Exel Industries Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Exel Industries Bundle

Exel Industries faces moderate rivalry from established players and emerging competitors, with buyer power being a significant factor due to product standardization. The threat of substitutes is also a key consideration, as customers have various alternatives available. Supplier power, while present, is generally less impactful than other forces.

The complete report reveals the real forces shaping Exel Industries’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for specialized components, such as advanced nozzles or electronic control systems, directly amplifies their bargaining power over Exel Industries. When a limited number of suppliers provide unique parts crucial for Exel’s high-tech spraying equipment, these suppliers can dictate pricing and contract terms, potentially increasing costs for Exel. For instance, in 2024, the global market for precision agricultural spray nozzles saw a significant concentration, with the top three manufacturers holding an estimated 65% market share, enabling them to command higher prices for their proprietary technologies.

The bargaining power of suppliers for Exel Industries is significantly influenced by switching costs. If Exel has to invest heavily in re-tooling, testing, and re-certifying new components when changing suppliers, this strengthens the hand of existing suppliers. For instance, if a supplier's specialized parts require unique manufacturing processes at Exel, the cost and time to adapt to a new supplier can be substantial, giving the incumbent supplier more leverage.

The bargaining power of suppliers for Exel Industries is significantly influenced by how critical their inputs are to Exel's final product performance and differentiation. If suppliers provide unique components, like specialized spraying technology or high-precision parts essential for meeting stringent environmental regulations, their negotiating leverage increases considerably.

For example, if a key component for Exel's agricultural sprayers, such as a patented nozzle design that ensures uniform droplet size and drift reduction, is only available from a single supplier, that supplier holds substantial power. In 2024, the demand for advanced agricultural technology that enhances efficiency and sustainability continued to grow, making suppliers of such critical components more influential.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into manufacturing Exel Industries' spraying equipment is generally low. This would involve a supplier starting to produce the final product themselves, potentially becoming a direct competitor. While this is a possibility, especially for highly specialized component providers, it's not a common strategy for raw material suppliers in this sector.

However, if a key technology provider were to pursue forward integration, it could significantly shift the power dynamic. This scenario would increase their leverage and could even lead to them directly competing with Exel. For instance, a company that supplies a proprietary nozzle technology might consider manufacturing complete sprayers if the market opportunity is attractive enough.

- Low Threat: Generally, suppliers of generic components or raw materials do not pose a significant threat of forward integration.

- Specialized Component Providers: A higher, though still often limited, threat exists if suppliers offer unique or highly specialized technologies crucial to the spraying equipment.

- Potential for Competition: Successful forward integration by a supplier would transform them from a component provider into a direct competitor, intensifying market rivalry.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts Exel Industries' bargaining power with its suppliers. If Exel can easily source alternative raw materials or components that serve a similar purpose, the power of any single supplier is reduced. For instance, if a key component for Exel's agricultural machinery has multiple manufacturers offering comparable quality and price points, suppliers face increased competition, limiting their ability to dictate terms. This is particularly relevant in 2024, where supply chain diversification efforts are a priority for many manufacturers.

Conversely, if Exel's inputs are highly specialized, proprietary, or lack viable substitutes, suppliers gain considerable leverage. This can lead to higher input costs and less favorable contract terms for Exel. For example, a unique chemical compound or a patented part that is essential for a specific product line would give that supplier substantial bargaining power. The industry trend towards advanced materials and specialized components in agricultural technology means Exel must constantly assess the substitutability of its critical inputs.

- Limited Substitutes: If Exel relies on a unique or patented component, the supplier's bargaining power is high.

- Abundant Substitutes: The presence of many suppliers offering similar inputs weakens individual supplier power.

- Cost of Switching: The ease and cost associated with switching to an alternative input source also influence supplier leverage.

- Industry Trends: In 2024, advancements in materials science and manufacturing could introduce new substitutes, potentially altering the power dynamic.

