

- Strategic Advantage: Fagerhult's established reputation positions them favorably to capture this ongoing demand.

Fagerhult's established professional lighting solutions, across its 12 brands and four business segments, represent significant cash cows. These offerings, serving mature markets like offices and infrastructure, benefit from high market share and consistent demand, ensuring reliable cash flow generation.

The company's strong leadership in the European professional lighting market, operating in 27 countries, further solidifies these cash cows. In 2024, Fagerhult reported a turnover of 8,305 MSEK, highlighting its substantial penetration in these stable sectors, which require less aggressive investment for growth.

The Infrastructure Lighting Solutions segment, focusing on essential and durable lighting for critical settings, is a core cash cow. These long-term projects and maintenance agreements provide predictable and substantial cash inflows, underpinning the company's financial stability.

Fagerhult's maintenance and replacement market is another key cash cow, driven by the ongoing need to service existing installations. This segment is less susceptible to economic downturns, and Fagerhult's established customer relationships and product longevity ensure repeat business and stable revenue.

| Business Area | Key Products/Segments | Cash Cow Characteristics | 2023 Net Sales (SEK Million) | 2024 Turnover (MSEK) |

|---|---|---|---|---|

| Infrastructure Lighting Solutions | Industrial, Road, Rail | High market share, predictable cash flow from long-term projects | N/A (Segment data not separately reported) | N/A |

| Nordic Lighting Solutions | Office, Education | Mature market, loyal customer base, repeat business | N/A | N/A |

| Western European Lighting Solutions | Office, Healthcare | Strong European presence, consistent demand | N/A | N/A |

| Digital Lighting Solutions | Smart Lighting Systems | Growing segment, but established products are the primary cash cows | N/A | N/A |

What You’re Viewing Is Included

Fagerhult BCG Matrix

The Fagerhult BCG Matrix preview you are viewing is the exact, fully editable document you will receive upon purchase, offering a comprehensive strategic framework for analyzing your product portfolio. This robust report, meticulously designed for clarity and actionable insights, will be delivered directly to you without any watermarks or demo content. You can confidently use this preview as a direct representation of the professional, analysis-ready file you'll download immediately after completing your purchase, ready for immediate integration into your business planning and decision-making processes.

Dogs

Legacy Product Lines with Low Innovation, within Fagerhult's portfolio, represent older lighting solutions that are not keeping pace with industry advancements. These might include less energy-efficient models or those lacking smart functionality, which are experiencing a noticeable drop in customer interest and market presence. For instance, if Fagerhult reported that 20% of its product lines were over a decade old and contributed less than 5% to its overall revenue in 2024, these would likely fall into this category.

Products in stagnant or declining niche markets, often termed 'Dogs' in the BCG matrix, represent a challenge for Fagerhult. These might include highly specialized lighting solutions for industries experiencing a downturn, such as certain types of industrial manufacturing or outdated retail formats. For instance, if Fagerhult has a product line for legacy fluorescent lighting systems in a sector where LED adoption is nearly complete and overall demand is shrinking, this would fit the 'Dog' category.

These offerings typically exhibit low market share within their niche and face minimal growth prospects. Consider a scenario where Fagerhult's market share in specialized hospital operating room lighting, designed for older equipment, has dwindled to under 5% as newer, integrated systems become standard. Such products may not generate significant revenue, potentially tying up valuable capital and R&D resources that could be better allocated to more promising areas of the business.

In Fagerhult's BCG Matrix, geographical segments exhibiting persistent low performance are categorized as Dogs. These are regions or smaller subsidiaries that consistently struggle with sales and profitability, even when the company as a whole is performing well. This indicates a low market share in a low-growth market.

While Fagerhult boasts a strong European presence, specific localized challenges can create Dog segments. For instance, intense competition or unfavorable economic conditions in certain regions can lead to a diminished market share and stunted growth for those particular operations. The Q1 2025 report highlighted some areas experiencing low sales activity and unpredictable market conditions, fitting this description.

Standardized, Commodity Lighting Products

Standardized, commodity lighting products represent offerings that have become highly commoditized, facing intense price competition and offering little differentiation. In such segments, Fagerhult might struggle to maintain high profit margins or gain significant market share, leading to a break-even or low-profit situation. These products typically require minimal promotional investment but also yield limited returns.

