Extreme Networks Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Extreme Networks Bundle

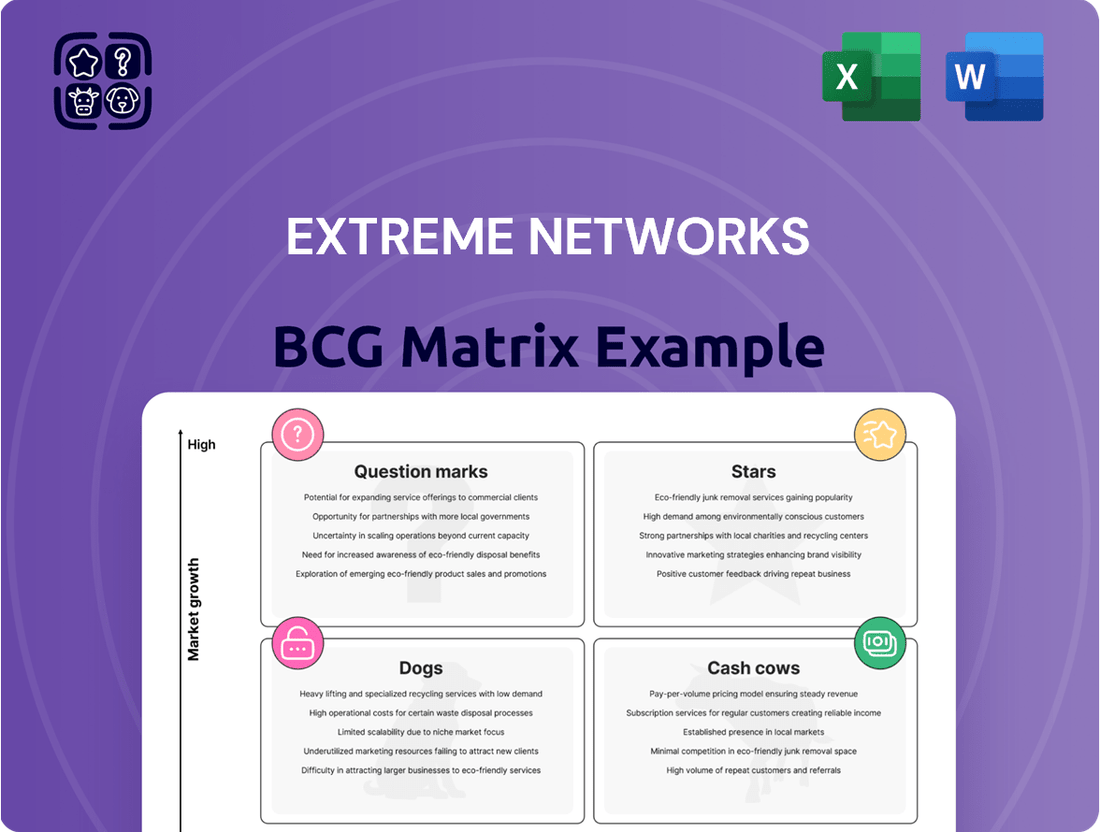

Curious about Extreme Networks' product portfolio performance? This preview offers a glimpse into their strategic positioning, hinting at which products might be market leaders and which could be draining resources. Understanding these dynamics is crucial for informed investment decisions.

Want to unlock the full strategic advantage? Purchase the complete Extreme Networks BCG Matrix to gain a definitive view of their Stars, Cash Cows, Dogs, and Question Marks. This comprehensive analysis provides the clarity needed to optimize your capital allocation and product strategy.

Don't miss out on actionable insights! The full BCG Matrix report delivers data-backed recommendations and a clear roadmap for navigating Extreme Networks' market presence. Elevate your strategic planning with this essential business tool.

Gain immediate access to a detailed breakdown of Extreme Networks' product performance. The full BCG Matrix is your shortcut to competitive clarity, revealing exactly where their offerings stand and where your focus should be.

Stars

Extreme Platform ONE represents a significant push into the AI-driven cloud networking and security market for Extreme Networks, with its recent general availability marking a key milestone. This platform is designed to streamline IT operations and offer comprehensive network visibility, tapping into a sector experiencing rapid expansion for intelligent solutions.

The platform's early adoption by over 265 customers underscores its perceived value and market potential, suggesting a strong foundation for future growth. This widespread acceptance positions Extreme Platform ONE as a potential market leader in simplifying complex networking environments.

