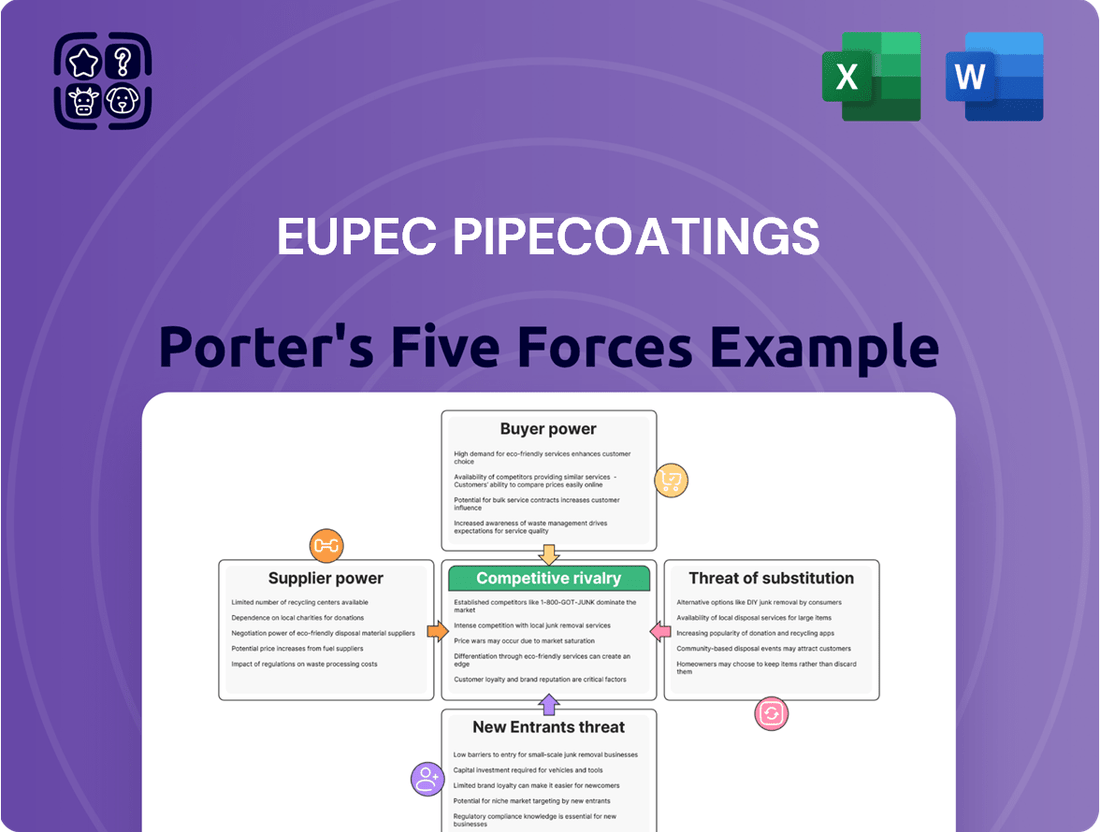

Eupec PipeCoatings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eupec PipeCoatings Bundle

Eupec PipeCoatings operates in a landscape shaped by intense rivalry, where the bargaining power of buyers and suppliers significantly influences profitability. The threat of new entrants, while moderate, requires constant vigilance and innovation to maintain market share.

The availability of substitutes presents a crucial challenge, as alternative solutions could erode Eupec's market position if not proactively addressed. Understanding these dynamics is key to navigating the industry effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Eupec PipeCoatings’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The market for specialized pipeline coating materials, including specific epoxy resins, polyolefins, and concrete additives, often sees a limited number of key global chemical manufacturers. This concentration means that suppliers can wield considerable influence over companies like Eupec PipeCoatings.

For instance, if a handful of chemical giants dominate the production of critical raw materials, they can dictate terms and pricing. In 2024, the global industrial coatings market, a relevant sector, was valued at over $70 billion, highlighting the significant scale of operations for major players.

Switching to alternative suppliers for these highly specialized components can also be a costly and time-consuming process for Eupec. This creates high switching costs, further solidifying the bargaining power of existing, concentrated suppliers.