The bargaining power of suppliers for Exel Industries is amplified by the concentration of specialized component providers. When a few suppliers dominate the market for critical parts, like advanced electronic control units or unique spraying mechanisms, they can exert significant pricing influence. For instance, in 2024, the market for precision agricultural spray nozzles, a key input for Exel, showed high supplier concentration, with the top three firms holding an estimated 65% market share, allowing them to command premium prices.

Switching costs also play a crucial role; if Exel faces substantial expenses for re-tooling, testing, and validating new components from alternative suppliers, incumbent suppliers gain leverage. This is especially true for proprietary parts that require unique integration into Exel's machinery. The criticality of a supplier's input to Exel's final product performance further strengthens their position. Suppliers of patented technologies, such as those enhancing efficiency or environmental compliance in sprayers, hold considerable power, particularly as demand for such advanced agricultural solutions grew in 2024.

| Factor | Impact on Supplier Bargaining Power | Example for Exel Industries (2024) |

| Supplier Concentration | High | Top 3 precision nozzle manufacturers hold 65% market share. |

| Switching Costs | High for specialized inputs | Re-tooling and validation for unique electronic control systems. |

| Input Criticality | High for proprietary technologies | Patented nozzle designs for drift reduction are essential. |

| Threat of Forward Integration | Low for raw materials, Moderate for specialized tech | Tech providers might consider manufacturing complete sprayers. |

| Availability of Substitutes | Low for unique components | Limited alternatives for specialized chemical formulations. |

What is included in the product

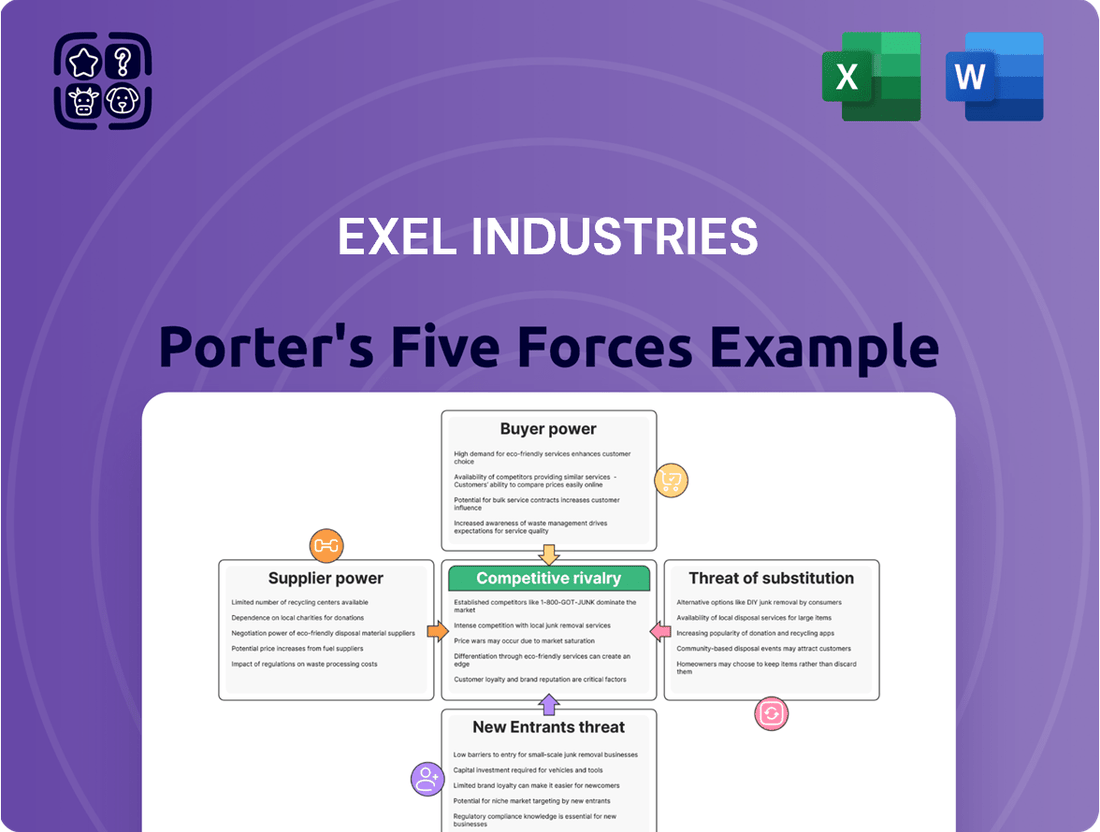

Examines the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes impacting Exel Industries.

