Exela Technologies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Exela Technologies Bundle

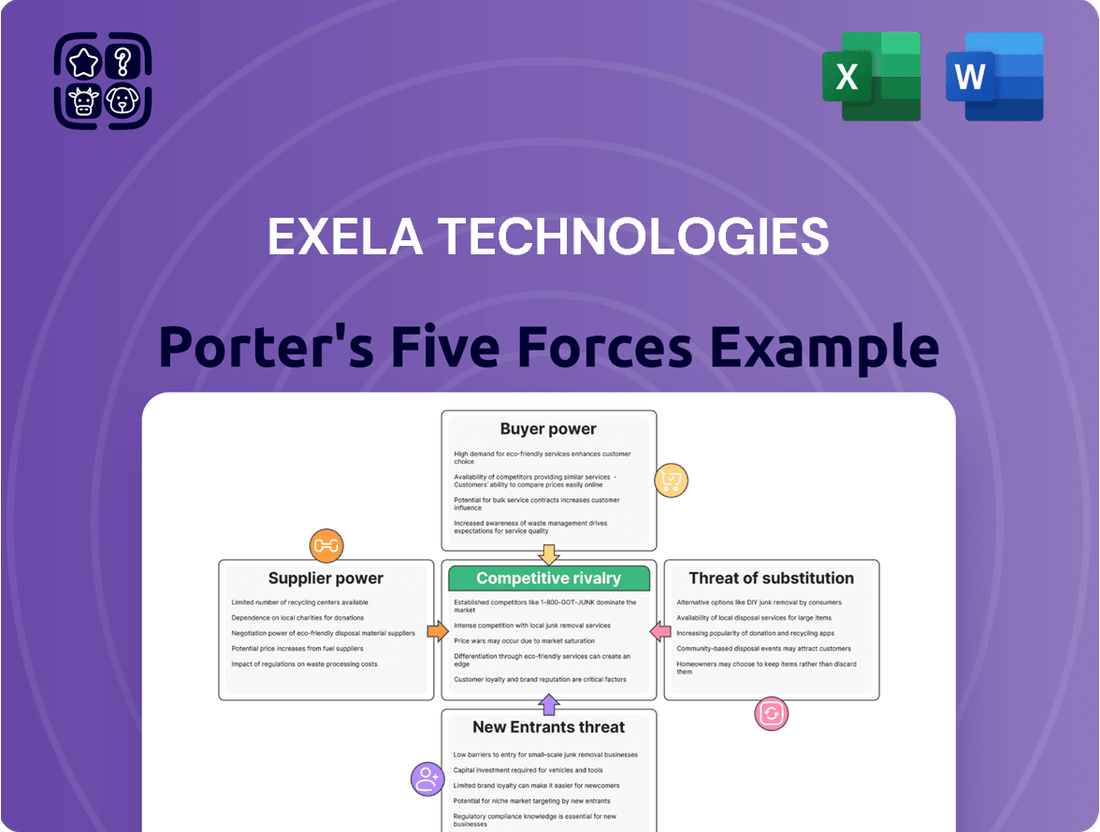

Exela Technologies operates in a dynamic market, facing moderate threats from new entrants and the availability of substitutes. The bargaining power of buyers and suppliers presents key considerations for its strategic positioning.

The complete report reveals the real forces shaping Exela Technologies’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Exela Technologies' reliance on sophisticated software platforms means suppliers with proprietary technology, particularly in areas like AI-driven automation or specialized data analytics, can exert considerable influence. If Exela finds it difficult or expensive to replace these unique technological components, these suppliers gain bargaining power. For instance, a supplier providing a critical, patented algorithm for Exela's document processing solutions could command higher prices or dictate terms, impacting Exela's cost structure.

The bargaining power of suppliers, particularly skilled labor, is a significant factor for Exela Technologies. The company's core business relies on advanced automation and intricate transaction processing, which demands a workforce possessing specialized technical skills. For instance, professionals proficient in AI, machine learning, and complex data management are in high demand.

A limited pool of candidates with these niche skill sets can empower labor suppliers. If Exela needs to quickly expand its specialized teams, perhaps to meet a surge in demand for its AI-driven solutions, this reliance on a narrow talent pipeline can increase the leverage of recruitment agencies or individual contractors. This was evident in 2024, where reports indicated a 15% increase in demand for AI specialists across various industries, potentially driving up recruitment costs for companies like Exela.