Eupec PipeCoatings' reliance on specialized coating technologies, such as Fusion Bonded Epoxy (FBE), Abrasion Resistant Overcoat (ARO), and 3-Layer Polyethylene/Polypropylene (3LPE/PP), directly impacts the bargaining power of its suppliers. These advanced coatings necessitate unique raw materials and highly specialized application equipment, giving suppliers of these critical inputs a significant advantage. For instance, proprietary additives or specific polymer formulations can be difficult for Eupec to source elsewhere, concentrating power in the hands of a few key suppliers.

The uniqueness of these inputs means that if alternative materials or machinery are not readily available or are of lower quality, suppliers can command higher prices and more favorable terms. This situation is exacerbated when the intellectual property behind these coating technologies is tightly held by the material or equipment manufacturers. The global market for these specialized pipe coating materials saw significant growth, with the global pipe coating market projected to reach over $15 billion by 2024, indicating substantial demand for such unique inputs.

Eupec PipeCoatings faces significant supplier power when it comes to specialized coating materials and essential machinery. Switching providers for these critical inputs can be a costly and time-consuming endeavor for Eupec. These expenses can include rigorous re-qualification of new materials, recalibration of specialized equipment to accommodate different specifications, and the inevitable disruption to ongoing production schedules, potentially delaying project timelines.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, while generally low for chemical providers to Eupec PipeCoatings, could increase if a major, diversified chemical conglomerate decided to invest in its own specialized pipeline coating application facilities. Such a move would allow them to capture more of the value chain. However, the substantial capital investment required and the project-specific nature of Eupec's operations make this a less probable scenario for most suppliers.

The capital intensity of establishing and maintaining advanced coating application lines, often running into millions of dollars, acts as a significant barrier to entry for chemical suppliers considering forward integration. For instance, a state-of-the-art facility for heavy-duty pipeline coatings might require an initial outlay exceeding $10 million. Eupec’s business model, which relies on specialized, often large-scale projects, means that suppliers would need to replicate significant operational expertise and infrastructure to effectively compete.

- Low Likelihood: Most chemical suppliers lack the specific expertise and capital to replicate Eupec's advanced coating application processes.

- Capital Barriers: Building and operating specialized coating facilities can cost tens of millions of dollars, deterring most suppliers.

- Project-Specific Needs: The project-based nature of pipeline coating means suppliers would need flexible, high-capacity application capabilities.

- Mitigating Factors: Eupec's established infrastructure and specialized know-how provide a strong competitive advantage against potential supplier integration.

Impact of Input Costs on Eupec's Profitability

Fluctuations in the prices of key raw materials, such as petrochemicals for polymers or specialized additives, can significantly impact Eupec's cost of goods sold and overall profitability. For instance, the price of ethylene, a primary component in many polymers used in pipe coatings, saw considerable volatility throughout 2023 and into early 2024, influenced by global energy markets and supply chain disruptions. These cost pressures directly affect Eupec's margins if they cannot be effectively passed on to customers.

Suppliers can exert considerable power by passing on increased costs, especially if Eupec faces challenges in immediately transferring these higher expenses to its clientele. This is particularly true in competitive markets where clients may have alternative suppliers or leverage pricing power.

- Petrochemical Price Volatility: For example, naphtha prices, a key feedstock for ethylene, experienced a notable surge in late 2023, impacting polymer costs for pipe coating manufacturers like Eupec.

- Limited Substitutability: Certain specialized additives or high-performance polymers used in advanced pipe coatings may have limited substitutes, giving those suppliers greater pricing leverage.

- Supplier Concentration: If the market for specific essential raw materials is dominated by a few large suppliers, their collective bargaining power increases, potentially leading to higher input costs for Eupec.

- Contractual Terms: The terms of supply contracts, including price escalation clauses, can either mitigate or exacerbate the impact of raw material price increases on Eupec's profitability.