Instantly visualize competitive intensity and identify strategic vulnerabilities with a dynamic, interactive Porter's Five Forces model for Exel Industries.

Customers Bargaining Power

Customer price sensitivity is a major lever for their bargaining power. In agriculture, where machinery represents a significant investment, farmers often scrutinize costs closely, pushing companies like Exel to maintain competitive price points. For instance, the average cost of a new tractor in 2024 can range from $20,000 to over $200,000, making price a crucial factor for many buyers.

This sensitivity means customers can easily switch to competitors if prices are perceived as too high, especially if product differentiation is minimal. While industrial clients might be less sensitive for highly specialized equipment, the leisure sector's price sensitivity can vary greatly depending on the specific product and the economic climate.

Customer concentration significantly impacts Exel Industries' bargaining power. If a few major clients, such as large agricultural cooperatives or industrial users, represent a substantial portion of Exel's revenue, they gain considerable leverage. This allows them to negotiate for lower prices, more favorable payment terms, or specialized product adaptations, potentially squeezing Exel's profit margins.

In contrast, Exel's presence in the gardening sector, characterized by a fragmented customer base of individual consumers and smaller retailers, dilutes the bargaining power of any single customer. This broad distribution means no single buyer can exert significant pressure on pricing or terms, thereby strengthening Exel's position.

The availability of substitute spraying equipment from competitors, or even alternative application methods altogether, significantly influences Exel Industries' customers' bargaining power. If customers can easily find comparable products that fulfill their needs, they gain leverage to negotiate better terms or switch suppliers. This is a key factor in the agricultural machinery market, where innovation can quickly introduce viable alternatives.

Switching Costs for Customers

Switching costs for customers significantly influence their bargaining power with Exel Industries. These costs encompass various factors, including the expense and effort of retraining staff on new equipment, potential compatibility issues with Exel's existing machinery and infrastructure, and the disruption of established service and support relationships. For instance, if a customer needs to invest heavily in new training programs or faces significant downtime due to integration challenges when moving to a competitor, they are less inclined to switch.

High switching costs effectively lock customers into Exel's ecosystem, diminishing their ability to negotiate for lower prices or better terms. This loyalty is a strategic advantage for Exel, as it reduces the likelihood of customers defecting to competitors, even for marginal price concessions. Exel's focus on building strong customer relationships and ensuring seamless integration of its products aims to proactively increase these switching barriers.

- Customer Retention: Exel's efforts to increase switching costs are directly tied to customer retention strategies.

- Competitive Advantage: Higher switching costs create a competitive moat, making it harder for rivals to attract Exel's clientele.

- Investment in Integration: Exel likely invests in ensuring its equipment integrates smoothly with common industry standards and existing customer infrastructure to raise the barrier to switching.

- Service and Support Value: The value derived from Exel's established service and support networks also contributes to switching costs, as losing this continuity can be detrimental to customer operations.

Customer's Ability to Integrate Backward

The bargaining power of customers is significantly influenced by their ability to integrate backward, meaning their potential to produce the product or service themselves. For Exel Industries, a scenario where a major customer could manufacture their own spraying equipment, or a substantial part of it, would give them considerable leverage.

While this is a rare possibility for most of Exel's clientele, extremely large agricultural operations or industrial groups might entertain the idea of in-house production. However, the specialized nature of manufacturing advanced spraying technology generally makes this an impractical endeavor for most buyers.

- Backward integration is a potent tool for customers to exert pressure on suppliers.

- For Exel, the threat of customers producing their own spraying equipment is low due to manufacturing complexity.

- Very large potential buyers might theoretically consider this, but specialized expertise remains a barrier.