Exela Technologies relies heavily on cloud infrastructure and data center services for its digital business process automation. The bargaining power of these suppliers is a key consideration. In 2024, the cloud computing market continued to consolidate, with major players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud holding significant market share.

This concentration means that if Exela's operations are critically dependent on a few dominant providers, those providers could wield considerable influence. The difficulty in switching providers, especially for complex, integrated systems, further strengthens supplier power. For instance, a significant portion of enterprise workloads in 2024 remained on-premises or in hybrid cloud environments, indicating the inertia and cost associated with migration.

The unique performance advantages offered by specialized data center services or advanced cloud features can also empower suppliers. If Exela requires specific, high-performance computing capabilities or unique data residency solutions that only a few providers can offer, their bargaining power increases substantially. This is particularly relevant as data security and compliance requirements become more stringent globally.

Specialized Hardware and Equipment Vendors

Specialized hardware and equipment vendors can hold significant bargaining power over Exela Technologies, particularly for critical components in document management and financial transaction processing. If Exela relies on a narrow selection of suppliers for high-speed scanners or secure processing units, these vendors can dictate higher prices and stricter terms. In 2024, the ongoing global supply chain challenges for advanced electronics continued to amplify the leverage of specialized equipment manufacturers, impacting lead times and costs for essential technology.

- Limited Vendor Options: Reliance on a few key providers for proprietary or highly technical hardware grants these suppliers considerable influence.

- High Switching Costs: Integrating new hardware often involves significant investment in software compatibility and training, making it costly for Exela to switch vendors.

- Technological Dependency: If Exela's operational efficiency is directly tied to the unique capabilities of specific vendor equipment, this creates a strong dependency.

- Supplier Concentration: In niche markets for advanced processing or scanning technology, a high degree of supplier concentration means fewer alternatives for Exela.

Data and Analytics Tool Providers

Exela Technologies relies on data and analytics to refine its offerings and improve customer interactions. Suppliers providing unique datasets, sophisticated AI/ML models, or specialized analytics tools that are crucial for Exela's competitive edge can wield significant bargaining power. This is especially true given the increasing demand for AI-driven automation solutions.

For instance, as of early 2024, the global market for AI in analytics was projected to reach over $20 billion, highlighting the growing importance of these specialized data and analytics providers. Companies that offer proprietary algorithms or access to exclusive, high-quality data that Exela needs to deliver its differentiated services may command higher prices or more favorable terms.

- Supplier Dependence: Exela's ability to offer advanced, AI-powered solutions directly correlates with the quality and uniqueness of data and analytics tools sourced from external providers.

- Market Trends: The accelerating adoption of AI and machine learning across industries amplifies the bargaining power of suppliers who possess cutting-edge technology in these areas.

- Differentiation Factor: Suppliers of specialized analytics or unique datasets are key to Exela's service differentiation, giving them leverage in negotiations.

Exela's reliance on specialized software and hardware components, particularly those with proprietary technology or unique performance advantages, grants suppliers considerable bargaining power. This is amplified when switching costs are high, as is often the case with integrated systems and specialized talent. The concentration of providers in niche markets for advanced technology further strengthens their position.

The demand for specialized skills in areas like AI and machine learning, critical for Exela's automation solutions, empowers labor suppliers. In 2024, the market saw a significant increase in demand for AI specialists, potentially driving up recruitment costs for companies like Exela. Similarly, the consolidation in the cloud computing market means dominant providers can exert influence, especially when migration is complex and costly.