Eupec PipeCoatings faces considerable supplier bargaining power due to the specialized nature of its raw materials and the limited number of global manufacturers for these critical inputs. This concentration allows suppliers to dictate terms and pricing, as seen in the global industrial coatings market valued at over $70 billion in 2024. High switching costs further entrench this supplier advantage.

The reliance on proprietary formulations for advanced coatings like FBE and 3LPE/PP means few alternatives exist, empowering suppliers of these unique materials. The projected growth of the pipe coating market to over $15 billion by 2024 underscores the demand for these specialized, often IP-protected, inputs.

Eupec's investment in specialized application machinery, potentially costing over $10 million for advanced lines, creates significant barriers for suppliers considering forward integration. Most chemical suppliers lack the necessary capital and expertise to replicate Eupec's complex, project-specific coating processes.

Price volatility in petrochemical feedstocks, such as ethylene, directly impacts Eupec's costs, with naphtha prices showing notable increases in late 2023. This cost pressure is magnified when limited substitutability for specialized additives or polymers allows suppliers to pass on higher expenses, impacting Eupec's margins.

| Factor | Description | Impact on Eupec | Example Data/Trend |

| Supplier Concentration | Limited number of global manufacturers for specialized coating materials. | Increased pricing power and leverage for suppliers. | Global industrial coatings market valued at >$70 billion (2024). |

| Switching Costs | High costs and time involved in qualifying new specialized materials. | Reduces Eupec's flexibility and increases reliance on current suppliers. | Re-qualification of materials, recalibration of equipment, production delays. |

| Input Uniqueness | Proprietary formulations and specialized polymers are difficult to substitute. | Suppliers of unique inputs command higher prices. | Global pipe coating market projected to exceed $15 billion (2024). |

| Raw Material Volatility | Fluctuations in petrochemical prices affect input costs. | Pressures Eupec's margins if costs cannot be passed on. | Naphtha price surges in late 2023 impacted ethylene costs. |

What is included in the product

This analysis dissects the competitive landscape for Eupec PipeCoatings, examining the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants, and the impact of substitutes.

Eupec PipeCoatings' Porter's Five Forces Analysis provides a clear, one-sheet summary for quick strategic decision-making, alleviating the pain of complex market analysis.

Customers Bargaining Power

Eupec PipeCoatings' customer base is largely concentrated among major oil and gas corporations and pipeline operators. These clients frequently engage in extensive, multi-year projects, meaning their purchasing volumes are substantial.

The sheer scale of these orders grants these key customers significant leverage. They can effectively negotiate for more competitive pricing and more advantageous contractual conditions, directly impacting Eupec's profitability.

For instance, a single large project secured by Eupec could represent a significant portion of its annual revenue. In 2024, major infrastructure projects in the energy sector, such as the expansion of LNG terminals or new cross-country pipelines, often involve contracts worth hundreds of millions of dollars, giving the awarding companies considerable bargaining strength.

This concentration means that Eupec must carefully manage its relationships with these few, high-volume buyers to maintain favorable terms and secure ongoing business.

Switching costs for customers in the specialized pipeline coating industry, particularly for large projects, are significant. For a customer to move from Eupec PipeCoatings to a competitor, they would likely need to undertake extensive technical re-evaluations of new coating specifications, initiate entirely new tender processes, and potentially face substantial project delays. These hurdles mean that once a customer is engaged with Eupec, their power to switch is somewhat diminished.

Pipeline coatings are absolutely essential for the integrity and long-term safety of oil and gas infrastructure. This critical role means customers place a premium on Eupec's anti-corrosion solutions, as any failure could lead to catastrophic consequences. The high importance of these services to a customer's core business operations directly translates to significant bargaining power.

Customer Price Sensitivity

Large oil and gas companies, the primary customers for Eupec PipeCoatings, exhibit significant price sensitivity. This is driven by the inherent volatility of commodity prices and their substantial capital expenditure requirements. Consequently, these clients actively seek the most cost-effective coating solutions, directly impacting Eupec's pricing power and potential profit margins, particularly for more commoditized coating products.