ExtremeCloud IQ, the linchpin of Extreme Networks' 'One Network, One Cloud' vision, is positioned as a Star in the BCG Matrix. Its robust SaaS Annual Recurring Revenue (ARR) growth, which saw a substantial year-over-year increase in 2024, highlights its commanding presence in the burgeoning cloud-managed networking sector. This platform is fundamental to Extreme's predictable revenue streams and fosters strong customer loyalty.

Extreme Fabric Connect is a significant differentiator for Extreme Networks, allowing them to secure crucial wins against larger competitors in the enterprise networking sector. This technology's ability to simplify network segmentation and automation makes it highly attractive to organizations prioritizing resilient and secure network infrastructures.

The success of Fabric Connect in displacing established vendors points to a growing market share for Extreme Networks in a segment experiencing robust expansion. For example, in the first quarter of 2024, Extreme Networks reported a 6% increase in total revenue, reaching $335.5 million, with strong performance attributed to their software and services, including Fabric Connect deployments.

Universal Hardware (Wi-Fi 6E/7 and Campus Switching)

Extreme Networks' Universal Hardware strategy, encompassing Wi-Fi 6E/7 access points and advanced campus switching, is a key driver of their market position. This approach offers a unified hardware foundation that simplifies deployment and management for enterprises. Their leadership status in the Gartner Magic Quadrant for Wired and Wireless LAN Access Infrastructure underscores the strength and adaptability of these solutions. For instance, in 2024, Extreme reported significant customer adoption of their Wi-Fi 6E and early Wi-Fi 7 solutions, indicating strong market traction.

This flexible hardware portfolio directly supports Extreme's cloud-centric networking vision, enabling organizations to seamlessly integrate and manage both wired and wireless networks. The ability to support next-generation wireless standards like Wi-Fi 7, which promises multi-gigabit speeds and reduced latency, positions Extreme to capitalize on the growing demand for high-performance connectivity. This strategy is crucial as businesses increasingly rely on robust and scalable network infrastructure to support digital transformation initiatives.

- Universal Hardware Platform: Enables unified management of wired and wireless networks, reducing complexity and operational costs.

- Wi-Fi 6E/7 Support: Positions Extreme to meet the increasing demand for higher speeds and lower latency in enterprise environments.

- Gartner Leader Recognition: Validates Extreme's strong market presence and technological capabilities in the enterprise LAN segment.

- Cloud-Driven Vision: Integrates seamlessly with cloud management platforms, offering scalability and enhanced visibility.

ExtremeCloud Universal ZTNA

ExtremeCloud Universal ZTNA represents a significant player in the burgeoning Zero Trust Network Access market. This offering consolidates network, application, and device security into one unified, cloud-managed platform, addressing the escalating demand for robust cybersecurity solutions.

The ZTNA market itself is a dynamic space, projected to see substantial expansion. For instance, industry analysts forecast the global ZTNA market to reach approximately $39.6 billion by 2028, growing at a compound annual growth rate of over 23% from 2023.

Extreme's integrated security approach provides a distinct competitive edge. This comprehensive strategy appeals to organizations actively seeking to streamline their security frameworks and enhance overall protection against evolving cyber threats.

- Market Position: ExtremeCloud Universal ZTNA leverages the high growth of the ZTNA market, estimated to exceed $39 billion by 2028.

- Competitive Advantage: Its integrated approach to network, application, and device security offers a simplified yet comprehensive security posture, attracting security-conscious enterprises.

- Customer Appeal: The solution caters to businesses prioritizing robust, unified security management in an increasingly complex threat landscape.

ExtremeCloud IQ, with its strong SaaS ARR growth in 2024, is a clear Star in Extreme Networks' portfolio. This cloud-managed networking solution is a primary driver of predictable revenue and customer loyalty.

Its expansion in the cloud networking sector, a rapidly growing market, solidifies its position. ExtremeCloud IQ's success is foundational to the company's 'One Network, One Cloud' strategy.

The platform’s robust year-over-year growth in 2024 demonstrates its market dominance and potential for continued expansion.

| Product/Service | BCG Category | Key Growth Drivers | Market Position | 2024 Data/Insights |

|---|---|---|---|---|

| ExtremeCloud IQ | Star | Cloud-managed networking, SaaS ARR growth | Market leader in cloud networking | Significant YoY SaaS ARR growth |

| Extreme Fabric Connect | Star | Network segmentation, automation, security | Strong enterprise adoption, displacing competitors | Contributed to 6% total revenue increase in Q1 2024 |

| Universal Hardware (Wi-Fi 6E/7) | Star | Unified management, next-gen wireless | Gartner Magic Quadrant Leader | Strong customer adoption of Wi-Fi 6E/7 |

| ExtremeCloud Universal ZTNA | Question Mark/Potential Star | Zero Trust Network Access, unified security | Growing ZTNA market | ZTNA market projected to exceed $39B by 2028 |

What is included in the product

Extreme Networks' BCG Matrix would analyze its product portfolio's market share and growth, guiding investment decisions.