Suppliers of specialized data and analytics tools also hold leverage, as these are crucial for Exela's service differentiation. The burgeoning AI market, projected to exceed $20 billion in early 2024, underscores the value these providers bring. This dependence on unique datasets and advanced algorithms allows them to negotiate favorable terms.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Exela Technologies | 2024 Data/Trend |

|---|---|---|---|

| Proprietary Software/AI Tech | Uniqueness, R&D investment, patents | Higher licensing fees, potential for price increases | Growing demand for AI solutions |

| Specialized Labor (AI/ML Experts) | Limited talent pool, high demand | Increased recruitment costs, potential wage inflation | 15% rise in AI specialist demand |

| Cloud Infrastructure Providers | Market concentration, switching costs | Potential for price hikes, dependence on service levels | Consolidation among major cloud players |

| Specialized Hardware (Scanners, Processors) | Limited vendors, supply chain issues | Higher equipment costs, longer lead times | Continued global electronics supply chain challenges |

| Unique Data/Analytics Providers | Data exclusivity, advanced modeling | Higher data acquisition costs, essential for service differentiation | AI in analytics market > $20 billion |

What is included in the product

Exela Technologies' Porter's Five Forces Analysis reveals the intense competition within its industry, the significant bargaining power of its customers, and the moderate threat of new entrants. It also highlights the low threat of substitutes and the moderate power of suppliers, collectively shaping Exela's strategic environment.

Exela's Porter's Five Forces Analysis provides a clear, one-sheet summary of all five forces—perfect for quick decision-making and identifying strategic pressure points.

Customers Bargaining Power

Exela Technologies' large enterprise customer base, which includes a significant number of Fortune 100 companies, grants these clients considerable bargaining power. With over 4,000 customers globally, Exela's reliance on these major accounts means they can negotiate terms and pricing due to the sheer volume of services purchased and their strategic importance. These sophisticated clients are well-equipped to leverage their scale to secure more favorable contracts.

Customer switching costs are a significant factor in Exela Technologies' competitive landscape. While Exela's solutions are deeply integrated into clients' mission-critical operations, making them sticky, the actual costs and complexities involved in switching providers for large-scale business process automation can be substantial for clients.

These high switching costs effectively reduce the bargaining power of customers once they are deeply embedded within Exela's ecosystem. For instance, migrating complex data, retraining staff, and reconfiguring workflows can easily run into hundreds of thousands or even millions of dollars for enterprise clients, discouraging them from seeking alternatives.

Exela Technologies' customers are often highly price-sensitive because many of its services are geared towards helping businesses cut costs and operate more efficiently. This focus on cost reduction means clients are always looking for the best deal, putting pressure on Exela to keep its prices competitive.

In the current economic climate of 2024, with ongoing inflation and concerns about global economic stability, this customer price sensitivity is even more pronounced. Businesses are scrutinizing every expenditure, and services that don't demonstrate clear, immediate cost savings can face significant pricing pressure.

Customer In-sourcing Capabilities

Large enterprises, especially those heavily invested in IT and digital transformation, can develop or enhance their own business process automation and information management systems. This capability for backward integration gives them significant leverage when negotiating with providers like Exela Technologies.

For instance, a major financial institution might decide to build its own document management system rather than rely solely on a third-party provider, especially if the cost savings and control over data are substantial. This threat of in-sourcing directly impacts Exela’s pricing power and customer retention strategies.

- Customer In-sourcing Capabilities: Large enterprises can develop internal solutions for automation and information management, reducing reliance on external vendors.

- Backward Integration Threat: The potential for customers to bring processes in-house serves as a powerful negotiation tool, influencing pricing and contract terms.

- Impact on Exela: Exela must demonstrate superior value, efficiency, and innovation to counter the threat of customers opting for self-sufficiency.

Availability of Competing Solutions

The market for business process automation, enterprise information management, and transaction processing is highly competitive, offering customers a multitude of alternative solutions. This abundance of choice, from specialized niche providers to larger, established companies, significantly amplifies customer bargaining power. Exela Technologies, for instance, operates in an environment with over 1,100 active competitors, giving clients considerable leverage.

Customers can readily switch providers or negotiate more favorable terms due to the sheer volume of available options. This dynamic forces companies like Exela to be more responsive to customer demands and pricing pressures.

- Market Saturation: The business process automation and information management sectors are crowded, providing ample alternatives for clients.

- Customer Options: A wide array of specialized and generalist competitors means customers have significant choice.

- Competitive Landscape: Exela Technologies faces over 1,100 active competitors, increasing customer leverage.

- Negotiating Power: The availability of substitutes empowers customers to demand better pricing and service terms.