Several factors contribute to this customer price sensitivity:

- Market Volatility: Fluctuations in crude oil and natural gas prices directly affect the profitability of E&P companies, making them more cautious about project costs. For example, in early 2024, oil prices saw considerable swings, impacting investment decisions and budget allocations for infrastructure projects.

- Project Scale: Major pipeline projects involve vast quantities of coated pipe, meaning even small per-unit price differences can translate into significant cost savings for the customer.

- Standardization: For many standard coating applications, there are fewer differentiating factors between suppliers. This allows customers to more easily compare prices and demand lower rates from all providers.

Threat of Backward Integration by Customers

Major oil and gas companies, Eupec PipeCoatings' primary clientele, generally do not pursue backward integration into specialized pipeline coating application. This is largely due to the substantial capital investment required for dedicated coating facilities, the need for highly specific technical expertise, and the relatively infrequent demand for such large-scale coating services compared to their core exploration and production activities. For instance, the upfront cost for a state-of-the-art pipe coating facility can easily run into tens of millions of dollars, a significant outlay for a non-core function.

This reluctance significantly mitigates the threat of customers undertaking coating themselves. The specialized nature of advanced coatings, such as those providing corrosion resistance or flow enhancement, demands proprietary knowledge and rigorous quality control that Eupec PipeCoatings has cultivated. The complexity of managing these processes efficiently, alongside the inherent risks and regulatory compliance involved, makes it far more practical and cost-effective for oil and gas majors to outsource this critical component of their infrastructure projects.

- High Capital Requirements: Establishing a dedicated pipe coating facility can cost upwards of $50 million, a prohibitive investment for companies focused on upstream operations.

- Specialized Expertise Needed: Advanced coating technologies require specialized knowledge in material science, application techniques, and quality assurance, which are Eupec's core competencies.

- Infrequent Demand: Large-scale pipeline coating projects are sporadic, making it inefficient for oil and gas companies to maintain in-house capabilities.

- Focus on Core Business: Major oil and gas firms prioritize their core competencies in exploration, production, and refining, viewing specialized coating as a non-strategic activity.

Eupec PipeCoatings faces substantial bargaining power from its concentrated customer base, primarily large oil and gas corporations. These clients, often involved in massive, multi-year projects, represent significant purchasing volumes, allowing them to negotiate aggressively on pricing and contract terms.

The critical nature of pipeline coatings for infrastructure integrity means customers value Eupec's expertise, but this doesn't negate their strong negotiating position, especially given the high capital expenditure in the energy sector. For example, major 2024 energy infrastructure projects often involved contracts in the hundreds of millions, amplifying buyer leverage.

Customers' price sensitivity is amplified by market volatility and the sheer scale of projects, making cost-effectiveness paramount. While switching costs exist, the need for standardization in many applications allows customers to readily compare prices and demand concessions.

Customers generally do not integrate backward into pipe coating due to high capital requirements, specialized expertise, and infrequent demand, which somewhat limits their direct power to produce coatings in-house.

What You See Is What You Get

Eupec PipeCoatings Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis for Eupec PipeCoatings details the intensity of rivalry within the industry, the bargaining power of buyers, and the threat of new entrants. It further elaborates on the bargaining power of suppliers and the threat of substitute products, providing a thorough understanding of the competitive landscape Eupec PipeCoatings operates within. This ready-to-use analysis equips you with critical insights for strategic decision-making.

Rivalry Among Competitors

The global pipe coatings market is intensely competitive, featuring a wide array of global and regional participants. These range from large chemical conglomerates to niche coating specialists, all vying for market share.

Eupec PipeCoatings faces significant rivalry from established companies such as Shawcor Ltd., PPG Industries, and Akzo Nobel N.V. This highlights a market that, while fragmented, demands constant innovation and efficiency to remain competitive.

In 2024, the industrial coatings market, a key segment for pipe coatings, was valued at approximately $150 billion globally, with a projected compound annual growth rate of around 4.5% through 2030, indicating substantial opportunities but also intense competition for growth.