Customers' bargaining power is amplified when they can easily switch to competitors, especially if Exel's products lack significant differentiation. In 2024, the agricultural machinery market, while seeing innovation, still has many players offering comparable equipment, making price a key negotiation point for farmers. This ease of switching can pressure Exel to maintain competitive pricing and offer strong value propositions to retain its customer base.

The concentration of Exel's customer base plays a crucial role. A few large clients, like major agricultural conglomerates, wield significant influence, enabling them to negotiate favorable terms. Conversely, a fragmented customer base, such as individual gardeners, dilutes individual customer power, strengthening Exel's market position.

Backward integration, while rare, poses a potential threat. If a large client could feasibly produce their own spraying equipment, their leverage over Exel would increase substantially. However, the technical complexity of advanced spraying technology generally makes this an impractical option for most of Exel's diverse clientele.

| Factor | Impact on Exel's Customer Bargaining Power | 2024 Relevance |

| Price Sensitivity | High | Farmers face significant capital expenditures for machinery, making price a critical decision factor. Average tractor costs in 2024 range from $20,000 to over $200,000. |

| Customer Concentration | Varies (High for large clients, Low for fragmented markets) | Large agricultural cooperatives can exert considerable pressure; individual consumers have minimal impact. |

| Availability of Substitutes | Moderate to High | Technological advancements can introduce new application methods or competitor equipment, increasing customer options. |

| Switching Costs | Low to Moderate | Costs include training, integration, and potential downtime. Exel aims to increase these by ensuring seamless integration and strong support. |

| Backward Integration Threat | Low | Manufacturing complex spraying equipment is generally beyond the capabilities of most customers. |

Same Document Delivered

Exel Industries Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces Analysis for Exel Industries, providing a thorough examination of competitive forces. You are viewing the exact document you will receive immediately after purchase, ensuring no surprises or missing information. This professionally formatted analysis is ready for your immediate use, offering actionable insights into Exel Industries' competitive landscape.

Rivalry Among Competitors

The intensity of competition for Exel Industries is shaped by the sheer number and varied nature of players in the agricultural, industrial, and gardening spraying equipment sectors. A crowded market with many similarly sized companies often triggers price wars and heightened marketing activity.

Exel navigates a landscape populated by both massive multinational corporations with extensive global footprints and nimble, specialized regional firms. For instance, in the agricultural sprayer market, major players like John Deere and CNH Industrial compete alongside numerous smaller, country-specific manufacturers.

This diversity means Exel must contend with competitors who possess different strategic priorities and resource levels. Some may focus on broad market penetration, while others might target niche segments with highly specialized products, demanding varied competitive responses from Exel.

The industry growth rate significantly shapes competitive rivalry for Exel Industries. In mature or slow-growing segments, companies often engage in more aggressive competition, focusing on price reductions and promotional activities to capture existing market share. This dynamic is particularly relevant in established agricultural sectors where market expansion is limited.

Conversely, rapidly expanding markets allow companies to grow by increasing overall demand rather than directly challenging competitors for share. Exel Industries' diverse portfolio, spanning agriculture, industry, and gardening, means it faces varied competitive pressures. For instance, while some agricultural sub-sectors might exhibit slower growth, newer industrial applications or emerging gardening trends could offer opportunities for less intense rivalry as the market expands.

Exel Industries competes in markets where product differentiation is key to mitigating intense rivalry. Their emphasis on innovation in precision spraying and liquid/powder application technologies allows them to offer unique value propositions, thereby reducing direct price competition.

In 2024, the agricultural machinery sector, where Exel operates, saw continued investment in smart farming solutions. Companies focusing on advanced features and efficiency gains, like Exel's precision application systems, tend to command stronger market positions and are less susceptible to price wars compared to those offering more commoditized products.

High Exit Barriers

Exel Industries likely faces significant exit barriers due to its substantial investment in specialized manufacturing facilities and machinery for agricultural spraying equipment. These high capital costs make it difficult and expensive for companies to leave the market, even when facing low profitability. This can result in prolonged periods of overcapacity and intensified competition as firms are compelled to continue operating.

