Exel Industries SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Exel Industries Bundle

Exel Industries is strategically positioned with strong brand recognition and a robust product portfolio, but faces challenges from intense market competition and evolving technological landscapes. Understanding these dynamics is crucial for navigating its future success.

Want the full story behind Exel Industries' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Exel Industries boasts a commanding global leadership in agricultural spraying technology, a sector vital for food security and agricultural efficiency. This strong market position is further bolstered by its substantial footprint in industrial and leisure spraying, demonstrating a strategic diversification.

This multi-sector approach, encompassing agricultural equipment, industrial applications, technical hoses, the nautical industry, and gardening, creates a robust business model. It effectively cushions the company against volatility in any single market segment, ensuring a more stable financial performance.

For example, during periods where agricultural spraying might face headwinds, growth in leisure and industrial spraying segments can offset these challenges. This inter-segmental balance was evident in Exel's 2023 performance, where despite a 3.2% drop in agricultural sales, industrial and leisure segments saw revenue increases, contributing to a resilient overall financial picture.

Exel Industries' enduring dedication to innovation, cultivated over seven decades, fuels its drive to create products that are not only unique and efficient but also competitive and user-friendly.

This commitment is tangibly demonstrated through consistent investment in research and development, a robust portfolio of patent registrations, and strategic modernization initiatives. A prime example is the new Sames plant in Stains, France, scheduled for operational launch in autumn 2025, underscoring their forward-looking approach to manufacturing and product development.

Exel Industries boasts a significant global presence, operating in 33 countries spread across five continents. This extensive reach is supported by 24 production sites strategically located worldwide, enabling the company to effectively serve diverse markets.

This widespread manufacturing network allows Exel Industries to remain agile, adapting to varying regional market conditions and fluctuating demand. For instance, their diversified geographical footprint proved instrumental in mitigating the impact of declining volumes within the agricultural sector by shifting focus and resources.

Financial Resilience and Debt Management

Exel Industries has shown impressive financial resilience, a key strength. Despite economic headwinds, the company maintained its revenue around €1.1 billion for the 2023-2024 period. This stability highlights a strong core business that can weather challenging markets.

A significant focus on debt reduction and cash flow generation further bolsters this strength. In the first half of the 2024-2025 fiscal year, Exel Industries made notable progress in improving its net financial debt. This was achieved through strategic initiatives aimed at optimizing working capital and reducing inventory levels.

- Revenue Stability: Maintained approximately €1.1 billion in revenue for 2023-2024.

- Debt Reduction Focus: Actively worked to lower net financial debt in H1 2024-2025.

- Working Capital Optimization: Improved financial health through efficient working capital management.

- Inventory Management: Strategic reduction in inventory levels contributed to debt reduction.

Commitment to Sustainability and CSR

Exel Industries demonstrates a strong commitment to sustainability by embedding Corporate Social Responsibility (CSR) into its core operations and financial strategies. A key initiative involves enhancing product lines, such as increasing the proportion of recycled PVC used in their hoses, directly addressing circular economy principles.

The company is proactively developing its CSR policy and pursuing certifications like the Corporate Sustainability Reporting Directive (CSRD) and Science Based Targets initiative (SBTi). This strategic alignment reflects the increasing global demand for robust environmental, social, and governance (ESG) performance, positioning Exel favorably in the evolving market landscape.

- Recycled Material Integration: Exel is increasing the use of recycled PVC in its hose production.

- CSR Policy Development: The company is actively structuring its CSR policy.

- ESG Certifications: Exel is preparing for certifications like CSRD and SBTi.

- Market Alignment: This commitment aligns with growing global emphasis on ESG factors.

Exel Industries' diversified business model across agricultural, industrial, and leisure spraying provides significant resilience. This broad market presence helps to buffer against downturns in any single sector, ensuring more stable revenue streams.

The company's long-standing commitment to innovation, spanning over seven decades, is a core strength. This dedication is evident in continuous R&D investment and a robust patent portfolio, ensuring a competitive edge.

Exel Industries maintains a strong global footprint with operations in 33 countries and 24 production sites. This extensive network allows for agility in responding to diverse regional market demands and economic fluctuations.

Financial stability is a key strength, with revenues holding steady around €1.1 billion for the 2023-2024 period. The company's focus on debt reduction and efficient working capital management, as seen in H1 2024-2025 progress, further solidifies its financial health.

What is included in the product

Delivers a strategic overview of Exel Industries’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Highlights key competitive advantages and potential threats, enabling proactive strategic adjustments.