The global pipe coatings market is seeing strong expansion. Projections show it growing from an estimated USD 9.95 billion in 2024 to USD 16.84 billion by 2034, a compound annual growth rate of 5.40%. This upward trend, fueled by significant spending on pipeline infrastructure, especially within the oil and gas sectors, creates ample room for market development. Such expansion can, in turn, moderate the intensity of direct price competition among existing players.

Eupec PipeCoatings distinguishes itself through a robust portfolio of advanced coating technologies, including Fusion Bonded Epoxy (FBE), Abrasion Resistant Overlay (ARO), 3-Layer Polyethylene/Polypropylene (3LPE/PP), and concrete weight coating.

This specialization in high-performance anti-corrosion solutions allows Eupec to offer tailored solutions, precisely matching specific project demands and stringent industry standards, thereby minimizing direct substitutability from rivals.

For instance, in 2024, Eupec secured a significant contract to supply specialized coatings for a major offshore pipeline project in the North Sea, a testament to their ability to meet unique and demanding technical specifications that many competitors cannot.

The company's focus on innovation and custom formulation for challenging environments, such as deep-sea applications or those with high-temperature requirements, creates a strong competitive moat.

High Exit Barriers

The pipeline coatings industry demands substantial capital for specialized facilities, advanced equipment, and a highly skilled workforce. This significant upfront investment creates substantial exit barriers, making it difficult and costly for companies to leave the market.

These high fixed costs and specialized, often non-transferable assets mean that companies are compelled to continue operating and competing, even when market conditions are unfavorable. This persistence intensifies competitive rivalry as firms strive to recoup their investments.

- Capital Intensity: The sector requires millions in specialized coating plants and application machinery.

- Specialized Workforce: Technicians need extensive training in coating application and quality control.

- Asset Specificity: Equipment is often designed for very specific coating processes, limiting resale value.

- Downturn Persistence: Companies are unlikely to divest assets that would incur significant losses, leading to continued, albeit potentially reduced, operational presence.

Strategic Commitments and Aggressiveness of Competitors

Competitors in the pipe coatings industry are fiercely vying for market position through aggressive strategies. This includes substantial investments in research and development to drive product innovation and technological advancements in coating materials and application processes. For instance, major players have been actively pursuing mergers and acquisitions throughout 2024 to consolidate market share and expand their service offerings, creating a dynamic and often volatile competitive landscape.

The pursuit of market share is relentless, with companies frequently engaging in strategic partnerships to leverage complementary technologies or access new geographical markets. This continuous development of advanced coating solutions, such as enhanced corrosion resistance or specialized application techniques, directly fuels the intense rivalry. Companies are not just competing on price but increasingly on the technological sophistication and performance of their offerings.

- Product Innovation: Companies are investing heavily in R&D, with many reporting increased R&D budgets in 2024, focusing on high-performance coatings.

- Technological Advancements: The adoption of new application technologies, like robotic coating systems, is becoming a key differentiator.

- Strategic Partnerships: Collaborations are common, aiming to combine expertise in materials science and application engineering.

- Mergers and Acquisitions: The sector saw several notable M&A activities in late 2023 and throughout 2024, consolidating market power.

Competitive rivalry within the pipe coatings sector is robust, driven by numerous global and regional players including giants like Shawcor and PPG. The market's projected growth, from an estimated USD 9.95 billion in 2024 to USD 16.84 billion by 2034, fuels this intensity, as companies like Eupec PipeCoatings focus on specialized, high-performance solutions to differentiate themselves.

Eupec's strength lies in its advanced coating technologies like FBE and 3LPE, which cater to demanding project specifications, as evidenced by their significant 2024 North Sea offshore project contract. This focus on technical superiority, rather than solely price, helps mitigate direct competitive pressures, though the overall market remains dynamic due to ongoing R&D and strategic consolidations.

| Key Competitors | Notable Technologies | 2024 Market Activity |

| Shawcor Ltd. | Fusion Bonded Epoxy (FBE), Thermoplastic coating systems | Continued investment in advanced application facilities |

| PPG Industries | Epoxy, Polyurethane coatings | Expansion of industrial coatings portfolio |

| Akzo Nobel N.V. | High-performance protective coatings | Acquisition of smaller specialty coating firms |

| Eupec PipeCoatings | FBE, 3LPE/PP, ARO, Concrete Weight Coating | Secured major North Sea offshore pipeline contract |