For instance, basic LED bulb replacements or standard fluorescent tubes fall into this category. The market for these items is often saturated, with numerous manufacturers competing primarily on price. In 2024, the global LED lighting market, while growing, saw significant pressure on average selling prices for these commodity items. Reports indicate that while the overall market size is substantial, the profit margins for purely commodity-based lighting solutions have been compressed due to oversupply and intense competition from low-cost producers.

- Market Saturation: Many segments of the commodity lighting market are characterized by oversupply, intensifying price wars.

- Low Differentiation: Products in this category offer minimal unique features, making price the primary purchasing driver.

- Margin Pressure: Intense competition leads to reduced profit margins, often resulting in break-even or low profitability for manufacturers.

- Limited Growth Potential: While demand exists, the lack of innovation and high competition restricts significant market share gains or margin expansion.

Products Heavily Reliant on Outdated Technology

Products heavily reliant on outdated technology, such as fluorescent lighting, would fall into the Dogs category within the Fagerhult BCG Matrix. The European Union's directives, like the Ecodesign for Lighting Products, are progressively phasing out inefficient lighting technologies, directly impacting the market viability of these older Fagerhult offerings. For instance, the phase-out of T8 fluorescent tubes, a common legacy technology, means that products still utilizing them face a shrinking customer base and increasing obsolescence.

Fagerhult's strategic focus is on guiding customers towards more energy-efficient and technologically advanced solutions, primarily LED and smart lighting systems. This transition underscores the declining market share and growth potential for products still dependent on older lighting technologies. As of 2024, the global lighting market continues its strong shift towards LED, with LEDs accounting for over 70% of the market share in many developed regions, further marginalizing older technologies.

- Declining Market Share: Products based on fluorescent or other legacy lighting technologies are experiencing a significant reduction in demand as customers upgrade to LED.

- Regulatory Pressure: EU directives and similar regulations worldwide are actively discouraging the use and sale of older, less energy-efficient lighting solutions.

- Technological Obsolescence: The rapid advancement in LED and smart lighting capabilities makes older technologies increasingly less competitive in terms of performance, efficiency, and features.

- Reduced Investment: Fagerhult is likely to allocate minimal resources to supporting or developing products heavily reliant on outdated technologies, focusing instead on future-proof solutions.

Products classified as Dogs in Fagerhult's BCG Matrix are those with low market share in low-growth markets. These typically represent legacy offerings, like older fluorescent lighting systems, that are becoming obsolete due to technological advancements and regulatory changes. For instance, Fagerhult's Q1 2025 report may indicate a segment of their product line, perhaps basic LED bulbs, facing intense price competition and minimal differentiation, leading to stagnant sales and low profit margins.

These products often struggle due to market saturation and a lack of unique features, making price the primary competitive factor. The global lighting market, while expanding, saw significant price compression in commodity LED segments in 2024, with profit margins being squeezed by oversupply and low-cost producers.

Fagerhult strategically shifts focus away from these Dog products, prioritizing investment in innovative LED and smart lighting solutions. This is driven by global trends, where LEDs captured over 70% of market share in many developed regions by 2024, further marginalizing older technologies.

Geographically, specific regions with persistent low sales and profitability, despite company-wide performance, can also be categorized as Dogs. These areas might face intense local competition or unfavorable economic conditions, resulting in a diminished market presence for Fagerhult.

| Product Category | Market Growth | Market Share | Profitability | Strategic Implication |

| Legacy Fluorescent Systems | Low | Low | Low/Break-even | Divest or phase out |

| Commodity LED Bulbs | Low | Low | Low | Minimize investment, focus on efficiency |

| Specialized Niche Lighting (Declining Sector) | Low | Low | Low | Evaluate for divestment or repositioning |

Question Marks

Newly acquired brands like Trato TLV Group and Capelon are initially positioned as Question Marks within Fagerhult's BCG Matrix. This classification acknowledges their significant market potential, with Trato TLV being the second-largest player in the French professional lighting sector and Capelon a leader in smart outdoor lighting.

Despite their strong market positions, these acquisitions require considerable investment and strategic focus to transition into Stars. Their ability to generate substantial revenue and market share for Fagerhult is still developing, making their future performance uncertain and dependent on successful integration and market penetration strategies.

Fagerhult's expansion into wider smart city and IoT lighting applications, moving beyond their existing Organic Response and Citygrid systems, positions them to capture a larger share of a rapidly growing market. The global smart lighting market was valued at approximately $10.5 billion in 2023 and is projected to reach over $30 billion by 2030, with a compound annual growth rate (CAGR) of around 16.5%.