The Extreme Networks BCG Matrix provides a clear, one-page overview, instantly relieving the pain of deciphering complex business unit performance.

Cash Cows

Mature wired access switches, like Extreme Networks' established switching lines, represent significant cash cows. These products are the bedrock of many enterprise networks, consistently delivering reliable revenue streams. For instance, in fiscal year 2024, Extreme Networks reported substantial contributions from its enterprise networking segment, which heavily features these mature wired solutions.

Despite a mature market, these switches continue to be a strong revenue source. Sales are driven by existing customers needing expansions and regular hardware refreshes. This steady demand, coupled with lower promotional spending due to their established reputation for reliability, solidifies their cash cow status.

Extreme Networks' core maintenance and support services are a true cash cow, forming the backbone of their financial stability. This segment, which includes vital technical assistance and hardware replacement for their extensive global clientele, consistently delivers a predictable and robust revenue stream. These services boast impressive profit margins, making them a critical component of Extreme Networks' overall profitability.

While the growth rate for these essential services might be modest, their unwavering cash generation is what truly defines them as a cash cow. This consistent inflow of funds allows Extreme Networks to invest in other areas of the business and maintain strong customer loyalty, a testament to the value provided. For instance, in fiscal year 2023, Extreme Networks reported that its Services segment contributed a significant portion to its total revenue, underscoring its importance.

Extreme Networks' established data center switching solutions represent a classic cash cow within their BCG matrix. These products cater to a stable, mature market segment where reliability and proven performance are paramount, rather than the latest technological advancements.

These offerings generate consistent and predictable revenue streams. For instance, in fiscal year 2023, Extreme Networks reported a 7.7% increase in total revenue, reaching $1.3 billion, with established products contributing significantly to this stable growth.

Enterprises continue to invest in these solutions for their critical infrastructure, valuing their proven track record and lower risk profile over more experimental technologies. This steady demand underpins their cash cow status.

The cash generated from these mature products can be strategically reinvested into other areas of Extreme Networks' portfolio, such as their emerging technologies or star products, fueling future growth and innovation.

Legacy On-Premise Management Software

Extreme Networks' legacy on-premise management software represents a classic Cash Cow in the BCG matrix. These products, while serving a mature and low-growth market, are vital for customers still operating with on-premise infrastructure. Revenue streams are consistent, primarily stemming from ongoing licensing, maintenance, and crucial support contracts with a dedicated customer base.

Despite the market's limited growth potential, these offerings continue to be profitable. For instance, in 2024, Extreme Networks reported continued steady revenue from its established software portfolio, underscoring the stable income generated by this segment. The strategy here is minimal investment, focusing on essential updates to ensure ongoing functionality and continued support for this loyal customer base.

- Stable Revenue Generation: Continues to bring in consistent income through licenses and support.

- Loyal Customer Base: Benefits from a dedicated installed base that relies on these solutions.

- Low Growth Market: Operates in a segment with limited expansion opportunities.

- Strategic Investment: Investment is primarily for maintenance and essential updates, not significant growth initiatives.

Older Generation Wireless LAN Infrastructure

Extreme Networks continues to support its installed base of older generation wireless LAN access points and controllers. These products represent a mature market segment, but still contribute significantly to the company's revenue. This stability is driven by ongoing replacement cycles and maintenance contracts, ensuring consistent income from existing customers.

While these older systems may not feature the latest Wi-Fi 6E/7 capabilities, they remain critical for many organizations. Customers who are not yet ready for a complete network overhaul rely on these established solutions, leading to incremental sales and continued service revenue for Extreme Networks.

- Mature Market Stability: The installed base of older generation wireless LAN infrastructure falls into a mature market segment, offering predictable revenue streams.

- Revenue Drivers: Key revenue sources include replacement cycles for aging hardware, lucrative maintenance contracts, and incremental sales to existing customers.

- Customer Inertia: Many businesses are not yet prepared for a full network overhaul, creating sustained demand for support and services for their current, older infrastructure.