SSubstitutes Threaten

While not a direct substitute for coatings, advancements in pipeline materials like advanced composites and highly corrosion-resistant alloys could lessen the need for external anti-corrosion coatings in specific scenarios. For instance, the global market for advanced composites in infrastructure, including pipelines, was projected to reach over $20 billion by 2023, indicating significant innovation. However, these alternative materials typically carry a higher upfront cost compared to traditional steel pipes with protective coatings.

While pipelines are dominant for bulk liquid transport, alternatives like rail, trucking, and marine tankers pose a threat, especially for shorter hauls or specialized fluids. For instance, in 2024, the U.S. saw significant volumes of crude oil moved by rail, offering flexibility where pipeline infrastructure is absent or congested. However, these modes generally incur higher per-unit costs and lower capacity compared to pipelines for large-scale, long-distance operations.

While Eupec PipeCoatings focuses on external protection, alternatives for internal pipeline integrity pose a threat. Internal pipeline linings, such as epoxy or cement mortar, directly address corrosion from the inside. Furthermore, corrosion inhibitors, injected into the transported fluids, offer another layer of defense. These internal solutions, while often complementary to external coatings, could diminish the perceived necessity of Eupec's core offerings if internal corrosion challenges become more pronounced or cost-effective to manage through these methods.

Maintenance and Repair Alternatives

Reactive maintenance and repair, such as patching or replacing sections of pipe, can be viewed as a substitute for preventative coating solutions offered by companies like Eupec PipeCoatings. While these methods might seem like an alternative, they often lead to higher overall costs and greater operational disruptions throughout a pipeline's lifecycle compared to a robust initial coating. For instance, unplanned repairs can incur significant labor and material expenses, not to mention the lost revenue due to downtime. In 2024, the cost of emergency pipeline repairs in the oil and gas sector, particularly for aging infrastructure, continued to rise, often exceeding the initial investment in advanced protective coatings by a considerable margin. This makes the long-term value proposition of preventative coatings increasingly compelling.

The threat of substitutes in the form of reactive maintenance is amplified by several factors:

- Increased Downtime Costs: Reactive repairs necessitate shutting down operations, leading to direct revenue losses. For example, a single day of pipeline downtime for a major oil producer can equate to millions in lost earnings.

- Higher Long-Term Expenses: While initial patching may seem cheaper, repeated repairs and the eventual need for full segment replacement often surpass the cost of a single, high-quality coating application. Studies from 2023 indicated that pipelines relying on reactive maintenance saw a 15-20% increase in total lifecycle costs compared to those with preventative coating strategies.

- Operational Inefficiencies: Frequent repairs disrupt planned maintenance schedules and can lead to less predictable operational performance, impacting overall efficiency and safety protocols.

- Limited Effectiveness: Patching and segment replacement do not address the underlying degradation mechanisms, potentially leaving the pipeline vulnerable to further issues in adjacent areas.

Longevity and Performance of Existing Infrastructure

The longevity and performance of existing infrastructure present a nuanced threat of substitutes for new pipeline coating projects. An increasing emphasis on extending the lifespan of aging pipelines through sophisticated integrity management and predictive maintenance technologies might seem like an alternative to new coatings. For instance, advancements in non-destructive testing and real-time monitoring can identify and address issues in existing coatings, potentially deferring replacement cycles.

However, these advanced maintenance strategies often presuppose and depend on the foundational integrity provided by effective, high-performance coatings. Without robust initial coating application, these predictive technologies would have a diminished capacity to safeguard the pipeline. The global pipeline coatings market, valued at approximately USD 6.3 billion in 2023 and projected to grow, indicates continued demand for protective solutions, suggesting that while maintenance is crucial, it doesn't entirely negate the need for new, superior coating systems.

- Predictive maintenance technologies can extend the service life of existing coated pipelines, acting as a partial substitute for immediate recoating or replacement.