Exela Technologies' customers, particularly its large enterprise clients, wield significant bargaining power. This is due to their substantial purchase volumes and the strategic importance of Exela's services to their operations, allowing them to negotiate favorable terms. In 2024, this power is amplified by a heightened customer focus on cost reduction amidst economic uncertainties, pushing Exela to maintain competitive pricing.

| Factor | Description | Impact on Exela | 2024 Context |

|---|---|---|---|

| Customer Concentration | Exela's large enterprise base, including Fortune 100 clients, means a few major accounts represent significant revenue. | These clients can leverage their scale to demand better pricing and contract terms. | Economic pressures in 2024 increase their willingness to negotiate aggressively. |

| Switching Costs | Deep integration of Exela's solutions into critical operations creates high costs for clients to switch providers. | While high, this can be offset by clients' willingness to invest in in-house capabilities if cost savings are significant. | Clients may explore in-sourcing if they perceive long-term cost advantages over Exela's service fees in 2024. |

| Price Sensitivity | Many of Exela's services are designed for cost efficiency, making clients inherently price-conscious. | This necessitates competitive pricing from Exela to retain business. | Inflationary pressures in 2024 intensify this sensitivity, demanding clear ROI demonstrations. |

| In-sourcing Capability | Large clients can develop or enhance their own automation and information management systems. | This threat of backward integration gives customers leverage to negotiate better deals with Exela. | The drive for greater control and potential cost savings may encourage more in-sourcing discussions in 2024. |

| Availability of Substitutes | The market for Exela's services is crowded with over 1,100 competitors. | This abundance of choice empowers customers to switch or negotiate more favorable terms. | The competitive landscape in 2024 remains robust, ensuring customers have ample alternatives. |

Preview Before You Purchase

Exela Technologies Porter's Five Forces Analysis

This preview shows the exact Porter's Five Forces Analysis of Exela Technologies you'll receive immediately after purchase, offering a comprehensive examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. You'll gain actionable insights into Exela's strategic positioning within its industry, enabling informed decision-making. This detailed analysis is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

Exela Technologies operates within a business process management sector that is incredibly fragmented, boasting over 1,100 active competitors. This intense rivalry stems from a multitude of companies all vying for a piece of the digital transformation, business process automation, and information management markets. The sheer number of players fuels aggressive competition, putting pressure on pricing and innovation.

The business process automation industry is a hotbed of innovation, with companies like Exela Technologies constantly needing to adapt. The rapid integration of artificial intelligence, machine learning, and hyperautomation means that staying competitive requires significant and ongoing investment in research and development. This relentless pace of technological change forces players to differentiate their offerings to remain relevant in a dynamic market.

The services sector Exela operates in is intensely competitive, often forcing companies to engage in aggressive pricing strategies to secure business. This constant pressure to offer lower prices directly impacts profit margins, as companies like Exela may have to reduce their own costs to remain competitive, potentially leading to margin erosion.

This dynamic is particularly evident when clients prioritize cost reduction. In such environments, winning contracts often hinges on the lowest bid, even if it means slimmer profits. Exela's reported revenue decline in Q2 2024 underscores the ongoing market challenges and the impact of such competitive pressures on financial performance.

Strategic Partnerships and Acquisitions

Competitive rivalry within the business process automation (BPA) sector, where Exela Technologies operates, is intense. Competitors are actively pursuing strategic partnerships and mergers and acquisitions (M&A) to bolster their capabilities, expand their customer reach, and grow their geographical footprint. This consolidation trend is a significant factor shaping the competitive landscape.

A prime example of this activity is XBP Europe's acquisition of Exela Technologies' Business Process Automation (BPA) division. This move, which occurred in January 2024, underscores the ongoing consolidation and strategic maneuvering occurring within the industry as companies seek to gain market share and enhance their service offerings. Such M&A activities directly impact Exela's competitive positioning.

- Industry Consolidation: The acquisition of Exela Technologies' BPA division by XBP Europe in early 2024 highlights a clear trend of consolidation within the business process automation market.

- Strategic Growth: Competitors are actively using partnerships and M&A to broaden their service portfolios, access new customer segments, and extend their operational reach globally.

- Competitive Pressure: These strategic moves by rivals directly increase competitive pressure on Exela Technologies, necessitating a proactive approach to maintaining and expanding its market presence.

