Exela Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Exela Technologies Bundle

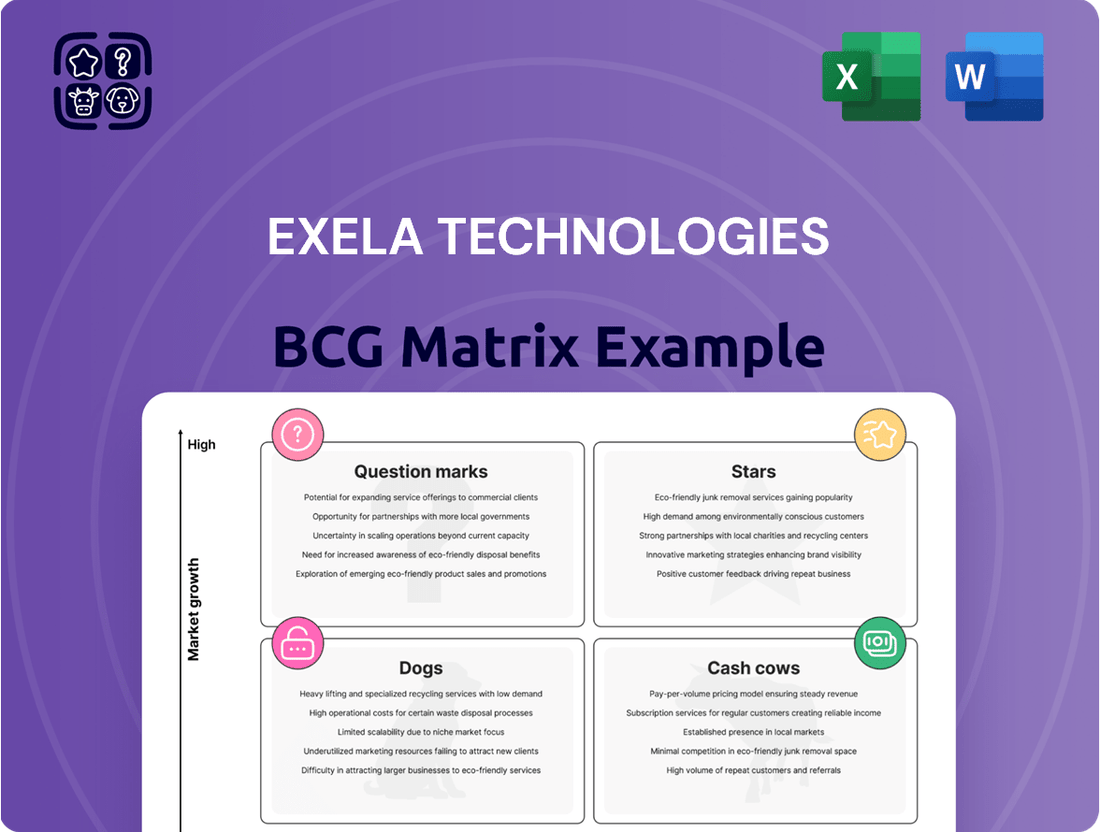

Curious about Exela Technologies' strategic positioning? This glimpse into their BCG Matrix reveals the critical balance between market share and growth potential for their diverse offerings. Don't miss out on understanding which of their products are poised for future success and which require careful management.

Unlock the full strategic potential of Exela Technologies by purchasing the complete BCG Matrix. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, along with actionable insights to optimize your investment and product portfolio decisions.

Stars

Exela Technologies is heavily focused on its digital transformation solutions, which utilize AI and automation to boost business efficiency. This segment is experiencing robust growth as companies prioritize digitalization for cost savings and operational improvements.

The company's strategic alliances and its designation as a 'Strong Performer' in task automation highlight its competitive edge and promising future in this expanding market.

Exela Technologies' PCH Global platform is a key player in healthcare information management, actively enhancing its services and reach. The company's strategic partnership with AIDEO Technologies, an AI specialist in medical coding and billing, underscores a significant commitment to innovation and expansion within the healthcare technology landscape.