- These technologies, however, are often reliant on the underlying performance and integrity of the original coating.

- The global pipeline coatings market's continued growth, projected to reach over USD 8 billion by 2030, demonstrates that new coating applications remain a significant factor in infrastructure management.

- The effectiveness of integrity management programs can be directly linked to the quality of the initial coating system.

While advancements in pipeline materials like composites offer an alternative, their higher upfront costs often make traditional coated steel pipes more economically viable for many projects. The global market for advanced composites in infrastructure, including pipelines, was projected to exceed $20 billion by 2023, highlighting innovation but also the cost factor. These material substitutes don't directly replace the need for protective coatings as much as they offer a different approach to pipeline construction.

Alternative transportation methods such as rail, trucking, and marine tankers serve as substitutes for pipelines, particularly for shorter distances or specialized cargo. In 2024, a notable volume of crude oil in the U.S. was transported via rail, demonstrating this flexibility. However, these modes generally incur higher per-unit costs and have lower capacity compared to pipelines for large-scale, long-distance movements.

Internal pipeline solutions like advanced linings and corrosion inhibitors can reduce the reliance on external coatings for corrosion control. While these often complement external protection, a significant shift towards highly effective internal measures could lessen the perceived necessity of Eupec's core external coating services. The increasing focus on internal integrity management underscores this evolving threat landscape.

Reactive maintenance, such as patching, serves as a substitute for preventative coating by addressing issues after they arise. However, this approach typically leads to higher long-term costs and operational disruptions. For instance, unplanned pipeline repairs in 2024 continued to escalate in cost for the oil and gas sector, often surpassing the initial investment in preventative coatings.

| Substitute Type | Description | Impact on Eupec PipeCoatings | Key Considerations |

| Advanced Pipeline Materials | Composites, corrosion-resistant alloys | Potential reduction in demand for coatings in specific high-end applications. | Higher upfront costs compared to coated steel pipes. Market growth projected over $20 billion by 2023 for composites in infrastructure. |

| Alternative Transport Modes | Rail, trucking, marine tankers | Threat for specific routes or volumes, especially shorter hauls. | Higher per-unit costs and lower capacity for bulk, long-distance transport. Significant U.S. crude oil moved by rail in 2024. |

| Internal Pipeline Protection | Linings, corrosion inhibitors | Could diminish the perceived need for external coatings if internal challenges are more effectively managed. | Often complementary to external coatings; effectiveness depends on internal vs. external corrosion criticality. |

| Reactive Maintenance & Repair | Patching, segment replacement | Higher lifecycle costs and operational inefficiencies compared to preventative coatings. | Unplanned repairs can be significantly more expensive than initial coatings. Costs of emergency repairs rising in 2024. |

Entrants Threaten

Entering the specialized pipeline coatings market, like that served by Eupec PipeCoatings, demands a significant upfront financial commitment. Companies need to invest heavily in state-of-the-art manufacturing facilities, sophisticated coating application machinery, and rigorous quality assurance testing equipment. For instance, establishing a single advanced coating line can easily run into millions of dollars, a figure that discourages many smaller or less capitalized entities from even considering entry.

Eupec's reliance on highly specialized coating technologies, such as Fusion Bonded Epoxy (FBE), Abrasion Resistant Overlays (ARO), and 3-layer Polyethylene/Polypropylene (3LPE/PP), creates a substantial barrier to entry. New companies would need to invest heavily in acquiring or developing the intricate technical expertise and proprietary processes required for these advanced applications. For instance, the global market for pipe coatings, including these specialized types, was valued at approximately USD 7.5 billion in 2023 and is projected to grow, indicating the significant capital and knowledge investment needed to compete.

Eupec PipeCoatings benefits significantly from its deeply entrenched customer relationships and a stellar international reputation, often cemented through multi-year contracts with major oil and gas firms. These long-standing partnerships, built on a track record of successful project delivery, create a formidable barrier for any new competitor attempting to break into the market. For instance, securing even a fraction of the estimated $50 billion global market for pipeline coatings requires not just technical capability but also proven reliability, something new entrants would find challenging to demonstrate quickly.