Global and Local Competition

Exela Technologies operates in a highly competitive arena, contending with both global giants and nimble local specialists. This dual threat necessitates a flexible approach, as large multinational corporations often leverage economies of scale and extensive resources, while smaller, regional players can excel through specialized offerings and deep understanding of local market nuances. For instance, in 2024, the business process automation market, a key area for Exela, saw continued intense competition, with significant players like IBM and Accenture also vying for market share alongside numerous niche providers focusing on specific industries or technologies.

The company's global presence, serving clients in over 50 countries, means it must constantly adapt its strategies to meet diverse regional and industry-specific demands. This requires a nuanced understanding of varying regulatory environments, customer expectations, and technological adoption rates across different geographies. For example, Exela's efforts in digital transformation services in Europe might be met with different competitive pressures and customer needs compared to its operations in North America or Asia, where local competitors may have established stronger footholds.

- Global Competition: Exela faces established multinational corporations with broad service portfolios and significant market penetration.

- Local Competition: Agile local players often provide specialized solutions tailored to specific regional or industry requirements, posing a distinct challenge.

- Strategic Adaptation: Exela's global footprint demands tailored strategies for over 50 countries, addressing varied regional and industry-specific demands.

- Market Dynamics: The business process automation sector, a core area for Exela, remains intensely competitive in 2024, with both large tech firms and specialized vendors actively competing.

Competitive rivalry is fierce for Exela Technologies, operating in a fragmented business process management sector with over 1,100 competitors. This intense competition, fueled by rapid technological advancements like AI and hyperautomation, forces constant innovation and aggressive pricing. The acquisition of Exela's BPA division by XBP Europe in January 2024 exemplifies the ongoing industry consolidation as companies seek to expand their capabilities and market share.

| Key Competitor Type | Key Characteristics | Impact on Exela |

| Global Giants | Economies of scale, extensive resources, broad service portfolios | Intensified pricing pressure, need for broad service offerings |

| Niche/Local Specialists | Specialized offerings, deep regional understanding, agility | Challenge to market share in specific segments or geographies |

| Acquiring/Acquired Entities | Strategic partnerships, M&A activity (e.g., XBP Europe's acquisition of Exela's BPA division in Jan 2024) | Market share shifts, potential for new competitive dynamics |

SSubstitutes Threaten

Many large organizations, including those in the financial sector which Exela Technologies serves, evaluate the cost-benefit of in-house development versus outsourcing. For instance, a 2024 survey indicated that 45% of large enterprises are increasing their investment in internal IT automation capabilities, potentially reducing reliance on external providers for certain business process outsourcing (BPO) functions.

These internal solutions can act as direct substitutes, especially when custom requirements are paramount or when perceived integration challenges with third-party vendors are a concern. This trend is further fueled by advancements in low-code/no-code platforms, making internal development more accessible and cost-effective for specific tasks.

Generic software and readily available cloud-based tools present a significant threat of substitution for Exela Technologies. Many businesses can leverage platforms like Microsoft 365 or Google Workspace for basic document management, communication, and even some workflow automation, bypassing the need for specialized business process outsourcing. This trend is amplified by the increasing affordability and accessibility of these generic solutions, allowing companies to achieve a degree of operational efficiency without the investment in more comprehensive, tailored business process automation services.

The increasing accessibility of AI agents and low-code/no-code platforms poses a significant threat of substitutes for Exela Technologies. These tools allow individuals without extensive technical expertise to create their own automation solutions, potentially bypassing the need for specialized service providers.

For instance, the global low-code development platform market was valued at approximately $15 billion in 2023 and is projected to grow substantially. This indicates a growing user base that can develop custom applications and automate processes independently, directly impacting demand for Exela's traditional offerings.

Consulting Services and System Integrators

Clients have the option to work with independent consulting firms or specialized system integrators. These external partners can analyze business processes and implement automation solutions using a diverse range of third-party software and tools. This offers an alternative path for companies to achieve automation benefits without committing to Exela's integrated suites.

This competitive pressure means Exela must continually demonstrate the value and cost-effectiveness of its end-to-end solutions compared to assembling a solution from various vendors. The market for automation consulting and system integration is robust, with many firms offering specialized expertise.