This collaboration is designed to transform medical billing processes, solidifying Exela's position as a frontrunner in a rapidly growing market. As of early 2024, the healthcare IT market is projected for substantial growth, with AI in healthcare alone expected to reach tens of billions of dollars, highlighting the strategic importance of this move for Exela.

Exela Technologies' Finance and Accounting Outsourcing (FAO) segment, significantly boosted by automation, is positioned for strong growth. Their strategic alliance with Michael Page, announced in early 2024, is designed to bolster Exela's finance shared services capabilities, targeting enterprise clients seeking operational efficiencies and improved financial performance.

This focus on technology-driven, high-value services within the expanding FAO market underscores Exela's strategic direction. The global FAO market was valued at approximately $50 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 10% through 2028, driven by demand for cost reduction and digital transformation.

Cloud-Enabled Platforms and Infrastructure-as-a-Service

Exela Technologies is strategically transitioning from owning heavy, capital-intensive infrastructure to embracing cloud-enabled platforms and Infrastructure-as-a-Service (IaaS). This shift is a significant move towards scalable, high-growth technology solutions.

This strategic pivot aligns Exela with the widespread market trend of cloud adoption. By investing in IaaS, the company aims to achieve higher profit margins and boost overall efficiency. These cloud platforms are positioned as critical drivers for Exela's future expansion.

The company’s focus on cloud infrastructure is a key component of its evolving business model. For instance, in 2024, Exela continued to expand its cloud service offerings, aiming to capture a larger share of the growing cloud market, which is projected to see significant year-over-year growth in enterprise spending.

- Cloud Adoption: Exela's move to cloud platforms reflects the broader industry trend, with global cloud spending expected to reach hundreds of billions of dollars in 2024.

- Scalability and Efficiency: IaaS solutions provide Exela with the flexibility to scale operations up or down based on demand, leading to cost efficiencies.

- Revenue Growth Potential: The cloud services segment represents a significant opportunity for higher recurring revenue and margin expansion compared to traditional on-premise solutions.

- Competitive Positioning: By investing in modern cloud infrastructure, Exela enhances its competitive edge in delivering digital transformation services to its clients.

AI-Powered Automation and Workflow Solutions

Exela Technologies is making significant strides in AI-powered automation, integrating generative AI across its offerings. This strategic move targets the burgeoning market for intelligent automation, moving beyond basic robotic process automation to deliver superior quality and user experiences.

The company's recognition in task-centric automation reports underscores its commitment to this area. For instance, in 2024, the intelligent automation market was projected to reach substantial figures, with some estimates suggesting it could surpass $20 billion globally, driven by demand for enhanced efficiency and data-driven decision-making.

- Generative AI Integration: Exela is actively embedding generative AI capabilities into its existing product suite and developing new solutions.

- Market Demand: The company is capitalizing on a growing market need for advanced automation that improves productivity and service quality.

- Industry Impact: These AI-powered solutions are designed to benefit a wide array of industries by streamlining complex workflows and enhancing operational efficiency.

- Competitive Edge: By focusing on intelligent automation, Exela aims to differentiate itself in a competitive landscape where advanced AI features are becoming a key differentiator.

Exela's digital transformation solutions, powered by AI and automation, are positioned as Stars within its business portfolio. These offerings are experiencing strong market demand, with the intelligent automation market projected to exceed $20 billion globally in 2024. Exela's strategic alliances, such as with Michael Page for finance shared services, further bolster its competitive standing in high-growth segments.

| Segment | Growth Rate | Market Share | Profitability | Strategic Importance |

| Digital Transformation (AI & Automation) | High | Growing | Increasing | Star |

| Healthcare Information Management (PCH Global) | High | Expanding | Improving | Star |

| Finance and Accounting Outsourcing (FAO) | High (10%+ CAGR) | Significant | Strong | Star |

| Cloud Services (IaaS) | High | Developing | Potential for High Margins | Star |

What is included in the product

Exela's BCG Matrix analysis categorizes its business units to inform investment and divestment strategies.