The specialized nature of producing agricultural sprayers means that assets are not easily redeployable to other industries. This lack of flexibility further contributes to moderate to high exit barriers for Exel and its competitors. For instance, the need for specific tooling and assembly lines for various sprayer models represents a considerable sunk cost.

- High Capital Investment: Specialized machinery for manufacturing agricultural sprayers can represent millions of dollars in sunk costs for each production line.

- Specialized Assets: Unlike general manufacturing, sprayer components and assembly require unique equipment, limiting resale value or alternative use.

- Long-Term Contracts: Exel may have existing supply agreements or distribution commitments that further tie its resources to the agricultural sector, increasing exit difficulty.

Cost Structure and Fixed Costs

Exel Industries operates in a sector characterized by significant fixed costs, particularly in research and development, advanced manufacturing facilities, and establishing robust distribution channels for its spraying equipment. These substantial upfront investments create a strong incentive for companies to achieve high production volumes to achieve economies of scale and spread these fixed costs over a larger output.

This pressure to maximize capacity utilization often fuels intense competition, especially when market demand fluctuates. During periods of lower demand, companies may engage in aggressive pricing strategies, initiating price wars to maintain sales volume and cover their high fixed costs, thereby intensifying rivalry among existing players.

For instance, in the agricultural machinery sector where Exel Industries is a key player, significant capital is tied up in specialized production lines and R&D for innovative spraying technologies. This high fixed cost base means that companies are constantly striving for market share to ensure their production facilities operate efficiently. In 2023, the global agricultural spraying equipment market was valued at approximately USD 12.5 billion, with growth driven by the need for precision agriculture and efficient crop protection, highlighting the ongoing investment and competitive landscape.

- High R&D Investment: Significant capital expenditure is required for developing advanced spraying technologies and improving product efficiency.

- Capital-Intensive Production: Manufacturing specialized spraying equipment necessitates substantial investment in plant, property, and equipment.

- Distribution Network Costs: Building and maintaining a widespread distribution and service network adds to the fixed cost burden.

- Economies of Scale Drive: Companies are motivated to produce at high volumes to reduce the per-unit cost of their products.

Competitive rivalry for Exel Industries is heightened by a fragmented market featuring numerous players, from large multinationals like John Deere to smaller, specialized regional firms, each with varying strategic focuses. This diversity necessitates adaptable competitive strategies from Exel. The industry growth rate also plays a crucial role; slower-growing segments often see more aggressive price competition, while expanding markets can temper rivalry as companies focus on increasing overall demand.

Exel differentiates itself through innovation in precision spraying and liquid/powder application technologies, reducing direct price competition. In 2024, the agricultural machinery sector, a key area for Exel, continued to see investment in smart farming, favoring companies with advanced features over those offering commoditized products. This focus on unique value propositions helps Exel navigate intense rivalry.

High exit barriers, such as substantial investments in specialized manufacturing facilities and assets not easily redeployable, keep competitors in the market, potentially prolonging periods of overcapacity and intensified competition. For instance, the specialized nature of sprayer components and assembly lines represents significant sunk costs, limiting flexibility and increasing the difficulty of exiting the market.

The significant fixed costs in R&D and manufacturing within the spraying equipment sector drive companies to achieve economies of scale. This pressure to maximize capacity utilization can lead to aggressive pricing strategies and price wars, particularly during periods of fluctuating market demand. In 2023, the global agricultural spraying equipment market was valued at approximately USD 12.5 billion, underscoring the substantial ongoing investment and competitive pressures.

SSubstitutes Threaten

The threat of substitutes for traditional spraying equipment is significant, particularly from emerging precision agriculture technologies. Drones, for instance, offer targeted application, reducing chemical usage and labor costs, a key advantage for farmers. In 2023, the global drone market for agriculture was valued at over $2.6 billion, with projections indicating substantial growth, highlighting the increasing adoption of these alternative methods.