- Cost-Effectiveness: Clients may find it cheaper to use off-the-shelf software and consultants rather than Exela's proprietary platforms.

- Flexibility: Independent solutions offer greater customization and the ability to swap components if needs change.

- Specialized Expertise: Niche consulting firms can provide deep expertise in specific automation areas that Exela might not cover as extensively.

- Market Growth: The global market for IT consulting and system integration services was projected to reach over $1.3 trillion in 2024, indicating a significant competitive landscape.

Alternative Data Processing Methods

For services like document management and financial transaction processing, alternative methods can pose a significant threat. For instance, advanced optical character recognition (OCR) software paired with efficient data entry services can replicate some of Exela Technologies' core functions. In 2024, the global OCR market was valued at approximately $4.7 billion, demonstrating a substantial and growing alternative.

Furthermore, emerging technologies like blockchain offer a decentralized and secure approach to transaction processing, potentially bypassing traditional intermediaries. This presents a substitute for secure and transparent financial record-keeping. The global blockchain market is projected to reach over $100 billion by 2027, indicating its increasing relevance as a substitute technology.

- OCR Software: Offers automated data extraction, reducing reliance on manual processing.

- General Data Entry Services: Can be a lower-cost alternative for less complex data tasks.

- Blockchain Technology: Provides enhanced security and transparency for financial transactions.

The threat of substitutes for Exela Technologies is significant, driven by advancements in technology and changing business preferences. Many organizations are exploring in-house development and readily available generic software, such as Microsoft 365 or Google Workspace, to handle specific business processes. The global low-code development platform market, valued at around $15 billion in 2023, highlights the growing trend of businesses creating their own automation solutions.

Alternative solutions also include specialized consulting firms and system integrators who can implement automation using various third-party tools. This competitive pressure necessitates that Exela continuously proves the value and cost-effectiveness of its integrated offerings. The IT consulting and system integration market, projected to exceed $1.3 trillion in 2024, underscores the breadth of these alternative service providers.

Furthermore, technologies like advanced OCR software and blockchain present direct substitutes for Exela's core services in document management and financial transaction processing. The OCR market alone was valued at approximately $4.7 billion in 2024, indicating a substantial alternative for data extraction. Blockchain's growing relevance, with a projected market exceeding $100 billion by 2027, offers a decentralized alternative for secure transaction handling.

| Substitute Category | Examples | Key Advantages | Market Indicator (2024/2023 Data) |

|---|---|---|---|

| In-house Development | Low-code/No-code platforms | Customization, perceived integration ease | Low-code market ~$15 billion (2023) |

| Generic Software | Microsoft 365, Google Workspace | Affordability, accessibility for basic tasks | Widely adopted across enterprises |

| Specialized Consulting | System Integrators | Niche expertise, flexible solution assembly | IT Consulting & System Integration market >$1.3 trillion (2024) |

| Emerging Technologies | Advanced OCR, Blockchain | Automation of data extraction, decentralized security | OCR market ~$4.7 billion (2024), Blockchain market projected >$100 billion by 2027 |

Entrants Threaten

The rise of low-code and no-code platforms is a significant factor increasing the threat of new entrants for companies like Exela Technologies. These platforms dramatically reduce the technical expertise and capital investment needed to create business process automation solutions. For instance, the low-code development market was valued at approximately $11.3 billion in 2023 and is projected to grow substantially, indicating a fertile ground for new, agile competitors to emerge.

Startups can leverage these tools to quickly build and deploy specialized applications, targeting specific market needs or inefficiencies that Exela might serve. This accessibility means that a company with a novel approach to workflow automation could enter the market with a fraction of the resources previously required, directly challenging established players in niche segments.

The availability of venture capital funding is a significant threat to Exela Technologies. In 2024, the technology sector continued to attract substantial investment, with venture capital firms deploying billions into software and IT services startups. This readily available capital allows new companies to enter the market with aggressive pricing and rapid innovation, directly challenging established players.

The rapid evolution of artificial intelligence and machine learning presents a significant threat of new entrants for companies like Exela Technologies. New players can leverage these advanced technologies to develop highly efficient, automated solutions that bypass established operational complexities. For instance, AI-powered customer service platforms or intelligent document processing systems can offer superior performance and cost-effectiveness, allowing agile startups to quickly gain market share.