Extreme Networks' robust portfolio of mature wired access switches, including established switching lines, clearly demonstrates their cash cow status. These products are fundamental to enterprise networks, consistently generating reliable revenue. In fiscal year 2024, Extreme Networks saw significant contributions from its enterprise networking segment, which is heavily reliant on these mature wired solutions, showcasing their enduring financial strength.

These switches continue to be a strong revenue contributor despite market maturity. Sales are bolstered by existing customers requiring expansions and regular hardware refreshes. This consistent demand, coupled with reduced promotional spending due to their established reliability, firmly cements their position as cash cows.

The company's core maintenance and support services for its extensive global clientele are a prime example of a cash cow, forming the bedrock of financial stability. These services, encompassing vital technical assistance and hardware replacement, consistently yield predictable and substantial revenue streams with impressive profit margins, making them a critical component of Extreme Networks' overall profitability.

| Product Category | BCG Status | Key Revenue Drivers | Market Dynamics | Fiscal Year 2023/2024 Data Point |

| Mature Wired Access Switches | Cash Cow | Existing customer expansions, hardware refreshes, maintenance contracts | Mature, stable demand, low growth | Enterprise networking segment significant revenue contributor in FY24 |

| Core Maintenance & Support Services | Cash Cow | Technical assistance, hardware replacement, service contracts | Stable, predictable, high margin | Services segment contributed significantly to total revenue in FY23 |

| Established Data Center Switches | Cash Cow | Reliability, proven performance, critical infrastructure investment | Mature, stable, low-risk preference | Total revenue increase of 7.7% in FY23 driven by established products |

| Legacy On-Premise Management Software | Cash Cow | Ongoing licensing, maintenance, support contracts | Mature, low growth, dedicated customer base | Continued steady revenue from established software portfolio in 2024 |

| Older Generation Wireless LAN APs/Controllers | Cash Cow | Replacement cycles, maintenance contracts, ongoing support | Mature, stable demand from existing installed base | Continued income from existing customers via replacement and service revenue |

What You’re Viewing Is Included

Extreme Networks BCG Matrix

The Extreme Networks BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after your purchase. This means no watermarks, no demo content, and no surprises – just a professionally crafted strategic tool ready for your immediate use. You can confidently assess its value, knowing that the final product will be exactly as you see it now, enabling swift integration into your business planning and analysis.

Dogs

Extreme Networks has announced end-of-sale (EOS) for several older hardware products, including the XA-1400 series, signaling their transition out of active product lines. This move reflects the natural lifecycle of technology as newer, more capable solutions emerge. These EOS products typically reside in a declining market, with sales largely ceasing and revenue primarily stemming from ongoing support agreements.

The company has prudently managed its inventory by making provisions for excess and obsolete stock associated with these legacy hardware generations. This proactive approach helps mitigate potential financial impacts and ensures a cleaner product portfolio. For instance, as of the first quarter of 2024, Extreme Networks reported a reduction in its inventory value, partly due to these strategic phase-outs.

Older undifferentiated routing platforms, not integrated into Extreme's fabric or SD-WAN strategies, are likely in a Dogs category. These legacy products face intense competition with little unique value.

Their market share is probably small, operating within a slow-growth segment of the networking industry. This means they contribute very little to Extreme Networks' overall revenue, even as they might still incur ongoing support expenses.

By mid-2024, the enterprise routing market, excluding SD-WAN, was showing modest growth, making it challenging for undifferentiated players. Companies like Extreme often evaluate these products for potential divestiture or phasing out to focus resources on more strategic offerings.

Unintegrated legacy acquired product lines within Extreme Networks, stemming from past acquisitions like portions of Enterasys or Aerohive that were never fully absorbed into the universal platform, likely occupy a Dogs quadrant in the BCG matrix. These products typically represent a low market share within stagnant or declining market segments. For instance, by late 2023, many such legacy offerings would have been phased out or supported only for existing customers, with minimal new investment.

These retained, but unintegrated, product lines can become resource drains. They may require ongoing support, maintenance, and occasional updates, diverting capital and engineering focus away from more strategic, high-growth areas. Extreme Networks' stated strategy has consistently been portfolio consolidation, aiming to streamline operations and enhance the value proposition of its core, integrated solutions.

The financial performance of these Dog-like segments would reflect this strategic prioritization. While exact figures for these specific unintegrated lines are not publicly itemized, the overall reduction in the number of distinct product SKUs over the past several years, a trend continuing into 2024, indicates a deliberate move to shed less profitable or redundant offerings. This focus on integration and simplification is key to improving overall operational efficiency and driving future growth.