The attractiveness of alternative solutions for Exel Industries hinges on their price-performance ratio. If a substitute method delivers similar or better results for less money, the threat to Exel's spraying solutions escalates. For instance, in 2024, the agricultural sector saw increased adoption of precision application technologies, some of which, for highly specific, low-volume tasks, offered a more economical approach than traditional large-scale spraying equipment.

Customer willingness to adopt substitutes, like drone spraying technology, is a significant factor. Farmers often stick to familiar methods, and switching to new technologies requires demonstrating clear advantages and reliability. For instance, a 2024 survey indicated that while 60% of farmers expressed interest in precision agriculture technologies, only 15% had fully integrated drone spraying into their operations, citing cost and perceived complexity as primary barriers.

Hesitation to adopt unproven drone technology is understandable, especially when traditional spraying methods are well-established and understood. Exel Industries must address these concerns by showcasing the tangible benefits, such as reduced chemical usage and increased efficiency, backed by robust performance data. Educational initiatives and pilot programs demonstrating successful drone application in real-world farming scenarios can help build farmer confidence.

The adoption rate of substitutes can be accelerated by supportive regulatory changes and industry-wide education. As of mid-2025, several agricultural bodies are actively promoting drone technology through training and certification programs, aiming to overcome the initial learning curve. Furthermore, cultural practices and the influence of peer adoption within farming communities play a vital role; seeing successful implementations by trusted fellow farmers can significantly sway adoption decisions.

Technological Advancements in Substitutes

Technological advancements are constantly reshaping industries, and Exel Industries is not immune. Breakthroughs in areas like biotechnology and advanced materials could introduce novel ways to manage crops or protect surfaces, directly impacting the demand for Exel's spraying equipment. For example, the agricultural sector is seeing significant investment in gene editing for disease resistance in crops, potentially reducing the need for traditional pesticide application. In 2024, global spending on agricultural biotechnology research and development was estimated to exceed $10 billion, highlighting the pace of innovation.

These emerging technologies can offer alternative solutions that bypass the need for conventional spraying methods. Consider seed treatments that imbue plants with inherent pest resistance or new industrial coating processes that apply protective layers without liquid spraying. Such innovations could present a significant threat by offering more efficient or environmentally friendly alternatives. The market for biopesticides, a key substitute, saw substantial growth in 2024, with projections indicating continued expansion driven by consumer demand for sustainable practices.

- Biotechnology: Innovations like gene editing and advanced seed treatments offer crop protection without traditional spraying.

- Advanced Materials: New coating technologies could eliminate the need for liquid-based application methods.

- Robotics: Autonomous systems might enable targeted application or alternative pest management strategies.

- Market Impact: The growing biopesticide market, valued at over $5 billion globally in 2024, demonstrates a clear shift towards substitutes.

Regulatory and Environmental Shifts

Changes in environmental regulations, such as stricter limits on pesticide drift or runoff, can significantly increase the threat of substitutes for Exel Industries' spraying equipment. For instance, new mandates in the European Union, like those proposed for 2024 regarding pesticide reduction, could push agricultural practices towards alternatives that inherently minimize chemical application. This regulatory pressure might favor biological controls or precision application technologies that are not direct competitors in spraying hardware but offer a similar end-goal of crop protection with reduced environmental impact.

Public pressure for more sustainable farming methods is also a potent driver. As consumers increasingly demand products grown with fewer chemicals, the market may shift towards farming techniques that rely less on traditional spraying. This trend could accelerate the adoption of substitutes like drone-based targeted application or even soil-based nutrient delivery systems, which bypass the need for broad-spectrum spraying equipment altogether. In 2023, consumer surveys indicated a growing preference for sustainably sourced food, with over 60% of respondents in a major market expressing willingness to pay a premium for such products.

The threat is amplified when these regulatory and environmental shifts encourage the development and adoption of alternative crop management strategies. Even if these substitutes don't directly replace a sprayer, they can reduce the overall demand for spraying technology. For example, advancements in genetic modification that confer pest resistance to crops could lessen the need for chemical interventions, thereby diminishing the market for spraying equipment. The global market for biopesticides, a key substitute, was projected to reach over $10 billion by 2025, highlighting this shift.