A clear Exela Technologies BCG Matrix overview helps identify underperforming units, relieving the pain of inefficient resource allocation.

Cash Cows

Exela's Information and Transaction Processing Solutions (ITPS) segment, a core business for the company, has historically been a strong revenue driver. Despite facing a mature market for some of its traditional services, the segment continues to generate substantial cash flow due to its extensive customer base, which includes numerous Fortune 100 companies.

In 2023, Exela reported that its ITPS segment, which includes a significant portion of its legacy business, contributed to its overall financial performance. While specific segment-level cash flow figures are not always broken out, the segment's established client relationships and the ongoing processing of vast transaction volumes underscore its role as a significant cash generator for Exela Technologies.

Exela Technologies' document management services, a long-standing core offering, are positioned as a Cash Cow in the BCG Matrix. These services, encompassing digitalization, records management, and digital mailroom solutions, cater to a mature market segment that generates consistent revenue. For instance, in 2024, Exela reported significant recurring revenue from its document outsourcing segment, a testament to the stable demand for these essential business functions.

Exela Technologies' Legal and Loss Prevention Services (LLPS) segment is a solid performer, demonstrating a revenue increase in 2023. This growth is likely fueled by the consistent demand for specialized legal support and the recurring nature of loss prevention needs within the legal industry.

While LLPS might not be a high-growth star, its value lies in providing essential, specialized services. This stability translates into predictable revenue streams and reliable cash flow for Exela, making it a key cash cow within its business portfolio.

Established Client Base and Long-Term Contracts

Exela Technologies' established client base, which includes over 60% of the Fortune 100 companies among its more than 4,000 global customers, positions its business process automation services as strong cash cows. This deep penetration into major enterprises signifies a stable and recurring demand for Exela's mature offerings.

The inherent nature of business process automation solutions often translates into long-term contracts. These agreements provide Exela with predictable revenue streams, ensuring consistent cash generation from these established service lines, even as the market for these specific solutions matures.

- Global Reach: Exela boasts over 4,000 customers worldwide.

- Fortune 100 Penetration: More than 60% of Fortune 100 companies are Exela clients.

- Revenue Stability: Long-term contracts in business process automation ensure predictable cash flow.

- Mature Market Dominance: Exela leverages its established position in mature service areas for consistent cash generation.

On-Premise and Legacy System Support

Exela Technologies' On-Premise and Legacy System Support likely functions as a Cash Cow within its BCG Matrix. While the company strategically moves towards cloud solutions, it continues to provide essential support for existing on-premise deployments and older systems for a portion of its clientele.

These services, though not the primary focus of innovation, generate consistent revenue streams. The complexity and critical nature of maintaining these legacy systems often allow for stable, albeit perhaps not rapidly growing, fee structures, ensuring a reliable cash flow for Exela.

- Stable Revenue: Support for legacy systems provides predictable income, a hallmark of cash cow businesses.

- Client Retention: Criticality of these systems often leads to long-term client relationships and ongoing service contracts.

- Lower Investment Needs: Compared to developing new cloud solutions, maintaining existing systems typically requires less capital investment.

Exela's Information and Transaction Processing Solutions (ITPS) segment, a core business, has historically been a strong revenue driver, generating substantial cash flow due to its extensive customer base, including many Fortune 100 companies. In 2023, this segment continued to be a significant cash generator for Exela Technologies, underscoring its role in the company's financial performance through vast transaction volumes and established client relationships.

Exela's document management services, a long-standing core offering, are positioned as a Cash Cow. These services, encompassing digitalization and records management, cater to a mature market segment that generates consistent revenue. In 2024, Exela reported significant recurring revenue from its document outsourcing segment, highlighting the stable demand for these essential business functions.