Commoditized Basic Network Appliances

Commoditized Basic Network Appliances within Extreme Networks' BCG Matrix represent products that have become largely undifferentiated in the market. These are often essential but standard components, facing fierce price wars due to their lack of unique selling propositions.

Such offerings typically exhibit low profit margins and struggle to capture significant market share against numerous competitors. The focus for companies with these products is often on cost optimization and minimizing further investment, as they offer little room for substantial growth or differentiation.

By 2024, the market for basic network switches and routers, for instance, continued to be heavily influenced by price sensitivity. Companies in this space, including segments of Extreme Networks' portfolio, are likely seeing revenue growth that barely keeps pace with inflation, if at all, with gross margins potentially hovering in the low-to-mid 20% range for these specific product lines, a stark contrast to more specialized or innovative network solutions.

- Low Market Share: Products in this category typically hold a small percentage of the overall market.

- Low Growth Rate: The demand for these basic appliances grows very slowly, often in line with general economic expansion.

- Price Competition: Intense rivalry among vendors drives down prices, squeezing profit margins.

- Minimal Differentiation: Features are often standard across different brands, making it hard to stand out.

Products with High Inventory Provisions

Products with high inventory provisions at Extreme Networks are flagged as potential Dogs in the BCG Matrix. These are items for which the company has set aside substantial funds to account for excess or obsolete stock, signaling a clear indication of declining demand and poor market prospects. For example, as of the first quarter of 2024, Extreme Networks reported a significant increase in its inventory write-downs, particularly for legacy networking hardware. This ties up valuable capital that could be deployed more effectively elsewhere, generating minimal to no return on investment.

These products typically operate within mature or declining market segments where growth is minimal. Furthermore, Extreme Networks is likely experiencing a shrinking market share for these offerings, as customers migrate to newer, more advanced solutions. The financial strain of carrying this unproductive inventory can impact profitability and operational efficiency.

- Declining Demand: High provisions directly correlate with products not meeting sales forecasts.

- Low Market Prospects: These items are in slow-growing or shrinking market segments.

- Capital Tie-up: Excess inventory prevents capital from being invested in more profitable ventures.

- Diminishing Market Share: Older generation products are losing ground to newer technologies.

Products classified as Dogs in Extreme Networks' BCG Matrix are those with low market share in slow-growth or declining industries. These often include legacy hardware, unintegrated acquired product lines, and commoditized basic network appliances. The company’s strategy involves phasing these out, as evidenced by end-of-sale announcements and provisions for excess inventory, a trend seen actively throughout 2024.

These offerings generate minimal revenue and can be resource drains due to ongoing support costs. Extreme Networks’ focus on portfolio consolidation and streamlining operations aims to shed these less profitable or redundant items, improving overall efficiency and freeing up capital for more strategic investments.

For instance, the end-of-sale of product series like the XA-1400 in early 2024 exemplifies this shift. Additionally, high inventory provisions for legacy hardware, as reported in Q1 2024, further underscore the presence of Dog-like segments within the company's portfolio.

The market for basic network switches and routers, a segment likely containing Dog products, saw price sensitivity continue into 2024, with growth barely keeping pace with inflation.

| BCG Category | Market Share | Market Growth | Profitability | Strategic Focus |

|---|---|---|---|---|

| Dogs | Low | Low/Declining | Low/Negative | Divest/Phase Out |

| Example Segments | Legacy Hardware (e.g., XA-1400 series) | Mature/Declining | Minimal | End-of-Sale, Inventory Reduction |

| Example Segments | Unintegrated Acquired Lines | Stagnant | Low | Consolidation, Streamlining |

| Example Segments | Commoditized Basic Appliances | Low | Low Margins | Cost Optimization |

Question Marks

Extreme Networks' Platform ONE showcases advanced conversational and agentic AI, positioning it as a Star in the BCG Matrix due to its high growth potential. However, these cutting-edge features, while innovative, are in the nascent stages of market adoption, reflecting a current low market share. As AI integration within networking continues to evolve, these capabilities are poised for significant expansion, but require substantial investment to accelerate customer uptake and fully realize their market impact.