Regulatory Hurdles and Compliance

The oil and gas sector is heavily regulated, demanding that pipeline coatings adhere to strict safety and environmental standards, often requiring specific industry certifications. For instance, in 2024, the U.S. Pipeline and Hazardous Materials Safety Administration (PHMSA) continued to emphasize robust safety protocols, impacting material specifications. New entrants would need substantial investment and time to navigate these complex compliance requirements and secure necessary governmental approvals, a process that can take years and significant capital outlay.

These regulatory barriers create a substantial threat for potential new competitors aiming to enter the pipeline coatings market. Companies like Eupec PipeCoatings have already invested heavily in establishing compliant manufacturing processes and obtaining the requisite certifications, giving them a significant head start. For example, achieving certifications for critical applications often involves rigorous testing and auditing, adding to the cost and complexity for newcomers. This high compliance threshold effectively limits the number of new players who can realistically challenge established market participants in 2024 and beyond.

- Stringent Industry Standards: Pipeline coatings must meet demanding specifications set by bodies like API, ISO, and NACE, which are regularly updated.

- Environmental Compliance: Adherence to regulations concerning volatile organic compounds (VOCs) and waste disposal adds significant operational costs for new entrants.

- Safety Certifications: Obtaining approvals for coatings used in critical infrastructure projects requires extensive testing and validation, a lengthy and expensive process.

- Navigating Bureaucracy: Gaining regulatory approval from multiple agencies, such as PHMSA in the US, can be a protracted and resource-intensive undertaking for new companies.

Economies of Scale and Cost Advantages

Established players like Eupec PipeCoatings enjoy significant cost advantages due to their scale. In 2024, the global oil and gas pipeline coatings market, estimated to be worth billions, sees larger companies leveraging bulk purchasing of raw materials like epoxy resins and polypropylene, leading to lower per-unit costs. This procurement power, coupled with highly optimized, automated production lines and experienced project management teams, allows them to maintain competitive pricing structures. New entrants would struggle to match these efficiencies, likely facing substantially higher operational and material expenses, thus hindering their ability to compete on price in the initial stages.

The threat of new entrants is tempered by the substantial capital investment required to establish a competitive presence in the pipe coatings industry. Building state-of-the-art coating facilities, acquiring specialized equipment, and developing the necessary technical expertise represent significant barriers. For instance, a new facility could require tens of millions of dollars in upfront investment. Without achieving similar economies of scale, new players would find it challenging to achieve profitability against incumbents who have already amortized these costs over years of operation. This cost disadvantage is a critical deterrent for potential new market participants.

The threat of new entrants in the pipe coatings market is low due to very high capital requirements and the need for specialized technology. Companies like Eupec PipeCoatings have already made substantial investments in advanced manufacturing and proprietary coating processes, creating a steep learning curve and significant upfront costs for any newcomers. For example, the global pipe coating market was valued at approximately USD 7.5 billion in 2023, with specialized coatings forming a significant portion, demanding considerable financial backing to enter.

Regulatory hurdles and stringent industry standards also serve as significant deterrents. New entrants must navigate complex compliance requirements and obtain numerous certifications, a process that is both time-consuming and expensive. Eupec, having already established compliant operations, possesses a distinct advantage. For instance, in 2024, agencies like PHMSA continue to enforce rigorous safety and environmental protocols, adding to the complexity for potential new market participants.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment in facilities and equipment (tens of millions USD). | Significant financial hurdle, limiting competition. |

| Technical Expertise | Need for specialized knowledge in FBE, ARO, 3LPE/PP coatings. | Requires substantial R&D or acquisition of skilled personnel. |

| Regulatory Compliance | Adherence to strict safety and environmental standards (e.g., PHMSA). | Lengthy and costly approval processes. |

| Customer Relationships | Established long-term contracts with major oil and gas companies. | Difficult for new entrants to secure initial projects. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Eupec PipeCoatings leverages data from industry-specific market research reports, Eupec's annual financial statements and investor presentations, and global trade association publications to provide a comprehensive view of the competitive landscape.