Weaknesses

Exel Industries' reliance on agricultural spraying makes it susceptible to market downturns. For instance, the agricultural sector saw significant volume and sales drops in key regions like North America, Australia, and France during 2024-2025, directly impacting Exel's revenue streams.

This dependency highlights the inherent volatility of the agricultural equipment market. Factors such as unpredictable weather patterns, fluctuating crop prices, and shifts in farmer confidence regarding capital investments create a challenging operating environment for Exel.

Exel Industries' global reach, while a strength, also presents a significant weakness: exposure to foreign exchange fluctuations. In the third quarter of the 2024-2025 fiscal year, the company experienced a notable €6.3 million impact on its financials directly attributed to currency shifts, specifically the dollar's depreciation. This kind of volatility can make revenue and profit forecasting a much trickier endeavor, adding a layer of unpredictability to financial management.

Exel Industries faces significant headwinds due to ongoing macroeconomic uncertainty, which directly impacts its order visibility. This uncertainty, particularly pronounced in the agricultural sector, creates a challenging environment for forecasting and strategic planning.

Farmers are adopting a cautious 'wait-and-see' approach, influenced by global trade dynamics and fluctuating agricultural revenues. For instance, in 2024, many agricultural markets experienced price volatility, leading to delayed purchasing decisions for new equipment, a core business for Exel. This can directly translate to lower order intake for the company.

The lack of clear visibility into future demand makes it difficult for Exel Industries to optimize production schedules and manage inventory effectively. This can lead to inefficiencies and potentially impact profitability if the company is unable to adapt quickly to shifts in market sentiment and demand.

Challenges in Specific Regional Markets

While Exel Industries reports positive sales trends in segments like leisure and industrial spraying, these gains are not uniform across all regions. For instance, industrial spraying revenue in Asia experienced a slight contraction in the first half of 2024. This regional weakness can temper the company's overall growth trajectory.

The European wine market presents another area of concern, with an uncertain outlook for 2024 impacting demand for related spraying equipment. This uncertainty highlights the vulnerability of certain business units to localized economic or market-specific headwinds, potentially offsetting stronger performances in other geographical areas.

- Regional Sales Disparities: Asia's industrial spraying segment saw a minor decline in H1 2024.

- European Market Uncertainty: The outlook for wine markets in Europe remains subdued.

- Offsetting Performance: Regional challenges can dilute the impact of growth in other segments.

Potential for Increased Competition in Certain Segments

Exel Industries could face heightened competition in specific markets, particularly from local players in regions like Asia's industrial spraying sector. This competitive pressure might impact sales volumes and market share, necessitating ongoing product development and aggressive pricing to retain its standing.

For instance, in 2024, the industrial spraying market in Asia saw significant growth, attracting new entrants. Exel Industries' ability to counter this by offering technologically advanced solutions and maintaining cost-effectiveness will be crucial for its continued success in these areas.

- Local Integrators: Increased presence of local competitors in key Asian markets.

- Pricing Pressure: Potential for downward pressure on prices due to competition.

- Market Share Risk: Threat of losing market share if competitive advantages are not maintained.

Exel Industries' significant reliance on the agricultural sector exposes it to the inherent volatility of commodity prices and unpredictable weather patterns. For example, during 2024, several key agricultural markets experienced price fluctuations, leading to delayed capital equipment purchases by farmers, directly impacting Exel's order intake.

The company's global operations also create vulnerability to foreign exchange rate fluctuations. In Q3 of the 2024-2025 fiscal year, currency shifts, particularly the dollar's depreciation, resulted in a €6.3 million negative impact on Exel's financials, complicating revenue and profit projections.

Macroeconomic uncertainty further hinders Exel's order visibility, as farmers adopt a cautious approach to spending. This makes it challenging for Exel to optimize production and manage inventory efficiently, potentially leading to inefficiencies and impacting profitability.

Regional sales performance is not uniform, with a slight contraction noted in Asia's industrial spraying revenue in H1 2024. Similarly, the European wine market faces an uncertain outlook for 2024, impacting demand for related equipment and potentially offsetting growth in other segments.