Cloud-Native and SaaS Business Models

The rise of cloud-native and SaaS models significantly lowers the barrier to entry for new competitors in the business process automation space. Companies can now launch services with minimal capital expenditure on physical infrastructure, allowing for rapid scaling and agile market penetration. For instance, in 2024, the global SaaS market was projected to reach over $326 billion, highlighting the immense growth and accessibility of this model.

This shift means new players can offer flexible, subscription-based solutions that are highly attractive to customers seeking cost-effectiveness and scalability. Exela Technologies faces a threat from these nimble entrants who can quickly adapt to market demands without the legacy burdens of on-premise solutions. The ease of deploying and updating cloud-based platforms allows new entrants to rapidly iterate and compete on service features and pricing.

- Reduced Infrastructure Costs: Cloud-native and SaaS models eliminate the need for substantial upfront investment in hardware and data centers for new entrants.

- Scalability and Agility: These models enable rapid scaling of services to meet demand and quick adaptation to market changes.

- Subscription-Based Revenue: Flexible subscription pricing models are appealing to customers and provide predictable revenue streams for new businesses.

- Global Reach: Cloud platforms offer immediate access to a global customer base, bypassing traditional geographical limitations.

Industry-Specific Niche Players

New entrants can pose a significant threat by targeting specialized niches within Exela Technologies' service areas. For instance, companies focusing solely on optimizing electronic health record (EHR) workflows or streamlining specific legal discovery processes can build deep expertise. This focused approach allows them to offer highly tailored solutions that might outcompete Exela's more generalized offerings in those particular segments.

These niche players, by concentrating their resources and innovation on a narrow market, can achieve a competitive edge. Their specialized knowledge allows them to respond more agilely to evolving client needs within that niche. This agility can translate into faster adoption and a stronger market position, potentially eroding Exela's market share in those specific, high-value areas.

Consider the healthcare sector, where specialized Revenue Cycle Management (RCM) providers have emerged, focusing on specific payer rules or medical specialties. In 2024, the RCM market was projected to reach over $40 billion globally, indicating significant growth and opportunities for specialized players to capture market share from larger, more diversified companies like Exela.

- Niche Focus: New entrants can gain traction by concentrating on specific industry segments, such as healthcare claims processing or financial document automation.

- Expertise Development: Specializing allows these new players to develop deep domain expertise, offering more tailored and efficient solutions than broader competitors.

- Market Penetration: By addressing unmet needs within a niche, these entrants can establish a foothold and potentially expand their offerings, challenging established players.

- Competitive Pressure: The rise of these specialized firms increases competitive pressure on Exela, forcing it to innovate and adapt its strategies for broader service portfolios.

The increasing availability of venture capital funding in 2024, particularly for technology startups, significantly lowers the barrier for new entrants to challenge Exela Technologies. Billions were deployed into software and IT services, enabling new companies to enter with aggressive pricing and rapid innovation.

New entrants can leverage advanced technologies like AI and machine learning to develop highly efficient, automated solutions, bypassing established operational complexities. This allows agile startups to quickly gain market share by offering superior performance and cost-effectiveness in areas like intelligent document processing.

The proliferation of low-code/no-code platforms, valued at over $11.3 billion in 2023, empowers new competitors by reducing the need for extensive technical expertise and capital, enabling rapid development of specialized business process automation solutions.

| Factor | Impact on Exela Technologies | Example Data/Trend |

|---|---|---|

| Venture Capital Availability | Increased threat from well-funded startups | Billions invested in tech startups in 2024 |

| Technological Advancements (AI/ML) | New entrants can offer superior, cost-effective solutions | AI-powered platforms offer enhanced efficiency |

| Low-Code/No-Code Platforms | Reduced technical barriers for new competitors | Market valued at $11.3 billion in 2023, growing rapidly |

Porter's Five Forces Analysis Data Sources

Our Exela Technologies Porter's Five Forces analysis leverages a comprehensive dataset including Exela's SEC filings, investor presentations, and competitor annual reports. We also incorporate industry-specific market research from firms like Gartner and IDC, alongside economic indicators from reputable sources such as the World Bank.