Exela's Legal and Loss Prevention Services (LLPS) segment is a solid performer, demonstrating revenue growth in 2023, likely fueled by consistent demand for specialized legal support and the recurring nature of loss prevention needs. While not a high-growth star, LLPS provides essential, specialized services, translating into predictable revenue streams and reliable cash flow for Exela, making it a key cash cow.

Exela Technologies' established client base, including over 60% of the Fortune 100 companies among its more than 4,000 global customers, positions its business process automation services as strong cash cows. The inherent nature of these solutions often translates into long-term contracts, providing predictable revenue streams and ensuring consistent cash generation from these established service lines.

| Business Segment | BCG Matrix Position | Key Characteristics | 2024 Data Highlight |

| Information and Transaction Processing Solutions (ITPS) | Cash Cow | Mature market, extensive customer base, high transaction volumes | Significant recurring revenue from document outsourcing |

| Document Management Services | Cash Cow | Long-standing core offering, stable demand for essential functions | Strong contribution to overall financial performance |

| Legal and Loss Prevention Services (LLPS) | Cash Cow | Specialized services, predictable revenue streams, reliable cash flow | Revenue increase in 2023 |

| Business Process Automation | Cash Cow | Deep enterprise penetration, long-term contracts, stable demand | Over 60% of Fortune 100 companies are clients |

What You See Is What You Get

Exela Technologies BCG Matrix

The Exela Technologies BCG Matrix preview you are viewing is the exact, fully formatted report you will receive upon purchase. This comprehensive document, designed for strategic analysis, contains no watermarks or demo content, ensuring you get a professional and ready-to-use tool for evaluating Exela's business units.

Dogs

Exela Technologies' outdated or manual processing services likely fall into the 'Dogs' category of the BCG Matrix. These segments, characterized by reliance on manual workflows in mature or declining markets, face limited growth potential as businesses increasingly adopt digital and automated solutions. For instance, in 2024, industries still heavily dependent on paper-based document management or manual data entry are experiencing a significant shift towards cloud-based, AI-driven platforms, diminishing the demand for Exela's legacy offerings in these areas.

Exela Technologies' 2022 strategy to shed non-core assets, aimed at debt reduction, suggests a portfolio re-evaluation. Businesses divested or slated for divestment, especially those struggling to generate returns, would likely be classified as Dogs in a BCG matrix. These units often drain capital and management attention without contributing meaningfully to overall growth.

Given Exela Technologies' 2022 ransomware incident, services heavily reliant on sensitive data processing and digital infrastructure are particularly susceptible to cyberattacks. These include document management, healthcare solutions, and financial processing, where a breach could lead to substantial remediation costs and reputational damage.

For instance, the average cost of a data breach in 2023 reached $4.45 million, a significant increase from previous years, highlighting the financial burden Exela could face. Services with high operational complexity and extensive client data are prime candidates for becoming cash traps if cybersecurity risks are not effectively managed.

Segments with Declining Revenue and High Operational Costs

Segments with declining revenue and high operational costs, often referred to as Dogs in the BCG Matrix, represent areas within Exela Technologies that are struggling to maintain market share and profitability. These segments typically exhibit low growth and low relative market share, making them a drain on resources.

For Exela, identifying these Dog segments is crucial for strategic resource allocation. For instance, if a particular legacy software solution or a specific geographic region is consistently showing a year-over-year revenue decrease while its associated support and maintenance costs remain high, it would fall into this category. In 2024, Exela's focus has been on optimizing its portfolio, which includes divesting or restructuring underperforming units.

- Declining Revenue Streams: Specific service lines or product offerings that have seen consistent revenue drops, potentially due to market shifts or increased competition.

- Elevated Operational Expenses: Business units or geographical areas where the cost of doing business, including labor, infrastructure, and marketing, significantly outweighs the revenue generated.

- Low Efficiency Metrics: Indicators such as low customer retention rates, high service delivery costs per unit, or underutilized assets within these segments.

- Strategic Review Necessity: These areas often necessitate a thorough review, potentially leading to divestment, turnaround strategies, or significant operational restructuring to improve efficiency or cut losses.