Extreme Networks is bolstering its next-generation SD-WAN offerings, a move driven by the acquisition of Ipanema and the ongoing development of its ExtremeCloud SD-WAN platform. This strategic integration positions the company to capitalize on the burgeoning SD-WAN market, which is experiencing significant expansion as businesses increasingly embrace distributed network architectures. The global SD-WAN market was valued at approximately $5.1 billion in 2023 and is projected to reach $16.9 billion by 2028, demonstrating robust growth. While this presents a substantial opportunity, Extreme's current market share in advanced SD-WAN solutions may be nascent, necessitating dedicated investment to secure a stronger foothold in this dynamic, high-growth sector.

Extreme Networks' hyper-specialized vertical AI/IoT solutions, targeting sectors like healthcare, education, and sports, represent a strategic move into high-growth niches. These offerings leverage AI and IoT to deliver tailored networking capabilities, aiming to solve unique industry challenges.

While the potential for significant growth in these vertical markets is evident, Extreme's current market share within the most hyper-specialized AI/IoT applications may still be in its early stages. This suggests these areas could be considered question marks in a BCG matrix, requiring substantial investment and focused development to establish a strong foothold and demonstrate scalability.

The success of these specialized solutions hinges on proving their unique value proposition and achieving widespread adoption within their respective industries. For instance, in healthcare, AI-powered IoT networks can enable real-time patient monitoring and data analytics, a field experiencing rapid technological advancement. According to industry reports from late 2024, the global healthcare IoT market was projected to grow at a compound annual growth rate of over 15% leading up to 2025, indicating substantial opportunity.

New Market Integrations (e.g., specific third-party ecosystem plays)

Extreme Networks' strategy of integrating its Extreme Platform ONE with third-party vendors like Microsoft highlights a focus on expanding its ecosystem. This move is intended to broaden its market reach by enhancing interoperability within the broader networking and security landscape. While these partnerships are crucial for future growth, the direct market share impact from these specific integrations is still in its nascent stages of development.

These new market integrations represent significant high-growth opportunities for Extreme Networks. However, realizing their full market share potential requires dedicated strategic nurturing. This includes focused co-marketing initiatives and ongoing development to ensure seamless functionality and value proposition for customers adopting these integrated solutions. For instance, in 2024, Extreme Networks announced expanded integrations with cloud security providers, aiming to capture a larger share of the secure access service edge (SASE) market, which is projected for substantial growth.

- Ecosystem Expansion: Integrations with vendors like Microsoft broaden Extreme Networks' potential market access.

- Developing Market Share: The direct market share gains from these specific interoperability plays are still emerging.

- High-Growth Avenues: These integrations are seen as key drivers for future revenue and customer acquisition.

- Strategic Nurturing: Success hinges on strategic development and co-marketing to convert potential into tangible market share.

Early Adoption of Wi-Fi 7 Technologies

Extreme Networks is positioned to capitalize on the emerging Wi-Fi 7 standard, a technology promising significantly faster speeds and lower latency. While Wi-Fi 7 offers substantial future growth potential, its current market adoption remains nascent. This is primarily due to the typical early-stage challenges of new technology: high initial equipment costs and a phased rollout of compatible devices. Extreme's strategic investment in Wi-Fi 7 solutions is a clear indicator of its commitment to future-proofing its offerings, though its specific market share within the nascent Wi-Fi 7 segment is still developing.

- Wi-Fi 7 Potential: Offers speeds up to 46 Gbps, a substantial leap from Wi-Fi 6/6E.

- Market Penetration: Expected to see increased adoption from 2024 onwards, with early enterprise deployments.

- Cost Factor: Initial Wi-Fi 7 access points and client devices are priced at a premium.

- Extreme's Strategy: Focuses on providing enterprise-grade Wi-Fi 7 solutions to support high-density and performance-critical environments.

Question Marks in Extreme Networks' portfolio represent areas with high growth potential but currently low market share. These are typically new products or technologies that require significant investment to gain traction. Success in these areas means they can transition into Stars, while failure could relegate them to Dogs.

The hyper-specialized vertical AI/IoT solutions and emerging Wi-Fi 7 offerings exemplify these Question Marks for Extreme Networks. While the markets for these technologies are expanding rapidly, Extreme's current penetration is still developing, necessitating strategic investment to capture market share.

Similarly, early-stage ecosystem integrations and nascent advanced SD-WAN capabilities also fall into this category. These initiatives hold promise for future growth, but their market impact is yet to be fully realized, demanding focused development and marketing efforts.

These segments require careful management and strategic allocation of resources to nurture their growth and move them towards a stronger market position.

BCG Matrix Data Sources

Our Extreme Networks BCG Matrix leverages a blend of financial disclosures, market analytics, and industry growth forecasts to accurately position each business unit within its respective market landscape.