Increased competition, especially from local players in Asian industrial spraying markets during 2024, poses a threat to Exel's market share and pricing power. Maintaining a competitive edge through technological advancement and cost-effectiveness is crucial.

| Weakness Category | Specific Issue | Impact/Example | Timeframe |

| Market Dependence | Reliance on Agricultural Sector | Volatile crop prices and weather impact order intake. | 2024 |

| Financial Exposure | Foreign Exchange Fluctuations | €6.3 million negative impact in Q3 2024-2025 due to dollar depreciation. | Q3 2024-2025 |

| Operational Challenges | Macroeconomic Uncertainty & Low Order Visibility | Difficulties in production planning and inventory management. | Ongoing (particularly 2024) |

| Geographic Performance | Regional Sales Disparities | Minor decline in Asia's industrial spraying (H1 2024); subdued European wine market outlook (2024). | H1 2024 / 2024 |

| Competitive Landscape | Increased Local Competition | Threat to market share and pricing in Asian industrial spraying markets. | 2024 |

Preview Before You Purchase

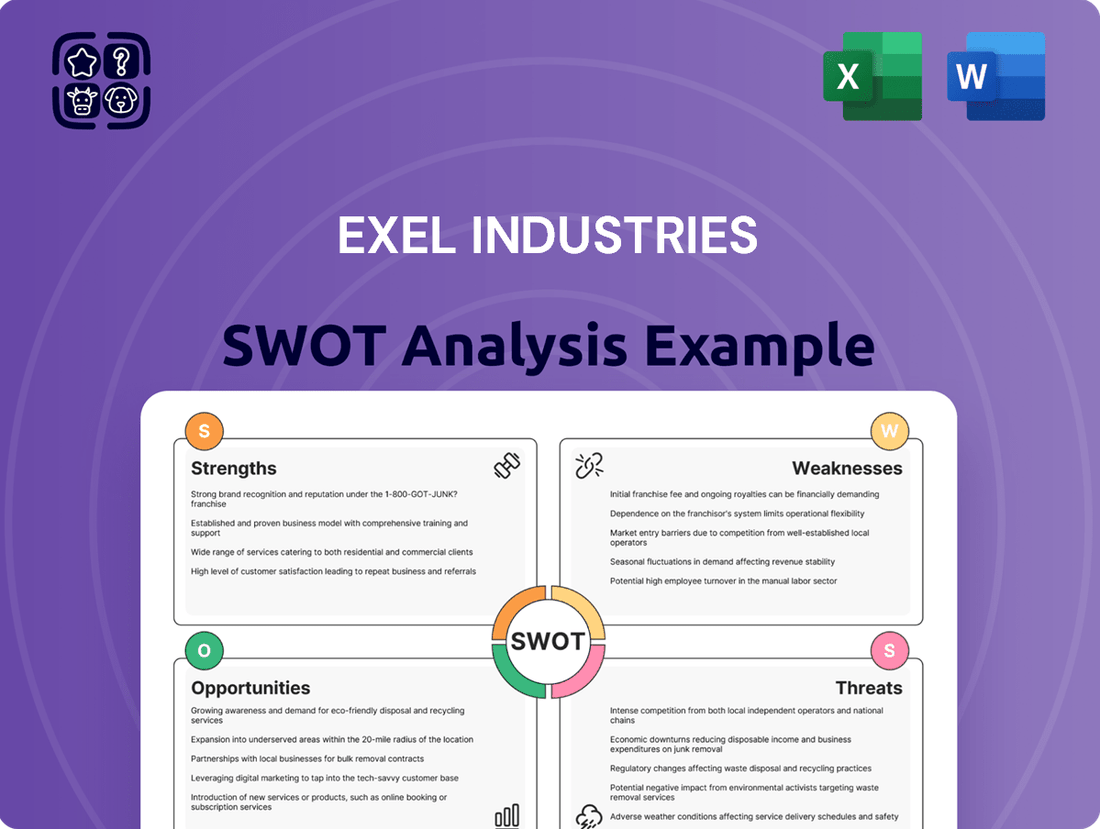

Exel Industries SWOT Analysis

This is the actual Exel Industries SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can see the detailed breakdown of their Strengths, Weaknesses, Opportunities, and Threats right here. Purchase unlocks the entire in-depth version.

Opportunities

The global push for sustainable farming is a major opening for Exel Industries to grow its precision agriculture offerings. This trend is fueled by the need to feed a growing population more efficiently.

Smart farming technologies, including AI, IoT, and data analytics, are revolutionizing agriculture by optimizing everything from water use to fertilizer application. For instance, in 2024, the global precision agriculture market was valued at approximately $10.4 billion and is projected to reach $22.5 billion by 2030, indicating substantial growth potential.

Exel can leverage these advancements to develop and market solutions that enhance crop yields and reduce environmental impact, aligning with market demand for eco-friendly agricultural practices.

Exel Industries has seen a steady or increasing performance in its industrial and leisure sectors, even with challenges in agriculture. For instance, its industrial coating division reported a 5% year-over-year revenue increase in the first half of 2024, demonstrating resilience.