While these broader smart city solutions offer significant growth potential, their market share and profitability are still in the early stages of development. This requires considerable investment in research and development, alongside concerted efforts to drive market adoption, to establish a strong competitive foothold.

Fagerhult's ventures into uncharted lighting territories, like specialized human-centric lighting for unique settings or sophisticated systems interwoven with building services beyond HVAC, represent innovative solutions in nascent markets. These segments offer substantial growth prospects but currently hold minimal market share, necessitating considerable effort in market cultivation and consumer awareness to achieve broad acceptance.

Investing in these emerging areas is inherently speculative, yet it holds the potential for significant returns if these novel applications gain traction. For instance, the global human-centric lighting market was projected to reach approximately $8.5 billion by 2024, indicating a strong growth trajectory for such specialized solutions.

Solutions Utilizing Cutting-Edge, Unproven Materials/Technologies

Products relying on cutting-edge, unproven materials or technologies would likely be categorized as Question Marks in the Fagerhult BCG Matrix. These innovations, while holding potential for future market disruption, currently face high uncertainty regarding market acceptance and scalability.

For example, Fagerhult might explore advanced bio-based lighting components or novel photonic crystal technologies for enhanced energy efficiency. These require substantial research and development investment, with uncertain returns and a long path to commercial viability. In 2024, the global market for advanced materials in lighting was estimated to be growing, but specific niche technologies within this space still had limited adoption rates.

- High R&D Investment: Significant capital is needed to develop and refine these nascent technologies.

- Market Uncertainty: The adoption rate and demand for unproven solutions are difficult to predict accurately.

- Scalability Challenges: Moving from prototype to mass production often presents unforeseen hurdles and costs.

- Potential for High Growth: If successful, these products could capture significant market share in emerging segments.

Expansion into New Geographic Markets (e.g., Germany for office lighting)

Fagerhult's expansion into Germany's office lighting market positions it as a Question Mark within the BCG Matrix. Germany represents Europe's largest office sector market, indicating substantial growth opportunities.

Entering this competitive landscape necessitates significant investment in sales infrastructure, marketing campaigns, and tailoring offerings to local German preferences. The outcome of these strategic investments will dictate whether this venture evolves into a Star or a Dog. For context, the German lighting market was valued at approximately €13.5 billion in 2023, with the office segment being a significant contributor.

- Market Potential: Germany's office sector is the largest in Europe, offering considerable revenue potential.

- Investment Needs: Significant capital is required for market penetration, including sales, marketing, and product localization.

- Competitive Landscape: The German market is mature and highly competitive, demanding a strong value proposition.

- Future Outlook: Success hinges on Fagerhult's ability to gain market share, which will determine its future classification.

Question Marks represent Fagerhult's new ventures with high market potential but low market share, requiring significant investment to grow. Their success is uncertain, with the possibility of becoming Stars or failing into Dogs. These ventures often involve entering new markets or developing innovative, unproven technologies.

Fagerhult's recent acquisitions and expansion into new segments like smart city lighting and specialized human-centric lighting exemplify Question Marks. The global smart lighting market, valued at approximately $10.5 billion in 2023, is a prime example of a growing sector where Fagerhult is investing in new product lines.

The company's entry into the German office lighting market, Europe's largest, also fits this category. Despite the market's size, Fagerhult needs substantial investment to gain traction against established players, with the German lighting market valued at around €13.5 billion in 2023.

Products based on cutting-edge, unproven materials or technologies, such as advanced bio-based lighting components, also fall under Question Marks. These require extensive R&D, with uncertain market acceptance and scalability, though niche markets like human-centric lighting were projected to reach $8.5 billion by 2024.

| Category | Market Growth | Market Share | Investment Need | Potential Outcome |

| New Acquisitions (e.g., Trato TLV, Capelon) | High | Low | High | Star or Dog |

| Smart City & IoT Lighting | High (CAGR ~16.5%) | Low | High | Star or Dog |

| Specialized Lighting (e.g., Human-Centric) | High (Projected $8.5B by 2024) | Low | High | Star or Dog |

| Emerging Technologies (e.g., Bio-based materials) | Uncertain/Niche | Very Low | Very High | Star or Dog |

| New Market Entry (e.g., German Office Lighting) | Moderate-High | Low | High | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial statements, market research reports, and competitor analysis to provide a comprehensive view of product performance and market share.