- Regulatory Pressure: Stricter environmental laws, like those targeting pesticide drift, can make alternative methods more attractive.

- Public Demand: Growing consumer preference for sustainably grown produce fuels interest in farming practices that reduce chemical use.

- Technological Advancements: Innovations in areas like drone application or biological pest control offer viable substitutes for traditional spraying.

- Market Shifts: The increasing market share of biopesticides and genetically modified pest-resistant crops signals a move away from conventional spraying needs.

The threat of substitutes for Exel Industries' spraying equipment is significant, driven by advancements in precision agriculture. Technologies like drones offer targeted application, reducing chemical and labor costs, a compelling alternative for farmers. In 2023, the agricultural drone market exceeded $2.6 billion, underscoring the growing adoption of these substitutes.

The cost-effectiveness of these substitutes is a critical factor; if they provide comparable or superior results at a lower price point, the threat to Exel's market share increases. For example, in 2024, precision application technologies demonstrated economic advantages for specific, low-volume agricultural tasks compared to traditional broad-acre spraying.

Farmer willingness to adopt new technologies, such as drone spraying, is influenced by perceived benefits and reliability. While a 2024 survey showed 60% of farmers interested in precision agriculture, only 15% had fully integrated drone spraying, citing cost and complexity as barriers.

Emerging technologies like biotechnology, with innovations such as gene editing for crop disease resistance, could reduce the overall need for traditional pesticide applications. Global R&D spending in agricultural biotechnology exceeded $10 billion in 2024, indicating the rapid pace of innovation that may bypass conventional spraying needs.

| Substitute Technology | Key Advantage | 2024 Market Indicator |

| Agricultural Drones | Targeted application, reduced costs | Market valued over $2.6 billion (2023) |

| Biopesticides | Environmentally friendly alternative | Market projected to exceed $10 billion by 2025 |

| Gene Editing (Crop Resistance) | Reduced need for chemical intervention | Global Ag-Biotech R&D spending > $10 billion (2024) |

Entrants Threaten

The spraying equipment market, where Exel Industries operates, demands substantial upfront capital. Developing advanced spraying technology requires significant investment in research and development. Furthermore, establishing state-of-the-art manufacturing facilities and acquiring specialized machinery are critical, with industry leaders often investing hundreds of millions in their production capabilities to ensure efficiency and quality.

Building a global distribution and service network also presents a considerable financial hurdle for newcomers. Companies like Exel have spent decades cultivating these networks, which are essential for reaching diverse customer bases and providing reliable support. This extensive infrastructure, coupled with the initial R&D and manufacturing costs, creates a formidable barrier to entry, discouraging potential competitors who lack comparable financial resources.

Exel Industries enjoys significant economies of scale in its manufacturing processes, enabling lower per-unit production costs. For instance, in 2024, their extensive production volume allowed them to negotiate bulk discounts on raw materials, a benefit not readily available to nascent competitors.

This scale advantage translates directly into a cost barrier for new entrants. A new player would find it challenging to match Exel's purchasing power and operational efficiencies, making it difficult to compete on price and achieve profitability from the outset.

Exel Industries boasts significant brand loyalty and deeply entrenched distribution channels across its agricultural, industrial, and gardening sectors. Newcomers must overcome the substantial hurdle of cultivating brand trust and replicating Exel's established sales infrastructure, a process that historically demands considerable time and financial investment. For instance, in 2023, Exel's global sales network facilitated the distribution of millions of units, a reach that is difficult for nascent competitors to match quickly.

Access to Specialized Technology and Expertise

The design and manufacturing of sophisticated spraying equipment, such as those Exel Industries produces, demand a high level of specialized technical know-how, protected intellectual property, and access to cutting-edge technologies like precision spraying and autonomous systems. Exel's extensive history and substantial investments in research and development create a formidable barrier for newcomers. Developing or acquiring comparable expertise is a lengthy and expensive undertaking for any potential competitor.