By continuing to invest in and prioritize these segments, such as expanding its range of industrial coatings and innovative gardening tools, Exel can build more diverse income sources. This strategic focus allows the company to leverage the inherent stability and growth potential within these non-agricultural markets.

Exel Industries' ongoing investments in modernizing its facilities, like the Stains plant, alongside significant upgrades to its Enterprise Resource Planning (ERP) systems, present a clear opportunity to boost operational efficiency. These initiatives are designed to streamline workflows and reduce costs, potentially leading to a more competitive cost structure.

Embracing digital transformation across its operations offers Exel Industries a pathway to enhance its overall competitiveness. This includes improving product development cycles and creating more agile business processes, crucial for navigating the evolving market landscape.

Strategic Acquisitions and Partnerships

Exel Industries has a proven track record of expanding through strategic acquisitions. For instance, in 2023, the company completed several bolt-on acquisitions that bolstered its presence in the sustainable packaging sector, a key growth area. Looking ahead, targeting companies with innovative technologies or those operating in adjacent markets presents a significant opportunity to consolidate market share and diversify revenue streams.

Further strategic mergers and acquisitions could unlock substantial value. By integrating businesses that offer complementary products or access to new customer bases, Exel can accelerate its growth trajectory. This approach is particularly relevant in the rapidly evolving agricultural technology space, where innovation is key to maintaining a competitive edge. The company's robust financial position, evidenced by its strong free cash flow generation in the first half of 2024, provides a solid foundation for such strategic moves.

Key opportunities for strategic acquisitions and partnerships include:

- Acquiring companies with advanced digital farming solutions to enhance precision agriculture offerings.

- Partnering with biotech firms specializing in crop protection or yield enhancement.

- Expanding into new geographic markets through targeted acquisitions of local players.

- Consolidating smaller competitors in its core business segments to achieve greater economies of scale.

Addressing Sustainability Demands and Circular Economy

The increasing global emphasis on sustainability presents a significant opportunity for Exel Industries. Consumers and businesses alike are actively seeking products that minimize environmental impact, driving demand for solutions incorporating recycled materials and eco-friendly processes. This trend is particularly evident in sectors where Exel operates, such as agriculture and industry.

Exel Industries can capitalize on this by further developing and promoting its product lines that align with circular economy principles. For instance, their work with PVC hoses that incorporate higher percentages of recycled content directly addresses this growing market preference. This not only differentiates their offerings but also appeals to a widening segment of environmentally conscious customers.

The market for sustainable solutions is projected for substantial growth. For example, the global circular economy market was valued at approximately $2.4 trillion in 2023 and is expected to reach over $4.5 trillion by 2030, indicating a clear and expanding opportunity for companies like Exel that can demonstrate a commitment to these practices.

- Growing consumer preference for eco-friendly products.

- Market expansion for circular economy solutions.

- Opportunity to enhance brand reputation through sustainable practices.

- Potential for cost savings through efficient resource utilization.

The global shift towards precision agriculture offers Exel Industries a significant avenue for expansion, driven by the necessity for efficient food production. This trend, coupled with advancements in smart farming technologies, creates a fertile ground for Exel's innovative solutions, as the precision agriculture market is expected to grow substantially in the coming years.

Leveraging its stable performance in industrial and leisure sectors, Exel can diversify its revenue streams by focusing on these resilient markets. For instance, the company's industrial coatings division saw a 5% year-over-year revenue increase in the first half of 2024, highlighting the potential in these areas.

Investments in operational efficiency, such as facility modernization and ERP system upgrades, position Exel to streamline processes and reduce costs. Embracing digital transformation further enhances its agility and competitiveness in a dynamic market environment.

Exel's history of successful acquisitions provides a clear strategy for growth, particularly in bolstering its sustainable packaging and agricultural technology offerings. The company's strong free cash flow generation in the first half of 2024 supports further strategic mergers and acquisitions to consolidate market share and expand into new markets.

| Opportunity Area | 2024 Market Value (Est.) | Projected 2030 Market Value (Est.) | Exel's Relevant Segment |

|---|---|---|---|

| Precision Agriculture | $10.4 billion | $22.5 billion | Smart farming technologies, AI, IoT |

| Circular Economy Solutions | $2.4 trillion | $4.5 trillion | Recycled materials, eco-friendly processes |

Threats

Global economic uncertainties and the specter of recessionary pressures pose a significant threat. These conditions can directly curb capital expenditure by Exel Industries' core customer base, including farmers and industrial clients, thereby dampening demand for their spraying equipment.

The Group has already experienced the impact of a sluggish economic environment, with particular weakness noted in Europe. This economic drag has demonstrably affected Exel Industries' financial performance, highlighting the vulnerability of its revenue streams to broader macroeconomic downturns.