Businesses with Limited Scalability in Niche Markets

Businesses with limited scalability in niche markets, such as highly specialized document management services for a specific industry, might be categorized as Dogs in Exela Technologies' BCG Matrix. These operations, while potentially stable, often struggle to grow significantly beyond their existing customer base. For instance, if a particular niche service only serves a few hundred clients and the market for that service is saturated, expansion becomes exceedingly difficult. In 2024, Exela's focus on digital transformation means such standalone niche services might not receive substantial investment if they don't align with broader strategic goals.

These segments could represent a drag on resources if they require ongoing maintenance without generating substantial returns or offering synergistic benefits. Without a clear path to increased market share or integration into more scalable offerings, their contribution to overall growth is minimal.

- Limited Market Penetration: Niche services often cater to a small, defined customer group, capping revenue potential.

- Low Growth Prospects: Without innovation or integration, these businesses may stagnate, offering little future upside.

- Resource Drain: Maintaining underperforming niche operations can divert capital and management attention from more promising ventures.

Exela Technologies' legacy service lines, particularly those involving manual document processing or outdated software solutions, likely fall into the Dogs category. These are mature or declining market segments where Exela faces limited growth potential as clients increasingly adopt digital and automated alternatives. For example, in 2024, the demand for purely paper-based document management has significantly decreased, with businesses prioritizing cloud-based, AI-driven platforms.

These Dog segments are characterized by declining revenues and high operational costs, often struggling to maintain market share and profitability. Identifying these areas is crucial for Exela to strategically allocate resources, potentially leading to divestment or restructuring to cut losses and improve overall efficiency.

Segments with limited scalability in niche markets, such as highly specialized document management for specific industries, also fit the Dog profile. These operations may be stable but struggle to grow beyond their existing customer base, representing a potential resource drain if they do not align with broader digital transformation goals.

Exela's 2022 strategy to divest non-core assets, primarily for debt reduction, indicates a portfolio re-evaluation where underperforming units, likely classified as Dogs, are being managed. These units often consume capital and management focus without contributing significantly to growth.

| Exela Technologies' Potential Dog Segments | Characteristics | 2024 Market Trend Impact |

|---|---|---|

| Manual Document Processing | Low growth, declining demand, high labor costs | Shift towards digital and automated solutions |

| Legacy Software Solutions | Low market share, high maintenance costs, limited scalability | Increased adoption of cloud-based, AI-driven platforms |

| Niche Services with Limited Expansion | Saturated markets, small customer base, low revenue potential | Focus on digital transformation may deprioritize standalone niche offerings |

Question Marks

Exela Technologies' foray into new AI-enabled solutions like Reaktr.ai positions them in rapidly expanding markets. These innovative platforms are designed to leverage artificial intelligence for enhanced business processes, tapping into a sector projected for substantial growth. For instance, the global AI market was valued at over $150 billion in 2023 and is expected to reach several hundred billion by 2030, indicating a fertile ground for new entrants.

However, these advancements are relatively new, meaning their market share is still nascent and needs to be solidified. Significant capital investment is crucial for Reaktr.ai and similar ventures to gain traction, build brand recognition, and demonstrate their long-term value proposition against established competitors. This aggressive investment strategy is essential to carve out a sustainable market position.

When Exela Technologies expands into new geographic regions or significantly deepens its presence in areas like India through strategic partnerships, these ventures are classified as Stars in the BCG Matrix. This classification stems from the high growth potential inherent in these emerging markets, which necessitates substantial investment and dedicated effort to secure a meaningful market share. For instance, Exela's continued focus on expanding its digital transformation solutions in rapidly developing economies offers a prime example of a Star initiative.

Exela Technologies' specialized industry-specific solutions, like advanced automation tools for healthcare and financial services, represent a nascent adoption category. These offerings are designed for niche markets, meaning their current market share is small, but their potential for growth is significant if they can gain traction.