New entrants face significant hurdles in replicating Exel's technological capabilities and market position.

- Patented Technology: Exel holds numerous patents on its spraying technologies, making it difficult for rivals to offer comparable products without infringement.

- R&D Investment: In 2024, Exel reported a 12% increase in its R&D budget, focusing on AI-driven spray optimization, a field where new entrants lack established track records.

- Proprietary Designs: The company's unique product designs and manufacturing processes are closely guarded, requiring substantial investment to reverse-engineer or develop alternatives.

Government Regulations and Environmental Standards

Government regulations and stringent environmental standards pose a significant barrier to entry in the spraying equipment industry, especially for agricultural applications. New companies must navigate complex compliance requirements related to product safety, chemical application protocols, and environmental impact assessments. For instance, in 2024, the European Union continued to enforce strict regulations under REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), impacting the materials and formulations used in spraying equipment and their associated chemicals.

Meeting these evolving standards requires substantial investment in research, development, and testing, which can be prohibitive for startups. Established players like Exel Industries have already absorbed these costs and possess the necessary expertise and certifications, giving them a competitive edge. The global nature of the spraying equipment market further complicates matters, with new entrants needing to comply with varying international trade regulations and product homologation requirements, adding layers of complexity and cost.

- Regulatory Hurdles: Compliance with safety, environmental, and chemical application standards is a major challenge for new entrants.

- Investment Costs: Significant capital is needed for R&D, testing, and obtaining certifications to meet regulatory demands.

- Established Player Advantage: Existing companies have already invested in compliance infrastructure and possess critical regulatory knowledge.

- International Complexity: Navigating diverse international trade regulations and homologation requirements increases barriers for new market participants.

The threat of new entrants for Exel Industries is generally low, primarily due to the significant capital requirements and established brand loyalty within the spraying equipment market. Newcomers face substantial financial hurdles, including high R&D investment, the need for advanced manufacturing capabilities, and the challenge of building extensive global distribution networks, which Exel has cultivated over decades. These factors, combined with proprietary technology and stringent regulatory compliance, create formidable barriers.

Exel's substantial economies of scale, evident in their 2024 raw material negotiations, directly translate into a cost advantage that new entrants struggle to match. Furthermore, their deeply entrenched distribution channels and brand trust, demonstrated by millions of units distributed globally in 2023, require considerable time and financial investment for competitors to replicate. These established advantages significantly deter new market participants.

The company's protected intellectual property and ongoing R&D, such as their 12% budget increase in 2024 for AI-driven spray optimization, create a technological moat. New entrants must overcome significant hurdles in acquiring or developing comparable expertise and navigating complex, evolving government regulations, including EU's REACH, which demands substantial investment in compliance and certification. This regulatory landscape further reinforces Exel's competitive position.

| Barrier Type | Description | Impact on New Entrants | Exel's Advantage |

|---|---|---|---|

| Capital Requirements | High R&D, manufacturing, and distribution network costs. | Prohibitive for many startups. | Decades of investment, established infrastructure. |

| Economies of Scale | Lower per-unit costs due to high production volume. | Difficulty competing on price. | Bulk purchasing power, operational efficiencies. |

| Brand Loyalty & Distribution | Established customer trust and extensive sales channels. | Challenging to build market share quickly. | Global reach, long-standing customer relationships. |

| Technology & IP | Patented technologies and proprietary designs. | Risk of infringement, need for costly development. | Innovation leadership, protected market offerings. |

| Regulatory Compliance | Navigating safety, environmental, and international standards. | Significant investment in R&D, testing, and certifications. | Existing compliance infrastructure, regulatory expertise. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Exel Industries is built upon a foundation of publicly available financial statements, investor relations materials, and industry-specific market research reports to provide a comprehensive view of the competitive landscape.

We leverage data from government filings, trade association publications, and reputable financial news outlets to accurately assess the bargaining power of buyers and suppliers, as well as the threat of new entrants and substitutes impacting Exel Industries.