Exel Industries faces a significant threat from intensifying competition, especially as new players emerge, particularly from Asia. These local integrators often offer competitive pricing, which can put pressure on Exel's profit margins and necessitate ongoing efforts in innovation and product differentiation to maintain market share.

Global supply chain vulnerabilities remain a significant concern, with ongoing geopolitical events and trade tensions contributing to volatility. For Exel Industries, this translates to potential disruptions in the flow of essential components and finished goods, impacting production schedules and increasing lead times. These external pressures directly affect operational efficiency and, consequently, profitability.

Fluctuations in raw material costs are another major threat. For instance, the price of key materials like steel and aluminum, crucial for many manufacturing sectors, has seen considerable swings in recent years. Exel Industries' stated focus on optimizing working capital and reducing inventory levels underscores a sensitivity to these cost variations, as holding excessive stock of materials with volatile prices can tie up capital and increase financial risk.

Regulatory Changes and Environmental Compliance

Exel Industries faces a significant threat from evolving environmental regulations, especially those impacting chemical applications and agricultural practices. These changes could lead to increased compliance costs and require substantial modifications to existing product designs and manufacturing processes. For instance, stricter regulations on pesticide runoff, a key area for agricultural chemical companies, could force investment in new formulation technologies or even phase out certain product lines.

While Exel Industries demonstrates a commitment to Corporate Social Responsibility (CSR), adapting to increasingly stringent environmental mandates remains a potential risk. The company must remain agile to navigate these shifts.

- Increased operational costs: New environmental compliance standards could necessitate investments in pollution control equipment or process redesign, impacting profitability.

- Product reformulation: Evolving regulations may require significant R&D to alter existing chemical formulations or develop entirely new, compliant product lines.

- Market access restrictions: Failure to meet new environmental standards could limit access to certain markets or lead to product bans, affecting revenue streams.

Geopolitical Tensions and Trade Policies

Geopolitical tensions and evolving trade policies, particularly tariff adjustments in North America, introduce significant economic uncertainty. This lack of economic visibility can directly affect Exel Industries' sales by prompting farmers to adopt a cautious, wait-and-see approach, thereby delaying crucial equipment purchases.

For instance, the ongoing trade disputes between major economies can disrupt global supply chains, increasing the cost of raw materials and components essential for manufacturing agricultural machinery. This volatility makes long-term planning and inventory management more challenging.

The agricultural sector is particularly sensitive to these shifts. Farmers, facing unpredictable market conditions and potential changes in export opportunities due to trade barriers, often postpone capital expenditures like new equipment. This directly impacts demand for Exel Industries' products.

- Trade policy uncertainty: Fluctuations in tariffs and trade agreements create unpredictable market access and cost structures for agricultural inputs and outputs.

- Farmer sentiment: Economic uncertainty leads to delayed capital investments by farmers, directly reducing demand for new machinery.

- Supply chain disruptions: Geopolitical events can interrupt the flow of materials and finished goods, impacting production schedules and costs.

Exel Industries faces significant threats from global economic slowdowns, with Europe already showing weakness, which directly impacts demand for its equipment. Intensifying competition, particularly from Asian manufacturers offering lower prices, pressures profit margins. Furthermore, supply chain disruptions due to geopolitical events and volatile raw material costs like steel and aluminum pose ongoing challenges to production and profitability.

| Threat Category | Specific Threat | Impact on Exel Industries | Relevant Data/Example (2024/2025 Focus) |

|---|---|---|---|

| Economic Uncertainty | Global Recessionary Pressures | Reduced capital expenditure by customers (farmers, industrial clients), dampening demand. | European economic slowdown reported in late 2023/early 2024, impacting industrial output. |

| Competition | Emergence of Asian Competitors | Price pressure on margins, need for continuous innovation. | Increased market share gains by lower-cost manufacturers in specific equipment segments. |

| Supply Chain & Costs | Geopolitical Instability & Trade Tensions | Disruptions in component flow, increased lead times, higher production costs. | Ongoing trade policy shifts and regional conflicts impacting global shipping costs and component availability. |

| Supply Chain & Costs | Raw Material Price Volatility | Increased input costs for steel, aluminum, impacting working capital. | Steel prices saw fluctuations in 2024, influenced by energy costs and demand shifts. |

SWOT Analysis Data Sources

This SWOT analysis for Exel Industries is built upon a robust foundation of data, drawing from publicly available financial statements, comprehensive market research reports, and insights from industry experts to ensure a thorough and accurate assessment.