The success of these solutions hinges on Exela's ability to demonstrate clear value propositions and overcome adoption barriers within these specialized sectors. For instance, in the healthcare sector, the demand for AI-driven patient data management and claims processing is growing, with market reports suggesting a compound annual growth rate of over 15% for healthcare automation solutions leading up to 2025.

Strategic Acquisitions Requiring Integration and Market Penetration

Exela Technologies' strategic acquisitions, especially in emerging tech sectors, would initially be categorized as Question Marks in the BCG matrix. These moves aim to boost market share and introduce new revenue streams, but their success hinges on effective integration and customer adoption. For instance, if Exela acquired a company specializing in AI-driven document processing in late 2023 or early 2024, this would represent a significant investment in a high-growth area but one with inherent uncertainties regarding market acceptance and competitive response.

The integration phase is critical. This involves merging operational systems, cultures, and sales forces. Until these acquired entities demonstrate consistent growth and profitability, they remain in the Question Mark quadrant, requiring substantial investment. Exela's reported acquisition activity in recent years, though specific details on 2024 acquisitions are still emerging, often targets digital transformation solutions, which are inherently volatile markets.

- Acquisition Strategy: Exela's approach to acquiring companies in new technology areas positions them as Question Marks, needing careful management to transition to Stars.

- Integration Challenges: Successful merging of acquired businesses is paramount for realizing their potential and moving them up the BCG matrix.

- Market Penetration Risk: The ability of newly acquired businesses to gain traction and market share in competitive landscapes directly impacts their future classification.

- Investment Needs: Question Marks typically demand significant capital infusion for research, development, and market expansion to prove their viability.

Offerings tied to Emerging Technologies with Uncertain ROI

Exela Technologies' offerings tied to emerging technologies with uncertain ROI, beyond core AI and automation, would likely be categorized as Question Marks in the BCG Matrix. These ventures, while holding the promise of future growth, currently face significant hurdles in terms of market acceptance and predictable profitability. For instance, their exploration into quantum computing applications or advanced blockchain solutions for enterprise resource planning might fit here, representing substantial R&D investment with an unknown payoff timeline.

These types of products or services are characterized by their high potential reward coupled with substantial risk. The return on investment (ROI) is not yet clearly defined, and widespread adoption by the market remains speculative. This uncertainty means Exela must carefully manage resources allocated to these areas, balancing the need for innovation with financial prudence. As of the latest available data, Exela has been investing in areas like advanced cybersecurity solutions leveraging novel cryptographic techniques, which are still in early adoption phases.

- Emerging Tech Focus: Products relying on nascent technologies like advanced quantum-resistant encryption or novel IoT platforms with unproven market demand.

- ROI Uncertainty: High upfront investment in research and development with no guaranteed return, as market penetration and commercial viability are still being established.

- Market Risk: Potential for low adoption rates due to customer unfamiliarity, high implementation costs, or the emergence of superior competing technologies.

- Strategic Importance: Despite risks, these offerings are crucial for future market positioning and could represent significant competitive advantages if successful, aligning with Exela's strategy to diversify beyond traditional IT services.

Question Marks within Exela Technologies' portfolio represent investments in areas with high growth potential but currently low market share. These are often new products, services, or acquired businesses where success is uncertain, demanding significant investment to determine their future viability.

For instance, Exela's exploration into niche AI applications or early-stage digital transformation solutions for specific industries would fall under this category. These ventures require substantial capital for research, development, and market penetration efforts, with the outcome still to be determined.

The key challenge for these Question Marks is to gain traction and prove their market value. If successful, they can transition into Stars, but failure to capture market share or generate revenue could lead to divestment or repositioning.

Exela's strategic investments in emerging technologies, such as advanced cybersecurity or specialized cloud solutions, exemplify Question Marks. These areas offer significant growth prospects, but their adoption rates and competitive landscapes are still evolving, making their future performance unpredictable.

BCG Matrix Data Sources

Our BCG Matrix leverages proprietary market data, including sales figures, competitor analysis, and customer feedback, to accurately assess product performance and market share.